http://www.zerohedge.com/news/2013-08-06/detroit-austrian-moment-making

Detroit - An "Austrian Moment" In The Making

Submitted by Tyler Durden on 08/06/2013 19:36 -0400

- Austrian School of Economics

- Creditors

- Deficit Spending

- Detroit

- Mark Spitznagel

- Michigan

- University Of Michigan

Authored by Mark Spitznagel, originally posted at Project Syndicate,

As Detroit begins to sort through the ill-begotten public liabilities that have driven it to bankruptcy, an important opportunity is at hand to revitalize the city that was once the epicenter of American entrepreneurship and manufacturing, while setting an example for other municipal governments that appear to be headed toward a similar fate. Here is an “Austrian moment” in the making, a potential libertarian awakening guided by the market-oriented, non-interventionist principles of the Austrian school of economics.

For years, Detroit’s expenditures vastly exceeded its revenues. With the tax base eroding, owing to a declining population and diminishing private-sector jobs, efforts to boost revenue by raising taxes would have been futile. (Detroit’s 2012 income-tax rate of 2.45% and its property taxes, which are among the country’s highest, are inexplicable, given the inadequacy of basic public services.) In this context, Detroit’s “Ponzi”-like fiscal situation would have continued to deteriorate, with no options other than to borrow more.

But, as long as investors were willing to purchase risky bonds, neither politicians nor unions would admit how unsustainable Detroit’s situation was. With the Federal Reserve’s near-zero interest-rate policy and purchases of trillions of dollars in long-term securities driving demand for such bonds, Detroit’s leaders were able to delay public-sector reform for far too long (a situation that is frighteningly similar to the federal government’s today). Detroit’s bankruptcy is thus exactly what the financial system needs.

Before any tears are shed for the bondholders, it is important to consider the fundamental differences between private and public debt. Private debt is an inter-temporal, contract-based exchange between two entities: the debtor, who needs capital, and the creditor, who is willing to provide that capital in exchange for a sufficient rate of return.

When it comes to public debt, however, creditors receive returns not from the governments to which they have lent money, but from taxpayers, who may be reluctant to cover the costs incurred by a contract to which they never really agreed. Given that the people who borrow and disburse government funds (typically, as in Detroit’s case, an entrenched political elite) are rarely the ones from whom revenues are later collected, public debt does not entail a willing inter-temporal exchange.

As the Austrian-school economist Murray Rothbard pointed out more than two decades ago, deficit spending and public debt represent “a growing and intolerable burden on the society and economy,” given that they transfer “resources from the productive [private sector] to the parasitic, counterproductive public sector.” Detroit’s predicament clearly demonstrates the need to reduce this burden, even if that means enduring a painful adjustment period.

In fact, public debt and deficit spending can be compared to a forest that has become choked with overgrowth, giving the false – and, ultimately, damaging – impression of an abundance of resources. In the forest, natural correcting mechanisms, such as small wildfires, might be suppressed by external actors with an interest in preserving the illusion of plenty, regardless of its potential consequences.

Likewise, rather than allow market forces to correct the problems of mounting public debt and deficit spending, policymakers manipulate interest rates to create excess liquidity and encourage investors to chase yield in a risky environment. Such interventions support unhealthy, distorted, and destabilizing growth, causing the debt burden to grow and, eventually, triggering systemic collapse.

The good news is that, as Rothbard noted, such a collapse “is the ‘recovery’ process,” and, “far from being an evil scourge, is the necessary and beneficial return,” whether in a forest or an economy, to “optimum efficiency.” Given this, purging Detroit’s balance sheet (specifically, the disproportionate unfunded liabilities that have plunged it deep into the red) is the best – maybe even the only – available path to renewal. The long-term benefits would more than offset the short-term costs.

Detroit can correct its past public-sector ineptitude and abuses by unleashing the private sector’s vast potential, rooted in the metropolitan region’s vibrant entrepreneurial and manufacturing culture, skilled workforce, and a robust technology base nurtured by world-class institutions like the University of Michigan. The city’s position on an important border crossing and access to an enormous fresh-water supply from the Great Lakes, not to mention the business community’s unrelenting support, enhance its prospects further. (In fact, in the wider metropolitan region, the private sector is realizing its potential even today, despite the barriers that Detroit’s dysfunctional public sector has erected.)

The time has come to free Detroit’s entrepreneurial spirit from the legacy of government mismanagement. Guided by the Austrian school’s libertarian principles, Detroit can transform itself from an example of municipal failure into a symbol of restoration and source of economic dynamism, the likes of which the US has never seen.

http://www.freep.com/article/20130802/NEWS03/308020091/financial-emergency-Pontiac-School-District-Gov-Rick-Snyder

The Pontiac School District is in a state of financial emergency, according to a review team that has spent the last few weeks studying the district’s finances.

The review team made the declaration today. Gov. Rick Snyder has 10 days to determine whether he agrees with the finding.

If Snyder also declares a financial emergency, it could lead to drastic options, including bankruptcy, the appointment of an emergency manager, a consent agreement or a neutral evaluation process.

District and board leaders could not be reached for comment. Aimee McKeever, president of the Pontiac Education Association, said the review team is correct in declaring a financial emergency in the district.

But she said the district can’t wait until a formal declaration by the governor.

“We need the state to step up now,” said McKeever, who said she believes a loan will be necessary in order for the district to open schools for the new school year in September.

will be necessary in order for the district to open schools for the new school year in September.

Caroll Turpin, president of the Pontiac Board of Education, said the declaration of a financial emergency was expected. If the governor agrees, she said, “the board will be discussing what our next steps should be.” She said that while the district is indeed applying for a loan , it won’t impact the opening of the school year.

, it won’t impact the opening of the school year.

“We have challenges, and we’ve had setbacks,” Turpin said. “But we are all working together in the district to make sure that school opens in September and that we’re able to educate our students.”

*****

http://usnews.nbcnews.com/_news/2013/07/22/19620244-shrinking-population-heavy-debt-make-turnaround-tough-for-detroit-schools?lite

****

One of the biggest problems facing the school system: Detroit’s dramatically shrinking population. The economic collapse has reduced the sprawling metropolis to a veritable ghost town.

The city’s population plunged by over a quarter of a million between 2000 and 2010, to just over 700,000 people, according to The Associated Press.

What does that mean for public schools? Population projections suggest that, by 2016, public school enrollment will slip to just 40,000 kids, according to the AP — a relatively meager number for a once-bustling American city.

“These schools are enormous,” said Moje. “But inside, there’s very few students.”

Martin said last Monday that boosting enrollment will be a top priority during his time overseeing public schools.

“I’ll first focus on starting school on time and without incident,” Martin said. “Enrollment is a major focus.”

What’s more, Detroit’s public schools are weighed down by mountains of debt, according to Moje. School administrators are sometimes forced to dip into the budget reserved for school resources to cover old debts, she added.

“Schools of today have less money to spend on their students because they’re paying off the debts of yesteryear,” she said.

That’s one of the reasons why state officials declared a financial state of emergency in public schools across Detroit in late 2008, five years before billions of dollars of debt forced the city to file Chapter 9, according to Terry Stanton, the communications director at the Michigan Department of Treasury.

Four other Michigan school districts have received the same grim prognosis — and all are now overseen by emergency financial managers, rather than traditional administrators, such as a superintendent, Stanton said.

Martin, 74, a certified public accountant, is the third emergency manager to preside over Detroit’s public schools since 2009. He has a lengthy resume at the intersection of finance and public policy — most notably, stints as the CFO of the U.S. Department of Education and CFO of the city of Detroit itself — which makes him a good fit for the numbers-crunching business of budget administration.

“The opportunity will allow me to continue offering leadership and making a positive impact in the Detroit community,” Martin said in a statement. “Fixing education in Detroit is foundational to addressing the myriad of other critical issues facing our community—locally and statewide.”

It remains to be seen if the confluence of Detroit’s bankruptcy and the city's public schools' woes will force officials to shutter more schools, as they did at a staggering rate during a budget-balancing wave in 2011, according to Moje.

Martin, widely seen as a financial wizard, may find a way around closing the doors to classrooms across the struggling city. And yet, ultimately, we shouldn't treat public education strictly as a "numbers game," Moje said.

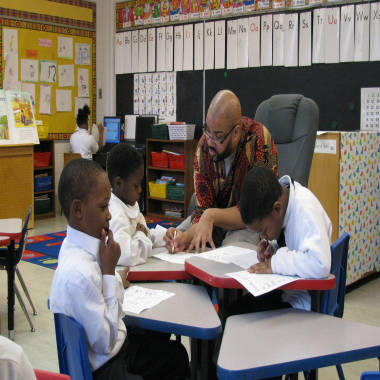

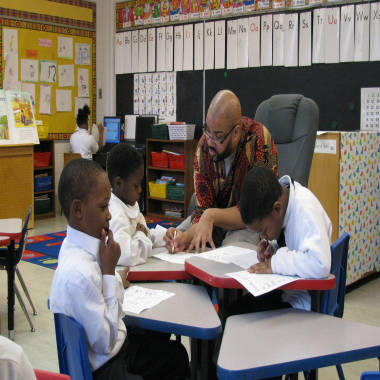

"Everybody is worried about the numbers and the money, but the bottom line is that we also need to think about improving the quality of teaching and learning in these classrooms."

No comments:

Post a Comment