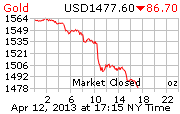

I challenge anyone one to provide credible evidence that manipulation of gold and silver doesn't exist after Friday ....... bring it ! Friday was not caused by a rising dollar ( see the data on the USD below) , the Friday massacre was not foreshadowed by Asian trading nor did the first hour of trading in London provide a tell - then wham , the boys and girls got the playbook for the day and just got really busy ..... a drop of 84 bucks for gold spot from Thursday ( down to 1477 ) and a 1.81 drop for silver ( down to 25.85 ) , brings 1450 ( funny how that hits GS target below ) and 25.50 into view for gold and silver respectively - one can then see 1400 and 25 for both looming ! Capitulation coming over the next couple of trading days ( after 25 , next major support for silver is about 22 - then 18 ) ?

This week's COT was blase , but after Friday , can you imagine what the COT will look like next Friday ? I think massive covering of shorts could be revealed as certainly one heck of an opportunity was presented Friday !

2011 yearly chart is interesting .... considering where we are now ( 1477 spot price Friday ) , 1500 support breached , 1450 support in view which could lead down to 1400..... after 1400 - 2011 bottom was at 1320....not a prediction , but it is POSSIBLE to see margins calls / stop running and typical Cartel manipulation drive gold down to 1300 - 1320 , where we should hopefully see strong support appear - Fibonnaci technical analysis would put 38.2 percent level for gold at 1285 , 50 percent level at 1088( 1285 therefore could be tested in this move. ) . Stay tuned !

One question in my mind - why have CME margins not been changed for gold and silver ( reduced 2/7 - The CME cut gold initial and maintenance margins from $6,600 & $6,000 to $5,940 & $5,400 respectively, and also slashed silver initial & maintenance margins from $12,100 & $11,000 to $10,400 & $9,500, a reduction of 10% in gold & 14% in silver !) , kinda volatile , right ? If we see CME raise margins for gold and silver next week , watch out ?

http://www.kitco.com/reports/KitcoNews20130412_technical.html

****

http://www.zerohedge.com/news/2013-04-14/gold-asian-liquidation-mode

And London will be calling in a few hours.....

http://goldtrends.net/FreeDailyBlog?mode=PostView&bmi=1267250

( One point of view of Friday takedown in gold... )

http://ausbullion.blogspot.com.au/2013/04/10-of-us-silver-supply-slides-into.html

( American Eagles are presently being rationed. But obviously losing 10 percent of US silver supply for the considerable future on 4/10 ( and news of same crossing 4/11) had no " fundamental effect " - in light of the silver massacre of 4/12.... )

http://www.infowars.com/assault-on-gold-update/

http://www.tfmetalsreport.com/blog/4641/here-where

http://www.zerohedge.com/news/2013-04-13/john-paulson-loses-over-300-million-fridays-gold-tumble

http://silverdoctors.com/sd-metals-markets-413-gold-silver-on-verge-of-capitulation-to-1400-22-prior-to-massive-rally/

( unless you on the Fed's email daisy chain , you simply don't know the playbook - but this could come to pass..... )

Paper Metals Market Madness: Silver Breaks $26 And Gold Dives Below $1500

The big story tonight is the epic raid Friday in the paper metals markets, as over 500 tons of paper gold were dumped on the market triggering sell-stops and capitulation in gold and silver, as gold broke below $1500 to $1485, and silver broke below significant long term support at $26 to as low as $25.72.

It was truly an epic sell-off, bringing back memories of the May 2011 silver collapse.

There was really no follow-through to this morning’s small rally, no conviction buying in the paper markets of any sort. We breached the low of $26.02 for the entire 2 year correction early this afternoon and with the 50 cent sell off at the end of the access session to close the week at $25.85, there is significant risk of a gap down overnight Sunday and early Monday, with the next major support in the $22 area. I’d give the odds at least 50/50 of a final gap-down spike low with silver dropping potentially as low as $22 and gold now potentially testing $1400 early next week.

That being said, silver was down almost $2, nearly 7%, and gold was down $85 today, nearly 6%, its largest single day decline since the February 29th 2012 Leap Day Massacre when LTRO2 was announced in Europe.

Gold hasn’t trading in the upper $1400′s since summer of 2011. Professionals are buying into this weakness, and when you look at the fundamentals with Japan going nuclear on QE just last week, the whole Cyprus bail-in contagion going global: 6% and 7% weakness in gold and silver are being responded to professional with accumulation. China has also been a massive buyer.

That being said, the potential for a capitulation spike low is now very real, so while today’s weakness must be responded to professionally with accumulation, it might be prudent to save a bit of dry powder for the event of a final capitulation overnight Sunday and into Monday.

Just as was seen in the massive sell-offs in 2008 and May of 2011, premiums are skyrocketing for physical metal (APMEX Buy-back price for 90% is now a whopping $3 OVER SPOT!), and even if the paper price trades down to $22 and $1400 early next week, it wouldn’t surprise us at all to see price for physical metal not dip much below $1600 and $30.

We set an all-time sales record today at SDBullion- I think we burned through nearly 10,000 ounces of silver. Our suppliers wouldn’t even answer the phones. One of our suppliers informed us they had already sold thousands of ounces of gold and hundreds of thousands of ounces of silver… before noon!

The demand for physical is simply enormous, and will result in widening spreads and premiums between paper and physical metal.

Vampire Squid Must Eat: The Set-up Before Cyprus Forks Over Gold

This movie is getting old. It would be one thing if the Western banksters were actually tossing some scraps around as they rape and pillage future generations — the somewhat hidden outcome of the dumping of debt obligations on nations to “fix” the insolvency the bankers created in the first place. But these thieves have absolutely no honor. Policy makers in Washington DC and Western Europe are no better. Talk about a bought and paid for lot. If money and perks aren’t enough for these createns, blackmail “control files” serve as backstop.

Let’s unpack the latest statements from Goldman Sachs’ alumnus and current European Central Bank head Super Thief Mario Draghi. Alan — babble them into indifference — Greenspan could learn a thing or two from Mario about lying.

Draghi was quoted by Bloomberg, as SilverDoctors reported:

Asked about a letter he wrote to Cyprus President Nicos Anastasiades, Draghi said the letter is “very, very clear.” He said the government must abide by the central bank’s handling of the gold stock, since it is independent from political control under European rules.

“The independence of central banks in the euro area is enshrined in the treaty,” Draghi said. “The ECB will look at developments in Cyprus from this angle.”

Speaking alongside Draghi, Dutch Finance Minister Jeroen Dijsselbloem said selling gold “has always been an option put forward by the Cypriot authorities.”

“But as mentioned in the program documentation, this is a decision to be made independently by the Cypriot central bank,” he said. “And it’s not any demand from the troika or the eurogroup.”

The full Bloomberg story is linked within the original SilverDoctors.com article.

Any notion that the Cypriot Central Bank having independence from anything is farcical. If a robber walks into your house and sticks a gun to your head, perhaps Dutch Finance Minister Jeroen Dijsselbloem would arrogantly suggest, “Giving the robber your money has always been an option put forward by other hold-up victims.”

We need to go back in time to understand how the game (arguably, a scam) is played:

First, Cypriot banksters make bad loans, for which traditional capitalist system remedies such as placing banks into receivership are not called upon to honestly fix the mess. Next, the situation becomes a crisis as credit to the Cypriot banking system dries up, a perfectly natural and expected reaction by even rational and non-corrupt bankers who are unwilling to lend further to bad creditors.

Hang in here, dear reader. It’s about to get interesting.

What does Draghi and his Brussels Brethren do next? Why, of course, tell the Cypriot government they can turn to the oh-so-independent Cypriot central bank to issue special loans to insolvent Cypriot banks under a program called Emergency Liquidity Assistance (ELA). That has been going on long before the Cypriot crisis was worldwide news. The ECB authorizes this direct ELA lending by the Cypriot national bank, which includes more permissive collateral requirements to grease the injection of liquidity — because no real banker not backstopped by taxpayers socializing losses would make such risky loans to already hobbled creditors without permissive collateral requirements! Result? A weak and failing Cypriot financial system is turned into a liquidity crack dependent, flat on it’s back and at the total mercy of subsequent demands from the ECB.

The end game is now set-up. Draghi gets to slither around in his calm, technocratic demeanor, claiming that the Cypriot central bank has independence while the ECB and the Brussels Brethren demand that the Cypriot central bank sell its gold to cover the ELA credit issued to supposedly fix the insolvent banking system. It’s not just gold the banksters are after, by the way. Cypriot gold is just the icing on the cake. The bankster bad loan losses above and beyond the value of the gold are entirely socialized on the backs of the citizens of Cyprus, which enables Brussels to exert greater political control over Cyprus, a supposedly sovereign nation.

Meanwhile, not one in ten thousand media professionals have the intellectual curiosity to investigate this chain reaction setup. Even those journalists that do understand usually dare not speak truth to power lest they find themselves facing friction from their employers, who may very well be owned outright by financial sector interests (e.g., Bloomberg, and another fine example, CNBC, and it’s 49% owner, GE, which also happens to own shadow banking system titan GE Capital, etc.).

Mainstream Media that isn’t directly owned by the financial sector must deal with other challenges because they either have dependence on financial sector advertising directly, or are simply aligned with general corporate interests. The average man on the street has no hope of learning the truth without spending considerable time seeking out alternative resources like SilverDoctors.com and the observations of financial market professionals like myself — people that have exited the belly of the beast in disgust and are willing to describe the machinations of that beast’s incessant, criminal appetite because our paychecks are not beholden to the beast.

# # # # #

Tribute To Bill Murphy, Chris Powell And GATA: An Open “Letter” From Eric Dubin And SilverDoctors.com

Apparently, cartel actions have become so obvious that an increasing number of money managers feel compelled to speak up. The latest: well known money manager and former candidate for US Senate Peter Schiff. During a CNBC interview, Mr. Schiff has finally declared that gold might be manipulated in service of the Fed:

“I think goldman wants to knock the price down either because they want to buy more cheaper for themselves, or maybe they’re trying to help out their friends out at the Federal Reserve. They have a pretty cozy relationship. The Federal Reserve does not want the price of gold to go up because it invalidates everything that they’re doing. So, they might be manipulating the market for that reason.” - Peter Schiff

It took you long enough, but Mr. Schiff we welcome you to “planet reality.” Or, as Bill Murphy would say, “Welcome to planet GATA” (versus “planet Wall Street”).

For well over a decade, Bill Murphy, Chris Powell and GATA have tirelessly collected documentation proving the existence of the gold cartel, detailing how and why they act. Detractors usually focus on Bill Murphy’s tendency towards exasperation in the face of the mainstream media’s general refusal to investigate this ongoing activity. In truth, Bill Murphy has not been tilting at windmills. The cartel is real and Murphy’s righteous indignation — combined with a huge dose of Irish tenacity — has served him well as GATA’s leader.

Bill Murphy is an American hero in the most classic sense of the term. GATA is taking up the fight of the underdog, the average citizen unaware how distortions in the capital markets injure the economy and the lives of millions. Consequences of the cartel’s actions transcend manipulation of precious metals markets. Consider the Fed and US Treasury’s management of the bond market. Few media professionals find it odd that management of the bond market and the price of money (interest rates) is open public policy and ok to talk about. But talk about the management of the price of gold, which indirectly has a massive impact on interest rates and confidence required to support the exchange value of the US dollar, is strictly verboten.

Truth be told, in order for the Fed’s public policy of control of the bond market to work, fund managers, traders and other market participants MUST know about it. That’s the jawboning propaganda mechanics behind so-called “financial repression.” The whole point is to make market actors think, “don’t fight the Fed” while pretending interest rates can stay low, reflating the housing market while banks take part of the liquidity they receive from the Fed in exchange for the crap mortgage back securities banks hold. The so-called liquidity then flows into the stock market and beyond. Neat trick. All the while, the common man and generations after him get stuck with the tax bill to pay off all that added debt while banksters socialize their losses.

With scams this large, is it any wonder there’s a propaganda war against truth telling organizations like GATA?

Yes, there have been times when Bill Murphy makes market calls that fail. All rational analysts, traders and investors understand being wrong from time to time is normal. Yes, there have been times when Bill Murphy’s righteous indignation has led him to call a given day’s gold trading action cartel-driven when it probably wasn’t (although, the past year has witnessed an unusually high level of cartel activity). So what? When it comes to the big picture, GATA’s amassed documentation speaks for itself. GATA, Chris Powell — and certainly — Bill Murphy have integrity and guts. Rather than criticizing them, market participants should be opening their checkbooks and writing a tax deductible donation to GATA. Market participants should also get off their duff and actually read all the documentation freely available at GATA.org.

Perhaps Peter Schiff has finally done just that. Who’s next? Pretend cartel denier but otherwise brilliant James Grant of Grants Interest Rate Observer? Heck, it’s my opinion that even the otherwise non-dogmatic Rick Rule hasn’t even bothered to take a week, roll-up his sleeves, and carefully examine the GATA document treasure trove. How could I make such a seemingly preposterous statement about Eric Sprott’s right hand man? For starters, Rule makes no secret he’s a bit skeptical about at least the level of manipulation in the precious metals market. He describes himself as skeptical about the ability for conspiracies and agendas to be able to be hidden for extended periods of time. During a recent radio interview with Al Korelin, Rule noted how no matter what manipulation efforts he saw during his days in the Vancouver investment community, truth eventually came to light.

How quaint.

Mr. Rule, the world of Vancouver resource finance amounts to a backwater when compared to the massive geostrategic imperatives necessary to maintain the dollar as the world reserve currency — with all the benefits that accrue to the nation burdened with such an exorbitant privilege.

Don’t get me wrong. I deeply respect Rick Rule. His intellect is at genius level, and his abilities as an investor are legendary. I’m in my mid 40s. When I grow up I hope to have at least half his wisdom and mastery over as many fields as Mr. Rule. Nevertheless, someone has got to call him out because resting on assumptions and dogmatic logic about what markets should and should not do just isn’t good enough for someone as good as Mr. Rule. Mr. Rule didn’t make billions as a slave to normalcy bias, and it’s time he joins GATA’s apparent latest (albeit not credited) convert, Peter Schiff.

An ancient Chinese proverb comes to mind: “The beginning of wisdom is to call things by their proper names.”

Enough said.

Thank you, Bill Murphy, Chris Powell and all the people that have helped make GATA what it is today. There will come a day when you are seen for what you are: true American heros.

Sincerely,

Eric Dubin

http://hat4uk.wordpress.com/2013/04/13/gold-greed-global-collapse-who-benefitted-most-from-yesterdays-spectacular-fall/

http://www.caseyresearch.com/gsd/edition/lawrence-williams-gold-price-manipulation-the-never-ending-game/

http://silverdoctors.com/hypothermia-contagion-in-the-eurozone/#more-24845

( Is there a correlation between Cyprus being forced to turnover their gold to the Troika , the ongoing incredible manipulations of gold and silver and the massive deleveraging of gold by the West to China ? )

http://www.paulcraigroberts.org/

For Americans, financial and economic Armageddon might be close at hand. The evidence for this conclusion is the concerted effort by the Federal Reserve and its dependent financial institutions to scare people away from gold and silver by driving down their prices.

When gold prices hit $1,917.50 an ounce on August 23, 2011, a gain of more than $500 an ounce in less than 8 months, capping a rise over a decade from $272 at the end of December 2000, the Federal Reserve panicked. With the US dollar losing value so rapidly compared to the world standard for money, the Federal Reserve’s policy of printing $1 trillion annually in order to support the impaired balance sheets of banks and to finance the federal deficit was placed in danger. Who could believe the dollar’s exchange rate in relation to other currencies when the dollar was collapsing in value in relation to gold and silver.

The Federal Reserve realized that its massive purchase of bonds in order to keep their

prices high (and thus interest rates low) was threatened by the dollar’s rapid loss of value in terms of gold and silver. The Federal Reserve was concerned that large holders of US dollars, such as the central banks of China and Japan and the OPEC sovereign investment funds, might join the flight of individual investors away from the US dollar, thus ending in the fall of the dollar’s foreign exchange value and thus decline in US bond and stock prices.

Intelligent people could see that the US government could not afford the long and numerous wars that the neoconservatives were engineering or the loss of tax base and consumer income from offshoring millions of US middle class jobs for the sake of executive bonuses and shareholder capital gains. They could see what was in the cards, and began exiting the dollar for gold and silver.

Central banks are slower to act. Saudi Arabia and the oil emirates are dependent on US protection and do not want to anger their protector. Japan is a puppet state that is careful in its relationship with its master. China wanted to hold on to the American consumer market for as long as that market existed. It was individuals who began the exit from the US dollar.

When gold topped $1,900, Washington put out the story that gold was a bubble. The presstitute media fell in line with Washington’s propaganda. “Gold looking a bit bubbly” declared CNN Money on August 23, 2011.

The Federal Reserve used its dependent “banks too big to fail” to short the precious metals markets. By selling naked shorts in the paper bullion market against the rising demand for physical possession, the Federal Reserve was able to drive the price of gold down to $1,750 and keep it more or less capped there until recently, when a concerted effort on April 2-3, 2013, drove gold down to $1,557 and silver, which had approached $50 per ounce in 2011, down to $27.

The Federal Reserve began its April Fool’s assault on gold by sending the word to brokerage houses, which quickly went out to clients, that hedge funds and other large investors were going to unload their gold positions and that clients should get out of the precious metal market prior to these sales. As this inside information was the government’s own strategy, individuals cannot be prosecuted for acting on it. By this operation, the Federal Reserve, a totally corrupt entity, was able to combine individual flight with institutional flight. Bullion prices took a big hit, and bullishness departed from the gold and silver markets. The flow of dollars into bullion, which threatened to become a torrent, was stopped.

For now it seems that the Fed has succeeded in creating wariness among Americans about the virtues of gold and silver, and thus the Federal Reserve has extended the time that it can print money to keep the house of cards standing. This time could be short or it could last a couple of years.

However, for the Russians and Chinese, whose central banks have more dollars than they any longer want, and for the 1.3 billion Indians in India, the low dollar price for gold that the Federal Reserve has engineered is an opportunity. They see the opportunity that the Federal Reserve has given them to purchase gold at $350-$400 an ounce less than two years ago as a gift.

The Federal Reserve’s attack on bullion is an act of desperation that, when widely recognized, will doom its policy.

As I have explained previously, the orchestrated move against gold and silver is to protect the exchange value of the US dollar. If bullion were not a threat, the government would not be attacking it.

The Federal Reserve is creating $1 trillion new dollars per year, but the world is moving away from the use of the dollar for international payments and, thus, as reserve currency. The result is an increase in supply and a decrease in demand. This means a falling exchange value of the dollar, domestic inflation from rising import prices, and a rising interest rate and collapsing bond, stock and real estate markets.

The Federal Reserve’s orchestration against bullion cannot ultimately succeed. It is designed to gain time for the Federal Reserve to be able to continue financing the federal budget deficit by printing money and also to keep interest rates low and debt prices high in order to support the banks' balance sheets.

When the Federal Reserve can no longer print due to dollar decline which printing would make worse, US bank deposits and pensions could be grabbed in order to finance the federal budget deficit for couple of more years. Anything to stave off the final catastrophe.

The manipulation of the bullion market is illegal, but as government is doing it the law will not be enforced.

By its obvious and concerted attack on gold and silver, the US government could not give any clearer warning that trouble is approaching. The values of the dollar and of financial assets denominated in dollars are in doubt.

Those who believe in government and those who believe in deregulation will be proved equally wrong. The United States of America is past its zenith. As I predicted early in the 21st century, in 20 years the US will be a third world country. We are halfway there.

http://canadafreepress.com/index.php/article/53842

( this has been pretty spot on - DHS Insider first reported concerns for this spring back in December....)

This week's COT was blase , but after Friday , can you imagine what the COT will look like next Friday ? I think massive covering of shorts could be revealed as certainly one heck of an opportunity was presented Friday !

2011 yearly chart is interesting .... considering where we are now ( 1477 spot price Friday ) , 1500 support breached , 1450 support in view which could lead down to 1400..... after 1400 - 2011 bottom was at 1320....not a prediction , but it is POSSIBLE to see margins calls / stop running and typical Cartel manipulation drive gold down to 1300 - 1320 , where we should hopefully see strong support appear - Fibonnaci technical analysis would put 38.2 percent level for gold at 1285 , 50 percent level at 1088( 1285 therefore could be tested in this move. ) . Stay tuned !

One question in my mind - why have CME margins not been changed for gold and silver ( reduced 2/7 - The CME cut gold initial and maintenance margins from $6,600 & $6,000 to $5,940 & $5,400 respectively, and also slashed silver initial & maintenance margins from $12,100 & $11,000 to $10,400 & $9,500, a reduction of 10% in gold & 14% in silver !) , kinda volatile , right ? If we see CME raise margins for gold and silver next week , watch out ?

http://www.kitco.com/reports/KitcoNews20130412_technical.html

****

From a Fibonacci technical analysis perspective, which is a valid and respected area of chart study, the situation is not so bearish for gold.

Followers of Fibonacci consider serious chart damage to have occurred in a bull market move when prices drop below significant "retracement" levels of the previous up-trending price move. The first major Fibonacci level is 38.2% and then 50%, with the 50% retracement level arguably being the most important. The price move from the 2001 low of $255 to the 2011 high of$1,923 sees a 38.2% retracement level come in at $1,285. A 50% retracement of that same move comes in at $1,088.

Followers of Fibonacci consider serious chart damage to have occurred in a bull market move when prices drop below significant "retracement" levels of the previous up-trending price move. The first major Fibonacci level is 38.2% and then 50%, with the 50% retracement level arguably being the most important. The price move from the 2001 low of $255 to the 2011 high of$1,923 sees a 38.2% retracement level come in at $1,285. A 50% retracement of that same move comes in at $1,088.

2011 gold chart....

| Exchg | Asset Class | Product | Product Code | Start Period | End Period | Initial | Maint. | Initial Vol. Scan | Maint. Vol. Scan |

|---|---|---|---|---|---|---|---|---|---|

| CMX | METALS | COMEX 100 GOLD FUTURES | GC | 04/2013 | 08/2013 | 5,940 USD | 5,400 USD | 0.06 | 0.05 |

| CMX | METALS | COMEX 100 GOLD FUTURES | GC | 10/2013 | 12/2013 | 5,940 USD | 5,400 USD | 0.03 | 0.03 |

| CMX | METALS | COMEX 100 GOLD FUTURES | GC | 02/2014 | 12/2018 | 5,940 USD | 5,400 USD | 0.02 | 0.02 |

Silver

| Exchg | Asset Class | Product | Product Code | Start Period | End Period | Initial | Maint. | Initial Vol. Scan | Maint. Vol. Scan |

|---|---|---|---|---|---|---|---|---|---|

| CMX | METALS | COMEX 5000 SILVER FUTURES | SI | 04/2013 | 07/2013 | 10,450 USD | 9,500 USD | 0.12 | 0.11 |

| CMX | METALS | COMEX 5000 SILVER FUTURES | SI | 09/2013 | 12/2013 | 10,450 USD | 9,500 USD | 0.06 | 0.05 |

| CMX | METALS | COMEX 5000 SILVER FUTURES | SI | 01/2014 | 12/2017 | 10,450 USD | 9,500 USD | 0.03 | 0.03 |

http://www.zerohedge.com/news/2013-04-14/gold-asian-liquidation-mode

Gold, Silver In Asian Liquidation Mode

Submitted by Tyler Durden on 04/14/2013 22:02 -0400

UPDATE: Spot Gold $1426 (from $1564 highs Friday)

As Asia opens to the bloodbath that occurred in precious metals on Friday in the US, it would appear that more than a few traders got the 'tap on the shoulder'. Shanghai futures are limit-down and spot gold and silver prices are plunging once again as we suspect forced margin-calls and the raising of cash (to cover extreme variation margin - or capital reserves) needed in JGB positions, as we explained here.Liquidation is certainly the theme of the evening - investors are selling JGBs (6th day in a row of multiple-sigma moves in long-dated Japanese bonds 30Y +56bps off its post-BoJ lows at 1.60%!), selling Japanese stocks (Nikkei -128 pts, second biggest down day post-BoJ), selling US Treasuries (futures down), selling gold and silver (gold spot down over $100 from Friday's highs), and despite selling JPY early (retracing 30% of the weakness post-BoJ), JPY is practically unchanged (jerking lower only on the US futures open and Asian equity open) - it seems Mrs.Watanabe is struggling and unwinding some her excessively short JPY and long NKY positions.

Gold down over $100 from Friday's highs...

Silver ugly too...

Another day, another 4-sigma move in JGBs...

and post the China data...

- GDP Miss

- Retail Sales Miss

- Industrial Production Miss

- Fixed Asset Investment Miss

... everything is red - JGBs down, Japanese stocks down, US Stocks down, US Treasuries down, Gold and Silver down, Copper down, Oil down

Charts: Bloomberg

And London will be calling in a few hours.....

http://goldtrends.net/FreeDailyBlog?mode=PostView&bmi=1267250

( One point of view of Friday takedown in gold... )

http://ausbullion.blogspot.com.au/2013/04/10-of-us-silver-supply-slides-into.html

( American Eagles are presently being rationed. But obviously losing 10 percent of US silver supply for the considerable future on 4/10 ( and news of same crossing 4/11) had no " fundamental effect " - in light of the silver massacre of 4/12.... )

Sunday, April 14, 2013

10% of US Silver Supply Slides into the World's Largest Hole

Bingham Canyon Mine north wall slide update

Posted: April 11, 2013

South Jordan, Utah (April 11, 2013) - Kennecott Utah Copper’s Bingham Canyon Mine experienced a slide along a geotechnical fault-line of its northeastern wall at 9:30 p.m. MDT April 10, 2013. Monitoring systems identified the event as a single slide that failed progressively.

All employees are safe and accounted for. Rio Tinto’s Kennecott Utah Copper wants to publicly thank them for their efforts and cooperation.

The magnitude of the impact from the slide is unknown at this point. Experts are assessing the site remotely. Once it has been established that it is safe to send people into the mine for closer assessment next response steps will be determined.

As far as we can determine, there have been no impacts to the community. The movement has been contained to the mine and presents no threat to the public. Minimal dust resulted from the slide, in part, because of favorable weather conditions.

Pit wall movement is infrequent but something we monitor and plan for and no other events are anticipated.

Assault On Gold Update

Paul Craig Roberts

Infowars.com

April 14, 2013

Infowars.com

April 14, 2013

I was the first to point out that the Federal Reserve was rigging all markets, not merely bond prices and interest rates, and that the Fed is rigging the bullion market in order to protect the US dollar’s exchange value, which is threatened by the Fed’s quantitative easing. With the Fed adding to the supply of dollars faster than the demand for dollars is increasing, the price or exchange value of the dollar is set up to fall.

A fall in the dollar’s exchange rate would push up import prices and, thereby, domestic inflation, and the Fed would lose control over interest rates. The bond market would collapse and with it the values of debt-related derivatives on the “banks too big too fail” balance sheets. The financial system would be in turmoil, and panic would reign.

Rapidly rising bullion prices were an indication of loss of confidence in the dollar and were signaling a drop in the dollar’s exchange rate. The Fed used naked shorts in the paper gold market to offset the price effect of a rising demand for bullion possession. Short sales that drive down the price trigger stop-loss orders that automatically lead to individual sales of bullion holdings once their loss limits are reached.

According to Andrew Maguire, on Friday, April 12, the Fed’s agents hit the market with 500 tons of naked shorts. Normally, a short is when an investor thinks the price of a stock or commodity is going to fall. He wants to sell the item in advance of the fall, pocket the money, and then buy the item back after it falls in price, thus making money on the short sale. If he doesn’t have the item, he borrows it from someone who does, putting up cash collateral equal to the current market price. Then he sells the item, waits for it to fall in price, buys it back at the lower price and returns it to the owner who returns his collateral. If enough shorts are sold, the result can be to drive down the market price.

A naked short is when the short seller does not have or borrow the item that he shorts, but sells shorts regardless. In the paper gold market, the participants are betting on gold prices and are content with the monetary payment. Therefore, generally, as participants are not interested in taking delivery of the gold, naked shorts do not need to be covered with the physical metal.

In other words, with naked shorts, no physical metal is actually sold.

People ask me how I know that the Fed is rigging the bullion price and seem surprised that anyone would think the Fed and its bullion bank agents would do such a thing, despite the public knowledge that the Fed is rigging the bond market and the banks with the Fed’s knowledge rigged the Libor rate. The answer is that the circumstantial evidence is powerful.

Consider the 500 tons of paper gold sold on Friday. Begin with the question, how many ounces is 500 tons? There are 2,000 pounds to one ton. 500 tons equal 1,000,000 pounds. There are 16 ounces to one pound, which comes to 16 million ounces of short sales on Friday.

Who has 16 million ounces of gold? At the beginning gold price that day of about $1,550, that comes to $24,800,000,000. Who has that kind of money?

What happens when 500 tons of gold sales are dumped on the market at one time or on one day? Correct, it drives the price down. Investors who want to get out of large positions would spread sales out over time so as not to lower their sales proceeds. The sale took gold down by about $73 per ounce. That means the seller or sellers lost up to $73 dollars 16 million times, or $1,168,000,000.

Who can afford to lose that kind of money? Only a central bank that can print it.

I believe that the authorities would like to drive the gold price down further and will, if they can, hit the gold market twice more next week and put gold at $1,400 per ounce or lower. The successive declines could perhaps spook individual holders of physical gold and result in actual net sales of physical gold as people reduced their holdings of the metal.

However, bullion dealer Bill Haynes told kingworldnews.com that last Friday bullion purchasers among the public outpaced sellers by 50 to 1, and that the premiums over the spot price on gold and silver coins are the highest in decades. I myself checked with Gainesville Coins and was told that far more buyers than sellers had responded to the price drop.

Unless the authorities have the actual metal with which to back up the short selling, they could be met with demands for deliveries. Unable to cover the shorts with real metal, the scheme would be exposed.

Do the authorities have the metal with which to cover shorts? I do not know. However, knowledgeable dealers are suspicious. Some think that US physical stocks of gold were used up in sales in efforts to disrupt the rise in the gold price from $272 in December 2000 to $1,900 in 2011. They point to Germany’s recent request that the US return the German gold stored in the US, and to the US government’s reply that it would return the gold piecemeal over seven years. If the US has the gold, why not return it to Germany?

The clear implication is that the US cannot deliver the gold.

Andrew Maguire also reports that foreign central banks, especially China, are loading up on physical gold at the low prices made possible by the short selling. If central banks are using their dollar holdings to purchase bullion at bargain prices, the likely results will be pressure on the dollar’s exchange value and a declining market supply of physical bullion. In other words, by trying to protect the dollar from its quantitative easing policy, the Fed might be hastening the dollar’s demise.

Possibly the Fed fears a dollar crisis or derivative blowup is nearing and is trying to reset the gold/dollar price prior to the outbreak of trouble. If ill winds are forecast, the Fed might feel it is better positioned to deal with crisis if the price of bullion is lower and confidence in bullion as a refuge has been shaken.

In addition to short selling that is clearly intended to drive down the gold price, orchestration is also indicated by the advance announcements this month first from brokerage houses and then from Goldman Sachs that hedge funds and institutional investors would be selling their gold positions. The purpose of these announcements was to encourage individual investors to get out of gold before the big boys did. Does anyone believe that hedge funds and Wall Street would announce their sales in advance so the small fry can get out of gold at a higher price than they do?

If these advanced announcements are not orchestration, what are they?

I see the orchestrated effort to suppress the price of gold and silver as a sign that the authorities are frightened that trouble is brewing that they cannot control unless there is strong confidence in the dollar. Otherwise, what is the point of the heavy short selling and orchestrated announcements of gold sales in advance of the sales?

From Here, Where?

I've been thinking since yesterday about what I should write today. My first idea was to overwhelm you with information. Charts, data, links...the usual stuff, only more so. Then it dawned on me...that's probably not what you want to hear right now.

Besides there are all kinds of other websites out there where you can get that stuff. And today, I'm not too concerned about technicals. You see, my obligation is to you and to the other 28,939 unique IPs that hit this site yesterday. What do you need to hear? Or, put this way, if I was in your shoes, what would I want to hear from Turd this weekend?

Therefore I've decided, at least for today, to dispense with the charts and the links. I'm not going to mention the info that Andy shared on KWN or the fact that the GLD incredibly shed another 22.86 metric tonnes of "inventory" yesterday. (That's another 1,840 bars or 10 of my pallets, by the way.) Nope, none of that. If I were you, I'd want to be reassured that this wasn't all just a big crock of shit. All this gold stuff. All of the new reserve currency stuff. All of the Cartel manipulation stuff. All of it. I'd want to know that I hadn't been snookered and taken advantage of. I'd want to know that all of these "internet people" that I follow aren't simply making stuff up as they go along. And I'd want to know that they're sincere and that they're just as frustrated as I am.

So, I guess I'll start with myself. I think everyone knows this but I'll state it again: I'm just a nobody. I live in the American Midwest and my entire life has been spent doing pretty-much normal stuff. About five years ago, I quit the "corporate ladder" and pursued a path of independence. In 2009, I discovered ZeroHedge and the rest, as they say, is history. I now find myself in the middle of a global struggle against elements of the established central and bullion banking order. Suffice it to say: It's a surreal existence and not one that I could ever have envisioned. But I'm here now and waist-deep in the fight. Does this make me infallible or all-knowledgeable? Of course not. But I do my best to share with you, my dear reader, as much information and insight as I can.

The past eight months have been the most challenging. Not only have I lost all remaining faith in the idea that Americans live in a self-governing, representative republic, I've also been privileged(?) to witness first-hand some of the true depth of the corruption. Concurrently, I allowed myself to be totally caught off-guard by the ferocity of the attack on the precious metals after the announcement of QE∞. At this critical time, I should have anticipated that all necessary measures would be taken todiscourage the ownership of any form of money other than fiat currency. In failing to recognize this contingency, I failed you, my dear reader. Though I am 100% confident in the accuracy of my predictions of "the end of the Great Keynesian Experiment", I failed to recognize that this current beatdown was both predictable and inevitable. I hope we've both learned something and that we both are able to keep from making the same mistake in the future.

But mistakes will still be made and the point of this post is to assure you that I am on your side and doing everything in my power to help you prepare for what is inevitably coming. I do so with all sincerity of purpose and the cloak of this responsibility wears heavily upon my soldiers every day. Just ask MrsF or the LTs. They'll tell you how they often catch me staring blankly off into the distance, seemingly detached from the moment. "What are you thinking about", they'll ask. "Oh, dear, where do I begin...". But that's OK; I'm not looking for sympathy. I just want you to know that I, and most everyone else I've had the privilege to meet within the metals "community", truly believe in the cause and we are doing our best to help as many as possible.

I've often said that the greatest thing about "being Turd" is the access this grants me and the friendships and contacts that I've been able to make, so, please indulge me this. As stated above, this post is not about me. It's about what I assume must be on your mind this weekend. Namely, is this real and are the people with these websites trustworthy? For what it's worth, here's some of what I know (with apologies to anyone I mistakenly leave out):

- Jim Sinclair (Santa): JSMineset was the first metals website I ever visited. That I've actually gotten to know Jim a little bit is a great honor. I've known a couple of NYSE-listed CEOs is in my life and Jim is no different. He smart and wise. Measured in his words but with a vision. Under no circumstances does he need to publish JSM but he does. Why? Because he cares. Period. He firmly believes that he can clearly see what is coming and he's trying to use his platform to warn as many as possible. You can trust and believe in him because I do.

- Andrew Maguire: Not sure where to start and I'll try to keep this brief. Andy is a true gentleman and staunch ally of all of us. Sort of like Jim Sinclair, he doesn't need any of this but he's sick of the injustice and the inequity created by the bullion banks...and he's fighting back. Even though we've never met, I've come to trust him implicitly.

- Ned Naylor-Leyland: I don't think you could find a nicer guy on the face of the planet. Again, just like so many of us, Ned's sort of had this stuff thrust upon him. But he's an eloquent spokesman for our cause and I've come to value him as a friend.

- Jim Willie: You may think that Jim has some crazy theories. I know I do. But please do not doubt his intellect, his intuition or his sincerity. The guy is a true visionary and I have no doubt that, one day soon, he will be vindicated and treated as such.

- Bill Murphy and Chris Powell: The veteran soldiers of the movement. Though Bill might seem a bit of a loose cannon from time to time, he's a good man and tireless campaigner against The Cartels. Chris is a solid, upright and honest man whose commitment and integrity benefits all of us.

- Ted Butler, Ranting Andy, Mike Krieger, Jim Quinn, Kerry Lutz, Dave Janda, David Morgan, Alasdair Macleod, Jeff Nielson, Detlev Schilchter, John Williams: All of these guys either write newsletters or offer paid subscription analysis and I have either met them in person or made their acquaintance via Skype. All of them provide a valuable resource and all of them are doing everything they can to help the cause. I feel I can personally vouch for them and I strongly recommend that you trust them, too.

- There are many others but, for the sake of your time, I'll stop here.

I could go on but I don't want to turn this into some kind of LoveFest. The point of this is what I stated above. Though you should always question the things you read, do your own research and due diligence, I wanted to pass along what I know to reassure you about the gold community and those involved within it. I hope I've done just that.

Please utilize the rest of this weekend to get some much-needed rest and relaxation. To me, it's quite clear that we have entered the final chapter of bullion bank hegemony and the days ahead are only going to get more volatile. You're going to need information and wisdom to see your way through it so I hope that this post has been a valuable use of your time.

See you Monday.

TF

http://www.zerohedge.com/news/2013-04-13/john-paulson-loses-over-300-million-fridays-gold-tumble

John Paulson Loses Over $300 Million On Friday's Gold Tumble

Submitted by Tyler Durden on 04/13/2013 18:11 -0400

There were many casualties following Friday's 4% gold rout, but none were hurt more than one-time hedge fund idol John Paulson, who according to estimates, lost more than $300 million of his own money in one day.

Per Bloomberg: "Paulson has roughly $9.5 billion invested across his hedge funds, of which about 85 percent is invested in gold share classes. Gold dropped 4.1 percent today, shaving about $328 million from his net worth on this bet alone." This is merely the latest insult to what has otherwise been a 3 year-long injury for Paulson and his few remaining investors, whose very inappropriately named Advantage Plus is among the bottom 10 hedge funds for the third year in a row. Yet despite being a one-hit wonder thanks to one lucrative idea (long ABX CDS) generated by one of his former employees (Pelegrini), Paulson still has been lucky enough to somehow amass a $10 billion personal fortune which can have a $300 million downswing in one day, even if it is in an asset class which eventually will go only one way - up. Unless, of course, like so many other fly by night billionaires, Paulson too hasn't somehow managed to lever up all his equity into numerous other downstream ventures, and where a $300 million blow up leads to margin calls and other terminal liquidity outcomes.

More:

“The recent decline in gold prices has not changed our long-term thesis,” John Reade, a partner and gold strategist at Paulson & Co., said in an e-mailed statement. “We started investing in gold at $900 in April 2009 and while it’s down from its peak to $1500, it’s up considerably from our cost.”Paulson investors can choose between dollar-and gold- denominated versions for most of the firm’s funds. In addition losses from bullion’s decline, investors in Paulson & Co. funds, including the firm’s founder, lost about $62 million today on their gold-stock investments, based on holdings as of Dec. 31, 2012. New York-based Paulson & Co.’s biggest wagers in miners include a 7.35 percent stake in AngloGold Ashanti Ltd.Paulson’s Reade said gold will continue to appreciate in the long run because governments are pumping money into the economy at a rate not seen before.“Federal governments have been printing money at an unprecedented rate,” said Reade. “We expect the strengthening of the economy and stock market to cause money supply to rise more than real growth and eventually lead to inflation. It is this expectation of paper currency debasement which makes gold an attractive long-term investment for us.”

That said, one doesn't have to be a bull in gold and gold equities to position appropriately for the eventual inflationary outcome, whose arrival is only a matter of time now that not one but two central banks are injecting $80+ billion in fresh liquidity into the global markets every month.

Recall that gold bull Hugh Hendry said in October that while he is long gold, he is short gold equities, a trade which has generated substantial alpha, courtesy of the 40% plunge in GDX and associated gold miners (a pair trade we have supported incidentally), and one which may well continue generating additional returns should Japanese financial institutions be forced to continue selling off the yellow metal on margin concerns, due to the record surge in JGB volatility as we explained yesterday.

As for gold as an inflation hedge, here Paulson is certainly correct. The only question is when will the price suppression scheme of gold as an alternative currency finally end. Since various official organizations (such as the Troika) are currently doing all they can to buy the sovereign gold of insolvent nations at firesale prices, it is likely that the period of artificially suppressed prices may continue.

Which, incidentally, for all those who lament the recent price drop in gold, is a good thing: for those who see gold as an alternative currency to fiat, all the recent sell off (as well as alleged or real downward price manipulation) does is provide a lower cost basis for accumulating hard monetary assets. Which is something to be welcomed and not mourned, especially if one plans on holding on to said gold (or silver) as a currency, instead of merely converting it back into fiat at a higher price point, and thus as an asset (something all those who bought BitCoin at $260 and sold at $50 appear to have completely forgotten).

http://silverdoctors.com/sd-metals-markets-413-gold-silver-on-verge-of-capitulation-to-1400-22-prior-to-massive-rally/

( unless you on the Fed's email daisy chain , you simply don't know the playbook - but this could come to pass..... )

# # # # #

Paper Metals Market Madness: Silver Breaks $26 And Gold Dives Below $1500

The big story tonight is the epic raid Friday in the paper metals markets, as over 500 tons of paper gold were dumped on the market triggering sell-stops and capitulation in gold and silver, as gold broke below $1500 to $1485, and silver broke below significant long term support at $26 to as low as $25.72.

It was truly an epic sell-off, bringing back memories of the May 2011 silver collapse.

There was really no follow-through to this morning’s small rally, no conviction buying in the paper markets of any sort. We breached the low of $26.02 for the entire 2 year correction early this afternoon and with the 50 cent sell off at the end of the access session to close the week at $25.85, there is significant risk of a gap down overnight Sunday and early Monday, with the next major support in the $22 area. I’d give the odds at least 50/50 of a final gap-down spike low with silver dropping potentially as low as $22 and gold now potentially testing $1400 early next week.

That being said, silver was down almost $2, nearly 7%, and gold was down $85 today, nearly 6%, its largest single day decline since the February 29th 2012 Leap Day Massacre when LTRO2 was announced in Europe.

Gold hasn’t trading in the upper $1400′s since summer of 2011. Professionals are buying into this weakness, and when you look at the fundamentals with Japan going nuclear on QE just last week, the whole Cyprus bail-in contagion going global: 6% and 7% weakness in gold and silver are being responded to professional with accumulation. China has also been a massive buyer.

That being said, the potential for a capitulation spike low is now very real, so while today’s weakness must be responded to professionally with accumulation, it might be prudent to save a bit of dry powder for the event of a final capitulation overnight Sunday and into Monday.

Just as was seen in the massive sell-offs in 2008 and May of 2011, premiums are skyrocketing for physical metal (APMEX Buy-back price for 90% is now a whopping $3 OVER SPOT!), and even if the paper price trades down to $22 and $1400 early next week, it wouldn’t surprise us at all to see price for physical metal not dip much below $1600 and $30.

We set an all-time sales record today at SDBullion- I think we burned through nearly 10,000 ounces of silver. Our suppliers wouldn’t even answer the phones. One of our suppliers informed us they had already sold thousands of ounces of gold and hundreds of thousands of ounces of silver… before noon!

The demand for physical is simply enormous, and will result in widening spreads and premiums between paper and physical metal.

Vampire Squid Must Eat: The Set-up Before Cyprus Forks Over Gold

This movie is getting old. It would be one thing if the Western banksters were actually tossing some scraps around as they rape and pillage future generations — the somewhat hidden outcome of the dumping of debt obligations on nations to “fix” the insolvency the bankers created in the first place. But these thieves have absolutely no honor. Policy makers in Washington DC and Western Europe are no better. Talk about a bought and paid for lot. If money and perks aren’t enough for these createns, blackmail “control files” serve as backstop.

Let’s unpack the latest statements from Goldman Sachs’ alumnus and current European Central Bank head Super Thief Mario Draghi. Alan — babble them into indifference — Greenspan could learn a thing or two from Mario about lying.

Draghi was quoted by Bloomberg, as SilverDoctors reported:

Asked about a letter he wrote to Cyprus President Nicos Anastasiades, Draghi said the letter is “very, very clear.” He said the government must abide by the central bank’s handling of the gold stock, since it is independent from political control under European rules.

“The independence of central banks in the euro area is enshrined in the treaty,” Draghi said. “The ECB will look at developments in Cyprus from this angle.”

Speaking alongside Draghi, Dutch Finance Minister Jeroen Dijsselbloem said selling gold “has always been an option put forward by the Cypriot authorities.”

“But as mentioned in the program documentation, this is a decision to be made independently by the Cypriot central bank,” he said. “And it’s not any demand from the troika or the eurogroup.”

The full Bloomberg story is linked within the original SilverDoctors.com article.

Any notion that the Cypriot Central Bank having independence from anything is farcical. If a robber walks into your house and sticks a gun to your head, perhaps Dutch Finance Minister Jeroen Dijsselbloem would arrogantly suggest, “Giving the robber your money has always been an option put forward by other hold-up victims.”

We need to go back in time to understand how the game (arguably, a scam) is played:

First, Cypriot banksters make bad loans, for which traditional capitalist system remedies such as placing banks into receivership are not called upon to honestly fix the mess. Next, the situation becomes a crisis as credit to the Cypriot banking system dries up, a perfectly natural and expected reaction by even rational and non-corrupt bankers who are unwilling to lend further to bad creditors.

Hang in here, dear reader. It’s about to get interesting.

What does Draghi and his Brussels Brethren do next? Why, of course, tell the Cypriot government they can turn to the oh-so-independent Cypriot central bank to issue special loans to insolvent Cypriot banks under a program called Emergency Liquidity Assistance (ELA). That has been going on long before the Cypriot crisis was worldwide news. The ECB authorizes this direct ELA lending by the Cypriot national bank, which includes more permissive collateral requirements to grease the injection of liquidity — because no real banker not backstopped by taxpayers socializing losses would make such risky loans to already hobbled creditors without permissive collateral requirements! Result? A weak and failing Cypriot financial system is turned into a liquidity crack dependent, flat on it’s back and at the total mercy of subsequent demands from the ECB.

The end game is now set-up. Draghi gets to slither around in his calm, technocratic demeanor, claiming that the Cypriot central bank has independence while the ECB and the Brussels Brethren demand that the Cypriot central bank sell its gold to cover the ELA credit issued to supposedly fix the insolvent banking system. It’s not just gold the banksters are after, by the way. Cypriot gold is just the icing on the cake. The bankster bad loan losses above and beyond the value of the gold are entirely socialized on the backs of the citizens of Cyprus, which enables Brussels to exert greater political control over Cyprus, a supposedly sovereign nation.

Meanwhile, not one in ten thousand media professionals have the intellectual curiosity to investigate this chain reaction setup. Even those journalists that do understand usually dare not speak truth to power lest they find themselves facing friction from their employers, who may very well be owned outright by financial sector interests (e.g., Bloomberg, and another fine example, CNBC, and it’s 49% owner, GE, which also happens to own shadow banking system titan GE Capital, etc.).

Mainstream Media that isn’t directly owned by the financial sector must deal with other challenges because they either have dependence on financial sector advertising directly, or are simply aligned with general corporate interests. The average man on the street has no hope of learning the truth without spending considerable time seeking out alternative resources like SilverDoctors.com and the observations of financial market professionals like myself — people that have exited the belly of the beast in disgust and are willing to describe the machinations of that beast’s incessant, criminal appetite because our paychecks are not beholden to the beast.

# # # # #

Tribute To Bill Murphy, Chris Powell And GATA: An Open “Letter” From Eric Dubin And SilverDoctors.com

Apparently, cartel actions have become so obvious that an increasing number of money managers feel compelled to speak up. The latest: well known money manager and former candidate for US Senate Peter Schiff. During a CNBC interview, Mr. Schiff has finally declared that gold might be manipulated in service of the Fed:

“I think goldman wants to knock the price down either because they want to buy more cheaper for themselves, or maybe they’re trying to help out their friends out at the Federal Reserve. They have a pretty cozy relationship. The Federal Reserve does not want the price of gold to go up because it invalidates everything that they’re doing. So, they might be manipulating the market for that reason.” - Peter Schiff

It took you long enough, but Mr. Schiff we welcome you to “planet reality.” Or, as Bill Murphy would say, “Welcome to planet GATA” (versus “planet Wall Street”).

For well over a decade, Bill Murphy, Chris Powell and GATA have tirelessly collected documentation proving the existence of the gold cartel, detailing how and why they act. Detractors usually focus on Bill Murphy’s tendency towards exasperation in the face of the mainstream media’s general refusal to investigate this ongoing activity. In truth, Bill Murphy has not been tilting at windmills. The cartel is real and Murphy’s righteous indignation — combined with a huge dose of Irish tenacity — has served him well as GATA’s leader.

Bill Murphy is an American hero in the most classic sense of the term. GATA is taking up the fight of the underdog, the average citizen unaware how distortions in the capital markets injure the economy and the lives of millions. Consequences of the cartel’s actions transcend manipulation of precious metals markets. Consider the Fed and US Treasury’s management of the bond market. Few media professionals find it odd that management of the bond market and the price of money (interest rates) is open public policy and ok to talk about. But talk about the management of the price of gold, which indirectly has a massive impact on interest rates and confidence required to support the exchange value of the US dollar, is strictly verboten.

Truth be told, in order for the Fed’s public policy of control of the bond market to work, fund managers, traders and other market participants MUST know about it. That’s the jawboning propaganda mechanics behind so-called “financial repression.” The whole point is to make market actors think, “don’t fight the Fed” while pretending interest rates can stay low, reflating the housing market while banks take part of the liquidity they receive from the Fed in exchange for the crap mortgage back securities banks hold. The so-called liquidity then flows into the stock market and beyond. Neat trick. All the while, the common man and generations after him get stuck with the tax bill to pay off all that added debt while banksters socialize their losses.

With scams this large, is it any wonder there’s a propaganda war against truth telling organizations like GATA?

Yes, there have been times when Bill Murphy makes market calls that fail. All rational analysts, traders and investors understand being wrong from time to time is normal. Yes, there have been times when Bill Murphy’s righteous indignation has led him to call a given day’s gold trading action cartel-driven when it probably wasn’t (although, the past year has witnessed an unusually high level of cartel activity). So what? When it comes to the big picture, GATA’s amassed documentation speaks for itself. GATA, Chris Powell — and certainly — Bill Murphy have integrity and guts. Rather than criticizing them, market participants should be opening their checkbooks and writing a tax deductible donation to GATA. Market participants should also get off their duff and actually read all the documentation freely available at GATA.org.

Perhaps Peter Schiff has finally done just that. Who’s next? Pretend cartel denier but otherwise brilliant James Grant of Grants Interest Rate Observer? Heck, it’s my opinion that even the otherwise non-dogmatic Rick Rule hasn’t even bothered to take a week, roll-up his sleeves, and carefully examine the GATA document treasure trove. How could I make such a seemingly preposterous statement about Eric Sprott’s right hand man? For starters, Rule makes no secret he’s a bit skeptical about at least the level of manipulation in the precious metals market. He describes himself as skeptical about the ability for conspiracies and agendas to be able to be hidden for extended periods of time. During a recent radio interview with Al Korelin, Rule noted how no matter what manipulation efforts he saw during his days in the Vancouver investment community, truth eventually came to light.

How quaint.

Mr. Rule, the world of Vancouver resource finance amounts to a backwater when compared to the massive geostrategic imperatives necessary to maintain the dollar as the world reserve currency — with all the benefits that accrue to the nation burdened with such an exorbitant privilege.

Don’t get me wrong. I deeply respect Rick Rule. His intellect is at genius level, and his abilities as an investor are legendary. I’m in my mid 40s. When I grow up I hope to have at least half his wisdom and mastery over as many fields as Mr. Rule. Nevertheless, someone has got to call him out because resting on assumptions and dogmatic logic about what markets should and should not do just isn’t good enough for someone as good as Mr. Rule. Mr. Rule didn’t make billions as a slave to normalcy bias, and it’s time he joins GATA’s apparent latest (albeit not credited) convert, Peter Schiff.

An ancient Chinese proverb comes to mind: “The beginning of wisdom is to call things by their proper names.”

Enough said.

Thank you, Bill Murphy, Chris Powell and all the people that have helped make GATA what it is today. There will come a day when you are seen for what you are: true American heros.

Sincerely,

Eric Dubin

http://hat4uk.wordpress.com/2013/04/13/gold-greed-global-collapse-who-benefitted-most-from-yesterdays-spectacular-fall/

GOLD, GREED & GLOBAL COLLAPSE: who benefitted most from yesterday’s spectacular fall

What you see above isn’t just the tale of a horrendous day for gold – it fell $88, or just over 4%, in a day – it is the record of a fall that steepened the minute New York opened, twice tried (and failed) to rally, and yet managed to do all this on a day when the vast majority of fundamentals should’ve been pushing the price up, not down.

The one exception to this was the Troika demand on Thursday that Cyprus sell its gold to help pay off debt. I have two observations to make about that: one, why do that to Cyprus now and not to anyone else before? And two, on paper it didn’t look like the sort of volume to start a gold freefall.

This is a murky business, so we need to consider it from all sensible angles.

The fundamentals

The US is degrading and diluting its currency, the UK’s austerity strategy is falling apart, the EU economy is flatlining, and Russia is massively overdependent on energy sales in a world where the outlook for energy consumption is awful: indeed, only the coldest european Spring for decades has enabled it to maintain any kind of momentum.

China’s slowdown now looks inevitable given the atrocious consumption outlook outside its borders, and US economic nerves tightened yesterday when the IMF cut its growth forecast for the year from 2% to 1.7%, alongside official figures confirming a 0.4% slump in retail sales in March – the biggest fall since last July. Factory output in the EU declined, and the north-south imbalance worsened as Slovenia edged towards the centre of the debt radar. Italy’s output fell by a disastrous 8%, and Portugal’s constitutional Court has rejected the Troika’s bailout plan. 41% of Germans no longer believe their banked money is safe.

The myth of Obama’s ‘recovery’ long ridiculed here is now clearly seen for the lie it was. The Cyprus ‘bailin’ has caused massive leakage of capital from the eurozone. The Troika’s Athens talks are acrimonious and stalled.

Every last indicator last week suggested a turning tide for gold as a hedge against currency devaluation, and as an asset which – even if it fell in value medium term – would be better than worthless paper. But that wasn’t the market mood, and it wasn’t what happened. To call that strange is like referring to the Krakatoa eruption as a small bang: worldwide gold demand in 2012 was another record high of $236.4 billion in the World Gold Council’s latest report. This was up 6% in value terms in the fourth quarter to $66.2 billion – the highest fourth quarter ever and real volume demand in the fourth quarter of 2012 was up 4% to 1,195.9 tonnes.

So who were the suspects behind what, I’m fairly sure this morning, was a massive fix?

The manipulation clues

The central banks bought gold at a rate ahead of market growth last year – which means their share of it grew.

Central bank buying for 2012 rose by 17% over 2011 to some 534.6 tonnes - the highest level since 1964. Central bank purchases stood at 145 tonnes in the fourth quarter – up 9% from the comparable period in 2011. Central banks have now been net purchasers of gold for eight consecutive quarters. This despite the non-stop stream of CB spin about there being no money-printing or inflation to get concerned about. Fancy that.

Did anything else make sense of this strategic decision by the Draghulas? Spookily enough it did. Last year, Basel III moved the goalposts on gold’s risk score, moving gold from tier 3 to quasi tier 1 status. Gold thus became “zero percent risk-weighted” in terms of credit risk – a whopping upgrade for the shiny metal. But to buy lots of it (and thus reduce risk-panic among investors) one needs the price to go down.

And guess what? Despite that massive Central Bank buying splurge since late 2010, gold has hovered and wobbled, been weak in its challenging of top prices – and persistent in challenging lows. Or put another way, the exact opposite of what the first rule of Supply and Demand dictates. My oh my.

The Guardian this morning ran a truly daft piece saying that ‘gold fell to its lowest level in more than 18 months on Friday night amid fears that sales of the precious metal forced on Cyprus by its desperate financial plight would lead to wholesale dumping by hard-pressed countries in the coming months’. Pardon me Gruauniad, but “Bollocks”. The sum total of Cypriot selling required is €400m tops. That is a flea-bite on the ankle of the gold sector.

More pertinent, perhaps, is that the Cyprus sale (1) enabled the CBs to buy still more of it, and (2) provides an excuse for the price fall that naifs might accept at face value.

Other potential culprits are also implicated. During January 2013, the COMEX gold futures platform pushed expectations for the price up by 8.3%. One wonders who pushed it in that direction, and why. What’s more, over the last 90 days without any announcement, stocks of gold held at Comex warehouses plunged by the largest figure ever on record. JP Morgan Chase’s reported gold stockpile dropped by over 1.2 million ounces – a staggering $1.8 billion dollars worth of physical gold in just 120 days. The owners involved took their metal offsite, and it’s no longer stored in Comex warehouses…did they do so from a lack of trust? Or did they know something we didn’t?

Then there’s the chance that the Fed itself was trying to reduce its cost of returning gold: Germany’s Bundesbank recently announced it would be moving a major portion of its reserves from the US and all of its reserves from France back to Frankfurt. Nearly half of Germany’s gold reserves are held in a vault at the Federal Reserve Bank of New York. Nice way to reduce loss of face on safe assets if you work for Washington.

Is there a bottom line here?

There is, but I don’t think one can see the exact nature of it just yet. What seems to me clear, however, is that this was a fix….and Cyprus was a cover story for it, not the reason why.

On balance, it feels to me like some leaking, some massaging, and some reduction in the cost of global looting. But whatever: next week is indeed going to be interesting.

http://www.zerohedge.com/news/2013-04-10/goldman-buying-gold-selling-treasurys-muppets-whom-it-advises-do-opposite

Goldman Buying Gold, Selling Treasurys To Muppets Whom It Advises To Do Opposite

Submitted by Tyler Durden on 04/10/2013 07:22 -0400

There was a brief period of confusion for a while when Goldman didn't have clear muppet-stomping trades on the book, and those who wished to frontrun the Goldman prop desk (and do the opposite of the muppet flow) were stuck furiously scratching their head. And granted while it's not a "Stolper", tonight we got two gifts (in the parlance of Whitney Tilson) with Goldman first telling its clients to sell gold following Goldman's lowering of its price target for the yellow metal (which as always means the hedge fund known as Goldman is buying what its clients are selling). And then, moments ago, we also learned that Goldman is also selling the 10 Year, which it advise muppets to buy.

First on gold:

Given gold’s recent lackluster price action and our economists’ expectation that the acceleration in US growth later this year to above-trend pace will support US real rates, we are lowering our USD-denominated gold price forecast once again. Our new forecast is further below the forward curve with year-end targets of $1,450/toz in 2013 and $1,270/toz in 2014. As a result, we recommend closing the long COMEX gold position that we first initiated on October 11, 2010 for a potential gain of $219/toz, with the risk reversal overlay expired on March 25. Our long-term gold price forecast (2017+) remains at $1,200/toz: while higher inflation may be the catalyst for the next gold cycle, this is likely several years away.

Or several months ago if you are the price of unleaded gas in Tokyo and pretty much anything else. It gets better:

While there are risks for modest near-term upside to gold prices should US growth continue to slow down, we see risks to current prices as skewed to the downside as we move through 2013. In fact, should our expectation for lower gold prices continue to prove correct, the fall in prices could end up being faster and larger than our forecast, as aggregate speculative net long positions across COMEX futures and gold ETFs remain near record highs. We therefore recommend initiating a short COMEX gold position as our ECS Top Trade #8, implemented through an S&P GSCI® front-month rolling index to further benefit from the contango in the COMEX future curve, targeting a move to $1,450/toz with a stop at $1,650/toz. While we may be end up too early in entering this trade, we prefer that to being late given our belief that the skew to current prices is to the downside.

Remember, however, to please execute the trade with your friendly Goldman trader, who will gladly buy all the gold you have to sell all the way down to $1450.

And just out moments ago, Goldman goes bearish (like everyone else) on the 10 Year - because you see, nobody has heard of the perpetually wrong "Great Rotation" call in 2010... or 2011... or 2012.... or 2013... Or at least Goldman clients haven't. And apparently not the Fed, which just can't get enough of buying just this.

We recommend going short 10-year US Treasuries via June futures (TYM3) at the current level of 132-20 for an initial price target of 130-00 and stops on a close above 134-00. In yields space, the corresponding move is from the current 1.76% to around 2.10%, and stops on a close around 1.60% - corresponding to the lows from last November.The rationale for our recommendation rests on the following four considerations:

- The valuation case for shorting Treasuries has become more compelling after the decline in yields following a worse-than-expected US jobs report and the BoJ’s easing. Our assessment of the macroeconomic outlook for the US and the main advanced economies has not changed; if anything, it has improved following the large fiscal and monetary stimulus in Japan.

- The market appears to have already factored in a softening in US growth during the second quarter, after a stronger-than-expected first quarter. Our US GDP Growth Basket (a ‘tracking portfolio’ of US real GDP growth) has retraced all the gains recorded between last November and mid-February. This should protect the trade should the forthcoming batch of macro data, starting with retail sales this Friday, be weaker than earlier in the year. That said, a near-term risk to the trade stems from an escalation of tensions in North Asia. So far, these developments appear to have had a small impact on global asset prices.

- We think the most persistent part of the BoJ's ‘surprise’ is a flattening of the 10s-30s segment of the yield curve. This is mostly a domestic play, with limited spill-over effects for overseas fixed income markets. We have likened this move to that resulting from the Fed’s ‘Operation Twist’: the slope of the ultra-long-end of the Treasury has remained in a 60-80bp range, while the level of 10-year yields has moved around. Interestingly, 10-year Japanese yields are heading back to pre-BoJ announcement levels.

- Treasury bond futures have tried to break above the upper end of a broad price range in place since July 2012, and failed. Short positioning in the rates market is lighter, according to anecdotal evidence.

Thank you Goldman - we can always rely on you.

Real metal isn't backing up short sales, Maguire tells King World News

Submitted by cpowell on Sat, 2013-04-13 01:34. Section: Daily Dispatches

9:30p ET Friday, April 12, 2013

Dear Friend of GATA and Gold:

London metals trader Andrew Maguire tells King World News tonight that no real metal is appearing to support the naked shorting of gold in the futures markets. "That official sellers are even more reliant on massive coordination of mainstream media and verbal interventions to back up these virtual sales, it's not going unnoticed by Middle-Eastern and Eastern-centric central banks and sovereigns." An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

China absorbs huge amounts of gold amid futures shorting: Maguire

Submitted by cpowell on Fri, 2013-04-12 17:24. Section: Daily Dispatches

1:21p ET Friday, April 12, 2013

Dear Friend of GATA and Gold:

London monetary metals trader Andrew Maguire today tells King World News that huge volumes of gold are moving to China amid the pounding of the gold price in the futures market. Maguire thinks that central bank purchases soon will overwhelm futures market shorting. An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Fed smashing metals to guard dollar against hyperinflation, Roberts tells KWN

Submitted by cpowell on Fri, 2013-04-12 21:06. Section: Daily Dispatches

5p ET Friday, April 12, 2013

Dear Friend of GATA and Gold:

Former Assistant Treasury Secretary Paul Craig Roberts tells King World News today that the smashing of gold and silver prices is a Federal Reserve campaign to defend the U.S. dollar against a hyperinflationary scenario.

"The exchange value of the dollar is threatened," Roberts says, "and if that collapses the Fed loses control over interest rates. Then the bond market blows up, the stock market blows up, and the banks that are too big to fail, fail. So it's an act of desperation because they've got to establish in people's minds that the dollar is the only safe place, it is the only safe haven, not gold, not silver, and not other currencies."

An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

http://www.caseyresearch.com/gsd/edition/lawrence-williams-gold-price-manipulation-the-never-ending-game/

¤ YESTERDAY IN GOLD & SILVER