Obama Nominates Israeli Bankster as Federal Reserve Vice Chair

Stanley Fischer will guide QE Infinity along its destructive path

Kurt Nimmo

Infowars.com

December 12, 2013

Infowars.com

December 12, 2013

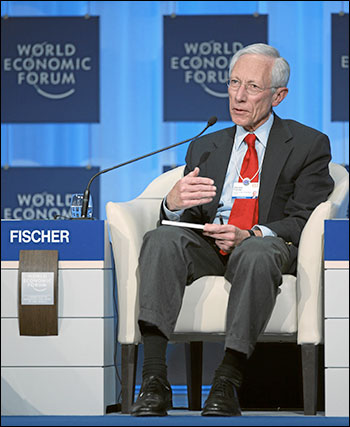

Dual American-Israel citizen Stanley Fischer has sterling globalist credentials. Photo: World Economic Forum

The Obama administration has nominated a top level globalist to act as vice chair of the Federal Reserve, the private banking cartel masquerading as a federal agency. If selected, he will replace Janet Yellen as Vice Chair of the Board of Governors of the Federal Reserve

Zambian-American-Israeli economist Stanley Fischer left mega-bank Citigroup to head up Israel’s central bank. He is the former number two honcho at the globalist loan sharking operation, the IMF, and the former chief economist at the World Bank. As an MIT economics prof Fischer tutored the current Fed boss, Ben “Helicopter” Bernanke and former Treasury Secretary Larry Summers. Fischer is a member of the influential Group of Thirty.

Obama was instructed over the summer by central banksters and establishment economists to nominate Fischer.

Stanley Fishcer is an ideal choice as number two at the Federal Reserve. He is a monetary “hawk” who will guide QE Infinity along its destructive path. His globalist credentials are sterling.

“Without the Fed, we’d have had a much deeper recession,” he pontificated from a pedestal at the Wall Street Journal CEO Council meeting last month. “Without the extraordinary things that it’s done, the economy would be in much worse shape today and we need to remember that.”

Former Hawkish Bank Of Israel Head Rumored To Be Next Fed Vice Chairman

Submitted by Tyler Durden on 12/11/2013 13:19 -0500

While Bernanke may be about to leave; none other than his mentor and thesis adviser - former Bank of Israel chief Stanley Fischer is rumored to be in line for a new role:

- FISCHER STEPPED DOWN AS BANK OF ISRAEL GOVERNOR IN JUNE

- FISCHER LEADING CANDIDATE TO BE DEPUTY FED CHIEF: ISRAEL CH. 2

- DJ WHITE HOUSE NEAR NOMINATING STANLEY FISCHER TO FED VICE CHAIR

And so the circle of life is complete. So far, the White House has declined to comment, but we note Fischer has a reputation for beng more hawkish than most - evidenced by his refusal to engage in the kind of dovish activity the rest of the world did while in charge in Israel and is especially downbeat on forward guidance.

Mr. Fischer said making such statements – known as forward guidance – can cause market confusion. “You can’t expect the Fed to spell out what it’s going to do,” Mr. Fischer said. “Why?Because it doesn’t know.”He added: “We don’t know what we’ll be doing a year from now. It’s a mistake to try and get too precise.” Mr. Fischer said he tried, on becoming governor of the Bank of Israel in 2005, to give signals to the market – but quickly gave up as he realized it restricted the bank’s future actions when circumstances changed.“If you give too much forward guidance you do take away flexibility,” said Mr. Fischer. Part of the problem around giving indications of future actions is they are conditional and nuanced.

Also of note: Fischer was once upon a time considered the "dark horse" candidate to replace Bernanke:

Dark-horse candidates include Stanley Fischer, an American citizen who recently stepped down as governor of the Bank of Israel, and Roger Ferguson, another former Fed vice chairman and now chief executive of TIAA-CREF, a not-for-profit financial-services company.

For now the market seems oblivious that the #2 person at the Fed may be far more hawkish than Larry Summers ever would be.

If You Don’t Trust the Fed, Here’s An Inside View That Confirms Your Worst Suspicions

Submitted by Tyler Durden on 12/12/2013 19:43 -0500

Submitted by F.F.Wiley of Cyniconomics blog,

Earlier this year the notion that the Fed might modestly taper its purchases drove significant upheaval across financial markets. This episode should engender humility on all sides. It should also correct the misimpression that QE is anything other than an untested, incomplete experiment.

- Former FOMC Governor Kevin Warsh, writing in the Wall Street Journal on November 13.

If I may paraphrase a sainted figure for many of my colleagues, John Maynard Keynes: If the members of the FOMC could manage to get themselves to once again be thought of as humble, competent people on the level of dentists, that would be splendid. I would argue that the time to reassume a more humble central banker persona is upon us.

- Dallas Fed President Richard Fisher, speaking in Chicago on December 9.

I fault the Fed for its lack of intellectual leadership on the economy and, in particular, Bernanke’s lack of forthrightness about the limits of the Fed’s ability to address slow growth and fiscal disequilibrium.

- Former St. Louis Fed President William Poole, speaking in Washington D.C. on March 7.

Does anyone else see a common theme?

Last month, we offered a plain language translation of the Warsh op-ed, because we thought it was too carefully worded and left readers wondering what he really wanted to say. Translation wasn’t necessary for Fisher’s speech, which contained a clear no-confidence vote in the Fed’s QE program. Poole’s comment was from a seminar question-and-answer session earlier this year, but it reached our inbox only last week in a transcript published in the latest Financial Analysts Journal. The Q&A was attached to an article that I’ll discuss here, because it makes claims we haven’t heard from others with FOMC experience.

Here’s an example:

Ben Bernanke talks a lot about risk management and the tradeoff between benefits and costs; he maintains that the need to balance these two issues justifies proceeding with the current policy. But Bernanke does not discuss the risk of political intervention in Fed policy despite numerous examples of the Fed giving in to political pressure and waiting too long to change its policy, which results in a detrimental outcome for the economy.…Essentially, pressure on the Fed will come from inside the government and may not be very visible; it may be limited to a few op-ed articles from the housing lobby. [FFW – presumably, Poole intended “it” to refer to the visible part of the pressure.] The true amount of political pressure will be largely hidden.

Poole is more or less saying that we have no idea what’s truly behind the Fed’s decisions. But he doesn’t stop there. He’s willing to make a prediction that you wouldn’t expect from an establishment economist:

[T]he real issue is the politics of monetary policy … I believe that the Fed will not successfully resist the political winds that buffet it. I am not a political expert or a political analyst by trade. My qualification for speaking on this topic is that I have followed the interactions between monetary policy and politics for a very long time. As with all things political, the politics of the Fed means that realities often fail to match outward appearances … I believe the Fed is likely to overdo its current QE policy of purchasing $45 billion of Treasuries and $40 billion of MBSs per month.

So there you have it: a 10-year FOMC veteran wants us to know that central banking isn’t all about the latest hot research on the wonders of unconventional measures. On the contrary, monetary policy is no different than other types of policymaking; it’s guided by hidden political forces.

If you don’t mind our saying so, we feel a bit vindicated. Our very first Fed post ten months ago included the following:

As for the flip-flop [the Fed’s commitment to lifting the stock market through QE so shortly after claiming no responsibility for stock prices in recent bubbles], it’s easy to find a logical explanation. The banks want QE. Influential political and economic leaders want QE. Therefore, the path of least resistance is to give them QE. On the other hand, market manipulation to prick the Internet and housing bubbles would have been widely unpopular. Therefore, policymakers rejected the idea that they should manipulate markets and prick bubbles. No one likes to be unpopular.More generally, QE seems to me to be explained by Bernanke (and his colleagues) being unable to sit still. This is natural behavior when you have to continually justify decisions. It’s not easy to explain to Congress, the media or public why you’re doing nothing but waiting for past policies to work. It won’t be long before people portray you as weak and indecisive and tell you to “Get to work, Mr. Chairman.” But once you start implementing new policies, especially if they’re in a direction that’s expedient for everyone in the short-term, then those criticisms go away. They’re replaced by adjectives like bold and proactive. And who doesn’t want to be known as bold and proactive?

We haven’t returned to this theme often, partly because it can’t be tested like we can test the Fed’s economic beliefs. Regular readers know that we do quite a lot of empirical work. We try our best to follow David Hume’s maxim that: “A wise man, therefore, proportions his belief to the evidence.”

As we see it, the Fed’s economic beliefs are proportioned more closely to political factors than real-life evidence. You might replace Hume with Upton Sinclair, who said “it is difficult to get a man to understand something when his salary depends on him not understanding it.”

In other words, politics and personal incentives are a huge part of the picture, and not just in central banking but in the economics profession more generally.

The theories underpinning current policies, which have built up over the last 80 years or so, can’t be properly understood without thinking through the motivations behind key developments. Some of the motivational factors are obvious, while others are more subtle, but I won’t clutter this post with our musings on the hidden drivers in economics. Detlev Schlichter offered a nice summary in his book, Paper Money Collapse:

It would be naïve to simply assume that the exalted position of [mainstream economic] theories in present debate is the result of their superiority in the realm of pure sciences. This is not meant as a conspiracy theory in the sense that professional economists are being hired specifically to develop useful theories for the privileged money producers in order to portray their money printing as universally beneficial. But it would be equally wrong to assume that the battle for ideas is fought only by dispassionate and objective truth-seekers in ivory towers and that only the best theories are handed down to the decision makers in the real world, and that therefore whatever forms the basis of current mainstream discussion must be the best and most accurate theory available. No science operates in a vacuum. The social sciences in particular are often influenced in terms of their focus and method of inquiry by larger cultural and intellectual trends in society. This is probably more readily accepted in the other major social science, history. What questions research asks of the historical record, what areas of inquiry are deemed most pressing and how historians go about historical analysis is often shaped by factors that lie outside the field of science proper and that reflect broader social and political forces.Moreover, ever since mankind began writing its histories they have served political ends. History frequently provides a narrative for the polity that gives it a sense of identity or purpose, whether this is justified or not, and the dominant interpretations of history can be powerful influences on present politics. Similarly, certain economic theories have become to dominate debate on economic issues because they fit the zeitgeist and specific political ideologies. This is not to say that economics cannot be a pure, objective science. It certainly can and should be. Whether theories are correct or not must be decided by scientific inquiry and debate, and not in the arena of politics and public opinion. But it is certainly true that many economists do depend for their livelihoods on politics and public opinion, and that they cannot operate independently of them.

Schlichter is one of many authors and bloggers willing to discuss the awkward realities lurking behind economic theory and central banking. But these ideas are considered taboo by most mainstream media outlets. They’re not discussed in establishment venues or spoken by establishment figures.

Or so I thought.

Poole’s refreshingly honest take on the Fed’s inner workings – from someone who truly knows what goes on behind the curtains – is more than welcome.

No comments:

Post a Comment