http://www.zerohedge.com/news/2013-05-25/mystery-surrounding-hong-kong-mercantile-exchange-collapse-deepens-four-arrested

http://silverdoctors.com/jim-willie-bank-runs-bullion-bank-runs-to-climax-soon-in-the-us/#more-25970

and......

http://www.caseyresearch.com/gsd/edition/addison-wiggin-cooking-the-gold-books

http://harveyorgan.blogspot.com/2013/05/gld-lowers-inventory-againcomex.html

http://www.zerohedge.com/news/2013-05-24/forget-prayer-its-lamb-slaughter-time-rational-mans-response-all-time-high-gold-shor

Mystery Surrounding Collapse Of Hong Kong Mercantile Exchange Deepens; Four Arrested

Submitted by Tyler Durden on 05/25/2013 22:30 -0400

A week ago, when the brand new Hong Kong Mercantile Exchange suddenly shuttered after being in operation for only two years, urgently settling what little contracts were outstanding, many questions were left unanswered.

Such as: how it was possible that the exchange, expected by many to become the new preferred trading venue for Asian precious metals and to steal the CME's crown, could close on such short notice, without barely having been given a fair chance at being profitable, let alone dominating Pacific rim metals trading.

This mystery deepened further after reports that the exchange barely had seen any volume, with allegedly only a tiny 200 open contracts remaining to be settled upon shuttering.

Now, the confusion surrounding the HKMex closure has taken another big step for bizarrokind following news that not only have at least four HKMex senior executive have been arrested having been found to be in possession of false bank docs for nearly half a billion in dollars, but that government itself was forced to "shore up confidence" in CY Leung, Hong Kong's 3rd Chief Executive, whose former top aide was none other Barry Cheung Chun-yuen, founder of the HKMex.

Yet another major geopolitical scandal centered around gold: how original.

From the South China Morning Post:

Three mainland men charged in a scandal over the failed Hong Kong Mercantile Exchange (HKMEx) were found in their hotel rooms with false bank documents purporting to be worth hundreds of millions of dollars, a court heard yesterday.Dai Linyi, 65; Li Shanrong, 49, and Lian Chunyan, 50, who were arrested on Tuesday, appeared in Kowloon City Court charged with "possessing false instruments with intent".The men were detained after the Securities and Futures Commission found serious irregularities with the finances of the exchange - chaired by executive councillor Barry Cheung Chun-yuen - and handed the details of its inquiry to the police.

Specifically, among the confiscated false documents were an acknowledgment letter, two letters of guarantee and three proofs of funds allegedly issued by HSBC and Standard Chartered Bank. There were also time deposits and at least one telegraphic transfer. "The acknowledgement letter, which was found among Dai's papers, was dated April 23 and allegedly issued by Standard Chartered in relation to a cheque for US$460 million (HK$3.57 billion). He also had a letter of guarantee from the same bank undertaking to pay US$460 million to a Zhang Jisheng."

Just as "surprising" is that HSBC is involved in another potential money-laundering scheme:

Dai also had a proof of funds dated May 8 and allegedly issued by HSBC confirming that US$11 million had been deposited into an account held by Lian. Both Li and Lian also held two other such "proofs" with the same descriptions. In addition, Dai and Lian had two documents dated May 7 proving the existence of two separate deposits of US$11 million each in another account held by Lian, the court heard.

However that is just the beginning:the scandal over the failed exchange threatens to go to the very top of Hong Kong's political ladder, following Friday's resignation of HKMEx founder Barry Cheung Chun-yuen, from all his public duties - including executive councillor and head of the Urban Renewal Authority - on Friday and is himself under police investigation over the collapse, the government has said.

The probe into the collapse of the Hong Kong Mercantile Exchange has widened, with police questioning three senior executives of the failed commodities agency.Separate sources confirmed yesterday that detectives from the commercial crime bureau had talked to a total of four staff from the exchange.

Where things get truly bizarre is the news that the head of Hong Kong itself and the founder of the HKMEx were very close.

The probe into the collapse of the Hong Kong Mercantile Exchange has widened, with police questioning three senior executives of the failed commodities agency.Separate sources confirmed yesterday that detectives from the commercial crime bureau had talked to a total of four staff from the exchange.Meanwhile, government officials moved to shore up confidence in Leung Chun-ying's administration amid the growing controversy surrounding HKMEx founder Barry Cheung Chun-yuen, who was formerly his top aide.Cheung resigned from all his public duties - including executive councillor and head of the Urban Renewal Authority - on Friday and is himself under police investigation over the collapse , the government has said.Speaking to the Sunday Morning Post yesterday, Cheung, 54, would say only: "Sorry, I am not taking calls today. I am at home with friends and family."

How long before there is a connection between Cheung and Hong Kong's top man CY Leung? Probably not very.

In the meantime, we don't hold much hope for the resurrection of the now shuttered mercantile exchange:

Meanwhile, Ben Kwong Man-bun, one of the 37 broker members of the HKMEx, said the exchange's business model would make it difficult for any would-be investor, or "white knight", to consider rebuilding the exchange."If you look at the exchange's record, not too many members were actively using the platform,"he said. "[The exchange] needs a lot of capital and infrastructure."

So... what was the HKMEx being used for? Well, one explanation is that it was nothing more than a highly structured gold financing vehicle?

Huh?

Recall our lengthy article about China's Copper Financing Deals, and how China is cracking down on the practice: something which will likely unencumber 500,000 tons of copper as Letter of Credit collateral, and force its market liquidation, further crushing the spot price.

The opposite process can also be just as true: while in China copper has long been the preferred financing-creation asset of choice, in Hong Kong it may well have been gold. Which ostensibly would make the previously discussed CCFDs convert into HKGFDs.

And with the recent collapse in the price of paper gold, suddenly the infinite rehypothection chain that whatever gold was at the HKMEx was used for, found itself in jeopardy, with margin funding pressure forcing collateral chains to break, as counterparties suddenly demanded excess margin on existing arrangements.

The subsequent escalation in the serial failure of assorted "HKGF" deals may have been the ultimate reason why suddenly not only the very exchange - which may have been nothing than a glorified bonded warehouse for tons of LC collateral - was forced to promptly shutdown, but all those associated with it had to scramble to procure fake financial documents on short notice to avoid someone else's wrath, while they found a way to ride into the sunset.

Naturally, all of the above is still speculation, and much can change in the coming hours and days as more information is disclosed, however, if indeed this is a scandal about (multiple times) encumbered gold, if it reaches the very top of HK's power structure, one can be assured that there will be some very angry counterparties on the losing side of whatever gold-financing deals Hong Kong's top politicians had engaged in over the past two years.

http://silverdoctors.com/jim-willie-bank-runs-bullion-bank-runs-to-climax-soon-in-the-us/#more-25970

The Fascist Business Model came into vogue in 2001. The merger of state with the largest of corporations, primarily the big banks, the big defense contractors, the big news media networks, and the big pharmaceuticals, has created a choke-hold around the neck of the nation, without 5% recognizing the function of the model during the strangulation in progress. The merger with the deeply corrupted corporations in power became standard fixtures following the 911 attacks, an elaborate self-destruction of the fundamental structure of the nation and its priorities by the syndicate. Think a massive elaborate bank heist of gold bars, bearer bonds, and diamonds, but such discussion belongs in other venues. Let it be said that the events of September 2001 were the syndicate coming out party and the Patriot Act their Nazi Manifesto, with painfully little recognition of events by the sheeple masses or the subservient press talking heads. The national socialists are back in force after a 70-year hiatus, with far more toys and devices. Their telltale signals are bank welfare and a flag wrapped in a cross with unending press coverage of terrorism. During the last twelve years, financial treachery and banking criminality have run rampant in a true global spectacle, their stock & trade. However, treachery with permitted bank and bond fraud, rigged financial markets, naked short ambushes, flash crashes, and lawsuits that convert criminal procedures into standard low business costs all have resulted in profound consequences.

The entire world has reacted, with some significant momentum having been generated in the last year. Back in 2009, repeated in 2010, the Jackass had stated that the nations who are first to move toward a non-USDollar system will thrust themselves into a global leadership position while at the same time permit a recovery from the cancerous fiat currency system led by the USDollar as reserve currency flagship. A basic tenet, the security forces are given more power when security is undermined, even if violent events are perpetrated by the security agencies themselves in great spectacles. The Western nations really truly sincerely need a wake-up call on reality, and it is coming as a paradigm shift with shock waves. But consequences have a way of developing out of natural systems in reaction. Some scientific types call it Newton’s Law. Others call it the order of natural systems. The Jackass preference is to call it a defensive maneuver motivated by the survival instinct, whereby the cancer or pathology is isolated, trapped, then suffocated and extinguished, left to die on the vine or shed like bad skin.

TREACHERY, FRAUD, PROTECTION

The collection of treacherous practices, most of which emanate from the myriad USGovt offices, have invited stern reaction by the global players. These diverse treacherous practices, often implemented by the Wall Street banks and their ring leader the US Federal Reserve, have invited stern reaction by the global players. The broad cover for treacherous practices, provided protective cover by the USGovt regulatory agencies, have invited stern reaction by foreign nations in a powerful response. The disintegration of the financial foundation built of USDollar steel beams and USTreasury Bond cement blocks has been crumbling and collapsing for the last four years, ever since the Lehman Brothers failure and the integration of Fannie Mae & AIG under the USGovt roof, where their $trillion frauds are kept deeply hidden in the shadows and basement. While the Manhattan Made Men continue to attempt to hold things together, they struggle mightily, lacking sufficient fingers and toes to plug the vast leaky dikes. In response to predation and treachery, the rest of the world has not only been undergoing reaction, they have also been developing the reaction into organized structures.The main victim has been trust and security, for money, bonds, and bank accounts. All property not nailed down is at deep risk. The current wave of treachery and fraud follows the last wave, where most Americans saw their home equity vanish, many foreclosed and jettisoned from the homestead. The public should harbor no trust, while clinging to suspicion toward the leadership crew that undermined security with its own hands.

The list of acts steeped in treachery is long. The reactions are impressive. When viewed as the mosaic for actions coming to pass, the global response is indeed formidable. The micro events are important in their own right, as each hilltop must be retaken and restored. The macro events are what will en masse change the world, as a Paradigm Shift is underway. The United States and its fascist allies are not in control. They will not find a path to retain or regain control. They have no solutions. The most powerful element of the shift has been the movement of gold wealth from Western locations (New York, London, Switzerland) to Eastern locations (China, Russia, Singapore, Taiwan, Hong Kong). Most residents of the United States, the United Kingdom, and Western Europe are in shock, constantly distracted by the sweeping disruptive events led by a) unstoppable government deficits, b) the powerful crumble of sovereign bonds, c) the ruinous insolvency of the banking systems, d) the relentless reign of tax terror, and e) the tragic decline of the underlying economies. The West is sinking in a sea of fecal soup, stirred with the toxic paper spew, infected by the rot of acidic corrosion, weighed down by absent legitimate solutions, exploited by criminal activity in high offices. The treachery has brought on powerful consequences. The Western lords are being deposed. They can appeal for squire posts to the East, or else they can wreck the globe. The biggest question is whether new trade devices will win out over the chosen Western fascist predilection toward wider war, release of more virulent viruses, more obvious slavery pens, and louder propaganda.

MEGA-ACTION & MEGA-CONSEQUENCE

Break the Gold Standard of Bretton Woods Accord: The action has wrecked the entire global financial system, the destruction a slow burn. The banking leaders are caught in a monetary vise where monetary policy is stuck with ZIRP (0% forever) and QE to Infinity (endless bond monetization purchases). A constant wrecking ball has been applied to the capital structures. Deep damage has come to the financial markets from lost trust, vanished integrity, and no semblance of proper value. The world reacts by searching for a USDollar alternative, since the removal of the Gold Standard has crippled the world and permitted widespread fraud. The new standard will usher in the new Gold Trade Standard. Many are its forces. Many are its motives. Many are its devices. A picture says 1000 words. Observe the Concentric Rings of Death, the great implosion of the USDollar and fiat currency. The rebirth of the Gold Standard will be based in trade settlement, not the banking and currency systems. A grand sidestep is being undertaken under heavy risk. The West controls the banks and FOREX mart. The East has been controlling trade, the emerging economies who finally stand up to demand a voice, even a hand in architecture. They are learning new ways, building new roads, forging new paths.

ACTION & CONSEQUENCE

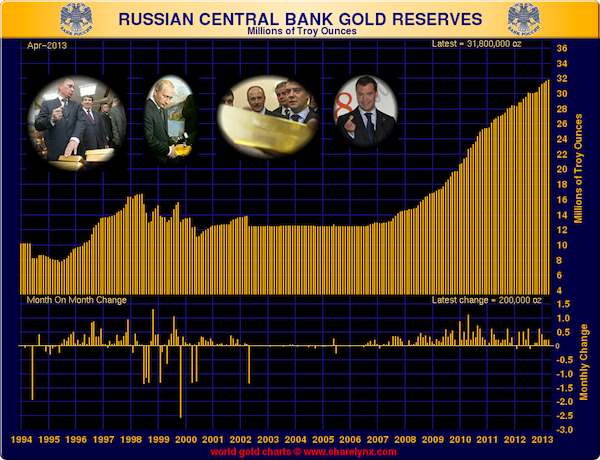

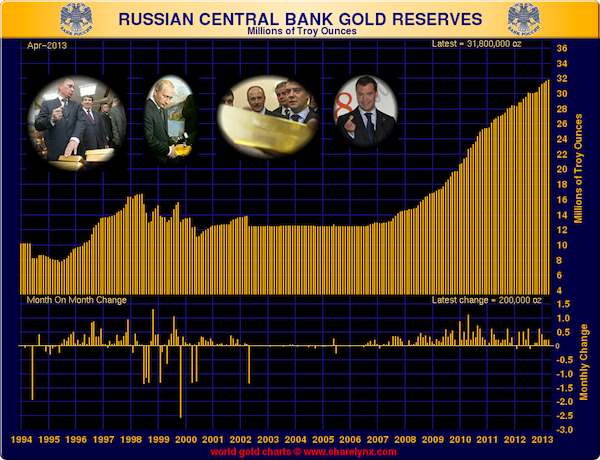

Quantitative Easing which is bond monetization: The action has unleashed hyper monetary inflation, known better as hyper monetary inflation by another less euphemistic name. The action constitutes a systematic undermine of assets held in reserve by angry foreign governments in the macro sense. The action debases the USDollar currency, in effect all currencies since they defend by competitive devaluations. Central banks around the world must debase their currencies, or else face economic hardship from lost export trade. The reserves held by governments, including sovereign wealth funds managed by government ministries, all lose value from the inflation effect by the USFed actions in debasement. The consequence is immediate. Eastern nations make decisions to diversify out of the USTBonds, the main US$-based vehicle. They have stepped up their accumulation of Gold bullion in reserves and wealth funds. They seek to discharge the USTBonds, and return them to sender. The owners of PIIGS sovereign debt can simply issue a sell order. But foreign nations must send USTBond back to their criminal underwriters and destructive central bank overlords. They must deploy more elaborate plans, like the Russians & Chinese building the Eurasian Trade Zone, who finance its infrastructure with USTBonds, sending the toxic bonds to London for digestion, then burial.

QE bond monetization which is pure inflation: The action is hyper monetary inflation, which works efficiently to cause rising prices in the broad micro sense. The design is to raise asset prices in a beneficial way by naive desperate hack architects. The reality is that the capital structures face severe threats. The deeply felt effects have been engrained in rising cost structure, shrinking profit margins, widespread job cuts, and powerful recession pressures within local economies. The stupidity is compounded by austerity measures, which would have had a positive effect 20 years ago, or even 10 years ago. Now they are a death spiral assurance. The consequence is simple survival. The world reacts by searching for and developing a USDollar alternative, a new standard upon which to build viable strong enduring systems with the requisite price stability. The Eastern nations work toward a new trade settlement system which will no longer see USTBonds paper chit exchanged for real goods, either bulk commodity and finished products.

Western central banks talk in empty terms about an Exit Strategy: The action is constant 0% in place (ZIRP forever) and endless bond monetization in redemption (QE to Infinity). No lessons have been learned by the Japanese monetary corner suffered for 22 years. In summer 2009, the Jackass called the Bernanke Fed a liar, after the pervasive deceptive talk of an exit strategy. They have none, proved each year. The consequence is that Eastern nations band together for a bonafide real Exit Strategy, as the vast array of nations, many led by the emerging economies giants, will depart the USDollar since the American toxic merchants and fraud kings cannot. The banking and FOREX standard out of the West has been the USDollar, steeped in longstanding hegemony. The trade settlement standard out of the East will be Gold, steeped in rebellion. The two fronts will clash for a monetary nuclear war.

Iran sanctions within the banking system: The story is such poppycock of Iran developing nuclear weapons. They have no weaponized plutonium. They have no missile delivery systems. What they did that was so objectionable was to sell energy products (crude oil & natural gas) outside the USDollar system. Such actions are considered usage of financial devices of mass destruction. The Saddam Hussein regime in Iraq committed the same banker sin. The sanctions are coupled by pressures against the UAE trade artery toward Iran, and pressures against the Turkish gold market working as intermediary to keep the Iranian supply chain filled. The usage of bank SWIFT code bans and lost credentials for Western banks that cooperate with Iran have backfired in a grand way. The resulting reaction inconsequence is astonishing. The Iran sanctions have done more to galvanize the entire Eastern nations into workaround devices and elaborate platforms which are coalescing into promising emerging global systems. The Eastern reaction has brought about a global initiative to develop a workable USDollar alternative, but centered in trade. The Gold Trade settlement is the center piece. Its device platforms include the BRICS Development Fund. Its proving ground is the Eurasian Trade Zone.

LIBOR price fixing revealed, bank derivative fraud made public: The action has permitted the world to observe how the foundation of the entire Western banking system is a deep fraud. Worse, the world is able to observe how no prosecution, no justice, and no remedy will be pursued for banker crimes. The LIBOR and derivative frauds are the next to final exposure to happen. The effect is a stench, a vast distrust across the entire banking system and bank derivative product pricing. The big bank profits are all an illusion based on lies and price rigging. The reaction in consequence is a pervasive perception of a corrupt system in need of replacement, and a willingness to work toward legal avenues. The reaction will be distrust of all asset prices and profound confusion. The reaction will be a vast writedown of wealth in bank failures and financial firm failures.

Allocated Gold Account theft and malicious usage: In order to make bilateral trade account settlement easier, the New York and London banking centers encouraged settlement to be done on a net basis. They went further, to encourage holding Gold bullion in trust at the New York Fed and at the Bank of England, held on account as special untouchable elite accounts serving as treasury emissary substitutes. They were touched. They were stolen. They were replaced with Gold Certificates of dubious value, without permission. The reaction in consequence has begun as a strong wind, but now a powerful storm. The reaction has been defiance in stated demands for repatriation of Gold Accounts, a return to home locations. Germany is the leader in the movement, a respected nation with deep wealth, sturdy prestige, and a no-nonsense attitude. The extension of the consequence is that a gaggle of private Allocated Gold Accounts are under scrutiny. They were also touched, stolen, replaced with worthless paper certificates. The gathering storm is building force and power. It is the final bank fraud to reveal how over 40,000 metric tons of gold have been stolen, in need of replacement in the open market. The true Gold price will reflect the acute supply shortage. A $7000/oz Gold price might not bring the Demand versus Supply imbalance into proper equilibrium. The price might have to be higher, to offset the gargantuan growth of money supply. The missing gold from supposedly guarded sacred accounts exceeds the central bank holdings in reserve on a global basis.

Phony USGovt citation of gold reserves in form of Deep Storage Gold: The USGovt takes the public for fools in a global sweeping sense. After leasing and selling all 8500 metric tons from Fort Knox, the Clinton Admin began to put phony entries on the official statements. The arrival of Deep Storage Gold should evoke laughter, even deep guffaws. They are nothing but mountain ore deposits, with a hope of becoming gold bullion some day. If truth be known, the grand misfortunes experienced at Barrick Gold, with shutdown of their Pascua Lama mine on the Argentine Andes, will interrupt the process of bringing the deep storage gold to the COMEX. Also, whatever portion of the Kennecott Utah mine output was due to see the COMEX vaults, it will not arrive anytime soon either. The landslide will curtail delivery for at least a year. The reaction in consequence by Eastern nations is to build gold reserves. They realize the United States, the Canadians, and the British are liars on almost all matters of gold accounting in reserves. The USDollar, the Canadian Dollar, and the British Pound have no collateral. Neither does the Euro currency. The Eastern nations will accumulate much faster than they claim. The Chinese and Russians have an order of magnitude more Gold bullion held in reserves than they admit. They feel no urge to share the truthful proper count.

Big US bank gold & silver naked short positions: The practice of naked shorting (sales with no intention of ever delivering the metal bars on the loading ramps) is plain illegal and corrupt beyond description. Imagine selling Mercedes Benz cars to push the price down, never to deliver the cars. The incredible sham takes place every day in the COMEX market, supported by the LBMA in London. The so-called paper gold price has no bearing or connection anymore to the physical Gold price. The consequence has been a profound shortage of gold bullion, gold bars, gold coins, and gold talents, even gold jewelry. The Eastern nations have responded by building gold reserves in much greater volume, sensing massive shortage of precisely what would stabilize the monetary system, namely Gold. The global market for various gold products has responded by imposing a premium on the official gold price, since it has become a forced cocktail of meaningless rubbish with a slimy foam head. The other more heart felt consequence is the return removal of Eligible gold in COMEX within the JPMorguen vaults. They have fallen by a reported 65% in just two days of vacated metal. The JPMorguen crew have handled a reported 99% of all gold delivery requests in the last three months time. A bank run is occurring, not in the commercial banks, but in the JPMorgen vaults where Chased out are the gold bars.

Wide distribution of tungsten fake gold bars in the 1990 decade: The action was largely directed at Hong Kong, the port for China. The volume according to my sources is beyond a thousand fake gold bars sent to Hong Kong banks during the Clinton-Rubin era. The reaction is an unspeakable anger and resentment. The remedy pursued in order to keep the lid on the scandal appears to be a secretive drain of US gold sent East by refiners (not central bank). Doing so enables it to be classified as Industrial Gold Supplies in the official trade data. The big red thumb in the data is the arrival of an outlier of exports to Hong Kong that did not exist last year. The more profound consequence is the intense scrutiny over Allocated Gold Accounts and their demanded repatriation. The bars are being assayed, verified, even recast. The distrust of the vile New York and London bankers has reached high pitch on the global stage.

Slug US coins in usage since 1965, making official coins mere plated tokens: The action has revealed the shell game deployed by government officials in their management of money. In ancient times, money was metal held in hand. The sophisticated criminal bankers have been unable to conceal the duplicity in money beyond coins as bonded securities became the standard. In past Roman times, the practice was called sovereignty, whereby the leaders would skim small amounts of gold from coins for personal accounts and family wealth tucked away. The American trend setters have gone far beyond what ancient Romans did. They have removed over 90% of the precious metal in circulated coins. They went the rest of the way to 100% by making paper the recognized legal tender, with zero gold backing to the USDollar. By breaking the Gold Standard in 1971, the USDollar has no gold in support. The coins are a mere side show. The consequence is an exercise in Gresham Law. Good forms of money are removed from circulation, removed from the risk that others might recognize their higher value than the worthless slugs circulating among hands. The coin market has seen fit to call the pre-1965 silver coins a strange name, Junk Silver. Their value is multiples greater than face value, a great embarrassment and signal flare of corruption.

Raids against the GLD & SLV exchange traded funds: The entire design of these sham deceptive ETFunds is brilliant. The Wall Street and London City designers deserve credit for building a Trojan Horse that has been ridden for almost ten years by absolute morons and lazy dolts, the greatest dupes ever to walk within the gold community gates. The dupes include meatheads like Adam Hamilton and other supposed wise men. The consequence in this case is not a retaliatory deed, but rather a drainage of the inventory at a rapid rate. Officially known as the SPDR Gold Trust, the GLD gold inventory is enjoying a half-life of destruction. Spare the engineering details. Note that on or about April 22nd, a whopping 18.3 tons were removed. An acceleration is plainly evident over the last few months. The first 50 tons took 75 days to depart the vaults. The next 100 tons took 48 days to be loaded off and depart. The next 100 tons took a mere 13 days to vanish. The most recent 100 tons took under 7 days, as the acceleration continues apace. At the current rate of departure, the SPDR Gold Trust will be vacant in around two months time. The refill replenishment will be required by the Swiss castles and Roman catacombs, but not the Tower of London (since nearly bone dry). Forget the embarrassing negative premium inherent to the ETFund over the last three years. Zero inventory is far more an embarrassment. The big questions are whether the indescribably stupid investors will notice, and whether lawsuits will hit the scene to bite hard.

Bail-in solution for bank failure, Cyprus style: The action is devious and destructive, whereby banks will talk of recapitalizing within elaborate restructure events. However, when the dust clears, the evidence is plain that the change to be seen will be dead banks in dissolution with private bank accounts vacated. In other words, razed leveled banks with no functioning operating offices, and bank accounts showing zero balances. The consequence is ugly and powerful, lost client trust in the banking institutions. Faith is a key ingredient to stable systems. The US account holders will be treated with stock shares in conversion for the dead banks, whose value will converge quickly to zero. Same effect, lost accounts. Expect soon the result to be a climax with bank runs. The bank runs will coincide with bullion bank runs, the fast removal of gold held in inventory vaults at the bullion banks, including JPMorguen and the GLD exchange traded fund.

Phony big US bank accounting with FASB blessing: In April 2009 a seminal event occurred, whereby the big financial institutions were given permission legally to declare any value they wish for their assets held on balance sheets. What an incredible travesty, like giving children the authority to grade their own school exams. Or like giving Al Capone the authority to approve his own tax returns. Naturally, almost all the big US banks pass the Street Tests, those shams to put a second layer of phony legitimacy on balance sheet wreckage. The consequence is multi-sided. The big US banks have grown dependent upon the USTBond carry trade for rebuilding their balance sheets. They borrow for free and invest in 10-year or 30-year USTreasurys. They tend to have no profitable business segments, not from commercial lending, not from investment bank functions like bond and stock issuance, not from credit cards. The banks have in the process lost their commercial credit function within the USEconomy. They have become casinos for carry trade, derivatives, even money laundering.

Most Favored Nation status granted to China, with a Golden twist: The pact was secret but its ugly features finally became known. The Wall Street bankers shepherded a curious pact in 1999, whereby China would lease to the syndicate bankers a sizeable portion of the Mao Tse-Tung era gold. China would benefit from a wave of foreign direct investment starting in 2002, to build a critical mass of factories, enough to industrialize the nation. With trade profits, they would recycle the surpluses into USTreasury Bonds, just like the Saudis agreed to do, beginning in the 1970 decade. The Wall Street bankers were thus able to continue their gold leasing game. They had gutted Fort Knox and its ample tonnage. They continued with the Chinese gold, leasing it to support the price suppression. The Wall Street Boyz did not honor the pact, did not return the Chinese gold in 2007, thus the trade war heated up fiercely. The consequence has been a multi-lateral trade war, culminating in a deadly conflict that has the Beijing leaders motivated to kill the USDollar as global reserve currency on numerous grounds. It is not worthy, the object of monetary inflation decided upon unilaterally by the USFed central bank. It is the common denominator of wrecked banking systems. It is the credit card for consumption, even foreign aggressive wars. It compensates for what the United States lacks in industry. The ultimate consequence will be the United States losing its privileged global reserve currency USDollar, suffering imported price inflation, contending with supply shortages, and entering chaos. The Third World will be the death sentence, complete with a vast police state and utter brutality.

Most Favored Nation status granted to China, with a Golden twist: The pact was secret but its ugly features finally became known. The Wall Street bankers shepherded a curious pact in 1999, whereby China would lease to the syndicate bankers a sizeable portion of the Mao Tse-Tung era gold. China would benefit from a wave of foreign direct investment starting in 2002, to build a critical mass of factories, enough to industrialize the nation. With trade profits, they would recycle the surpluses into USTreasury Bonds, just like the Saudis agreed to do, beginning in the 1970 decade. The Wall Street bankers were thus able to continue their gold leasing game. They had gutted Fort Knox and its ample tonnage. They continued with the Chinese gold, leasing it to support the price suppression. The Wall Street Boyz did not honor the pact, did not return the Chinese gold in 2007, thus the trade war heated up fiercely. The consequence has been a multi-lateral trade war, culminating in a deadly conflict that has the Beijing leaders motivated to kill the USDollar as global reserve currency on numerous grounds. It is not worthy, the object of monetary inflation decided upon unilaterally by the USFed central bank. It is the common denominator of wrecked banking systems. It is the credit card for consumption, even foreign aggressive wars. It compensates for what the United States lacks in industry. The ultimate consequence will be the United States losing its privileged global reserve currency USDollar, suffering imported price inflation, contending with supply shortages, and entering chaos. The Third World will be the death sentence, complete with a vast police state and utter brutality.

Reliance upon asset bubbles in USEconomy, dependence upon housing bubble: The decision to dispatch the bulk of US industry to China from 2001 to 2004 was a critical turning point in the USEconomy. It convinced the Jackass immediately of political and corporate sabotage of the nation. To forfeit industry and the legitimate income was to put the nation at systemic risk. Any dependence upon the housing and mortgage gigantic asset bubbles for the USEconomy consumption spending was a perilous step to lock in. At the time, the Jackass expectation was for the twin bubbles to bust around 2006 or 2007, sending the nation into an uncontrollable tailspin. The actual years were 2007 with the subprime mortgage bust and 2008 for the Lehman bust. The Wall Street mavens attempted to sell the clean industry plan of financial engineering within an advanced system and sophisticated economy. They failed, as did the phony offset risk structures. The consequence is the nation approaching systemic failure amidst unstoppable central bank hyper monetary inflation, with the Weimar nameplate on the overheated printing press. The consequence is the collapse of Europe in tandem, and a revolt among Eastern nations which seek a USDollar alternative for both trade settlement and banking reserves management.

The TARP Fund following the Lehman/ Fannie Mae/ AIG bust: A major turning point for the public to wise up to Wall Street criminality was the $700 billion TARP Fund designed for the big US bank system rescue. The USCongress and the public were told that $700 billion was urgently needed to keep the lending channels flush with cash, so as to avoid a systemic seizure in the entire credit system. The arrogant megalomaniac vile bankers instead funded preferred stock for the big US banks, and made sure executive bonuses were funded as well. The largest US banks quickly became giant hollow reeds without hope of remedy. The bankers in firm control of the USGovt realized that directing funds to the credit lending pipelines would not have avoided insolvency and ruin. So they filled their pockets. The consequence was the lost trust by the public of big US banks, which slowly they realize are crime syndicates immune from law. The Too Big To Fail banks are widely regarded as now Too Big To Jail, a big shift in perceptions. The popular movements began, alongside the scattered lawsuits.

Abuse of Petro-Dollar arrangement with accomplice OPEC Saudi leader: Claiming that the USTBond was our debt but your problem, stated to foreigners, was arrogant and callous. It invited a response. The many energy importing nations have been forced to pay for crude oil with USDollars for over four decades. They resent the stricture, since it means they must arrange for USTBonds to serve as the reserve foundation within their banking systems. Numerous fronts have been engaged with non-USDollar alternatives in response. However, Russia has a unique strategy as consequence, sure to weaken the OPEC cartel and possibly to force its crumbled path. The Russian energy giant Gazprom is working avidly to create a NatGas Cartel. Several large natural gas producers are already onboard, like Iran and Qatar. Their devices are pipelines and liquefied natural gas terminals. The zinger in the NatGas new coalition is Qatar, already a key OPEC crude oil player. The coffin nail in the new coalition could be Israel, whose Tamar floating natgas rig in the Mediterranean has promised to send surplus output through the Gazprom system to European customers. Add Cyprus to the Med mix, and Gazprom has captured Europe with its new cartel.

Criminal banking activity, with collusion and protected by USGovt ministries and agencies: Since the 1990 decade, the criminality has become deeply rooted. The gutting of Fort Knox by the Clinton-Rubin Admin was the main seminal event. It climaxed in the 911 false flag event that still confuses half the nation of sleepy dopey types. The 2000 decade featured the mortgage finance bubbles, laced with massive fraud. Its primary clearing house was Fannie Mae, which proved useful for several other fraud rings run by the USGovt, thus requiring its formal adoption and certainly not liquidation with prying eyes. Fannie Mae is the multi-$trillion fraud store that is linked to most every scummy seamy slimy game run by the USGovt. The consequence of the permitted and impervious banking sector criminality can be seen from the inside and from the outside. The domestic front saw the rise of Occupy Wall Street, which federal police and local police conspired to label as terrorist. The movement has been disbanded easily. The more powerful threat might be the secession movement combined with states pursuing gold for usage as legal tender, even applied for debt satisfaction. Those are critical points cited in the Constitution when defining MONEY. The US States have begun to exercise their independence via the Tenth Amendment with secession movements. The foreign response is more toward isolation of the United States, both for its governing bodies and its currency, which means the USTreasury Bond flagship will lose its reserve status. Numerous reports hit my desk of foreign corporations and even government ministries not returning phone calls in a grand global shun of US offices. They object to the arrogance and practiced hegemony on financial matters in a queer global kingdom manifestation. The USGovt acts like a global emperor, and foreign nations resent it. The recent FACTA test is worth watching for reaction. Generally the East ignores it, while the West dislikes it. Switzerland will not deal with US citizens in banks any longer, a cheaper alternative. The isolation has parallels in seeking non-USDollar alternatives.

The confusion of money, ordained debt backed money used as legal tender: The floating currency system used by the United States and the West has a pernicious undercurrent, whereby by default the Western currencies are deemed essentially as denominated debt coupons, designated for usage as money for managing transactions and settling debts public and private. The West thereby has confused money with legal tender for several decades. The Western money is not money, but rather denominated debt. The foundation of the monetary system is sovereign debt, in deed, in reality. Not 1% of the American public comprehends this subtle but highly important point. The super abundance of debt has reached crisis levels, and has been in writedown phase for over four years, since the Lehman Brother signal flare event. The phony debt based money has persisted. For decades the wealth accumulation process has been laced with the cancer of phony money. As the debt correction occurs in accelerated speed, the sovereign debt of the West undergoes deep losses. In the process, the nasty consequence is that entire national wealth vanishes as part of a debt writedown. It can be seen in the planned failures of systemically important financial institutions (SIFI), as the Bail-In features wipe out private accounts. The private accounts for savings, stock accounts, futures accounts, even pensions, are merely badly defined debt markers within the vast cockeyed skewed misaligned perverted system. Much of the US private wealth will vanish in the debt writedown and financial firm failures, one decade after phony home equity wealth vanished in a similar manner.

Ambush of the gold market in mid-April, reported as a massive selloff: The gold market selloff was as shocking an event as it was pathetic. It was as destructive an event as it was hilarious to observe. The bankers committed suicide on the global stage. Rather than permit a London and New York gold market default, they committed a grand illegal act by selling $20 billion in gold through paper certificates in two days. The grand sale was executed without benefit of any metal changing hands, without promise of any metal changing hands, with full protection by the USGovt for its criminal actions. The ambush attack did not net more than a handful of gold bars from margin calls, themselves mere paper entries. The consequence is vast and has brought huge changes to the entire monetary stage. A tremendous increase has been seen in gold demand, from Turkey to India to Mexico to the United States to Japan to China to Thailand to Singapore. The corrupt bankers avoided a default, but they assured a more unavoidable future default by lighting a fire of global gold demand, on the physical side with bars, coins, and jewelry. Gold contract defaults will spring up everywhere, lately even for the Chairman of the CME Group on his own contracts held. They exposed the paper gold sham based upon gold futures contracts. The most powerful consequence is that the banker syndicate has revealed the absent link between price discovery and gold delivery. They have therefore ruined the essence of the COMEX & LBMA gold market, rendering it a perverse playground for criminals. It has no gold in inventory sufficient to handle the delivery demands. The COMEX will soon be totally ignored, its price considered a meaningless sideshow that only lacks criminal prosecution.

QUICK CONCLUSION

Miscellaneous other deep dark deceptions have occurred, far too numerous to delineate in complete fashion. A general effect must be cited, since so pervasive and insidious. Gold and USTBonds aint a market. Their so-called official trading arenas are empty rooms with USGovt and USFed devices filling the empty space, creating a phony price.The false Gold price has no real supply. The false Bond price has no real demand. The claimed price is not where Supply meets Demand to clear the table on the market. Therefore the claimed price is not the real price. Neither Gold more the USTBonds are a real market. Witness pure heresy.

and......

http://www.caseyresearch.com/gsd/edition/addison-wiggin-cooking-the-gold-books

¤ YESTERDAY IN GOLD & SILVER

NOTE: With the U.S. markets closed on Monday, I probably won`t have a column on Tuesday...unless the precious metal markets blow sky-high during Far East and London trading in the interim.

Friday turned out to be a 'nothing' sort of day in all markets on Planet Earth...and both tiny rallies in gold got sold off the moment that they hinted that they might encroach on the $1,400 spot price mark. Gold close at $1,386.30 spot...down $5.20 on the day. Net volume was only 94,000 contracts, which was very light.

It was pretty much the same story in silver...and the metal finished the Friday session at $22.24...down 24 cents from Thursday's close. With gross volume only 31,000 contracts, I wouldn't read much into the price action.

The dollar index closed at 83.75 on Thursday...and after a tiny rally attempt that didn't make it over the 84.00 mark in Far East trading, it chopped lower into the New York close...finishing on Friday at 83.64...down 11 basis points. Nothing to see here.

The CME's Daily Delivery Report showed that and amazing 1,000 gold contracts were posted for delivery on Tuesday. JPMorgan Chase [out of its client account] was the only short/issuer...and the only two stoppers were Barclays with 749 contracts...and Canada's Bank of Nova Scotia with 251 contracts. I'd guess that only one trade was involved in this delivery. In silver there was only 1 contract issued...and that was it. The link to yesterday's Issuers and Stoppers Report is here.

There was another withdrawal from GLD yesterday. This time it was 77,344 troy ounces...and there were no reported changes in SLV.

There was no sales report from the U.S. Mint once again.

Over at the Comex-approved depositories on Thursday, they reported receiving 1,551,187 troy ounces of silver...and shipped 163,800 troy ounces out the door. The link to that activity ishere.

In gold these depositories reported receiving 96,146 troy ounces...and shipped out 64 troy ounces...two kilobars. Here`s the link to that activity

The Commitment of Traders Report was not what I was expecting/hoping...and I don't know what to make of the numbers. The Commercial net short position in silver only declined by about 6.5 million ounces...and is now down to 59.63 million ounces. Reader EWF told me that "The silver commercials hold their lowest net short position since September 10, 2001...and Ted Butler's silver raptors hold their largest net long position in the history of the data." I must admit that I was expecting more, but maybe when we're this close to the bottom of the barrel, there aren't that many longs left to liquidate...and very few tech funds are prepared to go short at these prices. Besides which, the precious metals markets are very illiquid...and it doesn't take too many contracts to move prices at these levels.

There was virtually no change in the Commercial net short position in gold, despite the price decline during the reporting week. Reader EWF commented that..."The gold commercials hold their lowest net short position since November 18, 2008.``

I know that Ted was expecting quite a bit more than this...as was I. Is it possible that the bullion banks didn't report everything in a timely manner? Certainly. But at these bottom-of-the-barrel readings we're at in the COT Reports, it's difficult to tell. Maybe next week report will clarify the situation...unless of course we have a major 'price event' between now and then.

Except for some minor declines in platinum and palladium, nothing much has changed in the concentration data...and Nick Laird's "Days to Cover Short Positions" chart looks almost the same as did a week ago...and here it is.

Except for some minor declines in platinum and palladium, nothing much has changed in the concentration data...and Nick Laird's "Days to Cover Short Positions" chart looks almost the same as did a week ago...and here it is.

(Click on image to enlarge)

But despite my disappointment at the numbers, we're still loaded for a moon shot in all four precious metals...especially if JPMorgan et al stand aside and let it rip.

and selected news and views......

Doug Noland: Kuroda's Gambit

It’s no surprise that investors/speculators in U.S. equities are determined to stick with the bullish thesis and disregard more global macro issues (it’s worked to this point!). Yet this unfolding Kuroda Gambit drama could prove too significant to ignore. The perception holds that the Fed’s $85bn will ensure ample bull market liquidity for at least the next several months.

The overall bullish take on marketplace liquidity could prove too complacent if things begin to unwind in Tokyo. And by unwind I mean that Japan bond market fragility forces a change of tack by the Kuroda BOJ. A spike in yields could prove highly destabilizing, with a bond and stock market crash not out of the question. Or perhaps the BOJ will work out an agreement with major Japanese institutions to ensure their support for low yields. The BOJ may need institutions to fall in line and stop selling bonds and the yen. Such an understanding might support a stronger yen, with less liquidity seeking higher yields overseas.

It would appear that there are now viable scenarios that are potentially problematic for the leveraged players - and for the Financial Euphoria that erupted around the globe. Perhaps an overdue bout of de-risking and de-leveraging actually commenced this week. At the minimum, the markets were reminded that there is as well a downside to all this central bank dependency and Bubble-inducing liquidity.

Doug's Friday commentary over at the prudentbear.com Internet site is a must read for me every week...and his tome from yesterday is no exception. I thank reader U.D. for sending it.

The overall bullish take on marketplace liquidity could prove too complacent if things begin to unwind in Tokyo. And by unwind I mean that Japan bond market fragility forces a change of tack by the Kuroda BOJ. A spike in yields could prove highly destabilizing, with a bond and stock market crash not out of the question. Or perhaps the BOJ will work out an agreement with major Japanese institutions to ensure their support for low yields. The BOJ may need institutions to fall in line and stop selling bonds and the yen. Such an understanding might support a stronger yen, with less liquidity seeking higher yields overseas.

It would appear that there are now viable scenarios that are potentially problematic for the leveraged players - and for the Financial Euphoria that erupted around the globe. Perhaps an overdue bout of de-risking and de-leveraging actually commenced this week. At the minimum, the markets were reminded that there is as well a downside to all this central bank dependency and Bubble-inducing liquidity.

Doug's Friday commentary over at the prudentbear.com Internet site is a must read for me every week...and his tome from yesterday is no exception. I thank reader U.D. for sending it.

London firms switching from Tories to UKIP, says Nigel Farage

City firms – most notably the hedge fund, insurance and commodities sectors – are sick of the “unending blizzard” of regulation coming out of Brussels, says Mr Farage, who claims traditional City Conservative supporters are switching allegiance to UKIP.

“Slowly but surely, donors who would have traditionally supported the Tories are now holding talks with us,” Mr Farage told The Daily Telegraph. “We are asking [City leaders] to help in any way we can.”

The most recent business convert to UKIP is Andy Brough, the star fund manager at Schroders, who is understood to have joined Mr Farage’s party after growing weary with the coalition Government and European attacks on the City.

Mr Farage also has the support of the influential hedge fund manager Crispin Odey, whose former father-in-law is News Corp chairman Rupert Murdoch.

No surprises here, as Nigel's is such a straight shooter, that the public is begining to understand that he'll be true to his word. This article was posted on the telegraph.co.uk Internet site yesterday afternoon BST...and I thank Roy Stephens for his second offering in today's column.

Lagarde Avoids Charges in Sarkozy-Ally Case as IMF Support Holds

International Monetary Fund Managing Director Christine Lagarde averted being charged by a Paris court investigating her decision to allow arbitration that benefited a supporter of former President Nicolas Sarkozy.

After two days of questioning, the court named Lagarde -- who was French finance minister under Sarkozy -- a material witness in the case. The status, while not precluding charges later, shouldn’t hurt her ability to stay at the IMF helm, said Jacob Kirkegaard, a senior fellow at the Peterson Institute for International Economics in Washington.

This news item was posted on the Bloomberg website yesterday afternoon MDT...and I thank U.A.E. reader Laurent-Patrick Gally for sharing it with us.

Special Report: The deeper agenda behind "Abenomics"

When ill health and political gridlock forced Shinzo Abe to quit after one dismal year as Japan's prime minister, his pride was dented and his self-confidence battered.

One thing, however, was intact: his commitment to a controversial conservative agenda centered on rewriting Japan's constitution. Conservatives see the 1947 pacifist charter, never once altered, as embodying a liberal social order imposed by the U.S. Occupation after Japan's defeat in World War Two.

"What worries me most now is that because of my resigning, the conservative ideals that the Abe administration raised will fade," Abe wrote in the magazine Bungei Shunju after abruptly quitting in September 2007. "From now on, I want to sacrifice myself as one lawmaker to make true conservatism take root in Japan."

Less than six years after his humiliating departure, Abe, 58, is back in office for a rare second term. He is riding a wave of popularity spurred mainly by voters' hopes that his prescription for fixing the economy will end two decades of stagnation. The policy, known as "Abenomics", is a mix of monetary easing, stimulative spending and growth-inducing steps including deregulation in sectors such as energy.

This longish Reuters report was filed from Tokyo...and posted on their Internet site just before midnight on Thursday EDT. It's a must read...and it's particularly a must read for all students of the New Great Game. I thank Elliot Simon for bringing this most excellent essay to my attention...and now to yours.

Three King World News Blogs

1. James Grant [#1]: "Monetary System Won't Last...and Gold Bullish". 2.Egon von Greyerz: "Suppliers and Bank Clients Denied Gold as Shortage Intensifies". 3. James Grant [#2]: "Here is What Jim Really Thinks".

Russia: The sleeping giant of gold producing countries

“The more gold a country has, the more sovereignty it will have if there’s a cataclysm with the dollar, the euro, the pound or any other reserve currency.” — Evgeny Fedorov, Russian lawmaker, United Russia Party

Among the countries that still make their gold production available to world markets, four of the top seven are in long-term decline — the United States, South Africa, Australia and Canada, some would say precipitously. Three enjoy rising production — China, Russia and Peru. Among the declining states, South Africa suffered the worst cutbacks, down 52% from production in 2000. U.S. production is down 39% over the same period; Canada is down 38% and Australia, 24%.

Russia’s gold production is an important piece of the overall supply puzzle in terms of both production and reserves. Few people know (or remember) that in 1980, Russia was the second largest global gold producer at 21% of the total global output (258 metric tonnes) South Africa was number one at 55% of the total global output (675 metric tonnes). With respect to future gold production, Russia is a sleeping giant that could leap-frog the United States and Australia soon.

This worthwhile read was posted on the usagold.com Internet site yesterday.

Ted Butler: Busting the Perfect Crime

A subscriber recently commented that the Oligarchs who rule Russia only wish they got to run things as efficiently as how JPMorgan and the big banks control our financial markets, particularly in the trading of precious metals. Based upon the last few days, it’s hard to argue with that. On Sunday evening shortly after 6 PM, the price of silver was taken down 10% within a few minutes on an insignificant number of contracts (1,600), evoking memories of the infamous 13% ($6) decline on the May 1 Sunday evening of 2011. If the Russian criminals oversaw silver trading and not the CME Group and the CFTC they could not possibly have rigged prices more corruptly.

What makes the silver (and gold) manipulation the perfect crime are a number of elements; short term price control through High Frequency Trading, compliant regulators and the fact that most victims don’t even realize they are being had, as the sellers are mostly just reacting to the deliberately-set lower prices. It’s hard to end an ongoing crime in progress when so many don’t realize it is in progress. Worse, there are still some who profess that there is no manipulation underway. And for the few who do realize what’s really going on, what can you do about it when the regulators are in bed with the manipulators? Perhaps the options are limited, but that’s not the same as non-existent.

This commentary by Ted falls into the absolute must read category...and it was posted on the silverseek.com Internet site yesterday...and I thank Elliot Simon for pointing it out...and for his last contribution to today's column.

Addison Wiggin: Cooking the Gold Books

We got a small, if bitter, taste of gold’s “Zero Hour” in the second half of April.

Either that, or the world’s largest banks engineered a take down of gold for the purpose of staving off Zero Hour… for now.

As you’ll recall from these pages in March, “Zero Hour” is the name we give to the moment when the price of real, physical gold in your hand starts to break away from the quoted price on the commodities exchanges.

This commentary by Addison was posted on The Daily Reckoning website yesterday...and is well worth reading. I thank Roy Stephens for today's last story...and his final offering in today's column.

¤ THE WRAP

The issue which has swept down the centuries...and which will have to be fought sooner or later...is the people vs. the banks. - Lord Acton, Historian...1834 - 1902

Today's pop 'blast from the past' popped into my head a couple of days ago...and I just can't get rid of it. I'm hoping that by posting it here, that I hit 'delete' button in my brain as well. I was eight years old when this Johnny Mathis tune came out in 1956...and it's a classic. To give you some idea of its age, it was originally released as a 78 r.p.m. single, as the vinyl 45 r.p.m. record had yet to be invented, as the use of plastic for anything was in its infancy. Turn up your speakers and then click here.

Today`s classical `blast from the past` is a Beethoven piano classic...his Appassionata Sonata No. 23 in F minor, Op. 57...which is the mother of all piano sonatas. This performance is in the very safe (and incomparable) hands of Maurizio (Mario) Pollini. The three videos are posted on the youtube.comInternet site...1st movement...2nd movement...3rd movement. Enjoy.

I wouldn`t read a whole heck of a lot into yesterday`s price action, as all the crooks headed for the Hamptons early for the Memorial Day long weekend. That`s why there was little price action...and even less volume.

Of course I wasn`t happy about the Commitment of Traders Report, so I`ll just have to stew in my own juices until the one comes out on May 31st. But as I mentioned further up, the price action in the interim may negate everything, so I`ll have to wait and see.

Here`s Nick Laird`s ``Total PMs Pool`` chart update with this week`s data...

(Click on image to enlarge)

As you are probably already beginning to suspect, the endless money printing is now starting to suffer some serious blow back, as Japan has now discovered...and it`s only a short segue into the other currencies and bond markets. And as James Grant said in his KWN commentary further up...the world`s financial and monetary system as we know it today, is on it`s last legs...and the warning signs of that were flashing `red alert` this past week.

Let`s just hope that we`re all ready for whatever comes next.

And as I said at the top of this column, unless the gold market blows up on Monday, I won`t have a column on Tuesday because the U.S. markets are closed...and I`ll see you on Wednesday.

http://harveyorgan.blogspot.com/2013/05/gld-lowers-inventory-againcomex.html

Saturday, May 25, 2013

GLD lowers inventory again/Comex registered gold lowers/Europe ready to stop the shadow banking industry/More troubles for Barrick/

Gold closed down $5.20 to $1386.80 (comex closing time). Silver fell by 1 cent to $22.48 (comex closing time)

In the access market at 5:30 pm, gold and silver finished trading at the following prices :

gold: 1386.30

silver: $22.39

Friday is generally a day that the bankers try and subdue to the price of gold and silver and they did not disappoint us with their criminal behaviour. Please remember that options expire Tuesday and first day notice for both the gold and silver contracts will be this coming Friday, the 31st of May.

At the Comex, the open interest in silver rose by 31 contracts to 147,342 contracts with silver's rise in price yesterday by 3 cents. The silver OI is holding firm at elevated levels . The open interest on the gold contract fell by 5,818 contracts to 445,517. The gold deliveries for May rose a bit today to 9.48 tonnes and this is an off month for gold. The number of silver ounces, standing for delivery in May remained constant at 17.210 million oz. ( On first day notice: 14.860 million oz.)

Again, at the Comex, gold is departing as investors are frightened to death of a confiscation similar to what happened at MFGlobal or Refco. Tonight, the Comex registered or dealer gold remains at 1.641 million oz or 51.04 tonnes. The total of all gold at the comex rose slightly but still well below the 8 million oz at 7.993 million oz or 248.6 tonnes of gold.

The GLD reported another loss in gold inventory of 2.41 tonnes. The SLV inventory of silver remained constant.

Today we have a great commentary from Bill Holter as he tackles flash trading. You do not want to miss this very important commentary.

In physical commentaries, we have a story on Barrick gold which was fined 16 million dollars..the maximum fine in Chile for environmental issues on its Pascua Lama project. The Argentinian side also state that there are issues with the many glaciers. It looks like this mine will be delayed again going into production.

We have reports on increase demand for Chinese jewellery re gold.

Egon Von Greyerz provided more stories on Swiss allocated gold holders who were refused entry to see their gold.

On the paper side of things:

Japan stabilized Thursday night but not before the yen increased in value sending holders of the Yen carry trade in a tizzy. The high volatility in the Japanese bond yields are causing massive derivative blowups at the Japanese banks. Also remember that the higher yields causes tier 1 asset to deteriorate which forces the banks to call in massive loans. Japan is one big mess!!

In Europe we had problems in Spain where banking officials stated that they now need an additional 10 billion euros. The shares of Bankia plummeted by 51% as they came to realize that there is no sovereign guarantee. Already 133 billion euros have been pumped into the Spanish banks all guaranteed by the sovereign and also remember that none of these loans has been included in sovereign Spain's total debt to GDP figures. They view this as a contingency liability and thus the authorities over there do not include it in official figures.

Over in Italy we are now witnessing a big increase in their non performing loans.

This has caused yields in the 10 yr Italy bonds (as well as Spain) to increase (lower prices). The NPL's of course create additional havoc to our bankers balance sheets.

Friday afternoon, we witnessed a surprise Bloomberg article suggesting that the Europe was ready to abandon the shadow banking industry. The shadow banking industry is huge and if you outlaw this practice, you suck the entire oxygen from the financial world. The world would immediately go into hyper-deflation as the entire world would stop functioning.

Then why would these guys announce this? Something sinister is rearing its ugly head.

We will go over these and other stories but first.....................

Let us now head over to the comex and assess trading over there today.

Here are the details:

The total gold comex open interest fell by 5818 contracts from 451,335 down to 445,517 with gold rising by $15.40 yesterday. I guess some of the paper players are giving up playing in the rigged Comex casino. The front non active delivery month of May saw its OI rise by 11 contracts up to 1067. However we had 25 delivery notice filed on Thursday. Thus we gained 36 gold contracts in May or an additional 3600 oz will stand for the May delivery month. The next active contract month is June and here the OI fell by 12,727 contracts to 147,241 as those who did not give up, rolled into August. June is the second biggest delivery month in gold's calender and first day notice is a week away on Friday the 31st of May .( I erred in my previous commentaries thinking that Memorial day is on Friday, it is this Monday) The estimated volume Friday was fair at 164,465 contracts. The confirmed volume on Thursday was extremely good at 257,252 contracts.

The total silver Comex OI completely plays to a different drummer than gold. It rose by 31 contracts from 147,311 up to 147,342, with silver's slight rise in price of 3 cents yesterday. The front active silver delivery month of May saw it's OI fall by 40 contracts down to 109. We had 40 delivery notices filed on Thursday so we neither gained nor lost any silver ounces standing in the May delivery month. The next delivery month for silver is June and here the OI fell by 23 contracts to stand at 349. The next big active contract month is July and here the OI fell by 1196 contracts to rest tonight at 76,667. The estimated volume on Friday was poor, coming in at 26,768 contracts. The confirmed volume on Thursday was excellent at 50,132.

We had 1 customer deposit today:

Into Scotia: 96,146.868 oz

total customer deposit: 96,146.868 oz

We had 2 customer withdrawal today:

i) Out of Scotia: 32.15 oz

ii) Out of HSBC: 32.15 oz

total customer withdrawals: 64.30 oz

2007 contracts x 100 oz per contract or 200,700 oz (served) + 1042 notices or 104,200 oz (to be served upon) = 304,900 oz or 9.483 tonnes of gold.

We gained an additional 200 oz of gold standing for the May delivery month.

This is extremely high for a non active month.

We now have the official USA production of gold last year and it registered 230 tonnes. Thus approximately 19.16 tonnes of gold is produced by all mines in the USA. Thus the amount standing for gold this month represents 49.5% of that total production.

The big June delivery month will surely be exciting to watch judging by the huge demand for gold in May. We will also see if the boys have any trouble servicing the last 1,042 contracts in the May delivery month We have 3 more trading sessions before first day notice. We will also watch what happens with JPMorgan with respect to its customer gold. It remains now at 9.25 tonnes of gold.

Late Friday night, the CME issued a report showing that 1000 contracts were served upon our longs for Tuesday. JPMorgan was the sole issuer of gold representing 100,000 oz or 3.1 tonnes of gold. (The OI outstanding prior to this notice filing was 1042 contracts. We will now wait until Tuesday to see the total OI standing as of Tuesday night to see if we have any increase in gold ounces standing.)

i) Out of Scotia: 40,823.95 oz

ii) Out of Delaware: 1954.60 oz

iii) Out of Brinks: 121,021.83 oz

total customer withdrawals: 163,800.38 oz

The registered vaults at the GLD will eventually become a crime scene as real physical gold departs for eastern shores leaving behind paper obligations to the remaining shareholders. As you can see, the bleeding of physical gold from this locale continues unabated. There is no doubt in my mind that GLD has nowhere near the gold that say they have and this will eventually lead to the default at the LBMA and then onto the comex in a heartbeat (same banks)

In the access market at 5:30 pm, gold and silver finished trading at the following prices :

gold: 1386.30

silver: $22.39

Friday is generally a day that the bankers try and subdue to the price of gold and silver and they did not disappoint us with their criminal behaviour. Please remember that options expire Tuesday and first day notice for both the gold and silver contracts will be this coming Friday, the 31st of May.

At the Comex, the open interest in silver rose by 31 contracts to 147,342 contracts with silver's rise in price yesterday by 3 cents. The silver OI is holding firm at elevated levels . The open interest on the gold contract fell by 5,818 contracts to 445,517. The gold deliveries for May rose a bit today to 9.48 tonnes and this is an off month for gold. The number of silver ounces, standing for delivery in May remained constant at 17.210 million oz. ( On first day notice: 14.860 million oz.)

Again, at the Comex, gold is departing as investors are frightened to death of a confiscation similar to what happened at MFGlobal or Refco. Tonight, the Comex registered or dealer gold remains at 1.641 million oz or 51.04 tonnes. The total of all gold at the comex rose slightly but still well below the 8 million oz at 7.993 million oz or 248.6 tonnes of gold.

The GLD reported another loss in gold inventory of 2.41 tonnes. The SLV inventory of silver remained constant.

Today we have a great commentary from Bill Holter as he tackles flash trading. You do not want to miss this very important commentary.

In physical commentaries, we have a story on Barrick gold which was fined 16 million dollars..the maximum fine in Chile for environmental issues on its Pascua Lama project. The Argentinian side also state that there are issues with the many glaciers. It looks like this mine will be delayed again going into production.

We have reports on increase demand for Chinese jewellery re gold.

Egon Von Greyerz provided more stories on Swiss allocated gold holders who were refused entry to see their gold.

On the paper side of things:

Japan stabilized Thursday night but not before the yen increased in value sending holders of the Yen carry trade in a tizzy. The high volatility in the Japanese bond yields are causing massive derivative blowups at the Japanese banks. Also remember that the higher yields causes tier 1 asset to deteriorate which forces the banks to call in massive loans. Japan is one big mess!!

In Europe we had problems in Spain where banking officials stated that they now need an additional 10 billion euros. The shares of Bankia plummeted by 51% as they came to realize that there is no sovereign guarantee. Already 133 billion euros have been pumped into the Spanish banks all guaranteed by the sovereign and also remember that none of these loans has been included in sovereign Spain's total debt to GDP figures. They view this as a contingency liability and thus the authorities over there do not include it in official figures.

Over in Italy we are now witnessing a big increase in their non performing loans.

This has caused yields in the 10 yr Italy bonds (as well as Spain) to increase (lower prices). The NPL's of course create additional havoc to our bankers balance sheets.

Friday afternoon, we witnessed a surprise Bloomberg article suggesting that the Europe was ready to abandon the shadow banking industry. The shadow banking industry is huge and if you outlaw this practice, you suck the entire oxygen from the financial world. The world would immediately go into hyper-deflation as the entire world would stop functioning.

Then why would these guys announce this? Something sinister is rearing its ugly head.

We will go over these and other stories but first.....................

Here are the details:

The total gold comex open interest fell by 5818 contracts from 451,335 down to 445,517 with gold rising by $15.40 yesterday. I guess some of the paper players are giving up playing in the rigged Comex casino. The front non active delivery month of May saw its OI rise by 11 contracts up to 1067. However we had 25 delivery notice filed on Thursday. Thus we gained 36 gold contracts in May or an additional 3600 oz will stand for the May delivery month. The next active contract month is June and here the OI fell by 12,727 contracts to 147,241 as those who did not give up, rolled into August. June is the second biggest delivery month in gold's calender and first day notice is a week away on Friday the 31st of May .( I erred in my previous commentaries thinking that Memorial day is on Friday, it is this Monday) The estimated volume Friday was fair at 164,465 contracts. The confirmed volume on Thursday was extremely good at 257,252 contracts.

The total silver Comex OI completely plays to a different drummer than gold. It rose by 31 contracts from 147,311 up to 147,342, with silver's slight rise in price of 3 cents yesterday. The front active silver delivery month of May saw it's OI fall by 40 contracts down to 109. We had 40 delivery notices filed on Thursday so we neither gained nor lost any silver ounces standing in the May delivery month. The next delivery month for silver is June and here the OI fell by 23 contracts to stand at 349. The next big active contract month is July and here the OI fell by 1196 contracts to rest tonight at 76,667. The estimated volume on Friday was poor, coming in at 26,768 contracts. The confirmed volume on Thursday was excellent at 50,132.

Comex gold/May contract month:

May 24/2013

Ounces

| |

Withdrawals from Dealers Inventory in oz

|

nil

|

Withdrawals from Customer Inventory in oz

|

64.3 (Scotia, Brinks)

|

Deposits to the Dealer Inventory in oz

|

nil

|

Deposits to the Customer Inventory, in oz

| 96,146.86 oz (Scotia) |

No of oz served (contracts) today

|

25 (2,500 oz)

|

No of oz to be served (notices)

|

1042 (104,200)

|

Total monthly oz gold served (contracts) so far this month

|

2007 (200,700 oz)

|

Total accumulative withdrawal of gold from the Dealers inventory this month

|

10,656.61

|

Total accumulative withdrawal of gold from the Customer inventory this month

| 732,301.75 oz |

We had fair activity at the gold vaults.

The dealer had 0 deposits and 0 dealer withdrawals.

We had 1 customer deposit today:

Into Scotia: 96,146.868 oz

total customer deposit: 96,146.868 oz

We had 2 customer withdrawal today:

i) Out of Scotia: 32.15 oz

ii) Out of HSBC: 32.15 oz

total customer withdrawals: 64.30 oz

We had 2 adjustments

i) Out of HSBC: 14,143.915 oz was adjusted out of the dealer account and back into the customer account at Brinks.

ii) Out of JPMorgan: 12,963.649 oz was adjusted out of the dealer account and back into the customer account.

The JPMorgan customer vault rises to close the week at 310,390.402 oz or 9.65 tonnes.

i) Out of HSBC: 14,143.915 oz was adjusted out of the dealer account and back into the customer account at Brinks.

ii) Out of JPMorgan: 12,963.649 oz was adjusted out of the dealer account and back into the customer account.

The JPMorgan customer vault rises to close the week at 310,390.402 oz or 9.65 tonnes.

Tonight the dealer inventory reduces again and stands tonight at a low of 1.641 million oz (51.04) tonnes of gold. The total of all gold slightly rises, resting tonight at 7.993 million oz or 248.68 tonnes.

The CME reported that we had 25 notices filed Friday for 2500 oz of gold.

To calculate the quantity of gold ounces that will stand, I take the OI standing for May (1067) and subtract out Friday's notices (25) which leaves us with 1042 notices or 104,200 oz left to be served upon our longs.

To calculate the quantity of gold ounces that will stand, I take the OI standing for May (1067) and subtract out Friday's notices (25) which leaves us with 1042 notices or 104,200 oz left to be served upon our longs.

Thus we have the following gold ounces standing for metal in May:

2007 contracts x 100 oz per contract or 200,700 oz (served) + 1042 notices or 104,200 oz (to be served upon) = 304,900 oz or 9.483 tonnes of gold.

We gained an additional 200 oz of gold standing for the May delivery month.

This is extremely high for a non active month.

We now have the official USA production of gold last year and it registered 230 tonnes. Thus approximately 19.16 tonnes of gold is produced by all mines in the USA. Thus the amount standing for gold this month represents 49.5% of that total production.

The big June delivery month will surely be exciting to watch judging by the huge demand for gold in May. We will also see if the boys have any trouble servicing the last 1,042 contracts in the May delivery month We have 3 more trading sessions before first day notice. We will also watch what happens with JPMorgan with respect to its customer gold. It remains now at 9.25 tonnes of gold.

end

Silver:

May 24.2013: May silver:

| Silver |

Ounces

|

| Withdrawals from Dealers Inventory | nil |

| Withdrawals from Customer Inventory | 163,800.38 oz (Scotia) |

| Deposits to the Dealer Inventory | nil |

| Deposits to the Customer Inventory | 1,551,187.73 (Brinks, Delaware, Scotia) |

| No of oz served (contracts) | 10 (50,000) |

| No of oz to be served (notices) | 99 (495,000 oz) |

| Total monthly oz silver served (contracts) | 3343 (16,715,000 oz) |

| Total accumulative withdrawal of silver from the Dealers inventory this month | 903,273.57 oz |

| Total accumulative withdrawal of silver from the Customer inventory this month | 4,914,163.30 oz |

Today, we had good activity inside the silver vaults.

we had 0 dealer deposits and 0 dealer withdrawals.

We had 3 customer deposits:

i) Into Brinks: 300,413.01 oz

ii) Into Scotia: 618,994.22 oz

iii) Into JPM: 631,780.50