http://www.caseyresearch.com/gsd/edition/india-to-import-around-350-400-tonnes-of-gold-in-q2-asia-demand-to-hit-reco

¤ YESTERDAY IN GOLD & SILVER

Despite the fact that the dollar index took a big dive during late Far East and early London trading on Wednesday, the gold price didn't move much. By the time that gold began to trade in New York yesterday morning, it had tacked about ten bucks onto its closing price from late Tuesday afternoon EDT.

But as soon as the Comex opened, almost the entire gain got wiped out, with the N.Y. low coming at the London p.m. gold fix. After that, the gold price crawled higher until about 1:00 p.m. EDT...and from there it traded mostly sideways into the 5:15 p.m. electronic close.

The low and high price ticks in New York were $1,382.40 and $1,396.40 spot respectively. Once again the gold price wasn't allowed a sniff of the $1,400 price mark.

Gold closed at $1,392.70 spot...up $11.30 spot on the day. Gross volume was around 325,000 contracts, but once all the roll-overs out of the June delivery month were subtracted from that, the net volume dropped to a tiny 10,000 contracts.

The silver price chopped around in a twenty-five cent price range right up until its low tick...which came around 3:00 p.m. Hong Kong time...which was also the start of London trading on their Wednesday. Silver chopped higher until 1:00 p.m. in New York as well...before trading sideways for the remainder of the day.

The Hong Kong low was around $22.10 spot...and the high was posted sometime after 1:00 p.m. in New York. Kitco recorded that as $22.63 spot.

Silver closed at $22.45 spot...up 18 cents from Tuesday. Gross volume was pretty light...around 30,500 contracts.

The dollar index closed on Tuesday in New York at 84.24. Once Far East trading began it rallied a bit, hitting its high of the day [84.36] shortly before 2:00 p.m. Hong Kong time before beginning to slide.

Then at 11:30 a.m. in London, the index dropped about 49 basis points in thirty minutes...hitting its low tick [83.51] shortly after 12:00 o'clock noon BST. From that low, it didn't do much for the rest of the day. The dollar index closed at 83.63...down 61 basis points.

The precious metals got clubbed when the dollar index gained 60 basis points recently...and it's certainly obvious that this phenomenon doesn't work as well when the dollar move is in the other direction.

* * *

The CME's Daily Delivery Report showed that 8 gold and zero silver contracts were posted for delivery on Friday. That should pretty much wrap it up for the May delivery month. We should get First Day Notice figures for delivery into the June gold contract later this evening EDT...and if not, they'll be posted late on Friday evening.

I know you'll find this hard to believe, but an authorized participant actually deposited some gold inGLD yesterday. It was only 29,002 troy ounces, but it was better than the alternative. However, over at SLV, they reported a withdrawal of 965,424 troy ounces.

There was no sales report from the U.S. Mint.

Tuesday was a big day in silver over at the Comex-approved depositories. They reported receiving 51,147 troy ounces...and shipped a rather large 1,865,789 troy ounces off to parts unknown. The link to that activity is here.

Not much happened in gold, as they reported receiving only 1,000 troy ounces...and shipped 14,143 troy ounces of the stuff out the door. The link to that activity is here.

* * *

news and views......

Risk of Bank Failures is Rising in Europe, E.C.B. Warns

The European Central Bank warned on Wednesday that the euro zone’s slumping economy and a surge in problem loans were raising the risk of a renewed banking crisis, even as overall stress in the region’s financial markets had receded.

In a sober assessment of the state of the zone’s financial system, the E.C.B. said that a prolonged recession had made it harder for many borrowers to repay their loans, burdening banks that had still not finished repairing the damage caused by the 2008 financial crisis.

Last year “was not a good year for banks at all,” Vítor Constâncio, the vice president of the E.C.B., said Wednesday.

While the E.C.B., as customary, did not mention specific banks, it said the most vulnerable were those in countries with high unemployment or falling house prices. That list would include Italy, Spain, Greece and Portugal among others. But ailing banks are also a problem in stronger countries like Germany, where Commerzbank and publicly owned Landesbanks, or state banks, are struggling with bad loans to the shipping industry and other problems.

This 2-page essay, filed from Frankfurt, was posted on The New York Timeswebsite yesterday...and it's courtesy of Phil Barlett.

Europe's 'new deal' for jobless dismissed as rhetoric

The Prado in Madrid has become the unlikely symbol of Europe’s unemployment curse. The museum recently advertised for 11 low-level jobs, mostly guarding paintings by Velasquez, El Greco and Picasso from enthusiastic tourists.

The starting salaries were just €13,000 (£11,100) a year yet, to the astonishment of the curators, 18,524 people applied. The print-out list of applicants runs for 357 pages.

This is the “white heat” of a youth jobs crisis that has crept up on EU leaders and now threatens to set off a volcanic political eruption.

Francois Hollande, the French president, warned on Tuesday that failure to offer these people hope risks destroying the EU altogether. “We must act urgently. Six million youths are out of work in Europe,” he said.

This Ambrose Evans-Pritchard article was posted on the telegraph.co.ukInternet site on Tuesday evening...and I thank Roy Stephens for his first offering in today's column.

Bank of France Seeking Yuan Liquidity Agreement for Euro Area

Bank of France Governor Christian Noyer said he’s seeking agreement among euro-area central banks for ways of providing liquidity support in Chinese yuan as countries compete for future business.

“The essential thing is liquidity backstops, either public or private ones,” Noyer said yesterday in a Bloomberg News interview in Paris. “On the public facility, we’re looking at it. We’re talking about how we can have a public backstop with a swap accord in the euro system.”

Paris is competing with London and Zurich to become the center for yuan trading in Europe as China makes its currency more widely used around the world. A swap arrangement would allow central banks to supply yuan to commercial banks whose customers may need that currency. The Bank of England said in February that it planned to sign a deal soon on a three-year currency swap arrangement.

This very short Bloomberg story, filed from Paris, showed up on their website late Tuesday afternoon MDT...and I thank reader 'David in California' for sending it.

Draghi vs. Germany: ECB President Surrounded by Critics

It looked like a showdown: Mario Draghi, the head of the European Central Bank (ECB), versus Jens Weidmann, president of Germany's central bank, the Bundesbank, and Draghi's sharpest critic within the ECB Governing Council.

Representatives of both the ECB and the Bundesbank have been summoned to testify before Germany's Federal Constitutional Court on June 11 and 12, when the court will address German policy on the effort to save the euro. But Draghi won't be there. In his place, German ECB Executive Board member Jörg Asmussen will be traveling to the southwestern city of Karlsruhe, where the court is located. Even though Draghi -- like Weidmann -- would only be asked to testify as an expert witness, he apparently knows that he would be treated like a defendant.

What is ultimately up for debate is Draghi's most spectacular rescue effort for the euro to date: the new ECB program to buy up government bonds, the announcement of which last summer was already enough to bring some calm to the euro crisis.

This very interesting story was posted on the German website spiegel.deearly yesterday afternoon Europe time...and it's Roy Stephens' second offering in today's column.

Three King World News Blogs

The first interview is with John Embry...and it's entitled "Physical Gold and Silver Now in Shocking Short Supply". Next is this blog with Rick Rule...and it's headlined "There is a War Going on Between Paper and Physical Gold". Lastly comes this commentary from the latest Investors Intelligencereport...and it bears the title "Here is a Huge Key to the Markets".

India to import around 350-400 tonnes of gold in Q2; Asia demand to hit record: WGC

Asian gold demand from this April to June will reach a quarterly record as bullion consumers in the region take possession of supply freed up by selling from exchange-traded funds (ETFs), the World Gold Council (WGC) said on Wednesday.

Gold prices fell to their lowest in more than two years at $1,321.35 an ounce in mid-April on signs of economic improvement in main markets and fears that central banks around the world could start to curtail their bullion-friendly policy measures.

The move scared investors in the West, triggering a sharp liquidation of speculative and ETF positions. But lower prices also prompted strong physical demand from price-sensitive countries such as India and China, which together account for more than 50 percent of consumer demand for bullion.

Gold prices fell to their lowest in more than two years at $1,321.35 an ounce in mid-April on signs of economic improvement in main markets and fears that central banks around the world could start to curtail their bullion-friendly policy measures.

The move scared investors in the West, triggering a sharp liquidation of speculative and ETF positions. But lower prices also prompted strong physical demand from price-sensitive countries such as India and China, which together account for more than 50 percent of consumer demand for bullion.

This excellent must read story was posted on the indiatimes.com Internet site early Wednesday afternoon IST...and I thank Nitin Agrawal for being the first person through the door with it.

What's Really Happening with China's Silver Demand?

Analysts at Barclays Bank recently noted that silver imports were down 28% in the month of April year on year.

But in an article reporting that news, the author makes it sound like demand was also off significantly for unwrought silver, for silver powder, and for jewelry manufacturing as well. Only if you take a myopic view would such assumptions be correct. However, just because trade between China and the rest of the world is down does not mean that silver demand is down. What it does reveal is a decrease for external demand of silver from the Chinese market.

China still remains a net importer of silver even with exports up of silver products. To me it's amazing that they need to buy silver through imports at all. In 2011 the Chinese government incentivized the mining industry in an effort to get off of dependence for base metals from foreign countries. With China experiencing growth as high as 10.4% over the last four years and in 2011 a 9.3% growth their demand for metals and minerals for construction and industry has grown exponentially as well.

I cannot vouch for the accuracy of the data in this story that was posted on thesilverseek.com Internet site yesterday. It was written by the vice-president of business development for BullionVault on Tuesday...and I thank Elliot Simon for his last contribution to today's column.

¤ THE WRAP

There are no markets anymore...only interventions. - Chris Powell, GATA

I'm not prepared to read much of anything into yesterday's price action in either gold or silver. But I would like to point out one thing that I mentioned earlier...and that was the fact that the gold price doesn't rise anywhere near as fast on big dollar index declines...as it falls when the dollar index rallies big.

But in the grand scheme of things since the bull market in gold and silver began thirteen years ago, what the dollar index has done over the long term has proved to be irrelevant to the what the gold price has done during the same period of time. Everyone likes to state the fact that they are trade opposite to each other, but any 15-year chart of these data sets proves otherwise.

The May delivery month is just about finished...and yesterday's gold figures confirm that there was heavy switching out of the June delivery month...and into the next front month, which is August. There is only the remainder of today for all futures and options contract holders on the Comex to sell, switch, or stand for delivery on Monday, so it wouldn't surprise me if the price action was rather subdued for the next couple of days.

But, having said that, I note that there was some interesting price action in gold in late afternoon trading in Hong Kong on their Thursday. The same can be said for silver...and that activity carried over into the first hour of London trading. Volumes are already very high...and most of the trading in gold is now in the new front month of August. As of 5:10 a.m. Eastern time, gold was up about fifteen bucks...and over the $1,400 spot price mark. Let's see how long that situation is allowed to last. Silver is up about two bits at the moment, but was up much more than that during the first hour of London trading. The dollar index is down about 24 basis points.

Nothing has changed regarding the bullish set-up for all four precious metals, as they are set for the proverbial moon shot...unless JPMorgan et al decide otherwise.

I await the New York open with great interest.

I hope your Thursday/Friday goes well...and I'll see you here tomorrow.

http://silverdoctors.com/chart-of-the-day-epic-plunge-in-total-comex-gold-inventory/#more-27070

Today’s chart of the day examines the epic plunge in total COMEX gold inventories, as total COMEX registered and eligible gold holdings have nearly been sliced in half over the past 6 months, from nearly 12,000 oz to 7,961 oz, and only a few small withdrawals from breaking the previous lows sit in the 2008 panic low.

To put the COMEX gold inventory plunge in perspective, let’s just say that the 5 year inventory chart resembles silver futures at any day at 8:15am EST.

http://www.zerohedge.com/news/2013-05-30/gold-bar-%E2%80%9Csupply-constraints%E2%80%9D-singapore-sees-record-premiums

Gold Bar “Supply Constraints” In Singapore Sees Record Premiums

Submitted by Tyler Durden on 05/30/2013 08:08 -0400

From GoldCore

Gold Bar “Supply Constraints” In Singapore Sees Record Premiums

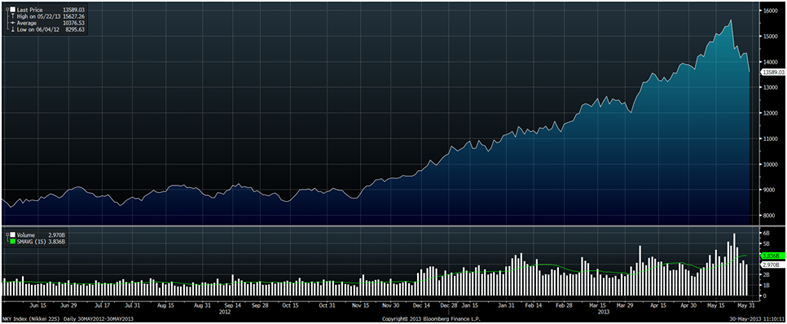

Gold rose to a one-week high, as the dollar and stocks retreated after another 5% plunge in Japan’s Nikkei. Silver, platinum and palladium advanced also.

Physical gold demand remains robust internationally and supply issues in Singapore have led to premiums reaching a record high there.

Some of the buying on futures markets may be shorts being forced to cover their record short position. The COT (Commitments of Traders) data clearly shows that there is the strong possibility of a significant squeeze of speculators short gold. This could be a catalyst to propel gold higher.

Traders and speculators are watching the $1,413/oz resistance level. A daily close above this level will likely trigger the beginnings of a short squeeze.

Holdings in the largest bullion-backed exchange-traded product expanded yesterday for the first time since May 9.

Strong premiums for gold bars in Asia show that jewellers and investors are busy buying bullion on this dip. In Singapore, Reuters reports that “supply constraints” have sent premiums to “all time highs” at $7 to spot London prices.

Animal spirits are returning to the gold market in the ‘Land of the Dragon’ in this the ‘Year of the Snake’.

The volume for the Shanghai Gold Exchange’s benchmark cash contract surged to 19,599 kilograms yesterday from 15,641 kilograms the day before. In two days the volumes have nearly doubled and surged from 10,094 kilograms to 19,599 or 94%.

Animal spirits have been greatly in evidence in global equity markets for many months now with abnormally strong gains seen in many surging markets. This is despite a very uncertain global economic outlook and great uncertainty regarding corporate earnings in the coming months.

With many stock markets overvalued on a host of benchmarks, there is the real risk of a material correction in the U.S. and other markets and this should lead to renewed diversification into gold.

It will also lead to renewed safe haven demand if other markets see stocks plummet as has been seen in Japan in recent days.

The 17% correction seen in the Nikkei in the last week alone, looks likely in the coming months in other markets which are increasingly being driven by liquidity, debt and margined speculation rather than value investing.

The rotatation out of gold and into stocks seen in recent months could reverse very quickly and investors may just as quickly rotate back into gold in order to hedge significant macroeconomic risks.

Update: so much for the kneejerk reaction sending futs higher on the bad data: USDJPY dragging everything down now.

Update: so much for the kneejerk reaction sending futs higher on the bad data: USDJPY dragging everything down now.

Bad News Is Good As GDP, Claims Miss Pushes Futures Higher; Five States' Data "Estimated"

Submitted by Tyler Durden on 05/30/2013 - 08:44 Update: so much for the kneejerk reaction sending futs higher on the bad data: USDJPY dragging everything down now.

Update: so much for the kneejerk reaction sending futs higher on the bad data: USDJPY dragging everything down now.

Just when there was some concern that the US economy was no longer imploding at the usual pace, we get confirmation that nothing is actually better, following the one-two punch of weaker than expected Q1 revised GDP data, printing at 2.4% on expectations of an unchanged 2.5% print driven by a revision in Private Inventories (from 1.03% to 0.63% of total GDP, offset by a plunge in imports sliding from -0.9% to -0.32%). Personal Consumption posted a tiny increase from 2.24% to 2.40% which can only mean the consumer overextended themselves in Q1 -perhaps it is about time to ask the question of how consumption in the "sequester" and tax-hike quarter was the highest since Q4 2010. Additionally, initial claims increased from the as usual upward-revised 344K to 354K, on expectations of a 340K print. But fear not: what both these data points showed is that any fears that the monthly Fed flow may slow down from the $85 billion monthly to a ghastly $75 billion or, heaven forbid, a tiny $65 billion monthly increase in the Fed's balance sheet, may be deferred. End result: futures jump higher. Because it is a Bizarro Ben, or Benzarro for short, market after all.

No comments:

Post a Comment