http://www.zerohedge.com/news/2013-03-21/euro-official-cyprus-markets-believe-we-will-find-solution-might-not-be-case-we-have

And so it goes......

The view from Greece and Cyprus......

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_21/03/2013_489090

http://www.zerohedge.com/news/2013-03-21/ecb-gives-cyprus-march-25-liquidity-ultimatum

Euro Official On Cyprus: "Markets Believe We Will Find A Solution, This Might Not Be The Case"

Submitted by Tyler Durden on 03/21/2013 09:04 -0400

While the market levitation courtesy of the Fed, BIS and BOJ continues unabated to give the impression that all is well, allowing empty momentum-chasing chatterboxes to say that Cyprus is not a big deal because... well, look at the market (and real traders the chance to quietly dump existing risk positions), the artificial, centrally-planned calm during the storm may be ending. The reason comes from none other than the Eurogroup, whose deputy finance ministers held a conference call last night, and whose transcript has been seen by Reuters.

Here are the highlights.

Euro zone finance officials acknowledged being "in a mess" over Cyprus during a conference call on Wednesday and discussed imposing capital controls to insulate the regionfrom a possible collapse of the Cypriot economy.

Not very confidence boosting. But then again, with confidence in Cyprus now gone, the time for damage control is long gone. Sure enough, it just goes from bad to worse:

"The (Cypriot) parliament is obviously too emotional and will not decide on anything, if Cyprus does not even feel that they can attend the call it is a big problem for us," the French representative said, according to the notes seen by Reuters."We have never seen this."

"Ring-fencing" is back, and so are Lehman references.

The official also referred to the need to resolve Cyprus's two biggest banks, both of which are close to collapse, and mentioned the possibility of Cyprus leaving the euro zone.In the event of an exit, the official said steps needed to be taken to "ring-fence" the rest of the euro zone from the impact and to ensure there was no contagion to Greece.

Bad news for locals: your economy is done, so may as well drag the entire Eurozone down with you:

"The economy is going to tank in Cyprus no matter what," the notes quoted him as saying. "Restrictions on capital will probably be imposed," he said, adding that further conference calls would be organised in the coming days.

And the punchline:

"Markets believe that we will find a solution and that we will provide more money and this might not be the case,"one of the participants on the call said

Hint to those confused: the market is not at all ignoring Cyprus. The central banks manipulating the market are doing their best to make it seem the market is not affected by a development which not even politicians have any idea how to negate as everything is now in unchartered territory. Of course, if and when control of the market is lost, that's when things get really interest.

And so it goes......

The view from Greece and Cyprus......

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_21/03/2013_489090

Dijsselbloem says Cyprus 'systemic' and has little option than to accept troika plan

Eurogroup chief Jeroen Dijsselbloem has taken responsibility for the initial proposal to tax all deposits in Cyprus but has also insisted that Nicosia does not have any other options than to accept the plan offered by the eurozone and International Monetary Fund.

“The decision [to tax small savers] was a joint one but as Eurogroup, I take full responsibility for the agreement,” he said during an appearance before European Parliament’s economics committee.

“Cyprus’s tax was a wealth tax, we specifically tried to target non-resident depositors,” said the Eurogroup head. "The vast amount of depositors in Cyprus are not really savers. They're investors."

However, Dijsselbloem indicated that it was the Cypriot government’s decision to tax deposits under 100,000 euros. “Different national interests, including the Cypriot government’s opinion, led to the idea that small savers should contribute.”

Dijsselbloem, however, indicated that Nicosia did not have any option but to return to the idea of a deposit tax in order to secure an EU-IMF bailout.

“I'm not sure that this package is completely gone and failed, because I don't honestly see many alternatives," he said. "There is of course a different way to do the levy, and we're very open to a more fair approach to the way the levy is structured."

The Dutch finance minister said it appeared that Russia was not interested in providing funding for Nicosia.

Dijsselbloem also said that loan from Russia would not help make Cyprus’s debt more sustainable.

"The only thing I can say that if the Russians were to say we could lend, that wouldn't help on the sustainability of the debt situation," he said "Building up the debt in Cyprus does not help them to work towards a new future."

He said one of the motives for the deposit tax was to keep Cyprus’s national debt as low as possible.

"I still think its probably inevitable there will be some kind of levy in the final package that we will agree upon," he said.

"The Eurogroup thinks it's very important that we should have a fair burden share, and that means a larger contribution from large depositors than, of course, from small depositors."

The Eurogroup chief said that the eurozone had taken too long to address the problems with the Cypriot banking model. He expressed concern about the consequences of the instability created in Cyprus.

“In the present situation I think there is definitely a systemic risk and I think the unrest of the last couple of days has proven this, unfortunately," he said in a comment that appeared to contradict some of his colleagues in the Eurogroup and the German position that the consequences of a Cypriot banking collapse and euro exit could be contained.

However, Dijsellbloem denied that the troika’s plan would bring down the Cypriot banking system. “We want the Cypriot financial sector to make a restart as part of the bailout,” he said.

SYRIZA MEP Nikos Chountis asked Dijsellbloem if the Eurogroup was simply incompetent or whether it had ulterior motives. The Dutchman said he would leave the Greek Euro MP to decide.

Russia, Cyprus in Second Day of Gas for Cash TalksTopic: Cyprus Bailout

14:14 21/03/2013

Originally posted at 12:35.Related News

MOSCOW, March 21 (RIA Novosti) – Russia and Cyprus are set to launch a second day of talks in Moscow on Thursday over a multibillion-dollar loan to help the island nation avoid a financial collapse.

Cyprus’ Finance Minister Michalis Sarris told reporters ahead of a new round of talks on Thursday that the Cypriot delegation was negotiating the terms of financial aid from Russia in return for stakes in the Mediterranean nation’s banks and gas projects.

“We are, of course, seeking assistance but in a way that would make economic sense for Russia,” Sarris said. “A large number of conditions are emerging during the discussion, related to banks, natural gas and other assets, on which we could base cooperation with Russia.”

Cypriot gas projects to explore and produce natural gas in deep-water zones off the island’s coasts are likely to be a hard sell to Russia, in light of possible opposition from Turkey, which has never recognized the Republic of Cyprus or its maritime borders after the island was split into two parts in 1974.

Both teams of negotiators comprising officials and bankers from Cyprus and Russia are working intensively on the terms of a deal, Sarris said.

In an interview with Reuters news agency, Sarris said that Cyprus was not seeking a fresh loan from Russia, but was in talks with Moscow on investments in its banks and energy resources to reduce its debt burden.

"The banks are the ultimate objective in any support we get, so it'll either be a direct support to the banks or the support that we get through other sectors will be channeled to the banks, because this is our biggest challenge to recapitalize the banks," Sarris told Reuters.

Sarris also told the news agency that Cyprus was seeking a five-year extension of an existing 2.5-billion euro loan from Russia, and a reduction in the interest rate on it to 2.5 percent from 4.5 percent.

The urgency for a multibillion-dollar loan from Russia emerged after the Cypriot parliament rejected on Tuesday a levy on bank accounts that international creditors, including the European Union and the International Monetary Fund, had set as a condition for providing a 10-billion euro ($13-billion) bailout for Cyprus.

The international creditors said on Saturday that their rescue package for debt-laden Cyprus was contingent on a one-off deposit levy to yield an additional 5.8 billion euros ($7.5 billion) in revenues for the cash-strapped Cypriot budget.

Overall, Cyprus needs about 17 billion euros in aid to shore up its budget and recapitalize its banks, which were forced to write down billions of euros in “voluntary” Greek debt restructuring.

Updated with Sarris' comments to Reuters.

http://ransquawk.com/headlines/russia-s-state-controlled-sberbank-ceo-says-the-bank-isn-t-interested-in-acquiring-a-bank-in-cyprus-21-03-2013

Russia's state-controlled Sberbank CEO says the bank isn't interested in acquiring a bank in Cyprus

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_21/03/2013_489139

|

http://www.zerohedge.com/news/2013-03-21/ecb-gives-cyprus-march-25-liquidity-ultimatum

ECB Gives Cyprus March 25 Liquidity Ultimatum

Submitted by Tyler Durden on 03/21/2013 07:46 -0400

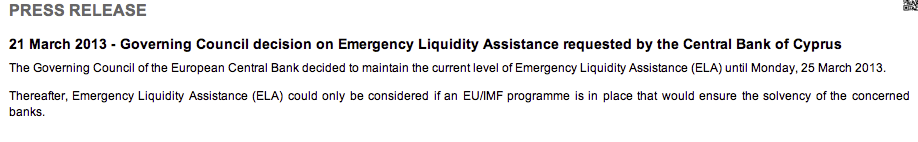

As reported yesterday, Cyprus banks are now expected to reopen next Tuesday. We would boldly go ahead and take the under following overnight news that the ECB has once more escalated its political interventions (remember the lies about "apolitical, independent" Central Banks - good times...), and following a Reuters report yesterday that the ECB is prepared to let Cyprus go, the FT now has doubled down on the propaganda, reporting (in an article with no less than five authors) that the ECB has issued an ultimatum to Cyprus to agree to a bailout by Monday (which is a holiday), or the free liquidity ends.

"The European Central Bank raised the stakes in the Cyprus crisis on Thursday, telling Nicosia it had until Monday to agree a bailout with the EU and International Monetary Fund or it would cut off emergency liquidity provision to the country’s banks. The hardline stance from the ECB sets a clear deadline for Cyprus to agree to a plan after its parliament rejected a bailout negotiated at the weekend that would have taxed the deposits of account holders in the country’s banks." Which means yet another weekend of ad hoc choices and spontaneous decisions awaits, only this time with a key non-Euro actor involved in the face of Russia, whose interest just in case there is any confusion, is to see Cyprus crushed, so it can swoop in later and "acquire" the assets on the cheap, or preferably, while the local population welcome the second coming of the glorious Red Army with open arms, delighted to be free of European slavery. Well played Putin.

The ultimatum came as EU leaders maintained pressure on Nicosia to come up with a new plan on its own and Russian prime minister Dmitry Medvedev told a visiting European Commission delegation that a solution had to include Russian participation.“It is now up to the Cypriot authorities to come up with proposals,” Jeroen Dijsselbloem, chair of the committee of 17 eurozone finance ministers who negotiated the bailout, told the European Parliament on Thursday morning.In a short statement the ECB said its 23-person governing council had agreed to maintain emergency liquidity provision to Cyprus’s banks until Monday. “Thereafter, Emergency Liquidity Assistance could only be considered if an EU-IMF programme is in place that would ensure the solvency of the concerned banks,” it said.The country’s two biggest banks, Bank of Cyprus and Laiki, are believed to be reliant on Emergency Liquidity Assistance provided by the Central Bank of Cyprus. The ECB’s governing council can terminate ELA if it believes the banks receiving it are no longer solvent.The move, however, raises the prospect of the ECB having to make good on its ultimatum on Monday, which could leave the banks unable to honour their obligations. Some analysts have speculated that the collapse of the banks could trigger a series of events that lead to Cyprus leaving the euro, with unpredictable consequences for the rest of the eurozone.

Will the ECB really be so stupid as to force the Cypriot bluff? Does Draghi really want to put the OMT into operation, which would inevitably happen once Cyprus is kicked out of the Eurozone, and a pan-European deposit run, which has so far been spared due to lack of tangible evidence that there is an actual "credibility" event in Cyprus due to what may be a permanent bank closure, becomes inevitable?

Most importantly, will the ECB truly shoot itself in the foot once again, and destroy all the so-called confidence it has rebuilt in the past four years on the back of endless promises, threats and urgings?

Tune in this time Monday to find out.

and additional news apart from Cyprus.......

http://www.zerohedge.com/news/2013-03-21/no-overnight-futures-levitation-due-abysmal-european-pmis

No Overnight Futures Levitation Due To Abysmal European PMIs, Deteriorating Cyprus Chaos

Submitted by Tyler Durden on 03/21/2013 07:06 -0400

- Ben Bernanke

- Bond

- China

- Copper

- Equity Markets

- European Central Bank

- Eurozone

- Fitch

- fixed

- France

- Germany

- headlines

- Japan

- Lehman

- Markit

- Monetary Policy

- Natural Gas

- Nikkei

- Philly Fed

- Recession

- United Kingdom

- Yen

Those wondering why the overnight ramp has not yet materialized despite promises from BOJ's new governor Kuroda to openly-endedly monetize Fukushima radiation if necessary in order to reflate the economy, will have to look at Europe where a raft of horrifying PMIs confirms what most have known: the relapse into a multi-dip European recession is progressing nicely, and the hoped for rebound in the core economies of France and Germany is once again on track to not happen, but at least there will be Cyprus to blame it all on this time.

The excuse this time was French and German Flash Manufacturing and Services PMI for March, all of which came far below expectations: German Mfg PMIs printed at a contracting 48.9 vs Exp. 50.5 (down from 50.3), while Services came at 51.6, down from 54.6 on expectations of a rise to 55.0, while French Mfg PMI stayed stubbornly flat at 43.9, despite hopes of a "bounce" to 44.3, even as the Service number ticked even lower from 43.7 to 41.9, below expectations of 44.3 and the lowest since February 2009. End result: Eurozone March Services PMI down from 47.9 to 46.5, vs Exp. of 48.2, while Manufacturing slid from 47.9 to 46.6 on hopes and prayers of a bounce to 48.2.

So much for the economy, which as everyone now knows is irrelevant for the market which means that all else equal we can expect K-Hen and the BIS boys to do everything in the next few hours to return the futures levitation ramp on schedule.

Which then takes us back to Cyprus, where things are not fixed yet, where the parliament is not expected to vote for a revised Bailout proposal yet, and where we got a cornucopia of brilliant one liners, such as these from the new Eurogroup head, who is filling in the shoes of his predecessor Juncker in style, and proving quite well that "things are serious":

- Dijsselbloem Says Additional Loan by Russia Wouldn’t Help Cyprus: “If the Russians were to say we could lend more, that wouldn’t help on the sustainability of the debt situation,” Dijsselbloem says. “Building up the debts in Cyprus doesn’t help them to work toward a new future,” Dijsselbloem says at EU Parliament

- Dijsselbloem Says Not Sure Cyprus Package Has Completely Failed, Says doesn’t see many alternatives for Cyprus

- Dijsselbloem Says Most Cyprus Deposits Are Investors, Not Savers: “The vast amount of deposits in Cyprus are not really savers, are investors,” Eurogroup head Jeroen Dijsselbloem says at the European Parliament.

- Dijsselbloem Says ECB Not ‘Using Threats’ With Cyprus Deadline: “I don’t think the ECB is using threats,” Eurogroup head Jeroen Dijsselbloem says. “What they are doing is doing as much as they can within their mandate,” Dijsselbloem says at European Parliament

Then we got a reparte from Russia which said it doesn't want a separate Cyprus deal with the EU, even as the ECB earlier said there would be ELA liquidity for Cyprus provided until March 25, which as already noted is a bank holiday in Cyprus. It is unclear what happens afterwards.

Then we got headlines out of Cyprus itself:

- Cyprus’s parliament speaker Yiannakis Omirous says initial decisions on how to tackle the country’s crisis taken today, in comments to reporters broadcast live on state-run CYBC.

- Spoke after meeting with President Nicos Anastasiades, political party leaders

- European attitudes to Cyprus “unacceptable,” Omirou says

- All solutions will go through euro area, Omirou says

Finally, putting the cherry on top, Germany's deputy parliamentary leader of Merkel’s CDU party, Michael Fuchs had a raft of his own pearls, as follow:

- Even 12 percent tax on Cyprus deposits “is not too much,” Merkel ally Fuchs says in Bloomberg TV interview.

- Germany ready to help “as much as we can” but can’t ask German taxpayers “to pay everything” for Cyprus

Michael Fuchs is deputy parliamentary leader of Merkel’s CDU party - “We want them in the euro -- no question,” Fuchs says

- Don’t believe there will be contagion

- Don’t want any country to be a tax haven

- If Cyprus bankrupt, business model is gone

To summarize - absolute, and total chaos, with ad hoc decision attempts out of everyone, even as Fitch itself says that Cyprus stalemate shows the dangers of ad hoc crisis respones in Europe. Which if funny, because in Europe everything is an ad hoc response.

For all the rest in the overnight action, here is DB's Jim Ried

I suppose when the Fed is continuing to buy $85bn a month of securities it puts the argument over where to find the €5.8bn in Cyprus in some perspective, however dramatic the situation remains. Indeed just over 2 days worth of Fed activity would get us to the amount the Cypriots are trying to conjure. After last night’s FOMC and press conference the most interesting remark was from the Chairman himself who said of a potential slowing in asset purchases that “we need to see sustained improvement (in the labour market)….so we’re just going to have to keep providing support for the economy and see how things evolve.” This suggests that payrolls need to maintain their recent improvements for a few months before they would consider changing the rate of purchases. Over the last couple of years payrolls have dipped into mid-year after a strong start so this is what Bernanke is referring to and he is therefore likely to want to see us get through the equivalent period with still elevated jobs numbers before he sanctioned a change.

The comments capped a better day for risk assets with the S&P 500 (+0.67%) closing near the session highs, following a stronger day for Eurostoxx (+1.38%). As we look ahead to today, it’s a fairly important day in terms of data headlined by the Euro area’s flash PMIs. Following the disappointment in the core last month, expectations are for only small improvements in this month’s readings. Starting with the manufacturing PMIs, consensus is for only a marginal uptick in France (44.2 vs 43.9 previous), Germany (50.5 vs 50.3 previous) and the Euroarea (48.2 vs 47.9 previous). Similarly, the consensus is looking for a 0.3pt improvement across each of the service PMIs in France (44.0 expected), Germany (55) and the Euroarea (48.2). Although we don’t get the Italian flash PMIs today it'll be interesting to try to imply a guestimate from the overall EU flash as the survey period will include the Italian election. Hard to believe that the election was almost 4 weeks ago now and we're still no nearer to a Government and that markets don't seem to care much.

Ahead of today’s euro PMIs, China has kicked off proceedings in a robust manner overnight with a flash manufacturing PMI reading of 51.7 (vs expectations of 50.8) which is up 1.3pts from the previous month’s print. The surprisingly strong PMI comes after a disappointing month for a number of Chinese-related assets. Iron ore, the Shanghai Composite and copper prices are down 14%, 4% and 8% respectively since mid-February. While there are probably seasonal factors at play following February’s Lunar New Year Holidays we should highlight that the index has now printed above 50.0 for five straight months, with month-on-month increases seen in four out of five of those months.

The stronger Chinese data has buoyed Asian equity markets with most bourses seen around 0.25% to 0.5% higher overnight. In what is becoming a familiar story, the Nikkei (+1.3%) is leading gains helped by chatter that the BoJ’s Kuroda will detail a shift in monetary policy at his first press conference as governor which is scheduled for 6pm Tokyo time today (9am London). Also in Japan, the trade data for February recorded the largest deficit (JPY1.0866trn vs JPY1102trn expected) since the Lehman period – in part driven by the J Curve effect.

The yen is trading marginally weaker against the USD at 95.9 while 10yr JGB yields hit their lowest level in almost a decade.

Returning to the situation in Cyprus, Bloomberg is reporting that President Anastasiades is set to draft a new funding plan following a cabinet meeting yesterday evening. The plan is said to include a revised version of the deposit levy according to the article and follows the stalling of talks between Cypriot Finance Minister Sarris and his counterpart in Moscow yesterday. The Ekathimerini wrote that the possibility of Moscow demanding involvement in the extraction of Cypriot natural gas or a naval or air force base on the island remains an option. Other alternatives appear to be closing though, with Russian lenders VTB and Gazprombank denying they were set to take over Cyprus Popular Bank or were unwilling to buy the bank for a symbolic sum while taking over its capitalization needs (Ekathimerini). Meanwhile the ECB is likely to delay a decision on whether to continue to supply Cypriot banks with liquidity as it awaits clarity on the government’s bailout plans, according to Bloomberg who cite EU officials.

Turning to the day ahead, aside from the all important Euro PMIs there is also an active data docket in the US with February existing home sales, the Philly Fed survey, the flash Markit PMI and weekly jobless claims. In the UK, retail sales for February are scheduled. The Eurogroup’s Dijsselbloem addresses the European Parliament’s Economic and Monetary Affairs panel (8am London) which may make for interesting viewing given the recent events in Cyprus. Spain and France will be holding bond auctions, and party leaders from Italy’s Five Star Movement will be meeting with President Napolitano as part of the latter’s consultations with major parties in the attempt to form a government.

http://www.guardian.co.uk/business/2013/mar/21/eurozone-crisis-cyprus-bailout-plan-b

Report: Cyprus to create National Solidarity Fund

Reports out of Cyprus in the last few minutes suggest that the country's leaders have decided to create "national solidarity fund", at this morning's talks in Nicosia.

Averof Neophytou, who is the deputy leader of the ruling Democratic Rally party, made the comments to reporters in Nicosia.

There's no word on what the fund would includes - but reports last night suggested pension assets, various state assets, and even property owned by the Church of Cyprus.

The parliament's speaker has also been speaking, suggested that a vote will not take place on the plan today. He also indicated that the leaders did not consider the issue of a bank levy -- suggesting a savings tax might now be off the agenda.

Worried officials discussed Cyprus leaving the euro - Reuters

Eurozone officials are increasingly alarmed about the situation in Cyprus, according to the notes of a conference call seen by Reuters.

During the call, which took place last night, officials admitted they were "in a mess" as they discussed whether capital controls (limits on bank withdrawals and cash movements) could protect the country.

Cyprus didn't attend the call - another worrying sign - as other officials talked about the risk of the country quitting the eurozone.

Reuters reports:

In detailed notes of the call seen by Reuters, one official described emotions as running "very high", making it difficult to come up with rational solutions, and referred to "open talk in regards of (Cyprus) leaving the euro zone".The call was among members of the Eurogroup Working Group, which consists of deputy finance ministers or senior treasury officials from the 17 euro zone countries as well as representatives from the European Central Bank and the European Commission. The group is chaired by Austria's Thomas Wieser.Cyprus decided not to take part in the call, a decision that several participants described as troubling and reflecting the wider confusion surrounding the island's predicament."The (Cypriot) parliament is obviously too emotional and will not decide on anything, if Cyprus does not even feel that they can attend the call it is a big problem for us," the French representative said, according to the notes seen by Reuters. "We have never seen this."

The full story is online here: Exclusive: Euro zone call notes reveal extent of alarm over Cyprus

ATM lines beginning - some photos.....

EU, Cyprus Act ‘Like Bull in China Shop’ – Russian PM

EU, Cyprus Act ‘Like Bull in China Shop’ – Russian PM

No comments:

Post a Comment