http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_13/12/2012_474388

Greece gets green light for crucial loans

Relief as Eurogroup OKs some 50 bln euros

|

Speaking at a news conference in the Belgian capital ahead of a European Union leaders’ summit, Samaras said the disbursement of the money would allow the government to recapitalize banks, pay the arrears it had built up with citizens and suppliers, which stand at about 9 billion euros, and give a much-needed boost to the economy and citizens alike.

“Over the next few months, we’ll get 52.5 billion euros, which is something nobody had expected,” he said. “About 40 billion of this will stay in the country and the rest is being used to reduce our debt.” The premier’s immediate response to news of the disbursement decision earlier in the day bordered on the triumphant. “Grexit is dead, Greece is back on its feet,” he told reporters.

Eurozone finance ministers agreed to release 49.1 billion euros of loans for Greece. Of this, 34.3 billion euros will be disbursed immediately, possibly as early as next week, while another 14.8 billion will be transferred to Athens in tranches during the first quarter of next year as long as reform “milestones” are met.

It was also clarified by European Financial Stability Fund chief Klaus Regling that the 11.3 billion euros Greece will receive in loans in order to execute its bond buyback program will come from the 109 billion entailed in its second bailout rather than from additional lending.

The completion of Greece’s bond buyback program this week means that the International Monetary Fund is also due to approve its payment as part of the Greek program. This is worth 3.4 billion euros, taking the total to the 52.5 billion Samaras referred to.

From next week’s disbursement, 16 billion euros will go toward bank recapitalization, 7 billion for budgetary financing and 11.3 billion to finance Greece’s bond buyback program.

“Within the next few weeks, we’ll complete the recapitalization of our banks, which will help liquidity and boost job creation, which is the top priority,” said Samaras.

“Some people expected us to be out of the euro and cannot believe that we are staying in,” added the prime minister. “We have restored trust in Greece abroad; now we will restore the dignity of the Greek people.”

Finance Minister Yannis Stournaras, who was also at the news conference, said that the Eurogroup’s decision on Thursday would douse, but not end, speculation about Greece leaving the euro.

“The threat of a euro exit is beginning to fade after today’s decision,” he said, adding that there was still much work for the government to do.

“Those who believed in Greece have been justified but we cannot rest,” said Stournaras. “The journey begins today.”

He emphasized that Greece would have to meet its commitments on structural reforms, starting with the new tax bill, which Stournaras said would be tabled in Parliament late on Thursday.

He said fellow eurozone finance ministers showed a keen interest in the draft law, particularly in terms of what measures Greece will take to boost revenues and cut down tax evasion.

In their public statements, European officials appeared upbeat on Greece’s prospects. “We are convinced that the program is back on a sound track,” Eurogroup Chairman Jean-Claude Juncker said.

EU Economic and Monetary Affairs Commissioner Olli Rehn went a step further, indicating that those who had doubted Greece’s future in the euro had been mistaken. “As we approach the end of this turbulent year, those Cassandras have been proven wrong,” he said.

and...

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_14/12/2012_474417

EU leaders commit to resolution mechanism for banks, closer union

By Luke Baker & Paul Taylor

European leaders agreed to press on with further steps to shore up their finances and sustain momentum in tackling the debt crisis on Friday, a day after clinching a deal on banking supervision and approving long-delayed aid to Greece.

After more than eight hours of late-night talks at a summit in Brussels, leaders promised to push ahead with setting up a mechanism to wind down problem banks, although it was unclear when the facility would be completed.

They also launched tentative discussions on how to make countries stick to economic targets and on creating a «solidarity fund» to help member states suffering one-off economic shocks, but did not delve deeply into either issue, pushing the debate out to the middle of next year.

With officials concerned about complacency creeping into decision-making now that financial markets have calmed and the crisis seems less acute, leaders appeared intent on showing that they are not relaxing.

That said, no concrete decisions were taken at the summit. Instead, it was more about verbal commitments to push ahead.

"This evening we decided to put in place a single resolution mechanism,» Herman Van Rompuy, the president of the European Council and chairman of the summit, told a news conference.

The European Commission will present a proposal on the mechanism, which would wind-up troubled banks by keeping the good parts alive while the unhealthy operations are shut down, during 2013, Commission President Jose Manuel Barroso said.

French President Francois Hollande told reporters the mechanism would «see the light of day» during the year, but it was not clear whether he expected it to be functioning by then or merely be in the early stages of construction.

"We agreed a roadmap for the future development of the currency union,» said German Chancellor Angela Merkel, without going into detail about the discussions.

The two-day summit, the sixth and last of 2012, had only ever been intended to be a detailed discussion on how best to overhaul economic and monetary union and correct the problems that have fuelled three years of debt crisis.

The meeting was held just hours after EU finance ministers achieved a significant breakthrough in negotiations over a 'banking union' by agreeing that the European Central Bank would be made the chief supervisor of euro zone banks. That decision, and another by euro zone ministers to release up to 50 billion euros in new aid to Greece, marked two positive developments after a long year of crisis-management and took some of the pressure off leaders to make major strides. ECB President Mario Draghi hailed the deal on banking supervision, the first stage towards a banking union with more pooled sovereignty, as an important step towards a stable economic and monetary union. Under the deal, officials said the ECB would regulate some 150 to 200 banks directly - all major cross-border lenders and state aided institutions - with the power to delve into all 6,000 banks in case of problems. Olli Rehn, the EU commissioner for economic and monetary affairs, said «Cassandras» who had predicted disaster for the euro and a Greek exit had been proven wrong. But there is little time to relax. The next stages of banking union - creating a resolution fund for winding up troubled banks and coordinating deposit guarantees to protect savers - may be fought over even harder. And then there will be political and financial hurdles to negotiate through the year. "The fact that the situation in the financial markets is now better than before should not be seen by the governments as a way to procrastinate,» European Commission President Jose Manuel Barroso told reporters. Much of southern Europe faces another year of grinding recession with record unemployment and deepening poverty that will tear at the fabric of wounded societies and may push governments' efforts to reduce deficits further off course. With Silvio Berlusconi vowing to contest an Italian election early next year, a full bailout of Spain still on the cards and a German election in September casting a long shadow, 2013 promises to be the EU's fourth turbulent year in a row, even without risks from bailout victims Greece, Ireland and Portugal. Italy is a particular concern if the next government rows back on any of the economic reforms put in place by technocrat Prime Minister Mario Monti, whose time in office has helped stabilise financial markets and stave off the crisis. Several participants at a pre-summit meeting of centre-right leaders in Brussels urged Monti to stand as a candidate in an election expected in February, but he gave no indication of his intentions, a person at the meeting said. Many European leaders fear a return of the erratic billionaire Berlusconi, who abruptly changed course on Wednesday, saying he would step aside if Monti agreed to lead the centre-right into the election.

and.....

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_13/12/2012_474389

|

http://www.guardian.co.uk/business/2012/dec/14/eurozone-crisis-summit-leaders-monetary-union

Little cheer in Greece despite aid pledge

Over in Greece, yesterday's decision to finally unlock aid for the country may have been greeted with euphoria in government circles but, as our correspondent Helena Smith reports, the crisis is far from over on the ground.

Helena writes:

From Greece's powerful -anti-bailout front to ordinary men and women on the street, the message is the same: away from the number crunchers in Brussels the crisis is far from over.The country's main opposition leader Alexis Tsipras has been quick to make the point, saying with Greeks about to enter a sixth straight year of recession, "no one is convinced" by the coalition government, and prime minister Antonis Samaras' argument, that the bumper 52 package of rescue loans will save the day. With self-defeating austerity policies the price of the assistance, Greece was still doomed."The efforts of the prime minister to present himself and his government as saviours convinces no-one," said the radical left leader. "This 'technical installlment of optimism" cannot hide the reality which the majority of society is living as a result of the memorandum's policy of austerity," he railed."[A policy] that reduces incomes, increases unemployment, spreads recession and destroys the country's prospects of growth that is viable and fair."

Two beggars wait on a pavement in Thessaloniki, Greece, yesterday. Photograph: SAKIS MITROLIDIS/AFP/Getty Images

Two beggars wait on a pavement in Thessaloniki, Greece, yesterday. Photograph: SAKIS MITROLIDIS/AFP/Getty Images

Unionists have also shot back, announcing massive strike action, Helenaadds.

The union of civil servants, ADEDY, said they would stage a general strike next Wednesday against "the policies of wretchedness." It will be the fifth general strike since September."Our life is not going to get better, it is going to get worse," Ilias Iliopoulos, ADEDY's general secretary told me. "The measures we are about to see include cuts in wages, 20 % drops in pensions, mass firings, a dramatic decline in health and other services and huge increases in the cost of basic utilities such as electricity. No people can endure such merciless austerity."

Rajoy: Spain doesn't need a bailout

Spain's prime minister has insisted that his country still does not need a bailout.

Mariano Rajoy declared this morning that Madrid would only request help if it were in the interests of the Spanish people - final confirmation that any aid package has been kicked well into 2013.

Speaking to Spain's Cadena Ser radio station, Rajoy said:

We will use this mechanism only if it necessary to defend the interests of the Spanish people.We do not need it today and that's why we haven't requested it.

Spain's borrowing costs remain affordable today, with its 10-year bonds yielding around 5.3% (from 7.6% in mid-July).

Suspect Rajoy endorses the FT's decision to make Mario Draghi theirMan Person of the Year.

New data on car sales this morning was uniformly bad across the eurozone, and not much better in the wider EU.

The UK was the only major market which didn't post a drop in sales in November, while total European sales slumped by 10.3%.

In Germany, sales were 3.5% lower compared to November 2011. In Greece, they were 47% lower.

As my colleague Jo Moulds reports:

Figures from the European Automobile Manufacturers' Association, the ACEA, showed demand for new cars fell for the 14th consecutive month in the European Union, as the economic gloom spread across the continent.It was the market's first double-digit contraction in more than two years and comes as European leaders met for the second day of a summit to discuss closer integration of the currency bloc to address the ongoing crisis.

The UK, though, saw an 11.3% jump in new car sales. Ireland was up 13.5%, although that actually meant just 883 sales during November in its minor (mini?) market.

A mixed bag of economic news this morning, with Germany's service sector posting its first growth since April, but its manufacturing sector performing poorly.

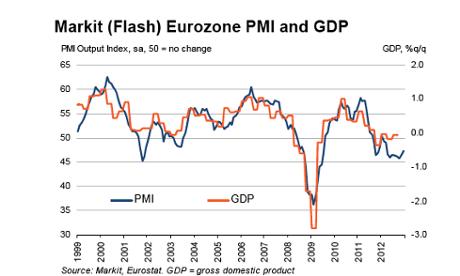

Here's the highlights of Markit's latest purchasing managers index (PMI) reports for December (in which 50=stagnation, >50=growth and <50=contraction).

German service sector PMI: 52.1 (up from 49.7 in November)

German manufacturing PMI: 46.3 (down from 46.8)

French service sector PMI: 46.0 (up from 45.9)

French manufacturing PMI: 44.6 (up from 44.5)

And the overall Eurozone private sector PMI hit its highest level in nine months - at 47.3.

Encouraging, but that still means the sector contracted -- suggesting the eurozone recession is deepening. As this graph shows:

Photograph: Markit

Photograph: Markit

No comments:

Post a Comment