Saturday items.....

http://healthaffairs.org/blog/2013/11/09/implementing-health-reform-the-individual-market-mental-health-and-substance-abuse-parity/

November 9th, 2013

http://hotair.com/archives/2013/11/09/obama-considers-costly-unilateral-fix-of-obamacare-subsidies/

http://twitchy.com/2013/11/08/perspective-email-to-bret-baier-on-healthcare-gov-debacle-generates-overwhelming-response/

http://dailycaller.com/2013/11/09/obama-to-cantor-in-2010-8-to-9-million-americans-will-lose-coverage/

Friday items.......

http://www.thegatewaypundit.com/2013/11/medicaid-enrollment-soars-with-obamacare-1-5-enrollees-so-far/

Note the slant by the NYT.

Supposedly costs won't rise much because few people demand mental health services. Well, watch what happens when you mandate expanded "free" services.

And if by some amazing miracle additional free services do not increase costs, it's important to note that a small percentage of people are responsible for huge portions of overall costs.

Cumulative Distribution of Personal Healthcare Spending

Facts and Figures

Those numbers are from a 2012 study on the Concentration of Healthcare Spending by the National Institute for Health Care Management (NIHCM).

Obamashock! Apology

Yesterday, the president made a quasi-apology for the holes and gaps in the law.

Link if video does not play: Exclusive: Obama personally apologizes for Americans losing health coverage

After the Non-Apology

CNN discuses Obamacare: After Obama's apology, talk of solutions and -- still -- the website

My Personal Experience - Obamashock!

More Obamashock! Glitches Hit Paper, Phone Applications; Obamacare Glitch Great Quotes

Mike "Mish" Shedlock

Read more at http://globaleconomicanalysis.blogspot.com/2013/11/expect-another-leap-in-healthcare-costs.html#Hh0JLwEp2BCl0Twf.99

http://hotair.com/archives/2013/11/08/new-obamacare-website-czar-on-repairs-were-a-long-way-from-where-we-need-to-be/

http://hotair.com/archives/2013/11/08/most-uninsured-ignoring-healthcare-exchanges/

http://hotair.com/archives/2013/11/08/vulnerable-democrats-on-getting-healthcare-gov-fixed-tick-tock-white-house/

Analysis: Tens of millions could be forced out of

http://healthaffairs.org/blog/2013/11/09/implementing-health-reform-the-individual-market-mental-health-and-substance-abuse-parity/

Implementing Health Reform: The Individual Market; Mental Health And Substance Abuse Parity

November 9th, 2013

The first week of November, 2013, was a very bad week for the health care reform project. Healthcare.gov continues to stumble. Although the Department of Health and Human Services continues to insist in daily briefings that the performance of the website is improving, and that it will be fully operational by the end of November, improvement is frankly not yet visible. Full functionality in time for millions of Americans to enroll in coverage in time for the premium tax credits becoming available on January 1, 2104, looks increasingly unrealistic.

The news of the week, however, focused not only on the website woes, but also on millions of Americans in the individual and small group markets who have received notices that their current coverage is not going to be available in 2014 and that the policies that are available are going to cost them more, and in some instances impose higher cost-sharing obligations. The media have characterized these notices as “cancellation” notices, but in fact in most instances they are not terminating coverage as such, but rather changing the form of coverage that is available. In any event, enrollees receiving these notices are understandably upset and are complaining loudly to the media and to their congressional representatives.

Both HHS Secretary Sebelius and Center for Medicare and Medicaid Services Administrator Tavenner testified before Congressional committees, facing hostile questions (indeed demands for resignation in the case of Sebelius) from Republicans, who have long fought against the legislation, and anxious pleas from Democrats, who have long stood by it. At the end of the week, President Obama, apologized to those whose premiums were increasing, saying, “I’ve assigned my team to see what we can do to close some of the holes and gaps in the law,” and suggesting that there might be some sort of “administrative fix” that could help those whose costs were increasing but who would not be eligible for the premium tax credits.

Analyzing Events In The Individual Market

A steady stream of bills were introduced in Congress over the week as members came up with their own fixes. Congressman Upton’s “Keep Your Health Plan Act of 2013” would allow insurers throughout 2014 to continue to offer outside of the exchanges any policy that they had offered in 2013 without complying with ACA requirements that go into effect in 2014, such as the ban on pre-existing condition clauses, the essential health benefits, or actuarial value tiering. Senator Landrieu’s “Keeping the Affordable Care Act Promise Act” would go further, allowing individuals who had coverage in the nongroup market in 2013 to keep that coverage indefinitely and prohibiting insurers from terminating it unless the insurer left the market altogether. Other proposed legislation would delay the individual responsibility requirement for a year.

It should have been clear from the beginning to anyone who was paying attention that the President’s promise, “If you like your plan, you can keep your plan,” did not apply to plans that people may purchase at any time in the future, but to plans that were in existence at the time the ACA became effective, March 23, 2010. That is what the statute says. Moreover, that is the way grandfather clauses work. New laws generally apply prospectively, and do not change existing arrangements. They do not protect noncompliant practices that are initiated after the law is enacted.

The individual market has always been volatile, and it was known from the beginning that few plans would retain grandfathered status by the time the 2014 reforms went into effect, as I noted in my Health Affairs Blog post on the grandfathered plan regulation in 2010. Moreover, the ACA only provided that the law itself would not terminate grandfathered status; it did not prohibit insurers from terminating grandfathered policies. Apparently, as the number of enrollees in grandfathered plans has steadily diminished, and presumably their risk experience deteriorated, a number of insurers have decided that now is the time to terminate those policies. True grandfathered coverage is thus disappearing.

A bigger problem, however, is that individual coverage is simply becoming more expensive, at least in many markets for many insureds. This is in part, no doubt, due to coverage improving. Existing plans in the individual market often have very high deductibles and out-of-pocket limits that are no longer legal under the ACA. They have also historically often excluded benefits such as maternity or mental health coverage, now required as essential health benefits. In some extreme cases, very cheap plans excluded hospital coverage. Of course, if individuals are satisfied with high deductible plans, it may be difficult to convince them that a lower deductible plan is in their own interest (or that it may protect others from having to pay for their care if they cannot ultimately afford cost sharing that they incur). Convincing older individuals that they need maternity coverage is an even harder sell.

But a larger share of the premium increase is likely not attributable to changes in coverage but rather to the changing nature of the risk pool. Insurers in the individual market have traditionally been able to underwrite based on health status, age, gender, or virtually any other factor they may consider relevant to risk. After January 1, 2014, they may only consider age (with a 3 to 1 variation), tobacco use, geographic area, and family size. Individuals who have long been denied coverage or charged very high premiums because of their medical condition will have access to coverage at standard rates. But individuals who have benefited in the past from low premiums attributable to their age, health, or gender will inevitably see higher premiums. Moreover, since insurers are undoubtedly projecting that more unhealthy than healthy individuals will enter the market, this is not simply a zero-sum game. Premiums are going up across the market.

This is the inevitable result of moving from health status underwriting to modified community rating with guaranteed issue and no pre-existing condition exclusions. It was clear from the beginning that this would happen. But it was hoped that the individual responsibility requirement and the availability of premium tax credits (plus the reinsurance, risk adjustment, and risk corridor programs) would stabilize the risk pool and make insurance affordable for all. The biggest problem right now is that healthcare.gov is not working, so that individuals who will be helped by the premium tax credits cannot see what they will really be paying. But it also seems that insurers have set their rates based on projections that the 2014 risk pool is going to be pretty expensive, and that state regulators have allowed them to do so.

In any event, the proposed solutions may simply make matters worse. Allowing insurers to offer or to continue 2013 coverage into 2014 (or worse, indefinitely) will simply segment the risk pool, making 2014 coverage even less affordable to those who have been excluded from coverage or would be excluded under 2013 underwriting rules. Of course, many insurers have already extended 2013 policies into 2014, increasing 2014 premiums, but the Upton and Landrieu legislation would simply make matters worse. Moreover, insurers have already set their 2014 rates. If they were allowed (or required) to continue 2013 coverage, they would have to recalculate their 2014 rates, and then have these rates approved by state insurance departments. This is not a simple matter and would greatly add to the cost of exchange coverage and federal subsidies.

I cannot imagine what, if any, administrative fix the President has in mind. The administration cannot simply dole out money to individuals who are seeing premium increases but who do not qualify for premium tax credits (unless there is a special FEMA fund that covers this sort of political emergency). We have already seen the administration delay enforcement of a number of ACA requirements, most notably the employer responsibility penalty. Perhaps the administration could delay enforcement of the essential health benefits requirement or the ACA cost-sharing limits to reduce the cost of coverage, but insurers would again have to redo their 2014 forms and rates, and the states would have to approve them.

Allowing insurers to continue to underwrite based on health status for 2014 could bring down premiums for some, but would turn the exchanges into high risk pools, dramatically driving up 2015 rates and possibly causing insolvencies among the CO-OP plans and other 2014 new entrants. Even delaying the enforcement of the individual responsibility requirement beyond March 31 (which is already a month and a half delay) or open enrollment beyond that date would have serious consequences for the risk pool and insurers.

In sum, HHS needs to get healthcare.gov working and enroll as many people as it can as quickly as it can. In the long run, more Americans will benefit from the reforms than will be hurt by them. But, as has been noted, those who are being hurt the most are often individuals who were already ideologically opposed to the law, and all of their beliefs are being confirmed. And moderate Democrats running in red states have every reason to fear the anger of these individuals.

A forgotten group. It must also be remembered that the biggest losers as 2014 approaches are low-income individuals in states that have refused to expand Medicaid. Millions of Americans with incomes below the poverty level in these states are not simply facing increased premiums, but being denied coverage altogether. But no one in Congress, or in the affected states, seems to be scrambling to fix this truly urgent problem.

Mental Health And Substance Abuse Parity

In the midst of this turmoil, HHS together with the Departments of Labor and Treasury, released on November 8, 2013, final rules implementing the Paul Wellstone and Pete Domenici Mental Health Parity and Addiction Equity Act of 2008 (MHPAEA). The agencies released with the rule a set of Frequently Asked Questions, as well as a study of large employer compliance with the law.

Congress adopted the original Mental Health Parity Act (MHPA) in 1996, prohibiting large group health plans that offered mental health benefits from imposing higher aggregate lifetime or annual dollar limits on mental health benefits than on medical/surgical benefits. The MHPAEA, adopted in 2008, strengthened parity protections; it extended parity protections to substance-use disorder benefits and provided that financial requirements (such as copayments or coinsurance) and treatment limitations (such as visit limits) that group health plans impose on mental health and substance-use disorder benefits cannot be more restrictive than the predominant financial requirements and treatment limitations that the plans apply to substantially all medical/surgical benefits.

The Affordable Care Act extended these parity requirements to the individual and small group markets. Indeed, the ACA required non-grandfathered health plans in the individual and small group market to cover mental and substance-use disorder benefits as essential health benefits and applied mental health parity requirements to qualified health plans. The ACA also made other changes that affected the parity requirements, such as eliminating annual and lifetime dollar limits for essential health benefits generally, including mental health and substance use disorder benefits, and requiring coverage of preventive services.

The three agencies published interim final regulations implementing the MHPAEA in February of 2010, effective July 2010. The Departments have also issued a series of frequently asked questions clarifying the interim final rules. The final rule adopts these interim final rules and clarifications with some further changes and extends and modifies their coverage as required by the ACA. It is effective July 1. 2014.

What the final rules say. The final rules define mental health and substance-use disorder benefits as benefits with respect to items and services for mental health conditions or substance use disorders as defined by the terms of the plan in accordance with federal and state law and classified consistently with general recognized standards for current medical practice. The basic rule is that where plans or issuers offer mental health or substance use disorder benefits in one of six classifications, they cannot impose financial requirements or quantitative treatment limitations on those benefits that are more restrictive than the predominant requirements or limitations that apply to substantially all medical surgical benefits in the same classification. The six classifications are in-network inpatient, out-of-network inpatient, in-network outpatient, out-of-network outpatient; emergency care, and prescription drugs. Plans or issuers are required to perform the parity analysis annually in years when a change in benefit design, cost-sharing structure, or utilization affects the analysis within a classification.

A financial requirement or quantitative treatment limitation is considered to apply to “substantially all” medical/surgical benefits if it applies to at least two-thirds of the medical/surgical benefits in a classification. A type of financial requirement or quantitative treatment limitation is considered “predominant” if it applies to more than one half of the medical/surgical benefits in a classification that are subject to the requirement or limitation. For example, if two thirds of the medical surgical benefits in a classification were subject to a coinsurance obligation, and more than half were subject to a coinsurance obligation of 30 percent, mental health benefits could be subject to a coinsurance obligation, but it could not exceed 30 percent.

Where different financial requirements or treatment limitations apply within a classification, plans may combine levels until the combination of levels applies to more than one half of the medical/surgical benefits subject to the requirement or limitation, and apply this requirement or limitation to mental health benefits. The portion of medical/surgical benefits subject to a financial requirement or quantitative treatment limitation is based on dollar amounts for plan payments for the benefits expected to be paid under the plan, before enrollee cost-sharing requirements are applied. So, for example, if 20 percent of payments for medical/surgical services were for services in a classification with a 10 percent coinsurance level, 40 percent for services with a 15 percent coinsurance level, and 40 percent for services with a 20 percent coinsurance level, the plan or issuer could apply a 15 percent coinsurance level to mental health and substance abuse disorder services. If plans offer coverage through separate insurers for mental health or substance use disorders on the one hand and medical/surgical services on the other, parity calculations must apply to combined coverage as a whole.

Outpatient benefits can be further sub-classified as office visits and all other outpatient items and services, but other sub-classifications, such as separate categories for generalists and specialists, are not permitted for parity analysis. Where plans or insurers have tiered networks in which different levels of financial requirements or treatment limitations apply to different tiers of providers, the parity analysis may also be applied within each tier as a sub-classification, as long as the tiering is based on reasonable factors and without considering whether a provider is a mental health/substance use disorder provider or medical/surgical provider.

Cumulative financial requirements, such as deductible requirements or out-of-pocket limits, and cumulative treatment limits (such as annual or lifetime visit limits) cannot be applied separately to mental health and substance use disorder and medical/surgical benefits. The large employer compliance study found that in fact virtually all large employers have eliminated separate mental health and substance abuse disorder deductibles in compliance with the law.

The 1996 MPHA prohibited plans and issuers from imposing annual and lifetime dollar limits on mental health benefits that were not imposed on medical/surgical benefits. The ACA eliminates lifetime dollar limits and, as of 2014, annual dollar limits on all essential health benefit items and services. The final rule continues to include dollar limit parity requirements, but these now only apply to mental health and substance abuse disorder services that are not essential health benefits, which will be a limited set of services.

The ACA does not require large group plans to provide mental health services. It does, however, require all plans and issuers to provide specific preventive mental health services, which include certain mental health or substance use disorder services, including alcohol misuse screening and counseling, depression counseling, and tobacco use screening. The final rule clarifies that large groups that cover these preventive services are not thereby considered to cover mental health services and required to cover the entire range of mental health and substance use disorder services.

The MHPAEA prohibits plans and issuers from imposing nonquantitative treatment limitations, “with respect to mental health or substance use disorder benefits in any classification unless, under the terms of the plan as written and in operation, any processes, strategies, evidentiary standards, or other factors used in applying the NQTL to mental health or substance use disorder benefits in the classification are comparable to, and are applied no more stringently than, the processes, strategies, evidentiary standards, or other factors used in applying the limitation with respect to medical/surgical benefits in the same classification.” The final rule includes a nonexhaustive list of NQTLs, including:

.

.

- Medical management standards based on medical necessity or medical appropriateness, or based on whether the treatment is experimental or investigative;

- Prescription drug formularies;

- Network tiers;

- Standards for provider admission to participate in a network, including reimbursement rates;

- Plan methods for determining usual, customary, and reasonable charges;

- Step therapy protocols;

- Exclusions based on failure to complete a course of treatment; and

- Restrictions based on geographic location, facility type, or provider specialty.

Plans and issuers must disclose medical necessity criteria to plan enrollees and contracting providers and must provide on request the reason for any denial based on medical necessity. Disclosure may also be required under ERISA or the ACA.

The final rule removes a provision from the interim final rules that authorized the application of NQTLs specific to mental health or substance use disorder treatments based on “recognized clinically appropriate standards of care.” Plans and insurers can still, of course, consider clinically appropriate standards of care, but must apply them to mental health and substance use services comparably and no more stringently than they are applied to medical/surgical services. Disparate results, however, do not alone mean that NQTLs are being applied improperly.

A difficult issue addressed by the final rules is whether plans and issuers must cover the full range of mental health and substance use disorder services within a classification or only services that are comparable to covered medical/surgical services. This is a particular issue for “intermediate services” such as residential treatment, partial hospitalization, or intensive outpatient services. The final regulation does not require coverage for these services, but if plans and issuers cover similar medical/surgical services such as rehabilitation or home health services, they may also be required to cover intermediate services.

The MHPAEA does not cover small employers. For ERISA plans and other plans regulated by Labor and Treasury, this means employers with 50 or fewer employees. For non-Federal governmental plans regulated by HHS, small employer is defined as an employer with 100 or fewer employees. The MHPAEA does not require large employers to offer mental health or substance abuse services. Indeed, it does not require plans and insurers that do provide such services to cover all mental health conditions or substance abuse disorders.

Under the ACA, however, non-grandfathered small group plans are subject to the MHPAEA and must cover mental health and substance use disorder benefits to the extent these benefits are required under the benchmark essential health benefits plan. Under the ACA and amendments to the MHPAEA, moreover, grandfathered and non-grandfathered individual plans must comply with the MHPAEA. The MHPAEA does not apply directly to Medicaid and CHIP managed care plans, but its principles apply to these plans through separate regulations. The law does not apply to retiree-only plans.

Under the MHPAEA, plans and health insurers that experience a cost increase of more than 2 percent the first year and one percent in subsequent years are excused from compliance for years beginning after July 1, 2014. This exemption may only be claimed every other year, since in years that plans are excused from compliance their compliance costs should not increase. The final rule sets out a formula and procedure for calculating increased costs. Plans that claim this exemption must give notice to their enrollees, the applicable federal department, and appropriate state regulators, and must on request make available to their enrollees at no charge a summary of the information on which the exemption is based.

State insurance laws regulating mental health and substance abuse coverage are only preempted by the MHPAEA to the extent that state laws prevent the federal law’s application. If state laws require mental health or substance abuse disorder services, those services must be provided in compliance with the federal law.

Finally, the final rule contains a technical correction clarifying the scope of the federal external review process.

Large employer compliance. The large employer study published with the rule found that most large employers have come into compliance with parity requirements with respect to inpatient, emergency, and prescription coverage. However, as late as 2011, a significant number of plans still required larger copayment or coinsurance rates for mental health services. The study also found that a very small percentage of employers — fewer than 2 percent — dropped mental health coverage in the wake of the MHPAEA. Small group coverage is estimated at 95 percent.

The preface to the rule, however, notes that currently about one third of individual policies do not cover substance abuse disorder services and nearly 20 percent have no mental health coverage. These plans will have to change for 2014. The MHPAEA should however, reduce out-of-pocket expenditures in the individual market, from 47 to 26 percent of mental health and substance use disorder costs. Even so, CMS estimates that implementation of the MHPAEA will expand health care costs only by 0.6 percent.

Other Notices

Finally, there have been a number of Paperwork Reduction Act notices published in recent days as HHS puts in place various forms and reporting requirements. These include program integrity reporting requirements , qualified health plan reporting requirements, and marketplace enrollee satisfaction survey forms. The satisfaction survey forms are available in Chinese, English, and Spanish.

http://hotair.com/archives/2013/11/09/obama-considers-costly-unilateral-fix-of-obamacare-subsidies/

Obama considers costly unilateral “fix” of Obamacare subsidies

POSTED AT 3:01 PM ON NOVEMBER 9, 2013 BY KARL

When the going for Obamacare gets tough, the Administration considers throwing more money at the problem. To quote the Allahpundit, “Shocka“:

The Obama administration is considering a fix to the president’s health care law that would expand the universe of individuals who receive tax subsidies to help buy insurance, an administration source told The Huffington Post.***According to the administration source, the White House is “looking at an administrative fix for the population of people in the individual market who may have an increase in premiums, but don’t get subsidies.”

Even liberal pundits like Paul Waldman wonder how the Administration does this without Congress. True, Obama has not considered the Constitution to be much of a constraint in other situations. On the other hand, exploding the projected cost of O-care subsidies from $458 billion to $1.2 trillion in just the first six years might be difficult to pull off with a wave of the administrative wand.

Yet the most interesting thing about this trial balloon is the extend to which it does not fix what you would think the Left would consider the problem with O-care subsidies. The proposal could be a purely unserious political feint which tries to put the GOP in opposition to decreasing O-care’s pain (per Waldman’s suggestion), or — like Obama’s “sorry, not sorry” this week — to avoid supporting broader legislative fixes. If not, the Administration may have deeper political concerns in mind.

The policy landscape is fairly well-understood, even across ideological lines. As Avik Roy and the Manhattan Institute crew show, health care premiums are set to increase significantly on average under Obamacare, even after the subsidies are included in the calculations. Moreover, there will be distinct winners and losers under this scheme. Men, particularly young men, will tend to be losers. Young women and those approaching retirement age will tend to benefit. TNR’s Jonathan Cohn does not directly dispute much of this analysis. Rather, he relies on experts suggesting O-care will produce more winners than losers, “as long as you account for subsidies, Medicaid, and the ability of young adults to enroll in special catastrophic plans or stay on their parents’ policies,” particularly the Medicaid expansion. These are important qualifiers, as we we will see later.

Cohn continues with perhaps the most salient point:

Of course, the debate about how premiums is just one piece of the story. The ultimate question is whether, under Obamacare, people buying insurance on their own think they are getting a good deal. And the answer to that question will depend on a bunch of factors—not just how much people pay up front in premiums, for example, but also what kind of out-of-pocket costs they face if and when they get sick. And what’s affordable to one person may not seem so affordable to another.

Indeed. Accordingly, it is useful to look at a couple of several examples provided by heath industry consultant Robert Laszewski, based on fairly typical figures from California for the mid-range “Silver” plans to which subsidy levels are tied:

A single person making $22,980 per year would face a premium, net of subsidies, of $121 per month. That’s pretty good.However, the point most people have been missing is that same person would also face a $500 deductible and up to $2,250 in out-of-pocket costs for things like co-pays. If the individual were sick, that looks like a pretty good deal. If they were healthy, would they spend what is perhaps 10% of their monthly take home income for a plan with an upfront $500 deductible?***For so many individuals and families, 10% of their take home income is a huge issue. This is the marginal income left at the end of the month, after taxes, rent, and car payments that is so critically important to them. As purely an insurance value, it’s a good deal. But the notion that hard earned and important dollars would be spent for something they aren’t going to get any measureable short-term value for is another matter entirely.***A family at 300% of the federal poverty level will make $71,000 and have to pay out 9.5% of their income for premium, or $6,700 a year for that second-lowest cost Silver plan. How many families making even this much have an extra $558 a month in their budget to buy a plan with a $2,000 per person deductible?

At The Guardian — no right-wing outlet — Marc Rubin notes the same problem with respect to the low-end “Bronze” plans:

The cost alone of these “low end” policies are producing sticker shock when people see them. It gets worse when people see what the insurance companies are actually offering for these premiums. That’s when they get the second shock.Many uninsured are finding that the bronze or lowest end policies are being priced in the range of $250 a month and up on average and that they come with $6,000 yearly deductibles(pdf) to be paid out of pocket before they get full coverage. Until then, they pay 40% in co-pays until the $6,000 out-of-pocket is reached in addition to the monthly premiums. And again, this is for the bottom tier polices for a single person, not a family. Costs to a family are higher.It doesn’t take Warren Buffet’s financial savvy to figure out that young, healthy uninsured Americans, who are largely uninsured because they can't afford health insurance in the first place, are not going to be flocking to buy these policies for the privilege of having a health insurance card in their wallets that requires another $6,000 out-of-pocket before their expenses are fully covered and includes co-pays of 40% of all initial costs until that $6,000 is reached. What most of them will do is what they have been doing – live without insurance and go to an emergency room if they need medical care where the law says they have to be treated whether they have insurance or not.

As Laszewski notes, the problem with the subsidies results in part from the fact that the Democrats wanted to price Obamacare at below $1 trillion for political reasons. We have already seen the establishment media begin to report on the degree to which the implementation of O-care — though Healthcare.gov — was compromised by political considerations. We have yet to see much revisiting the degree to which politics warped the creation of the policy itself. Jay Cost has been tweeting about it, and the many times progressives have done it in the past.

Politics also would appear to be the motivating factor behind the Administration’s latest trial balloon. As Byron York noted earlier this week, “[t]he key to Obamacare’s success or failure — provided the administration can actually learn to operate the system — is whether it helps more people than it hurts, or hurts more people than it helps.” I would slightly amend that argument. The key is whether the Administration, and Democrats in general, have a net gain politically.

Progressives see a net gain, but not just on the subsidized voter — they rely on those getting Medicaid (to the extent Medicaid actually helps) and young people staying on their parents’ plans. But the younger and poorer population is also less likely to vote than the older, healthier and wealthier. Providing subsidies to people with incomes higher than 400% above poverty may help stabilize a risk pool currently being filled mostly by the Medicaid expansion. However, as subsidizing the more affluent does nothing for the people in the examples described above, one might be forgiven for suspecting the Administration is looking to buy off more likely voters who will feel the pains of O-care.

http://twitchy.com/2013/11/08/perspective-email-to-bret-baier-on-healthcare-gov-debacle-generates-overwhelming-response/

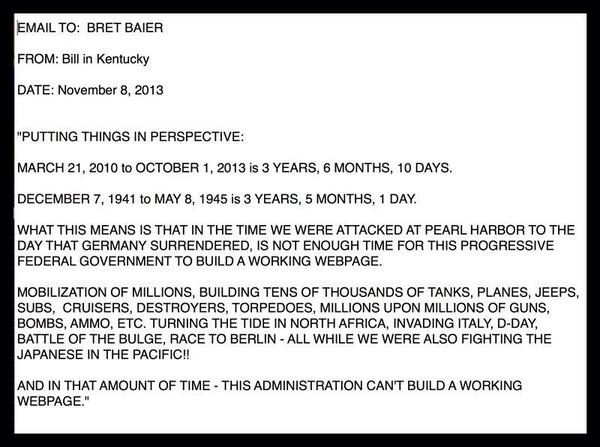

This message came to us from Bill in Kentucky.“Putting things in perspective: March 21st 2010 to October 1 2013 is 3 years, 6 months, 10 days. December 7, 1941 to May 8, 1945 is 3 years, 5 months, 1 day. What this means is that in the time we were attacked at Pearl Harbor to the day Germany surrendered is not enough time for this progressive federal government to build a working webpage. Mobilization of millions, building tens of thousands of tanks, planes, jeeps, subs, cruisers, destroyers, torpedoes, millions upon millions of guns, bombs, ammo, etc. Turning the tide in North Africa, Invading Italy, D-Day, Battle of the Bulge, Race to Berlin – all while we were also fighting the Japanese in the Pacific!! And in that amount of time – this administration can’t build a working webpage.”

http://dailycaller.com/2013/11/09/obama-to-cantor-in-2010-8-to-9-million-americans-will-lose-coverage/

President Barack Obama admitted in 2010 that 8 or 9 million Americans would lose their existing health insurance plans under Obamacare.

plans under Obamacare.

“The 8 to 9 million people that you refer to that might have to change their coverage — keep in mind out of the 300 million Americans that we’re talking about — would be folks who the CBO, Congressional Budget Office, estimates would find the deal in the exchange better,” Obama said to Rep. Eric Cantor at a February 25, 2010 White House summit on health insurance regulation.

The millions of Americans recently thrown off their existing health plans are finding the deals in the Obamacare exchanges to be not better, but actually much, much worse.

exchanges to be not better, but actually much, much worse.

Friday items.......

http://www.thegatewaypundit.com/2013/11/medicaid-enrollment-soars-with-obamacare-1-5-enrollees-so-far/

Medicaid Enrollment Soars With Obamacare – 1.5 Million Enrollees So Far

Posted by Jim Hoft on Friday, November 8, 2013, 7:49 PM

It’s worse than we thought.

Medicaid enrollment has soared since the Obamacare exchanges opened on October 1, 2013. In Maryland the number of new enrollees is more than 25 times the number of those who signed up for private coverage. 1.5 million have signed up for Medicaid so far.

Medicaid enrollment has soared since the Obamacare exchanges opened on October 1, 2013. In Maryland the number of new enrollees is more than 25 times the number of those who signed up for private coverage. 1.5 million have signed up for Medicaid so far.

The cost of Obamacare’s Medicaid expansion will further burden state governments already struggling to afford the program.

Heritage

Heritage

The Senior Journal reported:

States are reporting far higher enrollment in Medicaid than in private insurance since the Affordable Care Act exchanges opened Oct. 1. In Maryland, for example, the number of newly eligible Medicaid enrollees is more than 25 times the number of people signed up for private coverage.Even some Medicaid experts say they are surprised at the early numbers.A Stateline survey of the 25 expansion states and the District of Columbia provides clear explanations for the strong Medicaid rollout so far.The biggest reason for the initial jump in Medicaid enrollment is that hundreds of thousands of people in the expansion states have been pre-qualified for expanded Medicaid because they are already enrolled in low-income state health care. Illinois, for example, will roll over 100,000 Cook County residents who have received expanded Medicaid benefits since 2011……Stateline’s survey indicates at least 1.5 million people have already signed up or have been pre-qualified for expanded Medicaid in the 19 states that provided counts. Expected total enrollment in those states is 3.7 million.

Friday, November 08, 2013 2:47 PM

Expect Another Leap in Healthcare Costs; New Obamashock Rules: Obamacare Expanded to Cover Mental Health and Addiction

If you are already stunned by rising Obamashock! healthcare costs, you can expect still more shocks thanks to new rules and expanded coverage for mental health and addiction programs.

A few snips from the New York Times article Rules to Require Equal Coverage for Mental Ills will explain.

A few snips from the New York Times article Rules to Require Equal Coverage for Mental Ills will explain.

The Obama administration on Friday will complete a generation-long effort to require insurers to cover care for mental health and addiction just like physical illnesses when it issues long-awaited regulations defining parity in benefits and treatment.Don't Worry "Experts" Say Costs Won't Rise "Significantly"

The rules, which will apply to almost all forms of insurance, will have far-reaching consequences for many Americans. In the White House, the regulations are also seen as critical to President Obama’s program for curbing gun violence by addressing an issue on which there is bipartisan agreement: Making treatment more available to those with mental illness could reduce killings, including mass murders.

According to administration officials, the rule would ensure that health plans’ co-payments, deductibles and limits on visits to health care providers are not more restrictive or less generous for mental health benefits than for medical and surgical benefits. Significantly, the regulations would clarify how parity applies to residential treatments and outpatient services, where much of the care for people with addictions or mental illnesses occurs.

Insurance companies have raised concerns about the expense involved in paying for the lengthy and intensive courses of treatment that the final regulations address. But experts have said the rules are not expected to significantly add to the cost of coverage because so few patients require these levels of care.

Former Representative Patrick J. Kennedy of Rhode Island, a co-sponsor of the 2008 law, said the rules could particularly help veterans. “No one stands to gain more from true parity than the men and women who have served our country and now need treatment for the invisible wounds they have brought home from Iraq and Afghanistan,” he said.

State insurance commissioners will apparently have the primary responsibility for seeing that commercial insurers comply with the parity standards. They already have their hands full, however, enforcing new insurance market rules, and in some states insurance regulators are considered close to the industry.

“We need enforcement,” Mr. Kennedy said in an interview. “The notion of delegating this to the states, which are looking to the federal government for direction, is problematic.”

Note the slant by the NYT.

- People want to curb gun violence and this will do it.

- It will help veterans.

- It won't cost much.

Supposedly costs won't rise much because few people demand mental health services. Well, watch what happens when you mandate expanded "free" services.

And if by some amazing miracle additional free services do not increase costs, it's important to note that a small percentage of people are responsible for huge portions of overall costs.

Cumulative Distribution of Personal Healthcare Spending

Facts and Figures

- Top 1% Spend Over 20% of Total Costs

- Top 5% Spend About 50% of Total Costs

Those numbers are from a 2012 study on the Concentration of Healthcare Spending by the National Institute for Health Care Management (NIHCM).

Obamashock! Apology

Yesterday, the president made a quasi-apology for the holes and gaps in the law.

Link if video does not play: Exclusive: Obama personally apologizes for Americans losing health coverage

After the Non-Apology

CNN discuses Obamacare: After Obama's apology, talk of solutions and -- still -- the website

As the president expressed regret in an exclusive interview with NBC News on Thursday, there already were plans being developed in Congress to address the matter as well as steps the administration might take to resolve the issue without reopening the politically charged healthcare law legislatively.More on Obamashock!

Health Secretary Kathleen Sebelius said there is no specific plan at the moment when asked in Atlanta on Friday what the administration was considering.

One priority, she said, is to identify those customers as well as approaches for solutions.

"But there is no specific option right now," she said.

My Personal Experience - Obamashock!

More Obamashock! Glitches Hit Paper, Phone Applications; Obamacare Glitch Great Quotes

Mike "Mish" Shedlock

Read more at http://globaleconomicanalysis.blogspot.com/2013/11/expect-another-leap-in-healthcare-costs.html#Hh0JLwEp2BCl0Twf.99

http://hotair.com/archives/2013/11/08/new-obamacare-website-czar-on-repairs-were-a-long-way-from-where-we-need-to-be/

New ObamaCare website czar on repairs: We’re a long way from where we need to be

POSTED AT 5:21 PM ON NOVEMBER 8, 2013 BY ALLAHPUNDIT

HHS admitted yesterday that they were running into new problems on the site even as old ones were being debugged. Now here’s Jeff Zients, the guy who was brought in to oversee the salvage operation, telling reporters that victory remains distant even as the de facto December 1 deadline approaches.

Obama and Sebelius won’t leave Senate Democrats in the dark until November 30. Prediction: We’ll start seeing stories next week quoting unnamed sources in the administration about delaying parts of the law.

The Obama administration’s HealthCare.gov adviser Jeffrey Zeints said on Friday that the trouble-plagued federal healthcare website is improving, but that higher volumes of visitors are exposing new capacity and software issues.In a conference call with reporters, Zeints said progress this week has been marred by roadblocks. He described HealthCare.gov as being “a long way from where it needs to be.”

Right now the website’s problems are running on a parallel track to Obama’s “if you like your plan” fiasco, but once O decides that he has no choice but to extend the enrollment period or delay the mandate, the two will merge. What do you do if you’ve just been dropped from your plan and the president’s telling you the website won’t let you enroll until after December 15, the deadline for signing up for a new plan if you want coverage to begin on January 1? Sebelius admitted today that there’s no specific proposal being considered by the White House (yet) to do something for the millions of people angry about having their plans canceled. Ace is right, undoubtedly, that Obama will eventually end up calling for more generous subsidies for new applicants to make the expensive new plans on the exchanges more affordable for the middle class — where the money for that is coming from, I have no idea — but that’s a secondary problem right now. The main problem is making sure they have some coverage on New Year’s Day, whatever the cost. What’s the plan for that? There … isn’t one yet.

It is unclear if the Health and Human Services Department has the legal authority to re-interpret the law’s definition of insurance plans that are “grandfathered” and could continue to exist, perhaps temporarily, under certain circumstances, even if those plans don’t meet the law’s basic benefits standards. The president has resisted suggestions on both sides of the aisle in Congress to extend the law’s open enrollment period beyond March 31.

Obama and HHS wrote the regs, didn’t they? Well, then they can unwrite them — I think. One of the complications of extending next year’s enrollment period is that the ObamaCare statute itself says that Sebelius has to specify the enrollment period by July 1, 2012. There may — may — be other deadlines that have already passed related to the regs about grandfathering old plans, which would complicate O’s ability to re-grandfather those plans. I’m no expert on the law so I’m not sure, although one of Boehner’s spokesmen said today, “We are highly skeptical that there is anything the President can do administratively to keep his pledge that would be both legal and effective.” Then again, Obama hasn’t let illegality stop him from solving ObamaCare’s “problems” before: He made the employer mandate, which is required by the statute itself, go bye-bye, so he could presumably do the same to any limit on his power to re-write the grandfathering regs. Although, if he’s going to do that, the cagey play would be to ask Congress to do it instead. Not only would that solve his legality problem, it would put Republicans on the spot. Would they resist joining Democrats on a bipartisan re-grandfathering bill given how much effort they’ve spent over the last few weeks lamenting the predicament of people whose plans got canceled? I doubt it, but I don’t know.

Here’s Obama explaining that he doesn’t write code but if he did he’d fix the website himself, which I guess makes up for his gross negligence in failing to oversee the people on his staff who do write it. Oh, by the way — the “important announcement” that Sebelius made today is that … she’s extending regulations about mental-health parity that were already enacted under the Bush administration to plans under ObamaCare. They said the new plans would be more “comprehensive” and they meant it. Now, about those premiums…

Most uninsured ignoring healthcare exchanges

POSTED AT 12:41 PM ON NOVEMBER 8, 2013 BY BRUCE MCQUAIN

So what was the point of all this drama? Why did Democrats pass this awful health care law? Wasn’t it to ensure that those without healthcare insurance would finally be covered?

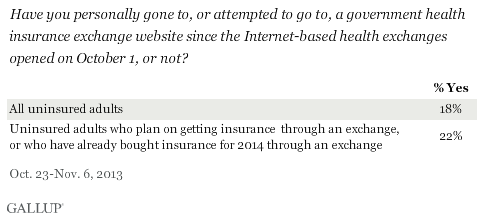

Hmmm … maybe someone should have asked the uninsured whether or not it was a priority for them. Gallup tells us most of them are ignoring the push for them to enroll:

In the midst of widespread news coverage of problems with the federal health exchange website, relatively few uninsured Americans (18%) — the primary target population for the exchanges — have so far attempted to visit an exchange website. The percentage is slightly higher, 22%, among uninsured Americans who say they plan to get insurance through the exchanges.These results are based on a series of questions Gallup asked uninsured Americans about the health exchanges from Oct. 23-Nov. 6.

Not exactly what one would call a “thundering herd” of uninsured, is it? In fact:

Gallup previously found that less than half of uninsured Americans (44%) who plan to get insurance say they will do so through an exchange, and about one in four say they are more likely to pay a fine instead of getting insurance. These findings help explain the low percentage of the uninsured who have attempted to access the exchange websites.

They certainly do. They also help explain why ObamaCare is likely to fail miserably. The only group which saw this as a huge priority were Democrats in Congress and the White House. Despite anecdotal complaints, the vast majority of Americans were either happy with their health care situation or felt fine without insurance (those usually being the young and healthy who saw no need for it at the time).

Are there broader implications?

The health exchange websites are not only fraught with the technical problems that have led to so much news coverage in recent weeks, but have also generated relatively little interest or use among uninsured Americans — the primary target group for the exchanges. The majority of uninsured Americans are unfamiliar with the exchanges and relatively few have tried to access them to date, even among those who say that eventually, they will most likely get their insurance through an exchange website.

The reality is this law was passed to satisfy a political agenda, not to satisfy the demands of the citizenry. And that reality is demonstrated by this sort of indifferent reception. Even though the rollout has been a disaster, the biggest problem remains government butting into a market where it was neither needed or wanted. The results are predictable.

~McQ

http://hotair.com/archives/2013/11/08/vulnerable-democrats-on-getting-healthcare-gov-fixed-tick-tock-white-house/

Vulnerable Democrats on getting HealthCare.Gov fixed: Tick tock, White House

POSTED AT 12:01 PM ON NOVEMBER 8, 2013 BY ERIKA JOHNSEN

Certain Democratic senators, very much aware of the impact that ObamaCare’s ongoing problems and glitches could very well have on their reelection prospects in next year’s midterms, are willing to give the White House some time to iron everything out and get the website finally running at least somewhat smoothly before they start piling on with their own accusations, criticisms, and fixes — but not much.

They have campaign schedules to keep, after all, and if ObamaCare isn’t working like a charm by early 2014, the situation could eventually mean some Senate Democrats are going to have to look out for themselves, even if it’s at ObamaCare’s expense. So reports Politico:

At the pleading of senior White House officials, Senate Democrats are holding off on demands to delay major aspects of the health care law until the Obama administration has the opportunity to fix the website problems that are thwarting enrollment in the program. …Sen. Chris Coons (D-Del.), who attended a tense two-hour meeting with President Barack Obama and Vice President Joe Biden on Wednesday over the issue, stressed that senators should give the administration just “a little bit” of breathing room. …Already, Sen. Jeanne Shaheen (D-N.H.) is preparing legislation to extend the enrollment period beyond March 31, and Sen. Mary Landrieu (D-La.) has offered a bill to allow consumers to keep their existing coverage. Sen. Joe Manchin (D-W.Va.) unveiled bipartisan legislation Thursday with Sen. Mark Kirk (R-Ill.) to delay for one year the penalties if consumers do not comply with the individual mandate. Unlike Shaheen and Landrieu, Manchin does not face reelection next year. …One senior Senate Democratic aide predicted that no action on the law would be taken before the end of the year but added that all bets are off if the problems extend into 2014.

Oh, boy. Add it to the long list of reasons that the news that ObamaCare’s programmers are only discovering more and more glitches as they delve deeper through the entire HealthCare.Gov process was especially bleak for the White House.

Particularly after Virginia’s gubernatorial election on Tuesday night, Democrats want/need to start strategizing on their messaging going into the midterms — and throwing ObamaCare at least partially under the bus isn’t off the table for everyone.

http://www.mcclatchydc.com/2013/11/07/207909/analysis-tens-of-millions-could.html

Analysis: Tens of millions could be forced out of

health insurance they had

Published: November 7, 2013 Updated 13 hours ago

President Barack Obama speaks at Temple Emanu-El in Dallas on Nov. 6, 2013.

LOUIS DELUCA — Dallas Morning News/MCT

- RELATED STORIES:

- Sebelius on the hot seat again over health care website

- HealthCare.gov official questioned about website security

- White House defends use of alternatives to HealthCare.gov

- Doctors are enlisted to aid both sides on health care law

- Sebelius shoulders blame for flawed health care website

WASHINGTON — Even as President Barack Obama sold a new health care law in part by assuring Americans they would be able to keep their insurance plans, his administration knew that tens of millions of people actually could lose those their policies.

“If you like your private health insurance plan, you can keep your plan. Period,” Obama said as he pitched the plan, the unqualified promise he made repeatedly.

Yet advisers did say in 2010 that there were large caveats and that anyone whose insurance plan changed would lose the promised protection of being able to keep existing plans. And a report in 2010 said that as many as 69 percent of certain employer-based insurance plans would lose that protection, meaning as many as 41 million people could lose their plans even if they wanted to keep them and would be forced into other plans. Another 11 million who bought their own insurance also could lose their plans. Combined, as many as 52 million Americans could lose or have lost old insurance plans.

Some or much of that loss of favored insurance is driven by normal year-to-year changes such as employers changing plans to save money. And many people could end up with better plans. But it is not what the president pledged.

Caught in the firestorm of his broken promise, Obama on Thursday apologized.

“I am sorry that they are finding themselves in this situation based on assurances they got from me,” he told NBC News Thursday evening. “We’ve got to work hard to make sure that they know we hear them and we are going to do everything we can to deal with folks who find themselves in a tough position as a consequence of this.”

The shifting narrative started as Obama worked to sell the entire health care overhaul to a skeptical nation and Congress. To win support from those who already had insurance, he made the promise that no one who liked their plan would lose it. The key was that millions of plans would be “grandfathered” in the new law, thus protected from any new requirements.

Yet as insurance companies started notifying hundreds of thousands this fall that their current policies were being canceled in preparation for new ones, it became clear that many were not guaranteed to keep their plans.

The White House and Congress have focused on cancelations of plans in the individual market, where people buy their own policies.

Obama insisted anew Thursday that the problem is limited to people who buy their own insurance. “We’re talking about 5 percent of the population who are in what’s called the individual market. They’re out there buying health insurance on their own,” he told NBC.

But a closer examination finds that the number of people who have plans changing, or have already changed, could be between 34 million to 52 million. That’s because many employer-provided insurance plans also could change, not just individually purchased insurance plans

Administration officials decline to say how many employer-sponsored plans could change. But those numbers could be between 23 million to 41 million, based on a McClatchy analysis of estimates offered by the Department of Health and Human Services in June 2010.

Obama aides did acknowledge around the time the law was enacted in 2010 that some people could lose their coverage if their plans changed after the law was passed. Those people would in turn receive what the administration described as superior coverage. But in the years since the law’s passage, HHS officials have downplayed that consequence of the hard-fought law.

“If health plans significantly raise co-payments or deductibles or significantly reduce (them) . . . they’ll lose their grandfather status and their customers will get the same full set of consumer protections as new plans,” Health and Human Services Secretary Kathleen Sebelius said at a June 15, 2010, news conference.

Many changes in the old insurance plans could trigger the loss of the protected status. Regulations issued by HHS state that the grandfathered status would be lost if the policies eliminate coverage for a particular condition, reduce the annual dollar limit on benefits, increase co-payments by as little as $5 or 15 percent, or increase out-of-pocket maximums by more than 15 percent or premiums by more than 5 percent.

Later in June 2010, Sebelius’ department published estimates in the Federal Register that 39 percent to 69 percent of employers’ fully insured plans would relinquish the coverage they had prior to the March 2010 passage of the ACA and thus would have to cancel or change policies.

About 60 million people are covered in fully insured plans, which make up about 40 percent of employer-provided health plans. Fully insured plans are usually offered by large employers. These plans have the insurance company rather than the employer assume the financial risk of annual health care expenses exceeding expectations. The rest of employers self-insure.

To escape having to provide the new law’s minimum required benefits, plans would have to largely maintain the co-pays, premiums and out-of-pocket limits that existed prior to March 2010.

Already this year, only 36 percent of employer plans were pre-2010 plans, compared with 56 percent in 2011, according to the Kaiser Family Foundation, a leading health care research organization. That means that millions of people’s plans already had changed or were canceled in the three and a half years since the law was enacted in March 2010.

That doesn’t automatically mean the plans were changed or canceled because of the new law.

“I think there needs to be great emphasis that plans are not being canceled because of ACA requirements,” said Jon Gabel, a senior fellow at the University of Chicago’s Health Care Research Department. “They’re being canceled because insurers do not want to ‘grandfather’ some plans.”

This week, after millions of Americans mostly in the market for individually purchased plans began receiving cancellation notices or price hikes from their insurance companies, Obama added the caveat that people could lose their plans if insurance companies changed the plans.

“Now, if you have or had one of these plans before the Affordable Care Act came into law and you really like that plan, what we said was you could keep it if it hasn’t changed since the law was passed,” he said, adding the qualifier Monday during a Washington event with supporters.

http://twitchy.com/2013/11/08/he-started-the-fire-narcissist-in-chief-shredded-for-complaining-hes-been-burned-by-o-care-website-disaster/

This is from President Obama’s “apology” yesterday. Transcript via Newsbusters:

BARACK OBAMA: I am deeply frustrated about how this website has not worked over the first couple of weeks. And, I take responsibility of that. My team takes responsibility of that. And we are working every single day, 24/7, to improve it. And it’s better now than it was last week. It’s certainly a lot better than IT WAS on October 1st. Having said that, given that I’ve been burned already with a website–well, more importantly the American people have been burned by a website that’s been dysfunctional, what we’ve also been doing is creating a whole other set of tracks, making sure that people can apply by phone effectively, making sure people can apply in person effectively.

He’s been burned? Obama’s comment didn’t go unnoticed:

http://www.michellesmirror.com/2013/11/some-people-have-army-of-davids-we-have.html

Friday, November 8, 2013

Some people have An Army of Davids; We have An Army of Pinocchios

While it’s true that new technology has created an Army of Davids empowered to beat Big Media and Big Government, never misunderestimate the power of OUR Army of Pinnocchios: the little people who are willing to go out there every day and lie for you. They are, by far, our unsung heroes; the hardest working people in Big Media and Big Government.

In a show of gratitude Barry himself went on TV last night with Chuck Todd to acknowledge their efforts.

After this week’s polling showed that nobody was buying the big lie, or the lie about the big lie, the Big Brains decided there was nothing left other than the hollow apology, so last night Big Guy finally apologized for welching on the promise he made publically at least 36 times before saying that he didn’t really say what he said. (“Welching” – how did that slip past my “lexicon of political correctness” I wonder?)

Anyway, I hope the rest of the Pinocchio Team has received the official “I’m sorry we weren’t clear” memo so they can stop perpetuating the lie and move on to other issues requiring their attention.

Because frankly, at the rate we’re racking up these awards - 8 Pinocchios and 1 Pants on Fire in the past month alone -

pretty soon our credibility might begin to suffer.

Anyway, like I said, I hope the team got the memo. Because poor little Debbie is getting so tongue-tied trying to defend the indefensible that people are beginning to make fun of her. I know – hard to imagine, butt they are. It’s almost crossed over the line into outright bullying.

Here’s DWS’s latest attempt to explain that neither she nor BO misled anyone about Obamacare. Unfortunately, as you’ll see at 1:09, either TOTUS pulled a little trick on her, or she needs to get a new prescription – for her contact lenses, I mean.

Anyhoo, that seemed to open the Alinsky-on-the-Right-gates. For example, look at this comment from John Holliday on YouTube:

Anyway regarding Little Debbie’s repetitious “at the end of the day” remark: not only has this been on Greg Gutfeld’s “banned phrase” list for over a year, butt – and again, I’m quoting a commenter - “this is the end of the day, and we’re all f***ed.”

So okay, remind me again: which one of these women is the dumb one?

So let’s hear it, cheerleaders: “Schlemiel! Schle-myzel! (H/T Twitchy) Obamacare mizz-underestimated!”

I hear we’re going to take a clue from the Reverend Al and try to turn this sucker into a positive.

“Mizzled We Much” – spread it around because all we have working this side of the aisle is An Army of Davids. Big Guy’s team has a whole Army of Pinocchios.

In a show of gratitude Barry himself went on TV last night with Chuck Todd to acknowledge their efforts.

After this week’s polling showed that nobody was buying the big lie, or the lie about the big lie, the Big Brains decided there was nothing left other than the hollow apology, so last night Big Guy finally apologized for welching on the promise he made publically at least 36 times before saying that he didn’t really say what he said. (“Welching” – how did that slip past my “lexicon of political correctness” I wonder?)

It was the presidential equivalent of the celebrity non-apology apology: “I’m sorry if anyone was offended by my remarks.”"I am sorry that they are finding themselves in this situation based on assurances they got from me," he told NBC News in an exclusive interview at the White House.

Anyway, I hope the rest of the Pinocchio Team has received the official “I’m sorry we weren’t clear” memo so they can stop perpetuating the lie and move on to other issues requiring their attention.

Because frankly, at the rate we’re racking up these awards - 8 Pinocchios and 1 Pants on Fire in the past month alone -

pretty soon our credibility might begin to suffer.

Pretty soon.But the distortions and broken promises have now become so frequent that many at home and abroad are finally tuning out the president. Almost nothing promised about the Affordable Care Act is proving true. Contrary to presidential assurances, Obamacare has not lowered premiums or deductibles. It will not reduce the deficit or improve business competitiveness. It really will alter existing health plans and in some cases lead to their cancellation. Signing up is certainly not as easy as buying something online on Amazon..

Anyway, like I said, I hope the team got the memo. Because poor little Debbie is getting so tongue-tied trying to defend the indefensible that people are beginning to make fun of her. I know – hard to imagine, butt they are. It’s almost crossed over the line into outright bullying.

Here’s DWS’s latest attempt to explain that neither she nor BO misled anyone about Obamacare. Unfortunately, as you’ll see at 1:09, either TOTUS pulled a little trick on her, or she needs to get a new prescription – for her contact lenses, I mean.

Are you smarter than a 5th grader?

Boy, you’d think that one of the smartest women in America wouldn’t be so easily “mizzled” (pronounced, according to Ms.DWS, “mizz-uld”) by a simple word like “misled” on the teleprompter. Especially since it was in the context of explaining how neither she nor Barry, well, you know…misled the American people. And man, it’s not even one of those $100 words like “corpsman.”

Anyhoo, that seemed to open the Alinsky-on-the-Right-gates. For example, look at this comment from John Holliday on YouTube:

You know, that’s just mean. And besides, TOTUS now spells out all the tough words like “misled” phonetically – hmmm; you don’t suppose that’s what they did for Little Debbie do you? “Mizz–led” – only with the em-fa-sis on the wrong sil-ah-bull?First, BS-NBC gives her the questions and the answers. Then they obama* her responses for her and she still can’t get them right. What a clown.*to “obama” –verb- put answers on a teleprompter because you’re too stupid to think for yourself.

Anyway regarding Little Debbie’s repetitious “at the end of the day” remark: not only has this been on Greg Gutfeld’s “banned phrase” list for over a year, butt – and again, I’m quoting a commenter - “this is the end of the day, and we’re all f***ed.”

So okay, remind me again: which one of these women is the dumb one?

“The Democrats promise that a government health care system will reduce the cost of health care, but as the economist Thomas Sowell has pointed out, government health care will not reduce the cost; it will simply refuse to pay the cost. And who will suffer the most when they ration care? The sick, the elderly, and the disabled, of course. The America I know and love is not one in which my parents or my baby with Down Syndrome will have to stand in front of Obama’s‘death panel’ so his bureaucrats can decide, based on a subjective judgment of their ‘level of productivity in society,’ whether they are worthy of health care. Such a system is downright evil.” - Sarah Palin without a teleprompter

In fairness to Ms.DWS, all that spinning probably does makes you a little dizzy, which makes it harder to read (read “reed” not “red” – see how tricky this can get?). From where I sit, it sounds like the whole team is feeling a little let down, and mizzled. Do you know what we need about now? We need a little team spirit!“At the end of the day, uh, uh, Americans were, were, were not, not only not mild, myzeld by the president, the overwhelming majority of Americans are already insured.” Debbie Wasserman Schultz – DNC Chairwoman, with teleprompter

So let’s hear it, cheerleaders: “Schlemiel! Schle-myzel! (H/T Twitchy) Obamacare mizz-underestimated!”

“Mizzled We Much” – spread it around because all we have working this side of the aisle is An Army of Davids. Big Guy’s team has a whole Army of Pinocchios.

by

by

No comments:

Post a Comment