Pro .......

http://www.zerohedge.com/news/2013-11-06/why-bitcoin-surging

Is This Why Bitcoin Is Surging?

Submitted by Tyler Durden on 11/06/2013 18:13 -0500

Bitcoin, an online-only currency scarcely four years old, is breaking out to new highs this week and now sports a total value of $2.8 billion. Just a few months ago, it looked like this economic experiment as the world’s first decentralized technology-based form of money would crash and burn. Since then, ConvergEx's Nick Colas points out that the U.S. government has shut down a large drug website which accepted bitcoins and promised further scrutiny of its uses; and omputer science experts have warned that bitcoin is neither especially private – one of its notional values – or especially well constructed. The market doesn't seem to care, with incremental demand from U.S. citizens (through Second Market) and Chinese nationals leading the path higher. Could bitcoin still fail? Sure. But, as Colas notes, its success to date speaks to how much the world is changing... Technology – properly packaged – can engender enough trust to develop a new asset class.

Bitcoin will eventually have to develop a lot more infrastructure to be a useful global currency, to be sure. But there’s close to $3 billion of real money to help back that transition.

Via ConvergEx's Nick Colas,

Bitcoin - The Lazarus Currency

Every great religion, or company, or country, or rock band has a dramatic ‘Creation myth’ – the story of its birth. The Judeo-Christian tradition has the story of God creating the world in seven days. Google has the grad-student thesis story. American culture is still informed by the Revolutionary War. And where would the Rolling Stones be if Keith hadn’t chatted up Mick on the train, just because he holding some new R&B albums from the States?

Bitcoin, the online-only stateless currency, has its own creation myth and it is purpose-made to appeal to exactly the kind of people who would find value in it. The highlights are:

The original design for bitcoin comes from a 2008 paper published by a person named Satoshi Nakamoto. Who, by the by, doesn’t actually exist.Bitcoin’s basic architecture is decentralized – no one is “In control.” People with fast computers and some coding skills compete to solve a puzzle created by the algorithm described in Satoshi’s paper. Simultaneously, they track all the transactions in the bitcoin universe – people and businesses exchanging value for goods and services. Every ten minutes, on average, some lucky coder – or group of coders – solves the puzzle, gets a few new bitcoins, and validates the transaction list. Then the whole thing resets and everyone gets to work on the next puzzle.In principle, this process leaves everyone exchanging or “mining” (cracking the code gets you 25 bitcoins currently) anonymously in the system. Everything in bitcoin is identified with a nearly-impossible-to-crack coding of letters and numbers. No names, phone numbers, or addresses needed.

Now, who do you think would find this creation story appealing? A few candidates:

Tech savvy people, who by their nature and high-functioning professional skills tend to have a few shekels lying around? Yep – classic early adopters.Then there might be independence-minded older white males in the U.S., ticked off by the Federal Reserve and government in general. Yes, they like the story as well.And then there are the criminals– drug dealers and so forth – who might not know a creation myth from crystal meth, but appreciate the potential for secrecy.Offshore millionaires from essentially anywhere in the world, looking for classic diversification and a liquid investment. All you need to access your bitcoins is that long alphanumeric key and a local bank account which links to a ‘Wallet’ – an online repository to hold the currency. Deposit money in China, write down the key, fly to Monaco and go into an Internet café. Easy-peasy.

The basic appeal of this “Genesis” creation story lit a fire under bitcoin, starting at the beginning of 2012 at around $5 and ending up in a spectacular bubble top at $240 in April 2013. The cause of that peak – overwhelming tulip-bulbish demand for bitcoin – was its undoing. Exchanges where people went to trade dollars or euros for bitcoin couldn’t keep up with the volume. Accounts froze or moved very slowly, and confidence in the currency dropped, along with the price. Just a few days after the $240 high, bitcoin was trading for less than $60.

Creation myths are great anchors for a belief system, but there have to be other parts to the narrative; bitcoin is safely into its own “Exodus” – the second book of the Old Testament. That fall from the highs was just the beginning of its problems.

The U.S. government made it clear that they expect all currencies and their users to adhere to anti-money-laundering laws, including know-your-customer statutes which eliminate the notional secrecy of bitcoin.The Feds also went after the druggies, shutting down Silk Road – a widely known website for the purchase of illicit substances.In an odd twist of fate, the U.S. government now owns about 174,000 bitcoins, with a current value of $42 million thanks to the Silk Road bust and other actions.

If bitcoin were a company, the class action lawyers would be circling, fighting for air with the bankruptcy experts. There is simply no way so much legal action, let alone several ongoing problems with security in the system, would have left Satoshi Nakamoto’s creation as anything but roadkill on the world’s economic superhighway.

But here’s the beauty part: bitcoin is making a new high this week, breaking through the spiky bubble levels of April in a pretty controlled and orderly manner. What gives? A few points:

The biggest bitcoin exchange is now in China, displacing Japanese, American and European sources of demand. That enterprise is called BTC China, and its CEO Bobby Lee hails from Yahoo! and Walmart China. Oh, and he graduated from Stanford with a degree in Computer Science. In short, an apparently pretty clever fellow.Our sources in the bitcoin community also agree that Second Market, the New York based business best known for trading pre-IPO company stock, has become a major player in demand for bitcoin. Earlier this year they started the Bitcoin Investment Trust, an open ended product to buy and hold bitcoins. There’s no way to know how much Second Market has purchased on behalf of its clients, but it must be a popular offering – the banner ad on their site for the trust occupied the top third of their front page.It’s not all been roses for bitcoin, even in this recent run-up. Back in September computer science researchers from UC – San Diego showed that it was actually fairly easy to track individual transactions in the bitcoin transaction ledger. Just this week, academics at Cornell proposed that bitcoin could eventually be coopted by a handful of “Miners” who could hijack the system.

So why is bitcoin seemingly minted on Teflon? Limited supply, for one reason. There will never be more than 21 million bitcoins, and there are only 12.0 million currently. In the 4-ish minutes it has taken you to read this far, the most new bitcoins that might have been issued is 25, or $6,250. In the same timeframe, the Federal Reserve has pushed another $7.8 million into the financial system with Quantitative Easing. And then there is the undeniable creation-story appeal – a technology based sort-of-secret store of value. If James Bond, Sergey Brin and Paul Volcker all got together and designed their ideal currency, it might look a lot like bitcoin.

At the same time, the story isn’t over yet. If the “Exodus” analogy is to fit at all, then bitcoin is still in the wilderness. It has clearly withstood many challenges, and there are probably more to come. The end of the journey actually has little to do with how much bitcoin is worth, but what it might be good for.

That’s the piece some investors – many made quite wealthy by the incredible increase in bitcoin’s value – are working on now. A few final thoughts here:

Bitcoin is a more efficient method of transferring money than the current global banking system. The transaction ledger is essentially kept for free by the mining community. Want to send $100 to someone in England and have them redeem British pounds? It will likely cost you $5 or more. A bitcoin transfer is essentially free.Merchants can accept bitcoin payments without paying the typical credit card fees of 1-5%. That’s one reason for the growing acceptance of bitcoin in China – online merchants are starting to accept this online currency.Bitcoin could become a country’s ‘Second currency’. One of the more interesting conversations with one of our industry sources is the thought that one or more sovereign nations would entertain making bitcoin a parallel currency to their existing monetary system. Keep in mind that our source owns a lot of bitcoin personally…. But it is an intriguing thought nonetheless.

and....

http://www.zerohedge.com/news/2013-11-06/bitcoin-spikes-record-high-270

Bitcoin Spikes To Record High At $270

Submitted by Tyler Durden on 11/06/2013 08:13 -0500

The last month has seen the USD price of Bitcoins double from $130 to $270 as a combination of wider acceptance (in China and even ebay/Paypal 'watching') and concerns over ongoing global money printing (delayed taper) have sent the cryptocurrency to new record highs. With most 'markets' now manipulated or repressed by government mandate, one wonders whether Bitcoin represents the last bastion of free market expression for concern at the fiat status quo? Or is it already 'broken'?

Charts: Bitcoincharts.com

and....

http://abcnews.go.com/Technology/wireStory/main-dutch-food-delivery-website-takes-bitcoin-20790866

Dutch Food Delivery Website Now Takes Bitcoin

The main website that arranges home delivery for restaurants in the Netherlands is now accepting payment in bitcoins, an increasingly popular form of digital currency.

Around 5,000 Dutch restaurants use the Thuisbezorgd.nl site to handle around 600,000 online orders and deliveries per month. The company's marketing manager, Imad Qutob, said in a statement Tuesday that Thuisbezorgd wants to offer customers more choice in how they pay.

The company says around half its customers pay cash on delivery. Others pay via the site using debit cards, credit cards, PayPal or an online system run by Dutch banks.

Paying with bitcoins could save customers a little change: Thuisbezorgd adds surcharges of up to one euro ($1.35) for other forms of online payment.

Bitcoin is a cryptography-based digital currency that advocates say is counterfeit-proof.

Its value is determined by supply — which is limited by its design — and demand. Among the various criticisms leveled at bitcoin are that it is too prone to price swings against other currencies to be useful.

On the biggest online exchange where bitcoin is bought and sold, it traded as high as $258 per bitcoin Tuesday. That's near its record high of $266 set in April, and an increase of more than 10 percent in the past 24 hours.

Thuisbezorgd is the latest in a series of mainstream businesses willing to accept the currency, which was once considered little more than an oddity.

http://motherboard.vice.com/blog/why-bitcoin-boomed-during-the-government-shutdown

Why Bitcoin Boomed During the Government Shutdown

Image: Flickr

Just two weeks after the Feds shuttered the Silk Road, the notorious online drug bazaar, bitcoin prices have touched a five-month high—with a single bitcoin fetching nearly $156 each on Tokyo-based exchange Mt. Gox.

Bitcoin’s resiliency can no longer be denied, especially as the digital currency continued its ascendancy even against the backdrop of a US government in utter disarray. At the 11th hour of the crisis, President Obama signed a bill that ended the partial government shutdown and, more importantly, raised the debt ceiling, an arbitrary limit on the amount of money the country can borrow that would have been surpassed today. If Congress had failed to reach a deal and the US was unable to pay its bills, the results might have been catastrophic, eclipsing the bankruptcy of Lehman Brothers five years ago, the domino that could trigger the worst financial crisis since the Great Depression.

“We could be looking at a 10 percent decline in GDP, and a 5 point rise in unemployment,”The New York Times economist Paul Krugman wrote of the immediate consequences of a potential US default. Moreover, the sudden impact on US debt, deemed the safest financial asset in existence, would cascade across the globe fueling a crisis in confidence that would call into question the status of the US dollar as the reserve currency of the world.

While a last ditch effort was always expected, the political farce precipitating in Washington is a stark reminder of the tenuous nature of our current financial system, where a group of ideologues could essentially hold the state of the world economy hostage simply because they felt like it. For bitcoin’s advocates, it’s simply another argument for the cryptocurrency’s relevance. Unlike fiat money, which is managed by governments, bitcoin’s decentralized model means that no one actually controls it, keeping it out of the hands of opportunistic politicians.

Similar to the events in Cyprus earlier this year, when the threat of direct withdrawals from citizen savings account led to a surge in the virtual currency’s interest, some believe the current uncertainty in the conventional system is fueling bitcoin’s recent rise even though the ecosystem has yet to find its “killer app.”

“The more stupid things governments do, the more attractive bitcoin becomes,” said Roger Ver, the director of Business Development at BitInstant, and long time bitcoin evangelist. “Bitcoin's strengths come from its nature. Governments can't inflate it or seize it at will.” As further evidence, Ver points to this chart demonstrating how various asset classes have performed this year:

Governments could, of course, outlaw bitcoin outright, a longstanding fear within the community that appears to have abated as authorities have adopted an approach of acceptance and regulation. This hasn’t always been the case. The seizure of funds of Mt. Gox, the largest bitcoin exchange, five months ago for apparent regulatory violations shook the system, shutting down a key source of funding that sent prices crashing.

And two weeks ago, the Silk Road crackdown was expected to blow another major dent in bitcoin’s armor. But prices quickly rebounded following a minor flash crash, perhaps to the surprise of casual observers as the underground dark web marketplace was widely considered bitcoin’s first true killer app. The Silk Road could not have existed without the hard-to-trace digital currency. And most people might have never heard of bitcoin if not for the novelty of buying drugs online. The link, however, has always been a double edged sword, providing the movement purpose but also plenty of bad press.

That bitcoin has survived the shutdown not only unscathed but stronger than ever is unsurprising to Ver.

“Bitcoin is unaffected by the Silk Road shutdown because of the numerous competitors that already exist,” he told Motherboard, citing the Black Market Reloaded as an example. And so for bitcoin, the Silk Road’s demise is only good news. It’s unlikely that the alternative markets already filling the gap will ever achieve the same level of brand recognition, allowing bitcoin to shed what has always been a PR headache, even as the demand for illegal goods online inevitably grows.

For Ver, this means only one thing. “Bitcoin will continue to gain more and more popularity around the world as people quickly figure out that it is superior to government issued money.”

http://www.brockpress.com/2013/11/worlds-first-bitcoin-atm-unveiled-in-vancouver/

World’s first Bitcoin ATM unveiled in Vancouver

Vancouver is now home to Canada’s first ATM that allows users to exchange cash for a new currency: the Bitcoin.

Bitcoin is like any other currency (e.g. Canadian Dollar, U.S. Dollar, Euro), except it exists solely on the Internet. The currency launched in 2009 and acts as a medium to exchange money across the world with few fees, no exchange rates, and no middlemen.

Bitcoin is like any other currency (e.g. Canadian Dollar, U.S. Dollar, Euro), except it exists solely on the Internet. The currency launched in 2009 and acts as a medium to exchange money across the world with few fees, no exchange rates, and no middlemen.

Bitcoin is not trademarked anymore than e-mail is trademarked. It is not owned by an individual company and it is not regulated by a central bank. It is a new currency and form of technology that exists on the Internet.

Bitcoin can be used to exchange money between individuals, but it is hoped to eventually play a larger role in business transactions.

Amanda Krystalovich, manager of Krystal Fit Studio in Vancouver said, “It’s a lot cheaper than accepting, say, Visa or MasterCard. It’s very secure as well”.

Michael Bliss, co-founder of the Bitcoin Co-op, said that they have added 20 businesses this year who are using the new currency. They anticipate that this number will increase as Bitcoin ATMs gain accessibility and presence.

Michell Demeter, co-founder of the Vancouver store Bitcoiniacs, is responsible for bringing the new ATM machine to Vancouver. He states that Bitcoin is not only useful for purchases, but also as an investment. “It is the best performing currency in the world,” he said. “It has grown over a thousand per cent year after year, for the last four years. So people are using it also as an investment”.

The Bitcoin is best known for its role in the Silk Road online scandal where Bitcoins owned by anonymous users were implicated in the online sale of illicit drugs.

Anthony Gallipi, a Canadian entrepreneur, argues that fixating on the illicit uses of Bitcoin detracts from “much bigger e-commerce use for this that’s growing and that’s growing rapidly.” He adds: “I can access my money from any computing device at any time and do whatever the heck I want with it”.

Bitcoins are a neat idea, but many governments and economists have expressed concern over its lack of governmental regulation, as well as its actual usefulness and real-life value. Judith Chevalier, former editor of the American Economic Review states, “Unlike government issued fiat money, there is no guarantee it can be used to pay taxes or settle other obligations”.

Bitcoins are a neat idea, but many governments and economists have expressed concern over its lack of governmental regulation, as well as its actual usefulness and real-life value. Judith Chevalier, former editor of the American Economic Review states, “Unlike government issued fiat money, there is no guarantee it can be used to pay taxes or settle other obligations”.

Economist Jeffrey Tucker disagrees with Chevalier, noting “A year ago I would have had to say that, well, it has a limited functionality, but now you can actually use Bitcoin at Walmart, at, you know, every kind of big box store, anybody that sells a gift certificate, you can buy this gift certificate with Bitcoin using very simple apps”.

Tucker elaborated on Bitcoin’s other benefits, “You can bypass government currency entirely…I’ll tell you, it only takes a few times of using Bitcoin to realize this is incredibly easy. It’s much easier than credit cards and there is no danger of fraud or identity theft and other things that come with the old-fashioned credit cards system. It’s just a pure technology”.

Con.......

( A million bitcoins stolen but the owner not going to the police to attempt to solve the crime ? Red flag warning...... )

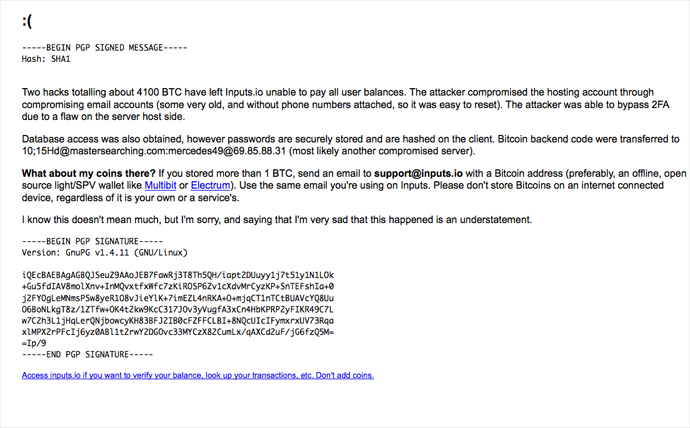

Bit-heist: Over $1mn in bitcoins stolen from Australian online bank

An Australian bitcoin bank holding over US$1 million of the crypto-currency has been hacked, leaving an unknown number of users with nothing – one of the largest thefts in the currency’s four-year history.

The incident took place on October 26, when the bank was hacked, with 4,100 bitcoins valued at $1.3 million stolen, the service’s operator only known as ‘Tradefortress’ said. He refused to give his name to the press, also stressing he was not much older than 18.

It took the bank’s owner two weeks to notify the affected customers.

Bitcoin is a decentralized, crypto-currency, free from any government or central bank control. Currency is sold and bought at online exchanges, and those transactions can be virtually anonymous.

One bitcoin is currently worth more than $300 on Mt. Gox, the world’s largest bitcoin exchange - up from around $50 in March. There are 11,925,700 million bitcoins in circulation.

The Sydney man offered the service called Inputs.io, which he claimed was "one of the most secure web wallets on the market." Customers were charged a small fee to keep their bitcoins there.

The site used two-factor authentication and location-based email confirmation, and said the page was started to avert "the hack of bitcoins even if the web server was compromised."

Some of the hacked money is to be refunded, the operator told Fairfax Media. Tradefortress said he would use 1,000 of his own bitcoins, as well as the money the hackers didn’t steal.

"Users are being repaid up to 100 percent depending on the amount (sliding scale), generally 40-75 percent," Tradefortress said.

The operator indicated the attack was possible due to “a flaw” in the system which allowed the hackers to bypass the protection.

Currently, there’s a sad face emoticon posted online and a notice that reads "I know this doesn't mean much, but I'm sorry, and saying that I'm very sad that this happened is an understatement."

It took the bank’s owner two weeks to notify the affected customers.

Bitcoin is a decentralized, crypto-currency, free from any government or central bank control. Currency is sold and bought at online exchanges, and those transactions can be virtually anonymous.

One bitcoin is currently worth more than $300 on Mt. Gox, the world’s largest bitcoin exchange - up from around $50 in March. There are 11,925,700 million bitcoins in circulation.

The Sydney man offered the service called Inputs.io, which he claimed was "one of the most secure web wallets on the market." Customers were charged a small fee to keep their bitcoins there.

The site used two-factor authentication and location-based email confirmation, and said the page was started to avert "the hack of bitcoins even if the web server was compromised."

Some of the hacked money is to be refunded, the operator told Fairfax Media. Tradefortress said he would use 1,000 of his own bitcoins, as well as the money the hackers didn’t steal.

"Users are being repaid up to 100 percent depending on the amount (sliding scale), generally 40-75 percent," Tradefortress said.

The operator indicated the attack was possible due to “a flaw” in the system which allowed the hackers to bypass the protection.

Currently, there’s a sad face emoticon posted online and a notice that reads "I know this doesn't mean much, but I'm sorry, and saying that I'm very sad that this happened is an understatement."

The response to the incident has been varied, with some users accusing Tradefortress of making up the whole hacking story to steal their money. He denies the accusation.

Customer Marco Martoccia tweeted (@sheet_metal) that he had lost 4 bitcoins as part of the heist, worth about $1,200. He said he was planning to use bitcoins as a part of the deposit for a house.

Specialists point to a lack of regulation as the main problem with the currency.

"The users of Inputs.io were trusting a random person with their money rather than in the real world when you're dealing with cash, where you trust banks to look after your money," Ty Miller, director of Australian IT security firm Threat Intelligence, told Fairfax Media.

He recommended storing coins with a strong password on a device not connected to the internet, using hard-drive encryption and antivirus protection.

A spokesman for the Australian Federal Police said to his knowledge, a theft of bitcoins has never been investigated at either a federal or state level.

The operator stated that he is not planning to address police with the matter.

Customer Marco Martoccia tweeted (@sheet_metal) that he had lost 4 bitcoins as part of the heist, worth about $1,200. He said he was planning to use bitcoins as a part of the deposit for a house.

Specialists point to a lack of regulation as the main problem with the currency.

"The users of Inputs.io were trusting a random person with their money rather than in the real world when you're dealing with cash, where you trust banks to look after your money," Ty Miller, director of Australian IT security firm Threat Intelligence, told Fairfax Media.

He recommended storing coins with a strong password on a device not connected to the internet, using hard-drive encryption and antivirus protection.

A spokesman for the Australian Federal Police said to his knowledge, a theft of bitcoins has never been investigated at either a federal or state level.

The operator stated that he is not planning to address police with the matter.

( Excuses for governmental actions and repression ? Or is this a " honeypot " type trap set up to catch flies ? )

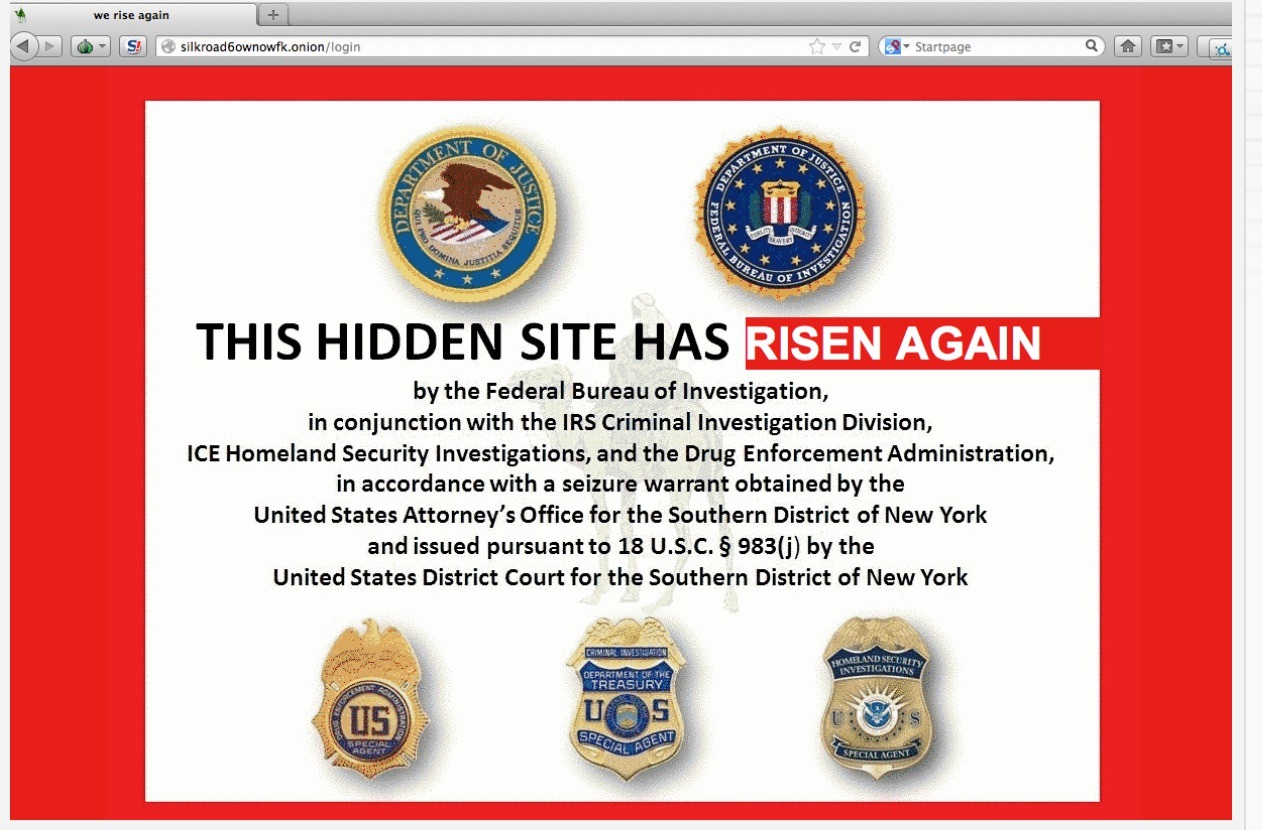

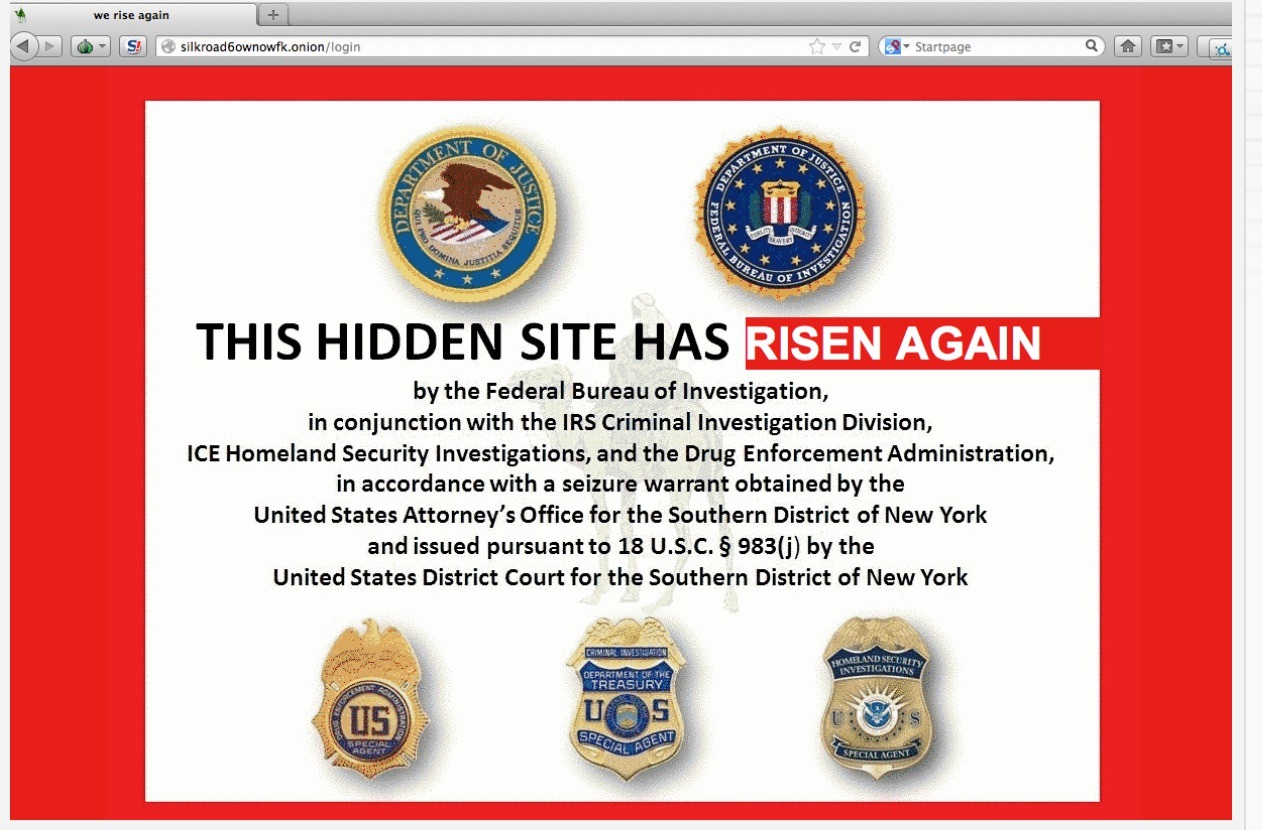

Silk Road 2.0 Has Been Born... New Website Mocks The Feds

Submitted by Tyler Durden on 11/06/2013 22:11 -0500

Submitted by Michael Krieger of Liberty Blitzkrieg blog,

The “authorities” can shut down website after website, but the tide of new technology and the human spirit itself cannot and will not be overcome. This is the hard lesson that statists and collectivists will be learning the hard way in the years to come, as decentralization and freedom stage a gigantic, peaceful revolution. A revolution that is already in full swing and gaining tremendous momentum with each passing day.

It took only a little over a month for Silk Road 2.0 to launch on the “dark web,” and there are already close to 500 illegal drug listings. As part of the new service there is even a new security feature that allows users to use their PGP encryption key as an extra authentication measure. The login page itself is even a parody of the Department of Justice’s seizure of the original site in early October. This is what you see when you visit:

More from Forbes:

On Wednesday morning, Silk Road 2.0 came online, promising a new and slightly improved version of the anonymous black market for drugs and other contraband that the Department of Justice shut down just over a month before. Like the old Silk Road, which until its closure served as the Web’s most popular bazaar for anonymous narcotics sales, the new site uses the anonymity tool Tor and the cryptocurrency Bitcoin to protect the identity of its users. As of Wednesday morning, it already sported close to 500 drug listings, ranging from marijuana to ecstasy to cocaine. It’s even being administered by a new manager using the handle the Dread Pirate Roberts, the same pseudonym adopted by the previous owner and manager of the Silk Road, allegedly the 29-year-old Ross Ulbricht arrested by the FBI in San Francisco on October 2nd.The only significant visible change from the last Silk Road, spotted by the dark-web-focused site AllThingsVice that first published the site’s new url, is a new security feature that allows users to use their PGP encryption key as an extra authentication measure. It also has a new login page, parodying the seizure notice posted by the Department of Justice on the prior Silk Road’s homepage, with the notice “This Hidden Site Has Been Seized” replaced by the sentence “This Hidden Site Has Risen Again.”“You can never kill the idea of Silk Road,” read the twitter feed of the new Dread Pirate Roberts twenty minutes before the site’s official launch.Many more of Silk Road’s users seem reassured, however, by the fact that Silk Road 2.0 is being managed in part by known administrators from the original Silk Road, particularly a moderator known as Libertas who has served as one of the more vocal leaders of the Silk Road community since Ulbricht, the alleged Dread Pirate Roberts, was arrested.

Full article here.

http://arstechnica.com/information-technology/2013/11/the-best-way-to-take-control-of-bitcoin-rally-other-greedy-selfish-miners/

The best way to take control of Bitcoin? Rally other greedy “selfish miners”

New research says luring others with big returns could lead to Bitcoin dominance.

Cornering the Bitcoin market may be easier than cornering orange juice futures.

Paramount Pictures / Aurich Lawson

Researchers at Cornell University have published a paper detailing what they see as a vulnerability in Bitcoin's protocol. Ittay Eyal and Emin Gün Sirer of Cornell's Department of Computer Science say Bitcoin is vulnerable to "selfish mining"—an attack by one or more members of the Bitcoin network who try to computationally corner the supply of bitcoins and control their flow.

"This attack can have significant consequences for Bitcoin," Eyal and Sirer wrote. "Rational miners will prefer to join the selfish miners, and the colluding group will increase in size until it becomes a majority. At this point, the Bitcoin system ceases to be a decentralized currency."

The Bitcoin community has been discussing the possibility of this sort of attack, sometimes known as a "cartel" attack, for over three years. But the risk in the past has been largely downplayed for one simple reason: it would require an attacker to have more computing power at his or her disposal than the rest of the Bitcoin network combined. The Cornell researchers' paper outlines a new strategy to the attack that still would require control of a significant number of the "nodes" in Bitcoin's transaction processing network, but it takes a different route to control—exploiting the rational behavior (and greed) of other miners.

Hi ho, hi ho, it's off to mine we go

Bitcoins are created, or "mined," by computers as they perform the cryptographic process of handling others' Bitcoin transactions and adding them to Bitcoin's "block chain"—a public record of previous Bitcoin transfers. The mining ensures that individuals can't re-use the same bitcoins they've previously spent, and those performing the mining are rewarded with bitcoins of their own. Transactions are normally doled out for processing randomly among the available mining "nodes."

Many of the attacks on traders in the Bitcoin currency have been your usual type of Internet skullduggery—malware, phishing, and hacking into Bitcoin "banks" to purloin others' bitcoins. Last year, hackers made off with $228,000 worth of bitcoins after knocking over the trading site Bitcoinica, gaining access to its Web host, and grabbing traders' whole "digital wallets" from the server.

But those who want the really big money—or just want to throw the entire Bitcoin economy into disarray—might want to find a way to break into the virtual treasury of the system by taking control of how bitcoins are minted. There have been many ways that would-be Bitcoin millionaires have tried to influence the flow of those transactions, including going as far as launching distributed denial of service attacks against other miners to keep them from advertising their availability to mine transactions.

"Selfish mining" takes the goal of redirecting Bitcoin traffic to a higher level by attempting to essentially take control of the entire network. In a selfish or cartel mining attack, a group of colluding miners keeps their own transactions within the nodes they control. And when the group detects a transaction from outside the colluding pool, the pool publishes a previous version of the "block" the transaction is tied to all at the same time—essentially making their version the trusted one, rolling back the transaction, and keeping the person responsible for originally mining the transaction from claiming a Bitcoin reward.

This is possible because the current Bitcoin mining protocol calls for miners to only broadcast the first version of a transaction "block chain" it receives of a certain length. If the selfish pool manages to push out enough of its own versions of transactions to other nodes in the network, it will eventually overwhelm other miners' versions. That would give the colluding miners control of the network and deliver all Bitcoin rewards for mining to themselves.

The possibility of "selfish miner" attacks has been known for some time, but they've generally been dismissed as impractical for a simple reason: you'd need an inordinate amount of computing power to pull it off. In order to gain control of the flow of created bitcoins and get the network to reject all of the blocks created by other miners, the attackers would need to have more computing power than the rest of the miners in the Bitcoin network combined—at least 51 percent of the computing power in the community.

Still, cartels of miners could take more than their fair share of bitcoins with control of much smaller portions of the Bitcoin network. Some simulations by members of the Bitcoin community have shown that control of as little as 15 percent of the network could pay off with out-of-proportion returns.

And it’s that sort of impact that provides the tipping point for the attack outlined by Eyal and Sirer. It uses the economic incentives that come with being part of a colluding cartel of coin miners to lure otherwise honest Bitcoin miners into the fray. The scheme offers them a bigger payout as a result of their collusion, making it rationally irresistible once the cartel reaches a size of about 25 percent of the Bitcoin network. As the paper describes it:

The researchers also found that attackers needed far less than 51 percent of the nodes in the network under their command to reach a point where they could control the system. Under the current protocol for Bitcoin, they found controlling a third of the network is sufficient to gain control.

Weighing the risk

The change Eyal and Sirer propose isn't a drastic rewrite of the system, and it should be backward compatible with existing Bitcoin mining software. Instead of processing just the first version of a block chain received, the new protocol would have miners select from multiple versions of the block chain at random. That would put the threshold for control back at over 50 percent, they asserted, and it makes cornering the Bitcoin market impractical for all but the biggest attacker (such as someone with a state-funded supercomputing environment).

Some in the Bitcoin community remain skeptical of the attack threat, particularly because it would require the cartel attacking the system to essentially announce its intentions to other miners to bring them into their pool.

Developers behind the Bitcoin network—many of whom work under the aegis of The Bitcoin Foundation, which maintains the standard for the protocol in question—are still assessing the risk as posed in the paper. Bitcoin Foundation chief scientist Gavin Anderson told IDG News Service that he believes the consensus in the end will be that the threat doesn't warrant a change. As he sees it, this attack, even with the lower threshold proposed by the Cornell researchers, simply is not technically practical.

http://www.zdnet.com/bitcoin-is-going-to-teach-you-a-lesson-a-costly-one-7000022352/

Bitcoin is going to teach you a lesson. A costly one

Summary: Bitcoin is a really bad idea. Promoting digital currency is like promoting digital food; it will leave you empty and you'll wonder why you ever thought it was a good idea.

There's nothing like watching someone trying to create a fake currency to make my day complete. Bitcoin is the silliest of ideas, even when explained in video format from the website. I registered a new account on the site just for fun. The crazy thing is that when I logged in, I discovered that I can buy one Bitcoin for $199.95. Really? Sign me up for that! In fact, put me down for a whole pocketful of them. Oh, wait, sorry, digital pocketful, since, you know, they don't really exist.

If you pay $200 for a single fake digital coin, you have something seriously wrong with you. And if you have $200 to blow on something stupid, you can donate it to the Ken Hess Party Fund. In fact, I'll accept Hesscoin exchanges in $5.00 increments. So, you can get 40 Hesscoins for the price of one Bitcoin. And Hesscoins have real value because I'll turn them into party supplies for me and 100 of my closest friends, which could include you. Maybe more if the donations...er...crowdsourced funds...er...purchases pile up to a level sufficient to support the guests.

That sounds like a really good plan. I'll call it the world's first crowdsourced party. I'll rent a place, supply the refreshments, entertainment, and a place for you to stay. Of course, the purchases have to support that. What I'll do is from all the purchases, is draw the names of 100 buyers of Hesscoin and they'll attend the party. Sound like a deal?

If I don't get 100 buyers, then what I'll do is randomly select 20 percent of the buyers to attend the party. OK, we're set. And I've digressed.

At least with Hesscoin, you have a chance of getting some value for the real money that you spend on the fake money that has no value.

The whole Bitcoin thing reminds me of a movement that I tried to get going a few years ago here in Tulsa, that I called Tulsa Dollars (based on the Ithaca Hour bartering plan). The concept was to create a barter currency that people could trade with each other for goods, services, and whatever. It never caught on.

Here's the problem with fake currencies. Aside from having no actual value, they have no tangible exchange rate. The theory behind barter dollars was that you have to set a standard value on labor, which at the time, it was suggested that we use $40/hour. Well, I charged $55/hour for computer consulting services, lawyers charge $100/hour to $200/hour for lawyering, and so on. You see, there's no way to standardize on something like labor because everyone views his labor as more valuable than yours.

When dollars had gold backing, there was actual value in our money too. Once the brilliant Franklin D. Roosevelt took us off the gold standard, our money dropped significantly in value.

You see, for a currency to work, it has to have some external value. Digital currency, no matter how cute it is, or how you spin it, it has no value. It's a silly concept but someone always tries it.

And here's the other thing. Just because some doofus creates something like this, doesn't mean you have to participate in the silliness. Things like Bitcoin only have value because you give it value. There's no external value in a digital coin.

The other reason why fake currencies fail is that you create a false sub economy with them. The good and services exchanged don't get taxed and while you might think that's a good thing, let me tell you that it's not. Taxes are how we pay for roads, electric lines, phone lines, Internet lines, and other necessities. And you should be aware that just because you're using a fake currency doesn't mean that you're necessarily excluded from owing taxes on your transactions. Even theBitcoin FAQ tells you that.

Underground economies don't give back anything to the common good. Plus, someone, at some point, is going to have to use real money and have a real job to support all these alternative types who want to undermine the evil government overlords.

Another thing that's really dumb about Bitcoin, or Bitcon, as I like to call it, is that the evil Bitcoin overlords are limiting the number of Bitcoins to 21 million. Weird.

FYI: There's an unlimited number of Hesscoins available.

I think that Bitcoin is a cute but annoying experiment in human folly. It proves that people will do dumb things for no apparent reason.

The whole Bitcoin thing still boggles my mind. It's hard to believe there's any attention at all given to it. It's even harder to believe that I'm spending time on it as well. The writers of the Bitcoin FAQ are a little off on what they believe to be a currency's value but at least they do understand some basic economic principles, though tainted by the downright silly factor of this whole Bitcoin thing.

My advice is to not spend time, effort, or actual dollars on Bitcoin. It's ridiculous and a 100 percent waste of time. So, stop mining, and focus on making real dollars. Underground economies don't work. Focus on something productive like viral videos, Gangnam style dancing, flash mobs, or taking up a new hobby. Quatloos, on the other hand, are real currency. You can buy people with them.

http://upstart.bizjournals.com/news/technology/2013/11/04/bitcoin-exceeds-pre-bubble-market-cap.html

At $2.7 billion in value, Bitcoin exceeds pre-

bubble market cap

- Michael del Castillo

- Upstart Business Journal Technology & Innovation Editor

- Email | Twitter

The UpTake: Just seven months after a Bitcoin crash drained half the currency's global value, it has recovered, and surpassed it's previous peak. But that's not necessarily reason to believe it won't happen again.

The total value of all the Bitcoins in existence today surpassed the highest it’s ever been, reaching $2.7 billion, accordingto Blockchain.info, a site that tracks the currency’s growth. This time around though, the growth looks slow and steady. But unless you’re a roulette person, you may still want to still want to sit this investment out, for now.“Bitcoin is pure speculation,” said Phil DeMuth a SEC registered investment advisor. “It’s like asking if red or black is going to come up on a roulette wheel.”

The last time global Bitcoin value was this high was back in April, when its market cap doubled in four months to $2.5 billion. Then, on April 10, the currency lost 37 percent of it’s value against the dollar, eventually bottoming out at a $.9 billion market cap.

By comparison, it took almost twice as long, seven months, for the currency to regain and surpass that lost value. Which on the Blockchain.info site looks like a nice, smooth growth side-by-side with the last exploded bubble.

But DeMuth, who is also a psychologist and regular contributor to Forbes, called the interpretation of such charts a “discredited” practice. Although they may show evidence of an investment’s momentum they do not reflect what will happen in the future.

Previous bubbles, like the Japanese land bubble of the 1980s, which rose for 10 years only to fall for another 15, are evidence of why investors may want to be wary about Bitcoin's steady growth over a measly seven months.

“In the long term, can Bitcoin establish itself as a currency that is free of government control?” DeMuth asked. “If it can do that, it will rule the world.”

Last week the maker of the 3-D printed gun, Cody Wilson, announced a crowdfunding campaign for a Bitcoin startup called Dark Wallet, with the goal to do exactly that: make sure the government can’t regulate the currency.

Until a clear winner is decided in that battle, no matter how high the currency rises it’s no safe bet for currency speculators.

Morning Fred,

ReplyDeleteYes, the mall shooter didn't want to shoot anyone, I guess it was more a public suicide poor guy. My employer is a decent size employer +1,000 so I hope that means less screwing over by Ocare.

Bitcoin still on a tear and gaining users. That Hess guy seems like a real asshole or maybe just ignorant. Yes it's only digital, yes it has been "created" but a dollar is mostly digital and those that are physical are either just paper or tokens with no intrinsic value. At least it takes some effort to make a bitcoin and there is a limit to how many are made. Not that I have made a major investment in bitcoins or that I'm some unquestioning believer but I know I should be skeptical about the dollar even more.

Morning Kev !

ReplyDeleteOn ObamaCare , it would appear for now Employer plans ( for large Employers ) are effectively grandfathered in . While that might change down the road , it would appear those are secure for now.

On BitCoin , I try to present pro and con news / points of view so folks can draw their own conclusions. It seems at present , Canada and Europe are moving forward toward acceptance of BitCoin , not sure what we may see happen here , whether the US Government will intervene against BitCoin. To the extent that dollar competitors such as gold are subject to manipulation , I would guess BitCoin will be attacked / manipulated if it becomes a threat here.

"...wider adoption indicates possibilities for Bitcoin as an alternative currency"

ReplyDeleteI couldn't agree more on that. The more people believe in bitcoin hype, the greater possibility that it can be the future currency. Every transaction is through virtual channel now that includes money transfer, bank transaction, and purchasing; so no wonder bitcoin is the next big thing. Let's just see how far it will stay.

Philip Jones

Betcoin™