http://soberlook.com/2012/12/the-fed-targets-45-billion-in-treasury.html

( keep your eyes on Treasuries , not stocks.... )

WEDNESDAY, DECEMBER 12, 2012

The Fed targets $45 billion in treasury purchases a month; why then did treasuries sell off?

The Fed has announced that in addition to the $40 billion of monthly MBS purchases, it will also commence $45 billion in treasury purchases. This unprecedented open-ended program will swell bank reserves and ratchet up the monetary base.

The announcement of this new asset purchase program should be a big positive for treasuries, right? Turns out that it wasn't. Longer dated treasuries rallied immediately after the announcement, but sold off shortly after, now trading at the lows for the week.

|

| 10y note futures (source: Barchart.com) |

|

| 30y bond futures (source: Barchart.com) |

With the FOMC doves running the show, the Fed announced it would target a specific combination of unemployment and short-term inflation expectations.

Bloomberg: - Thirty-year yields reached a one-month high after the Federal Open Market Committee said interest rates will stay low “at least as long” as the jobless rate stays above 6.5 percent and inflation “between one and two years ahead” is at no more than 2.5 percent.The two-year inflation expectation (the so-called breakeven rate) however now stands at about 1.3% - which means the Fed has given itself quite a bit of room to get to 2.5%. And that was the reason for the selloff - such an open-ended policy clearly runs inflation risks.

Bloomberg: - “The Fed is losing some of its credibility as an inflation fighter,” said Gary Pollack, who helps manage $12 billion as head of fixed-income trading at Deutsche Bank AG’s Private Wealth Management unit in New York. “They will allow inflation to go above the long-term target. That’s disappointing for the market.”

http://www.zerohedge.com/news/2012-12-12/fomc-does-exactly-what-market-told-it-do

( Ben played the tune the market demanded - we shall see how long any effect that is market positive last... )

FOMC Does Exactly What Market Told It To Do

Submitted by Tyler Durden on 12/12/2012 12:31 -0500

Just as consensus demanded expected, the FOMC transformed sterilized 'Twist' into unsterilized QE4 in addition to QE3's MBS buying and lowered economic forecasts - dropping calendar-based rate guidance unchanged with a shift to "Evans-Rule"-like threshold-based guidance. High inflation, forget it; 'lower' unemployment, naah; market wants 'moar' so market gets 'moar'. $4 Trillion balance sheet here we come (check to Draghi's OMT and Spain or EUR 'richness' crushes hopes of recovery).

- *FED BOOSTS QE WITH $45 BILLION IN MONTHLY TREASURY PURCHASES

- *FED TO KEEP BUYING MORTGAGE BONDS AT PACE OF $40 BLN PER MONTH

- *FED SAYS MONTHLY PURCHASES TO TOTAL $85 BLN

- *FED ADOPTS ECONOMIC THRESHOLDS FOR POLICY TIGHTENING

- *FED: RATES TO STAY EXCEPTIONALLY LOW WITH JOBLESS ABOVE 6.5%

- *FED: RATES TO STAY LOW WITHINFLATION SEEN AT 2.5% OR LESS

- Disappointingly for AAPL investors, there was no explicit decision to monetize mini-iPads (or their own subsidized student loan debt in the ultimate reacharound).Pre- And Post- Levels (post = 15 mins after news) - small moves in general* * *

http://soberlook.com/2012/12/rbas-glenn-stevens-takes-on-major.html

( as a supplement to the concerns of Fama and Palotta , interesting to see comments from two Central Bankers knocking the Fed ( among other Central Banks ) in the past day..... )

WEDNESDAY, DECEMBER 12, 2012

RBA's Glenn Stevens takes on major central banks

RBA's Governor, Glenn Stevens today took a jab at the four major central banks (Fed, BOJ, EBK, BOE) without naming any names. Here are two key points summarized by Goldman:

1. The rapid expansion of the balance sheets of many central banks has "blurred the distinction between fiscal and monetary policy" and therefore the future exit from these policies which "provide cheap funding for governments may prove politically difficult". Ultimately, while central bank actions have bought government's time to put public finances back on track, central banks cannot solve these longer run challenges.This is an excellent point. Central banks are called upon to fix structural problems, but all they can do is make sure governments have access to cheap funding for some period of time. At some point these central bank actions become counterproductive, yet any exit from these strategies may prove politically difficult (effectively creating a trap).

2. The expansion of central bank balance sheets has created disquiet in the global policymaking community as it has led to spillovers and distortions at the international level via an acceleration in cross-border flows of capital in search of higher returns. Although central banks are effectively factoring-in these flows into their policy decisions, there is not a consensus on how this should be done and there is an argument that central bank mandates would need to be changed to appropriately account for these spillovers. At the very least, increased global cooperation is optimal on this front.Here he is referring to the persistent strength in the Australian dollar, which is killing the nation's export sector. He is attributing this strength to other central banks keeping incredibly high liquidity levels and near zero rates - forcing capital to flow to assets like the AUD.

and another Central Banker hits Bernanke....

http://www.zerohedge.com/news/2012-12-11/hong-kong-feds-epiphany-bernanke-wrong-about-everything

It seems not every nation's head of central banking believes in the Bernanke Doctrine of moar QE is better QE... Hong Kong Monetary Authority Chief Executive Norman Chan said Monday that quantitative easing is not a panacea, and added:

...there is a possibility that the process of deleveraging is disrupted by quantitative easing, leading to sharp increases in asset prices in the first place. Yet, since such increases are not supported by economic fundamentals, any increase in wealth will be seen as transient... (and asset prices might drop sharply and remain volatile). As a result, households are unwilling to increase spending and in the end, the real economy fails to rebound.

Via CRI English:

Hong Kong Monetary Authority Chief Executive Norman Chan said Monday that if the process of deleveraging is disrupted by quantitative easing, asset prices might drop sharply and remain volatile.When delivering a speech entitled the Global Deleveraging: The Right Track at the Hong Kong Economic Summit 2013, Chan said that excessive leveraging, or over-borrowing, in major industrialized countries was the root causeof both the global financial crisis and the more recent sovereign debt crisis plaguing Europe.Chan said quantitative easing is not a panacea, but it is the exact opposite of deleveraging. In the past three years, quantitative easing had limited stimulating effect on the real economy. "In order to solve the structural imbalances built up in the past two decades, we must get to the bottom of the problem."

There is a possibility that quantitative easing produces the desired results, which is a very desirable scenario as global economy will return to its normal growth path, he noted.

However, there is a possibility that the process of deleveraging is disrupted by quantitative easing, leading to sharp increases in asset prices in the first place. Yet, since such increases are not supported by economic fundamentals, any increase in wealth will be seen as transient.As a result, households are unwilling to increase spending and in the end, the real economy fails to rebound, if inflationary pressure builds up alongside asset price increases, central banks may consider exiting the market and raise interest rates, the authority's head said.

When economic performance, inflation or monetary policy falls short of market expectation, asset prices might drop sharply and remain volatile, he added.Chan said he was certain that since the outlook for macro economic and financial environment is very uncertain, it is highly possible that large fund inflows and outflows as well as sharp fluctuations in the financial markets will continue to be seen."We should all take precautionary measures and get to the bottom of the problem, learn from others' experiences and avoid overstretching ourselves. Otherwise, we may find ourselves being trapped in the debt abyss with no way out," he said.

http://www.marketoracle.co.uk/Article36423.html

( From Tony Pallota on September 9, 2012 - his analysis rang true then , and the facts on the ground still ring true... laying out why the Fed should NOT launch QE 3 / 3.5 / 4 or whatever they might call it today , although they very well may do so..... )

Why The Fed Will Not Launch QE3

Interest-Rates / Quantitative EasingSep 09, 2012 - 10:46 AM

By: Tony_Pallotta

Whether the Fed decides to launch QE3 this week is far more a complex decision than they lead us to believe. It is not as simple as monitoring economic data and deciding whether to expand the balance sheet or not.

Whether the Fed decides to launch QE3 this week is far more a complex decision than they lead us to believe. It is not as simple as monitoring economic data and deciding whether to expand the balance sheet or not.

Yet the Fed rarely discusses what that other criteria is in making such an important decision. The recent Jackson Hole speech by Chairman Bernanke did offer some insight to the other factors, as well as his recent Congressional testimony.

And there are many factors to consider beyond a weaker than expected non-farm payroll. From inflation and market liquidity to balance sheet risk and confidence the Fed needs to weigh all the risks and rewards in finding the right balance.

I am not a fan of the Chairman's policy but do not believe he is a mad man, determined to "support the banks" at all costs. I don't believe he intends to expand the balance sheet to create massive inflation. Nor do I believe a drop in equity prices will be an automatic trigger of QE. But I do believe we will never understand the true nature of the Fed's decision making policy. We have no idea of the political pressure being applied (remember Chuck Schumer's comments) for example.

But based on what we do know, my belief is the risks currently outweigh the rewards. And that is why I continue to believe we will not see QE3 launched this Thursday.

Inflation VS Deflation

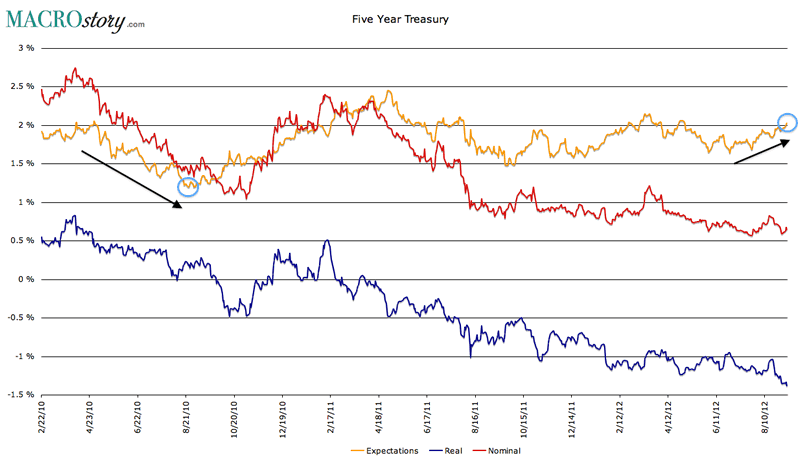

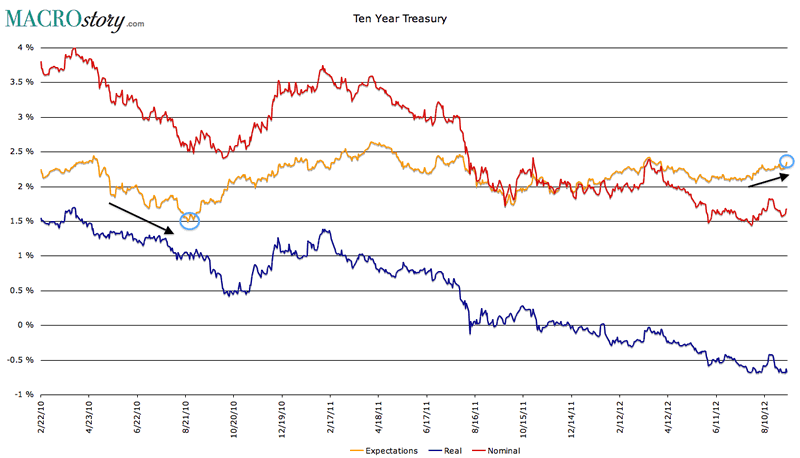

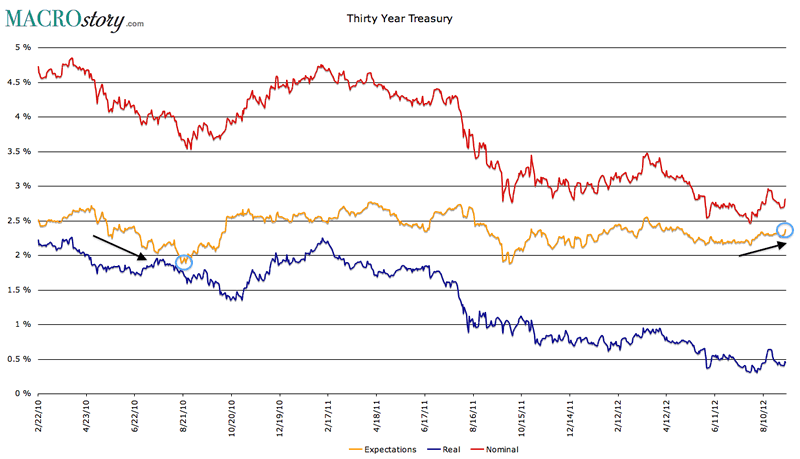

This is the biggest factor in my view. In a slowing global economy the risk is one of deflation. There is simply no overheating economic output to push demand above supply and force prices to rise (beyond abnormal weather patterns). In the summer of 2010 there was a clear deflationary trend. And that was the basis to launch QE2. The Fed had "room" to risk creating an inflationary threat. And that is exactly what QE2 created. In combatting the deflationary risk, inflation expectations have since pushed up to the 2% upper limit targeted by the Fed.

So now absent any deflationary risk, there is no further "room" for inflation expectations to expand. While the economy represents a deflationary risk, expanding the balance sheet represents an inflationary risk. The two must be balanced. And balanced they are right now. Though one could argue based on levels now pushing 2.5% that there is an inflationary bias.

That alone says the Fed cannot launch QE3. Yes, a simple subtraction of TIPS and nominal yields answers a mighty daunting question. Just look at what happened during QE2. Ten year inflation expectations moved from 1.5% to 2.6% in about six months. That alone told you there was no way QE3 would come immediately thereafter.

Five Year Expectations

Ten Year Expectations

Thirty Year Expectations

Market Function

Chairman Bernanke outlined the following risk to expanding the Fed balance sheet during his Jackson Hole speech.

"Conceivably, if the Federal Reserve became too dominant a buyer in certain segments of these markets, trading among private agents could dry up, degrading liquidity and price discovery. As the global financial system depends on deep and liquid markets for U.S. Treasury securities, significant impairment of those markets would be costly, and, in particular, could impede the transmission of monetary policy. For example, market disruptions could lead to higher liquidity premiums on Treasury securities, which would run counter to the policy goal of reducing Treasury yields."

And this week UBS highlighted how the Fed may have pushed the limits in finding such a balance (courtesy of ZeroHedge).

"the Fed owns all but $650 billion of 10-30 year nominal Treasuries." Also as pointed out above, Twist 2, aka QE 3.5 is already absorbing all of the long end supply. And herein lies the rub. To quote UBS: "Taking out, say, $300 billion in long-end Treasuries almost certainly would put tremendous pressure on liquidity in that market....Ploughing ahead with a large, fixed size QE program could cause liquidity to tank."

Less Is More

Rising prices for non-discretionary purchases like food and fuel amid a fixed consumer income will reduce demand for discretionary purchases. The result, "more" QE would likely inflate demand away, causing economic weakness, contrary to what the Fed is trying to stimulate. And from a political standpoint, with stock prices elevated going into the election, the risks shift to rising prices at the pump to upset voters. Why else has the SPR release rumor surfaced twice in just the past month.

Going It Alone

Other than a muted policy response from the ECB this week (sterilized and conditional), no other central banks have been aggressive in altering policy. In fact China through reverse repurchase operations is removing liquidity in an attempt to combat food inflation. Why would the Fed launch their own effort when no one else is? Remember, the Fed may still need to fight the monetary war on another front if and when Europe deteriorates and TALF type facilities are needed by MS and others with such exposure.

Balance Sheet Risk

Again during Jackson Hole, Chairman Bernanke was quoted.

"A fourth potential cost of balance sheet policies is the possibility that the Federal Reserve could incur financial losses should interest rates rise to an unexpected extent. "

If inflation were to truly take off, the Fed would be powerless to stop. Unless they wanted to incur some serious losses. The Fed would be selling debt securities to soak up liquidity into a market in decline. Any rise in yield would directly result in a drop in market value for the underlying assets they own.

Imagine the Fed having to acknowledge such a blunder. It would crush any remaining confidence investors have, another risk highlighted during the Chairman's speech

"A second potential cost of additional securities purchases is that substantial further expansions of the balance sheet could reduce public confidence in the Fed's ability to exit smoothly from its accommodative policies at the appropriate time."

Bottom Line

By no means is the above meant to be an all inclusive list of factors going into the "QE decision." There are many I simply am not aware of such as political pressure (on both sides of the aisle). But when I put it all together, with a big focus on inflationary risks, I do not see the Fed acting this week.

I am not naive though. And I do remain a bit cautionary of the unknowns and how the members of the FOMC weigh each risk and reward. People like Charles Evans and Eric Rosengren truly scare me. But the Chairman may have made it very simple for us to understand what the FOMC will do on Thursday. He finished his Jackson Hole speech as follows.

"Overall, however, a balanced reading of the evidence supports the conclusion that central bank securities purchases have provided meaningful support to the economic recovery while mitigating deflationary risks."

The environment today versus two years ago when QE2 was launched is completely different. The balance between risk and reward is far more skewed towards risk. QE3 would not allow the Chairman to make such a proud and confident statement. Instead he would be forced to say something like the following.

"Capital losses were incurred to mitigate uncontrolled inflationary risks."

With a little over a year left in his tenure, that is not the legacy he wants to be known for. The man who truly blew up the Fed.

By Tony Pallotta

and.....

http://www.safehaven.com/article/28002/fama-on-the-fed-and-inflation

Fama on the Fed and Inflation

I don't agree with Eugene Fama on everything, but I'd be a fool if I didn't agree with him on quite a bit. Fama wrote the paper which, back in the early 1980s, pointed out that if you modeled inflation as a result of monetary factors and Keynesian factors (unemployment, e.g.), the Keynesian factors didn't add anything. Since then, economists have pretty much forgotten that lesson, so that we have to continually battle the Keynesian "let's just expand government spending" crowd.

Many of his views about efficient markets are pretty extreme, and that's where I can't agree wholeheartedly. However, I read with interest the discussion between Fama and Bob Litterman in this month's issue of the Financial Analysts Journal. The full interview, called "An Experienced View on Markets and Investing," is located here, and since the FAJ has made the entire interview available for free I am going to quote liberally from the last page. Indeed, I am going to print three of the last four questions, because they correlate exactly to things I have written in this space, and echo almost exactly the views I have expressed. Considering Fama is one of the godfathers of modern finance, I take this as indication I am on the right track, at least sometimes.

In the passages below, I have added all the emphasis marks.

.

Litterman: What impact will the big expansion in the Federal Reserve's balance sheet have on the markets?

Fama: It has basically rendered the Fed powerless to control inflation. In 2008, when Lehman Brothers collapsed, the Fed wanted to get the markets moving and made massive purchases of securities. The corollary to that activity, however, is that reserves issued by the Fed and held by banks exploded. An explosion in reserves causes an explosion in the price level unless interest is paid on the reserves. So, the Fed started to pay interest on its reserves, which means that the central bank issued bonds to buy bonds. I think it's a largely neutral activity.

Before 2008, controlling inflation was a matter of controlling the monetary base (currency plus reserves). But when the central bank pays interest on its reserves, it is the currency supply that determines inflation. But banks can exchange currency for reserves on demand, which means the Fed cannot control the currency supply and inflation, or the price level, is out of its control. The Fed had the power to control inflation, but I don't think it does under the current scenario.

[Ashton's note: Fama identifies why the monetary base is no longer tied to inflation - the link to transactional money has been severed thanks to IOER. See some of my remarks on this here.]

Litterman: But isn't one way out of our debt problem to inflate it away?

Fama: Yes, that's one way to handle it, but it's far from a great solution. If the Fed were to stop paying interest on its reserves, we'd probably have a big inflation problem. The monetary base was about $150 billion before the Fed stepped in in 2008. Currency plus required reserves are still in that neighborhood, but the Fed is holding $2.5 trillion -- trillion! -- worth of debt financed almost entirely by excess reserves. The price level could expand by the ratio of those two numbers, and that translates into hyperinflation. Economies typically do not function well in hyperinflation. The real value of the government debt might disappear, but the economy is likely to disappear with it.

Litterman: What would your suggestion be for monetary or fiscal policy at this point?

Fama: Simple. Balance the budget. I heard a very prominent person say in private that we could balance the budget by going back to the level of government expenditures in 2007. The economy is currently about the size it was then. If you just rolled expenditures back to that point, I think it would come close to balancing the budget.

[Ashton's note - just this month, I commented that all you have to do to get the budget back into a semblance of balance was to reverse most of the things that were done over the last decade.]

http://yanisvaroufakis.eu/2012/12/10/on-the-sad-algebra-of-the-greek-debt-buyback/

In a previous post, I dissected the recent Eurogroup plan to save Greece (again!). Today I single out the debt buyback operation which is a crucial aspect of that plan.

The net debt reduction that any debt buyback operation achieves is simple to compute: By spending sum S on purchasing its own bonds, at a ‘distressed’ y% of face value, the debtor (in this case the Greek government) can expect a net debt reduction equal to NDD = S times {(100-y)/y}.

The last Eurogroup decision proclaimed a target of reducing Greece’s debt by 40 billion in aggregate. Of that sum, 2 billion would be the result of a reduction in the interest rate payable on Bailout Mk2 loans and another 7 billion will come from the ECB returning to Greece the profits it is making from past purchases of Greek government bonds (in the context of the ill-fated SMP). Which means that a further 31 billion of debt reduction is placed on the shoulders of the debt buyback.

The Eurogroup also decided to set the price at which bonds would be repurchased at y=28% of face value – the price at closing on the preceding Friday. With 10 billion at its disposal, the Greek government would, at best, manage to reduce its debt by 25.7 billion, assuming that Greek banks sell all 15 billion of their holdings and, in addition, hedge funds add another 25 billion (of the 45 they hold) to the pot. We see that, even under these ideal conditions, the debt reduction program agreed at the Eurogroup would be short of 5.3 billion. Alas, the conditions are far from ideal and the benefits will be much, much thinner.

Indeed, since the Eurogroup decision, the goalposts have been moved and the rules have changed. First, the offered price was substantially increased. Instead of a flat 28% of face value, Greece’s debt management authorities (ostensibly with the troika’s permission) have called for a Dutch auction within the wide range of 30.2% to 40.1%. Splitting the difference, and assuming an average price of about 35%, the largest possible net debt reduction is approximately 18.6 billion - a far cry from the planned 31 billion and still contingent on the Greek banks offering all of their bonds (against their wishes to hold as many of them as possible) and the hedge funds chipping in at least 14 to 15 billion.

While awaiting official briefings on the agreed prices and quantities tendered (with the sound of Greece bankers’ arms being twisted by the Finance Ministry in our ears), one thing is clear: The much heralded Greek debt buyback is a tale of two worlds. It constitutes a reward to hedge funds and a ruthless domestic PSI No. 2 (aka a massive involuntary haircut) for Greece’s embattled banks. Moreover, its effect will be a net debt reduction 40% less than the Eurogroup’s stated target.

Meanwhile, the Greek government is struggling to convince Greek public opinion that its domestic default vis-à-vis the Greek banks does not constitute a… default. That, in the final analysis, the banks are better off. To that effect, the domestic kleptocracy’s loyal press core have been arguing that the banks had already marked government bonds to market (at around 25% of face value) and, therefore, that the banks are making a… profit from the buyback. This would be laughable if it were not so pregnant with malicious propaganda the purpose of which is, clearly, to disguise this latest assault on rationality and on the public interest (both of Greek and European taxpayers).

Consider the history of these bonds: they resulted from last February’s PSI, in the context of which Greek banks (along with all other private bondholders) were forced to accept a swap that diminished the present value of their government debt holdings by 75%. The bonds they received after that default incident, branded PSI for marketing purposes, are now the ones that are being bought back at 35% of face value. Recalling, that last February the banks were promised that, due to the success of the PSI, and in return for accepting the PSI, the new bonds that they would receive would be ‘gold plated’, the banks never marked them to market officially (for EBA auditing purposes, that is) – not even after these very bonds began to tumble in value. Moreover, and this is crucial, Greece’s banks have been posting these same bonds with the Bank of Greece (as part of the Greek ELA) as collateral (with only a 30% haircut), thus securing liquidity on a day to day basis. And now, at a time that rumours of a debt buyback have pushed these bonds prices to above 43%, they are being asked to accept 35% or else…

Or else what? Well, it is a common secret that Greece’s banks are bankrupt and exceptionally eager to get their hands on the 24 odd billion that the Greek government is about to borrow from the EFSF to recapitalise them with. So, when the government is ‘offering’ to buy back their bonds, as a precondition for the recapitalisation, this is an offer that the banks ‘cannot refuse’. Of course the tragedy is that this recapitalisation is, especially now, utterly devoid of logic. To see why consider the cobweb of insanity being weaved presently:

The bankrupt Greek state is haircutting almost 10 billion of the money it owes to Greek banks so as to be allowed by the troika to borrow 24 billion, on behalf of these same Greek banks, in order to recapitalise them and in the hope that this recapitalisation will help stimulate private sector interest in the bonds and shares of these banks so that the banks can begin lending to the Greek private sector again, thus kickstarting the Greek economy with a view to generating the taxes from which the nation’s debt to the troika can be repaid. Meanwhile, because Greece’s debt will, quite obviously, not be reduced to anything like the proclaimed (by the Eurogroup) levels, and given that the banks need much, much more than 15 billions to be properly recapitalised, no private investors will invest in Greek banks (especially as they note that they are tied to an insolvent state), the Greek banks will hoard the money that the state will have borrowed from the EFSF on their behalf (fearing that any decent EBA-ECB audit will find their capitalization ratio extremely low, and thus declare them bankrupt) and, at the end of the day, tens of billions of fresh loan tranches will have (like all those that preceded them) authored another nasty act in the cruel theatre of horrors that is the Greek bailout.

And all this will be described by our leaders and mainstream press as a successful debt buyback program that heralds a new beginning for Greece. Just wait for it!

No comments:

Post a Comment