http://hat4uk.wordpress.com/2013/12/24/global-economy-the-china-domino-syndrome-creeps-ever-closer/

GLOBAL ECONOMY: The China domino syndrome creeps ever closer

BEIJING IS IN TROUBLE: WAKE UP & THINK ABOUT IT

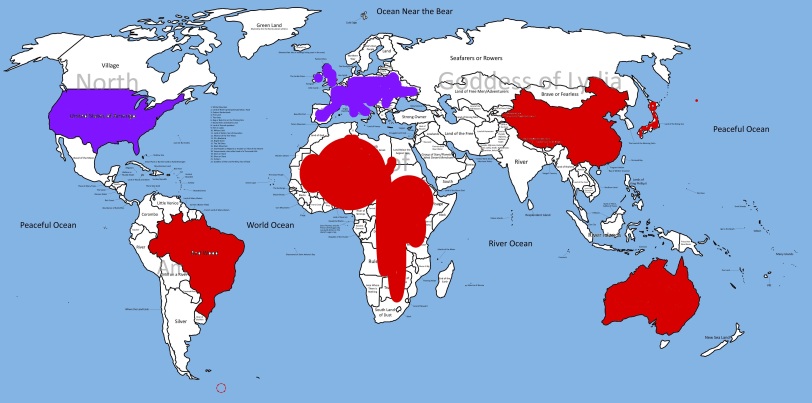

You won’t see many visual aids simpler than the one above. The countries in red represent China’s biggest trading partners and (in particular) suppliers. The purple people have the most debt owned by China.

China is struggling to contain a major credit crunch within its own banking system: last Tuesday, the People’s Bank of China injected 29 billion yuan through reverse repos in open market operations on Tuesday morning. And interest rates within China’s interbank market spiked to their highest level since June in recent days.

So: that now makes India, China and – yes, amazingly – the UK mulling higher interest rates which, you’ll recall, will not be allowed to happen until everything is just fine. Well, hate to say I told you so…but it’s happening, guys.

However, while about 90% of the acres of Western sites and newsprint don’t give a monkey’s about Sino liquidity crunches, as you can see a China that doesn’t solve its problem will completely screw the exports of the folks in red, and get even more antsy about big debtors seemingly intent on just one thing – vapourising the debt they owe to China with that good old money printing bazooka.

Higher interest rates and nervous creditors will increase the borrowing costs of the US, UK and EU so much, they’ll all default.

And a China bringing down the import shutters will collapse the Brazilian, Australian and African economies as well.

That leaves just Japan then, whose printing stimulation will hurt those latter economies further…and turn Tokyo into a basket case right next door to an atomic meltdown.

But don’t panic, because we’re turning the corner into a boom, so everything’s just fine. Merry Christmas. Only one more misery inducing Slogpost to go, and then you can pour yourselves into the Holidays.

http://www.businessinsider.com/patrick-chovanec-on-the-spike-in-chinese-interbank-rates-2013-12

The Biggest Financial Story In The World Is Playing Out Right Now In China

After a back credit crunch in June, we saw the seven-day funding rate, a measure of funding, surge to 8.94% on Monday, though at one point this went up to 10%.

This was the highest level since it hit 9.29% during the run up in rates in June.

But these aren't isolated incidents. We're seeing increased credit risk as defaults are rising, and bond yields are surging across the board.

Patrick Chovanec, chief strategist at Silvercrest Asset Management, told Business Insider in a telephone interview, that China's financial system has "high blood pressure." He said China's interbank lending market is "a petri dish of risk," and that this is the most important financial story this holiday season.

Here are some key points from our interview with Chovanec:

- The underlying issue is China's credit fueled expansion and that any moves to impose discipline lead to a run up in money market rates and risk provoking a crisis.

- The roots of the run up in rates this time around are the same as those that precipitated the credit crunch in June.

- The reserve requirement ratio, or the cash reserves that the Chinese central bank mandates banks need, has become a real constraint for banks. And the shadow banking system makes it more complex, because it allows banks to overextend themselves but these liabilities don't show up on balance sheets.

- We should expect more instances of rising money market rates going forward. But it isn't limited to this. We've seen government and corporate bond yields go up in the past several months. So this isn't a fluke regarding the interbank lending market.

- The interbank lending market is "a petri dish of risk," and China's financial system has become fragile and tangled up.

- The investment led growth model has made it so it's almost like the PBoC has ceded control of monetary policy to the shadow banks.

- The People's Bank of China is faced with a difficult choice, accommodate the banks or risk them going bust.

- The rise in Chinese money market rates, not the Fed taper, is the biggest financial story of the holiday season.

Here's the entire interview:

Business Insider: What's behind the rise in Chinese money market rates?

Patrick Chovanec: Well I think the underlying issue here is that China has been increasingly dependent on rampant credit expansion to finance its investment boom, and also to paper over losses from investments that have gone bad. And what that means is that more and more credit is needed to generate less and less real output. The People's Bank of China (PBoC) is very aware, and has been aware for many years of the danger of rapid credit expansion and that both it's fueling rising bad debt and also causing inflation, particularly asset inflation in the property market in China. But when they try and dial it back even a little bit, not tighten, just try to rein in the rate of credit expansion, they find that you've got banks and investment vehicles and companies that are overextended and can't meet their obligations.

That means that they either they have to pull the rug out from under them or essentially accede to their need for cash.

There's some people saying this is the PBoC, the Chinese government, trying to take control of the banking system. And in a sense it is but they are playing catch up and every time they do try they try, to use the word clamp down overstates it, that's the problem, every time they try to impose any kind of discipline over the rate of credit expansion, they risk provoking a crisis. So they end up accommodating the rampant credit creation that's already taking place. They're presented with a fait accompli - we've lost all this money or we have to roll over these debts, accommodate us or else.

BI: Some are saying this is like the credit crunch we saw in June...

PC: The roots of it are the same, maybe not the immediate causes, you can point to different immediate causes of why you know at the end of the year there's a particular need for cash. You have a couple of things going, the first is that for two years now, we've had at the end of every quarter there's a spike in the interbank lending rate, used to go up to 5%, which is now nothing, it used to go from 2-5%. What would happen was, small banks throughout China would blend, and they would turn then to the larger banks, and that's the way the interbank lending market has worked in China traditionally. It's the large banks are the ones that are basically the recipient for deposits, and the small banks throughout China are the ones that spearhead lending. And so it's the opposite of the way it used to be in the United States, with the money center banks, where basically you had all the smaller banks in the country that were taking in deposits and then they would send the money to New York to the interbank lending system, and those banks would be the main lending banks. It's the opposite of that. And the reason it is the opposite is that a lot of China's deposit growth is driven by its current account surplus, and to some degree what used to be a capital account surplus. And the large banks were the recipients of those deposits.

What happened was that every quarter, to meet the reserve requirement ratio, so every quarter the reserve requirement ratio became a real constraint in the beginning of 2011. We saw every quarter it would spike. They would make the loans and say we have to cover our positions. We have to get the cash to meet reserve requirement and that would place pressure. What subsequently happened, on top of that, that continues to be the case, but it's become more complex. The shadow banking system has both allowed banks to overextend themselves even further, in the hope that they can bring a bunch of stuff on the balance sheet at the end of the quarter. And the other thing that happened is there are a lot of instruments roll over at the end of every quarter and they are supposedly just investment instruments and have nothing to do with the banks' balance sheets. They're not on the banks' balance sheets. The money to cash them out is supposed to come from the investments themselves but they're not generating cash they're completely illiquid investments and so when they roll over the banks can just let them default, which they don't want to do. Not only do the have unhappy customers, they would have to default. So, what they end up doing, is they cash them out themselves and what that means is that there is a cash obligation that banks have, that shows up nowhere on their balance sheets.

That's why I use the word shadow bank, because it's not just informal lending as it used to be, but it has really become a hidden balance sheet to the banks, and that balance sheet has both assets of questionable worth and cash liabilities and obligations that don't show up. If you look at their balance sheet you would never say this bank is illiquid. But when people show up and they want to cash out their products that they bought and the bank doesn't want to let them default, they need cash.

It's not that the PBoC is unaware of it, but it's very difficult to gauge because it's not transparent. And also the PBoC has been trying for the past year or so to discipline the banks, to prevent them from going out and incurring these sorts of obligations, but once the obligations are created, they are there. And the PBoC is sort of presented with a fait accompli, 'okay you told us not to, but we did, and if you don't give us the cash to cover this then we're bust' and they [PBoC] say 'well okay, but don't do it again'.

BI: So, going forward, should we expect more of these rate spikes?

PC: Yeah. Back in June I said we're going to see this again, this is not an isolated incident. People said this is an isolated incident, some kind of aberration, the PBoC did it internationally to show people who is boss. Maybe yes there is an element of them imposing some kind of discipline but when they try they get this hug result which they didn't expect and this is a chronic problem. I think I may even have said this to you, that China's financial system has high blood pressure. In June it had a heart attack, it wasn't fatal but the heart disease is still there.

And it's not just the interbank lending market by the way. Everyone focuses on the interbank lending market but we've seen yields go up across the board in China. We've seen government bonds, we've seen corporate bonds, the rates go up steadily throughout the past several months. So this is not something that's sort of a fluke regarding the interbank lending market. Although the interbank lending market is a petri dish of risk. There are so many cross currents, there's so much circular money flows that goes through the interbank lending market to keep everyone liquid that's why it's the most complicated, the most fragile, and the most vulnerable to these sort of spikes.

BI: So where does this leave the PBoC which on the one hand is going for reform but on the other is still injecting cash to alleviate the symptoms?

PC: This is where it's bigger than the PBoC and it's management of monetary policy. This is where after the Third Plenum and the big report that was issued, everyone was so excited about it and I said wait a minute, because the biggest problem that they have is the fragility of the banking system. That they are on a runaway credit train and they have to rein it in, but the moment they try and rein it in they get which was always a reason why they shied away from it in the past, but also defaults. And that's where de-regulation of interest rates and accountability they look great on paper, but when you try and put it to practice then the imbalances have become so great, that there's a real cost to be paid. And this reminds me of back in April after they had a lending boom and GDP nevertheless slid, instead of producing a bump, it slid, Premier Li and he said we can no longer use credit fueled investment stimulus to drive growth, we have to engage in real reform, real rebalancing, shift to a new growth model and it's back to a month before when he stood before the MPC and said reform is going to be painful like slitting our wrists. So, I think there was this recognition on his part that this was a dead end, that yes you could kick the can down the road, but this road was a dead end. And that moving away from it would be very painful.

But look what happened in May going into June, you had a government bond issue fail and then you had the June credit crunch. Again, the moment you try to dial it back, even a little bit, you get something where they say okay, we capitulate, we have to provide whatever cash is necessary to keep everybody liquid. And again what you effectively do is cede control of monetary policy to the shadow banks, not in the sense that this is some kind of agenda they have. It's just the model that pushes out investment led growth through insatiable demand for credit but is generating less and less real result. The question is how do they get over it? When you're in a hole the first you do is stop digging.

BI: The PBoC's open market operations don't even seem to be helping...

PC: It's hard to tell what the PBoC is doing right now. And it was hard to tell in the after math when they move from their transparent mechanism like reverse repos, but what we saw in June was to directly providing assistance without any announcements, to key banks. I've heard there were TARP like sums involved in order to ensure liquidity. We don't know, they might announce they're doing something but we wont know the amount, the conditions, or the recipients. They can certainly do that and we may not even be fully aware of the level of intervention. That's why it was a little difficult to interpret what was happening in the wake of the June liquidity crunch. It sounds like with these SLOs they're moving in that direction of direct under the table assistance to key banks, on an undisclosed basis. We'll see it with rates falling they'll do whatever they have to do to bring the rates down. But it doesn't solve the problem, it alleviates the symptoms of the problems. But it actually makes the problem worse.

BI: There was an FT report about propaganda officials telling financial journalists to tone down the coverage of the rise in money market rates and the liquidity squeeze we're seeing...

PC: It was reported by the Financial Times and the only thing I know about that is what I read in the article. But I do think that that is significant. If this really was something that was not a concern I think they would brush it aside and they would say talk all you want about it,but we've got it under control. I always think that whenever they say okay don't talk about this, it's obviously something worth talking about. When they protest too much, and it's obviously something. It just seems to me it shows their anxiety over a situation that is not easily containable.

It is easily resolvable in that the PBoC can print as much money as it wants, and yes you can bring rates down and you can have plentiful liquidity in the system. But then what have you done? You've basically waved the white flag, you've said okay we're not going to rein in credit at all, in fact we're going to give you as big of a punch bowl as you could possibly want. They could that but that would only make it worse because the lending continues, the bad debt continues to rise, you have to roll over even more bad debt, and the demand for cash becomes even greater. And in the mean time you're pumping all this money in, and its going into the property market and bidding up property prices like crazy.

BI: What is the biggest takeaway from this for investors?

PC: The biggest takeaway, when I was writing on the risk of financial instability in China two years ago, most people would laugh like that's ridiculous. And I think it's starting to dawn on people just how fragile, and what's the word I'm looking for, tangled China's financial system has become. A lot of people say they hold $3.5 trillion in reserves, they own the banks, which is all true, though the bit about the $3.5 trillion in reserves is irrelevant. But people would say stuff like it's inconceivable that we would see any form of financial instability in China. Well what we're seeing is a form of financial instability. It takes place in the context of a week ago when a major trust blowing up. So it's not some kind of isolated thing, we see yields rising across the board, we've seen a major trust product blow up, the latest of many that did not garner the same attention. Credit risk is rising, you talk to most Chinese officials, they'll admit credit risk is rising. And we see overall debt levels rise dramatically in China. And we've got the interbank lending market, which is keeping everyone from defaulting, is on the verge of a breakdown. Because once you get above 10% the market begins to break down.

BI: How would you describe China's financial system in one sentence?

PC: I don't think people have appreciated how much China's financial system has changed in the last three years. It is unrecognizable from what it was. I'm not going to be flip and say it's a Ponzi scheme, but the risk of real financial instability China has been neglected by people for a long time.

BI: Is there anything else you think our readers should know?

PC: One thing I would add is we think of China as an emerging market, that's going to go through it's own emerging market crisis and it's not going to affect the rest of the world. But it's the number two economy in the world. The global financial system doesn't have that much direct exposure, but there's a lot of indirect impact through China's real economy, through currency flows, capital flows in particular, we've see the U.S. dollar carry trade over the past several months. I would say what's going on in China right now is the most important story over this holiday season. It's the most important financial story out there now. I mean honestly compared to QE, they reined in QE purchases by $10 billion a month, big deal, compared to the idea that you could have the financial system in the second largest economy in the world really go haywire.

http://www.zerohedge.com/news/2013-12-23/china-folds-un-tapers-repo-rates-remain-elevated

China Folds, "Un-Tapers"; But Repo Rates Remain Elevated

Submitted by Tyler Durden on 12/23/2013 21:09 -0500

UPDATE: Un-Taper didn't work - 7-day repo just hit 9% as (just as we warned) the small banks are left wth scraps

For the first time in 3 weeks, the PBOC un-tapered and added CNY 29 billion liquidity (via reverse repo). Despite the Chinese governments denial of any liquidity crisis, the decision to "fold" reflects a clear indication that, as Monex strategist Eimear Daly notes, "China's attempting to incrementally liberalize markets and to allow instabilities to unwind with minimal damage; and spikes in interbank lending rates show authorities are struggling to manage this task."

The liquidity was provided at 4.1% (not a particularly low rate but overnight repo is well off the highs of the last week) but 7-day repo rates (though down 3.5%) remain high at 5.5% (150bps above the 'normal' levels of July to October).

The night is young though as we suspect, just as yesterday, the big banks will soak up the first juice and leave the small banks (who need the most) floundering...

As Eimear Daly adds,

Under govt-protected financial markets, instabilities build up: a property market bubble, unprofitable lending, severe overcapacity and high levels of private and local govt debtTaking the economy from govt control to unrelenting scrutiny of financial markets involves a shockEven if China manages to bring its economy onto a slower growth path with limited turbulence, it will weigh on growth across EMs

Chart: Bloomberg

http://www.zerohedge.com/news/2013-12-23/fat-finger-sends-long-bond-futures-soaring-overnight-trade

Fat Finger Sends Long Bond Futures Soaring In Overnight Trade

Submitted by Tyler Durden on 12/23/2013 07:23 -0500

Anyone who had the pleasure of trading the long bond March future ZB H4 just before 1:40 am Central witnessed one of the more abnormal fat fingers seen in recent months, one that did not involve equities but instead was all bond.... long bond, which soared from 130 to over 135, after a large clip was traded on what was apparently an erroneous buy order put through during very illiquid trading. Then again, with no trades busted by the CME (yet), maybe it was intentional.

They saw this:

And, zoomed in, this.

It is unclear who or why executed the fat finger: we expect to learn more today, although we do know that a move like this during regular trading hours would have had an unprecedented and very adverse impact on not only bonds, but absolutely all risk-chasing asset classes. Let's just hope it's not a test, and certainly not a harbinger of what's in store for bond traders now that HFT algos have firmly moved into the asset class and where "price action" is determined solely by what someone else's "price" does.

Update: The CME will "revise" all trades above 131.12 down.

http://www.zerohedge.com/news/2013-12-22/china-fixes-liquidity-crisis-banning-media-use-words-cash-crunch

China "Fixes" Liquidity Crisis By Banning Media Use Of Words "Cash Crunch"

Submitted by Tyler Durden on 12/22/2013 23:20 -0500

UPDATE: 7-day repo is now up 220bps at 980bps - as the "liquidity crisis" is worse than any other seasonal effect on record...

and to think the media was proclaiming the crisis over just an hour ago as the rate (in green) was sent around the world...

How do you "fix" a nations' banking system's increasingly desperate need (and dependence upon) for government-provided liquidity without giving in and just providing all the inflation-stoking liquidity the banks demand?Simple - in China - you ban the media from discussing it. As The FT reports, Chinese propaganda officials have ordered financial journalists and some media outlets to tone down their coverage of a liquidity crunch in the interbank market, in a sign of how worried Beijing is that the turmoil will continue. The censors have warned reporters not to "hype" the multiple-sigma spikes in overnight-funding rates and have forbidden the press from using the Chinese words for "cash crunch."

Of course - early prints in today's repo market are seeing levels normalize back to around 4-5% (just as Goldman Sachs 'suggested' they would because this liquidity spike is nothing but 'seasonals' - hhhmm)

Via The FT,

Chinese propaganda officials have ordered financial journalists and some media outlets to tone down their coverage of a liquidity crunch in the interbank market, in a sign of how worried Beijing is that the turmoil will continue when markets reopen on Monday.Short-term interest rates for loans in the interbank market shot up last week in an apparent repeat of the cash crunch in June...Money market rates surged again on Friday, even after China’s central bank announced on Thursday evening that it had carried out “short-term liquidity operations” to alleviate the problem....In response Chinese censors have warned financial reporters not to “hype” the story of problems in the interbank market, and in some cases have forbidden them from using the Chinese words for “cash crunch” in their stories, according to two people with direct knowledge of the matter who asked not to be named.The Communist party’s powerful propaganda department and various other party and government bureaux frequently issue bans and detailed instructions to Chinese media on “sensitive” issues that could undermine party legitimacy....That directive also ordered media to “strengthen their positive reporting” and “fully report the positive aspect of our current economic situation, bolstering the market’s confidence”, according to a copy obtained by the FT.

No comments:

Post a Comment