http://seekingalpha.com/article/1095221-the-big-gaping-hole-in-the-employment-report-and-fed-folly

http://www.zerohedge.com/contributed/2013-01-03/us-2s10s-10s30s-breaking-out

Bond market rolling over......

http://www.zerohedge.com/news/2013-01-04/155000-jobs-added-december-unemployment-rate-78

http://www.businessinsider.com/december-nfp-preview-2013-1

Due out this morning at 8:30 AM ET is the December nonfarm payrolls report from the BLS, and the release of the FOMC minutes Thursday afternoon from the Federal Reserve's latest policy meeting just made it a lot more interesting.

http://www.zerohedge.com/news/2013-01-04/payrolls-do-investors-fear-1994-redux

The Big Gaping Hole In The Employment Report And Fed Folly

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

A lie always contains a certain factor of credibility, since the great masses of the people in the very bottom of their hearts tend to be corrupted rather than consciously and purposely evil, and that, therefore, in view of the primitive simplicity of their minds, they more easily fall victim to a big lie than to a little one, since they themselves lie in little things, but would be ashamed of lies that were too big - Adolph Hitler, "Mein Kampf"

One of the most important aspects of financial analysis is determining not only the reliability of reported numbers (accounting issues) but also analyzing the "quality" of a reported number. "Quality" includes the sustainability of a business model - and the quality of the underlying sources of revenue and profit generation.

Without getting into the whether or not the monthly employment report is a manipulated and fictitious number - much has been written about this and it's now commonly accepted that the jobs report is not believable - I stumbled on an aspect of the Bureau of Labor Statistics'(BLS) monthly employment report that has a huge hole in it. I have not seen anyone comment on this aspect of the employment statistics or question the "quality" of it.

The fact of the matter is that even if the jobs growth number is bona fide, it's not sustainable and the fact that it's not sustainable means that yesterday's Fed minutes report indicating that the FOMC was leaning toward removing QE this year is also more fiction than fact. This being the case, the negative reaction to yesterday's report by the precious metals, mining stocks and bond market is an opportunity to capitalize on the high probability that those market sectors will rebound and move higher over the next several months. Let me explain.

I noticed in digging through the line items of today's report that one line item contributed substantially to the overall headline number of 155,000: Education and health services, 65,000.

Anyone see anything wrong with that number? 65,000 is 41% of the total headline number. But think about the "quality" of that number. How much of that number do you think is the result of direct or indirect Government spending, and thus dependent on taxpayer revenue?

Table B of the BLS report, LINK, attributes 55k of that number to "health care and social assistance." Without knowing the breakdown of that number, I think we can assume most of the jobs in that particular category are funded by Medicare, Medicaid and now, Obamacare. Even the private hospital and nursing service companies that would be considered "private companies" and who hire the people in this category have a large portion of their revenues derived from Government reimbursement/entitlement programs.

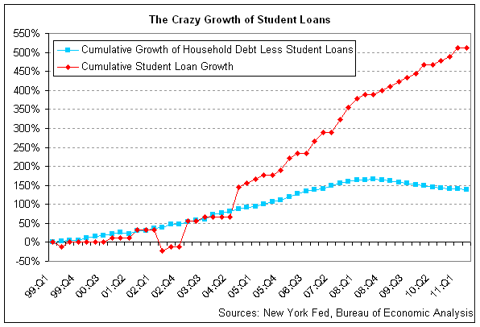

Let's examine the "education" part of that line item, which does not get further line item detail in the BLS report. I can summarize the quality of that number with two graphs. This graph shows the recent parabolic growth rate in student loan debt (source of graph: the Atlantic):

And this graph shows the growth in student loan delinquencies (source of graph: Zerohedge):

The total amount of outstanding student loan debt according the latest quarterly Federal Reserve report as of September 30, 2012 was $956 billion, with a $42 billion increase in during Q3: NY Fed. It's safe to say that number is now around $1 trillion.

That trillion dollars in student loans is primarily comprised of loans directly owned by the Federal Government and student loans that are guaranteed by either the Federal Government or State Governments. In other words, a significant portion of education is funded directly and indirectly by the Government/Taxpayer. This means that a significant amount of the employment that makes up the BLS' employment report is directly attributable to Taxpayer funding.

In the context of the accelerating level of student loan delinquencies per the above chart, any respectable financial analyst will admit that the growth in student loans, and therefore the portion of jobs growth that is directly attributable to this significant source of direct or indirect Government funding, is unequivocally not sustainable.

Any job growth connected to the student loan source of taxpayer revenue will not be recurring and will likely reverse when real budgetary austerity is imposed on the Government. Furthermore, to the extent that any healthcare related jobs are directly or indirectly connected to Government/Taxpayer funding, they are not sustainable and any real growth in that area will also reverse.

It thus looks like the Government has engineered another questionable monthly employment report in order to make the headline number appear as if the economy is back on track to economic health. But the truth is that even if the number is real, it is clearly not sustainable unless the Government intends to continue on its path of accelerating spending deficits and new Treasury debt issuance.

If the latter is the case in order to keep the economy from falling into a deep recession, the Federal Reserve is going to have to continue expanding its balance beyond 2013 buy continuing its substantial purchasing of Treasury bonds and mortgage-backed paper. Given this likely outcome of future Fed policy, the current plunge in gold, silver, mining stocks and bonds is an opportunity to deploy capital in those sectors and generate trading profits. If you are looking for a shorter term plays, I recommend GLD, SLV, GDXJ and TLT.

http://www.zerohedge.com/contributed/2013-01-03/us-2s10s-10s30s-breaking-out

U.S. 2s10s / 10s30s Breaking Out

Submitted by CrownThomas on 01/03/2013 21:51 -0500

The treasury curve is steepening, why is anyone's guess. Doubtful that there is a major roll out of treasuries and into equities right now until the debt ceiling issues get resolved. In a normal, non-centrally planned world, this may indicate potential inflation concerns, but who knows. Maybe our man Kevin just got pissed off that he has to re-use his starbuck's cup & stopped working for the past few days.

Bond market rolling over......

http://www.zerohedge.com/news/2013-01-04/155000-jobs-added-december-unemployment-rate-78

155,000 Jobs Added in December, Unemployment Rate 7.8%

Submitted by Tyler Durden on 01/04/2013 08:33 -0500

BLS reports that 155,000 Jobs were added in December, right on top of the 152,000 expected, and in line with the number needed to keep up with the growth in the population, or at least the Old Normal growth - in the New Normal only handouts matter. The unemployment rate was 7.8%, vs the 7.7% expected: who else is surprised that the rate is now rising with Obama reelected? The November unemployment rate was revised from 7.7% to 7.8%, just so headlines can proclaim the rate was unchanged. The Underemployment rate, U-6, remains steady at 14.5%. ADP, which will certainly be revised lower now, remains a farce.

The labor force participation rate: 63.6%, same as November:

http://www.businessinsider.com/december-nfp-preview-2013-1

The Whole World Will Be Watching Today's Jobs Report — Here's What You Need To Know

The Fed recently announced that it would tie its interest rate policy guidance to a 6.5 percent unemployment rate threshold – meaning unemployment data has taken on special significance for markets. Thursday's FOMC minutes release revealed, however, that the Fed is already discussing scaling back or ending quantitative easing as soon as later this year, which makes the course of employment data even more important for markets in the short term.

The consensus estimate among Wall Street economists is for a 153K rise in nonfarm payrolls in December after a 146K gain the month before.

Private payrolls are expected to rise 150K after adding 147K in November, and manufacturing payrolls are expected to rise by 5K after falling by 7K in November.

The headline unemployment rate is expected to stay unchanged at 7.7 percent.

Deutsche Bank's Chief U.S. Economist, Joe LaVorgna, wrote in a note Thursday that he expects the unemployment rate to actually tick up slightly on Friday morning:

In regards to December nonfarm payrolls, we currently anticipate +150k on the headline (+165k private) and a one-tenth increase in the unemployment rate (to 7.8%). This would be in line with the average over the past 12 months (151k). As we have previously written (US Economics Weekly, December 14), based on the trend of the past several years, we estimate that the unemployment rate will reach 6.5% by H2 2014. This is earlier than what the Fed’s central tendency forecasts imply, which suggest sometime in 2015.

On Thursday, ADP's monthly payrolls report blew by expectations. ADP says 215K private-sector jobs were created in December, well above estimates of a 150K gain.

The number caused BofA Merrill Lynch economists Michelle Meyer and Ethan Harris to bump up their estimates for Friday's nonfarm payrolls report. They wrote in a note to clients Thursday:

While we are cautious in reading too much into the signal from ADP, we don’t want to dismiss it entirely. Even if there is an upward bias, it is still significantly above our initial forecast of 100K for private payrolls and 90K for total jobs. In addition, the employment index from the ISM manufacturing survey improved, suggesting an uptick in manufacturing jobs. And lastly, the continued gain in housing construction suggests hiring in the sector, particularly after the surprising decline in construction jobs in November. We are therefore revising up our forecast to 130K for total payrolls and 140K for private payrolls.

However, Meyer and Harris say their estimate for Friday's nonfarm payrolls is still below consensus:

Despite our upward revision, we remain below the consensus forecast of 150,000 for NFP. We feel comfortable with this forecast for three reasons. First, we anticipate retail hiring to be soft given the rapid gains in retail jobs over the prior three months. This is consistent with the strong start to the holiday shopping season but sluggish end. Second, business and consumer confidence remained weak in December, likely related to the fiscal cliff. And finally, initial jobless claims, after accounting for seasonal factors, are hovering at pre-Sandy levels.

Citi economist Steven Wieting parses the latest jobless claims data, released in the U.S. on a weekly basis, to come up with a nonfarm payrolls forecast of 140K new jobs in December:

Claims in the month of December averaged about 360,000 (a couple of days are needed to pro-rate the actual monthly reading). This marked a monthly cycle low as is typical of early-to-mid cycle recoveries. However, at 360,000 the claims pace is only consistent with moderate employment gains. With claims at 368,000 at the mid month survey period, we expect total non-farm employment rose 140,000 in December.

Morgan Stanley economist David Greenlaw is perhaps one of the most bullish heading into Friday's nonfarm payrolls report. He forecasts a 185K gain in nonfarm payrolls, owing to payback from Hurricane Sandy:

Although the BLS indicated that Hurricane Sandy did not “substantively impact” the November employment data, we suspect that the effect on payrolls was at least -50,000. We arrive at this conclusion based on the big move in our favorite proxies for weather-related influences on the data and an analysis of the state-by-state breakdown that was released a couple of weeks after the national report. The state data showed that jobs declined by 40,000 in the NY/NJ region, while rising about 140,000 in all other states. We suspect that many of the businesses that were forced to close in the aftermath of Sandy were reopened by the time the December survey period arrived. This factor is expected to help boost the payroll tally relative to the 2011-12 trend of about +150,000 per month. Finally, a partial rebound in labor force participation this month should contribute to an unchanged reading for the unemployment rate.

However, Societe Generale economist Brian Jones is even more bullish. He forecasts a 225K gain in nonfarm payrolls and expects the unemployment rate to fall to 7.6 percent.

In addition to the improvement in various other labor market indicators cited by others, Jones sees weather conditions providing a pickup:

On the technical side, a dramatic swing in weather conditions between canvasses will likely provide a significant lift to observed job creation in several industries including construction and manufacturing. The breadth of job gains across industries, as measured by the BLS’ one-month diffusion index, had been expanding fairly rapidly over the August-October span and the reported November dip likely represented only a temporary pause. The number of persons unable to work because of bad weather from the household survey, our proxy for the impact of climatic conditions on hiring, soared to 369,000 in November – a record for that month. Our NFP forecast incorporates a halving in that variable to 186,000, matching the average December reading over the 2007-11 span. That assumption could prove conservative. Indeed, at 695, the number of heating degree days in December was 122 below normal.

http://www.zerohedge.com/news/2013-01-04/payrolls-do-investors-fear-1994-redux

On Payrolls, Do Investors Fear A 1994 Redux?

Submitted by Tyler Durden on 01/04/2013 08:08 -0500

Via Steven Englander of Citi,

The median Bloomberg expectation for NFP is 153k, Citi is at 140k; the central tendency of the forecasts is about 125-185k. Among forecasts that have changed today (presumably because of ADP) the median is 180k. Not everyone shades forecasts because of ADP (especially given its relatively poor forecasting track record) but it seems possible that the true market forecast has shifted up somewhat, maybe to around 160k..

Before the Minutes were released, there was little anticipation or discussion on payrolls.Now that the Minutes are out and have raised market fears that the fed will pull back from ease earlier than anticipated, investors are worried about a repeat of 1994, when a surprise Fed tightening after a long period of easy money (by standards of those days) devastated fixed income markets. Then 10yr Treasury yields rose 170bps over a two month period.

In that light, you have to respect bond market skittishness, whenever 10yr Treasury yields go up by 21bps over three business days. We are not convinced this is what the Fed intended to convey. With fiscal tightening taking 1%+ off US GDP growth in 2013 and mortgage spreads versus Treasuries wider than the Fed hoped for, monetary conditions may not be as easy relative to underlying domestic demand as the Fed intended.

However, you have to respect the market response. And if payrolls come anywhere near close to a 200k handle we will very likely see further a further equity and fixed income sell off. So there is the possibility that we will have a much more exciting morning after payrolls than anyone had anticipated. With investors having started the year buying risk hand over fist, any sign that the Fed is less than forthcoming will likely lead to position cutting. As much as we have liked the risk trade, fear of Fed tightening would likely reverse the trade at least temporarily.

Levels to watch – even with some upward revision to expectations, above 180k would be well above the last three months and viewed as being above trend. Above 200k would bring back the optimism of early 2012, but probably lead to major asset market setbacks, with rate fears dominating stronger activity.

On the weak side 130k would now be viewed as disappointing, barely at trend and showing little change from the prior three months. That might re-establish the expectation that ease is likely to be persistent.

Given the Fed’s use of the unemployment rate as a threshold indicator (even as they insist that they will not use it mindlessly and independent of participation rates), a drop to 7.6% will stoke even more fears of impending tightening. The consensus is almost even divided between 7.7% and an uptick to 7.8%, with 7.6% a tiny minority, so the pain side is still lower, rather than higher, unemployment.

In currency terms JPY is vulnerable as US yields approach the critical 2% level. However risk correlated currencies in both G10 and EM stand to lose if there is a sharp adjustment downward in the expectation of liquidity provision. So even if US fixed income investors face the prospects of severe losses on their holdings, the prospect of US hikes should be worrisome enough to lead to cutting of short USD positions.

No comments:

Post a Comment