http://www.zerohedge.com/news/2012-11-04/how-targeted-quote-stuffing-denial-service-attacks-make-stock-trading-impossible

How Targeted Quote Stuffing "Denial Of Service" Attacks Make Stock Trading Impossible

Submitted by Tyler Durden on 11/04/2012 14:11 -0430

Back in the summer of 2010, when the SEC was still desperate to (laughably) scapegoat the May 6 Flash Crash on Waddell and Reed, in an attempt to telegraph to the public that it was in control of the HFT takeover of the stock market (an attempt which has since failed miserably as days in which there areno occult trading phenomena have become the outlier and have resulted in the wholesale dereliction of stock trading by retail investors), we first endorsed the Nanex proposal that the flash crash was an "on demand" (either on purpose or by mistake) event, one which occurred as a result of massive quote stuffing which prevented regular way trading from occuring and resulting in a 1000 DJIA point plunge in minutes (the audio track to which is still a must hear for anyone who harbor any doubt the market is "safe"). It turns out that in the nearly 3 years since that fateful market crash, not only has nothing been done to repair the market (ostensibly broken beyond repair and only another wholesale crash, this time without DKed trades, and bailed out banks, could possible do something to change the status quo) but the Denial of Service (DoS) attacks that HFT algos launch, for whatever reason, have become a daily occurrence as the following demonstrations from Nanex confirm beyond a shadow of a doubt.

And while none of this is surprising: after all why should the algos and their HFT-coding masters change their ways if the SEC still has no idea how to approach and regulate a market that is fractured beyond comprehension in the aftermath of Reg NMSand Reg ATS, what the below data also confirms is what we noted two weeks ago, namely that "stock market fragility is rapidly approaching "flash crash" levels." The only question is whether anyone will even notice, or care about, the next inevitable 1000 point DJIA plunge...

From Nanex:

DoS Algo's Effect on Trades

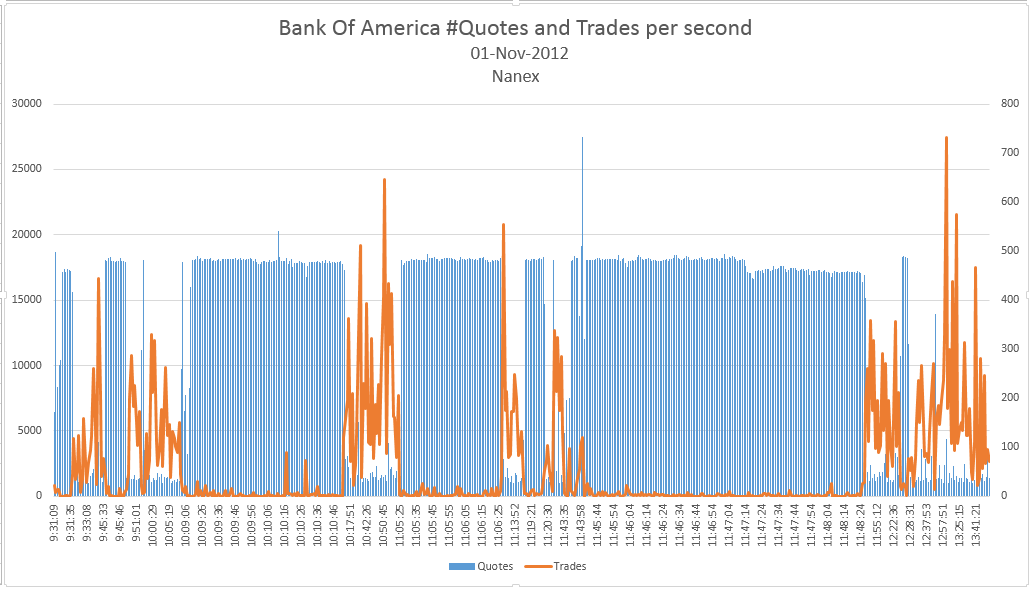

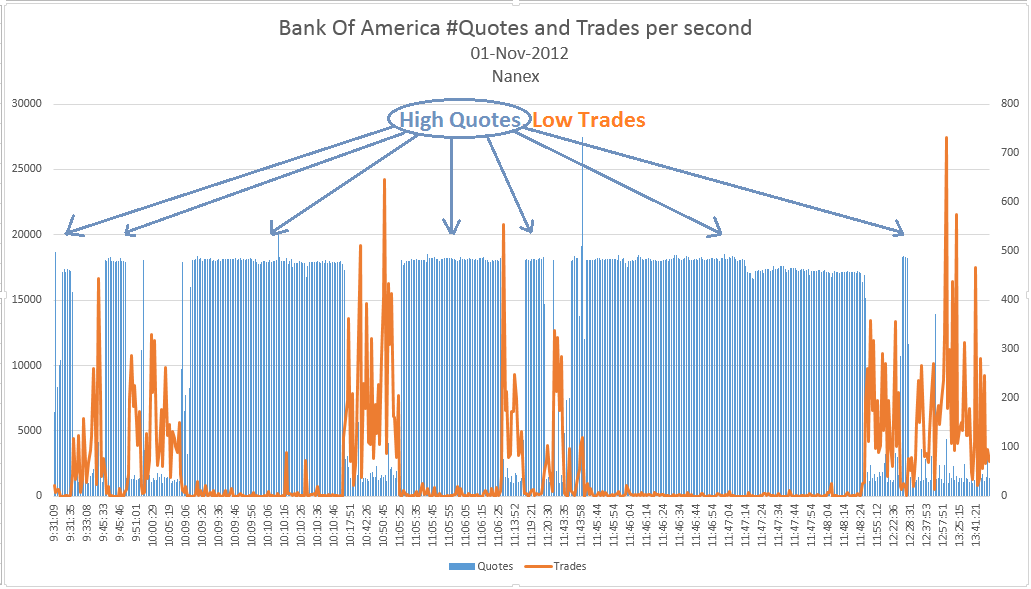

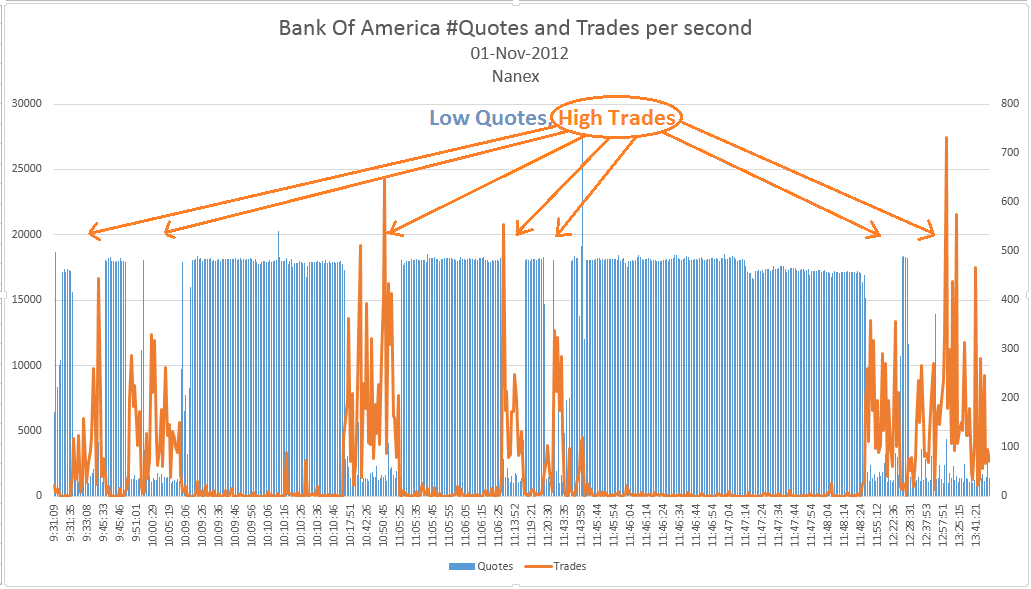

While working on identifying and cataloguing the high quote traffic generated by Denial Of Service algo from 01-Nov-2012, we here at Nanex stumbled upon something interesting. Below is an image that shows the trades per second and quotes per second in Bank Of America (BAC) from 9:30-13:45 ET. Each data point represents any second that contained 1000 quotes or more per second in BAC.

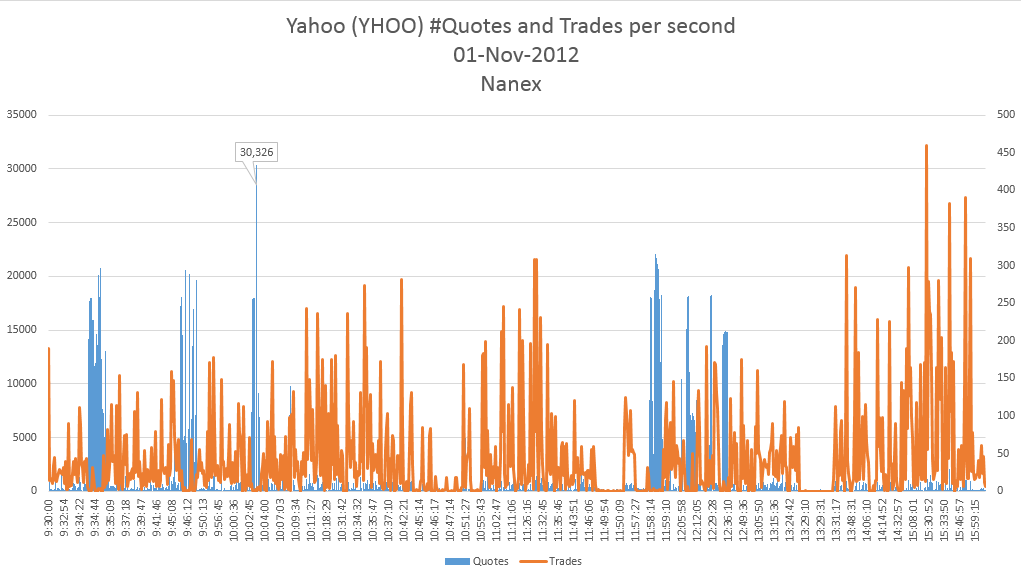

The blue represents the number of quotes in a second, the orange represents the number of trades for that same second. When you graph them together using multiple axis, a distinct pattern emerges. For those seconds that contain abnormally high quote traffic, the number of trades drops dramatically.

And conversely, the seconds that contained a higher amount of trades appear when the quote traffic is less.

There might be a few reasons for this:

- Other HFT algos were smart enough to pick up on this behavior and pulled out during that time period.

- The various computational and network systems in place that route, analyze and do computations on this data can do nothing but handle raw quote traffic, so not as many trades can be processed during that time.

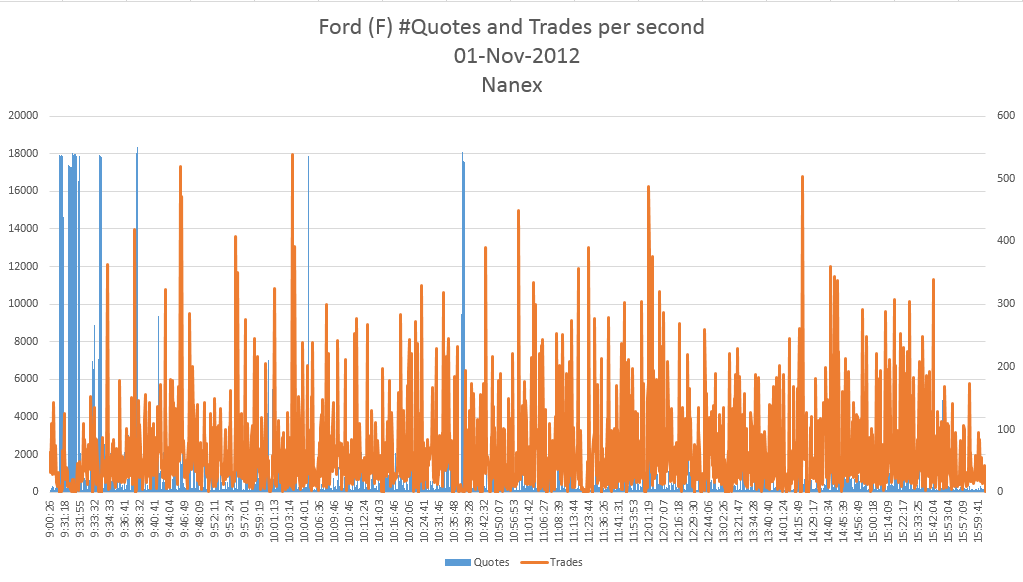

- Below are similar graphs for the other securities that were affected:

- Ford Motor Company (F)

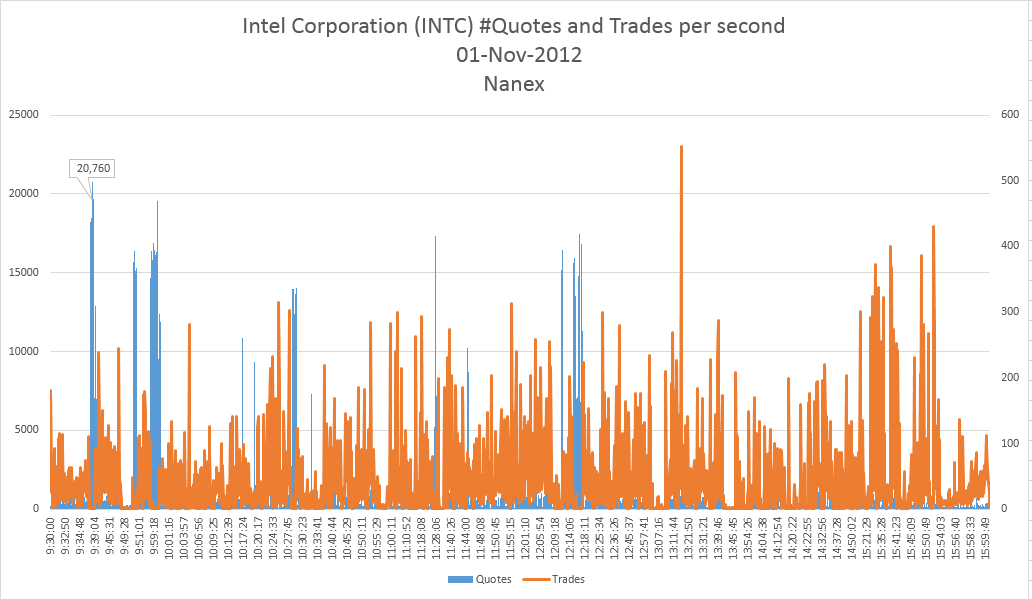

- Intel Corporation (INTC)

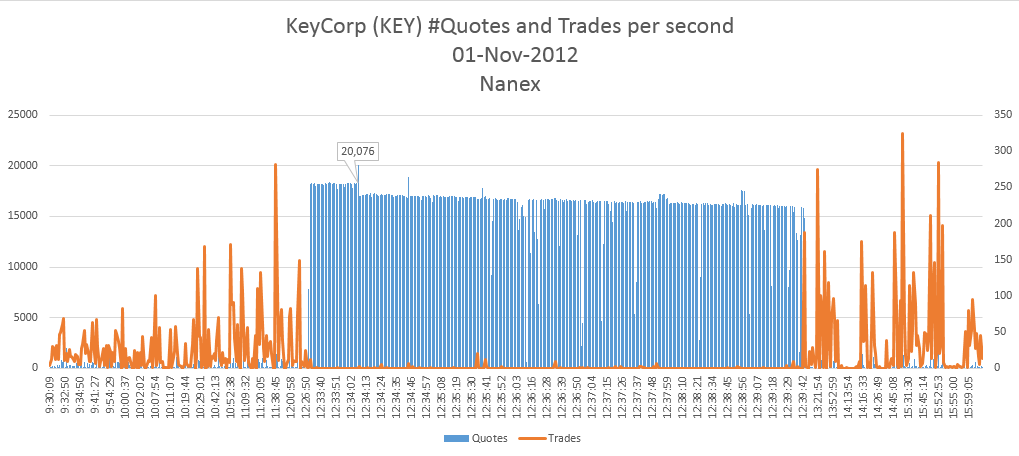

- KeyCorp (KEY)

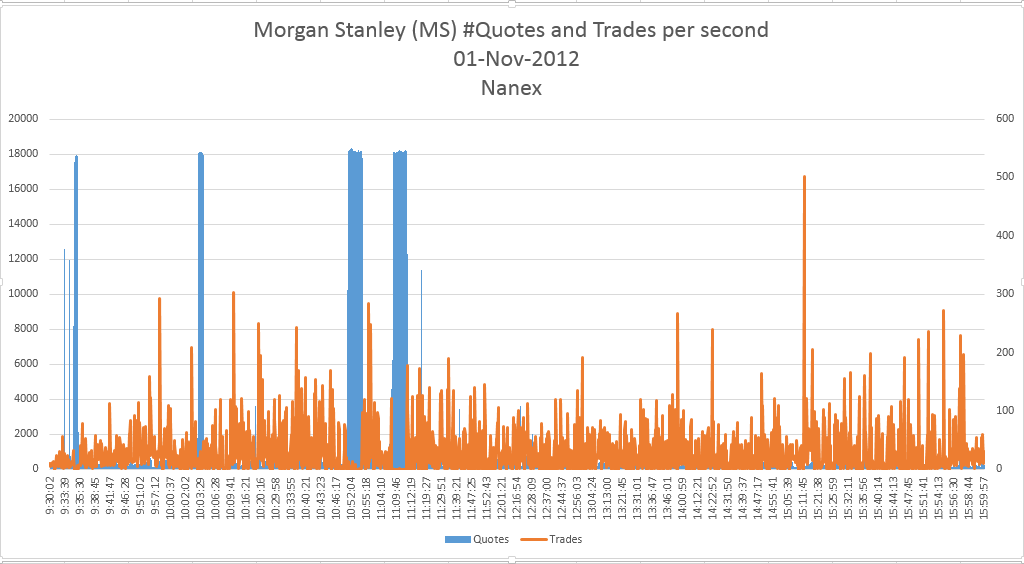

- Morgan Stanley (MS)

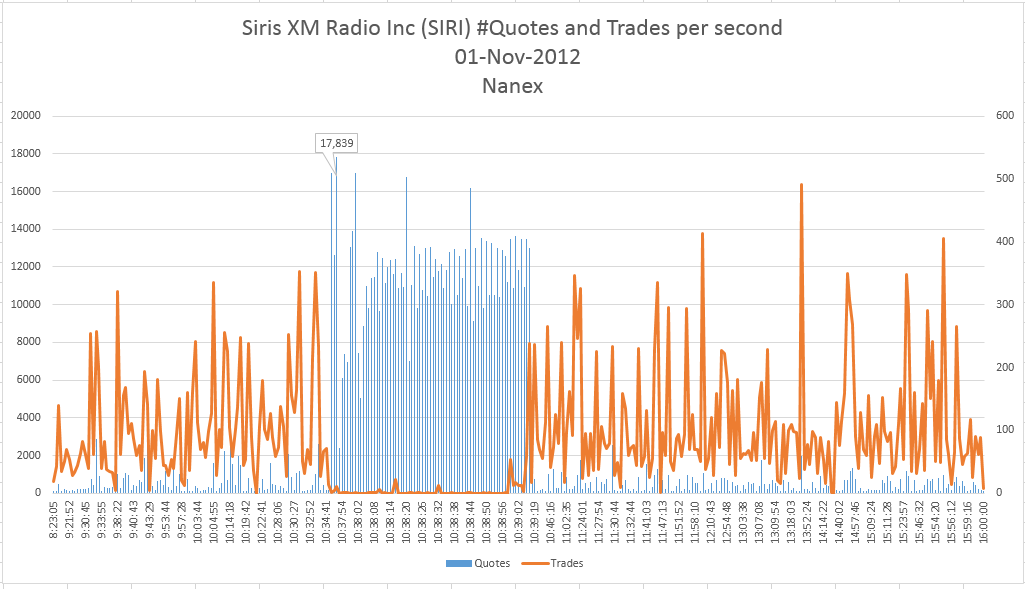

- Sirius XM Radio Inc (SIRI)

- Yahoo (YHOO)

Note The data below was taken where the security had 100 or more quotes per second.1. F - 333 seconds had 1,000 quotes or more. 40 of those seconds had 10,000 or more quotes per second.Here is the entire day in Ford showing every second that had 100 or more quotes per second.2. INTC - 242 seconds had 1,000 quotes or more. 61 of those seconds had 10,000 or more quotes per second.Here is the entire day in Intel showing every second that had 100 or more quotes per second.3. KEY - 386 seconds had 1,000 quotes or more. 347 of those seconds had 10,000 or more quotes per second.Here is the entire day in KeyCorp showing every second that had 100 or more quotes per second.4. MS - 140 seconds had 1,000 quotes or more. 89 of those seconds had 10,000 or more quotes per second.Here is the entire day in Morgan Stanley showing every second that had 100 or more quotes per second.5. SIRI - 110 seconds had 1,000 quotes or more. 62 of those seconds had 10,000 or more quotes per second.Here is the entire day in Sirius XM Radio showing every second that had 100 or more quotes per second.6. YHOO - 157 seconds had 1,000 quotes or more. 51 of those seconds had 10,000 or more quotes per second.Here is the entire day in Yahoo showing every second that had 100 or more quotes per second.The official word on the street is that this abnormally high traffic had a "modest impact", I think the data speaks otherwise. During those seconds where there were abnormally high amounts of quote traffic (10,000+ quotes/sec), the number of trades that were occurring simultaneously dropped significantly. In total there were 651 seconds (almost 11 minutes) of market time today that were affected. That's 11 min of potential future economic growth. These seemingly small increments of time eventually add up and serve to slowly erode the confidence of investors small and large.

No comments:

Post a Comment