http://jessescrossroadscafe.blogspot.com/2013/08/comex-registered-gold-drops-to-702000.html

About 11,600 ounces of gold were added to the eligible storage facility at HSBC, and 22,446 ounces were transferred from registered (deliverable) status to eligible storage. This is the activity which occurred on Thursday which was reported today.

Total ounces of registered deliverable gold have fallen to 702,488 ounces of gold bullion.

The total ounces of gold stored in COMEX authorized warehouses remains a little over 7 million ounces.

September is not a delivery month on the COMEX. But most gold in the world changes hands in exchanges like Shanghai and London. And they will be open for business as always.

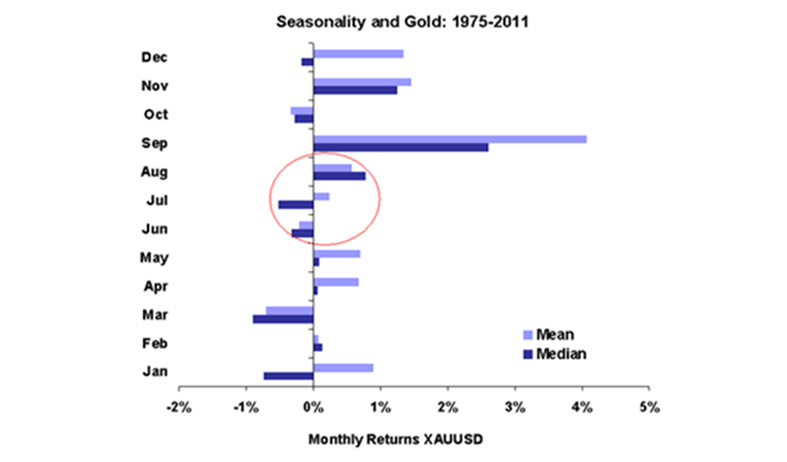

Ironically September is often a good month for gold on a seasonal basis.

The New York crowd may push the price around the plate, but on an historical basis their hands and mouths are moving quickly, but their pockets are light. And won't that be a day of days...

30 AUGUST 2013

COMEX Registered Gold Drops To 702,000 Ounces On the Day Before Delivery End

About 11,600 ounces of gold were added to the eligible storage facility at HSBC, and 22,446 ounces were transferred from registered (deliverable) status to eligible storage. This is the activity which occurred on Thursday which was reported today.

Total ounces of registered deliverable gold have fallen to 702,488 ounces of gold bullion.

The total ounces of gold stored in COMEX authorized warehouses remains a little over 7 million ounces.

September is not a delivery month on the COMEX. But most gold in the world changes hands in exchanges like Shanghai and London. And they will be open for business as always.

Ironically September is often a good month for gold on a seasonal basis.

The New York crowd may push the price around the plate, but on an historical basis their hands and mouths are moving quickly, but their pockets are light. And won't that be a day of days...

Mike Kosares: Currency and debt collapses are bigger threats than Syria

Submitted by cpowell on Thu, 2013-08-29 18:41. Section: Daily Dispatches

2:34p ET Thursday, August 29, 2013

Dear Friend of GATA and Gold:

Currency and debt collapses are probably bigger threats to the world economy than anything involving Syria, Centennial Precious Metals' Mike Kosares writes today at Centennial's Internet site, USAGold. Kosares' commentary is headlined "A New Contagion Is Brewing -- Gold Could See Mega-Highs, According to Two Super-Bank Economists":

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Actin Committee Inc.

Gold Anti-Trust Actin Committee Inc.

India might buy gold from citizens to ease rupee crisis

Submitted by cpowell on Thu, 2013-08-29 12:33. Section: Daily Dispatches

By Suvashree Dey Choudhury

Reuters

Thursday, August 29, 2013

Reuters

Thursday, August 29, 2013

MUMBAI -- India is considering a radical plan to direct commercial banks to buy gold from ordinary citizens and divert it to precious metal refiners in an attempt to curb imports and take some heat off the plunging currency. A pilot project will be launched soon, a source familiar with the Reserve Bank of India plans told Reuters. India has the world's third-largest current account deficit, which is approaching nearly $90 billion, driven in a large part by appetite for gold imports in the world's biggest consumer of the metal.

For the full story:

http://www.silverdoctors.com/golds-strongest-months-since-1975-are-september-and-november/#more-31279

From Goldcore:

Today’s AM fix was USD 1,392.75, EUR 1,051.85 and GBP 899.19 per ounce.

Yesterday’s AM fix was USD 1,406.25, EUR 1,059.96 and GBP 906.79 per ounce.

Yesterday’s AM fix was USD 1,406.25, EUR 1,059.96 and GBP 906.79 per ounce.

Gold fell $8.60 or 0.61% yesterday, closing at $1,407.10/oz. Silver fell $0.44 or 1.81%, closing at $23.85. Platinum fell $11.61 or 0.8% to $1,518.99/oz, while palladium was down $8.78 or 1.2% to $734.22/oz.

Gold is set for its second consecutive higher monthly close which is bullish from a momentum and technical perspective. Gold is nearly 5% higher for the month in dollars and euros, 2.5% in pounds and 12% in rupees after the rupee collapsed in August.

Gold quickly fell from $1,407/oz to $1,395/oz at 0800 London time despite no data of note and little corresponding movement in oil and stock markets. Profit taking and an increase in risk appetite may have contributed to the falls after the U.K. parliament voted to reject military action against Syria and fears over oil supply disruptions in the Middle East eased.

Oil prices are still heading for the largest monthly gain in a year, with Brent up more than 6% in August after unrest cut output in Libya by around 1 million barrels per day and production fell in Iraq, Nigeria and elsewhere.

The U.S. seems likely to proceed with a strike against Syria even after U.K. lawmakers rejected action which should support prices. The yellow metal reached $1,433.83/oz on August 28th, its highest since mid May on concerns that the U.S. will go to war with Syria.

Gold’s recent gains are primarily due to very strong physical demand globally and increasing supply issues, particularly in the LBMA gold bullion market. Syria and the increasing geopolitical uncertainty in the Middle East are creating real oil price and inflation risk which has contributed to the increased bullion buying in recent days.

As ever it is important to focus on the medium and long term drivers of the gold market:

Medium Term Market DriversThe medium market themes guiding the market currently are as follows:

SeasonalLate summer, autumn and early New Year are the seasonally strong periods for the gold market due to robust physical demand internationally.

This is the case especially in Asia for weddings and festivals and into year end and for Chinese New Year when China stocks up on gold. Gold and silver often see periods of weakness in the summer doldrum months of May, June and July.

This week will see the end of August trading and September is, along with November, one of the strongest months to own gold. This is seen in the charts showing gold’s monthly performance over different time frames – 1975 to 2011, 2000 to 2011 and our Bloomberg Gold Seasonality table from 2003 to 2013 (10 years is the maximum that can be used).

Thackray’s 2011 Investor’s Guide notes that the optimal period to own gold bullion is from July 12 to October 9. During the past 25 periods, gold bullion has outperformed the S&P 500 Index by 4.7%.

COMEXFutures market positioning as seen on the COMEX is now very bullish.

Short positions held by hedge funds in the gold and silver markets remain very high and the stage is now set for a significant short squeeze which should propel prices higher in the coming months. Arguably we are in the early stages of this short squeeze.

Hedge funds have consistently been caught wrong footed at market bottoms for gold and silver in recent years and high short positions have been seen near market bottoms, prior to rallies in gold and silver.

Conversely, the smart speculative money, bullion banks such as JP Morgan have reduced their short positions and are now long in quite a significant way and positioned to profit from higher prices in the coming weeks and months.

Federal Reserve “Tapering”The Federal Reserve has been suggesting for months, indeed years, that they would return to more normal monetary policies by reducing bond buying programmes and gradually increasing interest rates.

‘Talk is cheap’, ‘actions speak louder than words’ and it is always best to watch what central banks do rather than what they say.

Near zero interest rates and bond buying are set to continue for the foreseeable future.

Precious metals will only be threatened if there is a sustained period of rising interest rates which lead to positive real interest rates. This is not going to happen anytime soon as it would lead to an economic recession and possibly a severe Depression.

Chinese Demand

Chinese demand for physical bullion continues to be very high and continues to support prices and will likely again contribute to higher prices in the coming months. China gold purchases surged 54% to 706.4 metric tons in the first half of 2013 from the first half of 2012 – a year of record demand in China.

Chinese demand for physical bullion continues to be very high and continues to support prices and will likely again contribute to higher prices in the coming months. China gold purchases surged 54% to 706.4 metric tons in the first half of 2013 from the first half of 2012 – a year of record demand in China.

Demand surged 87% for bars and 44% for jewelry. China’s gold demand should hit a record 1,000 tonnes this year and will almost certainly overtake India, the world’s largest saver in gold.

The People’s Bank of China is almost certainly continuing to quietly accumulate gold bullion reserves. As was the case previously, they will not announce their gold bullion purchases to the market in order to ensure they accumulate sizeable reserves at more competitive prices. They also do not wish to create a run on the dollar – thereby devaluing their sizeable foreign exchange reserves.

Expect an announcement from the PBOC, sometime in 2013 or 2104, that they have doubled or even trebled their reserves to over 2,000 or 3,000 tonnes.

India

Indian demand has fallen somewhat due to recent tariffs but will remain robust and should be as high as 1,000 tonnes this year.

Indian demand has fallen somewhat due to recent tariffs but will remain robust and should be as high as 1,000 tonnes this year.

Gold Forward Offered Rates (GOFO)

Gold forward offered rates (GOFO) or the cost to borrow gold remains negative. Negative gold borrowing costs is likely due to a lack of supply of large 400 ounce bars as mints, refineries and jewellers internationally and especially in Asia are scrambling to secure supply.

Gold forward offered rates (GOFO) or the cost to borrow gold remains negative. Negative gold borrowing costs is likely due to a lack of supply of large 400 ounce bars as mints, refineries and jewellers internationally and especially in Asia are scrambling to secure supply.

Gold Backwardation

Gold is in backwardation. Meaning that gold for future delivery is trading at a discount to physical market prices – a rare situation that has occurred only after the Lehman Brothers collapse and near the bottom of the gold market in 1999. Spot prices or prices for delivery now are higher than prices for future contracts at later dates. This is very unusual and means that buyers are willing to pay a premium for physical. It also strongly suggests that there is tightness in the physical market.

Gold is in backwardation. Meaning that gold for future delivery is trading at a discount to physical market prices – a rare situation that has occurred only after the Lehman Brothers collapse and near the bottom of the gold market in 1999. Spot prices or prices for delivery now are higher than prices for future contracts at later dates. This is very unusual and means that buyers are willing to pay a premium for physical. It also strongly suggests that there is tightness in the physical market.

Eurozone Debt Crisis

The Eurozone debt crisis is far from over and will rear its ugly head again – probably as soon as the German elections are over. Politicians and bankers have managed to delay the inevitable day of reckoning by piling even more debt onto the backs of already struggling tax payers thereby compounding the problem and making it much worse in the long term.

The Eurozone debt crisis is far from over and will rear its ugly head again – probably as soon as the German elections are over. Politicians and bankers have managed to delay the inevitable day of reckoning by piling even more debt onto the backs of already struggling tax payers thereby compounding the problem and making it much worse in the long term.

Greece, Spain, Portugal, Italy, Ireland, now Cyprus and even France remain vulnerable.

Japan, U.K., U.S. Debt CrisisIn Japan, the national debt has topped the ¥1 quadrillion mark. A policy of money printing pursued for a decade has failed abysmally and now politicians look set to pursue currency debasement in an even more aggressive manner – with attendant consequences.

The U.K. is one of the most indebted countries in the industrialised world – the national debt continues to rise rapidly and is now at more than 1.2 trillion pounds ($1.8 trillion) and total (private and public) debt to GDP in the U.K. remains over 500%.

The U.S. government is once again on the brink of defaulting. At the start of the ‘credit crisis’ six years ago, U.S. federal debt was just $8.9 trillion. Today, U.S. federal debt stands at $16.738 trillion – 88% higher and increasing rapidly. This does not include the $70 trillion to $100 trillion in unfunded liabilities for social security, medicare and medicaid.

Long Term Fundamentals

The long term case for precious metals is based on the four primary drivers – the ‘MGSM’ drivers that we have long focussed on.

The long term case for precious metals is based on the four primary drivers – the ‘MGSM’ drivers that we have long focussed on.

Macroeconomic Risk

Macroeconomic risk is high as there is a serious risk of recessions in major industrial nations with much negative data emanating from the debt laden Eurozone, U.K., Japan, China and U.S.

Macroeconomic risk is high as there is a serious risk of recessions in major industrial nations with much negative data emanating from the debt laden Eurozone, U.K., Japan, China and U.S.

Geopolitical Risk

Geopolitical risk remain elevated – particularly in the Middle East. This is seen in the serious developments in Syria and increasing tensions between Iran and Israel. There is the real risk of conflict and consequent affect on oil prices and global economy. There are also simmering tensions between the U.S. and its western allies and Russia and China.

Geopolitical risk remain elevated – particularly in the Middle East. This is seen in the serious developments in Syria and increasing tensions between Iran and Israel. There is the real risk of conflict and consequent affect on oil prices and global economy. There are also simmering tensions between the U.S. and its western allies and Russia and China.

Systemic Risk

Systemic risk remains high as few of the problems in the banking and financial system have been addressed and there is a real risk of another ‘Lehman Brothers’ moment and seizing up of the global financial system. The massive risk from the unregulated “shadow banking system” continues to be underappreciated.

Systemic risk remains high as few of the problems in the banking and financial system have been addressed and there is a real risk of another ‘Lehman Brothers’ moment and seizing up of the global financial system. The massive risk from the unregulated “shadow banking system” continues to be underappreciated.

Monetary Risk

Monetary risk or currency risk remains high as the policy response of the Federal Reserve, the ECB, the Bank of England and the majority of central banks to the risks mentioned above continues to be to be ultra loose monetary policies, zero interest rate policies (ZIRP), negative interest rate policies (NIRP), deposition confiscation or “bail-ins”, the printing and electronic creation of a tsunami of money and the debasement of currencies.

Monetary risk or currency risk remains high as the policy response of the Federal Reserve, the ECB, the Bank of England and the majority of central banks to the risks mentioned above continues to be to be ultra loose monetary policies, zero interest rate policies (ZIRP), negative interest rate policies (NIRP), deposition confiscation or “bail-ins”, the printing and electronic creation of a tsunami of money and the debasement of currencies.

Should the macroeconomic, systemic and geopolitical risks increase even further in the coming months, as seems likely, than the central banks response will likely again be more cheap money policies and further currency debasement which risks currency wars deepening.

Conclusion

Absolutely nothing has changed regarding the fundamentals driving the gold market. We are confident that gold, and indeed silver, are still in long term secular bull markets likely of a 15 to 20 year duration.

Absolutely nothing has changed regarding the fundamentals driving the gold market. We are confident that gold, and indeed silver, are still in long term secular bull markets likely of a 15 to 20 year duration.

http://www.silverdoctors.com/jim-willie-syria-pipeline-politics-opec-the-usdollar/#more-31297

Refer to trade settlement outside the USDollar and diversification away from USTreasury Bond reserves management. It took some time to realize it, but the Cyprus bank incident was a misdirected attack against Gazprom. It failed. The entire Arab Spring movement, an ambitious disruptive project waged with foolhardy ambitions, has turned on itself. Egypt fell, its US puppet discharged. The entire North African region will be in flames soon. The USGovt interfered with a grand industrialization project for European industry, to be placed on North Africa intended to take advantage of cheaper labor, available minerals, nearby resources, and easy shipping. The resentment of Europe will show up in the future. The Middle East and Persian Gulf region is shifting its salute to Russia & China, as the noisy sectarian battles have been a common fixture since long ago. Bahrain has erupted. Saudi is clamping down and converting into an Islamic police state to create the Iran-Saudi repressive bobsey twins. Chaos is the longstanding objective of the USGovt in foreign policy infection, no change in decades.

Syria is about a lot of things, most of which are volatile, many unsolvable. To be sure, the naval port of Tartus is valuable for the Russian Military, always eager to wrest a seaport. Like Lebanon, Syria is a hotbed stronghold for HezBollah, never to be taken lightly. They are mortal enemies to Israel, whose nations have exchanged covert violence for years. Syria might have tight relations with the Shiites of Iran, even some in Iraq. However, Syria represents the crossroads of many important shifting geopolitical roadways that pertain to the global financial structure and commercial systems. Syria is the tipping point for a Grand Global Paradigm Shift. It is the last stand for the Anglo Banker world. Syria will not go easily into the Russian camp, into the Gazprom fold, into the European energy market sphere. For if it does, the entire USDollar system of commerce and the USTreasury Bond system of reserves management will fall by the wayside and open a new era with Eastern dominance. But the Western powers cannot stop it. Clouds of whatever type do not halt pipeline flow, nor pipeline geopolitics.

WHAT SYRIA MEANS

Syria stands at the door to the emergence of the Eastern Alliance, the new dominant energy pipelines, a new payment system detached from the USDollar and Anglo banks. Syria stands at the door which controls some incremental European energy supply. Syria stands at the door to Gold Trade Settlement, with a transition step that brings more importance to commodity backed currencies and proper valid systems for trade. Syria means the pipelines strangle the USDollar. Syria means the end of the US system of IOU coupons that pollute the global banking system. Syria means the status quo is coming to an abrupt end. Syria represents a clash of East versus West, which has more commercial and bank significance than anything reported by the lapdog press. Notice the direct line from Iran through Iraq to Syria. The natgas of Iran reaches the Mediterranean Sea through Syria.

RISE OF PIPELINE POLITICS

Syria is the end port for what the Jackass calls the Shiite Gas Pipeline. It begins in Iran and ends at the Mediterranean seaport in Syria. It was designed to terminate at a Shiite friendly nation. Thus my informal name. Ironically, Qatar is fighting against the Syrian Assad loyalists, but the Qatari natural gas will be directed into the same pipeline. In the last year, a giant Persian Gulf gas discovery was made in a joint Iran-Qatar project. Syria is about the last gasp for the Petro-Dollar. It represents a climax in Energy Pipeline Politics. Quietly for the last 15 to 20 years, Russia has been building crude oil pipelines and natural gas pipelines from the Mother Russian lands to points in Europe and China and the Former Soviet Republics. They have been constructing modern LNG gas port facilities. They have been forging contracts to supply energy to countless nations. The US-led plans have been more interference than constructive. They have consistently attempted to obstruct, rather than to build with some justification of common benefit.

The US news networks cannot tell why or how Syria is important relative to the USDollar. Most Americans cannot define money, let alone conceive of a Petro-Dollar defacto standard. They do not comprehend the global banking system having practices as an extension of Saudi crude oil sales in USDollars. They remember nothing of the Kissinger Arab Oil Surplus Recycle Pact into USTreasury Bonds and US big bank stocks. The focus should be on Pipelines and the closely related geopolitics. The focus should be on the eclipse of OPEC. The focus should be on the loss of Western Europe to the Russian fold, where natural gas supply will alter decisions. Notice the UK Parliament did not offer military support for the USGovt in Syria. They might have received a phone call from either Putin at the Kremlin or the CEO of Gazprom. Coming to a world near you is the NatGas Coop led by Gazprom. A regular feature in geopolitical decisions will be the integration of natgas supply to Europe and Great Britain.

ECLIPSE OF OPEC

Clearly heading out is OPEC and its influence. The dirty secret for ten years has been the depletion and decline in Saudi oil reserves. The water cut has surpassed 80% on a regular basis at Saudi oilfields. It is the percentage of water in produced “oil” wells. The interior pressures are dissipated. The Saudis are suffering from lost oil surplus, rising government debt, higher domestic energy costs, higher food costs, internal strife, fascist islamic rule, rising political prisoner population, and geriatrics at the throne. It sure would be good to know how King Abdullah returned from a coma after a few months, where his organs were declared defunct. Maybe like Saddam Hussein, he has some handy doubles. The OPEC nations in the last several years have become a loud disorganized gaggle of devious dealers who discount prices and lie on output on a regular basis. The cartel has no unity anymore. Their honorable Saudi core is disintegrating. The Saudi OPEC core is precisely the foundation to the Petro-Dollar and the justification for global banking systems being based in USTreasury Bonds. Coming online is the NatGas Coop. Coming online is gold trade settlement. Coming online is the BRICS Bank. Coming into prominent view is Gazprom, the leader of the NatGas Coop. It has some powerful strange bedfellows who deal in one currency, natural gas.

CYPRUS INDIRECT ATTACK

The news networks told of Cyprus being the site of bank crisis, account confiscations, the bail-in procedures creating a Western model, and resolutions. It took a while to realize, but the Jackass back in the March Hat Trick Letter noted the Gazprom angle and potential motive. The Jackass mapped out a Prima Facie case for motive on the Cyprus bank attack. It was a challenge to Gazprom and the Russian banking system, more than a Bail-in Model. It was an attempt to cut off the Russian encroachment into Europe with their Gazprom weapon, the most disruptive economic weapon seen in decades.

Cyprus used to serve as the primary window for the entire Russian banking system, and the central bank too. All bank transactions from Russia went through Cyprus. The conclusion could be that the Bail-in procedure is a suicide pact for the West. It is a declaration that if accounting rules are to be enforced, and capital requirements enforced, then the big Western banks would slit their throats and force the vanish of private bank accounts. Ditto if the legal prosecution of big bank were to begin in earnest. They cannot pull that switch unless major banks are all dead gone, from grotesque contagion. Since Lehman failed, all the big Western banks are lashed together, much like sailors at sea on deck during a nasty storm. If one goes, all go. The banker elite needed to disguise their attack of Gazprom in Cyprus. They wanted to interrupt the progress made by Russia in Pipeline Politics. The public bought the false story, again, like they always do. They do not think beyond the first visible layer.

FAILED USGOVT POLICY

The USGovt lost on disruptions to Iran internet and undersea communication lines between 2004 and 2007. To be sure, the planned Iranian island center for trade processing never occurred, a success of sorts. The USGovt lost on Iranian sanctions. The rise of Turkey, India, and Chinese deals with unique payment systems have come to the table. Even the Japanese and South Koreans refused to play along. The entire workaround process served as a training ground for gold trade settlement. It will have a certain blossom, with the full weight of the BRICS nations behind the current initiatives. The US lost on Iran-Pakistan Pipeline, since China stepped forward, guaranteed funding for its completion, and even worked to extend the connected pipelines to the Western border of China for supply. The USGovt lost with its puppet named Mohammed Morsi, who was ousted in Egypt. The unspoken cause was food price inflation, not political discord as reported by the US news network minions. The USGovt won the Qaddafi’s gold (144 tons) but with a grand backfire on the Libyan Embassy controversy. The Pentagon does not appreciate the sacrifice of Navy SEALS to deceit and hidden motives. The biggest failure by the USGovt could be the monetary policy at work by the US Federal Reserve. The QE bond purchase program has produced massive broad price inflation globally, in addition to rising energy costs, rising material costs, and rising related follow-on costs. It is difficult to find any USGovt or USFed policy of value, other than to serve the bank syndicate.

NATGAS COOP

The key to the future is seen on the margin of new power. It is the Natural Gas Coop. To date, it has no name. Curiously, its power might lie in the fact that it has no name, no central nexus. It is a de-centralized cooperative. But more accurately, it has a Russian core, a brain trust at Gazprom. It has a certain Kremlin command center, since a newfound strategic weapon. It is their greatest global weapon in decades. The strange bedfellows consist of Russia (home HQ of Gazprom), Turkmenistan (#2 natgas global producer), Iran (giant renegade producer), Qatar (biggest LNG star), and Israel (from Tamar Platform). The presence of Sunni Qatar from the Persian Gulf and US Fascist Ally Israel make for the odd mix. In June, the Israel Govt signed a deal with Russian Gazprom. It called for directing all surplus natgas output from Tamar to the Gazprom pipeline system, and the European market. The Israeli Economy will greatly benefit from the surplus revenue.

Game over for OPEC and a guaranteed demise of the Petro-Dollar. Simply stated, Saudi Arabia is to OPEC, what Russia is to NatGas Coop. The phase out of OPEC is in progress, without much recognition. The emergence of the NatGas Coop is to be better understood in the near future. A tremendously important shift is taking place in energy geopolitics. The consequences will be rapid diversification out of the USTreasury Bond, colossal Indirect Exchange in asset deals, and broad abandonment (aka dumping). In the process, almost no buyers of USGovt debt will be visible, and the USFed will be leaned upon more fully for bond purchases. The Weimar machinery will strain to the limit. The USGovt debt default will occur, as the event has become more visible, a 2008 Hat Trick Letter forecast.

DEMISE OF PETRO-DOLLAR

Not 5% of Americans comprehend the defacto Petro-Dollar standard. They will when the Saudis must step aside and permit OPEC to be eclipsed by the NatGas Coop with its expansive global network of pipelines. The great USDollar devaluation will occur when the Petro-Dollar falls by the wayside. The result will be profound price inflation in the USEconomy. The fall of the Saudi regime is guaranteed eventually, and likely soon. The Saudis cannot play both sides (US & Russia) successfully. They will fail with both partners. The NatGas Pipelines are critical, as they wield enormous economic leverage and power. Together, the NatGas Coop phases out OPEC and assures the end of the USDollar as it is currently known and structured. Watch the Saudis soon indicate that non-USDollar payments are accepted for crude oil sales, like accepting GBPounds, Euros, Japanese Yen, even Swiss Francs. Watch the Saudis closely for various signals of impending doom, death signals. As energy sales move gradually, then rapidly, away from the USD settlement, the world will go through a transformation. The banking system will change in their foundations, one nation at a time, with diversification away from USTBonds. It is Game Over!!

Syria is the last line of defense for the USDollar and the exalted position of OPEC. Syria is the potential recognized debut of the NatGas Coop in significance. It is all hidden, except to the Hat Trick Letter. In the new era emerging, Gold will prevail as the Gold Trade Standard is put in place. It will not be done with a stake in the ground from the banking system of the FOREX currency trading arenas. Therefore it is so dangerous to the status quo. My full expectation is that the USGovt will back off in Syria. The retreat will not be seen as a magnanimous gesture, but rather more like a bully backing down. Revelations will be very damaging on chemical weapons and the roles played. Roots to Saddam Hussein will be reviewed. Iran already has tens of thousands killed by chemical weapons over 20 years ago in a war waged with Iraq, with a hand from the Bushes. The United States leadership is in for some cold water in the face. The United States is due for some extreme isolation. The NatGas Coop will change the global map. It will open the door to the Eurasian Trade Zone for commerce, and open the door to the Gold Trade Settlement for finance. Some quantum leaps are in store and soon. Gold will emerge with a new Gold Trade Standard, whose price will shock most observers. Think multiples higher. Syria is a seminal event for gold.

http://www.silverdoctors.com/chris-martenson-the-periphery-is-failing/

For years we’ve preached the From the Outside In principle of markets: When trouble starts, it nearly always does so out in the weaker periphery before creeping towards the core.

We saw this in the run-up to the housing bubble collapse, as sub-prime mortgages gave way before prime loans, and in Europe, as smaller economies like Greece, Ireland, and Cyprus have fallen first and hardest (so far). We see this today in accelerating food stamp use among poorer U.S. households. In each case, the weaker economic parties give way first before being followed, over time, by the stronger ones.

Using this framework, we can often get several weeks to several months of advance notice before trouble erupts in the next ring closer to the center.

Which makes today notable, as we’re receiving a number of new warning signs. The periphery is giving way.

The next big economic dislocation might be only weeks away.

We saw this in the run-up to the housing bubble collapse, as sub-prime mortgages gave way before prime loans, and in Europe, as smaller economies like Greece, Ireland, and Cyprus have fallen first and hardest (so far). We see this today in accelerating food stamp use among poorer U.S. households. In each case, the weaker economic parties give way first before being followed, over time, by the stronger ones.

Using this framework, we can often get several weeks to several months of advance notice before trouble erupts in the next ring closer to the center.

Which makes today notable, as we’re receiving a number of new warning signs. The periphery is giving way.

The next big economic dislocation might be only weeks away.

Submitted by Chris Martenson, Peak Prosperity:

Ever since the current economic “recovery” began, we’ve been warning of the high risk of a renewed financial crisis. That risk is now uncomfortably high. This is because nothing that led to the first round of troubles was actually addressed at the root level. Instead, prior troubles were simply papered over with central-bank liquidity, leaving structural weakness intact – for instance, our ‘too big to fail’ banks are just as big, and our sovereign debt levels are even worse than they were pre-2008.

The next crisis will be larger and more damaging than the last one, principally because nothing got fixed, political capital was spent, and trust has been eroded, leaving everyone depleted and ready to bolt for the financial exits.

With the periphery failing, we likely have only weeks – perhaps a month or two – until the next big dislocation hits.

DÉJÀ VU (ALL OVER AGAIN)

We’ve been here before. We’ve seen trouble start on the outside and progress inwards, and not all that long ago.

In 1999 and 2007, we saw the financial markets blithely trundle along higher, even as clear signs of trouble at the margins were abundant.

One of the common myths about the stock market, often repeated in the press, is that it peers into the future. The market is the ‘great discounting machine.’

But the stock market powered higher into the new millennium, despite being the most overvalued it had ever been in history, before diving violently in 2001. So much for peering into the future.

And again, the stock market went to new heights in 2007, even as the housing market was obviously deteriorating and about to suffer a truly historic break after an unprecedented and bubbly run to the upside. The great discounting machine ended up reacting to trouble rather than anticipating it.

Despite these two obvious failures, many still hold to the belief that the stock market is a useful indicator of future health or distress, which means this view is more a matter of faith than fact.

My view has always been that the stock market is a ‘great liquidity detecting machine’ – something that fits the data very, very well – and that it’s reacting to liquidity in the system more than anything truly fundamental. This has not always been the case, but ever since Greenspan opened the Federal Reserve printing presses to each and every minor financial sniffle in the mid-1990s, Fed-supplied liquidity has been the dominant driver of equity prices.

To tilt the conversation slightly, one of the enduring mysteries to me is how we have managed to experience not one, not two, but three full bubbles in the space of less than 15 years. Tech stocks, then housing, then all stocks and bonds; three bubbles, each bigger than the last.

As I have written extensively in the past, the current all-time highs in both bond AND equity prices (with bonds collectively including everything from 1-month T-bills to the worst junk paper you can buy), is nothing more and nothing less than the biggest financial asset bubble in history.

In order to believe this will all turn out well, you have to believe that this time will be different…not just a little bit different, but 180 degrees away from literally every single other financial bubble in all of history.

This is precisely what is being asked of us each day by the financial press, the Fed, the Bank of Japan, the European Central Bank (ECB), and the politicians in the Western power centers.

Our view here is that it’s never different. To that we’ll add:

- A crisis rooted in too much debt cannot be ‘solved’ by creating more debt.

- Prosperity cannot be printed out of thin air.

- Rigged systems and markets destroy trust.

- Nothing can grow exponentially forever, except for the number of zeros printed on your currency.

Collectively, the above list boils down to Anything that cannot go on forever…won’t. [credit: Herb Stein]

DEFICITS AND DEBTS DO MATTER

Deficits don’t matter! Dick Cheney once famously growled, putting to words the belief system that envelops the U.S. today, especially its financial and monetary authorities. Because we’ve managed over the past three decades to dodge any serious consequences from racking up debts, these folks believe that will always be true. Absence of evidence becomes evidence of absence.

Sticking just to the economic “E” (leaving aside energy and the environment), our diagnosis of the current difficulties is simply that the OECD economies left reason aside and instead embarked on a sustained period of borrowing at a rate nearly twice as fast as underlying economic growth.

That is, we collectively fell for the idea that one could simply borrow more than one earned…forever. I’m always surprised by how an entire culture can collectively believe in something that no individual would ever hold to be true.

We know that we cannot individually borrow more than we earn forever. And we are equally sure that this remains true if we pool ten people together. But we accept the idea that a sovereign nation can somehow magically pull this off. This either represents a profound inability to apply logic, or a form of cultural schizophrenia, or both.

HOT-MONEY BUBBLE DYNAMICS

For years now, ever since the Fed et al. embarked on the global rescue plan that involved little more than flooding the world with historically unprecedented amounts of freshly printed money (a.k.a. “liquidity”), that money has been sloshing around looking for things to do.

With interest rates on ‘safe’ investments at 0% (or close enough), that hot money has been looking for anything that resembles a decent yield. This ‘yield chasing’ went to every corner of the globe and piled into any and every market that it could.

Some of these markets were the headline U.S. and European equity and bond markets, and some of them were so-called ‘emerging markets,’ such as Brazil, India, Thailand, the Philippines, and Indonesia.

As this hot money flowed into these emerging markets, the respective countries – in order to prevent their currencies from rising too much – did the usual and recycled the money-flows back into U.S. Treasury paper, German Bunds, and other sovereign debt instruments.

Now, all of this is being undone.

It is a hot-money machine running in reverse, and it is creating the usual distortions, difficulties, and hardships for the afflicted countries. Currencies are plummeting, as are local equity and bond markets.

In short, to understand where our financial markets are and where they are headed, you don’t need to know much about fundamentals at all. Earnings, GDP, job growth, etc. are secondary to liquidity flows. That’s why the various markets are so keyed on the Fed’s next statements and when and how extreme the ‘tapering’ might be.

That’s all that really matters.

Well, that’s not entirely true. For reasons that cannot be entirely explained nor controlled, sometimes bubble dynamics just end. People stop believing. And what was once a virtuous cycle suddenly morphs into vicious one.

I believe that’s the moment where we are now. And, as always, it’s starting from the outside in.

In Part II: Blast Shields Up! Prepare for Incoming! we look at the growing number of klaxons warning that central bank policies to prop up the global economic system are failing at an accelerating rate.

There are many fronts on which this losing battle will be fought, but our biggest concerns lie in the bond markets –ultimately and including U.S. Treasurys.

Defensive maneuvers are the name of the game now for the prudent. Make sure you’re one of them.

Click here to access Part II of this report (free executive summary; enrollment required for full access).

Hi Fred, I can see Friday night High school football is going to be putting me behind. I was half expecting to wake up to the news that we had started the bombing. Maybe there are some second thoughts going on, probably not.

ReplyDeleteDoug Noland has some interesting comments on muni finance this week.

Morning kev - Friday night Lights , right ? Lol

ReplyDeleteWell , no war just yet , no announcements as to when the bombings will begin ( if I recall from the Iraq war , the US gave warnings for when the war would begin ) ...... why the delay ? Maybe , it's the lack of global support( UK failure to get war authorization stung US war mongers more than they let on initially ) , reluctance of the President ( Val Jarrett ) to start dropping bombs without either UN authorization or Congress approval of war authorization , funding issues - did anyone run cost estimates before shooting off their mouths , lack of a strategy - what happens next after our limited kinetic non mockable bombings end , concern that President Obama's poll numbers ( presently 44 percent ) , could hit the thirties if he unilaterally starts a War and it goes off the rails .

I can't imagine Obama wants to be at the G-20 with the US bombing still ongoing . So , we either see the US start their bombing runs ( by Sunday at the latest and running through perhaps Wednesday , which is when Obama leaves the country ( on Wednesday ) en route to Sweden for an official visit and then onto the G-20 ) OR perhaps Obama will decide to wait until Congress returns , allows a War vote , and /or allows the UN to complete its investigation an provide results - which they said Thursday would take two weeks ( mid- september. )