http://www.caseyresearch.com/gsd/edition/russia-todays-capital-accountcftcs-chilton-repeats-belief-silver-market-manipulation

and....

http://jessescrossroadscafe.blogspot.com/2012/11/gold-daily-and-silver-weekly-charts_13.html

Gold and silver moved sideways today, as stocks remained weak and treasuries gained.

Trading remained quiet. There is an intraday post on the sort of commentary about gold that was 'popular' in 1999.

In the monetization of official debt department, JPM Agrees to Fully Backstop NJ $2.6 Billion Debt Offering. Just in case you were wondering who the 'house bank' is and why they keep it around.

All the Fed and Treasury need are a few cooperative intermediaries in the private sector willing to take the vig, and they can run the money machine day and night through the wonderful price discovery mechanism of market 'auctions.'

I wonder if they will have an open bar and jumbo shrimp at this prix fixe bond event? Maybe a nice ice sculpture of the queen of the silver market?

Have a pleasant evening.

http://www.zerohedge.com/news/2012-11-13/guest-post-gold-dollar-are-less-correlated-everyone-thinks

http://www.silverdoctors.com/eric-sprott-western-central-banks-have-no-more-gold-only-gold-receivables/#more-17192

On Russia Today's 'Capital Account'...CFTC's Chilton Repeats Belief in Silver Market Manipulation

Nov

14

¤ YESTERDAY IN GOLD AND SILVER

The gold price didn't do much until the Comex open on Tuesday morning in New York...and then rallied until 9:00 a.m. Eastern...before getting sold off until precisely 9:30 a.m. Then a rally began that got halted in its tracks at precisely 11:00 a.m. Eastern time...4:00 p.m. GMT...which was the London close. Note the sell-off at the London close on Monday as well. Nothing free market about any of this.

The New York low was $1,717.00 spot...and the high tick at the London close was $1,734.50 spot...a one percentage point price swing.

Gold closed at $1,724.90 spot...down $3.90 on the day. Net volume was pretty light...around 116,000 contracts, but much higher than the 70, 000 contract day we had on Monday.

The New York low was $1,717.00 spot...and the high tick at the London close was $1,734.50 spot...a one percentage point price swing.

Gold closed at $1,724.90 spot...down $3.90 on the day. Net volume was pretty light...around 116,000 contracts, but much higher than the 70, 000 contract day we had on Monday.

Here's the New York Spot Gold [Bid] chart so you can see the precision of JPMorgan et alwhen they're in action.

As you already know, the silver price action was more 'volatile'...and that's being polite about it. A rally began shortly after the London open at 8:00 a.m. GMT...and that topped out around the 12 o'clock noon GMT silver fix. After that, the silver price had pretty much the same price path as gold...although the percentage price swings were much bigger.

The New York low in silver was $32.04 spot...and the high tick was $32.95 spot. The London low...and Far East low...also checked in around the $32.05 spot price, so the intraday price move in silver was about 90 cents...almost 3 percent.

Silver closed the Tuesday trading session at $32.50 spot...up the magnificent sum of 8 cents the ounce. Net volume was around 36,000 contracts...about 50 percent higher than Monday's volume.

As you already know, the silver price action was more 'volatile'...and that's being polite about it. A rally began shortly after the London open at 8:00 a.m. GMT...and that topped out around the 12 o'clock noon GMT silver fix. After that, the silver price had pretty much the same price path as gold...although the percentage price swings were much bigger.

The New York low in silver was $32.04 spot...and the high tick was $32.95 spot. The London low...and Far East low...also checked in around the $32.05 spot price, so the intraday price move in silver was about 90 cents...almost 3 percent.

Silver closed the Tuesday trading session at $32.50 spot...up the magnificent sum of 8 cents the ounce. Net volume was around 36,000 contracts...about 50 percent higher than Monday's volume.

Like Monday, it should be obvious to any casual observer that both gold and silver would have finished materially higher in price if a not-for-profit seller hadn't shown up a couple of times during the Comex trading session...especially at the London close.

It was a different story with the other two precious metals of note. Platinum closed up 1.02%...and palladium was the star...up 4.28%. It's obvious that there weren't too many not-for-profit sellers around in these white metals.

It was a different story with the other two precious metals of note. Platinum closed up 1.02%...and palladium was the star...up 4.28%. It's obvious that there weren't too many not-for-profit sellers around in these white metals.

The dollar index traded in a fairly wide range just above the 81.00 level for the entire Tuesday trading session...and closed virtually unchanged at 81.11. Nothing to see here, folks...please move along.

* * *

The CME Daily Delivery Report was another yawner, as only 1 gold and 5 silver contracts were posted for delivery from the Comex-approved depositories on Thursday.

There was no reported change in GLD...but for the second day in a row an authorized participant withdrew silver from SLV. This time it was 822,901 troy ounces.

Bron Suchecki over at The Perth Mint sent me an e-mail regarding the quick deposits of silver into Sprott's Physical Silver Trust...PSLV...that I mentioned in this space yesterday. This is what he had to say...

"Hi Ed, I noted your comment in today's piece that the Sprott deliveries were fast. FYI, the reported figures reflect when Sprott bought the metal and not when it was delivered.

The reasoning is that for the fund to accurately calculate its daily Net Asset Value, so investors know what its fair value is, it has to show its true financial position. The figure are therefore reported on an accrual accounting basis, not a cash (or metal) flow basis." Regards - Bron [That sounds entirely plausible to me. - Ed]

The U.S. Mint had a pretty decent sales report yesterday. They sold 4,500 ounces of gold eagles...1,000 one-ounce 24K gold buffaloes...and a rather chunky 647,000 silver eagles.

It was a busy day at the Comex-approved depositories on Monday. They received 1,177,273 troy ounces of silver...and shipped only 30,924 troy ounces of the stuff out the door. The link to that activity is here.

There was no reported change in GLD...but for the second day in a row an authorized participant withdrew silver from SLV. This time it was 822,901 troy ounces.

Bron Suchecki over at The Perth Mint sent me an e-mail regarding the quick deposits of silver into Sprott's Physical Silver Trust...PSLV...that I mentioned in this space yesterday. This is what he had to say...

"Hi Ed, I noted your comment in today's piece that the Sprott deliveries were fast. FYI, the reported figures reflect when Sprott bought the metal and not when it was delivered.

The reasoning is that for the fund to accurately calculate its daily Net Asset Value, so investors know what its fair value is, it has to show its true financial position. The figure are therefore reported on an accrual accounting basis, not a cash (or metal) flow basis." Regards - Bron [That sounds entirely plausible to me. - Ed]

The U.S. Mint had a pretty decent sales report yesterday. They sold 4,500 ounces of gold eagles...1,000 one-ounce 24K gold buffaloes...and a rather chunky 647,000 silver eagles.

It was a busy day at the Comex-approved depositories on Monday. They received 1,177,273 troy ounces of silver...and shipped only 30,924 troy ounces of the stuff out the door. The link to that activity is here.

I have a couple of charts for you today. The first is courtesy of Washington state reader S.A...and it's self-explanatory. Silver rocks!

(Click on image to enlarge)

The other is from Nick Laird and, based on his calculations, the graph is titled "Annual Chinese Gold Accumulation Since 2000"...and as Nick said in his covering e-mail..."At the current rate, China will exceed U.S. gold holdings within 4 years." One of Nick's presumptions when putting this graph together was "that all imports into China came in through Hong Kong." Some day we'll know for sure...maybe.

* * *

news of note....

Why Texas Could Probably Secede

As of this writing, the Texas petition to peacefully “withdraw” from the United States via the White House’s open petition webpage is up to 62,481 signatures, on its way to tripling the required names needed to trigger a response from the Obama administration.

No doubt Texas’ desire to break free is a source of amusement inside a White House that has mastered the art of belittling the opinions of its challengers, but there is one not-so-small problem here: Texas could pull it off.

This short story was posted on the businessinsider.com Internet site yesterday afternoon...and I thank Roy Stephens for sending it...and the link is here.

No doubt Texas’ desire to break free is a source of amusement inside a White House that has mastered the art of belittling the opinions of its challengers, but there is one not-so-small problem here: Texas could pull it off.

This short story was posted on the businessinsider.com Internet site yesterday afternoon...and I thank Roy Stephens for sending it...and the link is here.

White House may respond to Texas secession petition

Looks like the Obama administration may have to respond to a petition seeking the green light for Texas to secede from the United States—one of 20 such requests filed on the official White House website since Election Day.

This news.yahoo.com story from Monday was sent to me by Alberta reader Jerome Cherry...and the link is here.

At the time of the writing of this post, the Texas secession petition had garnered 25,318 signatures—above the White House's self-imposed rules for requiring a reply.

Other secession petitions include requests for Arkansas, South Carolina, Georgia, Missouri, Tennessee, Michigan, Colorado, Oregon, New Jersey, North Dakota, Montana, Indiana, Mississippi, Kentucky, North Carolina, Alabama and New York.This news.yahoo.com story from Monday was sent to me by Alberta reader Jerome Cherry...and the link is here.

US. Conference Board fears BRICS miracle over as world faces decade-long slump

The catch-up boom in China, India, Brazil is largely over and will be followed by a drastic slowdown over the next decade, according to a grim report by America’s top forecasting body.

Europe's prognosis is even worse, with France trapped in depression with near zero growth as far as 2025 and Britain struggling to raise its speed limit to 1pc over the next three Parliaments.

The US Conference Board’s global economic outlook calls into question the "BRICs" miracle (Brazil, Russia, India, China), arguing that the low-hanging fruit from cheap labour and imported technology has already been picked.

This Ambrose Evans-Pritchard offering was posted on The Telegraph's website early yesterday evening GMT...and I thank Donald Sinclair for sending it. The link is here.

Europe's prognosis is even worse, with France trapped in depression with near zero growth as far as 2025 and Britain struggling to raise its speed limit to 1pc over the next three Parliaments.

The US Conference Board’s global economic outlook calls into question the "BRICs" miracle (Brazil, Russia, India, China), arguing that the low-hanging fruit from cheap labour and imported technology has already been picked.

This Ambrose Evans-Pritchard offering was posted on The Telegraph's website early yesterday evening GMT...and I thank Donald Sinclair for sending it. The link is here.

Judge orders Barclays to reveal names of 208 staff linked to LIBOR probe

Lawyers for Barclays will on Wednesday disclose the names after a High Court judge ordered the bank to hand them to the legal team of a care home operator that is suing the bank for mis-selling it complex interest rate derivatives.

The disclosure follows an attempt by Barclays to argue against the need for disclosure. However, Mr Justice Julian Flaux said on Tuesday that it was “unacceptable” to deny access to the names.

Guardian Care Homes is claiming £38m from Barclays over interest rate swaps the company alleges it was mis-sold. Barclays said: “It would be premature to comment on proceedings before the Judge has made his decision.”

This is the third and final offering from Donald Sinclair...and it's also from yesterday evening's Telegraph. The link is here.

The disclosure follows an attempt by Barclays to argue against the need for disclosure. However, Mr Justice Julian Flaux said on Tuesday that it was “unacceptable” to deny access to the names.

Guardian Care Homes is claiming £38m from Barclays over interest rate swaps the company alleges it was mis-sold. Barclays said: “It would be premature to comment on proceedings before the Judge has made his decision.”

This is the third and final offering from Donald Sinclair...and it's also from yesterday evening's Telegraph. The link is here.

Civil Disobedience: Greek Mayors Rebel Against Public Layoffs

While the Greek government has passed the most recent austerity measures demanded by its international lenders, it continues to encounter resistance to their implementation. In a rare act of unity, cities and unions are refusing to comply with demands for layoffs.

The atmosphere was tense at the courtyard of the Thessaloniki city hall. Dozens of municipal workers in Greece's second-largest city staged a protest Monday morning against the planned lay-offs of 27,000 civil servants. "I have been working for the city for 22 years," said one of the city administration's 4,000 employees. He requested anonymity for fear of jeopardizing his position even further. "I fear for my job. All of us do."

A few hours later, city workers and journalists packed inside city hall to observe the city council meeting. The meeting ended with a decision to disobey the central government. Mayor Yiannis Boutaris had submitted the motion -- a refusal to send the Interior Ministry a list of workers ripe for dismissal. City administration and unions, so often enemies, were united.

This story showed up on the German website spiegel.de yesterday...and I thank Roy Stephens for his third offering in today's column. The link is here.

The atmosphere was tense at the courtyard of the Thessaloniki city hall. Dozens of municipal workers in Greece's second-largest city staged a protest Monday morning against the planned lay-offs of 27,000 civil servants. "I have been working for the city for 22 years," said one of the city administration's 4,000 employees. He requested anonymity for fear of jeopardizing his position even further. "I fear for my job. All of us do."

A few hours later, city workers and journalists packed inside city hall to observe the city council meeting. The meeting ended with a decision to disobey the central government. Mayor Yiannis Boutaris had submitted the motion -- a refusal to send the Interior Ministry a list of workers ripe for dismissal. City administration and unions, so often enemies, were united.

This story showed up on the German website spiegel.de yesterday...and I thank Roy Stephens for his third offering in today's column. The link is here.

On Russia Today's 'Capital Account'...CFTC's Chilton repeats belief in silver market manipulation

This 28-minute video clip is a must watch...and Chris Powell has a few things to say in this preamble as well that are more than worth reading. The video clip itself was posted over at the youtube.com Internet site yesterday afternoon...and the link to the GATA release is here.

The direct question about the silver investigation is contained in this 3-minute youtube.com clip...and I thank Matthew Nel for sending it. The link to that is here.

The direct question about the silver investigation is contained in this 3-minute youtube.com clip...and I thank Matthew Nel for sending it. The link to that is here.

¤ THE WRAP

Socialism in general has a record of failure so blatant, that only an intellectual could ignore or evade it. - Thomas Sowell

Yesterday was just another day at the office for JPMorgan et al...as their handiwork in gold and silver during the Comex trading session, was pretty much visible to all of those who cared to look.

It was another light volume day as well...and the CME's preliminary volume report for Tuesday shows that there are still about 250,000 gold contracts open in December...along with 60,000 silver contracts. Except for the 5 percent or less of those that will stand for delivery in December, everyone else has to sell or roll out of these positions by November 27th. So, based on that, we have some absolutely enormous volume days still ahead of us...and Ted's and my big fears are that it will be accompanied by an engineered price decline by "da boyz".

I was very encouraged to see Bart Chilton show up on Russia Today yesterday. The sharp-as-a-tack Lauren Lyster put Bart's feet to the fire...and now the CFTC is pretty much on the hook to resolve this issue...and it's looking less likely that JPMorgan Chase is going to be able to use their "Get-out-of-jail-free" card this time around. I think it's fairly safe to say that, thanks to Ted Butler's pioneering work on this issue, everyone knows that JPMorgan Chase is the big short in the silver market by now...and you have to wonder just how much pressure they're under, both internally and externally, to resolve this issue. One thing is for sure...and that is that the noose is tightening around their necks and, like Ted, I'd guess that this issue will not resolve itself quietly.

I'm also curious to know how warm it's getting over at Canada's Scotiabank/Scotia Mocatta...as it's my opinion that they are the big #2 short in the silver market...and between them and JPMorgan Chase, they're collectively short just about 45% of the entire Comex futures market in silver on a net basis.

Yesterday was just another day at the office for JPMorgan et al...as their handiwork in gold and silver during the Comex trading session, was pretty much visible to all of those who cared to look.

It was another light volume day as well...and the CME's preliminary volume report for Tuesday shows that there are still about 250,000 gold contracts open in December...along with 60,000 silver contracts. Except for the 5 percent or less of those that will stand for delivery in December, everyone else has to sell or roll out of these positions by November 27th. So, based on that, we have some absolutely enormous volume days still ahead of us...and Ted's and my big fears are that it will be accompanied by an engineered price decline by "da boyz".

I was very encouraged to see Bart Chilton show up on Russia Today yesterday. The sharp-as-a-tack Lauren Lyster put Bart's feet to the fire...and now the CFTC is pretty much on the hook to resolve this issue...and it's looking less likely that JPMorgan Chase is going to be able to use their "Get-out-of-jail-free" card this time around. I think it's fairly safe to say that, thanks to Ted Butler's pioneering work on this issue, everyone knows that JPMorgan Chase is the big short in the silver market by now...and you have to wonder just how much pressure they're under, both internally and externally, to resolve this issue. One thing is for sure...and that is that the noose is tightening around their necks and, like Ted, I'd guess that this issue will not resolve itself quietly.

I'm also curious to know how warm it's getting over at Canada's Scotiabank/Scotia Mocatta...as it's my opinion that they are the big #2 short in the silver market...and between them and JPMorgan Chase, they're collectively short just about 45% of the entire Comex futures market in silver on a net basis.

But nobody knows for sure just how this is going to turn out exactly...however it sure looks like the issue will get resolved...but as for timing, it's hard to say.

As has been the case lately, neither gold nor silver did much during the Far East trading session...and as I write this paragraph at 2:20 a.m. Eastern time, we're still about forty minutes away from the London open. Volumes are vapour...and the dollar index isn't doing a thing.

Two hours into the London trading day, volumes are still very light...and there are few roll-overs out of the December contract, but I expect that to change very quickly once New York begins to trade. The dollar index is hanging in there just above the 81.00 mark...and the prices of both metals are basically unchanged from Tuesday's close.

The next couple of weeks are going to be very interesting. As I've said many times in the past month or so, I could rationally explain a price explosion or price implosion in either gold or silver...and it's just a matter of which come first and how big it will be.

I await the Comex open with great interest.

As has been the case lately, neither gold nor silver did much during the Far East trading session...and as I write this paragraph at 2:20 a.m. Eastern time, we're still about forty minutes away from the London open. Volumes are vapour...and the dollar index isn't doing a thing.

Two hours into the London trading day, volumes are still very light...and there are few roll-overs out of the December contract, but I expect that to change very quickly once New York begins to trade. The dollar index is hanging in there just above the 81.00 mark...and the prices of both metals are basically unchanged from Tuesday's close.

The next couple of weeks are going to be very interesting. As I've said many times in the past month or so, I could rationally explain a price explosion or price implosion in either gold or silver...and it's just a matter of which come first and how big it will be.

I await the Comex open with great interest.

and....

http://jessescrossroadscafe.blogspot.com/2012/11/gold-daily-and-silver-weekly-charts_13.html

13 NOVEMBER 2012

Gold Daily and Silver Weekly Charts - Eric Sprott on Gold - JPM Backstops NJ Debt Offering

Gold and silver moved sideways today, as stocks remained weak and treasuries gained.

Trading remained quiet. There is an intraday post on the sort of commentary about gold that was 'popular' in 1999.

In the monetization of official debt department, JPM Agrees to Fully Backstop NJ $2.6 Billion Debt Offering. Just in case you were wondering who the 'house bank' is and why they keep it around.

All the Fed and Treasury need are a few cooperative intermediaries in the private sector willing to take the vig, and they can run the money machine day and night through the wonderful price discovery mechanism of market 'auctions.'

I wonder if they will have an open bar and jumbo shrimp at this prix fixe bond event? Maybe a nice ice sculpture of the queen of the silver market?

Have a pleasant evening.

http://www.zerohedge.com/news/2012-11-13/guest-post-gold-dollar-are-less-correlated-everyone-thinks

Guest Post: Gold & The Dollar Are Less Correlated Than Everyone Thinks

Submitted by Tyler Durden on 11/13/2012 14:19 -0500

- BLS

- Bond

- Bureau of Labor Statistics

- Census Bureau

- Central Banks

- China

- ETC

- Federal Reserve

- Federal Tax

- Global Economy

- Gross Domestic Product

- Guest Post

- Monetary Base

- Monetary Policy

- None

- Purchasing Power

- Reserve Currency

Submitted by Charles Hugh-Smith via Peak Prosperity,

Whenever I make the case for a stronger U.S. dollar (USD), the feedback can be sorted into three basic reasons why the dollar will continue declining in value:

- The USD may gain relative to other currencies, but since all fiat currencies are declining against gold, it doesn’t mean that the USD is actually gaining value; in fact, all paper money is losing value.

- When the global financial system finally crashes, won’t that include the dollar?

- The Federal Reserve is “printing” (creating) money, and that will continue eroding the purchasing power of the USD. Lowering interest rates to zero has dropped the yield paid on Treasury bonds, which also weakens the dollar.

The general notion here is that, given the root causes of our economic distemper – rampant financialization, over-leverage and over-indebtedness, a politically dominant parasitic banking sector, an aging population, overpromised entitlements, a financial business model based on fraud, Federal Reserve monetizing of debt, and a dysfunctional political system, to mention only the top of the list – how can the USD appreciate in real terms?All of these objections are well-grounded.Let’s look at some charts to discern what factors are “pricing” the dollar, domestically and internationally.Before we start, though, let’s spend a few moments thinking through what a declining dollar means in the real world. Since the USD is the world’s reserve currency, we have to ask the question in two contexts: the domestic economy and the global economy. The Triffin Paradoxexplains why the domestic monetary policy of the nation that issues the reserve currency will conflict with the needs of the international community using the currency for reserves.

Let’s say that thanks to a depreciating dollar (what many call “inflation”), gasoline that once cost 40 cents a gallon now costs $4 a gallon. Back when gasoline cost 40 cents a gallon, the average wage was $1.60, so an hour of labor could buy four gallons of gasoline.

This ten-fold rise in the cost of fuel would certainly be catastrophic if earnings didn’t rise as well. But if earnings rose to $16 per hour, then an hour’s labor would still buy four gallons of gasoline. If gasoline rose to $4,000 a gallon, if earnings per hour also climbed to $16,000 per hour, then the purchasing power of an hour’s labor would remain constant.

If wages rose such that an hour’s labor bought five gallons of gasoline, the wage earner’s purchasing power has actually increased despite the apparent 90% drop in the value of the currency.This suggests that a depreciating currency is not a domestic catastrophe unless earnings (and assets) do not rise in lockstep with the price of goods and services.

In terms of the international community, a depreciating dollar means oil exporters paid with dollars (so-called "petro-dollars") will have to raise the price of oil to offset the depreciation, and this could wreak havoc on other nations importing oil. In other words, the U.S. “exports inflation” by depreciating its currency, which is precisely what happened in China: Inflation leaped in China while it remained placid in the U.S. (at least by official calculations).

No wonder understanding the dollar’s value is so complex; it plays a duel role as the reserve currency and the U.S. currency, and it is influenced by a large number of domestic and international forces.

Charting the Dollar and the Metrics That Influence Its Value

Let’s start with two charts showing the dollar’s massive decline in domestic value over the past century and half-century.

From the long view, the USD had already lost 30% even before the Federal Reserve was founded. The much-discussed end of the gold standard (when the USD was no longer backed by gold) in 1971 had little effect.

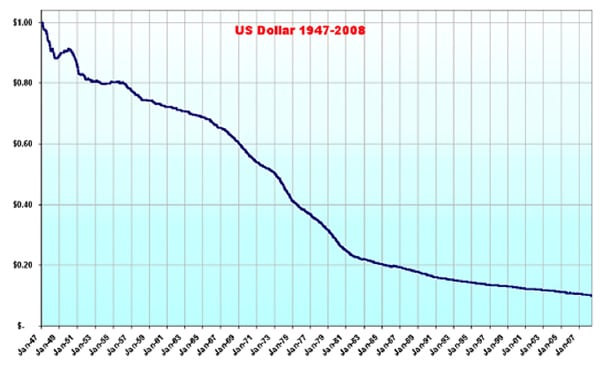

Here is the dollar from 1947 to 2008. In 1970, it was worth $0.60, and it has since slumped to $0.10 in constant 1947 dollars. This is confirmed by the BLS inflation calculator, which equates $1 in 1970 with $6 in 2012 dollars.That is a nasty decline in 42 years, to be sure. Now let’s look at gross domestic product, earnings, and the size of the population and workforce.

According to the Census Bureau, the population of the U.S. was 203 million in 1970, and it is now 307 million, a roughly 50% increase.

The number of workers has risen 75%, from 80 million in 1970 to 140 million today.

If productivity remained constant, we might expect that gross domestic product would rise by 75% due to a larger workforce and the six-fold increase due to depreciation of the dollar. Since GDP was $1.038 trillion in 1970, we could expect $1T X 1.75 = $1.75T X 6 = $10.5 trillion. Actual GDP is over $15 trillion, a 50% increase over the adjusted-for-workforce-inflation result.

If productivity remained constant, we might expect that gross domestic product would rise by 75% due to a larger workforce and the six-fold increase due to depreciation of the dollar. Since GDP was $1.038 trillion in 1970, we could expect $1T X 1.75 = $1.75T X 6 = $10.5 trillion. Actual GDP is over $15 trillion, a 50% increase over the adjusted-for-workforce-inflation result.

Here is the adjusted (real) GDP:

Adjusted for inflation/dollar depreciation, the GDP has tripled since 1970. Even if we discount half of this as official under-reporting of inflation, that is still a significant increase.

Adjusted for inflation/dollar depreciation, the GDP has tripled since 1970. Even if we discount half of this as official under-reporting of inflation, that is still a significant increase.

Next, let’s look at the critical metric of employee compensation. Did earnings rise along with prices?

It appears that earnings rose almost fourteen-fold while costs rose six-fold. Thus “real” earnings increased despite the depreciating dollar. Here is a chart of real household income, courtesy of DShort.com.

Here we see income disparity at work. Lower-income workers saw their real (adjusted) earnings rise by about 20%, middle-class employees registered gains of around 40%, while the top 20% realized gains of about 70%. The top 5% has seen real income almost double.

Note that the income in all brackets has declined or stagnated since 2000.

Now let’s look at some other basic measures of economic activity: corporate earnings and government spending. Corporate profits have zoomed over thirty-fold since 1970, while Federal spending has increased about eighteen-fold.

Corporate profits have zoomed over thirty-fold since 1970, while Federal spending has increased about eighteen-fold. Federal tax receipts have increased about twelve-fold.

Federal tax receipts have increased about twelve-fold.

What does all this mean? It appears that a steadily depreciating dollar did not harm the nation’s output, earnings, corporate profits or government spending. Though rising income disparity is troubling, it cannot be traced to the depreciating dollar.

Next, let’s look at the three factors most often mentioned as setting the value of the dollar internationally: interest rates, the monetary base, and gold.

Interest rates, measured here by the yield on the ten-year Treasury, topped at 16% in 1982.

If interest rates drive the value of currencies, we would expect to see the dollar rise and decline along with interest rates. Here is the trade-weighted dollar, valued against a basket of our trading partners’ currencies.

The correlation is not perfect, as the USD peaked in 1985, triggering the Plaza Accord, a concerted campaign by central banks to depreciate the dollar against rival currencies. Nonetheless, the USD has trended lower as interest rates fell.Here is the monetary base of the dollar, which skyrocketed as the Fed ramped up the base in response to the global financial crisis of 2008-09. If this was a dominant force on the dollar, we would expect to see a corresponding decline in the trade-weighted dollar and a leap in the USD price of gold.

The trade-weighted dollar is about where it was before the three-fold expansion of the monetary base. Gold did skyrocket, roughly doubling from its 2008 price range to about $1,750 per ounce today.

But if the price of gold were correlated to the trade-weighted dollar, we would expect to see a rise in gold as the dollar fell from its 1985 peak. It did not, but it did rise as the USD declined from its 2002 peak. In other words, the correlation of gold to the trade-weighted USD is very inconsistent; the USD has remained in a small range since 2008 while gold doubled.

Gold and the USD have actually risen together in some timeframes.

If we step back, what do we notice about the charts of GDP, employee compensation, corporate profits, government expenditures, and gold? Roughly speaking, all have increased ten-fold or more from 1975. From this point of view, gold has simply “caught up” with earnings, GDP, profits, government spending, etc.While the dollar’s value against other currencies has declined as bond yields dropped, from the long view its 2009 value places it back in a range going back two decades to the early 1990s.

Though the monetary base roughly doubled from 1990 to 2005, gold in 2005 was still around $400 per ounce, same as its price back in 1990.

In other words, the price of gold is not consistently correlated to the monetary base, the trade-weighted dollar, or interest rates. Gold appears to march to an independent drummer.

A Distinct Lack of Consistent Correlations

Where does this comparison of charts leave us? With a distinct lack of consistent correlations.[ZH: though we note in the very recent past that correlation 'mathematically' has risen consistently]

It would seem that the commonly touted drivers of the dollar’s value, measured in either trade-weighted USD or in gold, are inconsistent; none of them correlate consistently over time.

The three metrics of interest rates, gold, and the trade-weighted dollar appear to have minimal impact on productivity, profits, output, earnings, or the domestic standard of living, as these three have jumped around with no visible impact on broad measures such as GDP or earnings.

We have seen interest rates leap to 16% and fall to near-zero; gold collapse, stagnate, and then quadruple; and the dollar gain and lose 30% of its trade-weighted value in a few years. None of these huge swings had any correlation to broad measures of domestic activity such as GDP.Clearly, interest rates occasionally (but not always) affect the value of the trade-weighted dollar, and the monetary base occasionally (but not always) affects the price of gold, but these appear to have little correlation to productivity, earnings, etc., or to each other.

http://www.silverdoctors.com/eric-sprott-western-central-banks-have-no-more-gold-only-gold-receivables/#more-17192

Bloomberg has released a

Bloomberg has released a

No comments:

Post a Comment