GUIDE

As Cyprus scrambles from Plan A ( deposit tax ) , Plan B ( solidarity tax but not deposit snatch , social security funds snatch , state assets snatch , Church of Cyprus assets snatch - all to be used to conjure up for sovereign debt ) , back to Plan A beta version - are the Cyprus political singling this sweet song to Russia ( "ready to love you forever " - just give me 5 - 6 billion euro now , extend the existing loans forever and chop the interest rates to negative numbers , baby ...... )

http://economia.elpais.com/economia/2013/03/20/actualidad/1363809937_713544.html

The ECB threatens to cut off credit to the Cypriot banking next Tuesday

Nicosia says that without more money from the banking system Frankfurt weeklong

The German member of the ECB Executive Board, Jörg Asmussen (left), talks with the bank's president, Mario Draghi. / EFE

Negotiations with Cyprus is like a muscle move. The Eurogroup bet big with the terms of the bailout . Nicosia raised the stake ( in rejecting the European proposal ) and now the European Central Bank (ECB) has launched the cracking. After the feast of Greek Independence Day, Monday, Tuesday is scheduled to open Cypriot banks. However, if the Eurogroup and Cyprus have agreed to that Tuesday, there will be no money to remove the windows.

So far, the bodies of the island have limited quantities delivered by the ATM, but have cut all wire transfers and online payments. According to the Ministry of Economy, no hose ECB liquidity, there will be no money for a week. Probably much less time.

If the threat is met, Cyprus will enter bankruptcy. And then it will come to the island chaos and serious problems for the entire eurozone by collateral damage and the serious consequences that could have the first bankruptcy in the euro zone. Since 2011, the banking Frankfurt Nicosia is subsidized to a greater or lesser extent, according to the Economy. This situation worsened in 2012 when it was applied to the Greek debt removes one of the major assets in which banks invested Cypriots. Another activity was to lend to Greek companies, who also live very bad moments.

Jörg Asmussen, the German representative on the board of the ECB, was positioned in the same sense as economics. According Asmussen entity chaired by Mario Draghi will not give liquidity to banks Cypriots if no agreement on the bailout that allows recapitalize.

The ECB can "provide emergency liquidity to solvent banks only," Asmussen said in an interview with the German weekly Die Zeit . "The Cypriot bank solvency can not be taken for granted unless stated soon an aid program for the timely recapitalization of the banking sector," he stressed.

Obviously, if banks are emptied, the hole would be even greater because Cyprus insolvency would be absolute. On the rate to depositors, Asmussen said that this is a solution "only" for Cyprus by imbalances of its banking sector, which in his opinion are not found in any other Member State. However, Cyprus is not the only center off shore (where non-residents are not taxed) of the euro area because Luxembourg has the same taxation.

According to sources of the Eurogroup, in a time of negotiation Nicosia said it could reduce the amount of 2,000 million rescue the heritage of public pension funds. This money would be invested in bank shares to bolster capital. The IMF dismissed this idea by arguing that implicitly would raise public debt as Cyprus in this figure, since the state is responsible for the health of the banking system.

and so drop dead day is now Tuesday ?

http://www.nakedcapitalism.com/2013/03/cyprus-will-the-mouse-that-roared-be-gored.html

WEDNESDAY, MARCH 20, 2013

Cyprus: Will the Mouse That Roared be Gored? (Updated)

Cyprus, as its President Nicos Anastasiades predicted but no one outside Cyprus quite believed would happen, has resoundingly defied the will of the Eurozone in failing to surrender a single Parliamentary vote to a diktat to haircut depositors to save its number two bank, whose failure would in all likelihood bring down Cyprus’s entire banking system. The members of the President’s own party abstained despite his resigned support for the deal. And mind you, this was after the terms revised to allow for deposits under €20,000 to be spared.

The EU was utterly unprepared for this rebellion. Heretofore, threat of withholding of funds and financial armageddon were sufficient to bring legislatures and national leaders to heel. Anastasiades, by contrast, didn’t even try to keep Parliament voting until the results changed. The finance minister tendered his resignation as an admission of failure but Anastasiades rejected it and has him negotiating with the Russians, at a minimum to restructure a €2.5 billion loan from 2011 but clearly to see if Russia will ride in to the rescue.

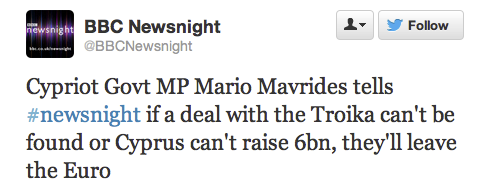

Although I have not seen an official announcement that banks will remain closed beyond their last scheduled opening time of this Thursday, it now appears the new target date is next Tuesday. Cyprus seems to be working on several backup plans in parallel (more on that later): a good bank/bad bank plan, trying to persuade Russia to bail it out, and leaving the Eurozone. Note that it is also working to put capital controls in place; these seem inevitable even if, miraculously, the Russians decide to write a very large check (although those controls might be less restrictive than under other scenarios). But absent a retreat by the Troika (which seems extremely unlikely) or a big Russian bailout (which is also unlikely but less so), it seems difficult to imagine than any other plan could be implemented by next Tuesday (eg, either a bank restructuring or a Euroexit). So considerable dislocation is likely to result, with unknown but potentially serious knock-on effects.

The reaction from Germany was vitriolic. From the BBC:

Germany’s finance minister has warned Cyprus that its crisis-stricken banks may never be able to reopen if it rejects the terms of a bailout.Wolfgang Schaeuble said major Cypriot banks were “insolvent if there are no emergency funds”.

In reality, this was merely repeating the ultimatum he’d apparently issued when delivering the deposit haircut, um, tax ultimatum last week, but there’s a big difference between a private threat and a public one.

But despite the browbeating, the Germans appear to realize they’ve created a huge problem for themselves. It’s key to understand that this crisis was created by the Troika. Cyprus asked for a bailout nine months ago and the deadline is a bond payment this June. And while it has become fashionable to pin the blame for this mess on Cyprus, the backstory is more complicated. From Cyprus.com:

Not all the banks are in the same condition.(a) Cyprus has two money-center type banks: Laiki (Popular) Bank and Bank of Cyprus.(b) Laiki was purchased by a Greek vehicle (Marfin Investment Group) backed by Gulf money. Marfin’s purchase of Laiki took Laiki from being a fairly conservative local bank to being highly exposed to Greece. Laiki is definitely insolvent and needs to be restructured.(c) Bank of Cyprus has been more conservative vis-a-vis Greece, but still has meaningful exposure. It is conceivable that, given time, Bank of Cyprus could survive.(d) Beyond the main two banks, there is Hellenic Bank (a much smaller bank with much less Greek exposure), Cyprus Development Bank (no Greek exposure), the Co-ops (no Greek exposure) and the Cyprus subsidiaries of foreign banks (aka, Russian, English, etc banks), also with no Greek exposure.(e) All the local oriented banks (BoC, Laiki, Hellenic, Coops) have exposure to the local real estate market that went through a bubble during the 2000-2009 period. This exposure however is not short-term and could be resolved over the period of years. It is a problem, not a crisis, and is offset by the fact that the two main banks have quasi-monopolistic earnings power locally. Given the time and some financial represssion (a la the United States) and the local issues would be manageable.

In other words, the bank that is the epicenter of the problem was driven into the ditch by foreign buyers. Now admittedly, the local bank supervisors did nothing to stop that, but can you point to a single national bank regulator (ex the Canadians) that put much in the way of constraints on their banks prior to the crisis?

And the idea that Cyprus is a hotbed of Russian Mafia money also appears to be exaggerated. This looks to be a combination of a need to scapegoat the latest supplicant to the Trokia plus Anglo-German prejudice against Central and Southern Europe.

Not to put too fine a point on it, Wachovia laundered over $800 million of Mexican drug money, and Standard Chartered admitted to “at least” $250 billion of Iran related money laundering. And HSBC, which paid the biggest fine ever in the US for drug-related money laundering for Central American groups, is now being charged by Argentina for similar activities. Let’s not kid ourselves. Citigroup has had a huge wealth management business, concentrated on Latin America, since the 1980s. What do you think that is about? To a significant degree, like Swiss private banks, Citigroup is the recipient of funds expropriated from national governments. For people like Martin Wolf of the Financial Times to get sanctimonious about what Cypriot banks are up to is more than a tad disingenuous, particularly when his own paper, the same day, describes how five Russian M&A transactions are having to be reworked due to the bank freeze in Cyprus. Yes, there is clearly dirty banking going on there. But it appears only 28% of the deposits are Russia related. A significant, if not overwhelming amount of that activity appears to be no worse than GE’s tax avoidance. And remember, depositors of every bank are being haircut to bail out the miscreant Laiki. That includes the roughly €3 billion of largely Russian deposits in the perfectly solvent Cyprus subsidiary of the Russian bank VTB.

The bail-in demand was sprung on Anastasiades with no warning, apparently in the hope that a new President would cave. That looks to have been a serious miscalculation.

Handelsblatt, for instance, was handwringing over the Cypriot refusal, stressing that it put the EU in an untenable situation. The second largest bank, Laiki, will become ineligible for ELA loans without a rescue. But as Schaeuble has said, Cyprus’s entire banking system is at risk under that scenario. And the EU has designated Cyprus as systemically important. So letting it founder would be “almost impossible”. At the same time, the Germans are acutely aware of the risk of letting a country defy them and win concessions as a result. In the charming broken English of Google Translate:

…the Euro-rescuers are in a dilemma: either they lose even more confidence or help Cyprus – no matter what the cost.Buckling would be long-term effects. “The signal for future bailouts would be fatal,” says [Nicolaus] Heinen [Europe expert at German Bank Research]. “Conditions for future bailouts could be formulated even softer to prevent the negative attitude of the parliaments catching on.”

This issue was not lost on other countries. For instance, KeeptalkingGreece, in Greeks stunned to hear Cypriot MPs attacking EU and reject the bailout, wrote (hat tip Richard Smith):

Greeks are deeply stunned and green from envy, to hear the debate inside the Cypriot Parliament during the crucial voting on bank deposits tax….a friend called me.“Look at them, look at them. They say NO to Troika, they will down vote the bank tax and our politicians said Yes to every dot and comma imposed by the Troika. Shame on them!”…Unbelievable things are spoke, down there in the Cypriot Parliament.Something that neither conservative Nea Dimocratia nor socialist PASOK ever did. Every parliament debate before loan agreement voting turned to a blame-game between the two parties that governed the country for almost four decades and ruined it with their policies.Instead for fighting a minimum of negotiation, they instead signed one loan agreement after the one and caused sheer panic among the Greek citizens with the total economical state collapse. As if we the loan agreements, we do have heating oil or medicine for our patients….

And where might the Cypriots go from here? It’s important to understand that Cyprus only had options ranging from bad to worse, thanks to the ham-handed EU intervention. Even if the Parliament had accepted the depositor cram-down, the very announcement of the idea has done tremendous damage to the banking system. You can expect capital flight, even with controls in place. This bailout is certain to be inadequate merely due to the economic impact of the loss of wealth. That almost assures a second goring of depositors. Why sit around and wait for that to happen? And you can’t be an international banking center with capital controls in place.

Now the IMF is supposedly working with Cyprus on a good bank/bad bank plan for its two biggest banks. But I can’t fathom how that works, since, as Macro Man pointed out, the real point of a good bank/bad bank plan would be to leave all those nasty English law bonds that would normally have been hard to restructure in the bad bank (now maybe the IMF is actually up for stiffing those investors, who knows). But you’d need also to have a hard look at what authority the local banking regulator has, and what resolution procedures are like (bank seizures and liquidations are basically special variants of bankruptcy law that apply only to banks). And as we indicated, this solution still torches the international banking business in Cyprus and thus will put the economy into a serious recession, if not a depression.

Second is to leave the Eurozone. This is not an idle threat.

As you can tell from above, the Troika has done so much damage already that the incremental costs of leaving the Eurozone would likely be considerably offset by depreciating the currency and being able to stimulate the economy by deficit spending. They also have greater hope of restoring something in the way of an international banking business after the shock of the currency devaluation wears off than they do under the tender ministrations of the Troika.

The cynic in me wonders if the crippling Cyprus international banking business is not simply an accidental by-product, but in fact was the motivator for the ambush of the new President. As the Financial Times indicates, legitimate Russian businesses are scrambling to move their deals to other tax haven centers, like Luxembourg. Remember that Russia is funneling arms to Syria. That means paying arms merchants. I would assume it’s harder to move those payments quietly through banking centers in the US or UK banking complexes than one largely outside it (well, you can always use overinvoicing and other tricks, but I assume that is more cumbersome).

Now the Eurozone is actually not keen about the idea of a Cyprus exit, since any country leaving raises the ugly possibility that someone else will depart. That in turn will lead to deposit flight of the countries seen to be most at risk (Portugal, Spain, Italy). That was straining the Eurozone prior to the OMT, which managed to calm down depositors enough to arrest money-moving. If the Cypriots were to impress upon the Troika that they were deadly serious about leaving, there is a small possibility that the Troika will blink and allow the ECB to keep funding Laiki while they wrangle. I am not certain that this leads to happy endings so much as keeping a tense situation in play.

The final alternative is that Russia stumps up enough cash to salvage Cyprus. Cyprus approached Russia nine months ago for assistance and was rebuffed, but as we will discuss, there has been one change in the interim that might lead Russia to change its posture.

To take the EU out of the question entirely is probably on the order of €30 billion, which seems a tall order for a €17 billion or so economy before the Eurozone stomped, Godzilla-like, all over its international banking business. Many people have focused on the rumor that Gazprom had offered to lend €13 billion in exchange for development rights in offshore gas fields, which Gazprom later denied. Now aside from the fact that these fields no doubt have others vying for development rights, the Troika would also probably want to retrade a deal that had Russians getting their hands into the country’s major economic asset. So even if Gazprom resurfaces, it is unlikely to act as a savior.

But Cyprus has another asset which the Eurocrats seem to have forgotten about: its real estate. Cyprus has a major airbase which is important to British operations in the Middle East. As reader Claudius pointed out in comments yesterday:

What has really pissed-off Russia was when, despite denials and assurances from the US state department, a meeting was held in Ankara (November 2012) with the American Ambassador to Cyprus, John Koenig, along with British, Greek and Turkey government heads. The meeting discussed a plan: British bases in Cyprus will be turned into NATO bases – the ‘three-party guarantee’ of Britain, Turkey and Greece will be abandoned – and NATO will take over. America wants its ships there.However, there was one small snag; for Cyprus, the plan is neither legal nor constitutionally permissible. When, last year, Nikos Anastasiades pushed for a majority in the Cyprus parliament to vote for and pass an act for the Cyprus to join NATO’s ‘Program for Peace’ (PfP); Cyprus being the only member of the 27-nation European Union that is not in NATO. President Christofias (whom helped broker the Russian $2.5Bln investment) vetoed it, citing that the act violated the Constitution and the separation of powers (one of Cyprus’ ‘basic principles’) as the PfP is neither “an international organization nor a treaty of alliance”.Nevertheless, and much to the Russia’s chagrin, the UN Secretary-General’s Special Advisor on Cyprus Alexander Downer has continued to develop talks with, now, Prime Minister Anastasiades whereby British bases in Cyprus will be handed to NATO as part of a new ‘Cyprus Peace Plan’ (one that encompasses PfP).How long the veto is, somehow, voided or nullified, is not an easy guess. So, if Russia can buy time, presence and influence in Cyprus by paying $30Bln to bail out Cyprus and save the day, it can keep NATO out and import all the couscous it wants; it’s a bargain.

Now €30 billion is a lot to pay for a soft assurance and to merely serve as a spoiler for an uncertain period of time. A more hardball strategy would be military Keynesianism. Russia would love to have a port in the Mediterranean, or alternatively, an airbase (Cyprus apparently has four big ones, one its main commercial airport, one the British airfield, one dormant one in DMZ and one in the north. Query whether there are any open or low population areas that could be converted to an airbase).

Now would Russia get very far with a scheme like that? The Americans and Nato would go absolutely bonkers. I’m not sure how this would game out, but the mere announcement of a Russian-Cypriot pact would put the US, England and Germany in overdrive figuring out how to get the Russians out. And that would seem to at least mean improving on the financial terms offered to Cyprus, and giving the Russians some assurances on the Nato plan.

In other words, the Russians could throw a serious monkey wrench into Nato’s plan to stick a base into what Russia regards as its back yard. Whether Russia sees the opportunity and is willing to escalate international tensions to a fever pitch remains to be seen, but it would be a very clever way to exploit the Trokia’s blunder.

Update 8:30 AM: Ekathimerini apparently reports (the site is busy!) that Russia will buy Laiki for €4 billion. This will put the Troika in an amusing quandary, since they had demanded that Cyprus stump up €5.8 billion but the threat was cutting off Laiki from the ELA. If Russia will now make sure Laiki is solvent, the Troika’s grenade has been disarmed. And for €4 billion plus ongoing support, they might have gotten a handshake on that airbase too. This looks to have been well played, given the circumstances, if the rumor pans out.

Ah, so much for rumors! Like the Gazprom investment story, it has now been denied.

Update Bloomberg pieces on the ramifications of a Russian bailout, the latest from the ECB re ELA, and from Renaissance Capital on why Russia has a dog in this fight (video).

Oh, and then there’s Turkey’s dog; and the ECB sticks to its guns.

The banks in Cyprus are now to stay closed until Tuesday…

and what does Russia want to achieve ?????

and what does Russia want to achieve ?????

The inhabitants of Limassol, Cyprus, sometimes like to call their city "Little Moscow" because of the number of Russian businesspeople residing there. Southern Cyprus is home to the holding companies of numerous Russian oligarchs. Now, because the parliament in Nicosia rejected the terms of the European Union's bailout package for the country, Cyprus' government is looking for assistance in Russia, a country from which countless billions have flowed into the Mediterranean island nation over the years.

ANZEIGE

What's Moscow 's position in the Cyprus crisis?

Like Greece, Cyprus holds a special status among EU countries in Russia. Many Cypriots and Greeks belong to the Orthodox Church, which maintains extremely close ties to the Moscow Patriarch. Archbishop Chrysostomos II of Cyprus has also asked Patriarch Kirill, the religious head of the Russian Orthodox Church, to put in a good word for Cyprus with Putin.

Even with such high-level support, it is unlikely that Sarris will be facing easy talks in Moscow. Russian Finance Minister Anton Siluanov is upset because, although representatives of the euro zone had agreed to consult the Kremlin on the Cyprus issue, the EU didn't consult with Moscow about the bailout package or the mandatory bail-in that would seize funds from most bank accounts in the country, particularly those of Russians. Siluanov's predecessor, Putin confidant Alexei Kudrin, even spoke of an "element of disrespect."

Does Russia have reason to fear the Cyprus crisis?

The answer is yes and no. In addition to British investors, Russians are the largest account holders on the island. It has been reported that not even the government in Moscow has a solid grasp on the exact figures. But various estimates place the amount of Russian investor deposits in Cyprus at between $20 billion and $40 billion. Russia's state-held Sberbank estimates that Russian depositors would ultimately have provided 40 percent of the €5.8 billion Brussels had hoped to raise by taking those who held accounts with Cypriot banks. The media in Moscow is already speculating over a possible contagion and that the crisis might spill over into Russia, saying that the two countries' banking systems are connected "like Siamese twins."

It's an exaggerated fear. It's true that an escalation of the Cyprus crisis or a default would hit Russian banks hard. The bank being named most this week is state-held VTB, which has a subsidiary in Cyprus. But given that the country has currency reserves of $530 billion, both the Russian state and economy appear to be strong enough to be able to weather even the total loss of all Russian deposits in Cyprus.

What does Russia want to achieve?

First, it wants to limit damage to Russian investors. Unlike former President Boris Yeltsin, Putin holds himself at a certain distance from the oligarchs. But Alexei Mukhin, a political analyst and head of the Center for Political Information, says the Kremlin still takes their interests into account and that it also tries to safeguard their investments. Putin has "no interest in creating additional adversaries," he says.

Second, Moscow wants to use the crisis to burnish its image. The Kremlin would like to position Russia as an anchor of stability in the crisis and as a financial safe harbor -- an image it wants to foster both in the foreign policy arena and for domestic audiences. This week, the Russian media seem to be trying to outdo themselves with swan songs for the European Union. The talk is of "Euro Bolshevism," and even opposition columnist Yulia Latynina has written of "European parasites feeding on Cyprus and Russia." And as Europe threatens to become suffocated by its debt burden, the Kremlin can point to its own economic and financial successes. Thanks to a hefty stream of revenues from gas and oil sales, Russia enjoyed a budget surplus in 2012 of 0.8 percent of gross domestic project. The country also has a sovereign debt ratio of less than 10 percent of GDP.

Will Russia help Cyprus?

The chances are that it will. Moscow already provided the government in Nicosia with a €2.5 billion loan last year, and Cyprus is hoping for an agreement to extend the terms of that loan until 2021 as well as a €5 billion increase in the credit line. However, Moscow is likely to impose conditions in exchange for its support. Such a loan, however, would increase Cyprus' debt load to an unsustainable level -- exactly what Brussels had been trying to avoid with the savings account levy.

What kinds of conditions is it likely to impose?

Greater transparency. Russia wants to obtain more information about the Russian money and firms located on the island. Dozens of billions are pumped into the island year after year from Russia, only to be promptly recirculated and reinvested back home. With close to $50 billion, Cyprus was Russia's largest foreign investor in 2010. By comparison, investments from Germany that year totalled just $21 billion.

Cyprus is a popular place for Russian oligarchs and criminals for whom the island is a tax haven and a place where they can launder money. Numerous large Russian corporations have officially registered satellite companies on the island, and the Kremlin would like to change that.

Control of Cypriot companies: Russia may demand that Russian companies be given access to state-owned companies Cyprus may seek to privatize.

Military presence: Russia would like to pursue ambitious plans for its own Mediterranean fleet, but only has access to a single harbor in the region: a small Navy base in Tartus, Syria. The possibility that Russia might demand tighter military cooperation in exchange for financial aid cannot be ruled out.

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_20/03/2013_488993

| |||

http://www.zerohedge.com/news/2013-03-20/cyprus-atms-low-cash-credit-card-payments-refused-medvedev-compares-europe-ussr

Cyprus ATMs Low On Cash, Credit Card Payments Refused; Medvedev Compares Europe To USSR

Submitted by Tyler Durden on 03/20/2013 18:26 -0400

So far the market has been largely oblivious of the shattered trust and changed dynamic in European banking dynamics for one simple reason: Cyprus banks have been closed, and likely will be closed indefinitely, preventing the mass media from broadcasting what happens when an entire population, and foreign depositors, decide to clear out the holdings of their bank accounts, either physically or electronically, and the public anger the will result when they find that courtesy of fractional reserve banking, only a tiny amount of said deposits is actually present.

In the meantime, retail depositors have had their withdrawals limited through a form of capital controls, allowing them to pull only as much as the daily limit is on given ATMs. So far the banks have had enough cash to keep ATMs stocked up to the daily required minimum, but that may soon be ending. BBC's Mark Lowen, in Nicosia, reports that "Cyprus' banks are still giving out cash through machines - although with limits, and some are running low." Ironically, as physical cash becomes ever scarcer, merchants are now clamping down on electronic payments unsure if they will ever be able to convert electronic euros into actual ones: "Some businesses are now refusing credit card payments, our correspondent reports."

Logically, this progression of limited transactions will accelerate exponentially until by some miracle, either normalcy returns and faith in the local banking system is restored, or every form of commerce, trade and exchange grinds to a halt, leading to a localized, at first, manifestation of the "just-in-time" supply-chain cross contagion that was explained in painful detail in "Trade-Off: a study in global systemic collapse."

Since we don't believe in miracles, our money is increasingly on the latter. This sentiment is further reinforced by former Russian president, current Prime Minister, and Putin mouthpiece, Dmitry Medvedev, who said that what Europe has done is nothing shy of what the USSR used to do in its attempt to destroy faith in private property, and thus, capitalism.

Mr Medvedev said the EU and Cyprus had acted “like an elephant in a China shop”.“All possible mistakes that could be made have been made by them,” he added."We are living in the 21st century, under market economic conditions. Everybody has been insisting that ownership rights should be respected.”Mr Medvedev also criticised the decision to freeze the Cypriot banking system, and not just withdrawals from troubled banks, warning that if this continued for any length of time it could “result in losses . . . even bury the whole banking sector of Cyprus. It will cease to exist,” he said....The proposed bank levy, rejected by the Cypriot parliament on Tuesday, had a "clearly confiscatory, expropriating character," RIA quoted him as saying - remarks that echo earlier criticism by Russian President Vladimir Putin.It was, Medvedev said, "absolutely unprecedented"."I can only compare it some of the decisions taken ... by Soviet authorities, who did not give a thought to the savings of the population."

Alas, it is not just in Cyprus that the current failing status quo has become the USSR incarnate: one can see it in the central planning of the stock market, in the general approach toward the wealthy, in the absurd penetration of cronyism and the terminal corruption of the system.

And while we commiserate with the simple people of Cyprus (and soon everywhere else), who have for no fault of their own become the first pawns to be sacrificed in the systemicendspiel, we are grateful to Europe for proving us, once again, correct.

Because our only purpose with this media experiment has been to warn our readers that concentrating unlimited decision-making power in the hands of a very few conflicted individuals, without checks and without balances, always, always, ends in absolute disaster, bloodshed, and ultimately war.

Sadly, at this point there is nothing that can change the final outcome of what is an ongoing systemic failure. One can, at most, prepare as much as possible and hope for the best.

http://www.zerohedge.com/news/2013-03-20/ecb-re-bluffs-cyprus-bluff-prepared-let-cyprus-go

ECB Re-Bluffs To Cyprus Bluff, Is "Prepared To Let Cyprus Go"

Submitted by Tyler Durden on 03/20/2013 13:33 -0400

When the market briefly surged yesterday, following the cryptic note from the ECB that it would "provide liquidity within existing rules" we urged to ignore the kneejerk algorithmic exuberance (although with only algos left trading that was obviously self-defeating) which interpreted this as an indication the ECB would provide unconditional liquidity now and forever, and that this was hardly a bullish sign because "the last thing the ECB wants is to appear weak, and fold letting every other broke deadbeat country to demand the same equitable treatment and diluting Germany's political might." Today,Reuters has picked up on this coming out with its own analysis that the "The European Central Bank is prepared to cut off funding to Cyprus and let the Mediterranean island succumb to financial meltdown if it has to, confident it has unlimited firepower to protect the rest of the euro zone."

It is unclear how much of the article is actual analysis, and how much interest-driven propaganda to put the ball back in Cyprus court with the imputed knowledge that the ECB will not fold and thus cave to Troika deposit haircut demands, but fundamentally the logic is there as, once more, the ECB will hardly want to appear weak and cave in to a "recalcitrant" and unyielding Cyprus. Of course, what happens if indeed Cyprus decides to pull the € plug, should Russia provide an unlimited backstop and in the process subjugate a part of European territory without firing a shot, and the precedent that Europe can and will let members go, nobody knows but one thing is certain: stocks will go, as always, up.

From Reuters:

Cyprus propelled the 17-nation bloc into uncharted waters on Tuesday by rejecting a proposed levy on bank deposits as a condition of a 10 billion euro ($12.9 billion) EU bailout.Without the aid, much of it to recapitalize Cypriot banks, the ECB says they will be insolvent, and it requires banks to be solvent for them to receive central bank support.Denied these funds, Cyprus would be left staring into a financial abyss.For the rest of the euro zone, the ECB has a suite of policy tools at its disposal to prevent contagion - with bond purchases and unlimited liquidity offers to the fore.

"Tools" such as the unlimited, open-endedand very much non-existent OMT, which only "works" as long as it never has to work,because the Deus Ex qualities attributed to it by Draghi would actually have to be formalized, with the legal conditionality precedents put in writing should it truly start buying up bonds, something which would immediately destroy its image as the "end all, be all" bazooka that can fix any ailment. Which is why the second the OMT must be used, is when the entire European house of cards implodes. The catch is that a country must first agree to an aid plan of reforms and austerity measures. The Cyprus case has highlighted just how difficult agreeing such a program can be. "Even if the principle of OMT is still there and valid, all the drama about Cyprus may remind people that the bar to get OMT is actually higher than they probably think," Deutsche's Gilles Moec summarized.

As for the ECB's hard line:

By stressing that it stands ready to provide liquidity "within the existing rules", the ECB is standing firm.The central bank is not ready to bend for Cyprus.As its governing council gathered for a mid-month meeting on Wednesday, Asmussen pressed Cyprus to agree to an aid plan:"We can provide emergency liquidity only to solvent banks and ... the solvency of Cypriot banks cannot be assumed if an aid program is not agreed on soon, which would allow for a quick recapitalization of the banking sector.With Cyprus sovereign bonds ineligible for use as collateral for ECB refinancing operations due to their low credit ratings, the Cypriot central bank is providing banks with Emergency Liquidity Assistance (ELA).These emergency loans are more easily available, but the ECB's Governing Council must approve provision of ELA. It reviews banks' eligibility every two weeks and needs a two thirds majority to stop these funds."If really need be, the euro zone would likely choose to let small Cyprus go and focus on containing the damage instead of softening the conditions to such an extent that much bigger countries than Cyprus could be encouraged to reject their own current bailout terms," said Berenberg Bank's Holger Schmieding.

And to think: so much pain and confusion over what CNBC can't stop repeating is nothing but a tiny, little country.

Tiny... maybe. But the precedent it will set may well be of Archduke Ferdinandian size.

http://www.zerohedge.com/news/2013-03-20/cyprus-banks-reopen-next-tuesday-earliest-capital-controls-become-reality

Cyprus Banks To Reopen Next Tuesday At Earliest As Capital Controls Become Reality

Submitted by Tyler Durden on 03/20/2013 12:17 -0400

We can only hope that nobody will be shocked that the greatly overhyped Friday Cyprus bank reopen has been postponed.

- CYPRUS BANKS EXPECTED TO REMAIN CLOSED THROUGH END OF WEEK:CYBC

And since March 25, Monday, is another Cyprus bank holiday, "Greek Independence Day" (from whom? Certainly not the Troika), it means Cypriot banks will now remain closed at least until next Tuesday and likely far longer. In the meantime, since TV cameras can't show lines of people at their freindly neighborhood bank, which will have been closed for over a week, the propaganda machine will blast full bore how because the market is pushed higher by the Fed, any fears of bank runs can be forgotten. Actually instead of "can", replace with "must."

But since banks have to reopen at some time, at which point the inevitable bank runs will become reality, the already discussed Plan B is now taking shape:

- CYPRUS CABINET TO DISCUSS DECREE ON CAPITAL CONTROLS: CYBC

It remains to be seen if a country can't have a bank run in the New Centrally-Planned and Despotic Normal, if there is simply a law saying it is now illegal to pull or transfer more than €100 of cash per day.

and older news of the day......

http://www.zerohedge.com/news/2013-03-20/european-rumor-leak-denial-trading-pattern-back

( Rumor snipe hunting is back ! )

European "Rumor Leak, Denial" Trading Pattern Is Back

Submitted by Tyler Durden on 03/20/2013 08:34 -0400

We already reported earlier that the only bid in the overnight session, aside from that of central banks of course, was courtesy of hopes that Russia would victoriously step in and gloriously deja vu bail out Cyprus from the clutches of a despotic (for lack of a better word) Germany. This happened moments before Russia explicitly denied any agreement between Russia and Cyprus was reached. So, in the aftermath of a brief glimpse of reality courtesy of FedEx which slashed its economic outlook across the board leading some to expect an outright decline in full year S&P earnings, what is a foundering insolvent status quo regime to do? Why regurgitate the same old already refuted rumor of course.Sure enough: "Kathimerini Cyprus reported that an agreement has been reached in principle for Russian investors to buy Cyprus Popular Bank (Laiki) in a deal that would reduce Cyprus' funding needs by 4 billion euros." Unsourced, unfounded, idiotic(because why would Russia buy a bank which will be promptly rendered insolvent by the deposit bank run that follows moments after it finally reopens). That was enough, however, to send the EURUSD soaring....

... and for us to comment on this as follows:

We overestimated the response time: 10 minutes later, just as we predicted, all has been denied:

- CYPRUS GOVERNMENT SPOKESMAN DENIES REPORTS OF DEAL TO SELL CYPRUS POPULAR BANK CPBC.CY TO RUSSIAN INVESTORS

And EURUSD tumbles:

Welcome back European pre-denial rumormonger: we missed you.

http://www.zerohedge.com/news/2013-03-20/hope-good-news-moscow-sees-return-overnight-futures-ramp

Hope Of Good News From Moscow Sees Return Of Overnight Futures Ramp

Submitted by Tyler Durden on 03/20/2013 07:11 -0400

- Australian Dollar

- Bank of England

- Bank Run

- Ben Bernanke

- BOE

- Bond

- CDS

- Consumer Confidence

- Equity Markets

- European Central Bank

- Eurozone

- Germany

- GETCO

- Gross Domestic Product

- headlines

- Jim Reid

- Monetary Policy

- Natural Gas

- POMO

- POMO

- Precious Metals

- Reality

- Unemployment

- United Kingdom

- Vladimir Putin

- Yen

The Cyprus finance minister Michael Sarris may or may not have submitted his resignation after the president formally declined to accept it, but now that he is back on the saddle he is back to spreading hope, cheer and goodwill. Those wondering why both the EURUSD, and its derivative, US stock futures have surged overnight and retraced all of yesterday's losses and then some, it is not due to any anachronistic events such as "good economic news" (especially since the Spanish PM said Spain will have to cut its economic outlook once again, or rather, as usual), but due to the following phrase uttered by Sarris a few hours ago: "We are hoping for a good outcome, but we cannot really predict"regarding his views on talks with Russia. That's right - the entire overnight ramp is based on the hope of one man, who thinks Russia can be blackmailed through deposit haircuts, into bailing out the tiny island which has now said nein to Europe and bet the ranch on a well-meaning Vladimir Putin. What can possibly go wrong: according to the GETCO algos all alone in levitating stocks, absolutely nothing. What is clear is that Cyprus is fully intent on seeing Europe "blink" whether due to Russia's involvement or just because it thinks (correctly) it has all the leverage as the alternative is a breakdown of the Eurozone.

Elsewhere, Nicholas Papadopoulos, a member of Cyprus’s democratic party Diko discussed the parliament’s rejection of a levy on bank deposits with Bloomberg TV, saying Cyprus would propose a new package to the EU. That's great. The only problem is that the math is simple: either a massive haircut on Russians sparing everyone else, or nothing, and if the Russians get whacked, there will be no deal with Russia, while parliament has already made it clear any deposit haircut would not fly. So back to square one even as Frau Merkel reiterated the Shaeuble talking points, saying she regrets the decision by the Cypriot parliament.

However, reality is irrelevant - all that matters to the vacuum tubes is that there is some hope out of Europe, and with no POMO today, the algos are very hopeful that Bernanke will not hint at any more rate cuts today in today's 2 pm FOMC minutes, as he has in the past two times, as that would surely kill any no volume levitation party.

More overnight highlights from Bloomberg:

- Treasuries fall for first time in four days as yen resumes decline vs U.S. dollar. Fed meeting concludes today; rate decision and eco projections at 2pm in Washington, Bernanke press conference at 2:30pm.

- Troika officials are in Cyprus discussing further capital controls and the possible extension of a bank holiday through the end of the week, according to a European official who spoke on conditions on anonymity

- Germany and its euro-area allies maintained pressure on the island’s politicians today to raise a planned EU5.8b via a levy on deposits; Austria finance minister Fekter raised the threat of a ECB funding cutoff while Germany’s Schaeuble said the nation’s “business model is no longer tenable”

- Russia and Cyprus are continuing loan talks, with Cypriot finance minister Sarris pledging to continue discussions “as long as it takes”

- BoE’s King was defeated for a second month in a vote to expand stimulus as the majority of policy makers said more bond purchases may erode their credibility and push the pound lower, minutes of the MPC’s March meeting showed

- GBP/USD rises 0.3% to 1.5138; Chancellor of the Exchequer Osborne presents his 2013 budget at 1:30pm in London

- U.K. jobless claims fell less than forecast in February while a wider measure of unemployment rose for the first time in a year

- Japan closed for holiday. Shanghai Composite +2.7%. European equity markets, U.S. index futures higher. Peripheral yields fall, spreads to Germany narrow Energy, precious metals rise

The full overnight narrative from DB's Jim Reid:

Cyprus looks set to continue to dominate the headlines in the near term although we do have Bernanke on show later and also the UK budget. As I'm sure you all know by now, the Cypriot Parliament rejected a reworked levy on deposits last night. The revised levy, which included an exemption on deposits below EUR20k, was rejected by 36 votes with 19 abstentions including the President's centreright DISY party abstaining from the vote. So a pretty categoric rejection. The 'no' led to immediate focus on Cyprus’ banking sector as we approach the ECB’s Emergency Liquidity Assistance (ELA) expiry today although our economists believe in practice some leeway for a few days exists. The provision of ELA funding is normally conditional on the receiving banks remaining intrinsically solvent but our economists noted that this condition hardly holds with the prospect of a bank run starting immediately after the expiry of the bank holiday.

After the no vote, the ECB released a vague statement saying that it "reaffirms its commitment to provide liquidity as needed within the existing rules". This helped the S&P500 (-0.24%) and EURUSD (-0.58%) close off the day’s lows. Reports suggest that Cyprus' banks could remain closed until next Tuesday March 26th with capital controls and transaction limits in place when banks eventually open (WSJ, Telegraph). The FT noted that Cyprus’ finance minister arrived in Moscow last night in an 11th hour attempt to request assistance from the Kremlin.

In many ways we're back to square one as the fact that the revised version of the bank levy was rejected by the Cypriot parliament suggests that the "reprofiling" of the levy, which was open to negotiations with the troika, was not the main issue. More likely, it is the very principle of a bank levy - and the adverse consequences it would have on the country's standing as an off-shore centre - which is being overwhelmingly rejected by Cyprus' political circles. It is obviously a setback for the EU, but as our Economists note, reaching a deal on the adjustment program at the first attempt has always been tough since the beginning of the crisis. Rationally they think the Cypriot government and parliament will have to accept the deal, at least the principle of a deposit levy, even if some sweeteners may have to be found (e.g. on the austerity measures).

But with the deposit levy facing political opposition what are the other fund raising options potentially available to Cyprus? Overnight the ekathimerini reported that Cyprus will attempt to sell the troubled Popular Bank of Cyprus, known as Laiki, and possibly other local lenders. The same article noted that it is likely the Russians will seek some form of compensation for such an investment. A naval port in Cyprus for the Russian fleet and access to the country’s natural gas reserves are among the rewards Moscow might seek. The option of tapping the social security funds’ reserves (amounting to EU5bn) is said to also being considered. The other option being reported is to offer depositors with more than EUR100k a voluntary haircut in return for natural gas-indexed bonds. The NYT also reported that Gazprom may enter the fray with a private bailout plan. Rather than tax deposits, Cyprus could raise money to right its economy by selling Gazprom exploration rights to offshore gas deposits in the Mediterranean Sea. Given that Gazprom is 50.02% owned by the Russian government and with former PM Putin being the current company chairman – such a deal certainly adds geopolitical dimension to the current situation. If raising the EU5.8bn in funds via the deposit levy is the pre-requisite for the EU bailout for Cyprus, then Gazprom seems financially quite capable of mustering a deal of some sort given its current market capitalisation of about EU84bn and a cash balance of c.EUR12bn at the end of September 2012.

So the question is whether the EU will revise its terms, whether the Cypriots find a way of raising the money in an acceptable manner or whether Russia rides to the rescue. The market is still assuming the money will be found somehow and hasn't yet considered the 'nuclear' alternative. A fascinating few days still lie ahead.

While the immediate focus is on the developments in Cyprus, we also have the FOMC statement (6.00pm London time) followed half an hour later by Bernanke’s press conference. For the record, DB’s US economists do not anticipate any major policy changes at today’s meeting - Chairman Bernanke and Vice Chair Yellen have been clear in recent commentary that the improvement in the labour market to date falls far short of what they will need to see before reducing monetary policy accommodation. In particular, Bernanke would like to see further rebound in the employment-population ratio, which has moved only slightly higher (58.6%) from its post-recession low (58.2%). For this reason, they anticipate a continuation of QE through at least mid-year, despite the improving tone in the economic data. In terms of the Fed’s latest economic projections, our economists expect that central tendency projections for 2013 real GDP growth (currently 2.3% to 3.0%) may be modestly upgraded while the year-end unemployment rate range of 7.4% to 7.7% may drift slightly lower.

Across the Atlantic, Chancellor George Osborne will be presenting the UK government budget for the next fiscal year today. News reports have suggested that government ministers have been ordered by the Chancellor to come up with GBP2.5bn of extra spending cuts. The extra cuts, equivalent to about 1%, over the next two years will apply to all departments apart from health, schools and hospitals, although police, defence and local government will also be granted some leniency. The savings are expected to be used to fund housing and other capital projects including a number of growth-oriented infrastructure items.

In addition to laying out the budget, some are expecting the Chancellor to use the opportunity to signal a change in the BoE’s mandate that would allow the central bank to loosen its 2% inflation target.

Turning to Asia, markets have been relatively quiet newsflow wise with Japanese markets closed for the Vernal Equinox public holiday. Chinese equities have posted strong gains overnight led by the Shanghai Composite (+2.5%) and Hang Seng (+0.8%) which is pulling other regional equity markets off the overnight lows. It is a similar story for the S&P500 futures (-0.05%) which has recovered from the overnight lows. In the currency space, the Australian dollar is marginally firmer against the USD. The CDS index roll has been the main focus for the Asian markets overnight and will likely be the main theme for European and US markets ahead today.

Looking at the rest of the day ahead, we have the BoE minutes from its March meeting which will show how the nine members of the MPC voted with respect to further easing. The UK labour report is scheduled to be released at the same time. The above mentioned UK budget is expected at 12:30pm GMT today. In the Eurozone, Italian President Napolitano is expected to begin consultations with political leaders this morning London time in an effort to form a government. Datawise, the advance consumer confidence reading for March will be the main data point in the Eurozone. In the US the focus will be squarely on the FOMC and Chairman Bernanke’s press conference but expect markets to continue to gyrate around developments in Cyprus for now.

Russia will seek high compensation for its white knight assistance......

http://ekathimerini.com/4dcgi/_w_articles_wsite2_1_20/03/2013_488764

and....

Russia will seek high compensation for its white knight assistance......

http://ekathimerini.com/4dcgi/_w_articles_wsite2_1_20/03/2013_488764

| |||

| Cyprus estimates its reserves at 3.4 billion cubic meters of gas and 235 million metric tons of oil, and the fields are well positioned for exports to Europe. Dmitry Afanasiev, chairman of law firm Egorov, Puginsky, Afanasiev & Partners, said the ideal lender to provide the loan would be VEB, the government's development bank. The lender could secure the loan with the rights to Cypriot gas reserves, as well as real estate and bank stocks, he said. VEB could then issue securities backed with the assets, Afanasiev told The Moscow Times. The plan is common for developing economies that seek to raise money, he said. The law firm, he said, helped restructure aluminum companyRusAl's $17 billion debt following the 2008 global economic meltdown. |

Cypriot Finance Minister in Moscow to Propose Assets-for-Bailout Deal

20 March 2013 | Issue 5092

Russia, Cyprus to Continue Vital Loan Talks

Topic: Cyprus Bailout

15:12 20/03/2013

Related News

Russian Banking Giant VTB Alarmed by Cyprus Deposit Tax

Russian Banking Giant VTB Alarmed by Cyprus Deposit Tax Russia’s Ex-Finance Minister Slams Cyprus Deposit Levy Plans

Russia’s Ex-Finance Minister Slams Cyprus Deposit Levy Plans Putin Blasts Cyprus Levy on Bank Deposits as ‘Unfair’

Putin Blasts Cyprus Levy on Bank Deposits as ‘Unfair’ Russian Ruble, Stocks Nosedive on Cyprus Debt Crisis

Russian Ruble, Stocks Nosedive on Cyprus Debt Crisis

MOSCOW, March 20 (RIA Novosti) – Cypriot Finance Minister Michael Sarris is set to continue negotiations on a potential Russian loan with Russia's First Deputy Prime Minister Igor Shuvalov on Wednesday, after initial talks between the two countries' finance ministries ended without an agreement.

The Cypriot minister is in Moscow to discuss the extension of a 2.5-billion-euro loan that Russia gave Nicosia in 2011 at a rate of 4.5 percent.

“We had a very good and constructive meeting and very fair talks. We understand that the situation is difficult. We will continue negotiations to find a decision that will allow us to get Russia’s support,” Sarris told journalists after talks with Russian Finance Minister Anton Siluyanov.

“We will be here until we reach an agreement,” said Sarris, who arrived late Tuesday.

The talks were attended by Russia’s Central Bank head Sergei Ignatyev and Central Bank deputy chairman Sergei Shvetsov. Sarris then headed for negotiations with Shuvalov.

The Wall Street Journal reported Wednesday that Sarris is expected to offer a deal that includes imposing a 20 percent or 30 percent levy on Russian-held deposits in Cypriot banks. In return, Russia would be given equity in Cyprus's future national gas company and control of the board of directors at Cypriot banks, the newspaper said, citing "a government official," presumably Cypriot. Other versions of potential proposals have also begun circulating in the press.

While Sarris, who no longer enjoys the support of the Cypriot president for his handling of the crisis, was en route to Moscow, media reports said he is about to be replaced upon his return from the trip. Sarris has dismissed the reports.

A source in the Cypriot embassy in Moscow told RIA Novosti on Wednesday that Cypriot President Nicos Anastasiades has received an invitation to visit Russia to discuss the current crisis, but the date has yet to be set.

Russian President Vladimir Putin and Anastasiades discussed the economic situation in Cyprus after Cypriot lawmakers rejected the Eurogroup’s bailout proposals, Kremlin spokesman Dmitry Peskov said.

Parliament in Cyprus on Tuesday rejected a government bill that envisioned a levy of 6.75 percent on deposits of less than 100,000 euros ($128,950) and 9.9 percent on larger deposits aimed at securing a European Union bailout loan.

Putin also reiterated his concerns about “any measures that could harm the interests of Russian businesses or individuals [in Cyprus].”

Russian banks are heavily exposed to Cyprus risk as they had around $12 billion on deposit with Cypriot banks at the end of last year, with Russian corporate deposits accounting for another $19 billion, according to estimates by Moody’s international rating agency.

Russian individuals and businesses had stood to lose around $2 billion if the levy proposal had gone through.

But if the island nation defaults on its obligations, Russian depositors risk losing over $50 billion, considering loans granted by Russian banks to Cyprus-registered companies, according to Moody's.

Meanwhile, Eurogroup chairman Jeroen Dijsselbloem said on Tuesday that the European bailout proposal was still on the discussion table, but the Cypriots would have to find a way to raise about 6 billion euros to unlock a 10-billion-euro package from the EU and IMF.

Updated with paragraphs 12-14.

and with russian interests standing at about 50 billion , what does Russia do ? Meanwhile , the troika waits.....Cyprus valiantly tries to work out a deal with russia to avoid troika controls over its sovereignty..... of course , would russian controls be different or better ?

http://hat4uk.wordpress.com/2013/03/20/brave-cyprus-pokes-ec-in-the-eye-pols-fly-to-moscow/

BRAVE CYPRUS POKES EC IN THE EYE, POLS FLY TO MOSCOW

Berlin meddling and Brussels incompetence = crisis

The UK has its eye off the ball on this one: we need to wake up

This morning’s Daily Telegraph relegates the Cyprus story at the expense of George Osborne’s UK Budget, but this represents a classic case of parochial journalism: the UK press obviously prefers covering the death of a salesman to what the Irish Independent yesterday called ‘the slow death of the eurozone’. What’s happening hour by hour in Cyprus is the biggest story in the world on two crucial geopolitical levels: defying the Brussels mafia, and a surfacing of the more important Major Power concerns in the South Eastern Europe/North Africa axis of energy.

The Cypriot parliament didn’t just reject the bailout scheme yesterday: it deliberately ignored late attempts by Brussels-am-Berlin to retrieve the situation. And then it said “Go take a running jump”. 36 votes against, 19 abstentions, zero votes in favour: this is more ejection than rejection.

Hardly had the discussion started in the Cypriot Parliament than Greeks were comparing the plain-speaking response of the Cyprus Parliament with the gutless toadying of their own elite. Said centre-left DEKO’s Party leader,

“The decision we will take today, isn’t painless, its historic. Our country is under unjust and premeditated attack. Eurogroup’s decision is a blackmail, we want our reply today to be a European one, not just Cypriot. It is clear now, the problem isn’t economic, it’s political, it’s geopolitical. We propose the rejection of Eurogroup’s decisions.”

Equally uncompromising were the comments of Yiannakis Omirou from EDEK, who said “Our proposal is to say No to agreement and renegotiation” or Dimitris Syllouris from EUROKO claiming “Cyprus can live without the Troika.”

Some speakers referred to the European Union as “having mutated into loan sharks”, and “villains” who hide confiscation behind “a tax when no tax is due”.

Some media have reported that the Cypriot President has called an emergency meeting of party leaders ‘in a frantic effort to put together a plan B after MPs rejected the terms of the bailout’, bu sources on the island deny this: they suggest that, having been given an ultimatum last Friday by Schäuble and the FinMins, they were happy to let the vote go ahead. (For this reason, the much-heralded postponement of the rejection vote didn’t take place.)

Be under no illusion, this is defiance: and the Führerin to the North did the expected thing late yesterday by warning Cyprus not to enter into negotiations with Russia, insisting this action could result in eurozone disintegration. Wolfgang Schäuble added his own threat, warning the country against “irresponsible solutions” – and insisting that the Cyprus economy had been “unsustainable for decades”.

This is complete bollocks, ignoring conveniently as it does that the economic, banking and geopolitical importance of Cyprus goes way beyond the days when it was a tiny island exporting potatoes. Its banking system was destroyed by loyally investing in the Greek recovery and then taking the hit after Draghi’s illegal haircut. Meanwhile, Big Geli ploughed on, her spokesman insisting that “The chancellor once again emphasises that the negotiations are to be conducted only with the troika (the European Union, European Central Bank and the International Monetary Fund)”. But Frau Doktor Merkel the fridge-collector is the Chancellor of Germany, not the EU.

Eurozone finance ministers say they remain ready to help Cyprus, but as of today the islanders aren’t in the mood to hear any further half-truths and spin: several of them are already in Moscow. Here they seek to secure further Russian investment on Cyprus, but chiefly the aim is to strike while the iron is hot. The discussions follow President Nicos Anastasiades’ half-hour phone call with Vladimir Putin, Russian president, after the vote on Tuesday night. Mr Anastasiades’ spokesman said the talks were “fruitful and constructive”. Predictably, this has all taken the twerps at the FCO by surprise (plus reste la même chose), but not The Slog: You read it here first. So stay tuned to the site that saw this coming.

Merkel awaits next proposals from cyprus after the rejection of the deposit grand larceny scheme....whatever proposals should come rather quickly - it looks like the ELA lifeline does not extend to Friday. No deal found with Russia so far.

http://www.reuters.com/article/2013/03/20/us-cyprus-parliament-idUSBRE92G03I20130320

(Reuters) - Cyprus pleaded for a new loan fromRussia on Wednesday to avert a financial meltdown, but won no immediate relief after the island's parliament rejected the terms of a European bailout, raising the risk of default and a bank crash.

Finance Minister Michael Sarris said in Moscow he had reached no deal with his Russian counterpart Anton Siluanov, but talks would continue.

Russia's finance ministry said Nicosia had sought a further 5 billion euros on top of a five-year extension and lower interest on an existing 2.5 billion euro loan.

Cyprus has to seek Moscow's help after the euro zone's plan for a 10 billion euro bailout was cast into disarray on Tuesday when the island's parliament rebuffed EU demands for a levy on bank deposits to raise 5.8 billion euros.

Moscow has its own interests in ensuring the survival of Cypriot banks, which have served as an offshore financial haven for Russian businesses and individuals.

The European Central Bank's chief negotiator on Cyprus, Joerg Asmussen, said the ECB would have to pull the plug on Cypriot banks unless the country took a bailout quickly.

"We can provide emergency liquidity only to solvent banks and... the solvency of Cypriot banks cannot be assumed if an aid program is not agreed on soon, which would allow for a quick recapitalization of the banking sector," Asmussen told German weekly Die Zeit in an interview conducted on Tuesday evening.

Austrian Chancellor Werner Faymann said he could not rule out Cyprus leaving the euro zone, although he hoped its leaders would find a solution for it to stay.

Cypriot officials disclosed that the country's energy minister was also in Moscow, ostensibly for a tourism exhibition, fuelling speculation that access to offshore gas reserves could be part of any deal for Russian aid.

Cyprus has found big gas fields in its waters adjoining Israel but has yet to develop them.

"We had a very honest discussion, we've underscored how difficult the situation is," Sarris told reporters after talks with Siluanov. "We'll now continue our discussion to find the solution by which we hope we will be getting some support.

"There were no offers, nothing concrete," he said.

Not a single Cypriot lawmaker voted for the bailout, which included a proposed levy that would have taken up to 10 percent from accounts over 100,000 euros.

Smaller bank accounts would also have been hit, although the government proposed to spare small savers with less than 20,000 euros in the bank.

It was the first time a national legislature had rejected the conditions for EU assistance, after three years in which lawmakers in Greece, Ireland, Portugal, Spain and Italy all accepted biting austerity measures to secure aid.

German Chancellor Angela Merkel, whose country is Europe's main paymaster, said it was up to the Cypriot government to come up with an alternative proposal but it was fair to expect savers with deposits over 100,000 euros to contribute to the bailout.

The EU has a track record of pressing smaller countries to vote again until they achieve the desired outcome.

"PLAN B"

Nicosia was eerily quiet on Wednesday, the morning after demonstrators cheered parliament's rejection of what was seen as an unfair EU diktat.

The government has not allowed banks to reopen this week to prevent a run, but cash machines which were emptied over the weekend have been replenished, giving people access to limited amounts of cash.

"Things won't be so bad as long as people can withdraw from ATMs but if they go too there will be a huge problem," said Titos Pitsillides, 50.

President Nicos Anastasiades, barely a month in the job, met party leaders and the governor of the central bank at his office. Government spokesman Christos Stylianides said a "Plan B" was in the works.

"A team of technocrats has gone to the central bank to discuss a plan B related to financing and reducing the 5.8 billion euro amount," he told reporters during a break in the meeting with party leaders. He did not elaborate.

Lawmaker Marios Mavrides told Reuters one option under discussion was to nationalize pensions funds of semi-government corporations, which hold between 2 and 3 billion euros.

Anastasiades was also due to hold a cabinet meeting and talk with officials from the so-called "troika" of the EU, European Central Bank and International Monetary Fund.

Among the most urgent decisions awaited was whether the government will allow banks to reopen as planned on Thursday, or keep them closed until next week. Deputy Central Bank governor Spyros Stavrinakis said no decision had been taken yet.

The crisis is unprecedented in the history of the divided east Mediterranean island of 1.1 million people, which suffered a war with Turkey and ethnic split in 1974 in which a quarter of its population was displaced. The Turkish-populated north considers itself a separate country, recognized only by Turkey.

While Brussels has emphasized that the tax measure was a one-off for a country that accounts for just 0.2 percent of Europe's output, fears have grown that savers in other, larger European countries might be spurred to withdraw funds.

GAS DEPOSITS

Leaders of the currency union said the bailout offer still stood, provided the conditions were met. Teetering Cypriot banks have been crippled by their exposure to the financial crisis in neighboring Greece, where the euro zone debt crisis began.

Germany, facing an election this year and increasingly frustrated with the mounting cost of bailing out its southern partners, said Cyprus had no one to blame but itself.

With Sarris and Energy Minister George Lakkotrypis in Moscow, there was mounting speculation that Russian oil and gas giant Gazprom had mooted its own assistance plan in exchange for exploration rights to Cyprus's offshore gas deposits.

Noble Energy reported a natural gas recovery of 5 to 8 trillion cubic feet of gas south of Cyprus in late 2011, in the island's first foray to tap offshore resources.

A senior source in the "troika" said dealing with Cyprus was even more frustrating than protracted wrangling with Greece.

"The Greeks wanted to cheat on you all the time, but they knew what they wanted. The Cypriots are leaving us really confused," the source said.

Merkel regrets Cyprus vote decision and awaits new proposals

Angela Merkel regrets the outcome of last night's vote in the Cypriot parliament, according to snaps on Reuters.

But the German chancellor accepts the decision and now awaits a proposal from the Cypriot government to the Troika. She will look at all the proposals the government makes.

Hammering home the point made by the ECB earlier, she said Cyprus does not have a sustainable banking sector.

Savers in Cyprus with more than €100,000 in the bank should be ready to contribute to any bailout (it was the plan to hit savers with more than €20,000 that scuppered the vote).

No ECB liquidity without bailout, says Bank's Asmussen

The statement from the European Central Bank following the Cyprus parliament's rejection last night of a savings levy was not exactly clear about what it meant.

The ECB reaffirmed "its commitment to provide liquidity as needed within the existing rules", but at Swordfish Research's Gary Jenkins said earlier, these rules seem to be made up as they go along.

Now come some newspaper comments from ECB board member Joerg Asmussen, from Die Zeit via Reuters.

Asmussen said Cyprus's banks were not solvent unless they were recapitalised quickly, and the ECB can only provide liquidity to solvent banks. He said:

We did not threaten (to cut off liquidity), but just pointed out as a matter of fact that we can provide emergency liquidity only to solvent banks and that the solvency of Cypriot banks cannot be assumed if an aid programme is not agreed on soon, which would allow for a quick recapitalisation of the banking sector.

He was also quoted as saying that no other country in the eurozone had a banking sector crisis comparable to Cyprus.

Sarris says no loan deal with Russia yet but talks continue

Cyprus's finance minister Michalis Sarris has said there has been no decision on a loan from Moscow yet but talks are continuing, according to Reuters.

Last night an idea circulating was that Russia would help out financially in return for some of the island's energy rights.

Meanwhile Austrian finance minister Maria Fekter said the European Central Bank would not provide liquidity indefinitely to Cypriot banks. The banks, currently closed, are dependent on emergency funding from the ECB and last night it said:

The ECB takes note of the decision of the Cypriot parliament and is in contact with its troika partnersThe ECB reaffirms its commitment to provide liquidity as needed within the existing rules.

But Fekter told reporters (quotes from Reuters):

[If Cyprus does not come up with a new plan] then the banks won't open on Friday because the ECB will not provide any more liquidity. That is a more horrible scenario than what is on the table now.We will certainly help out the Cypriots but only under conditions that make sense. Certainly neither the ESM [bailout fund] nor the ECB can allow a bottomless pit.

More thoughts on Russia's possible involvement in easing Cyprus's financial woes. Norman Villamin, chief investment officer for Europe at Coutts said:

Russia, with probably the greatest direct economic interest and social and historical connection to the island, is at this point a passive participant in plan to save Cyprus. The challenge will be to bring the Russians to the table and get them to share the burden.Having displayed the stick (deposit levy) to get Russia to the table, the most obvious next step would be to dangle some carrots (such as offshore drilling rights) to facilitate a solution. This is not without precedent, as part of the Greek bailout programme included asset sales/privatisation.The challenge is that this needs to be completed today, or authorities need to extend the bank holiday. With this in mind, it seems to me the Russians have a bit of an advantage in the negotiation. The only real pressure the troika could exert would be to cut off funding for the Cyprus central bank, which is reliant on the emergency liquidity assistance scheme (ELA). This would potentially raise the cost to Russia for not stepping in.What are the near-term implications for asset markets? We have seen the euro push to recent lows, Spanish and Italian stocks sell off and yields on their government bonds rise (prices fall). Further downside from here requires a policy error, which though not impossible, I would be hesitant to suggest is the base-case scenario. Like flare-ups in the eurozone before, I believe a face-saving agreement will be found. It’s not likely to solve the broader crisis, but once again kick the can a bit further down the road.

No comments:

Post a Comment