Wednesday, January 22, 2014 7:45 PM

Italian Banks Need Extra $57 Billion for Loan Loss Reserves, 18% of Loans Non-Performing

It will be interesting to see how well Italian banks handle stress tests later this year given new S&P capital shortfall estimates.

Of course, the stress tests were watered down twice already, and if need be I am sure ECB president Mario Draghi can find additional ways to further dilute the tests.

Yet, whether or not the losses are hidden, they are real. S&P warns Full recovery a long way off for Italian banks

Of course, the stress tests were watered down twice already, and if need be I am sure ECB president Mario Draghi can find additional ways to further dilute the tests.

Yet, whether or not the losses are hidden, they are real. S&P warns Full recovery a long way off for Italian banks

Italian banks will need to set aside as much as 42 billion euros ($57 billion) in new provisions for credit losses by the end of 2014 and some may have to raise additional capital, rating agency Standard & Poor's said on Tuesday.History suggests the rating agencies are rather conservative when estimating such losses. Thus, I expect shortfalls to be much bigger than estimated, especially given the overly rosy estimates of a European recovery that is realistically nowhere in sight.

It said a full recovery for the sector, which was badly hit by the euro zone debt crisis and is struggling with rising bad debts, remained a long way off because of Italy's weak economic prospects and continued deterioration in asset quality.

S&P expects the stock of bad loans at Italian banks to rise to 310 billion-320 billion euros by the end of this year, or about 18 percent of customer loans.

That will force the lenders to set aside an additional 32 billion-42 billion euros to cover for credit losses between June 2013 and December 2014, according to the agency's estimates. Combined loan loss reserves stood at 111 billion euros at the end of June last year.

"The large stock of NPAs (non-performing assets) is likely to remain a burden for Italian banks as a protracted economic recovery and rising unemployment could lead to further asset quality deterioration," S&P said in a report.

Mike "Mish" Shedlock

http://hat4uk.wordpress.com/2014/01/22/how-the-clubmed-bonds-miracle-was-manipulated-how-hollandes-reform-arm-got-twisted/

HOW THE CLUBMED BONDS MIRACLE “WAS MANIPULATED”, HOW HOLLANDE’S REFORM-ARM GOT TWISTED

Part Two of The Slog’s inside analysis of EU debt politics

Sources allege central bank directionalising fix to save Italy

Draghi & Cannata’s personal lifeboat

How Hollande was ‘arm-twisted into economic reform’

Despite an outstanding bond debt of €1.7 trillion, a frozen government, and a flatlining economy, money for debt bonds is pouring into Italy’s basket case. In this second part of a debt politics special, The Slog analyses the forces that made Draghi act, and the likely effect of the move on the sudden change in direction from Francois Hollande.

Up until a month ago, foreign holdings of Italian bonds had fallen to only a third of the total. The decline began as Italy came surging onto the debt radar in July 2011, and nervous money pulled out.What saved the Italians was its central bank buying neo-junk sovereign debt bonds from the Italian Treasury in huge amounts. This clearly couldn’t last forever, but in the midst of Beppo Grillo, Bunga-bunga and Parliamentary stalemate, it got sorted of parked on a small, spluttering back burner in a corner of the overheated kitchen.

But then last November – almost like Bernanke and his ‘taper’ – Italy’s head of debt at the Central Bank Maria Cannata called time, saying that Italian domestic banks would drastically curb their holdings of sovereign debt during 2014. As I recorded in the first part of this analysis, Italy already has the largest debt issuance in the EU. On January 6th 2014, the Treasury quietly announced that in the coming year, it’s going to issue even more debt bonds.

This truly made Italy a unique traffic accident in the eurozone. While Spain’s mess seems just as bad (in different ways, it’s worse) Madrid has announced that it will require less debt issuance this year. It also has one concrete achievement, albeit hyped: a better export performance based on lower production costs. Italy’s trade balance is far more stagnant in origin: it imports and exports a risible amount. The country is on its knees.

ECB officials (so I’m informed) met with Brussels bigwigs, and Berlin was also – despite very strained relations between the Merkeschäuble/the Bundesbank and Draghi/the ECB – brought fully into the loop.

Berlin seems to have taken the situation in its stride. If ever there was a red warning flag to sound the alarm for dirty dealing off the bottom in ClubMed, then the run-up to Christmas 2013 was it. Almost every financial commentator forecast that ClubMed States would be in trouble as interest in buying distress debt bonds waned…especially with local central bank support pulling back.

But that’s the opposite of what happened. Suddenly, big money was flowing into Spain, Italy and Ireland….and the MSM was full of bollocks about “analysts seeing the turnaround”.

Of course, there was and is no turnaround. What (it is alleged) has been put together is an EU/global central banker fix to stop the following disastrous events from tumbling into place:failed ClubMed bond sales >> spiking ClubMed bond yields >> sharks circling the Italian basket case >> Italy’s ability to honour debt in doubt >> contagion rains on Spain’s ‘recovery’ parade >> eurozone destabilised >> German voter wakes up to the Merkeschäuble electoral con >> Wall Street facing massive debt insurance Tsunami >> Asia loses key European market as consumption collapses further >> Abenomics explodes >> you don’t want to know the rest.

“Basically,” The Slog’s longstanding Brussels mole told me last weekend, “there is some kind of merry-go-round scheme, under which the central banks in one Member country buy the debt bonds of another, and the operation is disguised further by putting it under different accounting headings, and then the ECB ‘sees them right’ by printing some more money to reimburse their purchase cost.”

This is not new news…and isn’t remotely way out there and wacky: central-bank buying globally accounted for over 50% of the total demand for bonds in 2013, and as both media and markets have wised up to this, the ECB has, I know from other sources, been at this ‘disguised QE’ racket for some time.

This time, however, it seems that the scam had to be bigger, because the potential backwash was so much greater for the global economy. In my opinion, there is only one bloke with the guile, vision and contacts to pull such a thing off: Mario Draghi….and others in Europe share that view. But equally – despite Merkel’s comfortable win in the Bundesrepublik elections – Draghi had to be sensitive to the Weidemann/Bundesbank fears about German debt exposure.

It is highly possible that, at some point in this process, France (more exactly, Francois Hollande) wound up being the bait to get Berlin onside. Hold that thought.

I do not know the exact modus operandi here. The arrangement is necessarily loose and secret. But there is a further observation emanating from Madrid sources suggesting that key Wall St firms and central banks (as far afield as Tokyo) were tipped off that, if they piled in with ‘directionalising’ ClubMed bond purchases, they would be well rewarded….as of course they would be, by later quietly selling on their purchases at a profit to ‘sap’ money drawn into the apparently wonderful new world of ClubMed recovery.

As I tried to make clear in yesterday’s Part 1 of this post, this ‘scheme’ has not been put into place as a means of making Iberio-Italian debt sustainable: that simply can’t be done on any model currently acceptable to the markets.

Rather, it was put together to distract from the immediacy of Italy’s problem…with everything to play for. Greece couldn’t sink the eurozone today. But Italy and Spain would. This isn’t can-kicking: this is highly-skilled transporting of a Domesday Bomb down the road, in the hope that somewhere further along, it can be disarmed.

It’s nigh on impossible for The Slog to get hold of/strip away the disguises of the audited list of ClubMed bond purchases. But Zero Hedge pointed up the Japanese element over a week ago. I invite anyone with the forensic skills and budget required to give this a shot. I can’t prove it, but I can assert that heavy-hitters in the eurobonds market and two European capitals think there is clear evidence for it.

I will go further however, and demonstrate that Mario Draghi has a strong personal motive for “doing whatever it takes” to stop worms wriggling out of Italian cans….as they inevitably would in the event of an uncontrolled Italian meltdown. On 26th June 2013, the FT dropped this bombshell:

Basically, the story alleged (to the point of near-proof) that Draghi fiddled the Italian entry conditions for the new euro currency by making derivative trades look more solid as assets than they were. The Pink’un somehow got hold of a 29-page report by the Italian Treasury in the first half of 2012, detailing Italy’s now massive exposure to these derivatives. The report included details of the restructuring of eight derivatives contracts with foreign banks with a total notional value of €31.7bn.

The following extract from the piece was particularly outspoken – especially for the FT:

‘Mario Draghi, now head of the European Central Bank, was director-general of the Italian Treasury at the time, working with Vincenzo La Via, then head of the debt department, and Ms Cannata, then a senior official involved with debt and deficit accounting. Mr La Via left the Treasury in 2000 and returned as its director-general in May 2012 – with the backing of Mr Draghi, according to Italian officials.

An ECB spokesman declined to comment on the bank’s knowledge of Italy’s potential exposure to derivatives losses or on Mr Draghi’s role in approving derivatives contracts in the 1990s before he joined Goldman Sachs International in 2002.’

Jean-Claude Trichet (ECB boss at the time who smoothed Draghi into his succession) later vetoed an attempt by French media to get a clearer statement out of the ECB. Smoke, fire, etc etc.

Now comes another fascinating connection. The lady who heads up Italy’s debt management Quango, Maria Cannata (left) was the same Maria Cannata visited by police of the Guardia di Finanza in April 2012, and asked by them for more details of the derivatives transaction concerned – which she supplied. Ms Cannata didn’t enjoy the experience. She is also the same Maria Cannata who told the media two months ago that Italian Banks would not support Italian debt bonds at anything like the same level any more. There are rumours that Ms Cannata is nervous about some of the, um, practices involved in this.

Now comes another fascinating connection. The lady who heads up Italy’s debt management Quango, Maria Cannata (left) was the same Maria Cannata visited by police of the Guardia di Finanza in April 2012, and asked by them for more details of the derivatives transaction concerned – which she supplied. Ms Cannata didn’t enjoy the experience. She is also the same Maria Cannata who told the media two months ago that Italian Banks would not support Italian debt bonds at anything like the same level any more. There are rumours that Ms Cannata is nervous about some of the, um, practices involved in this.

Cannata joined the Italian Treasury as an analyst in 1980, and has worked her way up holding various positions, becoming ever more involved in active public debt management.

She was entrusted with the transition to the euro by the Italian Treasury. She is also a member of the EU Sub-Committee of Government Bills and Bonds Markets, of the Steering Group of the OECD Working Group on Public Debt Management, and of the Governance Group of the OECD.

So then, a network almost as good as Mario Draghi’s. At the time of the derivatives debt scam, Maria Cannata was working very closely alongside Mario Draghi (see above) as a senior official working on deficit accounting. Draghi liked and promoted her within the agency.

You could say, in fact, that Maria had as much to lose from Italian meltdown as Mario. She too has been talking Italy up of late. In an upbeat frothy pr piece in Euroweek, Cannata alleged:

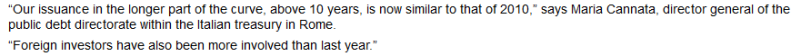

That simply isn’t borne out by the facts. The first claim is contradicted by the debt structure chart I showed yesterday, and the second (as this chart supplied by US source Butch shows) is somewhat fast and loose with reality. What she says is accurate, but this is what it looks like:

That simply isn’t borne out by the facts. The first claim is contradicted by the debt structure chart I showed yesterday, and the second (as this chart supplied by US source Butch shows) is somewhat fast and loose with reality. What she says is accurate, but this is what it looks like: Maria is a bullsh**ter up there with Mario. She has the contacts. And she too obviously realised the importance of foreign involvement when it comes to creating false confidence in Italian debt. “We are confident about a significant and growing presence of institutional foreign investors,” Cannata told Reutersin November. Why? We can only guess…and keep digging.

Maria is a bullsh**ter up there with Mario. She has the contacts. And she too obviously realised the importance of foreign involvement when it comes to creating false confidence in Italian debt. “We are confident about a significant and growing presence of institutional foreign investors,” Cannata told Reutersin November. Why? We can only guess…and keep digging.

Maria likes talking about Japan; last year, she told a journalist source of mine she expected Italy/German bond spreads to fall once Abenomics/BOJ purchasing got to Europe. That does seem to have happened: but Zoeb Sachee (the head of European government bond trading at Citi) specifically predicted, “There’s going to be a slow and protracted flow, I don’t think the asset allocation decisions are going to be made in the space of a month.’ Yet they have. The Slog’s Madrid source is equally doubtful about how likely the Japanese would’ve been to pile in without, shall we say, some persuasion. He confides, “The Japanese are incurably, even rigidly, cautious about overseas investments, especially in Europe right now.”

Most analysts as late as mid December said any Japanese inflow “could take several months at least” and was unlikely to go big on ClubMed. JP Morgan’s Carl Norrey agreed late last year: “We know from what we’ve seen before that (Japanese) targets have been mainly France, and when yields have risen they’ve got back into Germany and at times they look at the Italian market”. Again, hold that thought about France.

But Japanese money poured into Italy in three weeks. And from elsewhere. Oh so conveniently for the Mario/Maria leap into la Dolce Vita.

So anyway, why do I say “keep an eye on France? France’s debt structure is, after all, far more sound than Italy’s. The French State incontinence when it comes to spending has for certain at last landed then in potential trouble. But just as suddenly as the bond buyers switched to ClubMed, France has been struggling this year to attract buyers of its debt.

The French government debt auction last week drew the weakest demand in a decade as investors piled into Spanish and Italian securities. The yield on France’s benchmark 10-year bonds is at 2.5% now…up rapidly from a record low of 1.74% last year. After Belgium, French bonds are suddenly the worst performers among the euro region’s major issuers this year.

The MSM analysis of this switch I find, yet again, unconvincing. “France is lagging behind in the process of regaining competitiveness,” said Gareth Colesmith, a senior portfolio manager for Insight Investment Management Ltd. France is ‘lagging behind’ Spain and Italy? Are you serious?

Spain “has won praise from economists for generating record exports last year by squeezing labor costs” said another commentator, “and the efforts have been rewarded in the bond market.” Yes chum, but France isn’t carrying dozens of empty banks and fictitious property developments. And Italy hasn’t won praise from anyone.

“Italy, unlike France, has a trade surplus” said another. Italy has a trade surplus based on exporting two cigarettes and importing one.

France is in medium-term trouble – and short-term trouble if bond rates and other interest rates spike. But the uncanny coincidence of France suddenly being talked down, followed by a massive switch out of Paris into the peripheries, is counter-intuitive. In my view – and that of others with whom I have regular market contact – it smacks of directionalising.

Obviously, in a relatively size-static Sovereign bond market, there must be winners and losers. My two questions remain: why so quickly, and why in this unexpected direction?

I’m not sure the answer stops in Frankfurt and Rome. I think it also concerns Germany’s deteriorating relationship with France.

A week ago today, Francois Hollande suddenly popped up and said something important and focused. This is a first in the Hollande Presidency. But it’s what he said that concerns us here: what he said in the light of the hammering his debt bonds had taken in the previous fortnight:

President Hollande spoke about cutting public spending by €15bn this year and a further €50bn by 2017, and about his “Responsibility Pact” to reduce charges for business and cut red tape. For a Socialist President, this was a massive conversion to l’Anglo-Saxonism…largely overshadowed by florid questions about his sexual adventures.

FN leader Marine Le Pen immediately attacked the speech as “a plan for the Germanisation of France”.

Reuters confirmed that ‘Berlin has been discreetly encouraging Hollande to take similar steps since the Socialist became president in 2012′. What Reuters doesn’t tell us is, discretion was getting nowhere. Merkel was getting impatient, along with her little friend Wolfie, for the grand neoliberal plan to be extended into the heart of Socialist idleness and agricultural inefficiency. And both wanted France firmly “in the cage” after Fiskalunion.

German foreign service reactions were gushing.”Germany also took its time and had to overcome certain hurdles before it could agree on reforms of the economy and labour market that promised improvement in the economic situation,” said Foreign Minister Frank-Walter Steinmeier, a member of the German Social Democrats (SPD) and Schroeder’s former chief of staff. “What the French president presented yesterday is first and foremost courageous,” he added, describing the measures as a new direction in policy that would help not only France, but Europe to “emerge stronger from its financial crisis”.

“We really must make French exports more competitive,” said Hollande in his speech. This has been Draghi’s mantra to the EU FinMins for nearly two years. And so, the circle is complete.

It’s amazing what a bit of financial pressure can achieve, on occasions.

http://hat4uk.wordpress.com/2014/01/21/slog-2-part-special-are-investors-really-rushing-to-be-part-of-italys-coming-meltdown/

SLOG 2-PART SPECIAL: ARE “INVESTORS” REALLY RUSHING TO BE PART OF ITALY’S COMING MELTDOWN?

Debt cloak and political dagger in the eurozone

Debt cloak and political dagger in the eurozone

In a two-parter to be completed in the coming 24 hours, The Slog analyses the desperate state of Italy’s finances, its long history of debt accrual, and the clouds that still hover over the political and banking class there. Why would anyone in their right mind be piling into unsustainable Italian debt investment in 2014? Are lower bond rates going to make any difference when the solids hit next year? Is this really a free-market investment play, or part of a bigger game. Decide for yourself today and tomorrow

Hugh Dixon at Reuters told his readers the other day that ‘A constitutional reform deal between the leader of Italy’s largest party and the leader of the opposition addresses one of the country’s biggest problems: its ungovernability.’

When ungovernability is just one of a nation’s problems, you know you’re in trouble. What might the others be, we wonder – imminent barabarian invasion? Ostrogoth II: This time we’re going to eat your pasta.

No, actually: this time Italy’s long-term structural debt problem is going to eat the country’s solvency. Italy is a basket case of corrupt officials, braindead biased media, crumbling infrastructure, and massive dark pools of hidden debt. Just how desperate the country now is was made clear in 2013 when the authorities falsified an entire quarter’s economic statistics. This must’ve left even the Met Police gaping on in awed admiration.

That makes it a nightmare for people like me because, to be frank, whereas the Greeks smile a lot while giving horrendous news, and the Spaniards have an impressive system of shifting the money around – like a minor amdram person playing several roles at once – the Italian authorities think quite carefully about what people want to hear, and then produce some statistics showing just that. It’s a crowd pleaser in the short term, but as the Nazi bigwigs discovered in April 1945, the million men who perished at Stalingrad might still be on the books, but they’re in no fit state to come to your rescue.

An Italian debt that stood at 116% in 2010 is now 127%, and both figures are false underestimates. Italian State accounting is a thing to behold – only not for too long, as your pupils will wind up heading out towards each side of your head. Remember, this is the Nation that not only takes forever to deliver mail: after three delivery failures they pulp it.

Under Berlusconi, huge amounts of money went missing…and whereas in Greece, there are backhanders that dilute the budget but the airports somehow miraculously get built, the bunga-bunga years dispensed with the formality of using budgets for some social purpose: a bit like the mail, they just disappeared. Driving through Italy these days, one gets the feeling of being in a Mad Max movie.

Yet despite this, yesterday Italian bonds were preferred to those of Australia. While I do realise that having a Trappist Prime Minister with the brain of a special-needs koala bear is bound to make the markets a little nervous, such a preference is undeniably potty. Italy (and Spain for that matter) appear to be using this sudden opening-up of unjustified bond market optimism to…here it comes again, kick the can down the road. As I tried to show late last week in relation to Greece, the short-term debt product does exactly what it says on the can: like a pesky rake, it just keeps zapping one on the schnoz at regular intervals in large amounts.

Everyone in the media is delighted because Italy is getting longer-term debt away: its debt costs on 10 yrs are back to well under 4%, the opinion-formers say. In another of those wonderfully gobbledegooked, calm-sounding statements (they always remind me of airline pilot-speak) this is now referred to in the EU space as “stabilising the average debt maturity”. Furthermore, those on-the-ball market experts always called in by the media majors to quote on such things are right up to speed. “Increasing the average life of debt is the big theme of the year for Italy and Spain,” said David Schnautz, rate strategist at Commerzbank in New York. Yessir, 2012 was fingers in ears and 2013 was the 400lb Grillo stalemate, but 2014 will be the year of the bigger cans kicked by leather-booted rugby fullback feet.

The reality, however, is that, given the upcoming maturity timetable, a genuine desire to invest in Italian debt ought to represent a prima facie case for being detained under the Mental Health Act.

A lot of ‘people’ buying Italian debt now are doing so, one suspects, with ulterior motives. I don’t want to go out on a completely dismembered limb here, but I think this may well be what’s going on in some cases. Whoever is buying this junk for whatever reason, it isn’t doing Italy any harm for now: already in 2014, it’s borrowed €1.7bn a 2028 maturity bond at very low cost. The problem comes when things are so badly tits up economically (and rates can only go up) all this frothy 15-20 year stuff being knocked out now becomes irrelevant when Italy defaults on a 3-year 8% bond it took out in 2011.

I have been wittering again recently about the reassertion of at least some fundamentals, and while we can all argue about specifics, there isn’t much of a heated debate about the state of Italy’s economy and finances.But this still doesn’t stop Rentagobs from diving in where Angels don’t even want to think about the smell involved in doing so.

“We have moved up the (yield) curve because we’ve become more certain the periphery was having an economic rebound and we’re still seeing that,” burbled Sandra Holdsworth, investment manager at Kames Capital this week. I’ve no idea how much Rome is paying her to serve that sort of guff, but I hope it’s enough to assuage the shame when she’s proved hopelessly wrong. Italy remains a basket-case. No, that’s unfair: Ms Holdsworth obviously isn’t being bribed, of course not. She’s just more dumbassed than an Australian Prime Minister.

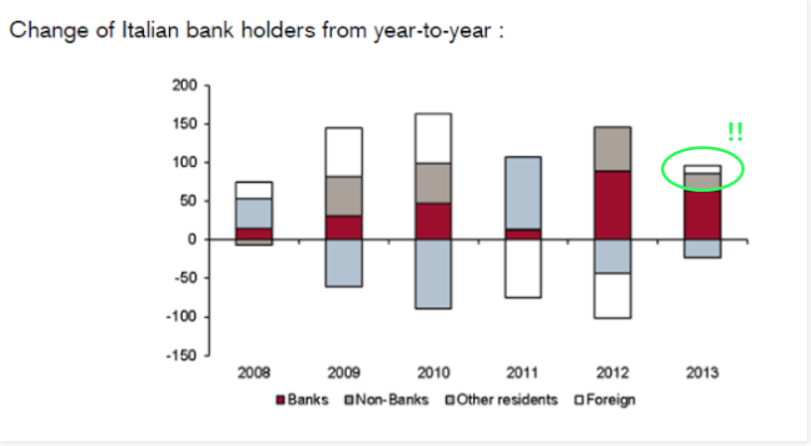

Among the EU big seven, Italy has the highest debt to gdp ratio at 127%; and while the odd piddling billion is being bought on longer maturities now, Italy also has the highest proportion of short-term debt in the Big Seven – at 18%. As this Italian Treasury chart shows, the trends of debt structure aren’t that great either:

What we see confirmed here is that 70% of Italy’s debt is at around ’7 year or shorter’ maturity, while variable rate borrowing is showing a sharp long-term decline. A large proportion of the Italian debt closer to maturity is at higher fixed rates. The yellow column is index-linked debt, a percentage that has grown ten times in ten years. This is like having a pension linked to Zimbabwean economic growth.

Indeed what all those currently ‘investing’ in Italian debt should remember is that, if Rome is the Eternal City, then debt is Italy’s eternal problem. The country has had a stability programme with bold plans and objectives since 2003. The picture overall ever since the advent of the euro in Italy is of various governments hoping that tomorrow never comes. Unfortunately, in the physical universe ruled by the illusion of time, tomorrow always comes.

The banking sector is in bad shape and riddled with mis-stated debt scandal. Non-performing bank loans (NPLs) are three times what they were six years ago…at 14% and rising. Given the still poor economic outlook, 30% of all banking firms are classified as vulnerable to a prolongation of the weak economic environment. Italy badly needs a recovery right now, but it isn’t going to happen.

It isn’t going to happen because ClubMed (and increasingly, the planet) is heading for a slump. With very high unemployment and vastly reduced pdi, consumers cannot drive a consumption recovery. The economy will probably stagnate in 2014, and it’s more than likely GDP growth will remain below 1% in 2015: don’t forget, growth during the last decade has been just 0.5% on average. Italy is suffering from structural stagnation and long-term rising debt servicing costs. Hence the term ‘basket case’.

Further, the political gearbox being in neutral means that structural reforms to improve competitiveness and productivity are highly unlikely. Arguments will continue along the usual axis of tax rises, welfare cuts and efficiency savings: but in Italy, that’s all so much hot air these days.

So forget what the yields are today, how easy is it going to be for Italy to deal with interest and maturing capital payments in the 2014-2016 period?

Italy’s outstanding bond debt stood at € 1,722,705.49 million (1.7 trillion) on the last day of 2013. In its 2014 Guidelines for public debt Management, the Italian treasury explains that ‘the redemptions of maturing securities and the coverage of the State Sector’s cash borrowing requirement are to be guaranteed through a market financing strategy’, which is of course woffle. Significantly, the guidelines talk at great length about debt issuance, but mature debt settlement doesn’t get a single mention.

Mind you, in a way it’s apposite that issuance is the key topic, because Italian bond issuance is far and away the biggest in the EU: at €260bn, it represents over a quarter of all bond issuance in the region.

The EC, of course, has an Excessive Deficit Procedure to impose on small, weak countries. It was going to do this for Italy, until Rome told them where to stick it. This might explain why, as of a week ago, the Italian government still hadn’t issued any details of plans to honour debt payments this year. However, barring some left-field event (and why bar them – they happen all the time under the globalist system) the country should get through 2014 with minimal bond maturity problems.

The tricky year is 2015. Next year, Italy will have to find €200bn in redemption payments: three times as much as Spain, and almost as much, in fact, as it will issue in debt this year. This is madness, and clearly unsustainable. As I evidenced earlier, the deadly combination of short term and fixed rate borrowing means that this size of payout is inevitable….and compared to today’s ‘market’, expensive.

Last October, Citigroup forecast that Italy would be in near-permanent recession, with growth of 0.1pc in 2014, zero in 2015, and 0.2pc in 2016. Ambrose Evans-Pritchard observed at the time, “The debt will punch above 140pc of GDP, beyond the point of no return for a country with no economic growth or sovereign currency.” He’s written some odd columns of late, but I agree completely with his conclusion there.

So we come back to my ever-returning question here: who is buying Italian bond debt and why?

I’ve spoken to informed opinion. I’ve spoken to a Brussels source. I’ve looked at motive, and recent events…in particular, the announcement by the Italian Central Bank last November that it would be buying less Sovereign debt in 2014 versus 2013.

Something had to be done, and I believe something is being done. It involves distracting attention away from Italy’s doom, and directionalising bond markets. It involves central banks in Europe. And perhaps most important of all, it concerns the relative power in the European Union of Germany and France.

Find out more in Part Two.

Italian Bad Loans Hit Record High - Up 23% YoY

Submitted by Tyler Durden on 01/21/2014 19:11 -0500

With all eyes gloating over Ireland's recent ability to issue debt in the capital markets once again (and now with 10Y trading only 40bps above US Treasuries), Europe's game of distraction continues. However, while spreads (and yields) tumble in all the PIIGS, with Italian yields at almost 7-year lows, it is perhaps surprising to some that Italian bad loan rates are at their highest on record. Having risen at a stunning 23% year-over-year - its fastest in 2 years, Italian gross non-performing loans (EUR149.6 billion) as a proportion of total lending rose to 7.8% in November (up from 6.1% a year earlier). As the Italian Banking Association admits in a statement today, deposits are declining (-1.9% YoY) and bonds sold to clients (-9.4% YoY) as Italy's bank clients with bad loans have more than doubled since 2008.

Italian bad loans continue to soar - entirely ignored by the nation's bond market particpants (why worry!?)

and if that chart does not make you rub your chin in utter delerium...

Ireland or US?

Charts: Bloomberg

Of course , spain and Greece reflect different real economy stories as compared with those told by EU and Country politicians.....

Greece.......

Greek Unpaid Electricity Bills Grow By €4 Million Per Day: Over 700,000 Pay In Installments

Submitted by Tyler Durden on 01/20/2014 12:03 -0500

Judging by the collapsing Greek yields, which at this rate may drop below US bonds soon enough, the Greek economy has never been stronger. Sadly, manipulated bond levels driven by yet another bout of pre-QE euphoria (suddenly the conventional wisdom is that the ECB will conduct QE in a few months as first explained here in November) no longer reflect anything besides a massive liquidity glut and momentum chasing lemmings. Alas, as usual the reality on the European ground is much worse. The latest example comes from the Greek Public Power Corporation which has reported that Greek households and corporations are finding it increasingly difficult to pay their electricity bills. In total, debts to the power utility from unpaid bills currently amount to some €1.3 billion and growing at an average rate of €4 million per day. Also known as the Grecovery.

Not surprisingly, it is the poorest households who have the bulk of the debt. Remember: "the rich hold assets, the poor have debt."

The lion’s share of that debt is owed by low- and medium-voltage consumers – households and very small enterprises. The total arrears of these categories amount to an estimated 600 million euros, of which some 65 percent concerns households. The debts of the broader public sector amount to 190 million euros. The arrears of corporations connected to the medium-voltage network total some 130 million euros, while mining company Larco alone has run up debts of more than 135 million euros.

So since such a substantial portion of low-income society, and in Greece that by definition means society period, is unable to even afford their electricity, the Greek state's solution is perfectly anticipated for a country which is insolvent due to too much debt but can't declare bankruptcy because it is ruled by a few not so good bankers: convert one's basic social amenity into a liability, and pay it off over time. i.e., a debt.

In an effort to make it easier for households to repay what they owe and to boost the cash inflow into its coffers, PPC introduced a flexible and extensive payment plan scheme last year that over 700,000 consumers have joined. The scheme has proven so popular that the utility has given its customers the option of securing a payment plan via telephone in order to reduce long queues at its offices, as staff had been unable to handle the volume of applications.PPC customers can now complete the process over the phone, by calling 11770 and applying to pay 12 monthly installments along with a down payment of between 20 and 50 percent. The category of socially sensitive consumers (the unemployed, those with low incomes etc) can pay their dues in up to 40 installments. Consumers only have to go to PPC offices to pay their installments.

In other words, for the low low price of €49.99, payable in 40 installments, you too can have electricity!

Which perhaps explains why the vast majority of households who had their electricity cut off opted not to fall even more in debt, but to take the short cut.

An estimated 7,500 households who had their supply cut off have now been reconnected thanks to a government decision to secure power for the country’s poorest households. There are, however, another 35,000 households, according to official figures, that have illegally reconnected their electricity supply, which is very dangerous.

Since Greece is now nothing more than a placeholder figurehead designed to preserve the stability of Deutsche Bank, the German export miracle, and the myth that all insolvent peripheral European banks are viable, who can blame them.

Spain......

Spanish Lending Rates Soar To Highest Since 2008

Submitted by Tyler Durden on 01/14/2014 10:11 -0500

Despite sovereign bond yields plumbing new record lows and the Prime Minister proclaiming (against Draghi's advice) that the nation has turned the corner and is out of the crisis; Spain's record unemployment and record loan delinquency is showing up in a major credit-creation-crushing way for small businesses. As Bloomberg's Jonathan Tyce reports, Spanish new business lending rates just experienced the largest 2-month surge in over a decade to their highest since 2008. At 4.04%, new business loans trade over 300bps above two-year sovereign debt (and are diverging) as the efforts of Europe's 'whatever it takes' central bank are being entirely wasted in terms of reaching the Keynesian growth-driving economy. We suspect this surge will once again raise talk of a rate-cut (and expose theimpotence of the ECB's transmission mechanisms).

Chart: Bloomberg

No comments:

Post a Comment