http://www.infowars.com/chase-bank-limits-cash-withdrawals-bans-international-wire-transfers/

http://www.zerohedge.com/news/2013-10-16/creeping-capital-controls-jpmorgan-chase

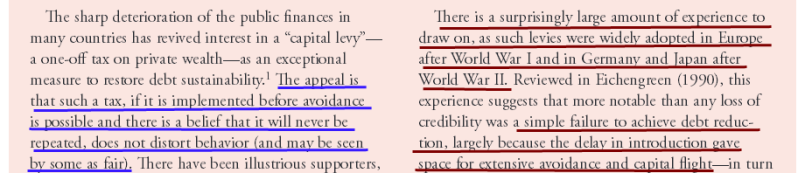

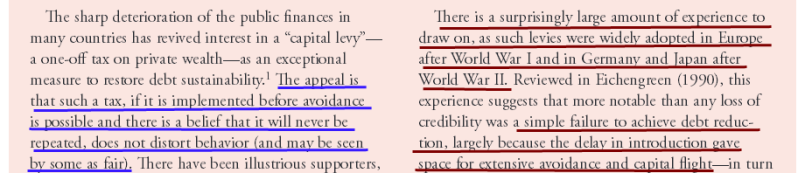

While most informed observers have become immune to the cynicism of the Troika and the EC, some of the phraseology in this extract is indicative of intention unmoved by compassion: “and there is a belief that it will never be repeated”, “a large amount of experience to draw on” and so forth.

While most informed observers have become immune to the cynicism of the Troika and the EC, some of the phraseology in this extract is indicative of intention unmoved by compassion: “and there is a belief that it will never be repeated”, “a large amount of experience to draw on” and so forth.

Chase Bank Limits Cash Withdrawals, Bans International Wire Transfers

Capital controls imposed on small business owners

Paul Joseph Watson

Infowars.com

October 16, 2013

Infowars.com

October 16, 2013

UPDATE: Chase Bank confirmed to Infowars that all business account holders were being subjected to these new regulations. They indicated that customers would have to pay a fee on every dollar withdrawn over the limit. Given that even a relatively small grocery store or restaurant is likely to turnover more than $50k a month in cash payments, this appears to be part of a wider move to shut down businesses who mainly deal in cash. Chase told us customers would have to upgrade to much more expensive accounts to avoid the capital controls, meaning larger corporations will not be affected. The bottom line is that banks think your money is their money and will do everything in their power to prevent you from withdrawing it in large quantities.

Chase Bank has moved to limit cash withdrawals while banning business customers from sending international wire transfers from November 17 onwards, prompting speculation that the bank is preparing for a looming financial crisis in the United States by imposing capital controls.

Numerous business customers with Chase BusinessSelect Checking and Chase BusinessClassic accounts have received letters over the past week informing them that cash activity (both deposits and withdrawals) will be limited to a $50,000 total per statement cycle from November 17 onwards.

The letter reads;

Dear Business Customer,Starting November 17, 2013:- You will no longer be able to send international wire transfers. You will still be able to send domestic wires and receive both domestic and international wires. We’ll cancel any international wire transfers, including reccurring ones, you scheduled to be sent after this date.- Your cash activity limit for these accounts(s) will be $50,000 per statement cycle, per account. Cash activity is the combined total of cash deposits made at branches, night drops and ATMs and cash withdrawals made at branches (including purchases of money orders) and ATMs.These changes will help us more effectively manage the risks involved with these types of transactions.

Another letter (PDF) received by Peak to Peak Charter School, an Elementary School in Colorado, states that the option to send both international and domestic wire transfers has been withdrawn from Chase business savings account holders.

Shortly after we posted this story, other Chase business customers confirmed they had also received similar or identical letters.

“I’m a Chase customer with both of the type accounts mentioned and got the letter posted,” wrote one.

“I have been a loyal customer of Chase for 11 years and I received the letter for my business and when I called about this I was told basically piss off and find another bank!” added another.

Chase Bank later confirmed in a tweet, “Certain biz accounts will no longer allow intl wire & large cash transactions,but customers can opt for Chase accounts that do,” (in other words accounts that are far more expensive).

http://www.zerohedge.com/news/2013-10-16/creeping-capital-controls-jpmorgan-chase

Creeping Capital Controls At JPMorgan Chase?

Submitted by Tyler Durden on 10/16/2013 15:31 -0400

A letter sent to a ZH reader yesterday by JPMorgan Chase, specifically its Business Banking division, reveals something disturbing. For whatever reason, JPM has decided that after November 17, 2013, it will halt the use of international wire transfers (saying it would "cancel any international wire transfers, including recurring ones"), but more importantly, limits the cash activity in associated business accounts to only $50,000 per statement cycle. "Cash activity is the combined total of cash deposits made at branches, night drops and ATMs and cash withdrawals made at branches and ATMs."

Why? "These changes will help us more effectively manage the risks involved with these types of transactions." So... JPM is now engaged in the risk-management of ATM withdrawals?

Reading between the lines, this sounds perilously close to capital controls to us.

While we have no way of knowing just how pervasive this novel proactive at Chase bank is and what extent of customers is affected, what is also left unsaid is what the Business Customer is supposed to do with the excess cash: we assume investing it all in stocks, and JPM especially, is permitted? But more importantly, how long before the $50,000 limit becomes $20,000, then $10,000, then $5,000 and so on, until Business Customers are advised that the bank will conduct an excess cash flow sweep every month and invest the proceeds in a mutual fund of the customer's choosing?

Full redacted letter below:

GLOBAL LOOTING: IMF implicated as the source of the 10% EU levy scheme

Mario Draghi the key to means and motive…as usual

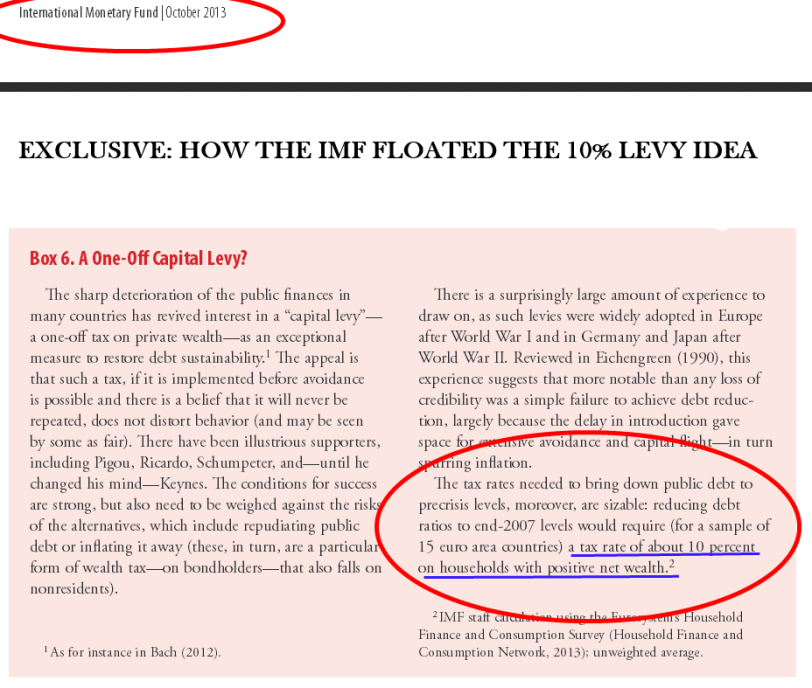

An exclusive leak from the IMF is today presented by The Slog as almost certainly the source of persistent rumours that have swept Europe about a massive bank account-bailin across the continent. These began following a piece in Greek newspaper HEMPHΣIA last Monday claiming that “active consideration” was being given to the idea.

The internal document is clearly dated ‘October 2013′ and judging from the ‘finished’ look of the print, almost certainly due for publication. However, the last public report on the European region was in April, and the IMF site shows no mention of this new one at all.

The text is notable in that there is very clearly an air of encouraging the EC FinMins to adopt the proposal. Given that the IMF is on the verge of having a loan written off for the first time in its history, they would say that: but the tone is interesting…and is self-explanatory as to why the document doesn’t appear to have been published:

While most informed observers have become immune to the cynicism of the Troika and the EC, some of the phraseology in this extract is indicative of intention unmoved by compassion: “and there is a belief that it will never be repeated”, “a large amount of experience to draw on” and so forth.

While most informed observers have become immune to the cynicism of the Troika and the EC, some of the phraseology in this extract is indicative of intention unmoved by compassion: “and there is a belief that it will never be repeated”, “a large amount of experience to draw on” and so forth.

When first shown the document, I was struck mainly by the talk of a ‘household levy’ – which is different to the bank account idea floated in the Greek press earlier this week. But I understand from EU Brussels-based sources that the bank account option is the only one eurocrats and politicians will accept: it is seen as faster, more easy to effect, and “less visible” – which struck me as an interesting observation.

A fortnight ago, the normally watertight Mario Draghi made some significant comments during a press conference on EU economic performance. He remarked, “….the necessary balance sheet adjustments in the public and private sectors will continue to weigh on economic activity….” by which of course he means the unrepayable black hole of debt in the eurozone. Note also the words from the IMF analysis of the levy idea, ‘an exceptional measure to restore debt sustainability’. But Draghi continued, talking of ‘further decisive steps’, and making reference to:

‘…the funding situation of banks….In order to ensure an adequate transmission of monetary policy to the financing conditions in euro area countries, it is essential that the fragmentation of euro area credit markets declines further and that the resilience of banks is strengthened where needed….’

There is no smoking gun on this developing story as yet. But the evidence we do have before us adds credibility to the Greek media reports of earlier this week. To summarise:

€ Draghi’s greatest fear is the level of bank insolvency driving yet more capital out of the ezone peripheral States.

€ The IMF has a report as yet unpublished urging the EC to hit citizens with a levy before they can get their money out. As per the Draghi fear above, if the intention were known, it would of course be self-defeating.

€ Brussels sources confirm that such a levy is being considered, and would involve bank accounts not domestic taxes.

€ Christine Lagarde would do anything to anyone any number of times to avoid going down in history as the person who oversaw the IMF’s first massive debt write-off.

Fortunately at least some extra cash can be still taken not only from banks. On the other hand I am lost in expectations what's next? The situation now reminds me the plot of the Ayn Rand's-Atlas Srugged more and more, though it seemed to be a pure fiction before.

ReplyDeleteThanks for sharing good and helpful article with us. This is very helpful for me.

ReplyDeleteMoney transfer