http://www.zerohedge.com/news/2013-11-29/e-gold-founder-launches-new-gold-backed-currency

( So , whom and where is the gold backing this scheme going to be stored ? )

and.....

Interesting how as BitCoin approaches 1200 ( how long before BitCoin mania takes a bitcoin past the price for an ounce of gold ? ) , we see news geared to knock sentiment.....

http://harveyorgan.blogspot.com/2013/11/nov-272013december-gold-oi-tonight-at.html

*****

http://dealbook.nytimes.com/2013/11/27/a-prediction-bitcoin-is-doomed-to-fail/?_r=0

http://money.cnn.com/2013/11/27/technology/bitcoin-silk-road/

http://www.zerohedge.com/news/2013-11-27/presenting-bitkillers-these-are-richest-holders-bitcoin

( How long before all of these accounts are looted ? About 12 billion there for the taking in the entire BitCoin universe.... )

http://www.zerohedge.com/news/2013-11-28/bitcoin-parabola-continues-10-12-hours-hits-1170

( So , whom and where is the gold backing this scheme going to be stored ? )

E-Gold Founder Launches New Gold Backed Currency

Submitted by Tyler Durden on 11/29/2013 21:17 -0500

Submitted by Mike Krieger of Liberty Blitzkrieg blog,

It was only a matter of time before thesuccess of Bitcoin led to a new attempt to create a digital currency backed by gold. It seems as if that day has now arrived.

Douglas Jackson is the founder of e-gold, which was shut down by U.S. authorities a little over five years ago under accusations of money laundering. While I fully think the ultimate monetary solution will be a decentralized payment protocol that merges Bitcoin-like technology with the ability to back it with gold, silver or whatever people want, I am of the view that it cannot be done from an overly centralized authority or protocol. There are several reasons for this.

First, when you have a centralized single issuer of a currency who also is responsible for vaulting the gold within the payment system you have an enormous degree of counter-party risk. The vault itself could be seized by “authorities” in whatever jurisdiction it is located in.Second, the human beings or company behind any currency system can themselves be pressured or threatened in order to comply with more powerful interests. The beauty of Bitcoin is that there is no “Bitcoin corporation.” It truly is decentralized and anarchic in nature. It basically puts “the powers that be” in a position that if they want to completey destroy it, they’d have to destroy the internet itself.

That said, I do believe the evolution of money is headed to a Bitcoin type system with the ability to have whatever backing is desired by the market. So at this point my questions to Mr. Jackson would be:

1) How decentralized is this currency system intended to be if at all?

2) Will there be an open source protocol available to all?

3) Are the units of currency distributed to those that own gold in a particular vault or vaults under a the custodianship of a particular company?

4) Is the currency limited to those who own gold in the currency issuer vaults, or will they be linking vaults all over the world if such vaults care to be linked.

2) Will there be an open source protocol available to all?

3) Are the units of currency distributed to those that own gold in a particular vault or vaults under a the custodianship of a particular company?

4) Is the currency limited to those who own gold in the currency issuer vaults, or will they be linking vaults all over the world if such vaults care to be linked.

While I love the idea, it would have to be done right or it will be doomed to fail. I’m very curious to learn more about this and I’d also love to hear reader feedback on this.

From the Financial Times:

The founder of one of the earliest virtual currencies has re-emerged with a rival to Bitcoin, more than five years after his first venture, e-gold, was shut down by the US Department of JusticeDouglas Jackson is consulting for a membership organisation called Coeptis that hopes to launch a new version of his gold-backed currency, which attracted millions of users at its height.Coeptis’s “global standard currency” would be fully backed by reserves of gold, held in a trust, in effect turning the precious metal into a medium of exchange.

Full article here.

and.....

http://www.zerohedge.com/news/2013-11-29/bitcoin-now-worth-more-gold

( That didn't take long.... )

Bitcoin Now Worth More Than Gold

Submitted by Tyler Durden on 11/29/2013 00:46 -0500

It seems the growing tensions in Asia (Japan-China sabre-rattling and Indian capital controls) have prompted more great rotation out of fiat and into digital currency as China/India markets open. For the first time ever, the price of one unit of Bitcoin exceeds the price of an ounce of gold...

1 oz of Gold = $1241.98 (Bloomberg)

1 unit of Bitcoin = $1242.00 (Bitcoinwisdom.com)

Interesting how as BitCoin approaches 1200 ( how long before BitCoin mania takes a bitcoin past the price for an ounce of gold ? ) , we see news geared to knock sentiment.....

http://harveyorgan.blogspot.com/2013/11/nov-272013december-gold-oi-tonight-at.html

Wednesday, November 27, 2013

Nov 27.2013/December Gold OI tonight at 3.3 million oz with one day to go/GLD loses a massive 5.7 tonnes/SLV loses 674,000 oz

Good evening Ladies and Gentlemen:

In the access market today at 5:15 pm tonight here are the final prices:

gold: $1238.00

Gold closed down $3.60 to $1237.80 (comex closing time ). Silver was down 21 cents at $19.63.

In the access market today at 5:15 pm tonight here are the final prices:

gold: $1238.00

silver: $19.67

*****

http://dealbook.nytimes.com/2013/11/27/a-prediction-bitcoin-is-doomed-to-fail/?_r=0

A Prediction: Bitcoin Is Doomed to Fail

BY EDWARD HADAS

The developers of bitcoin are trying to show that money can be successfully privatized. They will fail, because money that is not issued by governments is always doomed to failure. Money is inevitably a tool of the state.

Bitcoin relies on thoroughly contemporary technology. It consists of computer-generated tokens, with sophisticated algorithms guaranteeing the anonymity, transparency and integrity of transactions. But the monetary philosophy behind this web-based phenomenon can be traced back to one of the oldest theories of money.

Article Tools

Economists have long declared that currencies are essentially a tool to increase the efficiency of barter, which they consider the foundation of all organized economic activity. In this view, money is a convenient instrument used by individuals to get things done. It is not inherently part of the apparatus of government.

I think of the concept of privately issued tender as “right money,” because the whole idea appeals instinctively to right-wing thinkers. They dislike centralized authority of all sorts, including monetary authority. For example, Friedrich Hayek, Margaret Thatcher’s favorite economist, proposed replacing the state’s monopoly on legal tender with competing currencies offered by rival banks.

Mr. Hayek presumably would have approved of bitcoin. The currency’s issuer is an unknown computer programmer, about as far from a government as can be imagined. Right now, bitcoin is tiny; at the current exaggerated exchange rate, the total projected volume of “coins” is worth less than the gross domestic product of Mongolia. Still, Mr. Hayek might well have dreamed of bitcoins becoming a global currency for wages, prices and loans. He would, though, have hoped for a more stable value, not the increase from $13 to $900 per bitcoin in less than a year.

But the right-money historical narrative is simply wrong, as the anthropologist David Graeber explains in his book ”Debt: The First 5,000 Years.” Straightforward barter played a tiny role in all premodern economies. Instead, what we think of as purely economic activity was inseparable from an intricate structure of social relationships and spiritual beliefs. Purely commercial activity was rare — and it almost always relied on some form of government-issued money. Barter was not the precursor to money; it has always been the inferior alternative.

So it is not surprising that barter economies only develop when governments break down. Similarly, truly private money is an inferior alternative to the money that comes with the backing of a political authority. After all, no bank or bitcoin-emitter can be as public-minded as a government, and no private power can raise taxes or pass laws to unwind monetary excesses.

In short, while the freedom promised by right money may be ideologically appealing, monetary relations are too closely interwoven with other economic, political and social relations to be managed well by any institution with less sway than a government. The detailed work of money creation can be delegated to independent central banks and to a credit system of regulated private banks, but the ultimate authority of any functioning monetary system will always be the ultimate political authority.

Bitcoin exemplifies some of the problems of private money: Its value is uncertain, its legal status is unclear, and it could easily become valueless if users lose faith. Besides, if bitcoin ever really started to take off, governments would either ban it or take over the system. The authorities might be motivated by a genuine concern about the stability of a shadow monetary system or they might act out of self-preservation. Tax evasion would be too easy in a right-money parallel economy.

Mr. Hayek thought left-wing thinkers ignored the dangers of big government. He may have been right, but his idealism cannot overturn reality. All effective money is state-backed — what could be called “left money.”

Of course, the global monetary system has suffered from appalling management in recent years. The authorities, especially in the United States, first allowed banks to act almost as if they were in a right-money world, lending and speculating wildly. That led to a typical right-money disaster — a sudden loss of trust and the failure of leading institutions. The authorities rescued the financial system, but their monetary system still cannot provide steady support to the rest of the economy.

The outcome could have been much worse. Banks are still in business and consumer inflation rates are generally low. Still, the typical current combination of low interest rates, large government deficits and high ratios of debt to G.D.P. amounts to an invitation to monetary accidents.

Part of the interest in virtual currencies like bitcoin is that their anonymity can provide a convenient cloak for criminal activity. Part is technological — this is a cool idea. And part is speculative — gamblers bet that bitcoin’s value will increase.

But I suspect another important factor is political: Bitcoin appeals because governments are not fully living up to the responsibility that comes with state-sponsored money. Bitcoin, or something like it, will thrive until the authorities do better.

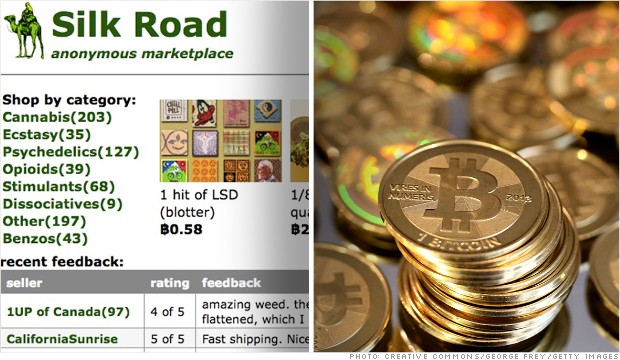

http://money.cnn.com/2013/11/27/technology/bitcoin-silk-road/

Report linking Bitcoin and Silk Road retracted

November 27, 2013: 11:54 AM ET

NEW YORK (CNNMoney)

After suggesting earlier this week that a link existed between the creators of Silk Road and Bitcoin, two Israeli computer researchers have retracted their report.

The academic report had suggested that Satoshi Nakamoto, the yet-unidentified creator of virtual currency Bitcoin, gave an unusually large sum of money to someone known as Dread Pirate Roberts, founder of the online black market Silk Road.

However, the person accused of sending the money to the Silk Road founder turned out to be Dustin Trammell, a tech-savvy libertarian in Austin, Texas. In actuality, he sent it to Mt. Gox, a Bitcoin exchange. Trammell said he's communicated by email with the famous Satoshi, but that's it.

"Unless I have split personalities and this is Fight Club, I definitely am not Satoshi Nakamoto," Trammell recently wrote on his blog.

The Weizmann Science Institute researchers, Dorit Ron and Adi Shamir, admitted that they were wrong, even though they said the link was merely a theory.

"Now that a better explanation exists, we no longer believe that the [account] belonged to Satoshi," the researchers said in an email.

In his blog, Trammell denied having any connection to Silk Road, saying he made the large transfer of money to himself. That wouldn't be odd, given that Bitcoin users often keep multiple digital wallets.

http://www.zerohedge.com/news/2013-11-27/presenting-bitkillers-these-are-richest-holders-bitcoin

( How long before all of these accounts are looted ? About 12 billion there for the taking in the entire BitCoin universe.... )

Presenting The BitKillers: These Are The Richest Holders Of Bitcoin

Submitted by Tyler Durden on 11/27/2013 18:32 -0500

The top holder of Bitcoins is the unlikely named1933phfhK3ZgFQNLGSDXvqCn32k2buXY8awith 111,111 units of the crypto-currency (up from 40,000 units in the summer of 2011) for a total value over $110 million. Perhaps most interesting is these 100 Bitcoin holders represent over 20% of the entire outstanding amount of the alternative currency.

The following 100 Holders represent 2.23 million Bitcoins of the 11.12 million total outstanding currently...

(click image for full list)

and the Number 1 Holder has been adding (though hasn't added since Feb 2013...)

And the concentration of Bitcoins has fallen from its early incarnation highs but has been static for recent months...

Source: BitcoinRichList

http://www.zerohedge.com/news/2013-11-28/bitcoin-parabola-continues-10-12-hours-hits-1170

The Bitcoin Parabola Continues: Up 10% In 12 Hours, Hits $1170

Submitted by Tyler Durden on 11/28/2013 09:18 -0500

Despite the US being largely on holiday, the demand for digital currencies continues to surge. Bitcoin has rallied another 10% overnight as Chinese appetite for alternative stores of value remains unabated (BTC China is nearing its record highs) as USD/BTC is trading at $1170 - on its way to crossing the Maginot line of gold's spot price (within a few hours at this pace). Bitcoin though has nothing on its smaller cousin Litecoin which has now run from $1.11 to over $48 in the last 5 weeks. In fact, almost every crypto-currency in the world - from Infinitecoin to AnonCoin is surging... with only the ironically named PhoenixCoin (-68% overnight) not rising from the flames of fiat torment.

Bitcoin is making new highs in USD...

Getting close in China...

and Litecoin is exploding...

Almost every digital currency is on fire... (via coinmarketcap.com)

No comments:

Post a Comment