http://www.zerohedge.com/news/2013-01-08/us-mint-sells-massive-39-million-ounces-silver-coins

http://www.pimco.com/EN/Insights/Pages/Money-for-Nothin-Writing-Checks-for-Free.aspx

( Note Bill Gross also doubts gold is in fort Knox in his January 2013 letter... )

* * *

Money for Nothin’

It was Milton Friedman, not Ben Bernanke, who first made reference to dropping money from helicopters in order to prevent deflation. Bernanke’s now famous “helicopter speech” in 2002, however, was no less enthusiastically supportive of the concept. In it, he boldly previewed the almost unimaginable policy solutions that would follow the black swan financial meltdown in 2008: policy rates at zero for an extended period of time; expanding the menu of assets that the Fed buys beyond Treasuries; and of course quantitative easing purchases of an almost unlimited amount should they be needed. These weren’t Bernanke innovations – nor was the term QE. Many of them had been applied by policy authorities in the late 1930s and ‘40s as well as Japan in recent years. Yet the then Fed Governor’s rather blatant support of monetary policy to come should have been a signal to investors that he would be willing to pilot a helicopter should the takeoff be necessary. “Like gold,” he said, “U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

It was Milton Friedman, not Ben Bernanke, who first made reference to dropping money from helicopters in order to prevent deflation. Bernanke’s now famous “helicopter speech” in 2002, however, was no less enthusiastically supportive of the concept. In it, he boldly previewed the almost unimaginable policy solutions that would follow the black swan financial meltdown in 2008: policy rates at zero for an extended period of time; expanding the menu of assets that the Fed buys beyond Treasuries; and of course quantitative easing purchases of an almost unlimited amount should they be needed. These weren’t Bernanke innovations – nor was the term QE. Many of them had been applied by policy authorities in the late 1930s and ‘40s as well as Japan in recent years. Yet the then Fed Governor’s rather blatant support of monetary policy to come should have been a signal to investors that he would be willing to pilot a helicopter should the takeoff be necessary. “Like gold,” he said, “U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

http://beforeitsnews.com/gold-and-precious-metals/2013/01/gold-in-fort-knox-is-there-any-2467138.html

US Mint Sells Massive 3.9 Million Ounces Of Silver Coins In First Few Days Of 2013, Triple December's Total

Submitted by Tyler Durden on 01/08/2013 15:32 -0500

Just a few days ago we noted the massive surge in physical gold coin sales from the US Mint, with silver surprisingly lagging. Today, we see an even more dramatic surge in the sales of physical Silver Coins in the first week of January, which in a few short days hit 3.94 million oz, already surpassing the entire December total of 1.64 million ounces. It seems that the paper-to-physical currency rotation is gathering pace even as, or thanks to the trillion dollar platinum coin mercifully ending its 15 minutes of page-clicking, ad revenue infamy. In the secondary market, inventories (via APMEX) of Silver coins remain negligible, if any: American Eagles are available as follows: 2013s may be available 1/18, maybe not; 2012 - 0; 2011 - 0; 2010 - 0; 2009 - 0; 2008 - 0; 2007 -0; 2006 - 0; 2005 - 0; 2004 - 0; 2003 - 0; 2002 - 0. They do have some 2000, 2001 and 2007, all about $5-6 over spot! It seems ever more people are getting nervous about the impact of currency wars on their "money"... or perhaps just want to make Silver shirts to attract the females?

http://www.pimco.com/EN/Insights/Pages/Money-for-Nothin-Writing-Checks-for-Free.aspx

( Note Bill Gross also doubts gold is in fort Knox in his January 2013 letter... )

* * *

INVESTMENT OUTLOOK

Money for Nothin’

Writing Checks for Free

It was Milton Friedman, not Ben Bernanke, who first made reference to dropping money from helicopters in order to prevent deflation. Bernanke’s now famous “helicopter speech” in 2002, however, was no less enthusiastically supportive of the concept. In it, he boldly previewed the almost unimaginable policy solutions that would follow the black swan financial meltdown in 2008: policy rates at zero for an extended period of time; expanding the menu of assets that the Fed buys beyond Treasuries; and of course quantitative easing purchases of an almost unlimited amount should they be needed. These weren’t Bernanke innovations – nor was the term QE. Many of them had been applied by policy authorities in the late 1930s and ‘40s as well as Japan in recent years. Yet the then Fed Governor’s rather blatant support of monetary policy to come should have been a signal to investors that he would be willing to pilot a helicopter should the takeoff be necessary. “Like gold,” he said, “U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

It was Milton Friedman, not Ben Bernanke, who first made reference to dropping money from helicopters in order to prevent deflation. Bernanke’s now famous “helicopter speech” in 2002, however, was no less enthusiastically supportive of the concept. In it, he boldly previewed the almost unimaginable policy solutions that would follow the black swan financial meltdown in 2008: policy rates at zero for an extended period of time; expanding the menu of assets that the Fed buys beyond Treasuries; and of course quantitative easing purchases of an almost unlimited amount should they be needed. These weren’t Bernanke innovations – nor was the term QE. Many of them had been applied by policy authorities in the late 1930s and ‘40s as well as Japan in recent years. Yet the then Fed Governor’s rather blatant support of monetary policy to come should have been a signal to investors that he would be willing to pilot a helicopter should the takeoff be necessary. “Like gold,” he said, “U.S. dollars have value only to the extent that they are strictly limited in supply. But the U.S. government has a technology, called a printing press (or, today, its electronic equivalent), that allows it to produce as many U.S. dollars as it wishes at essentially no cost.”

Mr. Bernanke never provided additional clarity as to what he meant by “no cost.” Perhaps he was referring to zero-bound interest rates, although at the time in 2002, 10-year Treasuries were at 4%. Or perhaps he knew something that American citizens, their political representatives, and almost all investors still don’t know: that quantitative easing – the purchase of Treasury and Agency mortgage obligations from the private sector – IS essentially costless in a number of ways. That might strike almost all of us as rather incredible – writing checks for free – but that in effect is what a central bank does. Yet if ordinary citizens and corporations can’t overdraft their accounts without criminal liability, how can the Fed or the European Central Bank or any central bank get away with printing “electronic money” and distributing it via helicopter flyovers in the trillions and trillions of dollars?

Well, the answer is sort of complicated but then it’s sort of simple: They just make it up. When the Fed now writes $85 billion of checks to buy Treasuries and mortgages every month, they really have nothing in the “bank” to back them. Supposedly they own a few billion dollars of “gold certificates” that represent a fairy-tale claim on Ft. Knox’s secret stash, but there’s essentially nothing there but trust. When a primary dealer such as J.P. Morgan or Bank of America sells its Treasuries to the Fed, it gets a “credit” in its account with the Fed, known as “reserves.” It can spend those reserves for something else, but then another bank gets a credit for its reserves and so on and so on. The Fed has told its member banks “Trust me, we will always honor your reserves,” and so the banks do, and corporations and ordinary citizens trust the banks, and “the beat goes on,” as Sonny and Cher sang. $54 trillion of credit in the U.S. financial system based upon trusting a central bank with nothing in the vault to back it up. Amazing!

* * *

http://beforeitsnews.com/gold-and-precious-metals/2013/01/gold-in-fort-knox-is-there-any-2467138.html

In the classic 1964 movie Goldfinger, James Bond tries to prevent the main villain, Auric Goldfinger, from detonating a dirty nuclear bomb inside Fort Knox. While in Fort Knox, Bond says:

Well, if you explode it [the bomb] in Fort Knox, the… the entire gold supply of the United States would be radioactive for… fifty-seven years.

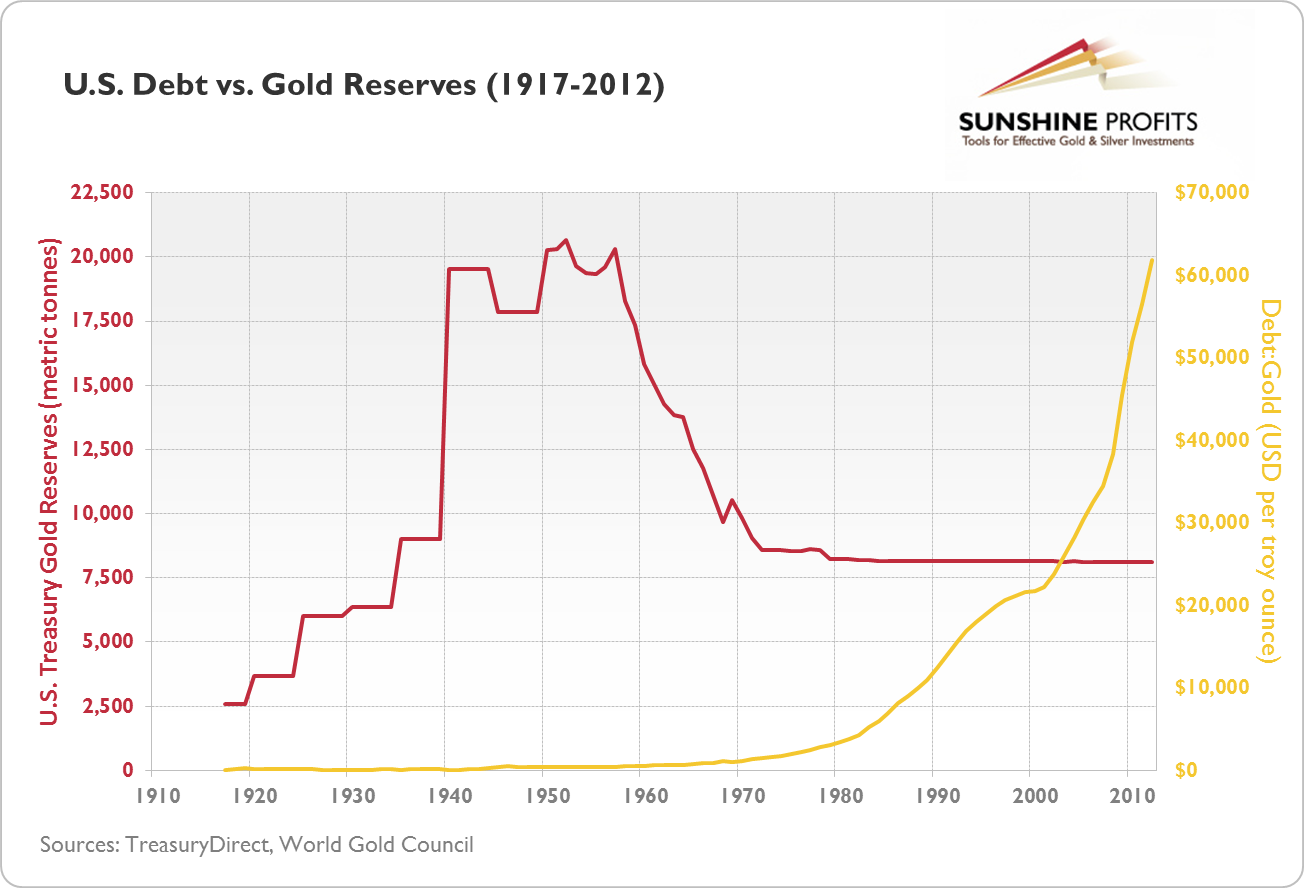

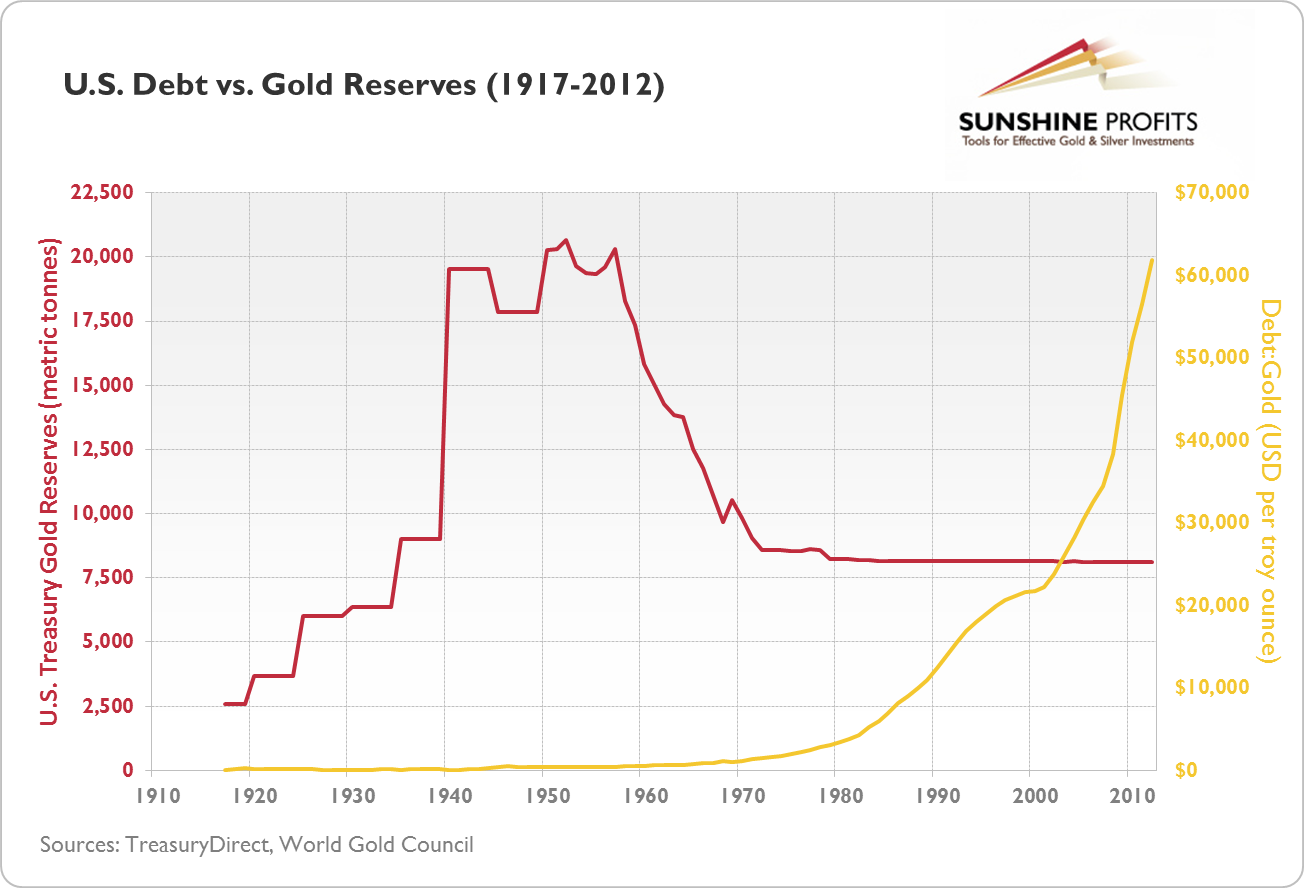

Goldfinger is only a work of fiction. Fort Knox wasn’t under the threat of a nuclear explosion (then again, who knows?). Nonetheless, it has been argued that it wouldn’t really make difference if the gold in the fort were radioactive – nobody has seen much of it since the 1950s. On December 4 and December 12, 2012 in our two-part story on gold and the U.S. dollar, we highlighted two possibilities: the dollar collapses, gold goes up like crazy or the dollar doesn't collapse, gold still appreciates. In those commentaries, we analyzed the possibilities of gold appreciating and tied possible price levels with a number of factors, for instance with U.S. gold reserves as presented on the chart below.

On December 4, 2012, we wrote the following:

This chart presents the (…) relation of U.S. debt to Treasury gold reserves – the amount of debt per one ounce of gold – up to 2012. The red line represents U.S. Treasury gold reserves in metric tonnes, while the yellow line denotes the amount of U.S. debt in dollars per ounce of gold. The debt per ounce has visibly increased since 1971, accelerating around 2000 and even more around 2008. In 2012, there were $61,796.11 of debt per one ounce of gold owned by the U.S. government.

Now, if a new gold standard is introduced and the agreement works like the Bretton Woods system, the dollar (or whatever other currency) would be tied to gold. As noted earlier in this essay, at the introduction of the Bretton Woods agreement in 1944 the debt coverage for the U.S. stood at 10.9% (or $319.90 of debt per one troy ounce of gold). If the new system were based on similar assumptions with debt coverage at 10%, this would imply a fixed price of $6,179.61 per ounce of gold ($6,179.61 per ounce of gold divided by $61,796.11 of debt per one ounce of gold gives us coverage of 10%).

Since the publication of this essay, we have received a particularly interesting question about the assumptions we used:

Dear Mr. Radomski

Your December 4, 2012 article (…) is exceeding well-written and researched, and I gained a lot of knowledge from reading it. However there is one potential problem I see in all the logic you are applying to the current situation. It seems to me you are assuming the USA actually has gold at Fort Knox and West Point. But there is mounting, but unproven evidence, both places have no gold in them at all, and are rather storage places for nerve gas. (…) An audit of the US gold holdings has been demanded by some for years, but the government will not allow it. The gold belongs to the American people, so why won’t they let us see it? Many think it is because it is no longer there. If that is indeed

the case, do we not face a “financial Armageddon?” Thanks for reading this and any response you might have. (I am not a conspiracy freak!) (…)

We always appreciate our readers’ feedback and would like to thank for it here. We also appreciate spot-on questions and see this particular one as intriguing, to say the least. Which brings us back to Fort Knox.

At first it may sound shocking, but the last audit of gold stored in Fort Knox took place in 1953. No typo here, 1953, just after U.S. President Dwight Eisenhower took office. Even though it is the last audit up to date, it can’t be described as satisfying. No outside experts were allowed and the audit team tested only about 5% of gold hoarded in the fort. So, there hasn’t been a comprehensive audit of Fort Knox in at least 60 (!!!) years. This is at least surprising, given the fact that large entities listed on stock exchanges are usually required to undergo an outside audit at least once a year. Of course, the U.S. Bullion Depository is no conventional company. Nonetheless, not auditing it independently for more than half of the century raises questions such as the one posted above.

This chart presents the (…) relation of U.S. debt to Treasury gold reserves – the amount of debt per one ounce of gold – up to 2012. The red line represents U.S. Treasury gold reserves in metric tonnes, while the yellow line denotes the amount of U.S. debt in dollars per ounce of gold. The debt per ounce has visibly increased since 1971, accelerating around 2000 and even more around 2008. In 2012, there were $61,796.11 of debt per one ounce of gold owned by the U.S. government.

Now, if a new gold standard is introduced and the agreement works like the Bretton Woods system, the dollar (or whatever other currency) would be tied to gold. As noted earlier in this essay, at the introduction of the Bretton Woods agreement in 1944 the debt coverage for the U.S. stood at 10.9% (or $319.90 of debt per one troy ounce of gold). If the new system were based on similar assumptions with debt coverage at 10%, this would imply a fixed price of $6,179.61 per ounce of gold ($6,179.61 per ounce of gold divided by $61,796.11 of debt per one ounce of gold gives us coverage of 10%).

Since the publication of this essay, we have received a particularly interesting question about the assumptions we used:

Dear Mr. Radomski

Your December 4, 2012 article (…) is exceeding well-written and researched, and I gained a lot of knowledge from reading it. However there is one potential problem I see in all the logic you are applying to the current situation. It seems to me you are assuming the USA actually has gold at Fort Knox and West Point. But there is mounting, but unproven evidence, both places have no gold in them at all, and are rather storage places for nerve gas. (…) An audit of the US gold holdings has been demanded by some for years, but the government will not allow it. The gold belongs to the American people, so why won’t they let us see it? Many think it is because it is no longer there. If that is indeed

the case, do we not face a “financial Armageddon?” Thanks for reading this and any response you might have. (I am not a conspiracy freak!) (…)

We always appreciate our readers’ feedback and would like to thank for it here. We also appreciate spot-on questions and see this particular one as intriguing, to say the least. Which brings us back to Fort Knox.

At first it may sound shocking, but the last audit of gold stored in Fort Knox took place in 1953. No typo here, 1953, just after U.S. President Dwight Eisenhower took office. Even though it is the last audit up to date, it can’t be described as satisfying. No outside experts were allowed and the audit team tested only about 5% of gold hoarded in the fort. So, there hasn’t been a comprehensive audit of Fort Knox in at least 60 (!!!) years. This is at least surprising, given the fact that large entities listed on stock exchanges are usually required to undergo an outside audit at least once a year. Of course, the U.S. Bullion Depository is no conventional company. Nonetheless, not auditing it independently for more than half of the century raises questions such as the one posted above.

This is no new topic. One of the first written accounts questioning the amount of gold really stored in Fort Knox appeared in 1974 in a tabloid, the National Tattler. An unnamed informant claimed that there was no gold left in Fort Knox. The sensational nature of the story, and of the newspaper, wouldn’t perhaps contribute to the credibility of the account but it was later revealed that the informant, Louise Auchincloss Boyer, secretary to Nelson Rockefeller, had fallen out of the window of her New York apartment and died three days after the publication in the Tattler. The tragic incident resulted in controversies over the possibility that the U.S. Bullion Depository may have misstated the actual amount of gold held in Fort Knox. Congressman John R. Rarick demanded aCongressional investigation and, on September 23, 1974 six Congressmen, one Senator and the press were allowed to enter Fort Knox to see for themselves if the gold was there or not.

The tour showed that there was gold in Fort Knox but, all the same, it sparked even more controversies. Only a fraction of the gold reserves were available to see. A photo of one Congressman published by Associated Press suggested that gold bars held in the fort may have been less heavy than would be usually expected.

Quite obviously, this has resulted in even more doubt about the fineness of gold in Fort Knox. None of these doubts have been put aside by any of the audits carried out since 1974. When the reserves were audited, the amount of the gold examined was fractional and there has been no comprehensive bar count and weighting. The same goes for assaying – if a fraction of gold bars were examined at all, then a fraction of this fraction were assayed. The methods used in the assaying process were not conventional. Usually, during an assay, gold bars are examined by means of drilling, which is called the core boring method. But the bars in Fort Knox were examined merely by cutting of small chips of the metal from their surface. This method only proved that the outer layer of the bars examined was made of gold.

This difference in assaying methods is important if you consider that counterfeit “gold bars” have been showing up in New York recently and that fake gold bars turned up in LBMA Approved Vaults in Hong Kong. All these bars had one common characteristic: they were made of tungsten, which has similar density as gold, and covered with a gold veneer. The problem here is that such bars can go undetected if they are examined with X-ray fluorescence scans or by means of simply scraping of a bit of the metal from the surface. So, to properly assess the fineness of gold bars in Fort Knox, a full core boring method should be employed.

In 2012, the German federal court ordered that the German central bank, Bundesbank, conduct anaudit of German gold reserves stored abroad, particularly in the U.S., U.K. and in France. The German authorities have never before conducted a comprehensive audit of their foreign gold reserves and the last time they were able to see their gold stored in the New York Federal Reserve vaults was supposedly in 1979/80. The Bundesbank has expressed that it doesn’t doubt the trustworthiness of the U.S. authorities but demands stricter control over its gold reserves. Because of that 150 tons of gold will be shipped from the U.S. to Germany to assess the fineness of the bars.

The tour showed that there was gold in Fort Knox but, all the same, it sparked even more controversies. Only a fraction of the gold reserves were available to see. A photo of one Congressman published by Associated Press suggested that gold bars held in the fort may have been less heavy than would be usually expected.

Quite obviously, this has resulted in even more doubt about the fineness of gold in Fort Knox. None of these doubts have been put aside by any of the audits carried out since 1974. When the reserves were audited, the amount of the gold examined was fractional and there has been no comprehensive bar count and weighting. The same goes for assaying – if a fraction of gold bars were examined at all, then a fraction of this fraction were assayed. The methods used in the assaying process were not conventional. Usually, during an assay, gold bars are examined by means of drilling, which is called the core boring method. But the bars in Fort Knox were examined merely by cutting of small chips of the metal from their surface. This method only proved that the outer layer of the bars examined was made of gold.

This difference in assaying methods is important if you consider that counterfeit “gold bars” have been showing up in New York recently and that fake gold bars turned up in LBMA Approved Vaults in Hong Kong. All these bars had one common characteristic: they were made of tungsten, which has similar density as gold, and covered with a gold veneer. The problem here is that such bars can go undetected if they are examined with X-ray fluorescence scans or by means of simply scraping of a bit of the metal from the surface. So, to properly assess the fineness of gold bars in Fort Knox, a full core boring method should be employed.

In 2012, the German federal court ordered that the German central bank, Bundesbank, conduct anaudit of German gold reserves stored abroad, particularly in the U.S., U.K. and in France. The German authorities have never before conducted a comprehensive audit of their foreign gold reserves and the last time they were able to see their gold stored in the New York Federal Reserve vaults was supposedly in 1979/80. The Bundesbank has expressed that it doesn’t doubt the trustworthiness of the U.S. authorities but demands stricter control over its gold reserves. Because of that 150 tons of gold will be shipped from the U.S. to Germany to assess the fineness of the bars.

All of this shows that the measures applied by the U.S. government to gold storage in Fort Knox and the Federal Reserve Bank of New York’s vaults are questionable and that this fact may have been recognized by German authorities. It’s hardly conceivable that there is no gold left in Fort Knox or the New York vaults. On the other hand, the lack of a comprehensive audit of either facility is unnerving. So are other irregularities associated with Fort Knox: missing shipments, audits acknowledging the existence of gold based on seals that were not broken, not on the actual count and examination of bars and so on.

Of course, a full audit of Fort Knox wouldn’t be an easy task because of the sheer amount of gold to be examined. But it’s feasible. The U.S. Mint estimated the cost of such an audit to stand at $60 million. The Treasury came up with a lower estimate – $15 million. Even if we take the higher value, and compare it to the value of gold stored in Fort Knox (as of December 31, 2012, $240.8 billion) it adds up to about 0.02% of these reserves. In this light the Treasury cannot really claim that this is too expensive.

Of course, a full audit of Fort Knox wouldn’t be an easy task because of the sheer amount of gold to be examined. But it’s feasible. The U.S. Mint estimated the cost of such an audit to stand at $60 million. The Treasury came up with a lower estimate – $15 million. Even if we take the higher value, and compare it to the value of gold stored in Fort Knox (as of December 31, 2012, $240.8 billion) it adds up to about 0.02% of these reserves. In this light the Treasury cannot really claim that this is too expensive.

No comments:

Post a Comment