http://www.smartknowledgeu.com/blog/2013/08/the-incredible-shrinking-comex-gold-warehouse-inventories/

The Incredible Shrinking COMEX Gold Warehouse Inventories

During this banker raid on paper gold and paper silver, while banking shill Nouriel Roubini was spouting more propaganda in the distribution channels of the mass media of a gold collapse to sub-par $1000 an ounce prices, we were busy informing our readers about the “Lies of Nouriel Roubini” (whose sole purpose in life, by the way, seems to be to scare uneducated people into selling off their physical gold and silver into the hands of waiting bankers). At the very start of this price slam this past April, we coined an in-depth piece about “Why the Western Banking Cartel’s Gold and Silver Price Slam Will Backfire.” Now, all the reasons we provided in that April piece are coming home to roost among the Western banking cartel today.

Just 3-1/2 years ago in early 2011, COMEX warehouses held more than 11 million ounces of eligible gold, with JPM holding more than 3 million of these 11 million ounces. As of August 9, 2013, JPM’s eligible gold has fallen from 3+ million ounces to 361,606 ounces. Thus, it is safe to conclude that physical gold is being withdrawn from COMEX warehouse due to a lack of trust in the global banking sector’s honesty and credibility. Though most statistics today discuss the collapse in eligible gold, I actually believe that the collapse in registered gold is more compelling. Recall that registered gold is the gold held at the COMEX that is available for delivery while eligible gold is not “eligible” for delivery.

It is interesting to note that just since last April, registered gold held at the COMEX depositories has collapsed from a total of 2,147,398 ounces to just 852,930 ounces. That is a collapse of 60% of the registered gold inventory in less than 4 months! To put this number in perspective, data from Hong Kong gold exports reveal that China has imported an average of 200 metric tonnes of gold every month this past April, May, and June. 200 metric tonnes is equivalent to more than 6.4 million ounces of gold. COMEX holds a total of just 852,930 ounces of registered gold at the current time.

In regard to silver, COMEX warehouses held a total of 45,945,448 ounces of registered silver in late April and now hold 40,504,656 ounces of registered silver as of August 9, 2013, a much less astounding but still significant 12% loss in inventory. However, if we break down silver manipulator JP Morgan’s COMEX holdings, the recent numbers become much more revealing. JP Morgan’s registered silver holdings, just since late April, have been drained from 17,848,170 ounces to 9,940,577 ounces, a massive 44% loss, while their eligible silver has increased a massive 61% from 18,094,433 ounces to 29,065, 774 ounces. JP Morgan, during this raid, has conscientiously converted millions of “registered” silver ounces into “eligible” silver ounces. Why would they do this? While there may certainly be more complex answers to this question that what meets the eye, a simple answer would be that JP Morgan wishes to cut their inventory of silver available for delivery and is limiting their exposure to losses of silver inventory after losing so much of their gold inventory. When we look at changes in the COMEX total eligible silver inventories from late April to the present time, we discover that the eligible inventories have increased slightly from 120,104,569 ounces to 123,988, 236 ounces. From merely poring over COMEX data, it appears that there is no physical silver shortage as the banker engineered silver takedown hardly seemed to affect COMEX eligible and registered silver inventories. However, this would be a misinterpretation of the physical silver market and here is why.

When we look at the annual turnover of gold futures contracts on the COMEX alone, we know that the gold futures markets trade a minimum of 100 ozs of paper gold for every real physical gold of ounce that exists every year. With silver, the fraud is even greater, with upward of a couple hundred of ozs of paper silver traded for every real physical ounce of silver that exists. In 2011, there were roughly only 320 million ounces of real, physical silver available for investment purposes, yet tens of billions of paper ounces of silver trade on the COMEX every year. In fact, during one of the banker raids in February of earlier this year, bullion banks traded 200 million ozs of paper silver on the COMEX in one minute in order to knock the price of silver down significantly!

Thus, given the record breaking sales of silver coins and bullion bars from the US mint, the Perth mint, and record sales reported by silver dealers worldwide, one should understand that there has been a run on physical silver and not just physical gold that has significantly depleted the reserves of physical silver available to investors. Furthermore, though the current 40.5MM ozs of silver held in the registered inventory in the COMEX has remained relatively unchanged (relative to gold that is) during the banker takedown in silver prices over the past few months, this figure is still miniscule considering that the COMEX trades tens of billions of ounces of paper silver ounces that could stand for delivery.

Though negative GOFO rates are making big news among the gold investment community at this time, and for good reason, as the 6-month GOFO just turned negative along with the 1-mo, 2-mo and 3-mo GOFO rates, we don’t have reported negative Silver Forward Offering (SIFO) rates yet. However the operative words here are “reported” and “yet” as I don’t trust the SIFO rates being reported by notoriously dishonest banks such as Barclays, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JP Morgan, Merrill Lynch, Mitsui & Co, ScotiaMocatta, UBS, and Société Générale. This not exactly a list that inspires confidence that SIFO rates are being reported honestly.

On November 2, 2012, when the LBMA stopped reporting SIFO rates because the SIFO rates“were indicative rates only and therefore not dealable rates unlike GOFO rates”, the 1, 2, 3, and 6-mo SIFOs were respectively listed as 0.62%, 0.616%, 0.618% and 0.612%. First of all, it was nice for the LBMA to finally reveal that the SIFO rates were not dealable rates, and in essence, meant nothing, when many people for years, had assumed that these reported rates were dealable rates. Secondly, On August 12, 2013, according to data I pulled today from Thomson Reuters, the 1, 2, 3, and 6-mo SIFOs were respectively nearly unchanged from the November 2, 2012 rates nearly 2 years ago at 0.600%, 0.585%, 0.584%, and 0.595%. The rates that used to be quoted were median rates among a very wide range of rates and thus not dealable rates. Because these silver forward rates available from Thomson Reuters are nearly identical to the last reported rates by the LBMA, I tend to deposit them in the “rubbish” category of unusable inaccurate data. Thus, despite the continuing smoke and mirrors of “official” data being generated by bankers that wish to produce a picture of no tightness in physical silver supplies, there will come a time in the not-so-distant future when one will notice that COMEX registered and eligible silver inventories are being drained in the same manner that COMEX registered and eligible gold inventories were just drained in the past several months.

There have been some interesting movements of silver at the Shanghai and Comex warehouses in the past several months. Keeping pace with its downward trend, silver continues to be drained out of Shanghai Futures Exchange ever since the April 12th price take-down.

Traders may say these interesting movements of silver are “Just part of what typically occurs in the warehousing business.”

However, we all in the precious metal community realize there is nothing TYPICAL taking place today in the gold and silver markets.

Traders may say these interesting movements of silver are “Just part of what typically occurs in the warehousing business.”

However, we all in the precious metal community realize there is nothing TYPICAL taking place today in the gold and silver markets.

From The SRSRocco Report:

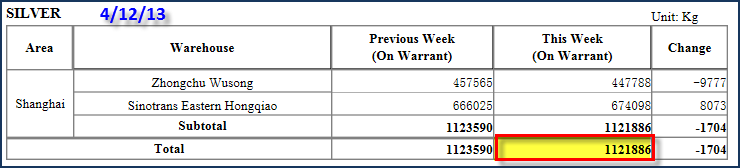

Here we can see that on April 12th, the Shanghai Exchange held a total of 1,123 tonnes of silver in its warehouses:

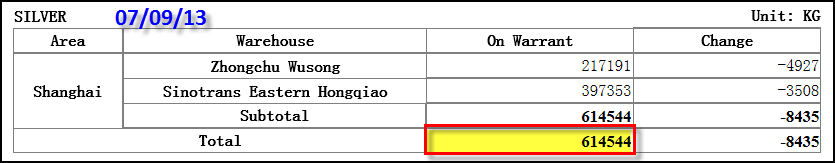

In an update that I put out on July 9th, the Shanghai silver stocks had declined a whopping 45% in less than three months:

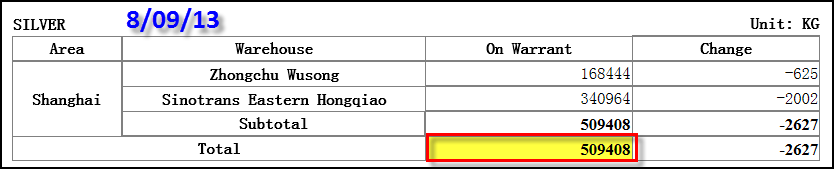

Here we can see that the Shanghai silver stocks decreased 509 tonnes from 1,123 tonnes on April 12th to 614 tonnes on July 9th. However, according to the most recent data, another 105 metric tonnes have been removed in the past month.

In just one month, 17% of the silver warehouse stocks have been removed from the Shanghai Futures Exchange. So, after a 26% decline in the price of silver since April 12th, the Shanghai Exchange has lost 55% of its silver inventories.

LARGE SILVER MOVEMENTS INTO JP MORGANS CUSTOMER CATEGORY

While the Shanghai Exchange has seen its silver inventories decline in the past several months, a great deal of silver has been moving into JP Morgans Eligible (customer) vaults in just the past three weeks.

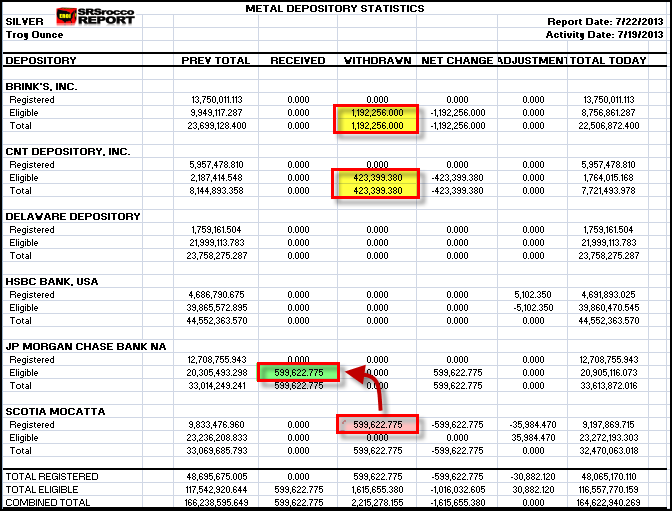

I noticed an interesting trend that starting taking place on July 22nd when 600,000 oz of silver were transferred from Scotia Mocatta’s Registered (dealer) category into JP Morgan’s Eligible. During that week there were two more large transfers of silver, each about 600,000 from Scotia Mocatta into JP Morgan’s Eligible.

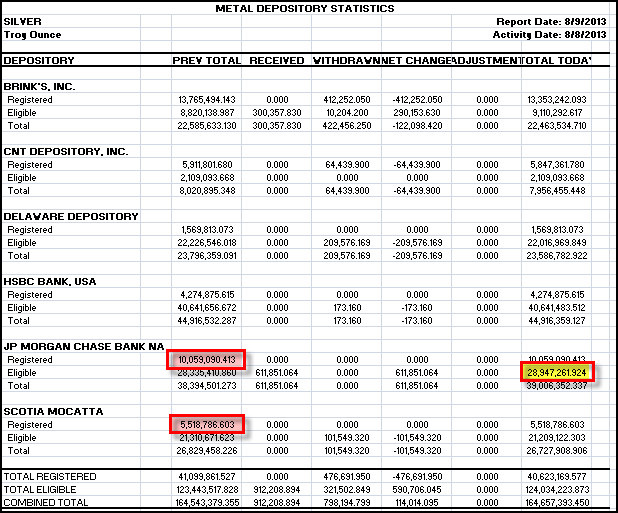

At the beginning of the week on July 22nd, JP Morgan had 20.3 million oz of silver in its Eligible category and 12.7 million in its Registered, while Scotia had 9.8 million oz of silver in its Registered. If we look at the Comex Inventories as of Friday, Aug 9th, we can see the change that has taken place even though the overall total inventory has remained about the same at 164 million oz.

First, highlighted in red, JP Morgan’s Registered inventory has fallen 21% from 12.7 million oz down to 10 million, while Scotia Mocatta’s Registered inventory declined 44% from 9.8 million oz to only 5.5 million oz — all in three weeks.

Second, JP Morgan’s Eligible inventory has increased 42% since July 22nd from 20.3 million oz to nearly 29 million (highlighted in yellow) on Friday, August 9th. There seems to be a serious motivation by futures participants to move Registered silver from several vaults to JP Morgan’s Eligible (customer) inventory.

Third, even though total Comex silver stocks have remained virtually the same in the past three weeks, eight million oz were transferred from the Registered to the Eligible category. This can been seen in the trend that has taken place over the past year.

There is a lot of speculation we can attribute to the strange movements of silver in and out of the registered category, but you will notice that the trend started to take place right after the QE 3 announcement in Sept 2012.

That being said, there is some motivation of the Comex Futures participants to move a great deal of silver into JP Morgan’s Eligible category. Again, all we can do is speculate why this is taking place. On the other hand, the Shanghai silver stocks have seen their inventories decline a substantial 55% in the past four months ever since the April 12th silver take-down.

Traders may say these interesting movements of silver are “Just part of what typically occurs in the warehousing business.” However, we all in the precious metal community realize there is nothing TYPICAL taking place today in the gold and silver markets.

http://harveyorgan.blogspot.com/2013/08/august-132013gld-finally-stops.html

Tuesday, August 13, 2013

august 13.2013/GLD finally stops bleeding/JPMorgan has its comex inventories fall to 9.05 tonnes/the Big 3 sees its gold inventory fall to 19.58 tonnes/Gold raid today yet silver rises by 1 cent/

Good evening Ladies and Gentlemen:

Gold closed down $13.50 to $1321.20 (comex closing time ). Silver was up 1 cent to at $21.34 (comex closing time).

In the access market today at 5:15 pm tonight here are the final prices:

gold: $1321.20

silver: $21.46

Our crooked bankers saw it necessary to hit our precious metals today. No doubt they were quite concerned with silver as it refuses to go negative. They were successful in knocking gold down but not silver.

At the Comex, the open interest in silver rose by 4908 contracts to 138,778 with silver up 93 cents yesterday.

The open interest on the entire gold comex contracts fell by 219 contracts to 393,542 with gold's rise in price on Monday by $2.20 .

Tonight, the Comex registered or dealer inventory of gold fell again as it is now well below the 1 million oz mark, at 777,418.227 oz or 24.18 tonnes. This is dangerously low especially when we are now into the August delivery month. The total of all gold at the comex (dealer and customer) remains constant tonight and this time remaining below the 7 million oz barrier resting at 6.999 million oz or 217.71 tonnes.

JPMorgan's customer inventory rises tonight to 175,226.522 oz or 5.45 tonnes. It's dealer inventory falls badly to 291,118.184 oz (9.05 tonnes)

The total of the 3 major gold bullion dealers( Scotia , HSBC and JPMorgan) in its Comex gold dealer account saw a huge reduction in their inventory tonight to 19.58 tonnes of gold. Brinks continues to record a low of only 4.14 tonnes in its dealer account.

The GLD reported no gain in inventory tonight with a reading of 911.13 tonnes of gold. We had no change in silver inventory at the SLV.

Today, we have the 27th consecutive day for negative GOFO rates with the 3 months rate remaining constant at -.075000 from yesterday's level of -.07500%. The one month GOFO rate remains relatively high in negativity at -.11000, a slight rise from yesterday's level of -0.10833% The two month rate rose slightly in negativity to-.0900% from yesterday's -0800%; and the 6 month GOFO rate went positive +.005% from yesterday's level of -00167%. Basically it means that gold is dearer in the present than in the future and it also signifies that London has scarce supplies of good delivery bars. No doubt that China, being a huge buyer of physical gold is responsible for this. The whacking of gold this month is incompatible with an increasing negative GOFO rates.

*****

Comex gold/August contract month:

August 13.2013

Ounces

| |

Withdrawals from Dealers Inventory in oz

|

4730.524 (Scotia)

|

Withdrawals from Customer Inventory in oz

|

99.33 (Scotia)

|

Deposits to the Dealer Inventory in oz

|

nil

|

Deposits to the Customer Inventory, in oz

| 4728.54 (JPM,Scotia) |

No of oz served (contracts) today

|

58 ( 5,800 oz)

|

No of oz to be served (notices)

|

1276 (127,600 oz)

|

Total monthly oz gold served (contracts) so far this month

|

2836 (283,600 oz)

|

Total accumulative withdrawal of gold from the Dealers inventory this month

|

29,518.655 oz

|

Total accumulative withdrawal of gold from the Customer inventory this month

| 135,750.23 oz |

****

Thus tonight we have big changes to JPMorgan gold inventory.

Here is JPMorgan's finalized inventory tonight:

JPM dealer inventory tonight: 291,118.184 oz or 9.05 tonnes (prev 361,606.12 oz 11.24 tonnes)

JPM customer inventory tonight: 175,226.522 oz or 5.45 tonnes (prev 100,112.028 oz or 3.11 tonnes)

Here is JPMorgan's finalized inventory tonight:

JPM dealer inventory tonight: 291,118.184 oz or 9.05 tonnes (prev 361,606.12 oz 11.24 tonnes)

JPM customer inventory tonight: 175,226.522 oz or 5.45 tonnes (prev 100,112.028 oz or 3.11 tonnes)

*****

The total dealer comex gold falls tonight to 777,418.227 oz or 24.18 tonnes of gold.The total of all comex gold (dealer and customer) remains intact tonight at 6.999 million oz or 217.71 tonnes.

Tonight, we still have the continuing disturbing piece of news concerning the low dealer gold inventory for our 3 major bullion banks(Scotia, HSBC and JPMorgan). These 3 dealer gold inventory fell again tonight to an extremely record low of 19.58 tonnes.

i) Scotia: 184,363.154 oz or 5.73 tonnes

ii) HSBC: 154,455.153 oz or 4.80 tonnes

iii) JPMorgan: 291,118.184 oz or 9.05 tonnes

total: 19.58 tonnes

Brinks dealer account which did have the lions share of the dealer gold saw its inventory level remain constant tonight at 133,125.52 oz or 4.14 tonnes. A few months ago they had over 13 tonnes of gold at its registered or dealer account.

*****

August 13/2013: July silver contract month:

August contract month

August contract month

| Silver |

Ounces

|

| Withdrawals from Dealers Inventory | 791,438.895 (Scotia) |

| Withdrawals from Customer Inventory | 5901.25 oz (,Delaware) |

| Deposits to the Dealer Inventory | nil |

| Deposits to the Customer Inventory | 791,438.895 (JPM) |

| No of oz served (contracts) | 0 ( nil oz) |

| No of oz to be served (notices) | 10 (50,000 oz) |

| Total monthly oz silver served (contracts) | 204 (1,020,000) |

| Total accumulative withdrawal of silver from the Dealers inventory this month | 2,552,428.7 oz |

| Total accumulative withdrawal of silver from the Customer inventory this month | 2,286,083.5 |

****

August 13:2013: no change again

Five years later...an

Tonnes911.13

Ounces29,293,742.45

Value US$38.894 billion

******

And now Bill Holter tackles QE and how this will never benefit our economies:

(courtesy Bill Holter/Miles Franklin)

And now Bill Holter tackles QE and how this will never benefit our economies:

(courtesy Bill Holter/Miles Franklin)

(courtesy Bill Holter/Miles Franklin)

Five years later...an

Nearly five years ago we saw the beginnings of our current "QE" ...and only now is the Fed sayinghttp://www.zerohedge.com/news/

Nearly five years ago we saw the beginnings of our current "QE" ...and only now is the Fed sayinghttp://www.zerohedge.com/news/

I wrote many times from July 2008 on that what we had was a "solvency" problem not a "liquidity" problem. Yes, we did need liquidity injected to keep the system from collapsing in 2008 but the QE that followed was only kicking the can down the road and continuing a system that was broken. The various QE's were only higher dosage drugs issued to the crack addicted system, it was exactly the same "drugs" (debt and unlimited fiat) that made the patient sick in the first place and landed it in the emergency ward.

So why exactly would the San Francisco Fed (Janet Yellen pres.) come out now with this revelation? Is it Janet Yellen jockeying for Fed Chairman position? Is it Janet Yellen trying soften her "monetize the entire world" position so when Larry Summers becomes Chairman she still has at least "some" relevance? Has it been put forward to prepare the markets for "tapering"? Or...because it's the truth?

First off, it is the truth. QE 1,2,3 and 3.5 have had virtually zero effect on the real economy, the only area that benefitted was the financial sector and anything associated with it. And yes, I do believe the Fed will at least try to taper because they are becoming too big of a factor in the "collateral" market. Their "attempt" at tapering may only last a few days as the amount of selling and unwinding's will turn the leveraged system into a smoldering black hole very quickly. Tapering will then turn into another, bigger, different (not at all) and "better" QE in order to save the system...again.

I want to point out again that the Fed is on a dead end road with no exits and no choices. They must inflate and do so at ever greater rates or the entire system will collapse. "inflate or die", period, end of story...almost. I say "almost" because I believe that we have a chance (good chance) that the rest of the world fully understands where this whole thing stands and there are plans already in place to revalue Gold higher and make currencies "ratio backed" to holdings. This...can set a path forward for the rest of the world in a currency system that is more fair and equitable.

As for the U.S., well, we either have the Gold that we say we do or we do not. We will find out one way or the other and may God help us if we don't (my opinion). If it turns out that the "Gold is gone" then we face a hyperinflation of unimaginable terms that will correlate directly to the amount of debt that we have already issued. It will have to be paid back "somehow". The "somehow" will be direct monetization and printing. Ordinary, daily and now taken for granted everyday goods will become scarce and priced maybe out of the reach of 90-95% of the population.

Think of it this way, for every year and every "Dollar" that we have lived beyond our means in the past, we will be FORCED to live under our means in the future...until we have paid back the "debt". Not the paper "debt" that we have already "borrowed", no, the real debt owed to Mother Nature herself. We will need to produce more, consume less and actually "save" and invest capital for future production. In other words, we will need to restore the "seed corn" that we have been eating for all of these years. Regards, Bill H.

No comments:

Post a Comment