http://www.ingoldwetrust.ch/week-3-2014-withdrawals-from-sge-vaults-60-tons-ytd-159-tons

Week 3, 2014 Withdrawals From SGE Vaults 60 Tons, YTD 159 Tons

Again an astounding trading week on the SGE; from January 13 – 17, 2014 physical withdrawals from the SGE vaults accounted for 60 tons of gold, year to date 159 tons. Although withdrawals are down 25 % from the previous week, the amount is still well above weekly global mine production.

This strong demand could be related to the Chinese Lunar year, which is celebrated on January 31, 2014. SGE withdrawals in the first three weeks were up 60 % compared to the same period in 2013.

A friend of mine who is traveling through Asia at the moment sent me a text message yesterday, it stated:

On three separate occasions I met with Chinese men who told me with a big smile China is buying A LOT of physical gold with printed dollars, they don't understand why the rest of the world is just watching this happening. These people are positive the price of gold is going to rise substantially.

Overview SGE data 2014 week 3

- 60 metric tonnes withdrawn in week 3, 13-01-2014/17-01-2014

- w/w - 25 %, y/y + 98 %

- 159 metric tonnes withdrawn year to date

- w/w - 25 %, y/y + 98 %

- 159 metric tonnes withdrawn year to date

My research indicates that SGE withdrawals equal total Chinese gold demand. For more information read this, this, this and this.

This is a screen dump from Chinese SGE trade report; the second number from the left (本周交割量) is weekly gold withdrawn from the vault, the second number from the right (累计交割量) is the total YTD.

This chart shows SGE gold premiums based on data from the Chinese SGE weekly reports (it’s the difference between the SGE gold price in yuan and the international gold price in yuan).

Below is a screen dump of the premium section of the SGE weekly report; the first column is the date, the third is the international gold price in yuan, the fourth is the SGE price in yuan, and the last is the difference.

In Gold We Trust

Do we see yet another ten tons leave JP Morgan's customer gold before the week ends ? I will be watching the Comex report Thursday evening to see if the recent pattern of large customer withdrawals continues.......

JPM Sees 28% Withdrawal From Gold Vault In One Day As Another 10 Tons Depart

Submitted by Tyler Durden on 01/28/2014 16:32 -0500

On Friday, when we remarked on the biggest recorded withdrawal from the JPM gold vault, we said: "Something tells us the next few days will see matching withdrawals from JPM's gold vault, which at last check was officially owned by the Chinese." As it turns out we wereabsolutely correct: according to the just released update from Comex, on Monday the infamous gold vault located below 1 C(hina)MPsaw an identical withdrawal of 321,500 ounces, matching the record withdrawal, and amounting to 28% of all JPM gold in storage. Adding to Friday's drop, this means that a record 47% of JPM's gold has been withdrawan in a few short days: a trend we are certain will continue until the total holdings of the vault drop to new record lows.

This withdrawal means total JPM gold slides from 1.128 million ounces to 816,027 ounces, down from 1.459 million ounces a week ago.

and.....

28 JANUARY 2014

Another Ten Tonnes of Gold Bullion Came Out of Comex Eligible Inventory at JPM Yesterday

"And we headed out of the hotel, went to the airport, got on the plane and, about halfway through the flight, I found myself alone in the President’s cabin with him. I said, 'Mr. President, you don’t have a cold. There’s something else going on.'

He said, 'You bet. There is something else going on.' And he said, 'When you find out, grab your balls [and run].'

Pierre Salinger, On the Cuban Missile Crisis

If I were short bullion I might consider squaring up and inching towards the exit, just to be on the safe side.

I cannot believe how little gold is left at Brinks. They have gone from total ounces of about 650,000 at the end of 2012 to a little over 186,000 ounces now.

Brinks and JPM only have about five and one half tonnes up for delivery. The two big boys are HSBC and Scotia, and they only have a little over six tonnes up for delivery between them.

That does not mean, however, that we will not see the usual shenanigans in the paper metals markets.

It's what they do, until they can't. And then they ask for a change in the rules, and a bailout.

1/28/14 updates.... items of note and " The Wrap " from Ed Steer's Gold and Silver Report - 1/28/14

Joshua Gibbons Warns on Tulving Company

For close to two decades, The Tulving Company has been well known for almost always offering the best prices on a fairly limited selection of items, with a high minimum order, and 'no-frills' being an understatement. We would always recommend them to people who could afford the minimums, and were looking for the best prices.

In the past, he would normally ship very quickly (often the same day he received your money).

However, starting mid-April, 2013, there were serious (read: illegal) issues with delays. Complaints to the BBB increased, and it looked like there could have been a problem.

Now, things are at the point where we feel that an alert needs to be issued. There are dozens of 300+ confirmed complaints of people waiting several up to 6+ months for $10,000 to $200,000+ orders.

This commentary by Joshua was posted on his website last Friday---and it's worth reading. All questions about this story should be directed to him---and his e-mail address is at the bottom of the linked commentary. I thank Ted Butler for pointing it out to me yesterday.

China's weekly gold off-take again exceeds world mine production, Koos Jansen reports

Gold off-take at the Shanghai gold exchange for the week ending January 17 continued to be greater than world gold mine production, gold researcher and GATA Koos Jansen reported yesterday.

"Again an astounding trading week on the SGE; from January 13 – 17, 2014 physical withdrawals from the SGE vaults accounted for 60 tons of gold, year to date 159 tons. Although withdrawals are down 25 % from the previous week, the amount is still well above weekly global mine production."

"This strong demand could be related to the Chinese Lunar year, which is celebrated on January 31, 2014. SGE withdrawals in the first three weeks were up 60 % compared to the same period in 2013."

I found this short commentary posted in a GATA release yesterday---and it's definitely worth reading

China’s Gold Imports From Hong Kong Climb to Record

Gold shipments to China from Hong Kong rose to a record in 2013 as bullion’s slump attracted buyers in the world’s second-largest economy.

Purchases that climbed by 51 percent in December before the Lunar New Year holiday starting Jan. 31 took net imports for the year to 1,108.8 metric tons, a 33 percent gain from 2012, according to calculations by Bloomberg News based on data from the Hong Kong Census and Statistics Department. The net figure deducts flows from China into Hong Kong.

Net gold imports jumped to 91.9 tons in December from the previous month as mainland buyers purchased 126.6 tons, including scrap, compared with 107.4 tons a month earlier, data from the Hong Kong government showed. China’s purchases in December were 10 percent higher than the 114.4 tons a year earlier, according to the Hong Kong data. Mainland China doesn’t publish such data.

This Bloomberg news item, filed from Beijing, was posted on their website in the wee hours of yesterday morning MST---and I thank Ulrike Marx once again. It, too, is worth reading.

Gold flows east as bars recast for Chinese defy slump

Gold's biggest slump in three decades has been a boon for MKS (Switzerland) SA's PAMP refinery near the Italian border in Castel San Pietro, whose bullion sales to China surged to a record as demand rose for coins, bars and jewelry.

As prices plunged 28 percent in 2013, investors dumped a record 869.1 metric tons from gold-backed funds traded mostly in the U.S. and Europe. Much of that metal is ending up in Asia, where companies such as The Brink's Co., UBS AG, and Deutsche Bank AG are opening new vaults. China's expanding wealth has made the country the world's largest buyer, surpassing India, as imports reached an all-time high.

PAMP Managing Director Mehdi Barkhordar, who credited China's "insatiable" appetite for a sales boost of as much as 20 percent last year, remains optimistic even as growth in the world's second-largest economy slows. "The demand in China is off its peak, but still respectable," he said last week.

This longish Bloomberg story, co-filed from London and Singapore, was posted on their Internet site on Monday evening MST---and it's another article I found embedded in a GATA release. It's definitely worth your while.

China’s Hong Kong gold trade hits new annual record, but where’s it all coming from?

Blaring headlines earlier today from Bloomberg and Reutersannounced that Chinese gold imports through Hong Kong reached a new record in 2014. Readers of Mineweb will hardly be surprised at that – indeed they will be aware that gold imports by this route had already achieved a record total a couple of months ago! But it’s nice, at least, to have the full year’s figures confirmed, even though the two agencies disagree a little on actual figures!

December’s net gold imports by Mainland China via Hong Kong bounced back to hit around 95 tonnes from 77 tonnes in November, but still way below the 131 tonnes recorded in October. For some reason Reuters and Bloomberg figures for Chinese gold imports seem to vary – despite both reporting statistics received from the same source – The Hong Kong Census and Statistics Department – but overall both sources confirm record net and gross import figures for the year and the variations are not important – it’s the trend that counts most. Reuters puts the total at 1,158 tonnes while Bloomberg at a rather lower 1,109 tonnes. Mineweb, which has been monitoring the announced Reuters figures month by month puts the total somewhere between the two at 1,139 tonnes – the differences rather more than can be accounted for by rounding monthly figures up and down – but be this as it may it suggests that Chinese gold imports through Hong Kong probably more than doubled in 2013 over 2012.

Since Hong Kong is actually a Special Administrative Region of China, we also publish gross figures (i.e. not discounting re-exports from Mainland China back to Hong Kong) – and this suggests China as a whole (i.e. Including Hong Kong) will have imported a little under 1,500 tonnes of gold in 2013.

This commentary by Lawrence Williams over at the mineweb.comInternet site yesterday, certainly falls into the must read category---and I thank reader M.A. for the final story in today's column.

¤ THE WRAP

What allows the manipulation to exist on the Comex is the sanctity of the delivery process. It is the delivery process itself, whether utilized or not, that makes the Comex legitimate. It is the possibility of converting a futures contract into actual metal [should one demand to do so] that legitimizes the exchange. The alternative of no delivery mechanism being present on a physical commodity futures contract [a cash settlement], removes any link or connection between paper trading and the actual commodity in question. Who in their right mind would trade on any futures exchange that didn’t allow for physical delivery should any seller or buyer choose to do so? Without the possibility of actual delivery there would be no connection between traded contracts and the actual commodity. Should Comex gold and silver futures contracts remove the physical delivery requirement and announce cash settlement only, trading would quickly migrate elsewhere, to other exchanges and instruments (ETFs). The Comex would quickly cease to exist. - Silver analyst Ted Butler: 25 January 2014

Today is options expiry for February on the Comex---and tomorrow is the last day for the large traders to roll out of their February futures contracts on the Comex as well---and by the end of trading on Thursday, every other trader holding a February Comex contract in any physical commodity must have either sold it, rolled it, or are standing for delivery on First Day Notice---and the first of those statistics will be posted on the CFTC's website late Thursday evening New York time. And, as always, it's who the issuers and stoppers are that matter. How big a part will the HSBC USA, Canada's Scotia Bank and, most importantly, JPMorgan Chase have in all of this? I'd guess that it will be almost all of it. It will be interesting to see how the delivery month unfolds.

The above Comex timetable, along with the FOMC meeting that starts today---and ends tomorrow afternoon---will be what drives the market for the remainder of the week. It matters not that platinum production is shut down in South Africa, or that China is sucking the world dry of every gold bar it can lay its hands on. Supply and demand mean---and have always meant---nothing. It's only what JPMorgan et al do, or are instructed to do, that matters---period.

Of course, in silver, there was a time when supply and demand mattered greatly---and that's when JPMorgan almost got overrun during the latter part of March and all of April in 2011---and why they and others took a sledge hammer to the Comex futures market in the drive-by shooting that began in the thinly-traded Far East market on Monday, May 1, 2011. That's also the day they began accumulating silver for the first time in their own warehouse. Ted Butler spoke about this at length in his commentary to his paying subscribers last week---and I've touched on this from time to time as well.

Reader and GSD contributor Michael Cheverton commented in an e-mail late last night---"This week has a surreal feel to it, but maybe I'm just getting old." My reply was that "No, you're right. Surreal is a good word---and the further down this rabbit hole we get, the more surreal it becomes. But when it does end---look out!"

And it won't end until either JPMorgan decides it's time, or is instructed to stand aside, as this state of affairs can't go on forever---and it won't. As I've said before, this is now a national security issue for the U.S.---especially pertaining to the status of the dollar and, as an extension to that, the entire world's financial system. The only way this will end will be suddenly---and violently. When it does, we will all be bystanders with our faces pressed against the glass in disbelief.

I will be one of them---as even though I've been mentally preparing myself for that day for the last 15 years, it will still be a shock when it happens.

In Far East trading on their Tuesday, prices are comatose---and net volume in gold is as low as I can remember, as most of the volume is rolls out of the February contract---and into the new front month which is April. Silver is quiet as well---and most of the volume is in the current front month, which is March---and it's mostly of the HFT variety. The dollar is comatose. London opens in about 15 minutes as I write this paragraph.

And as I fire today's effort off to Stowe, Vermont at 5:05 a.m. EST, I note that there's still not much going on in any of the precious metals. Net volumes are extremely light---and for that reason alone I wouldn't read a thing into the price action of any of them. The dollar index, which hit a low of 80.40 at 2:40 p.m. Hong Kong time, is now up to 80.60 as of 10 a.m. GMT in London.

I note that Casey Research has a new FREE video event coming our way. It's entitled "Upturn Millionaires: How to Play the Turning Tides in the Precious Metals Market"---and it's happening at 2 p.m. EST on Wednesday, February 5. You probably received notification of this last week, but if you've been sitting on the fence about it, you can find out more by clicking here.

You're guess is as good as mine as to how the trading day will turn out in New York. Because of options expiry, I'm not expecting a lot of big price movement, but you just never know.

Enjoy your day---and I'll see you here tomorrow.

http://www.tfmetalsreport.com/blog/5430/beneath-surface

( Brain teaser - if the Fort Knox's gold was gone as of 1974 , whose gold has been used for gold price manipulations ever since ? And better yet , if the gold held at the New York Fed , Bank of England and French Central Bank has been used to fill the gap , how much gold is actually left at the three Central Banks , how many claims are on said gold , how much longer will the gold cuckolds remain silent and will the Attorney General for New York pursue gold theft with the same vigor as we have seen with bitcoin exchange operators ? )

Beneath the Surface

I went to High School on the Nevada side of Lake Tahoe, and the largest employer in our town was the local casino. Having legal gambling in your community probably seems quite strange to most people, but frankly it was pretty tame and ordinary where I grew up- basically like having a few big hotels in your town. I had lots of friends whose parents worked in what we called the ‘tourist industry’, from food services to accounting to dealers, and it was all very commonplace. We used to make fun of the tourists who showed up thinking that it was all going to be like the Godfather, asking if they could see the part of the lake where Fredo got whacked (as if it actually happened). Oh, we all knew that back in the day there was some kind of organized crime involvement in the gambling industry, but that was decades in the past. Now it was all multinational corporations and balance sheets, just a boring but respectable tourist business.

Or was it?

A guy I knew was a respected coach at the local high school, and made extra money during the summer running the boat rentals for the biggest casino in town. When I was in my early twenties I ran into him again, and during the course of an evening’s conversation, he related the following story in a very matter of fact way.

One morning he showed up to the casino (we called it “the hotel”) before dawn as he normally did to unlock the dock, prepare the boats, and get things ready for the tourist rentals. As he walked to the shore, he was shocked to see the gate unlocked and open, and one of the casino’s rental boats motoring at a leisurely pace back to the dock. His first thought was that some drunken tourists had broken in and somehow hotwired the boat (the keys were kept in a locked cabinet) during the night, and were just coming back in as the sun was starting to rise. My friend charged out to find out what the hell was going on.

The boat pulled up and it was no drunken party of tourists. In fact, there was only one person on board and he was impeccably dressed in an expensive suit and matching shoes. He calmly pulled up to the dock, jumped out and walked straight up my friend, who was suddenly quite uncertain about what was going on. The guy reached into his jacket (giving my friend a heart attack), calmly pulled out a roll of bills and peeled-off five crisp hundreds. “I need you to clean that boat thoroughly. Is that going to be a problem?” as he pressed the bills into my friend’s hand. His quiet tone suggested that there better not be a problem. At that moment, my friend realized the guy had to have had a casino-issued key to unlock the dock, and another one to unlock the cabinet where the boat keys were kept. That, and the guy’s demeanor, told my friend that he better say “No problem. I’ll clean the boat”. So that’s what he did. The man calmly walked past him and back towards hotel parking lot, and he never saw him again.

The kicker of the story is that when my friend got to the boat, he found that the floor had blood all over it. Given the amount, it certainly wasn’t from the guy in the suit- you know, the guy who returned to the dock completely alone. So… yeah.

The story made me think a great deal about appearance vs. reality. What were all of the signs and public gestures of community engagement and local involvement really about? Did I wear the name of that casino on my little league jersey for three years because they were a kindly local business doing their part for their town by sponsoring youth sports, or did they have a different agenda, one involving normalizing themselves and planting the message that they were no different than “Jim’s Tire and Auto”? What about the yearly scholarships to UNLV for local kids to study Hotel Restaurant and Tourism Management? Or all of the generous “community engagement” activities, from supporting local charities to loaning out their banquet room to the local chamber of commerce free of charge? Viewed benignly, all of these things were just a responsible business doing its part to support and nurture its community. Viewed differently, these might all be considered necessary cover to establish the veneer of propriety, and the uglier the underlying truth the more crucial such cover becomes. But it doesn’t take much to shatter that appearance of respectability.

What does all this have to do with gold and silver? Well read on and you can judge for yourself.

. . .

I’d like to introduce you to Mrs. Louise Boyer, a very decent lady and a highly competent secretary. So competent, in fact, that she spent nearly three decades working as the personal secretary of one of the most powerful men in America, Governor Nelson Rockefeller. From rubbing elbows with the high society of the world, to arranging his personal meetings with national and international leaders, coordinating his political events, or seeing to the details of his extensive travels, this was obviously an intelligent, capable, and steady lady.

At least, she was. Until she decided in the summer of 1974 to contact a New York newspaper and tell them that she was privy to explosive information regarding the Rockefeller family arranging with the Fed for large amounts of US gold to be sold and shipped to buyers in Europe, reportedly at the official price of $42.22/oz, while gold on the open market was selling for somewhere around $175/oz. The story was published under the rather catchy headline “NO GOLD LEFT IN FORT KNOX! Federal Reserve System Charged With Secret Sale of U.S. Gold Supplies Overseas”. In the aftermath of the revelations regarding the London Gold Pool (it never having been explained just where the US obtained all the gold for these price suppression sales), this was an interesting headline to say the least! Whether these buyers in Europe were just front-men for the Rockefellers as some rumors had it, or if the family would simply be given a cut of the spoils for arranging the deal, or whether the deal was being done for other reasons, was unclear.

What was not unclear was that three days after the publication of the article, Ms. Boyer was found dead, having “apparently” thrown herself through the windows of her tenth-story New York apartment and plunging to her death. I use the word “apparently” because that is the way the police worded it- an apparent suicide (they seem to have left themselves some wiggle room because strangely, there was no suicide note found, and friends who had just met with her reported her to be in fine spirits immediately prior to her, uh, unfortunate event). The author of the explosive article was a former legal counsel for both the American Gold Association, and the U.S. Export-Import Bank, Dr. Peter David Beter, and after Ms. Boyer’s untimely death, he came forward and confirmed that Louise Boyer had indeed been the key anonymous source behind the article.

Suddenly, public attention was being drawn to the question of whether the great United States gold hoard was intact. The story was picked up by a large Dallas radio station, people started contacting their congressmen, and within weeks the necessity of holding a formal audit of US gold reserves was being discussed openly on the floor of the House of Representatives. The honesty and legitimacy of the Fed/Treasury complex was being publicly questioned. The cat, it seems, was very nearly out of the bag. Obviously, it had to be put back in.

. . .

What followed is surely one of the strangest “dog and pony shows” of all time, a simulation of government accountability and pretended openness so threadbare that it raised more questions than it answered, and was such an embarrassment that its’ like has never again been attempted. Later that same year in the fall of 1974, a tour of Fort Knox was arranged for a few elected representatives, all to be dutifully recorded by the press. The tour was not an audit of any kind, nor would the entire facility be open to the Congressmen and the press. Instead, the outing was nothing more than a bizarre PR event, carefully limited to the viewing of a single chamber which was said to be just one of thirteen such vaults on the premises.

Gold was shown, people posed with bars, and the photographs were presented in newspapers across the country, ostensibly to dispel the ‘irresponsible rumors’ occasioned by the original article and by Mrs. Boyer’s untimely death.

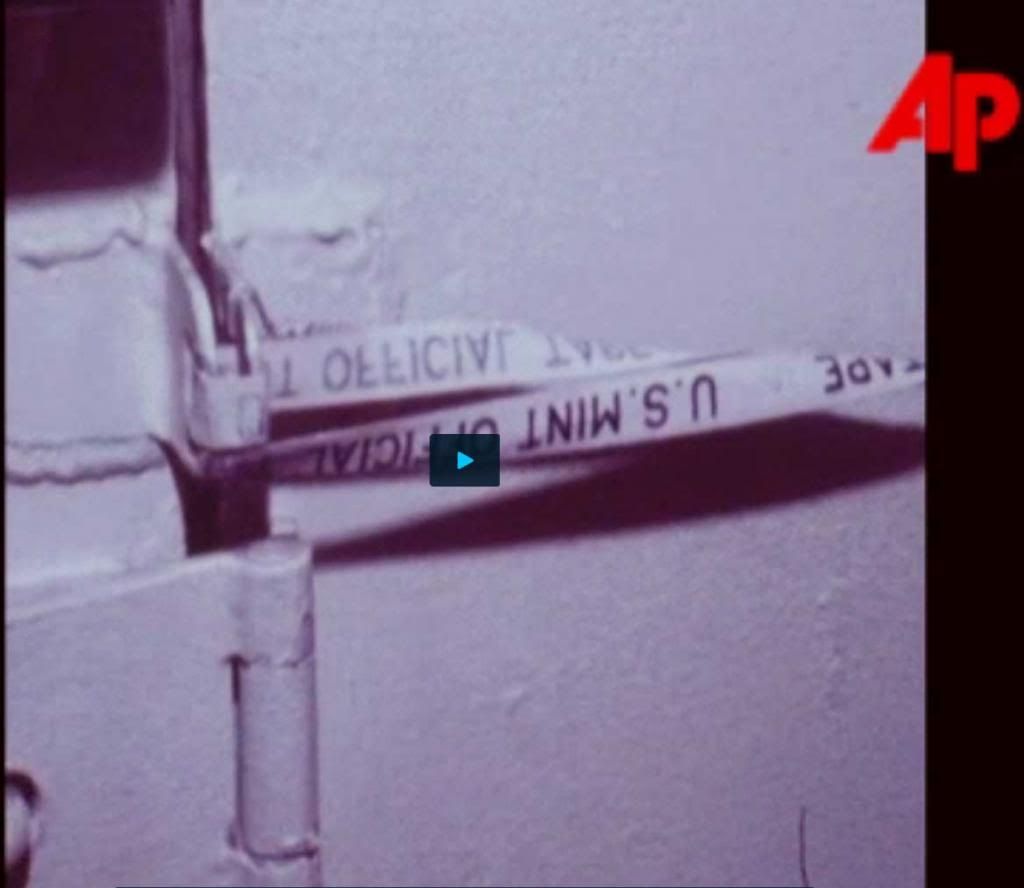

Amazingly, I found that the Associated Press actually has, buried within their digitized online archives, two minutes of raw stock footage of this 1974 “inspection”. I will provide you the link through which to view it at the end, but I have screen-captured some stills from the footage to illustrate a few points (and in case the original source video is pulled for some reason). Below is a newspaper photograph, likely of the very AP photographer recording the film footage we are going to watch:

A carnival-like atmosphere surrounded the proceedings, with people joking and milling around excitedly, as if sensing this was not a serious inquiry on behalf of the citizenry so much as a vaudeville act, so they might as well enjoy the show! Six representatives and one Senator were joined by small entourages and invited members of the press.

It was explained that only one of the vaults would be opened for their viewing on that day because “the vaults are sealed”, suggesting that it would be amazingly difficult to unseal all of them. One might imagine that “sealed” meant something rather substantial, like huge doors welded shut or even entire openings bricked-up to enclose and protect the precious contents within. One would be mistaken.

Take a look at the photograph below. This is one of the “sealed” vaults- it is nothing more than “US MINT OFFICIAL TAPE” strung across the entrance. Observers reported that for the single vault which was unsealed for the tour, “unsealing the vault” consisted of nothing more than US Mint Director Mary Brooks taking some scissors and cutting the tape! Holy cow, it is no wonder that only one vault was opened for viewing, given the herculean task that unsealing all thirteen would have represented.

The sign below was stationed above the single vault that was opened for viewing, and the statistics there show an average bar weight of 326.6 ounces per bar, meaning that the gold they were shown was not in 400oz good delivery condition. Additionally, several observers from numismatic and gold circles noted that a large percentage of the gold was actually quite copper hued, indicating that it was coin-melt gold made in the wake of Roosevelt’s 1933 gold confiscation, and therefore containing as much as 10% copper. Again, this is not good-delivery standard.

Nonetheless, the elected representatives of the people posed with bars and mugged for the cameras, strangely happy to erroneously proclaim “It’s all here!” for the press, thus proving conclusively to all the world nothing more than that a single room containing 368 metric tons of gold (just 1/22nd of the total purported gold holdings of the US) did, in fact, exist. Un-assayed, and in non-good delivery form based on weight and composition.

This, it seems, was reckoned good enough to put all those irresponsible speculations about gold sales to rest. Problem solved, bitchez!

Finally, here is the raw footage from the AP piece- the Fort Knox tour footage starts at roughly 40 seconds in, and runs for the next two minutes. As you watch it, please remember that all of this was the official “answer” to the US Congress regarding questions surrounding the state of the gold reserves of the United States, occasioned by the publication of the Rockefeller/Fed gold sales article and by the death of its anonymous source, Ms. Louise Boyer.

AP Television: ROVING REPORT GOLD

Story No: w009831

Date: 12/04/1974

So where does all of this leave us? Well, the truth is that nobody knows. Those who claim the US has sold off part or all of its gold reserves over the years have no definitive proof to back up their claim, though the circumstantial evidence (from the London Gold Pool to the statements of various Fed chairs about selling gold to the Washington Agreement) is suggestive, to say the least. Those who say all this is conspiracy theory hogwash ALSO have no definitive proof to back up their claim, as no formal audit has taken place for more than sixty years now. The ridiculous performance noted above created more questions than answers, and unsurprisingly, such a stunt has not been repeated since. Despite multiple requests from congress over the years, despite multiple bills submitted to the House for a formal audit of the gold reserves of the United States, all such requests have been met with resistance, stony refusal, or outright ridicule.

And so the official figure of 8,133 metric tons is still dutifully reported as truth in all discussions of US gold holdings, and the legitimacy of the Fed and the financial system is psychologically reinforced every single day by respectable people in suits saying respectable things on television, and maybe all of it is legit.

And hey, maybe that guy in the boat just cut himself shaving. At night. In the middle of a lake.

Keep stacking.

http://jessescrossroadscafe.blogspot.com/

27 JANUARY 2014

Gold Daily and Silver Weekly Charts - FOMC Week Shenanigans

Gold spiked higher in the morning on a pure flight to safety, but was pushed lower as stocks attempted to rally. Reality versus liquidity?

The FOMC will meet this week, so we might expect the usual FOMC shenanigans, but bear in mind that the big traders are squaring off against the upcoming February delivery.

I do not expect any curve balls from the Fed which is now locked into its mild tapering. Their monetization has clearly failed, being a 'top down' approach to The Recovery, which has exacerbated the strains in the real economy versus the financialized, paper economy.

The gold/silver ratio seems rather high at 63 to 1, and that reflects the fact that gold has led silver up this month in the precious metals rally. Once silver gets started higher, it may kick in some serious jets and catch up rather quickly. But one step at a time.

As solid and well-informed the Bloomberg print reporting may be, their television counterparts all too often have the depth of cackling chuckleheads, with a few notable exceptions. Well, they do have nice smiles, and so forth.

It really is annoying, but alas, Fox and CNBC are little better. I have never understood why the US treats visual financial reporting as light entertainment, as compared to Europe and Asia which have a more journalistic approach.

Have a pleasant evening.

India to review gold restrictions by end of March

Submitted by cpowell on Mon, 2014-01-27 20:02. Section: Daily Dispatches

By Manoj Kumar

Reuters

Monday, January 27, 2014

Reuters

Monday, January 27, 2014

NEW DELHI -- India will review its tight curbs on gold imports by the end of March, the finance ministry said on Monday.

India used to be the world's biggest buyer of bullion until last year, when a swollen current account deficit prompted the government to slap a record 10 percent duty on imports and the central bank to tie imports to exports.

With the current account deficit now expected to be sharply down in the current fiscal year and the leader of the Congress party, which heads the government, reportedly asking for a reprieve, a change was increasingly on the cards.

... For the full story:

Tocqueville's Hathaway cites ever-rising leverage in Comex gold

Submitted by cpowell on Mon, 2014-01-27 18:00. Section: Daily Dispatches

1p ET Monday, January 27, 2014

Dear Friend of GATA and Gold:

The Tocqueville Fund's John Hathaway today tells King World News about the ever-rising leverage in Comex gold futures, leverage that makes a spike in the gold price more likely:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Scrambling Gold Mints Around The World Plead: "We Can’t Meet The Demand, Even If We Work Overtime"

Submitted by Tyler Durden on 01/27/2014 12:05 -0500

- Australia

- Bear Market

- China

- Exchange Traded Fund

- Goldman Sachs

- goldman sachs

- Morgan Stanley

- Precious Metals

- Short-Term Gains

One of the big disconnects over the past year has been the divergence between the price of paper gold and the seemingly inexhaustible demand for physical gold, from China all the way to the US mint. Today we get a hint on how this divergence has been maintained: it now appears the main culprit is the massive boost in supply by gold mints around the world working literally 24/7, desperate to provide enough supply to meet demand at depressed prices in order to avoid a surge in price as bottlenecked supply finally catches up with unprecedented physical demand.

Bloomberg reports that "global mints are manufacturing as fast as they can after a 28 percent drop in gold prices last year, the biggest slump since 1981, attracted buyers of physical metal. The demand gains helped bullion rally for five straight weeks, the longest streak since September 2012. That won’t be enough to stem the metal’s slump according to Morgan Stanley, while Goldman Sachs Group predicts bullion will "grind lower" over 2014." Odd - one could make the precisely opposite conclusion - once mints run out of raw product, the supply will slow dramatically forcing prices much higher and finally letting true demand manifest itself in the clearing price.

More from Bloomberg:

“The long-term physical buyers see these price drops as opportunities to accumulate more assets,” said Michael Haynes, the chief executive officer of American Precious Metals Exchange, an online bullion dealer. “We have witnessed some top selling days in the past few weeks.”

The propaganda is well-known: “Prices are likely to drop further as global economic conditions are stabilizing and tapering worries continue,” said Rob Haworth, a senior investment strategist in Seattle at U.S. Bank Wealth Management, which oversees about $110 billion of assets. “There is no doubt that physical demand has improved, but it will not be enough to support prices." Uhm, yeah. That makes no sense: what happens when global mints are hit by capacity bottlenecks from gold miners for whom it is becoming increasingly more economic to just halt production at sub-cost levels.

Meanwhile, here is a case study of how individual mints are working overtime to plug the unprecedented demand comes from Austria:

Austria’s mint is running 24 hours a day as global mints from the U.S. to Australia report climbing demand for gold coins even while Goldman Sachs Group Inc. says this year’s price rebound will end.Austria’s Muenze Oesterreich AG mint hired extra employees and added a third eight-hour shift to the day in a bid to keep up with demand. Purchases of bullion coins at Australia’s Perth Mint rose 20 percent this year through Jan. 20 from a year earlier. Sales by the U.S. Mint are set for the best month since April, when the metal plunged into a bear market.

It's not just Austria. Presenting the US Mint:

The U.S. Mint, the world’s largest, sold 89,500 ounces so far this month. The Austrian mint that makes Philharmonic coins, saw sales jump 36 percent last year and expects “good business” for the next couple of months, Andrea Lang, the marketing and sales director of Austria’s Muenze Oesterreich AG, said in an e-mail.“The market is very busy,” Lang said. “We can’t meet the demand, even if we work overtime.”The price for the Austrian mint’s 1-ounce Philharmonic gold coin slumped 27 percent last year, according to data from the Certified Coin Exchange.“It’s been a very bad year for gold,” said Frank McGhee, the head dealer at Integrated Brokerage Services LLC in Chicago. “People who bought coins have lost value, but they are not looking at short-term gains, and hope springs eternal.”

Tell that to China.

That said, keep an eye on GLD ETF holdings - for now the biggest marginal setter of gold price remains the paper ETF, whose "physical" gold holdings have cratered in the past year. Once this resumes going higher, buy.

Gold & Silver Sold As Benoit Gilson Gets Back To Work

Submitted by Tyler Durden on 01/27/2014 08:38 -0500

What goes up (and tests $1,280 overnight)... must not be allowed to go up for the sake of the children of the status quo. It would appear the BIS' Benoit Gilson took over the reins from Michel Charoze this morning and the precious metal pilfering has begun. Why not? What else would you do faced with an Emerging Market FX crisis, various nations in mass upheaval, China's liquidity crisis front-and-center, and growth hopes around the developed and emerging world collapsing... buy US stocks and sell gold...

The BIS head of FX and Gold trading is hard at work

London afternoon currency spikes subside under regulators' glare

Submitted by cpowell on Mon, 2014-01-27 05:24. Section: Daily Dispatches

By Liam Vaughan and Gavin Finch

Bloomberg News

Sunday, January 26, 2014

Bloomberg News

Sunday, January 26, 2014

Trading is changing in the minutes before currency benchmarks are set as regulators shine a light for the first time on alleged misconduct in the $5.3 trillion-a-day foreign-exchange market.

Sudden fluctuations in exchange rates ahead of the 4 p.m. London close, cited by market participants as indicative of potential manipulation, have become rarer and less pronounced in the past six months, according to data compiled by Bloomberg.

The shift reflects an industry in flux as authorities on three continents examine instant messages and phone records for evidence of collusion and senior traders are suspended or fired. Banks including Citigroup Inc. and UBS AG have curbed the use of chat rooms, and some investors are shunning the WM/Reuters benchmarks set at the close that are now the subject of probes.

"Wherever we are in a position to do so, we are moving away from trading at the WM/Reuters rates," said Jasper Steger, treasurer at Dutch fund manager MN Services NV based in The Hague, which manages about 85 billion euros ($116 billion). "Clients see the news reports and want to know what we are doing about it. We need to respond to that."

Investigators from Switzerland to Hong Kong are probing currency markets after Bloomberg News reported in June that dealers said they shared information on client orders with counterparts at other banks and timed trades to influence prices at the close. The 4 p.m. benchmark, known as the fix, is used by managers of $3.6 trillion of funds that track international indexes. At the center of the inquiries are instant-message groups with names such as "The Cartel," "The Bandits' Club" and "The Mafia."

The probes come at a time when currency dealers are battling shrinking margins and increased competition. While trading reached a record high last year, the banks' share of that business is being eaten into by institutional investors, hedge funds and high-frequency trading firms.

The biggest dealers had a 39 percent market share last year, down from 53 percent in 2004 and 63 percent in 1998, according to Bank for International Settlements data. Years of record-low interest rates are squeezing profits, which are also being eroded by the rise of electronic-trading platforms.

Bloomberg News first reported in August that trading patterns in the 30 minutes before the fix on the last working day of the month, when funds that track indexes typically transact most, exhibited one-way price surges. Spikes of at least 0.2 percent for 14 currency pairs were found 31 percent of the time over a two-year period from July 2011 through June 2013, data compiled by Bloomberg show. To qualify, the moves had to be one of the three largest of the day for that pair and have reversed by at least 50 percent within four hours.

Since June, the surges have been less frequent. From July through the end of December, qualifying jumps on the last working day of the month occurred only 10 percent of the time. For several currency pairs, including U.S. dollar to Japanese yen and U.S. dollar to Canadian dollar, spikes have disappeared altogether. In dollar-euro, the most widely traded pair, the frequency has fallen to 17 percent from 50 percent on the same six days in 2012.

Some spikes ahead of the fix are inevitable because a large volume of business at that time comes from tracker funds balancing portfolios to reflect stock-market movements, according to two senior currency traders who asked not to be named while an investigation is active.

Even so, such frequent and dramatic moves are unexpected and may occur because dealers are sharing information about what trades will be made during the window when the benchmark rates are set, according to Rosa Abrantes-Metz, a professor at New York University's Stern School of Business who advises the European Commission and the World Bank on market rigging.

One possible reason for the decline is that traders are now executing large orders over a longer period of time using computer algorithms, rather than pushing them through at the fix manually, according to David Woolcock, chairman of the committee for professionalism at ACI, a Paris-based group representing 13,000 currency and money-market traders in 60 countries.

Diminished price fluctuation also may be contributing to the drop, according to one former trader who asked not to be identified. Deutsche Bank AG (DBK)'s Currency Volatility Index, which measures the market's expectation of future price swings for nine currency pairs, slumped to 8.36 percent on Dec. 31 from 10.61 percent on June 28. That's a 21 percent drop. It was as high as 15.8 percent in September 2011.

For Abrantes-Metz, the changes have more to do with the behavior of markets.

"There is strong evidence to suggest that when news becomes public about something wrong in a market, such as collusion, there is immediate and often permanent change in market outcomes," said Abrantes-Metz, whose 2008 paper "Libor Manipulation" helped spark a global probe of attempted rigging of interbank borrowing rates. "What you are finding seems to be consistent with this evidence."

If it lasts, lower volatility at the fix could reduce transaction costs for tracker funds that use WM/Reuters rates. Trading at the close instead of a daily weighted average could erase 5 percentage points of performance annually for a fund tracking the MSCI World Index, according to a May 2010 report by Paul Aston, then an analyst at Morgan Stanley.

WM/Reuters rates, based on a median of trades during a one-minute period beginning 30 seconds before 4 p.m., are collected and distributed by World Markets Co., a unit of Boston-based State Street Corp., and Thomson Reuters Corp. Bloomberg LP, the parent company of Bloomberg News, competes with Thomson Reuters in providing news, information and currency-trading systems.

"WM continually reviews recommended methodology and policies in order to ensure that industry best practices are considered," State Street said in a statement. A spokesman for Thomson Reuters didn't return messages left on his mobile and work phones.

The U.S. Department of Justice, the U.K.'s Financial Conduct Authority and the Swiss Competition Commission are among agencies that began formal probes into currency rate-rigging in October. Since then, at least 17 traders have been fired, suspended or placed on leave at firms including Deutsche Bank, JPMorgan Chase & Co. and HSBC Holdings Plc.

That's been disruptive, according to a fund manager at one of the world's five largest investment firms, who said there was a lack of experience in the market now that many chief dealers aren't around. While pricing and liquidity haven't been affected, the individuals executing trades might not be as proficient in managing risk, said the manager, who asked not to be named because of the probes.

Banks also are overhauling rules governing how traders execute client orders and communicate ahead of benchmarks. Goldman Sachs Group Inc., Royal Bank of Scotland Group Plc, UBS, JPMorgan and Citigroup banned employees from taking part in chat rooms involving other banks. The move put an end to the multi-dealer conversations used by traders to agree on transactions, share gossip and exchange tips on business flows.

Spokesmen for HSBC, Citigroup, Deutsche Bank, JPMorgan, Barclays, UBS and Goldman Sachs declined to comment.

While traders are prohibited from discussing specific client orders with counterparts at other firms, they have in the past been free to talk about potential transactions that may move prices -- known in the market as providing "color."

Two bank employees interviewed by Bloomberg News said the probes had created such a sense of paranoia about what they could and couldn't discuss that they were now avoiding having any discussions about client flows. That caution has spread to conversations traders have with their clients, the dealers said.

"Several of the banks we deal with are telling us, ‘We're not going to show our book anymore, we're not in a position to do that while there are investigations going on,'" said MN Services' Steger. "They're disclosing less information about upcoming flows at the fix."

Foreign-exchange sales employees at RBS (RBS) in London have written to clients pledging that traders at the bank won't share details of their orders or use them to make proprietary bets, according to an Oct. 23 e-mail read to Bloomberg News.

"We are currently considering processes around the benchmark service," Sarah Small, a spokeswoman at RBS, said in a statement. "The e-mail does not reflect final policy and we have clarified this with our clients."

Some investors are taking the investigations as a cue to move away from trading at the WM/Reuters rates. Seattle-based Russell Investments Group, which buys and sells currencies for its own funds and other institutional investors, is advising its clients to avoid the fix where possible, according to Michael DuCharme, head of foreign-exchange strategy.

Steger at MN Services, which trades about 200 billion euros of currency a year, said his firm no longer was using benchmarks when buying and selling securities. The rates were still suitable for amending rolling currency hedges, he said.

At a meeting of the ACI last week in London, senior traders and investors said they detected a drop in business being transacted at the fix, according to Woolcock.

Investors aren't placing as many orders, and banks are "probably a little bit more wary at the moment of taking very large orders for the fix," he said.

Unlike sales of stocks and bonds, which are regulated by government agencies, spot foreign exchange -- the buying and selling for immediate delivery as opposed to some future date -- isn't considered an investment product and isn't subject to specific rules. Instead, banks sign on to voluntary codes of conduct, which outline best practices and standards.

At the November meeting of the Federal Reserve Bank of New York's foreign-exchange committee, bank executives said the probe probably would result in changes in the way traders are taught to handle client orders. ACI also is looking into amending its code of conduct to include guidelines for trading around fixes, Woolcock said.

For some money managers, the changes in practices are too little, too late.

"I find it shocking that some professional investors seem uninterested in this matter," Russell Investments' DuCharme, said in a telephone interview. "If one knows there's a problem, persisting in the behavior is surprising, especially if these investors have a fiduciary duty to act in their clients' best interests."

Australian law provides for gold confiscation -- and it's not unique

Submitted by cpowell on Mon, 2014-01-27 02:36. Section: Confiscation

9:45p ET Sunday, January 26, 2014

Dear Friend of GATA and Gold:

Writing tonight for The Market Oracle, Paul Behan notes that a mechanism for government confiscation of privately held gold is already explicitly part of the law in Australia. Behan's commentary is headlined "Gold and Silver Confiscation? It's Written In the Law" and it's posted at The Market Oracle here:

Six years ago the Perth Mint's Bron Suchecki noted as much at his Internet site, Gold Chat, but elaborated in detail about the law's nuances and the political circumstances likely to bear on any attempt to implement it. Suchecki commented astutely that any confiscation of gold by government probably would manifest itself as nationalization of mines, the sources of large amounts of gold, long before it got around to privately held metal. Suchecki's commentary was headlined "Australian Gold Confiscation" and it's posted here:

With some difficulty seven years ago GATA extracted an answer on the point from the U.S. Treasury Department, which replied that the U.S. government, upon proclamation of an emergency by the president, claims the power provided by statutes enacted in 1917 and 1977 to confiscate from the people not just gold and silver but any damn thing the government feels like confiscating:

Since most U.S. citizens can't even spell gold and fewer still own it, such confiscation probably would not accomplish much, and certainly the rationale for the U.S. government's trying to confiscate gold as it did in 1933 evaporated long ago, gold then being a huge part of the country's official money stock and today constituting none of it.

And yet if, as some observers suspect will happen, gold is restored to an official place in the international financial system, once again backing currencies directly or indirectly, gold held in the United States might become more vulnerable to confiscation.

This is largely a political question that can't be answered with any assurance, and in the end, of course, liberty will belong only to those ready to put themselves at risk for it. But the worsening authoritarianism of governments in even nominally democratic countries may argue for diversification in the location of the vaulting of one's monetary metals.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Hi Fred, Could you please advise who wrote 'Beneath the Surface'?

ReplyDelete" Beneath the Surface " was written by Pining 4 the Fjords ( the author does guest post at Turd Ferguson's blogspot )

Delete