Cyprus news items......

http://www.zerohedge.com/news/2013-04-12/cyprus-central-bank-shambles-following-third-board-member-resignation

http://www.zerohedge.com/news/2013-04-12/mario-draghi-orders-cyprus-sell-gold-cover-bailout-shortfall

and.....

http://www.nakedcapitalism.com/2013/04/troika-demands-another-e6-billion-from-cyprus-making-rescue-bigger-than-gdp.html

http://www.zerohedge.com/news/2013-04-12/cyprus-central-bank-shambles-following-third-board-member-resignation

Cyprus Central Bank In Shambles Following Third Board Member Resignation

Submitted by Tyler Durden on 04/12/2013 13:17 -0400

Perhaps the most underfollowed story of the day is the blatant takeover of the Cypriot Central bank by the ECB, which as we reported earlier, has been ordered to sell their gold by the ECB's Mario Draghi, even though the disposition decision of the "independent" central bank of the now insolvent nation is supposedly theirs. First it was this:

- PANICOS DEMETRIADES SAYS CYPRUS CENTRAL BANK INDEPENDENCE UNDER ATTACK,

- DEMETRIADES SAYS GOVT WANTS TO SELL GOLD WITHOUT CONSULTATION.

And now we learn that not one, not two, but three board members of the central bank have called it a day:

- THIRD BOARD MEMBER OF THE CYPRUS CENTRAL BANK RESIGNS - CYBC

We are sure there are at least a few more board members who can resign topped off by Panicos himself bailing, before the entire central bank implodes, and there is nobody left in charge of the now obsolete monetary policy apparatus. What happens then: will Goldman appoint a new "technocratic" Board and governor, or will the country finally confirm that all European lies about member bank Independence is just one big lie?

http://www.zerohedge.com/news/2013-04-12/mario-draghi-orders-cyprus-sell-gold-cover-bailout-shortfall

Mario Draghi Orders Cyprus To Sell Gold To Cover Bailout "Shortfall"

Submitted by Tyler Durden on 04/12/2013 11:52 -0400

Update, and sure enough:

- PANICOS DEMETRIADES SAYS CYPRUS CENTRAL BANK INDEPENDENCE UNDER ATTACK,

- DEMETRIADES SAYS GOVT WANTS TO SELL GOLD WITHOUT CONSULTATION.

- CYPRUS CENTRAL BANK GOV DEMETRIADES SAYS HE AND HIS FAMILY RECEIVED DEATH THREATS

As a reminder, Panicos holds the now obsolete position of head of the Cyprus Central Bank.

* * *

As was noted two days ago (so certainly not the news catalyst for today's gold sell off as some are trying to make it appear) as part of itsbailout expansion by 35%, Cyprus announced, then refuted, then re-admitted, it would need to fund a portion of the incremental €7 billion in cash demands by selling €400 million, or nearly all 13.9 tons, of its central bank gold. Today, we learn that this demand came from none other than the head of the ECB Mario Draghi. Bloomberg reports: "European Central Bank President Mario Draghi said the profits of any gold sales by the Cypriot central bank must be used to cover losses it may sustain from emergency loans to Cypriot commercial banks."

Of course, to make it seem that the Cyprus central bank is "independent", the "European creditors today left a possible gold sale in the hands of the Cypriot central bank, which manages 13.9 metric tons of the metal, according to the World Gold Council." Naturally, it would not be very politically correct to give the impression that it is none other than the collateral and asset-starved European central bank that is effectively running local monetary policy of its member states, and certainly would not make Cypriots, already devoid of their uninsured bank deposits, happy that the next demand by the ECB for the privilege of staying in the EUR is for them to hand over the only real asset their country has.

More from Bloomberg:

“The decision is going to be taken by the central bank,” Draghi said after a meeting of euro-area finance officials in Dublin. “What’s important, however, is that what is being transferred to the government budget out of the profits made out of the sales of gold should cover first and foremost any potential loss that the central bank might have from its ELA.”ELA stands for Emergency Liquidity Assistance, a lifeline that can be offered by national central banks in the euro region to commercial banks that can’t get funding.Asked about a letter he wrote to Cyprus President Nicos Anastasiades, Draghi said the letter is “very, very clear.” He said the government must abide by the central bank’s handling of the gold stock, since it is independent from political control under European rules.“The independence of central banks in the euro area is enshrined in the treaty,” Draghi said. “The ECB will look at developments in Cyprus from this angle.”Speaking alongside Draghi, Dutch Finance Minister Jeroen Dijsselbloem said selling gold “has always been an option put forward by the Cypriot authorities.”“But as mentioned in the program documentation, this is a decision to be made independently by the Cypriot central bank,” he said. “And it’s not any demand from the troika or the eurogroup.”

In other words, central banks are independent, except for when the ECB tells them to sell gold to cover losses for loans made by collateralizing already worthless assets, or simply created out of thin air and backed by the full faith and credit of the Euro.

Naturally, for every seller of gold, there is a buyer. The only question now is whether Cyprus' gold will end up in the willing hands of China, Russia or the very ECB telling it to sell the gold, and at very depressed prices at that.

Finally recall that the Fed and BOJ are now injecting about $160 billion in newly created money in the G-7 market every month, and there is no end in sight to said monetarily dilution, a number which is set to rise to at least €200 billion once the BOE joins the fray this summer once Mark Carney finally arrives.

In this context, one wonders: should one side with those who are selling their gold, or those who are buying it, such as Goldman whichadvised its clients two days ago to sell their gold to Goldman's willing traders...

and.....

http://www.nakedcapitalism.com/2013/04/troika-demands-another-e6-billion-from-cyprus-making-rescue-bigger-than-gdp.html

FRIDAY, APRIL 12, 2013

Troika Demands Another €6 Billion from Cyprus, Making “Rescue” Bigger Than GDP

Nothing like dramatic proof that austerity is a failure. Less than one month forcing Cyprus to take a “bailout” (which in reality was paid for entirely by the Cypriots) under the threat of effectively throwing them out of the Eurozone, a leaked Debt Sustainability Report shows that that the Troika will demand another €6 billion from Cyprus, increasing the total cost from €17 to €23 billion. From theGuardian:

Cypriot politicians have reacted with fury to news that the crisis-hit country will be forced to find an extra €6bn (£5bn) to contribute to its own bailout, much of which is expected to come from savers at its struggling banks.A leaked draft of the updated rescue plan, which emerged late on Wednesday night, revealed that the total bill for the bailout has risen to €23bn, from an original estimate of €17bn, less than a month after the deal was agreed – and the entire extra cost will be imposed on Nicosia.

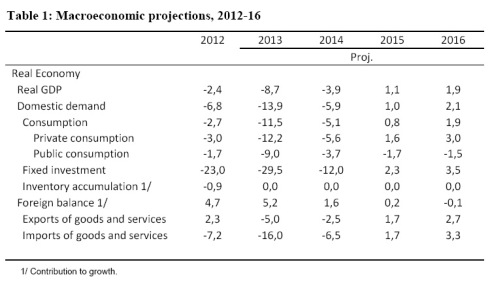

The worst is, as Pawel Morski demonstrated in an impressive shred of the Debt Sustainability Report is that it is ludicrously optimistic in terms of how the economy will fare with Germany having decided to kill its international banking sector (this while the EU is funding advertising for Bulgaria, which is low tax jurisdiction, the very sin Cyprus was guilty of):

1) the economic forecasts are worse than literally laughable (table) . The drops in consumption and investment look dementedly optimistic given the events of the past month. Exports to drop a mere 5% with the destruction of the banking industry and the introduction of capital controls. The wealth effect wiping deposit worth 60% of GDP will apparently barely register on consumption – the Troika must think the deposits are all Russian. Compare with Iceland (50% drop in investment) or Latvia (40%), the former boosted by devaluation the latter by an intact financial system. Public consumption drops 9% – Iceland held the line here, and we have bitter experience from Greece on how big fiscal multipliers are. These projections cross the line from wild optimism into contemptuously half-hearted fable. This table is a bare-faced lie.

So get this, sports fans: not only did the Eurocrats underestimate how badly their little program would hurt the economy, they are continuing to underestimate how brutal it will be. Morski notes later:

The banking sector shrinks. The domestic banking industry shrinks at a stroke from 550% of GDP to 350% by a deft combination of taking people’s money and stripping the Greek operations (120% of Cypriot GDP) out and selling them to Pireaus. Given that the Greek operations were to a significant degree responsible for the disastrous GGB trades that wiped out the banks, and given that Pireausstock rallied sharply afterwards, the Cypriots find themselves in the position of the Blackadder character who not only had a relative murdered, but had to pay to have the blood washed out of the murderer’s shirt. (excellent stuff here on how the Cypriot banks blew up, based on leaked documents).

Of course, this means at a minimum, that uninsured depositors in Laiki and the Bank of Cyprus will not get any money back.

The Troika is also demanding that Cyprus sell 2/3 of its gold. That’s a mere €400 million; this looks like gratuitous punishment, to make it clear to Cypriots that they are being reduced to penury….for what? Ambrose Evans-Pritchard argues that it is long-awaited payback (emphasis mine):

It is an interesting question why Cyprus has been treated more harshly than Greece, given that the eurozone itself set off the downward spiral by imposing de facto losses of 75pc on Greek sovereign debt held by Cypriot banks.And, furthermore, given that these banks were pressured into buying many of those Greek bonds in the first place by the EU authorities, when it suited the Eurogroup.You could say that this is condign punishment for the failure of Cyprus to deliver on its side of the bargain on the 2004 Annan Plan to reunite the island, divided by the Attila Line since the Turkish invasion in 1974.

Greek Cypriots gained admission to the EU on the basis of a gentleman’s agreement, then resiled from the accord. President Tassos Papadopoulis later deployed the resources of the state to secure a “No” in the referendum on the Greek side of the island. No wonder the EU is disgusted.But there again, Greece behaved just as badly. It threatened to block Polish accession to the EU unless a still-divided Cyprus was admitted, much to the fury of Berlin.

The Cyrpiots appear to be rebelling a bit against the Eurozone authorities again, despite the fact that the response last time was to rough the islanders up even more. The Financial Times reports that the ECB is ordering Cyprus not to fire the head of its central bank:

Mario Draghi, president of the European Central Bank, has warned the Cypriot government against sacking Panicos Demetriades, the central bank governor, over his handling of Cyprus’ worsening financial crisis.

In a letter addressed to the Cypriot president and speaker of parliament, the ECB head underscored the independence of EU central banks, adding that the launch of procedures that could lead to a governor’s dismissal marked “a very serious step”.A decision to remove the governor would be subject to review by the EU court of justice, he said…The Cyprus parliament’s ethics committee said on Wednesday it would investigate Mr Demetriades’ record in the year since his appointment to determine whether he had acted against the public interest by failing to avert the collapse of Laiki Bank, the island’s second-largest lender.If the committee rules against him, the Cyprus attorney-general would decide whether Mr Demetriades should be indicted on criminal charges.The rift between Mr Demetriades and the government appeared to widen further on Thursday when a central bank spokesperson said the bank, not the finance ministry, should decide on the sale of gold reserves to help finance Cyprus’s €13.5bn contribution to a €23.5bn international bailout.

Someone might tell Draghi it isn’t clear whether Demetriades is being pushed or jumping (hat tip Antonis):

While the speed of the retrade of the Cyprus deal is dramatic, it is hardly alone in having targets fail to be met because austerity is counter-productive, leading to additional bailouts and even more exquisite economic tortures, necessitating yet more bailouts. Greece is up to three. The Troika is recommending restructuring Irish and Portuguese bailout loans by extending their maturity seven years, but it’s not clear that this will be enough to keep Portugal from needing a second rescue. Slovenia looks like an early stage Cyprus. The Netherlands have gone wobbly. And of course, Spain and Italy are on the “bailout soon” list too, but they’ve held out due to understandable reluctance to accept “conditionality” aka loss of sovereignity, complicated in Italy by the usual government instability and the rapid rise of anti-Eurozone politicians.

And that’s before we see whether the rough handling of Cyprus leads to a resumption of the slow-motion run on banks in the periphery, as those who can shift balances to banks in the Germany and safer havens. But not to worry, all those Eurobanks passed stress tests, so everything is fine, right? Unfortunately, we may find out sooner than we’d like.

http://www.eurointelligence.com/

April 12, 2013

0

Cyprus extends capital controls, but relaxes thresholds

The government of Cyprus has extended the capital controls for another week, but relaxed the restrictions. The Wall Street Journal reports that the size of domestic transfers for businesses has been increased from €25,000 to €300,000, and the limit on transfers abroad from €5000 to €20,000. Travellers can now take €2,000 on a trip abroad. But the daily withdrawal limit at cash machines remains capped at €300.