http://jessescrossroadscafe.blogspot.com/2013/06/physical-vs-paper-shanghai-gold.html

When push comes to shove, the COMEX is only pushing paper.

Weighed, and found wanting.

Source: GoldMiner Pulse

http://goldsilver.com/article/comex-options-interest-in-super-high-gold-prices-by-end-august/

There has been considerable throughput of gold in western capital markets, with substantial buying from all round the world following the April price crash. The supply can only have come from two sources: the general public, or one or more governments. It really is that simple. Two months later the gold price has only partially recovered, so physical supplies have continued to be made available. Physical demand cannot have been entirely satisfied by ETF liquidations, confirming governments are involved. This article looks at the dynamics of the gold market around this event and the implications.

There has been considerable throughput of gold in western capital markets, with substantial buying from all round the world following the April price crash. The supply can only have come from two sources: the general public, or one or more governments. It really is that simple. Two months later the gold price has only partially recovered, so physical supplies have continued to be made available. Physical demand cannot have been entirely satisfied by ETF liquidations, confirming governments are involved. This article looks at the dynamics of the gold market around this event and the implications.

http://harveyorgan.blogspot.com/2013/06/gld-gold-remains-constantcomex-dealer.html

15 JUNE 2013

Physical vs. Paper: The Shanghai Gold Exchange vs. the COMEX

When push comes to shove, the COMEX is only pushing paper.

Weighed, and found wanting.

SHANGHAI GOLD EXCHANGE (SGE)

Weekly Gold Delivery From Vault

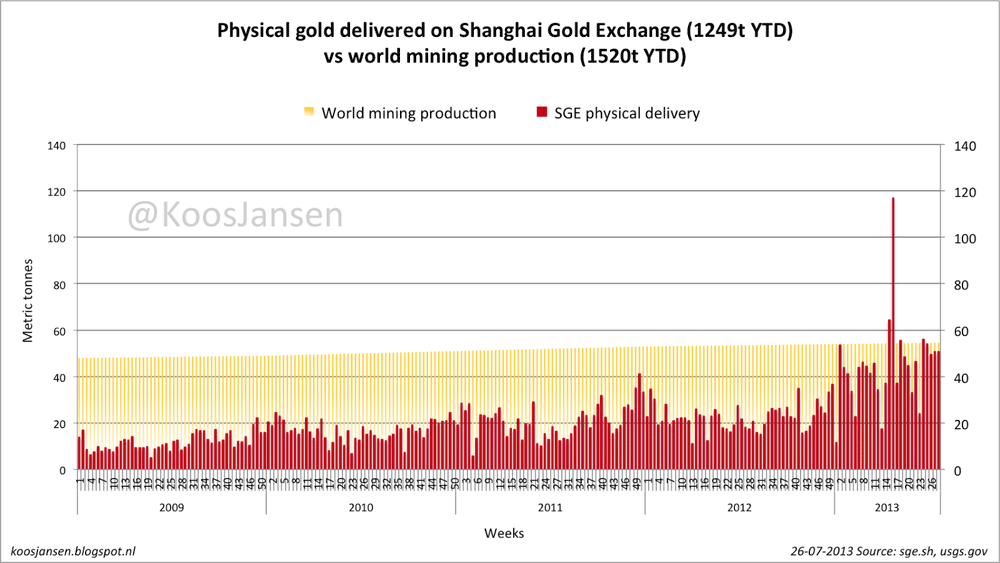

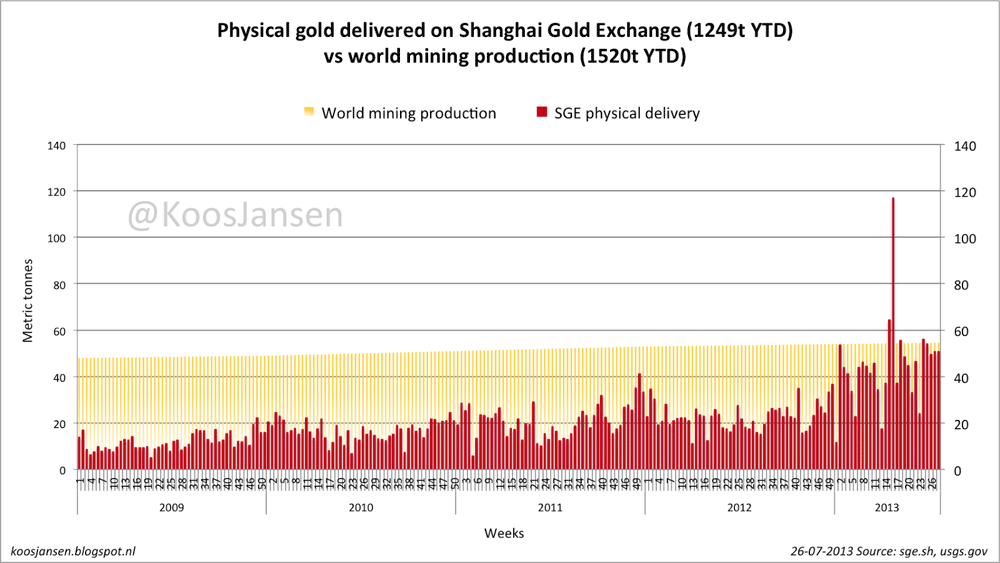

The above graph of physical gold delivery out of the Shanghai Gold Exchange (SGE) vaults was prepared by @KoosJansen based on the weekly reports from the Chinese portion of the SGE site. The SGE has confirmed these are deliveries from the vault and the numbers are updated on a weekly basis (each Friday). I will publish the links to the exact Chinese pages next week and will ensure there is updated weekly delivery data available here.

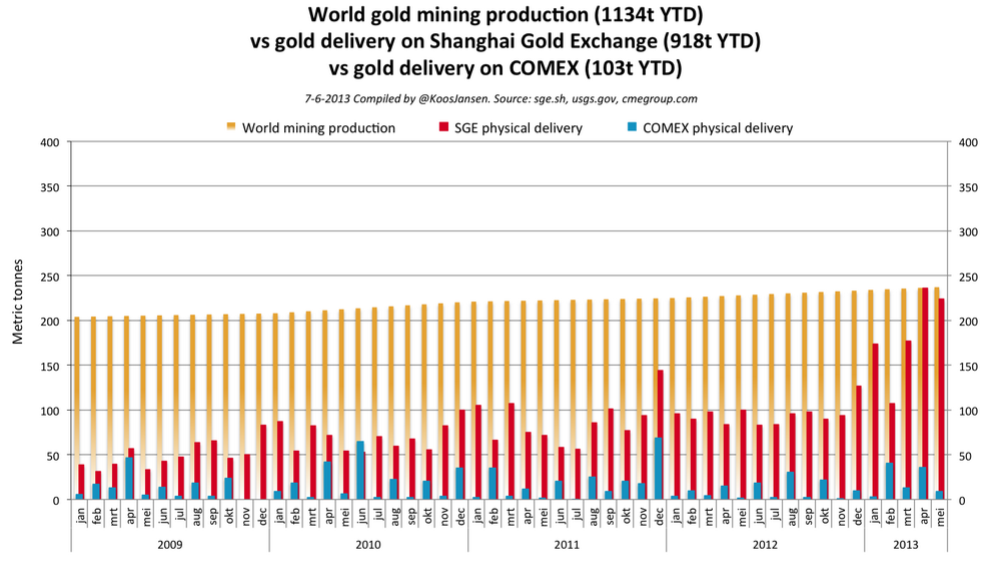

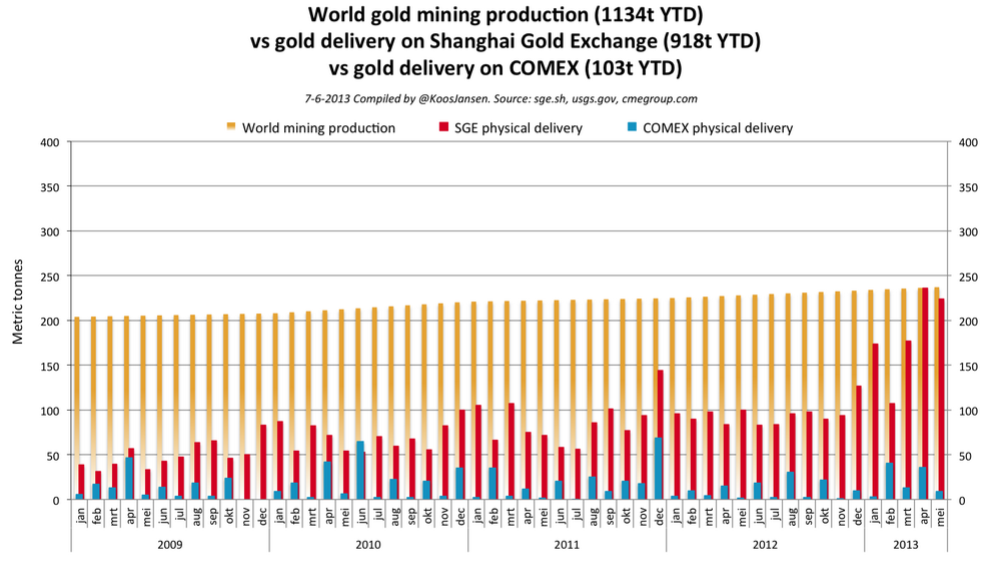

Monthly Physical Delivery From Vault: SGE Versus COMEX

The above graph of monthly gold delivery from vault demonstrates very clearly what many have expressed repeatedly on sites such as KingWorldNews -- the COMEX is a paper gold market while the SGE is quite clearly a world class market for physical gold.Source: GoldMiner Pulse

http://goldsilver.com/article/comex-options-interest-in-super-high-gold-prices-by-end-august/

COMEX Options Interest In Super High Gold Prices By End-August

GoldSilver.com

JUNE 14, 2013

JUNE 14, 2013

Behind the scenes we have noticed the very excited state of interest in gold at the COMEX, despite JP Morgan's vault being almost empty of deliverable gold.

One can see for themselves with the CME Group's Open Interest tool, below is a screenshot of August, the next delivery month, with orange representing those who are betting price will fall (puts) and green, for those who are betting price will be higher (calls) by the end of August.

The higher the spikes, the more interest at that price. We selected a few to mark up, showing the interest at the $1,400, $1,775 and $1,900 price levels.

Of course, you wouldn't be on GoldSilver.com if we did not remind that these days, PRICE rarely will reflect VALUE, and one must always look at both sides of a trade (both the goods or services you're buying or selling AND the value of the currency) moving forward.

http://www.goldmoney.com/gold-research/alasdair-macleod/gold-is-being-supplied-by-western-governments.html?gmrefcode=gata

Gold is being supplied by western governments

2013-JUN-16

There has been considerable throughput of gold in western capital markets, with substantial buying from all round the world following the April price crash. The supply can only have come from two sources: the general public, or one or more governments. It really is that simple. Two months later the gold price has only partially recovered, so physical supplies have continued to be made available. Physical demand cannot have been entirely satisfied by ETF liquidations, confirming governments are involved. This article looks at the dynamics of the gold market around this event and the implications.

There has been considerable throughput of gold in western capital markets, with substantial buying from all round the world following the April price crash. The supply can only have come from two sources: the general public, or one or more governments. It really is that simple. Two months later the gold price has only partially recovered, so physical supplies have continued to be made available. Physical demand cannot have been entirely satisfied by ETF liquidations, confirming governments are involved. This article looks at the dynamics of the gold market around this event and the implications.

While the investing public in the western nations has been generally stunned following the April price smash, demand from Asia is running at record levels, illustrated in the chart below, which is of physical gold deliveries on the Shanghai Gold Exchange. (Thanks due to @KoosJansen for pointing me to the data on the SGE’s Chinese website).

The increase in deliveries for April and May was spectacular, totalling 460.5 tonnes, with the week ending 26 April alone seeing phenomenal deliveries of 117 tonnes. In addition, according to the Economic Times , India imported 142.5 tonnes in April and 162 tonnes in May, compared with an average monthly rate of 86 tonnes in Q1 2013. Therefore these two countries imported 765 tonnes of gold in two months, before considering any unofficial imports or their government purchases in foreign markets. The rest of Asia, from Turkey to Indonesia would certainly have stepped up their demand for gold as well, as did the western world itself for physical metal as opposed to paper entitlements.

The table below puts this into context.

A prefatory note about the statistics in this table: there is no single defined source of statistics on gold movements, and there are considerable variations in the same numbers reported by different organisations. The figures in the table above can only illustrate bullion flows. I have sourced the statistics from official sources where possible. The cash-for-gold business has had the easy pickings by now, so an assumption that this is about 600 tonnes per annum is I believe cautiously over-generous. It is based on a speech made by Jeffrey Rhodes of INTL Commodities DMCC to the LBMA in 2010, when he identified scrap supply as 583 tonnes in North America and Europe, whose central banks are in the gold suppression business. At that time, 1,091 tonnes were recycled in the East, including Turkey. Since the Chinese, Russian and other gold-producing governments of Central Asia retain most if not all of their domestically mined gold amounting to over 700 tonnes, there is less than 2,000 tonnes of free mine supply annually available for global markets, based on US Geological Survey figures.

Looking at the bottom line for 2012, there were only 87 tonnes of gold supply for the rest-of-the-world, after Asian and Russian central bank and global ETF purchases. In other words, there must have been a severe deficit overall, which can only have been covered by central bank sales.

About 150 tonnes of ETF gold were liquidated in Q1, providing temporary relief until the Cypriot crisis, when concerns over the security of large deposits in eurozone banks prompted a flight into physical gold, but interestingly, not into ETFs. This was because there were escalating systemic concerns over having physical gold and currency deposits with European banks, while at the same time portfolio investors were worried that the 12-year bull market might have ended.

From the point of view of the western central banks, as well as the bullion banks with short positions on Comex, in March the alarm bells must have been ringing loudly. Chinese demand was accelerating and there was an increasing likelihood that ETF liquidation would cease if the gold price stabilised. If that happened, as the table above clearly shows, an epic bear-squeeze would likely develop, fuelling a rush into gold and potentially bankrupting many of the bullion banks short in the futures markets and/or offering unallocated accounts on a fractional reserve basis.

Therefore, investors had to be dissuaded from buying gold, otherwise the ensuing crisis would not only cause a market failure that could spread to other derivatives (particularly silver), but it would come at the worst possible time, given the coincidental programme of monetary expansion currently being undertaken by all the major central banks.

The reasons for governments to intervene on the side of the bullion banks were therefore compelling. As one would expect, the intervention was well-timed: on Friday 12 April two large sell orders of 100 and 300 tonnes were placed on Comex, clearly designed to do maximum damage to the price, and setting it up for all remaining stops to be taken out the following Monday. Furthermore, central banks were prepared to supply physical gold to keep the price from recovering. We know this because lower prices generated a surge in private demand, not only in China and India, but from everywhere. The only possible supply, other than inadequate ETF liquidation, is from governments.

India and China have absorbed enough gold in the last two months of April and May to leave the rest of the world in a supply deficit, requiring matching sales of western government gold to continue to suppress the price.

The future

We now know for certain that government-controlled gold has been used to defuse a developing crisis in gold markets that had the potential to destabilise bullion banks, other derivative markets and ultimately the whole fiat currency system. We have seen the surge in demand for physical gold, which is the consequence of sharply lower prices. Realistically, the priority has been to ensure such a crisis is avoided, rather than for the price of gold to be continually suppressed.

The difficulty for the casual observer is compounded by the available information being one-sided. We are all painfully aware of both the losses inflicted on investors and their loss of faith in gold at a time when other investment media, such as stocks and bonds, have been doing well. Concealed from us is the real financial condition of the banks and governments themselves, which is the fundamental reason for owning gold. We are acutely aware of the sellers’ pain and only dimly aware of the buyers’ motivation.

Nervous western investors in a market of 160,000 tonnes are in truth a small part of the whole, particularly since gold has been migrating from the west to the east where it has been more valued ever since the 1970s oil crisis. More fundamentally we know that the stock of gold grows at about 1½% annually in line with global population growth. We also know that central banks everywhere are expanding their balance sheets at an accelerating rate. The disparity between the rate of growth for gold and paper currencies will certainly lead to increased tensions between precious metals and currencies generally, and it is this that will drive future demand for gold, not whether or not western investors think it is in a bull or bear market.

A second point about the market being 160,000 tonnes and not just the sum of mine and scrap supply is that the market is far bigger than western governments’ gold reserves. Gold held by them is officially about 19,000 tonnes, but it may well be only half that, or 5% of the aboveground stock, when unrecorded leasing and selling over the last 25 years are taken into account. The ability of central banks to contain a global surge in gold demand such as that which followed the April price-crash and continuing to this day is therefore limited.

But this is only a part of the story. There are the factors concealed from us, such as the buying opportunity given to gold-friendly governments and sovereign wealth funds, both with surplus dollars, as well as the appetite for gold from the growing ranks of the Russian and Asian mega-rich. There are factors known to the financially savvy, such as the growing instability of the Indian rupee and other emerging market currencies, the increasing systemic risks in eurozone banks with the threat posed to deposits, and the revenue shortfalls that force governments to raise money by printing their currencies at an increasing pace: all will impact the gold market in coming months.

These and other systemic problems are deteriorating. A potentially destabilising crisis in the gold market from runaway prices has been defused by allowing the bullion banks the space to square their books. There can be no other realistic objective in supplying government-owned gold into the market. As to the embarrassment of the gold price rising at a time of accelerating money printing – that will have to be accepted, presumably emphasising the official line, that the gold price is irrelevant to a modern economy.

http://harveyorgan.blogspot.com/2013/06/gld-gold-remains-constantcomex-dealer.html

Saturday, June 15, 2013

GLD gold remains constant/Comex dealer gold falls again to 44.32 tonnes/Total of all Comex gold falls to 239.31 tonnes/JPMorgan inventory remains constant/Comex Silver OI rises despite silver's fall in price on Thursday/

Good morning Ladies and Gentlemen:

Gold closed up by $9.70 to $1387.30 (comex closing time). Silver rose by 37 cents to $21.95 (comex closing time)

In the access market at 5:00 pm, gold and silver finished trading at the following prices :

gold: 1391.50

silver: $22.08

At the Comex, the open interest in silver rose by a rather large 2060 contracts to 150,483 contracts with silver's fall in price, Thursday night by 15 cents. The silver OI is still holding firm at these highly elevated levels. The bankers will desperately try and remove some of these stubborn longs before the big July delivery month rolls around. I am still holding out of the thesis that the longs in silver are really the Chinese government. It could only be a sovereign who could withstand so much pain and still remain in the silver game. China at one time (around 1990) had in excess of 300 million oz of silver stored away. It is quite logical that the Chinese secretly loaned their hoard to the USA as the American above ground silver was running out.

It is also possible that China (like Germany) are asking for their metal back and the USA said no. Thus they are trying to get their metal back by waiting patiently and standing for as much silver as they can on each major delivery month at both the Comex and at the LBMA.

China went along with the scheme because they really wanted gold at lower prices, knowing full well the USA was manipulating precious metals lower. China, in order to become the new reserve currency of the world, would need to purchase as much gold as they could to satisfy their populace as well as increase official reserves. The plan may have worked quite well for them.

The open interest on the entire gold comex contracts rose by 1180 contracts to 375,024 which is still extremely low. There is no question that all of the weak speculators in gold have now departed. The number of ounces which is standing for gold in this June delivery month is 931,100 or 28.96 tonnes.The number of silver ounces standing in this non active month of June rose by 120,000 oz to 715,000 oz.

Tonight, the Comex registered or dealer inventory of gold falls badly to 1.425 million oz or 44.32 tonnes. This is getting dangerously low. The total of all gold at the comex fell again and now it is well below the 8 million oz mark at 7.694 million oz or 239.31 tonnes of gold.

JPMorgan's customer inventory shows no change and rests tonight at its nadir of 136,380.611 oz or 4.24 tonnes. Its dealer inventory remains at 413,526.284 oz but it still must settle upon contracts issued in the June delivery month which far exceeds its inventory.

The total of the 3 major bullion dealers, Scotia , HSBC and JPMorgan have in the dealer account only 29.8 tonnes of gold

The GLD reported no change in gold inventory. The SLV inventory of silver also remained firm with no losses or gains in inventory.

In physical stories we have reports from Chris Powell of GATA as well as a discussion with GoldMoney.com and David Morgan.

Eric King has a good discussion with Egon Von Greyerz on why he believes silver will rise higher on a percentage basis than gold.

On the paper side of things, we have an excellent paper presented by Dave Kranzler of the Golden Truth written for Seeking Alpha and it deals with the notion that it will be impossible for the Fed to taper as they basically need to fund their deficit and that deficit will surely be around 1 trillion USA dollars and not the 640 billion USA as projected by the CBO.

We will go over these and many other stories but first.....................

Let us now head over to the comex and assess trading over there today.

Here are the details:

The total gold comex open interest rose by 1248 contracts from 375,024 back up to 376,272 with gold falling by $14.20 on Thursday. The front active month of June saw it's OI rise by 102 contracts from 1440 up to 1542. We had 3 deliveries served upon our longs on Thursday. We thus gained 105 contracts or 10,500 additional oz that will stand in this delivery month of June. The next delivery month is the non active July contract and here the OI rose by 43 contracts up to 719. The next active delivery month for gold is August and here the OI fell by 1784 contracts from 214,397 down to 212,613. The estimated volume today was poor at 96,905 contracts. The confirmed volume yesterday was also poor at 138,210. It seems that the many now realize that the Comex is a crooked game so investors are seeking other means to acquire gold.

The total silver Comex OI rose appreciably as silver decreased in price by 21 cents on Thursday. It's OI rose by a considerable 2060 contracts to 150,483. The longs in silver remain resolute, willing to take on the criminal bankers. The front non active June silver contract month shows a loss in OI of 19 contracts resting tonight at 34. We had 17 notices filed yesterday so in essence we lost 2 contracts or an additional 10,000 silver ounces will not stand for metal on the June contract month. The next big delivery month is July and here the OI fell by 1045 contracts down to 60,987. We are exactly two weeks away from first day notice (June 28.2013) and judging from the OI we may see some fireworks in silver. The estimated volume on Friday was very high, coming in at 47,233 contracts. The confirmed volume on Thursday was extremely good at 73,853. I guess the bankers will try and throw everything possible at the silver longs including the kitchen sink, the bathtub and you name it in an attempt to dislodge the longs from their positions.

We again had 1 customer deposits on Friday

i) Into Scotia: 9027.628 oz (this arrived from HSBC which had the exact withdrawal yesterday)

total customer deposit: 9027.628 oz

It is very strange that in a big delivery month, we are witnessing no gold enter the dealer or even the customer.

we had one tiny customer withdrawal:

i) Out of Brinks, 32.15 oz was withdrawn.

zero ounces were withdrawn from JPMorgan on Friday as well as no notices were issued them as well.

On Tuesday we reported to you that JPMorgan withdrew a huge amount of gold from its customer account:

Out of JPMorgan: 217,844.96 oz.

If you will recall, we needed to see 100,000 oz of gold removed from JPMorgan's customer account. (1000 contracts served upon our longs in mid May).

Last Tuesday, we had 15,416.93 oz removed from the JPM's customer account. No doubt that this gold was part of the 1000 contracts issued by JPMorgan customer account and thus we calculated that as of last night 28,389.579 oz was settled upon, leaving 71,611.00 oz still left to arrive in the settling process.

In summary on the customer side of things for JPMorgan:

Last Wednesday we had 333 notices served upon and all were issued by JPMorgan's customer side.

Thursday morning we received notice that we had 826 notices served upon of which 725 contracts were issued by JPMorgan's customer account and 10 notices from their house or dealer account.

Friday morning, 318 notices were filed and of that total 317 notices were issued by JPMorgan and all of these were on their client or customer account.

8046 contracts x 100 oz per contract or 804,600 oz served upon + 1370 contracts or 137,000 oz (left to be served upon) = 941,600 oz or 29.28 tonnes of gold.

We gained back 105 contracts or 10,500 oz and this additional gold will stand in the June contract month.

We now have the official USA production of gold last year and it registered 230 tonnes. Thus approximately 19.16 tonnes of gold is produced by all mines in the USA per month. Thus the amount standing for gold this month represents 152.8% of that total production.

Ladies and Gentlemen: we have a three-fold problem:

i) the total dealer inventory of gold is at a very dangerously low level of only 44.32 tonnes and none of the 9.5 tonnes delivery notices from May and the 29 tonnes from June have been removed from inventory as of yet.

ii) a) JPMorgan's customer inventory remains at an extremely low 136,380 oz.

If you are a customer of JPMorgan and have your gold in its vault, I think it is best to remove it before we have another fiasco like MFGlobal.

ii b) JPMorgan's dealer account rests tonight at 413,000 oz. However all of this gold has been spoken for plus an additional 81,000 oz

iii) the 3 major bullion banks have collectively only 29.8 tonnes of gold left!!

Jan 13/2013:

The company called the move part of an effort to streamline its operations and improve efficiency by shifting more focus on production and profitability to operational teams closer to its mines.

"Rising costs across the industry and continued volatility in metal prices only reinforces the need to run our operations as safely and efficiently as possible to ensure success in any commodity cycle," said spokesman Omar Jabara.

Newmont currently employs approximately 750 people locally, the vast majority at its headquarters in Greenwood Village. The company directly employs 16,000 people globally, and contractors bring that total to 40,000.

"We face some very difficult decisions in streamlining our organization and are committed to treating people fairly throughout this process. Ultimately, we cannot postpone the work we need to accomplish now to create sustainable value for our stakeholders into the future," CEO and president Gary Goldberg said in a statement

.

The exact number of cuts in Colorado and at other sites is still undetermined, Jabara said. The workforce remaining in Colorado will be focused on strategy and governance.

After peaking above $1,900 an ounce in mid-2011, gold is now trading under $1,400 an ounce, with a large drop in early April after reports that China's economy was slowing. That decline has put intense pressure on gold-mining companies and gold-related investments across the board.

Newmont's stock price has fallen from nearly $58 a share in October to $33.33 a share at Wednesday's close, knocking the company off its long-held perch as the state's largest public company in market value.

Part of the squeeze mining companies such as Newmont face comes from the fact that the cost to mine gold has increased dramatically over the years along with the price, Goldberg said in a March interview.

Although gold prices rose by more than $1,000 an ounce during the recently ended 12-year run, the cost of bringing that ounce of gold out of the ground rose by $900, Goldberg said.

Those operational costs remain fairly static even as the price buyers are willing to pay for gold falls sharply.

Denver, thanks to its historical roots, talent base and companies such as Newmont, is known as the country's gold-mining capital.

Newmont relocated its headquarters in late 2008 from the Wells Fargo Building downtown to the new Palazzo Verdi, a 300,000-square-foot building at 6401 S. Fiddler's Green Circle.

The move was necessary in part to accommodate rapid employee growth at Newmont, which relocated about 400 employees.

"They are under pressure," said John Brackney, president and CEO of the South Metro Denver Chamber of Commerce. "We assume they will come back up. They have a very talented workforce."

Newmont, founded in 1921, has assets in the U.S., Australia, Peru, Indonesia, Ghana, Mexico and New Zealand. It has faced protests over the year at some of its locations, especially in Peru.

Newmont had land holdings of 29,000 square miles and 99.2 million ounces of proven and probable gold reserves at the end of last year, making it the largest U.S.-based gold-mining firm.

Gold closed up by $9.70 to $1387.30 (comex closing time). Silver rose by 37 cents to $21.95 (comex closing time)

In the access market at 5:00 pm, gold and silver finished trading at the following prices :

gold: 1391.50

silver: $22.08

At the Comex, the open interest in silver rose by a rather large 2060 contracts to 150,483 contracts with silver's fall in price, Thursday night by 15 cents. The silver OI is still holding firm at these highly elevated levels. The bankers will desperately try and remove some of these stubborn longs before the big July delivery month rolls around. I am still holding out of the thesis that the longs in silver are really the Chinese government. It could only be a sovereign who could withstand so much pain and still remain in the silver game. China at one time (around 1990) had in excess of 300 million oz of silver stored away. It is quite logical that the Chinese secretly loaned their hoard to the USA as the American above ground silver was running out.

It is also possible that China (like Germany) are asking for their metal back and the USA said no. Thus they are trying to get their metal back by waiting patiently and standing for as much silver as they can on each major delivery month at both the Comex and at the LBMA.

China went along with the scheme because they really wanted gold at lower prices, knowing full well the USA was manipulating precious metals lower. China, in order to become the new reserve currency of the world, would need to purchase as much gold as they could to satisfy their populace as well as increase official reserves. The plan may have worked quite well for them.

The open interest on the entire gold comex contracts rose by 1180 contracts to 375,024 which is still extremely low. There is no question that all of the weak speculators in gold have now departed. The number of ounces which is standing for gold in this June delivery month is 931,100 or 28.96 tonnes.The number of silver ounces standing in this non active month of June rose by 120,000 oz to 715,000 oz.

Tonight, the Comex registered or dealer inventory of gold falls badly to 1.425 million oz or 44.32 tonnes. This is getting dangerously low. The total of all gold at the comex fell again and now it is well below the 8 million oz mark at 7.694 million oz or 239.31 tonnes of gold.

JPMorgan's customer inventory shows no change and rests tonight at its nadir of 136,380.611 oz or 4.24 tonnes. Its dealer inventory remains at 413,526.284 oz but it still must settle upon contracts issued in the June delivery month which far exceeds its inventory.

The total of the 3 major bullion dealers, Scotia , HSBC and JPMorgan have in the dealer account only 29.8 tonnes of gold

The GLD reported no change in gold inventory. The SLV inventory of silver also remained firm with no losses or gains in inventory.

In physical stories we have reports from Chris Powell of GATA as well as a discussion with GoldMoney.com and David Morgan.

Eric King has a good discussion with Egon Von Greyerz on why he believes silver will rise higher on a percentage basis than gold.

On the paper side of things, we have an excellent paper presented by Dave Kranzler of the Golden Truth written for Seeking Alpha and it deals with the notion that it will be impossible for the Fed to taper as they basically need to fund their deficit and that deficit will surely be around 1 trillion USA dollars and not the 640 billion USA as projected by the CBO.

We will go over these and many other stories but first.....................

Here are the details:

The total gold comex open interest rose by 1248 contracts from 375,024 back up to 376,272 with gold falling by $14.20 on Thursday. The front active month of June saw it's OI rise by 102 contracts from 1440 up to 1542. We had 3 deliveries served upon our longs on Thursday. We thus gained 105 contracts or 10,500 additional oz that will stand in this delivery month of June. The next delivery month is the non active July contract and here the OI rose by 43 contracts up to 719. The next active delivery month for gold is August and here the OI fell by 1784 contracts from 214,397 down to 212,613. The estimated volume today was poor at 96,905 contracts. The confirmed volume yesterday was also poor at 138,210. It seems that the many now realize that the Comex is a crooked game so investors are seeking other means to acquire gold.

The total silver Comex OI rose appreciably as silver decreased in price by 21 cents on Thursday. It's OI rose by a considerable 2060 contracts to 150,483. The longs in silver remain resolute, willing to take on the criminal bankers. The front non active June silver contract month shows a loss in OI of 19 contracts resting tonight at 34. We had 17 notices filed yesterday so in essence we lost 2 contracts or an additional 10,000 silver ounces will not stand for metal on the June contract month. The next big delivery month is July and here the OI fell by 1045 contracts down to 60,987. We are exactly two weeks away from first day notice (June 28.2013) and judging from the OI we may see some fireworks in silver. The estimated volume on Friday was very high, coming in at 47,233 contracts. The confirmed volume on Thursday was extremely good at 73,853. I guess the bankers will try and throw everything possible at the silver longs including the kitchen sink, the bathtub and you name it in an attempt to dislodge the longs from their positions.

Comex gold/May contract month:

June 14/2013

the June contract month:

the June contract month:

Ounces

| |

Withdrawals from Dealers Inventory in oz

|

12,178.55 oz (Brinks)

|

Withdrawals from Customer Inventory in oz

|

32.15 (Brinks)

|

Deposits to the Dealer Inventory in oz

|

nil

|

Deposits to the Customer Inventory, in oz

| 9027.628 (Scotia) oz |

No of oz served (contracts) today

|

172 (17,200 oz)

|

No of oz to be served (notices)

|

1370 (137,000 oz

|

Total monthly oz gold served (contracts) so far this month

|

8046 (804,800 oz)

|

Total accumulative withdrawal of gold from the Dealers inventory this month

|

78,856.579oz

|

Total accumulative withdrawal of gold from the Customer inventory this month

| 258,950.53 oz |

We again had tiny activity at the gold vaults

The dealer again had 0 deposits but did have 1 dealer withdrawal.

We had a very big dealer withdrawal:

i) Out of brinks: 12,178.55 oz was withdrawn

We had a very big dealer withdrawal:

i) Out of brinks: 12,178.55 oz was withdrawn

We again had 1 customer deposits on Friday

i) Into Scotia: 9027.628 oz (this arrived from HSBC which had the exact withdrawal yesterday)

total customer deposit: 9027.628 oz

It is very strange that in a big delivery month, we are witnessing no gold enter the dealer or even the customer.

we had one tiny customer withdrawal:

i) Out of Brinks, 32.15 oz was withdrawn.

zero ounces were withdrawn from JPMorgan on Friday as well as no notices were issued them as well.

On Tuesday we reported to you that JPMorgan withdrew a huge amount of gold from its customer account:

Out of JPMorgan: 217,844.96 oz.

If you will recall, we needed to see 100,000 oz of gold removed from JPMorgan's customer account. (1000 contracts served upon our longs in mid May).

Last Tuesday, we had 15,416.93 oz removed from the JPM's customer account. No doubt that this gold was part of the 1000 contracts issued by JPMorgan customer account and thus we calculated that as of last night 28,389.579 oz was settled upon, leaving 71,611.00 oz still left to arrive in the settling process.

In summary on the customer side of things for JPMorgan:

Last Wednesday we had 333 notices served upon and all were issued by JPMorgan's customer side.

Thursday morning we received notice that we had 826 notices served upon of which 725 contracts were issued by JPMorgan's customer account and 10 notices from their house or dealer account.

Friday morning, 318 notices were filed and of that total 317 notices were issued by JPMorgan and all of these were on their client or customer account.

Monday, 132 notices were filed (all from JPMorgan) of which 131 notices were issued from JPMorgan's customer account and one notice from the dealer side.

Tuesday, of the 195 notices issued for this day, 136 notices were issued from JPMorgan and all of these came from its customer account.

Wednesday, the CME reported that 18 customer notices were filed for delivery and all were issued from JPMorgan's customer side.

Wednesday, the CME reported that 18 customer notices were filed for delivery and all were issued from JPMorgan's customer side.

Thursday, the CME reported that we had 3 notices filed but JPMorgan issued zero from the customer accounts and zero from their house account.

On Friday, as we indicated above, zero notices were issued from JPMorgan whether from the dealer account or customer account.

If we add the 71,611.00 oz that was owed last week, together with the following notices converted into oz: (we do not include the 136 + 18 + 0 + 0 notices as these will be settled later in the week or next week), we have the following in oz settled:

i) 333 notices equals 33300 oz

ii) 725 notices equals 72500 oz

iii 317 notices equals 31700 oz

plus the above 71,611.00 oz or

we have 209,111 oz of gold to be settled upon. On Tuesday we had 217,844.96 oz withdrawn from JPMorgan's customer account, no doubt satisfied these claims and were settled upon.

We still have 154 notices or 15,400 oz that need to be withdrawn from JPMorgan's customer account.

Friday we had one adjustment.

i) out of Scotia: 13,452.685 oz was adjusted out of the dealer account and this landed in the customer account of Scotia.

Thus tonight we have the following closing inventory figures for JPMorgan:

i) dealer account: 413,526.284 oz

ii) customer account remains at 136,380.611 oz. (or only 4.2 tonnes of gold)

Now for JPMorgan's dealer side and what the inventory should be:

Last Tuesday night we reported that 4935 contracts have been issued by JPMorgan's house account since first day notice and not yet subtracted out of inventory

You will also recall a week ago on Saturday and again last Monday night, I reported that JPMorgan had 470,322.102 oz in it's dealer account. From that day until now, 58,795.82 oz was either withdrawn or adjusted out, leaving the dealer side at 413,526.284 oz where it sits tonight.

On the dealer side a week ago Thursday, we had 10 notices issued on JPMorgan's dealer account.

Last Friday: zero

On Friday, as we indicated above, zero notices were issued from JPMorgan whether from the dealer account or customer account.

If we add the 71,611.00 oz that was owed last week, together with the following notices converted into oz: (we do not include the 136 + 18 + 0 + 0 notices as these will be settled later in the week or next week), we have the following in oz settled:

i) 333 notices equals 33300 oz

ii) 725 notices equals 72500 oz

iii 317 notices equals 31700 oz

plus the above 71,611.00 oz or

we have 209,111 oz of gold to be settled upon. On Tuesday we had 217,844.96 oz withdrawn from JPMorgan's customer account, no doubt satisfied these claims and were settled upon.

We still have 154 notices or 15,400 oz that need to be withdrawn from JPMorgan's customer account.

Friday we had one adjustment.

i) out of Scotia: 13,452.685 oz was adjusted out of the dealer account and this landed in the customer account of Scotia.

Thus tonight we have the following closing inventory figures for JPMorgan:

i) dealer account: 413,526.284 oz

ii) customer account remains at 136,380.611 oz. (or only 4.2 tonnes of gold)

Now for JPMorgan's dealer side and what the inventory should be:

Last Tuesday night we reported that 4935 contracts have been issued by JPMorgan's house account since first day notice and not yet subtracted out of inventory

You will also recall a week ago on Saturday and again last Monday night, I reported that JPMorgan had 470,322.102 oz in it's dealer account. From that day until now, 58,795.82 oz was either withdrawn or adjusted out, leaving the dealer side at 413,526.284 oz where it sits tonight.

On the dealer side a week ago Thursday, we had 10 notices issued on JPMorgan's dealer account.

Last Friday: zero

On Monday: 1

On Tuesday: 0

On Wednesday : 0

On Wednesday : 0

on Thursday: 0

on Friday: 0

Thus, 4946 notices have been issued by JPMorgan so far for 494,600 oz and these ounces have yet to settle from JPMorgan's dealer side.

JPMorgan's dealer vault registers tonight 413,526.284 oz.

Somehow we have a huge negative balance as i) the gold has not left JPMorgan's dealer account and has yet to settle

and

ii) it is now deficient by 81,074 oz (413,526 inventory - 494,600 oz issued = 81,074 oz)

In other words, the entire 413,526 must be first transferred out of Morgan's dealer category ( in the same format as in the customer category) leaving it with zero, plus the 81,074 of additional gold

JPMorgan has not had any deposits in gold in quite some time. As a matter of fact, zero ounces has entered on the dealer side from the beginning of 2013.

How will JPMorgan satisfy this shortfall??

on Friday: 0

Thus, 4946 notices have been issued by JPMorgan so far for 494,600 oz and these ounces have yet to settle from JPMorgan's dealer side.

JPMorgan's dealer vault registers tonight 413,526.284 oz.

Somehow we have a huge negative balance as i) the gold has not left JPMorgan's dealer account and has yet to settle

and

ii) it is now deficient by 81,074 oz (413,526 inventory - 494,600 oz issued = 81,074 oz)

In other words, the entire 413,526 must be first transferred out of Morgan's dealer category ( in the same format as in the customer category) leaving it with zero, plus the 81,074 of additional gold

JPMorgan has not had any deposits in gold in quite some time. As a matter of fact, zero ounces has entered on the dealer side from the beginning of 2013.

How will JPMorgan satisfy this shortfall??

Tonight the total dealer gold inventory falls again to 1.425 million oz (44.32 tonnes of gold). The total of all comex gold falls again , resting tonight at 7.6940 million oz or 239.31 tonnes.

Another disturbing piece of news is the low dealer gold inventory for our 3 major bullion banks: Scotia, HSBC and JPMorgan equal to 29.8 tonnes

i) Scotia: 276,777.003 oz or 8.6 tonnes

ii) HSBC: 270,197.277 oz or 8.4 tonnes

iii) JPMorgan: 413,526 oz or 12.8 tonnes

Brinks dealer account has the lions share of the dealer gold at 445,398.58 oz 13.89 tonnes.

Today we had 172 notices served upon our longs for 17,200 oz of gold. In order to calculate what I believe will stand for delivery in June, I take the OI standing for June (1542) and subtract out Friday's notices (172) which leaves us with 1370 contracts or 137,000 oz left to be served upon our longs.

Another disturbing piece of news is the low dealer gold inventory for our 3 major bullion banks: Scotia, HSBC and JPMorgan equal to 29.8 tonnes

i) Scotia: 276,777.003 oz or 8.6 tonnes

ii) HSBC: 270,197.277 oz or 8.4 tonnes

iii) JPMorgan: 413,526 oz or 12.8 tonnes

Brinks dealer account has the lions share of the dealer gold at 445,398.58 oz 13.89 tonnes.

Today we had 172 notices served upon our longs for 17,200 oz of gold. In order to calculate what I believe will stand for delivery in June, I take the OI standing for June (1542) and subtract out Friday's notices (172) which leaves us with 1370 contracts or 137,000 oz left to be served upon our longs.

Thus we have the following gold ounces standing for metal in June:

8046 contracts x 100 oz per contract or 804,600 oz served upon + 1370 contracts or 137,000 oz (left to be served upon) = 941,600 oz or 29.28 tonnes of gold.

We gained back 105 contracts or 10,500 oz and this additional gold will stand in the June contract month.

We now have the official USA production of gold last year and it registered 230 tonnes. Thus approximately 19.16 tonnes of gold is produced by all mines in the USA per month. Thus the amount standing for gold this month represents 152.8% of that total production.

Ladies and Gentlemen: we have a three-fold problem:

i) the total dealer inventory of gold is at a very dangerously low level of only 44.32 tonnes and none of the 9.5 tonnes delivery notices from May and the 29 tonnes from June have been removed from inventory as of yet.

ii) a) JPMorgan's customer inventory remains at an extremely low 136,380 oz.

If you are a customer of JPMorgan and have your gold in its vault, I think it is best to remove it before we have another fiasco like MFGlobal.

ii b) JPMorgan's dealer account rests tonight at 413,000 oz. However all of this gold has been spoken for plus an additional 81,000 oz

iii) the 3 major bullion banks have collectively only 29.8 tonnes of gold left!!

now let us head over and see what is new with silver:

Silver:

June 14.2013: June silver contract month:

| Silver |

Ounces

|

| Withdrawals from Dealers Inventory | nil |

| Withdrawals from Customer Inventory | 21,763.99 oz (CNT,Delaware) |

| Deposits to the Dealer Inventory | nil |

| Deposits to the Customer Inventory | 701,662.87 oz |

| No of oz served (contracts) | 5 (25,000 oz) |

| No of oz to be served (notices) | 29 (145,000 oz) |

| Total monthly oz silver served (contracts) | 112 (560,000 oz) |

| Total accumulative withdrawal of silver from the Dealers inventory this month | 982,955.47 oz |

| Total accumulative withdrawal of silver from the Customer inventory this month | 2,951,374.2 oz |

Today, we had good activity inside the silver vaults.

we had 0 dealer deposits and 0 dealer withdrawals.

We had 2 customer deposits:

i) Into Brinks: 300,908.32 oz

ii) Into CNT: 400,754.55 oz

total customer deposit; 701,662.87 oz

We had 2 customer withdrawals:

We had 2 customer deposits:

i) Into Brinks: 300,908.32 oz

ii) Into CNT: 400,754.55 oz

total customer deposit; 701,662.87 oz

We had 2 customer withdrawals:

i) Out of Brinks: 20,767.39 oz

ii) Out of Delaware: 996,60 oz

total customer withdrawal : 21,763.99 oz

ii) Out of Delaware: 996,60 oz

total customer withdrawal : 21,763.99 oz

we had 0 adjustments today

Registered silver at : 41.758 million oz

total of all silver: 165.118 million oz.

The CME reported that we had 5 notices filed for 25,000 oz today. In order to calculate what we believe will stand in the month of June, I take the Oi standing for June (34) and subtract out Friday's notices (5) which leaves us with 29 notices or 145,000 oz.

Thus the total number of silver ounces standing in this non active delivery month of June is as follows:

112 contracts x 5000 oz per contract (served) = 560,000 oz + 29 contracts x 5000 oz or 145,000 oz left to be served upon = 705,000 oz

we lost 10,000 oz of silver on Friday which will not stand at the Comex delivery month of June.

Thus the total number of silver ounces standing in this non active delivery month of June is as follows:

112 contracts x 5000 oz per contract (served) = 560,000 oz + 29 contracts x 5000 oz or 145,000 oz left to be served upon = 705,000 oz

we lost 10,000 oz of silver on Friday which will not stand at the Comex delivery month of June.

Now let us check on gold inventories at the GLD first: flatline......

Jam 14/ 2013:

Jam 14/ 2013:

Tonnes1,003.53

Ounces32,264,597.16

Value US$44.860 billion

Tonnes1,003.53

Ounces32,264,597.16

Value US$44.659 billion

* * *

Selected news and views.....

Newmont Mining to let go of one-third of its Colorado workforce

Posted: 06/12/2013 04:49:56 PM MDT

Updated: 06/13/2013 08:23:06 AM MDTBy Aldo Svaldi

The Denver Post

Updated: 06/13/2013 08:23:06 AM MDTBy Aldo Svaldi

The Denver Post

Newmont Mining said Wednesday that it would cut its Colorado workforce by a third over the next 90 days in one of the most tangible hits to the state from weaker gold prices.

"Rising costs across the industry and continued volatility in metal prices only reinforces the need to run our operations as safely and efficiently as possible to ensure success in any commodity cycle," said spokesman Omar Jabara.

Newmont currently employs approximately 750 people locally, the vast majority at its headquarters in Greenwood Village. The company directly employs 16,000 people globally, and contractors bring that total to 40,000.

"We face some very difficult decisions in streamlining our organization and are committed to treating people fairly throughout this process. Ultimately, we cannot postpone the work we need to accomplish now to create sustainable value for our stakeholders into the future," CEO and president Gary Goldberg said in a statement

.

The exact number of cuts in Colorado and at other sites is still undetermined, Jabara said. The workforce remaining in Colorado will be focused on strategy and governance.

After peaking above $1,900 an ounce in mid-2011, gold is now trading under $1,400 an ounce, with a large drop in early April after reports that China's economy was slowing. That decline has put intense pressure on gold-mining companies and gold-related investments across the board.

Newmont's stock price has fallen from nearly $58 a share in October to $33.33 a share at Wednesday's close, knocking the company off its long-held perch as the state's largest public company in market value.

Part of the squeeze mining companies such as Newmont face comes from the fact that the cost to mine gold has increased dramatically over the years along with the price, Goldberg said in a March interview.

Although gold prices rose by more than $1,000 an ounce during the recently ended 12-year run, the cost of bringing that ounce of gold out of the ground rose by $900, Goldberg said.

Those operational costs remain fairly static even as the price buyers are willing to pay for gold falls sharply.

Denver, thanks to its historical roots, talent base and companies such as Newmont, is known as the country's gold-mining capital.

Newmont relocated its headquarters in late 2008 from the Wells Fargo Building downtown to the new Palazzo Verdi, a 300,000-square-foot building at 6401 S. Fiddler's Green Circle.

The move was necessary in part to accommodate rapid employee growth at Newmont, which relocated about 400 employees.

"They are under pressure," said John Brackney, president and CEO of the South Metro Denver Chamber of Commerce. "We assume they will come back up. They have a very talented workforce."

Newmont, founded in 1921, has assets in the U.S., Australia, Peru, Indonesia, Ghana, Mexico and New Zealand. It has faced protests over the year at some of its locations, especially in Peru.

Newmont had land holdings of 29,000 square miles and 99.2 million ounces of proven and probable gold reserves at the end of last year, making it the largest U.S.-based gold-mining firm.

Chinese Cash Squeeze Leads To First Failed Liquidity-Draining Debt Auction Failure In 23 Months

Submitted by Tyler Durden on 06/14/2013 08:25 -0400

It was less than 24 hours after we warned that the Chinese "liquidity shortage" had hit an all time high, as a result of the PBOC's intransigence to inject liquidity into a financial system roiled by Bernanke's and Kuroda's offshore hot-money flows, that things got worse when early in the Chinese trading session we learned that the PBOC experienced its first liquidity drainage failure in 23 months, when the Chinese Finance Ministry failed to sell over 30% of the debt offered at auction - the direct result of a cash squeeze currently ravaging the country's banks.

The ministry sold 9.53 billion yuan ($1.55 billion) of 273-day bills, less than the 15 billion yuan target, according to Chinabond, the nation’s biggest bond-clearing house. Agricultural Development Bank of China Co. raised 11.51 billion yuan in a sale of six-month bills last week, less than its 20 billion yuan goal.

We explained the reasons for this previously but, once again, here is why China continues to find itself between an inflationary, foreign-liquidity sourced rock, and a contracting and failing credit transmission mechanism hard-place.

Banks are hoarding money to meet quarter-end capital requirements at the same time as capital inflows are easing amid a worsening economic outlook and speculation the Federal Reserve will rein in monetary stimulus. The seven-day repurchase rate, a gauge of interbank funding availability, has more than doubled in the past month and the Hang Seng China Enterprises Index (HSCEI) of shares slid today for a record 12th day in Hong Kong.

“The cash crunch is curbing demand for bonds,” said Chen Ying, a fixed-income analyst at Sealand Securities Co. in Shenzhen. “The crunch may persist if the central bank doesn’t come out to inject more capital into the financial system. If it lasts longer, it may affect issuance of both government and corporate bonds.”

The average yield at today’s bill sale was 3.76 percent, according to two traders who are required to bid at the auctions. That compares with a 3.14 percent rate yesterday for similar-maturity existing securities, according to data compiled by Chinabond. The ministry’s last failed auction was a sale of 182-day bills in July 2011.

The PBOC has been very unwilling to inject any incremental liquidity in a long time, halting reverse-repo based injections in February 7.

The People’s Bank of China added a net 92 billion yuan to the financial system this week, down from 160 billion yuan in the five days through June 7, according to data compiled by Bloomberg. The monetary authority refrained yesterday from draining cash for the first time in three months as money markets reopened after a three-day holiday.The last time it used reverse-repurchase agreements to inject funds was Feb. 7.

“If the central bank doesn’t conduct reverse-repurchase agreements or short-term liquidity operations to inject capital, cash supply will stay tight for the rest of the month,” said Cheng Qingsheng, a bond analyst at Evergrowing Bank Co. in Shanghai.

What is more disturbing is that China also stated that this may not change much any time soon as a result in a downshift in growth (and inflation) strategy, which is always dictated via the monetary, and credit channels. So while we expect that the PBOC may surprise the world with an RRR, or interest rate cut, as we speculated yesterday, whether or not China does this is another matter.

We are confident (or at least hope) the PBOC realizes that the trade-off to a slowing economy is a banking system which is unsustainable if the credit expansion to which the local banks are used, continues to "taper."

And the flipside is that if and when it finally gives in and resumes injecting liquidity, then the people, well-conditioned from years of inflationary fears, will line up dutifully in calm, cool and collected lines to buy up that old barbarous relic: gold.

Those who wish to keep track of Chinese liquidity first hand, best visualized by various SHIBOR tenors, can do so at the following site. And while ultra-short term liquidity conditions have improved modestly in the past 3 days, SHIBOR beyond a 1 month maturity continues to rise.

Treasury Sales By Foreigners Hit Record High In April

Submitted by Tyler Durden on 06/14/2013 10:28 -0400

The monthly TIC (foreign capital flows) data gets less respect than it should. Perhaps it is because it is two months delayed, or perhaps due to the Treasury Department labyrinth one has to cross in order to figure out what is going on. Either way, for those who do follow the data set, will know by now that in April, foreign investors, official and private, sold $54.5 billion. Why is this number of note? Because it is the biggest monthly sale of Treasurys by foreigners in the history of the data series. The TSY revulsion was somewhat offset by a jump in MBS purchases, which saw $23 billion in acquisitions, while corporate bonds were sold to the tune of $4.5 billion. Finally, looking at equities, foreigners were responsible for some $11.2 billion in US stock purchases. The great rotation may not be working domestically, but it seems to be finally impacting foreign investors.

As for the question who sold the most US paper, the answer is below: not surprisingly, Japan is at the top, and we can only imagine the proceeds from the sale were used to fund (currently even more money losing) purchases in the Nikkei, which is currently at levels last seen in March, or before the great BOJ intervention.

¤ YESTERDAY IN GOLD & SILVER

The gold price didn't do much of anything in Far East trading...and then got sold down five bucks starting at 9:00 a.m. BST in London, with the low of the day coming minutes after 11:00 a.m...about two hours later.

From there, the gold price was flat until five minutes before trading began on the Comex in New York. The subsequent rally got chopped off by a short seller of last resort about twenty minutes later, when it appeared the market was about to go "no ask"...and the gold price was about to punch through the $1,400 spot price ceiling. A second rally at the London p.m. gold fix suffered the same fate...and after that the price didn't do much until after the Comex close.

Then starting around 2:30 p.m. EDT, the gold price began to slowly tick higher for the rest of the New York Access market. The low tick in London looked to be around the $1,378 spot mark...and the high tick in New York was recorded by Kitco as $1,393.60 spot...and that occurred at the London p.m. gold fix.

Gold finished at $1,3191.50 spot...up $5.80 on the day...and net volume was a very light 106,000 contracts.

Here's the New York Spot Gold [Bid] chart that shows the New York action in far more detail.

Silver traded in a very tight range in both Far East and London yesterday...and was down about 20 cents when the price blasted off at 8:15 a.m. in New York yesterday morning. The market went "no ask" fifteen minutes later...before the usual not-for-profit seller[s] showed up. By 9:20 a.m. the price was back down to $22.07 spot...and barely moved for the remainder of the trading day.

Kitco recorded the high tick as $22.68 spot...and if "da boyz" hadn't shown up when they did, we would be looking at a very big silver price right now.

But when all was said and done at the 5:15 p.m EDT close in New York, silver was only up 23 cents on the day...and closed at $22.08...and above the $22 price ceiling. Volume, net of roll-overs out of the July delivery month, were a bit heavier than normal...close to 33,000 contracts.

Here's the New York Spot Silver [Bid] chart, so you can see the dramatic action in the first 15 minutes of Comex trading for yourself.

The dollar index closed in New York late Thursday afternoon at 80.72...and then fell to 80.61 by 10:00 a.m. in Tokyo. From there it rallied to its high of the day...80.99...just minutes after 8:30 a.m. in New York. At that point, the index fell completely out of bed...hitting a low of 80.65 by 11:40 a.m. EDT. The subsequent rally was tiny...and very short. From there the dollar index headed lower, finishing the Friday session on its low tick...80.62...and down 10 basis points from Thursday.

You should carefully note that vertical price spikes in both gold and silver got hammered flat at the precise moment that the dollar index fell off a cliff just minutes after 8:30 a.m. EDT. There's absolutely no chance that this was a coincidence. As Chris Powell's famous quote goes..."There are no markets anymore...only interventions".

* * *

The sell-off in the precious metal stocks probably had more to do with what was happening in the general equity markets in New York at the time.

The CME's Daily Delivery Report showed that a surprisingly large 414 gold contracts were posted for delivery on Tuesday within the Comex-approved depositories. The two big short/issuers of note were Barclays with 324 contracts out of its client account...and ABN Amro with 88 contracts. The three largest long/stoppers were HSBC USA, Barclays...and Canada's Bank of Nova Scotia, with 234, 94 and 69 contracts respectively. The long/stoppers at Barclays were in the bank's proprietary [in-house] trading account...the bank betting against its customers again.

There were only 4 silver contracts posted for delivery on Tuesday...and the link to yesterday'sIssuers and Stoppers Report is here.

There were no reported changes in either GLD or SLV yesterday...and no sales report from theU.S. Mint, either.

Over at the Comex-approved depositories on Thursday, they reported receiving 701,662 troy ounces of silver...and 21,763 troy ounces were shipped out the door. The link to that activity ishere.

In gold on the same day...9,027 troy ounces were reported received...and 12,210 troy ounces were shipped out. The link to that activity is here.

The Commitment of Traders Report was pretty much as expected, as there were improvements in the Commercial net short position in both gold and silver...but particularly silver...and several new records were set.

In silver, the Commercial net short position [the total Commercial short holders subtracted from the total Commercial long holders] declined by 16.9 million ounces...and is now down to a shockingly low 25.1 million ounces. Reader E.W.F. said that "In silver, the Commercial traders hold their smallest net short position since 29 July 1997." That's almost 16 years ago!!!

The four largest traders are short 196.5 million ounces of silver...and the next '5 through 8' traders are short an additional 55.9 million ounces of silver. Ted says that he's no longer sure what JPMorgan's short position in silver might be.

As far as concentration goes, once you remove all the market-neutral spread trades from the total open interest, the Big 4 are short 35.3% of the entire Comex futures market in silver. The short positions of the '5 through 8' traders adds another 10.0%. So the Big 8, in total, are short 45.3% of the entire Comex futures market in silver.

Reader E.W.F. says that "the silver raptors [the small commercial traders other than the Big 8] hold their largest net long position in the history of the data."

In gold, the Commercial net short position declined by 333,000 troy ounces...and is now down to 5.83 million ounces. Reader E.W.F. says that.."the Commercials hold their smallest net short position in gold since 31 May 2005."

The four largest traders are short 9.94 million ounces of gold...and the '5 through 8' traders are short an additional 4.67 million ounces.

As far as concentrations go, once the market-neutral spread trades are removed from gold's total open interest, the four largest traders are short 31.0 percent of the entire Comex futures market in gold...and the '5 through 8' traders add another 14.6 percentage point. So the Big 8 in total are short 45.6% of the entire Comex futures market in gold.

Reader E.W.F. pointed out that "the gold raptors are net long 87,851 contracts. This is their largest net long position since April 10, 2001. On that date the gold raptors were net long 95,984 contracts."

Here's Nick Laird's "Days of World Silver Production to Cover Comex Short Positions" chart for all physically traded commodities on that exchange.

(Click on image to enlarge)

Selected news and views.......

Doug Noland: The King of Emerging Markets

Japanese policymakers have really mucked things up. The Nikkei sank 6.5% Thursday and was down 1.5% for the week. Perhaps it’s a little early to pronounce the BOJ’s “shock and awe” monetary experiment a failure. The yen rallied 3.5% this week against the dollar. Against the Philippine peso its was up 4.5%, versus the South Korean won 4.1%, the Indian rupee 4.31%, the Malaysian ringgit 4.0%, the Indonesian rupiah 3.2%, the Argentine peso 3.9% and the Brazilian real 4.2%. Indonesia raised rates to support its weak currency. The yen “carry trade” (sell yen and use proceeds to buy higher-yielding instruments globally) is doling out painful losses – forcing the unwind of leveraged trades across many markets. I wouldn’t be surprised if the yen short is the largest short position in modern history. The yen bears are now running for cover – causing all kinds of havoc in the currencies and securities markets.

“Emerging” Asian markets are in the middle of an unfolding financial storm. Friday’s 2.1% gain cut the Philippine’s loss for the week to 9.2%. Even with Friday’s 4.4% recovery, the Thailand stock exchange ended the week down 3.4%. South Korea’s Kospi dropped 1.8%.

Latin America is as well caught in troubling dynamics. Brazil’s currency (real) trade to a four-year low against the dollar this week – despite currency interventions and the removal of taxes on financial flows and currency derivatives. Brazilian equities were hit for 4.4% this week, increasing y-t-d losses to 19.1%. Mexican stocks dropped 2.4%, boosting y-t-d losses to 10.2%.

Another absolute must read from Doug Noland that was posted on theprudentbear.com Internet site yesterday evening...and I thank reader U.D. for bringing it to our attention.

Singapore Censures 20 Banks on Traders’ Bids to Manipulate Rates

Singapore’s monetary authority censured banks for trying to rig benchmark interest rates and ordered them to set aside as much as S$12 billion ($9.6 billion) at zero interest pending steps to improve internal controls.

ING Groep NV, Royal Bank of Scotland Group Plc and UBS AG were among 20 banks at which 133 traders tried to manipulate the Singapore interbank offered rate, swap offered rates and currency benchmarks in the city-state, the Monetary Authority of Singapore said in a statement yesterday. The regulator said it will also make rigging key rates a criminal offense and bring supervision under its direct oversight.

Singapore, seeking to bolster its reputation as a major financial hub, is cracking down amid a widening global review of benchmarks. Bloomberg News reported this week traders manipulated key foreign-exchange rates in the $4.7 trillion-a-day currency market. Barclays Plc, UBS and RBS have been fined $2.5 billion over the past year for rigging Libor.

Well, Singapore's monetary authorities mean what they say...and if the banks are real smart they'll toe the line. This Bloomberg story, filed from Singapore, was posted on their website early yesterday afternoon MDT...and I thank Marshall Angeles for his second contribution to today's column.

Singapore Censures 20 Banks on Traders’ Bids to Manipulate Rates

Singapore’s monetary authority censured banks for trying to rig benchmark interest rates and ordered them to set aside as much as S$12 billion ($9.6 billion) at zero interest pending steps to improve internal controls.

ING Groep NV, Royal Bank of Scotland Group Plc and UBS AG were among 20 banks at which 133 traders tried to manipulate the Singapore interbank offered rate, swap offered rates and currency benchmarks in the city-state, the Monetary Authority of Singapore said in a statement yesterday. The regulator said it will also make rigging key rates a criminal offense and bring supervision under its direct oversight.

Singapore, seeking to bolster its reputation as a major financial hub, is cracking down amid a widening global review of benchmarks. Bloomberg News reported this week traders manipulated key foreign-exchange rates in the $4.7 trillion-a-day currency market. Barclays Plc, UBS and RBS have been fined $2.5 billion over the past year for rigging Libor.

Well, Singapore's monetary authorities mean what they say...and if the banks are real smart they'll toe the line. This Bloomberg story, filed from Singapore, was posted on their website early yesterday afternoon MDT...and I thank Marshall Angeles for his second contribution to today's column.

Three King World News Blogs

1. Egon von Greyerz [#1]: "Silver is Coiling For a Major Upside Explosion in Price". 2. Citi analyst Tom Fitzpatrick: "Stocks to Plunge as World Enters Massive Bank Panic". 3. Egon von Greyerz [#2]: "Financial Chaos, Disappearing Freedom and Hyperinflation".

France bans the mailing of gold, silver

France's government has banned sending currency by mail — including coins, cash and all forms of precious metals.

BullionStreet notes that the legislation, which was approved May 23, was not announced by the government at the time and has been little reported on by media outlets.

Published via Legifrance, the law states: “the insertion of banknotes, coins and precious metals is prohibited in mailings, including the insured items, registered items and items subject to formalities certifying deposition and distribution.”

This story has been around the Internet for a week or so now, so it's not really new...but I wanted to see it posted on a more well-known Internet site before I was going to post it in this space. This version of it appeared on the mining.comInternet site yesterday...and it's courtesy of Marshall Angeles.

On This Day in 1933...the U.S. Confiscates Gold

Roosevelt had only been in office for 101 days and while there was broad bipartisan support for inflationary policies in Congress, it’s safe to say that most of those who voted for FDR never expected him to confiscate private holdings of gold coins, bullion, and certificates.

Roosevelt called the measure a temporary one (it wasn’t), and he followed it up by invalidating gold clauses in private contracts that obligated payment in gold dollars, which had the effect of devaluing the assets of bond and contract holders. Many of these hoarders and slackers purchased gold as a hedge against the (Fed-fueled) inflationary boom of the 1920s and then hung on to it during the Hoover years when his crazed and unprecedented interventions in wages and prices caused a normal market correction to devolve into a depression. Why would they trust Roosevelt any more?

They were smart not to. By January 1934, Roosevelt increased the dollar price of gold from $20.67 to $35, thus devaluing the dollar by 70 percent while increasing the value of gold that the government now owned.

This Zero Hedge piece from yesterday is well worth your time...and I thank Elliot Simon for his last story of the day.

¤ THE WRAP

As democracy is perfected, the office of President represents, more and more closely, the inner soul of the people. On some great and glorious day the plain folks of the land will reach their heart's desire at last...and the White House will be occupied by a downright moron. --- H.L. Mencken, The Baltimore Evening Sun, July 26, 1920

Today's pop 'blast from the past' is by the Queen of Soul herself. This hit was recorded in 1968...and you will know it instantly. The link is here.

Last week's classical selection was by German composer Max Bruch...and this week's is as well. Last week it was his Scottish Fantasy...and this week it's his Violin Concerto No. 1, in G minor, Op. 26...composed in 1866. I have a lot of 'favourite' violin concertos...and this is certainly one of them. Here's the incomparable Sarah Chang doing the honours in a posting over at youtube.com...and the link is here. Neither the video quality, nor the fidelity, are the greatest...but it's the only recording that I could find that has all three movements.

After yesterday's big run-up in the silver price, it's easy to see that there is no real liquidity in the precious metals market, as most of the trading is of the high-frequency variety. There are really no legitimate buyers and sellers present in the Comex futures market...just the machines.

If left to their own devices, there isn't a "free market" that wouldn't melt down, or melt up, if given the opportunity to do so. Chris Powell was oh, so prophetic with his quote..."There are no markets anymore...only interventions."

The Commitment of Traders Report, especially in silver, was a sight to behold...and with the way things are currently configured in all four precious metals, copper...and the dollar index...they are an 'accident' waiting to happen to the upside.

However, since there are no free markets, when something does blow up...or melt down...it won't be by accident. JPMorgan et al were in full control of this market on the short side...and there's no reason at all to assume that they won't continue to hold the power when the smoke clears to the upside.

JPMorgan will not only control the 'when'...they will also determine how high and how fast we get to the new precious metal prices, which are all but baked in the cake. They didn't go to all this trouble over the last six months or so to extricate themselves from the short side of the gold market, to put their head back in the lion's mouth again. They'll control things from the long side from now on.

Even if you only read all the stories I have posted in this column this weekend, you should be able to tell from their contents that the entire planet is about to come unglued economically, financially...and monetarily. It's only the time line that is uncertain...and whether or not it will be a controlled event, or will events and circumstance quickly spiral out of the control of the powers that be?

I don't know the answer to that...and neither does anyone else. So we wait.

Here's Nick Laird's "Total PMs Pool" chart updated with data from the week just past...and it doesn't require any further explanation from me. As I said a week ago, I felt that we were done for liquidations out of the big ETFs with last week's report...and it appears that this is the case.

(Click on image to enlarge)

Before heading off to bed, I'd like to point out that Casey Research has another FREE ON-LINE VIDEO EVENT in the works. This one is entitled "GOLD: Dead Cat...or Raging Bull?"

It will feature Jim Cramer, Eric Sprott, Doug Casey, Steven Feldman, Rob McEwen andJeff Clark. They explore the recent fluctuations of the gold price and what it means for investors. Does gold's drop signal the end of its bull run, or is it just taking a breather? Should investors load up on or unload gold? The free online event Gold: Dead Cat...or Raging Bull? hosted by The Streetand Casey Research, with Jim Cramer, Eric Sprott, Doug Casey, and others will provide some answers.

This free video will air on June 25th at 2:00 pm Eastern Daylight Time. It will be available for viewing after the initial stream for those who have schedule conflicts. You can check it out...and then sign up for it here. It pretty much goes without saying that it will be worth your time.

That's all I have for the day...and the week. Enjoy what's left of your weekend...and I'll see you here on Tuesday.

Submitted by Tyler Durden on 06/14/2013 08:25 -0400

It was less than 24 hours after we warned that the Chinese "liquidity shortage" had hit an all time high, as a result of the PBOC's intransigence to inject liquidity into a financial system roiled by Bernanke's and Kuroda's offshore hot-money flows, that things got worse when early in the Chinese trading session we learned that the PBOC experienced its first liquidity drainage failure in 23 months, when the Chinese Finance Ministry failed to sell over 30% of the debt offered at auction - the direct result of a cash squeeze currently ravaging the country's banks.

The ministry sold 9.53 billion yuan ($1.55 billion) of 273-day bills, less than the 15 billion yuan target, according to Chinabond, the nation’s biggest bond-clearing house. Agricultural Development Bank of China Co. raised 11.51 billion yuan in a sale of six-month bills last week, less than its 20 billion yuan goal.

We explained the reasons for this previously but, once again, here is why China continues to find itself between an inflationary, foreign-liquidity sourced rock, and a contracting and failing credit transmission mechanism hard-place.

Banks are hoarding money to meet quarter-end capital requirements at the same time as capital inflows are easing amid a worsening economic outlook and speculation the Federal Reserve will rein in monetary stimulus. The seven-day repurchase rate, a gauge of interbank funding availability, has more than doubled in the past month and the Hang Seng China Enterprises Index (HSCEI) of shares slid today for a record 12th day in Hong Kong.“The cash crunch is curbing demand for bonds,” said Chen Ying, a fixed-income analyst at Sealand Securities Co. in Shenzhen. “The crunch may persist if the central bank doesn’t come out to inject more capital into the financial system. If it lasts longer, it may affect issuance of both government and corporate bonds.”The average yield at today’s bill sale was 3.76 percent, according to two traders who are required to bid at the auctions. That compares with a 3.14 percent rate yesterday for similar-maturity existing securities, according to data compiled by Chinabond. The ministry’s last failed auction was a sale of 182-day bills in July 2011.

The PBOC has been very unwilling to inject any incremental liquidity in a long time, halting reverse-repo based injections in February 7.

The People’s Bank of China added a net 92 billion yuan to the financial system this week, down from 160 billion yuan in the five days through June 7, according to data compiled by Bloomberg. The monetary authority refrained yesterday from draining cash for the first time in three months as money markets reopened after a three-day holiday.The last time it used reverse-repurchase agreements to inject funds was Feb. 7.“If the central bank doesn’t conduct reverse-repurchase agreements or short-term liquidity operations to inject capital, cash supply will stay tight for the rest of the month,” said Cheng Qingsheng, a bond analyst at Evergrowing Bank Co. in Shanghai.

What is more disturbing is that China also stated that this may not change much any time soon as a result in a downshift in growth (and inflation) strategy, which is always dictated via the monetary, and credit channels. So while we expect that the PBOC may surprise the world with an RRR, or interest rate cut, as we speculated yesterday, whether or not China does this is another matter.

We are confident (or at least hope) the PBOC realizes that the trade-off to a slowing economy is a banking system which is unsustainable if the credit expansion to which the local banks are used, continues to "taper."

And the flipside is that if and when it finally gives in and resumes injecting liquidity, then the people, well-conditioned from years of inflationary fears, will line up dutifully in calm, cool and collected lines to buy up that old barbarous relic: gold.

Those who wish to keep track of Chinese liquidity first hand, best visualized by various SHIBOR tenors, can do so at the following site. And while ultra-short term liquidity conditions have improved modestly in the past 3 days, SHIBOR beyond a 1 month maturity continues to rise.

Treasury Sales By Foreigners Hit Record High In April

Submitted by Tyler Durden on 06/14/2013 10:28 -0400

The monthly TIC (foreign capital flows) data gets less respect than it should. Perhaps it is because it is two months delayed, or perhaps due to the Treasury Department labyrinth one has to cross in order to figure out what is going on. Either way, for those who do follow the data set, will know by now that in April, foreign investors, official and private, sold $54.5 billion. Why is this number of note? Because it is the biggest monthly sale of Treasurys by foreigners in the history of the data series. The TSY revulsion was somewhat offset by a jump in MBS purchases, which saw $23 billion in acquisitions, while corporate bonds were sold to the tune of $4.5 billion. Finally, looking at equities, foreigners were responsible for some $11.2 billion in US stock purchases. The great rotation may not be working domestically, but it seems to be finally impacting foreign investors.

As for the question who sold the most US paper, the answer is below: not surprisingly, Japan is at the top, and we can only imagine the proceeds from the sale were used to fund (currently even more money losing) purchases in the Nikkei, which is currently at levels last seen in March, or before the great BOJ intervention.

¤ YESTERDAY IN GOLD & SILVER

The gold price didn't do much of anything in Far East trading...and then got sold down five bucks starting at 9:00 a.m. BST in London, with the low of the day coming minutes after 11:00 a.m...about two hours later.