IS TED BUTLER’S SILVER PANIC IMMINENT? APPLE CONTRACTOR CLAIMS NEW IMAC PRODUCTION DELAYED OVER SILVER SHORTAGE!

http://truthingold.blogspot.com/2013/01/germany-pays-visit-to-united-states.html

THURSDAY, JANUARY 17, 2013

Germany Pays A Visit To The United States

Press Release from the Bundesbank: LINK

Knock Knock.

Ben Bernanke: Who's there?

Bundesbank (German Central Bank): We would like our gold

back please.

Ben Bernanke: ROFLMAO

(note: "roflmao" is texting-code for, "rolling on floor, laughing my ass off")

Here's what Jame Turk has to say about this - for the record, in studying/researching the gold market exclusively for the better part of 12 years, I believe Turk knows as much as about the subject of Central Bank gold manipulation as anyone I've encountered:

The most likely scenario is that, while it's possible, though not a certainty, that the bars may be sitting in the West Point deep storage Fed gold vault, it has been leased out and swapped out in legal transactions designed to manipulate the price of gold. What this means is that private parties (think: China's central bank, very wealthy foreigners, India, etc) have the legal title to any gold that has been leased or swapped and sold outright.

If you are skeptical as to the credibility of this reality, please take the time to read this paper authored by James Turk in January 2002 - it is quite revealing: Fed Gold Swaps

It’s quite clear that the German gold is being held hostage. They are not getting what they want. They are getting what the Federal Reserve is telling them they can have. The fact that they are doing it over 7 years rather than 7 weeks, is just an indication that gold probably isn’t in the Federal Reserve, and the Federal Reserve doesn’t want to have to go out and buy it overnight to fulfill the German demand. They are trying to stretch it out as long as possible in order to keep gold prices controlled.Here's the link to his interview with Eric King: LINK

The most likely scenario is that, while it's possible, though not a certainty, that the bars may be sitting in the West Point deep storage Fed gold vault, it has been leased out and swapped out in legal transactions designed to manipulate the price of gold. What this means is that private parties (think: China's central bank, very wealthy foreigners, India, etc) have the legal title to any gold that has been leased or swapped and sold outright.

If you are skeptical as to the credibility of this reality, please take the time to read this paper authored by James Turk in January 2002 - it is quite revealing: Fed Gold Swaps

http://harveyorgan.blogspot.com/2013/01/gold-and-silver-have-upside-day.html

THURSDAY, JANUARY 17, 2013

Gold and silver have upside day reversals/more discussion on German repatriation of gold/

Good evening Ladies and Gentlemen:

Gold closed:up today by $7.70 to finish the comex session at $1690.40 Silver finished up 27 cents at $31.79. Both silver and gold have upside outside day reversals. The gold and equity shares languished despite the high precious metals price. The banking cartel never allow a follow through on an upside outside day reversal and with the languishing equity prices with tomorrow being Friday (options expiry on equities) you can probably assume that they will raid again tomorrow.

We have witnessed many analyst try and decipher the German announcement of the repatriation of their gold reserves in New York and France.

I would have to agree with James Turk and T. Ferguson that the real reason for the announcement is that the Americans are refusing to supply the metal. The Americans will only provide 43 tonnes per year which is around 18% of American production. No doubt Germany will be taking a lot of pressure to bring the gold hoard much faster. Many talking heads are still demanding a full auditing of the gold together with proper ownership. The world is beginning to understand that the USA may have this gold sitting in NY but it has issued many obligations on this gold and in so doing they have sent these obligations through multiple hypothecation and rehypothecation occurrences. It is important to understand that many countries are also witnessing this and probably they have come to the same conclusion as us. Although the USA may not hand over it's metal, you can bet the farm that countries will try to repatriate their gold reserves to the motherland.The French issue is also important. France will deliver 53 tonnes of gold per year or 374 tonnes at the end of the 7th year. It is a short distance from Paris to Frankfurt. Why the wait for 7 days? By guess>>>

this gold has also been hypothecated time and time again. The bulk of the physical stories today is one this issue. Before delving into these discussions.........Gold closed:up today by $7.70 to finish the comex session at $1690.40 Silver finished up 27 cents at $31.79. Both silver and gold have upside outside day reversals. The gold and equity shares languished despite the high precious metals price. The banking cartel never allow a follow through on an upside outside day reversal and with the languishing equity prices with tomorrow being Friday (options expiry on equities) you can probably assume that they will raid again tomorrow.

We have witnessed many analyst try and decipher the German announcement of the repatriation of their gold reserves in New York and France.

I would have to agree with James Turk and T. Ferguson that the real reason for the announcement is that the Americans are refusing to supply the metal. The Americans will only provide 43 tonnes per year which is around 18% of American production. No doubt Germany will be taking a lot of pressure to bring the gold hoard much faster. Many talking heads are still demanding a full auditing of the gold together with proper ownership. The world is beginning to understand that the USA may have this gold sitting in NY but it has issued many obligations on this gold and in so doing they have sent these obligations through multiple hypothecation and rehypothecation occurrences. It is important to understand that many countries are also witnessing this and probably they have come to the same conclusion as us. Although the USA may not hand over it's metal, you can bet the farm that countries will try to repatriate their gold reserves to the motherland.The French issue is also important. France will deliver 53 tonnes of gold per year or 374 tonnes at the end of the 7th year. It is a short distance from Paris to Frankfurt. Why the wait for 7 days? By guess>>>

Let us now head over to the comex and assess trading today.

The total comex gold OI fell by 4222 contracts from 447,773 down to 443,551. The non active January contract month fell by 3 contracts from 96 down to 93. We had 0 delivery notices filed yesterday so in essence we lost 3 contracts or 300 oz of gold standing for the January delivery month. The next big delivery month is February and here the OI fell by 13,163 from 200,441 down to 187,278 as many rolled into April and June. The estimated volume today was OK at 218,821,however you must consider the many rollovers. The confirmed volume yesterday was a lot lower at 182,194.

The total silver comex continues to play to a different drummer. It's OI rose by 580 contracts from 140,443 up to 141,023. Our bankers are having a tough time shaking these longs out of silver. The non active January contract month saw it's OI fall by 19 contracts from 45 down to 26. We had 22 delivery notices filed yesterday so again we gained 3 contracts or 15,000 in additional silver ounces standing. The next big active month for silver is March and here the OI rose by 464 contracts from 75,226 up to 75,690. The estimated volume at the silver comex was very high at 53,002. The confirmed volume yesterday was much lower at 34,899.

Comex gold figures

Jan 17.2013 The January contract month

Ounces

Withdrawals from Dealers Inventory in oz

nil

Withdrawals from Customer Inventory in oz

nil

Deposits to the Dealer Inventory in oz

0 (nil)

Deposits to the Customer Inventory, in oz

nil

No of oz served (contracts) today

0 (nil)

No of oz to be served (notices)

93 (9,300 oz)

Total monthly oz gold served (contracts) so far this month

902 (90,200 oz)

Total accumulative withdrawal of gold from the Dealers inventory this month

17,799.16

Total accumulative withdrawal of gold from the Customer inventory this month

316,767.55 oz

and silver...

Silver:

January 17.2013: The January silver contract month

Silver

Ounces

Withdrawals from Dealers Inventory nil Withdrawals from Customer Inventory 1,085,428.39 oz (Brinks,Delaware, Scotia) Deposits to the Dealer Inventory nil Deposits to the Customer Inventory 800,622.37 oz (CNT, Brinks) No of oz served (contracts) 10 (50,000 oz) No of oz to be served (notices) 16 (80,000 oz) Total monthly oz silver served (contracts) 682 (3,410,000 oz) Total accumulative withdrawal of silver from the Dealers inventory this month 2,465,925.6 Total accumulative withdrawal of silver from the Customer inventory this month 4,284,014.0

****

And now for the major physical stories we faced today:

Goldcore also thinks the public does not like the 7 year wait for it's gold.

your early morning gold trading courtesy of Goldcore

(courtesy Goldcore)

Germany's Gold Repatriation Unlikely To Assuage Public Concerns

Submitted by Tyler Durden on 01/17/2013 09:44 -0500

- Bank of England

- Bank of New York

- British Pound

- Central Banks

- Debt Ceiling

- Federal Reserve

- Federal Reserve Bank

- Federal Reserve Bank of New York

- Germany

- International Monetary Fund

- Monetary Policy

- PIMCO

- Precious Metals

- Real Interest Rates

- Reuters

- Twitter

- Wall Street Journal

Submitted by GoldCore

Germany's Gold Repatriation Unlikely To Assuage Public Concerns

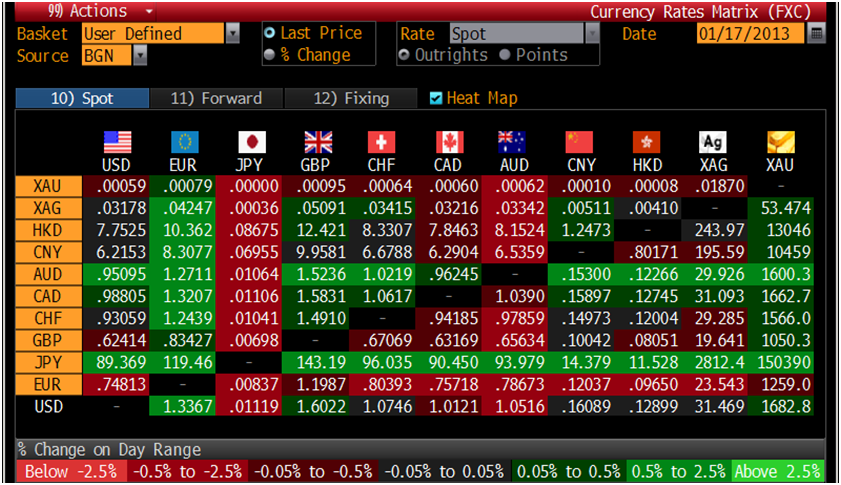

Today’s AM fix was USD 1,683.25, EUR 1,260.11, and GBP 1,050.85 per ounce.

Yesterday’s AM fix was USD 1,679.75, EUR 1,262.78 and GBP 1,047.55 per ounce.

Silver is trading at $31.53/oz, €23.68/oz and £19.75/oz. Platinum is trading at $1,687.50/oz, palladium at $725.00/oz and rhodium at $1,125/oz.

Gold inched up $1.00 or 0.06% in New York yesterday and closed at $1,679.90/oz. Silver rose to $31.46 in Asia before it dropped off to $31.07 in London, but it then climbed to as high as $31.551 in New York and finished with a gain of 0.25%.

Gold held firm on Thursday, as investors weighed concern about slowing global economic growth and expectations for more stimulus measures.

Platinum supply shortages in South Africa limited its 7 day rally.

Thomson Reuters GEMS reported that gold investment favoured by negative real interest rates and debt concerns, is expected to drive prices to a record average high in 2013.

Although the U.S. Fed minutes earlier in the month stirred concerns about tightening monetary policy, the U.S. debt ceiling issue still looms and without an agreement the U.S. government will run out of money by mid February.

The Bundesbank announced yesterday that they will repatriate 674 metric tons of their total 3,391 metric ton gold reserves from vaults in Paris and New York to restore public confidence in the safety of Germany’s gold reserves.

Whether the repatriation of only some 20% of Germany's gold reserves from the Federal Reserve Bank of New York and the Banque of Paris back to Frankfurt manages to allay German concerns remains in question.

Especially given that the transfer from the Federal Reserve is set to take place slowly over a seven year period and will only be completed in 2020.

The German Precious Metals Association and Germany's ‘Repatriate Our Gold’ campaign said that the move by the Bundesbank did not negate the need for a full audit of Germany's gold.

They want this to take place in order to protect against impairment of the gold reserves through leases and swaps. Indeed, they have called for independent, full, neutral and physical audits of the gold reserves of the world's central banks and the repatriation of all central bank gold - the physical transport of gold reserves back into the respective sovereign ownership countries.

It seems likely that we may only have seen another important milestone in the debate about German and global gold reserves.

Mohamed El_Erian of PIMCO in an op-ed piece in the Financial Times said that the German gold move should have “minimum systemic impact”.

But he acknowledged the risk that this could be wrong and the decision could “fuel greater suspicion” which could result in a “hit to what remains in multilateral policy cooperation would be problematic for virtually everybody.”

He warned that “growing mutual mistrusts” could “translate into larger multilateral tensions, then the world would find itself facing even greater difficulties resolving payments imbalances and resisting beggar-thy-neighbor national policies.”

Germany creates pile of golden opportunities – The Financial Times

Germany Repatriates Gold Reserves – The Wall Street Journal

Concern in Dublin: Six tonnes of Irish gold in Bank of England – The Australian

Bundesbank Weighs Bullion Against Public Pressure – The Financial Times

The Meaning of Germany’s Gold Decision - The Financial Times

****

I want everyone to read the following conversation between Jame Turk and Eric King of Kingworld news. I have met James several times including a dinner outing with Reg Howe. I consider this gentleman one of the best in analyzing gold (and silver).

He correctly states that Germany was caught in a corner as the Americans have refused to deliver gold stored at the Federal Bank of NY. He feels that Germany tried to put a good light on the situation and not cause an avalanche of selling in equities buy saying that the gold will arrive in 7 years. No doubt that this is the only amount that the Americans state that they would supply them. The Bundesbank official when questioned as to why they are keeping gold in NY, stated that it was because the FRBNY is a major gold trading centre, which is totally false. London and Zurich are the major physical gold trading centres, not New York

I would put your money with James Turk as both him and Reg Howe together with James Sinclair are your authorities on gold.

(courtesy James Turk/Kingworldnews)

Germany's gold is hostage to worldwide market default, Turk tells King World News

Submitted by cpowell on Thu, 2013-01-17 19:23. Section: Daily Dispatches

11:17a PT Thursday, January 17, 2013

Dear Friend of GATA and Gold:

Germany's gold is being held hostage by the Federal Reserve because it is long gone and can't be recovered without defaulting the gold market worldwide, GoldMoney founder and GATA consultant James Turk today tells King World News. Turk adds that the Bundesbank's statement about its limited plan for gold repatriation lied when it said that New York is a gold trading center, when it is not. An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Jim Sinclair comments on the Ambrose Evans Pritchard below on a new gold standard about to be born:

First Jim Sinclair:

GOLD WILL SAVE THE FINANCIALLY COLLAPSING WORLD OF DEBT

My Dear Extended Family,

The following article from the Telegraph was sent to us from Dean Harry Schultz. It was Dean Harry Schultz that gave me my first great opportunity. I worked for him for 11 great years.

I have been outlining this evolution to you for more than a decade. This article touches on it, but does not outline it. This article smells it but does not yet fully appreciate it. This process is behind the ascendancy of the euro despite every bear argument to the settlement currency of choice.

This is happening in the marketplace, and not behind closed doors in smoke filled rooms. Yes, there are closed doors involved in it, but they are free market proponents. I know more about this than even the people who have already adopted a name for it.

Gold is going to and beyond $3500 based entirely on this initiative certain to become completed as a reality. It is already happening right in front of your eyes, but the world is still blind to it.

This is why gold will rise to $3500 and beyond, but never do a 1980 fall again.

This is why silver is a great trading vehicle, but not a great long term holding.

This is why I have invested $32,000,000 in my own approach towards gold.

This is why I sold ALL of my personal material treasures to make this investment when only I would do it.

This is why I took on large debt to accomplish my plan.

This was the basis for my career interview by Forbes in Dec 2000.

No government fund, no gold bank, and no long cycle analyst can stop the progression of gold. The capitalization of the forces behind gold will overcome all these other bearish considerations. I say this because I know this, not because I think this.

I knew gold’s first most important number was $1650 11 years ahead of time. I did not think it. I am telling you now because I know it that gold will go to and beyond $3500. It will be gold that saves a financially collapsing world of debt.

A new Gold Standard is being born

Last updated: January 17th, 2013

London Telegraph

The world is moving step by step towards a de facto Gold Standard, without any meetings of G20 leaders to announce the idea or bless the project.

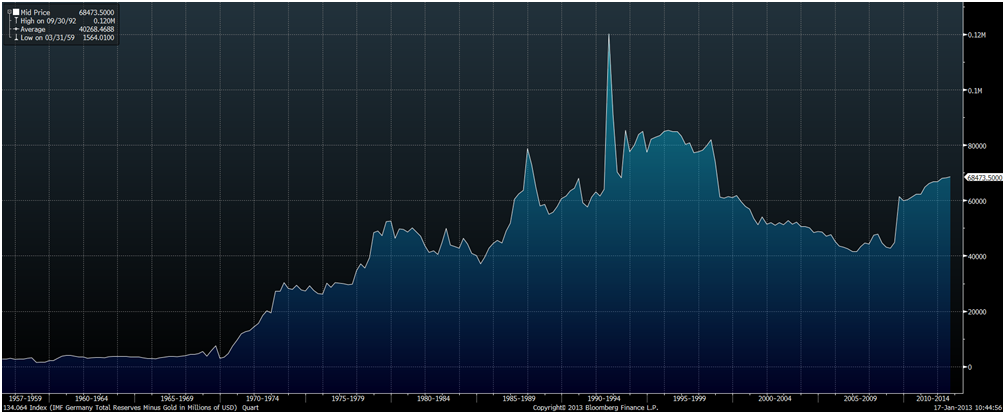

Some readers will already have seen the GFMS Gold Survey for 2012 which reported that central banks around the world bought more bullion last year in terms of tonnage than at any time in almost half a century.

They added a net 536 tonnes in 2012 as they diversified fresh reserves away from the four fiat suspects: dollar, euro, sterling, and yen.

The Washington Accord, where Britain, Spain, Holland, South Africa, Switzerland, and others sold a chunk of their gold each year, already seems another era – the Gordon Brown era, you might call it.

That was the illusionary period when investors thought the euro would take its place as the twin pillar of a new G2 condominium alongside the dollar. That hope has faded. Central bank holdings of euro bonds have fallen back to 26pc, where they were almost a decade ago.Neither the euro nor the dollar can inspire full confidence, although for different reasons. EMU is a dysfunctional construct, covering two incompatible economies, prone to lurching from crisis to crisis, without a unified treasury to back it up. The dollar stands on a pyramid of debt. We all know that this debt will be inflated away over time – for better or worse. The only real disagreement is over the speed.

The central bank buyers are of course the rising powers of Asia and the commodity bloc, now holders of two thirds of the world’s $11 trillion foreign reserves, and all its incremental reserves.

It is no secret that China is buying the dips, seeking to raise the gold share of its reserves well above 2pc. Russia has openly targeted a 10pc share. Variants of this are occurring from the Pacific region to the Gulf and Latin America. And now the Bundesbank has chosen to pull part of its gold from New York and Paris.

Personally, I doubt that Buba had any secret agenda, or knows something hidden from the rest of us. It responded to massive popular pressure and prodding from lawmakers in the Bundestag to bring home Germany’s gold. Yet that is not the end of the story. The fact that this popular pressure exists – and is well-organised – reflects a breakdown in trust between the major democracies and economic powers. It is a new political fact in the global system.

Pimco’s Mohammed El Erian said this may have a knock-on effect:

“In the first instance, it could translate into pressures on other countries to also repatriate part of their gold holdings. After all, if you can safely store your gold at home — a big if for some countries — no government would wish to be seen as one of the last to outsource all of this activity to foreign central banks.

If developments are limited to this problem, there would be no material impact on the functioning and well-being of the global economy. If, however, perceptions of growing mutual mistrusts translate into larger multilateral tensions, then the world would find itself facing even greater difficulties resolving payments imbalances and resisting beggar-thy-neighbour national policies.

“The most likely outcome right now is for Germany’s decision to have minimum systemic impact. But should this be wrong and the decision fuel greater suspicion – a risk scenario rather than the baseline – the resulting hit to what remains in multilateral policy co-operation would be problematic for virtually everybody.

As I reported on Tuesday, gold veteran Jim Sinclair thinks it is an earthquake, comparing it to Charles de Gaulle’s decision to pull French gold from New York in the late 1960s – the precursor to the breakdown of the Bretton Woods system three years later when Nixon suspended gold conversion.Mr Sinclair predicts that the Bundesbank’s action will prove the death knell of dollar power. I do not really see where this argument leads. Currencies were fixed in de Gaulle’s time. They float today. It is within the EMU fixed-exchange system – ie between Germany and Spain – that we see an (old) Gold Standard dynamic at work with all its destructive power, and the risk of sudden ruptures always present. The global system is supple. It bends to pressures.

and from Silver Doctors.....funny the Mint is out of silver already !

JANUARY US MINT SILVER EAGLE SALES PASS 6 MILLION, MINT SUSPENDS SALES, STATES EAGLES ARE SOLD OUT!!

http://www.silverdoctors.com/jim-willie-the-coming-isolation-of-usdollar/

Jan 17.2013 The January contract month

Ounces

| |

Withdrawals from Dealers Inventory in oz

|

nil

|

Withdrawals from Customer Inventory in oz

|

nil

|

Deposits to the Dealer Inventory in oz

|

0 (nil)

|

Deposits to the Customer Inventory, in oz

| nil |

No of oz served (contracts) today

|

0 (nil)

|

No of oz to be served (notices)

|

93 (9,300 oz)

|

Total monthly oz gold served (contracts) so far this month

|

902 (90,200 oz)

|

Total accumulative withdrawal of gold from the Dealers inventory this month

|

17,799.16

|

Total accumulative withdrawal of gold from the Customer inventory this month

| 316,767.55 oz |

and silver...

Silver:

January 17.2013: The January silver contract month

| Silver |

Ounces

|

| Withdrawals from Dealers Inventory | nil |

| Withdrawals from Customer Inventory | 1,085,428.39 oz (Brinks,Delaware, Scotia) |

| Deposits to the Dealer Inventory | nil |

| Deposits to the Customer Inventory | 800,622.37 oz (CNT, Brinks) |

| No of oz served (contracts) | 10 (50,000 oz) |

| No of oz to be served (notices) | 16 (80,000 oz) |

| Total monthly oz silver served (contracts) | 682 (3,410,000 oz) |

| Total accumulative withdrawal of silver from the Dealers inventory this month | 2,465,925.6 |

| Total accumulative withdrawal of silver from the Customer inventory this month | 4,284,014.0 |

****

And now for the major physical stories we faced today:

Goldcore also thinks the public does not like the 7 year wait for it's gold.

your early morning gold trading courtesy of Goldcore

(courtesy Goldcore)

Goldcore also thinks the public does not like the 7 year wait for it's gold.

your early morning gold trading courtesy of Goldcore

(courtesy Goldcore)

Germany's Gold Repatriation Unlikely To Assuage Public Concerns

Submitted by Tyler Durden on 01/17/2013 09:44 -0500

- Bank of England

- Bank of New York

- British Pound

- Central Banks

- Debt Ceiling

- Federal Reserve

- Federal Reserve Bank

- Federal Reserve Bank of New York

- Germany

- International Monetary Fund

- Monetary Policy

- PIMCO

- Precious Metals

- Real Interest Rates

- Reuters

- Wall Street Journal

Submitted by GoldCore

Germany's Gold Repatriation Unlikely To Assuage Public Concerns

Today’s AM fix was USD 1,683.25, EUR 1,260.11, and GBP 1,050.85 per ounce.

Yesterday’s AM fix was USD 1,679.75, EUR 1,262.78 and GBP 1,047.55 per ounce.

Yesterday’s AM fix was USD 1,679.75, EUR 1,262.78 and GBP 1,047.55 per ounce.

Silver is trading at $31.53/oz, €23.68/oz and £19.75/oz. Platinum is trading at $1,687.50/oz, palladium at $725.00/oz and rhodium at $1,125/oz.

Gold inched up $1.00 or 0.06% in New York yesterday and closed at $1,679.90/oz. Silver rose to $31.46 in Asia before it dropped off to $31.07 in London, but it then climbed to as high as $31.551 in New York and finished with a gain of 0.25%.

Gold held firm on Thursday, as investors weighed concern about slowing global economic growth and expectations for more stimulus measures.

Platinum supply shortages in South Africa limited its 7 day rally.

Thomson Reuters GEMS reported that gold investment favoured by negative real interest rates and debt concerns, is expected to drive prices to a record average high in 2013.

Although the U.S. Fed minutes earlier in the month stirred concerns about tightening monetary policy, the U.S. debt ceiling issue still looms and without an agreement the U.S. government will run out of money by mid February.

The Bundesbank announced yesterday that they will repatriate 674 metric tons of their total 3,391 metric ton gold reserves from vaults in Paris and New York to restore public confidence in the safety of Germany’s gold reserves.

Whether the repatriation of only some 20% of Germany's gold reserves from the Federal Reserve Bank of New York and the Banque of Paris back to Frankfurt manages to allay German concerns remains in question.

Especially given that the transfer from the Federal Reserve is set to take place slowly over a seven year period and will only be completed in 2020.

The German Precious Metals Association and Germany's ‘Repatriate Our Gold’ campaign said that the move by the Bundesbank did not negate the need for a full audit of Germany's gold.

They want this to take place in order to protect against impairment of the gold reserves through leases and swaps. Indeed, they have called for independent, full, neutral and physical audits of the gold reserves of the world's central banks and the repatriation of all central bank gold - the physical transport of gold reserves back into the respective sovereign ownership countries.

It seems likely that we may only have seen another important milestone in the debate about German and global gold reserves.

Mohamed El_Erian of PIMCO in an op-ed piece in the Financial Times said that the German gold move should have “minimum systemic impact”.

But he acknowledged the risk that this could be wrong and the decision could “fuel greater suspicion” which could result in a “hit to what remains in multilateral policy cooperation would be problematic for virtually everybody.”

He warned that “growing mutual mistrusts” could “translate into larger multilateral tensions, then the world would find itself facing even greater difficulties resolving payments imbalances and resisting beggar-thy-neighbor national policies.”

Germany creates pile of golden opportunities – The Financial Times

Germany Repatriates Gold Reserves – The Wall Street Journal

Concern in Dublin: Six tonnes of Irish gold in Bank of England – The Australian

Bundesbank Weighs Bullion Against Public Pressure – The Financial Times

The Meaning of Germany’s Gold Decision - The Financial Times

****

I want everyone to read the following conversation between Jame Turk and Eric King of Kingworld news. I have met James several times including a dinner outing with Reg Howe. I consider this gentleman one of the best in analyzing gold (and silver).

He correctly states that Germany was caught in a corner as the Americans have refused to deliver gold stored at the Federal Bank of NY. He feels that Germany tried to put a good light on the situation and not cause an avalanche of selling in equities buy saying that the gold will arrive in 7 years. No doubt that this is the only amount that the Americans state that they would supply them. The Bundesbank official when questioned as to why they are keeping gold in NY, stated that it was because the FRBNY is a major gold trading centre, which is totally false. London and Zurich are the major physical gold trading centres, not New York

I would put your money with James Turk as both him and Reg Howe together with James Sinclair are your authorities on gold.

(courtesy James Turk/Kingworldnews)

|

Germany's gold is hostage to worldwide market default, Turk tells King World News

Submitted by cpowell on Thu, 2013-01-17 19:23. Section: Daily Dispatches

First Jim Sinclair:

11:17a PT Thursday, January 17, 2013

Dear Friend of GATA and Gold:

Germany's gold is being held hostage by the Federal Reserve because it is long gone and can't be recovered without defaulting the gold market worldwide, GoldMoney founder and GATA consultant James Turk today tells King World News. Turk adds that the Bundesbank's statement about its limited plan for gold repatriation lied when it said that New York is a gold trading center, when it is not. An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

Gold Anti-Trust Action Committee Inc.

Jim Sinclair comments on the Ambrose Evans Pritchard below on a new gold standard about to be born:

First Jim Sinclair:

GOLD WILL SAVE THE FINANCIALLY COLLAPSING WORLD OF DEBT

My Dear Extended Family,

The following article from the Telegraph was sent to us from Dean Harry Schultz. It was Dean Harry Schultz that gave me my first great opportunity. I worked for him for 11 great years.

I have been outlining this evolution to you for more than a decade. This article touches on it, but does not outline it. This article smells it but does not yet fully appreciate it. This process is behind the ascendancy of the euro despite every bear argument to the settlement currency of choice.

This is happening in the marketplace, and not behind closed doors in smoke filled rooms. Yes, there are closed doors involved in it, but they are free market proponents. I know more about this than even the people who have already adopted a name for it.

Gold is going to and beyond $3500 based entirely on this initiative certain to become completed as a reality. It is already happening right in front of your eyes, but the world is still blind to it.

This is why gold will rise to $3500 and beyond, but never do a 1980 fall again.

This is why silver is a great trading vehicle, but not a great long term holding.

This is why I have invested $32,000,000 in my own approach towards gold.

This is why I sold ALL of my personal material treasures to make this investment when only I would do it.

This is why I took on large debt to accomplish my plan.

This was the basis for my career interview by Forbes in Dec 2000.

This is why silver is a great trading vehicle, but not a great long term holding.

This is why I have invested $32,000,000 in my own approach towards gold.

This is why I sold ALL of my personal material treasures to make this investment when only I would do it.

This is why I took on large debt to accomplish my plan.

This was the basis for my career interview by Forbes in Dec 2000.

No government fund, no gold bank, and no long cycle analyst can stop the progression of gold. The capitalization of the forces behind gold will overcome all these other bearish considerations. I say this because I know this, not because I think this.

I knew gold’s first most important number was $1650 11 years ahead of time. I did not think it. I am telling you now because I know it that gold will go to and beyond $3500. It will be gold that saves a financially collapsing world of debt.

A new Gold Standard is being born

Last updated: January 17th, 2013London Telegraph

The world is moving step by step towards a de facto Gold Standard, without any meetings of G20 leaders to announce the idea or bless the project.

Some readers will already have seen the GFMS Gold Survey for 2012 which reported that central banks around the world bought more bullion last year in terms of tonnage than at any time in almost half a century.

They added a net 536 tonnes in 2012 as they diversified fresh reserves away from the four fiat suspects: dollar, euro, sterling, and yen.

The Washington Accord, where Britain, Spain, Holland, South Africa, Switzerland, and others sold a chunk of their gold each year, already seems another era – the Gordon Brown era, you might call it.

That was the illusionary period when investors thought the euro would take its place as the twin pillar of a new G2 condominium alongside the dollar. That hope has faded. Central bank holdings of euro bonds have fallen back to 26pc, where they were almost a decade ago.Neither the euro nor the dollar can inspire full confidence, although for different reasons. EMU is a dysfunctional construct, covering two incompatible economies, prone to lurching from crisis to crisis, without a unified treasury to back it up. The dollar stands on a pyramid of debt. We all know that this debt will be inflated away over time – for better or worse. The only real disagreement is over the speed.

The central bank buyers are of course the rising powers of Asia and the commodity bloc, now holders of two thirds of the world’s $11 trillion foreign reserves, and all its incremental reserves.

It is no secret that China is buying the dips, seeking to raise the gold share of its reserves well above 2pc. Russia has openly targeted a 10pc share. Variants of this are occurring from the Pacific region to the Gulf and Latin America. And now the Bundesbank has chosen to pull part of its gold from New York and Paris.

Personally, I doubt that Buba had any secret agenda, or knows something hidden from the rest of us. It responded to massive popular pressure and prodding from lawmakers in the Bundestag to bring home Germany’s gold. Yet that is not the end of the story. The fact that this popular pressure exists – and is well-organised – reflects a breakdown in trust between the major democracies and economic powers. It is a new political fact in the global system.

Pimco’s Mohammed El Erian said this may have a knock-on effect:

“In the first instance, it could translate into pressures on other countries to also repatriate part of their gold holdings. After all, if you can safely store your gold at home — a big if for some countries — no government would wish to be seen as one of the last to outsource all of this activity to foreign central banks.

If developments are limited to this problem, there would be no material impact on the functioning and well-being of the global economy. If, however, perceptions of growing mutual mistrusts translate into larger multilateral tensions, then the world would find itself facing even greater difficulties resolving payments imbalances and resisting beggar-thy-neighbour national policies.

“The most likely outcome right now is for Germany’s decision to have minimum systemic impact. But should this be wrong and the decision fuel greater suspicion – a risk scenario rather than the baseline – the resulting hit to what remains in multilateral policy co-operation would be problematic for virtually everybody.

As I reported on Tuesday, gold veteran Jim Sinclair thinks it is an earthquake, comparing it to Charles de Gaulle’s decision to pull French gold from New York in the late 1960s – the precursor to the breakdown of the Bretton Woods system three years later when Nixon suspended gold conversion.Mr Sinclair predicts that the Bundesbank’s action will prove the death knell of dollar power. I do not really see where this argument leads. Currencies were fixed in de Gaulle’s time. They float today. It is within the EMU fixed-exchange system – ie between Germany and Spain – that we see an (old) Gold Standard dynamic at work with all its destructive power, and the risk of sudden ruptures always present. The global system is supple. It bends to pressures.

and from Silver Doctors.....funny the Mint is out of silver already !

JANUARY US MINT SILVER EAGLE SALES PASS 6 MILLION, MINT SUSPENDS SALES, STATES EAGLES ARE SOLD OUT!!

http://www.silverdoctors.com/jim-willie-the-coming-isolation-of-usdollar/

Silver expert

Silver expert

With this week’s

With this week’s

No comments:

Post a Comment