http://www.caseyresearch.com/gsd/edition/gold-solution-banking-crisiseric-sprott-david-baker

( Note Ed's report covers data through thursday..... )

and....

http://harveyorgan.blogspot.com/2012/11/gold-and-silver-advancelarge-reduction.html

Comex gold figures

Nov 29.2012 Month of November now complete

(first day notice for the December contract will be Nov 30.2012)

selected non redundant gold / silver news of note....

The Unmistakable Sign Of Illegal Market Manipulation

http://www.silverdoctors.com/ned-naylor-leyland-lbma-smoke-signals-smell-fishy/#more-18084

and....

and.....

http://www.zerohedge.com/news/2012-11-29/gold-falls-just-13-despite-massive-odd-35-million-ounce-sell-orders

http://harveyorgan.blogspot.com/2012/11/gold-and-silver-raidsilvers-oi-for.html

Let us head over to the comex as assess the damage due to the vicious raid today.

The total comex gold open interest fell dramatically today from 492,435 down to 479,373.

No doubt some of our longs left the arena refusing to play with the crooked bankers. The non active November contract saw it's OI fall by 8 contracts from 21 down to 13. We had 9 delivery notices yesterday so in essence we gained another 1 contract or 100 oz of additional gold will stand in November. The big December contract saw many roll into February and April. The OI for December now stands at 97,808 falling from yesterday's level of 155,234. The estimated volume today was huge at 445,880. The confirmed volume yesterday was also large at 310,898.

The total silver comex OI refuses to fall like gold. Today the OI fell by a tiny 2669 contracts from 153,396 down to 150,727. The non active November contract month is off the board and all contracts have been fulfilled. The big December contract month saw it's OI fall by 12,100 contracts from 33,889 down to 21,789. We have OI readings for tomorrow (basis today), and Friday's reading which will be basis Thursday.We should lose about 8,000 contracts, so it looks like about 14,000 contracts will stand which is still extremely high (70 million oz). Blythe Masters will be a very busy girl trying to whittle that down. The estimated volume today must be close to a silver record at 148,042. The confirmed volume yesterday was also very high at 104,638.

Comex gold figures

Nov 28.2012

http://www.silverdoctors.com/2-4-million-ounces-of-silver-withdrawn-from-comex-stocks/#more-18022

( Note Ed's report covers data through thursday..... )

Gold: Solution to the Banking Crisis...Eric Sprott & David Baker

Nov

30

"It just feels like the precious metal markets are wound up just about as tight as they can get...especially in silver"

¤ YESTERDAY IN GOLD AND SILVER

It was a pretty unexciting day in the gold market on Thursday. The tiny rally that developed around 3:00 p.m. Hong Kong time, didn't amount to much...and got sold off the moment that Comex trading began in New York.

At that point another tiny rally developed that peaked a few minutes after the 1:30 p.m. Eastern time Comex close...and then sold off a hair into the 5:15 p.m. electronic close.

The gold price closed at $1,725.80 spot...up $6.00 from Wednesday. There was big gross volume yesterday...and once the last of the December contracts were subtracted out of that total, the net volume showed as 185,000 contracts...most of it in February...the new front month for gold.

At that point another tiny rally developed that peaked a few minutes after the 1:30 p.m. Eastern time Comex close...and then sold off a hair into the 5:15 p.m. electronic close.

The gold price closed at $1,725.80 spot...up $6.00 from Wednesday. There was big gross volume yesterday...and once the last of the December contracts were subtracted out of that total, the net volume showed as 185,000 contracts...most of it in February...the new front month for gold.

The silver price was much more 'volatile'. After selling off about two bits in Far East trading...it, too, began to rally around 3:00 p.m. Hong Kong time. And, like gold, it got sold off shortly after Comex trading began.

But the subsequent rally really developed some legs from there, before getting cut off at the knees going into the 10:00 a.m. Eastern time London p.m. gold fix. From there it more or less traded sideways into the close...although the high tick of the day....$34.52 spot...came about five minutes before the Comex trading session ended.

The silver price closed at $34.27 spot...up 50 cents. Volume, net of December roll-overs, was pretty decent at 61,500 contracts, most of which was in March...the new front month for silver.

The dollar index opened at 80.30...and traded flat until about 3:30 p.m. in Hong Kong...before rolling over. The low price tick came at precisely 10:00 a.m. in New York...and the subsequent rally lasted two hours. About one minute before noon, the index began to sag a bit...and the dollar index closed the day at 80.21...down a whole 9 basis points.

But the subsequent rally really developed some legs from there, before getting cut off at the knees going into the 10:00 a.m. Eastern time London p.m. gold fix. From there it more or less traded sideways into the close...although the high tick of the day....$34.52 spot...came about five minutes before the Comex trading session ended.

The silver price closed at $34.27 spot...up 50 cents. Volume, net of December roll-overs, was pretty decent at 61,500 contracts, most of which was in March...the new front month for silver.

The dollar index opened at 80.30...and traded flat until about 3:30 p.m. in Hong Kong...before rolling over. The low price tick came at precisely 10:00 a.m. in New York...and the subsequent rally lasted two hours. About one minute before noon, the index began to sag a bit...and the dollar index closed the day at 80.21...down a whole 9 basis points.

I suppose a case can be made for some co-relation between the dollar index and the gold price up until the 3:00 p.m. London gold fix...10:00 a.m. in New York. But it's a bit of a stretch after that.

At the moment, it appears that the dollar index is holding onto the 80.00 mark by its proverbial fingernails.

At the moment, it appears that the dollar index is holding onto the 80.00 mark by its proverbial fingernails.

* * *

The CME Daily Delivery Report for Day One of the December delivery month was a big surprise...at least in gold...as it showed that only 71 gold contracts were posted for delivery on Monday. I was expecting thousands of contracts...which would be normal.

In silver, there were 571 contracts posted for delivery on Monday within the Comex-approved depositories. It came as no surprise to me that the two big short/issuers were JPMorgan with 358 from its proprietary in-house account...and the Bank of Nova Scotia with 142 contracts. The two biggest long/stoppers were JPMorgan in its customer account with 239 contracts...and Barclays with 163 contracts. The Issuers and Stoppers Report is definitely worth looking over...and the link is here.

There were no reported changes in GLD...but it was the same old story over at SLV, as an authorized participant withdrew 725,937 troy ounces of silver...making it almost 9.5 million ounces withdrawn since the peak on November 9th.

It was another big sales day over at the U.S. Mint...as they reported selling 11,000 ounces of gold eagles...1,500 one-ounce 24K gold buffaloes...and 75,000 silver eagles.

With this latest sales figure, the U.S. Mint has now surpassed gold eagles sales for January...and that makes November the biggest gold eagles sales month of 2012 so far.

And it was also a busy day at the Comex-approved depositories on Wednesday. They received 1,655,376 troy ounces of silver...and shipped 624,870 troy ounces of the stuff out the door. The link to that activity is here.

The chart below is self-explanatory...and comes from a November 26th article by Doug Short over at the advisorperspectives.com Internet site. The article [with lots of other excellent charts] is headlined Median Household Incomes: The "Real" Story...and I found it in yesterday's edition of the King Report. The link is here.

In silver, there were 571 contracts posted for delivery on Monday within the Comex-approved depositories. It came as no surprise to me that the two big short/issuers were JPMorgan with 358 from its proprietary in-house account...and the Bank of Nova Scotia with 142 contracts. The two biggest long/stoppers were JPMorgan in its customer account with 239 contracts...and Barclays with 163 contracts. The Issuers and Stoppers Report is definitely worth looking over...and the link is here.

There were no reported changes in GLD...but it was the same old story over at SLV, as an authorized participant withdrew 725,937 troy ounces of silver...making it almost 9.5 million ounces withdrawn since the peak on November 9th.

It was another big sales day over at the U.S. Mint...as they reported selling 11,000 ounces of gold eagles...1,500 one-ounce 24K gold buffaloes...and 75,000 silver eagles.

With this latest sales figure, the U.S. Mint has now surpassed gold eagles sales for January...and that makes November the biggest gold eagles sales month of 2012 so far.

And it was also a busy day at the Comex-approved depositories on Wednesday. They received 1,655,376 troy ounces of silver...and shipped 624,870 troy ounces of the stuff out the door. The link to that activity is here.

The chart below is self-explanatory...and comes from a November 26th article by Doug Short over at the advisorperspectives.com Internet site. The article [with lots of other excellent charts] is headlined Median Household Incomes: The "Real" Story...and I found it in yesterday's edition of the King Report. The link is here.

Washington state reader S.A. sent me the 1-year Gold:Silver Ratio chart...and as you can see, we're testing new lows for this move down. Let's all join hands and pray that it continues.

(Click on image to enlarge)

* * *

Selected news items ......

Fed's Dudley Sees Unacceptable Joblessness as More QE Weighed

Federal Reserve Bank of New York President William C. Dudley said he is focusing on “unacceptably high” joblessness as he considers whether the central bank should increase its asset purchases.

“I will be assessing the employment and inflation outlook in order to determine whether we should continue Treasury purchases into 2013,” Dudley, 59, said today in a speech at Pace University in New York. “The Fed will promote maximum employment and price stability to the greatest extent our tools permit, and we will stay the course.”

Fed officials are considering whether to step up record accommodation to offset the scheduled expiration next month of Operation Twist, a program swapping short-term Treasuries with longer-term debt. A “number” of Fed officials said at their policy meeting last month that the Fed next year may need to expand its monthly purchases of bonds, according to the minutes of the Federal Open Market Committee’s Oct. 23-24 gathering.

This Bloomberg story was posted on their website mid-morning Mountain Standard time yesterday...and I thank West Virginia reader Elliot Simon for sending it. The link is here.

“I will be assessing the employment and inflation outlook in order to determine whether we should continue Treasury purchases into 2013,” Dudley, 59, said today in a speech at Pace University in New York. “The Fed will promote maximum employment and price stability to the greatest extent our tools permit, and we will stay the course.”

Fed officials are considering whether to step up record accommodation to offset the scheduled expiration next month of Operation Twist, a program swapping short-term Treasuries with longer-term debt. A “number” of Fed officials said at their policy meeting last month that the Fed next year may need to expand its monthly purchases of bonds, according to the minutes of the Federal Open Market Committee’s Oct. 23-24 gathering.

This Bloomberg story was posted on their website mid-morning Mountain Standard time yesterday...and I thank West Virginia reader Elliot Simon for sending it. The link is here.

Bank of England Says UK Banks Should Act Now to Raise Capital

British banks need to act now to bolster their defenses against financial shocks, as many have underestimated the cost of loans going sour and future fines for misconduct, the Bank of England said on Thursday.

Underlining a growing sense of urgency about capital defenses, BoE Governor Mervyn King said that while the problem was "manageable", he wanted the banks' regulator to report back by March on what steps banks were taking, and warned that he did not want them to cut lending.

Underlining a growing sense of urgency about capital defenses, BoE Governor Mervyn King said that while the problem was "manageable", he wanted the banks' regulator to report back by March on what steps banks were taking, and warned that he did not want them to cut lending.

"(Our) primary concern has been to ensure that UK banks have sufficient capital ... so that they are on a solid footing to support economic growth," King told a news conference.

This Reuters story, filed from London, was posted on The New York Timeswebsite yesterday morning around 10:00 a.m. Eastern time...and I thank Phil Barlett for bringing it to our attention. The link is here.

Greek deal frays as IMF threatens walk-out on debt buy-back impasse

The International Monetary Fund said on Thursday that it would not disburse funds under its part of the EU-IMF package unless the eurozone delivers on a bond "buy-back" scheme, which is supposed to cut Greece’s burden by 10pc of GDP and is deemed crucial for restoring long-term viability.

If the IMF withdraws, Finland and Holland will also pull out of the programme. "This has become a really big problem," said Raoul Ruparel from Open Europe.

The dispute comes as Moody’s said the EU-IMF deal to unlock €44bn in bail-out payments to Athens merely papers over cracks and does little to alleviate Greece’s "extreme economic and social fragility".

"We believe that the country’s debt burden remains unsustainable," it said. Moody’s warned that there can be so lasting solution until EU states and official creditors agree to write down their holdings, now the lion’s share.

One of these days the bond holders are going to finally realize that they will take a 100% loss on all of Euroland's debt. This Ambrose Evans-Pritchard commentary was posted on The Telegraph's web site early yesterday evening GMT...and I thank Manitoba reader Ulrike Marx for sending it along. It's definitely worth your time...and the link is here.

If the IMF withdraws, Finland and Holland will also pull out of the programme. "This has become a really big problem," said Raoul Ruparel from Open Europe.

The dispute comes as Moody’s said the EU-IMF deal to unlock €44bn in bail-out payments to Athens merely papers over cracks and does little to alleviate Greece’s "extreme economic and social fragility".

"We believe that the country’s debt burden remains unsustainable," it said. Moody’s warned that there can be so lasting solution until EU states and official creditors agree to write down their holdings, now the lion’s share.

One of these days the bond holders are going to finally realize that they will take a 100% loss on all of Euroland's debt. This Ambrose Evans-Pritchard commentary was posted on The Telegraph's web site early yesterday evening GMT...and I thank Manitoba reader Ulrike Marx for sending it along. It's definitely worth your time...and the link is here.

Greeks turn to the forests for fuel as winter nears

As austerity tightens its grip, many of the middle class find themselves in a desperate struggle to make ends meet.

It is early Sunday. The sun has barely risen above the chestnut forest that lies somewhere near the crest of Mount Pelion, but loggers' pick-up trucks are already streaming through the muddy slush, their cargo bouncing in the back. Theirs are rich pickings, much in demand as winter envelopes the villages and towns of an increasingly poverty-stricken Greece. As they pass, they do not look up because many do not have permits to do what they have just done.

From their new home a little further on, Yiannis Chadziathanasiou and Natasa Rempati watch the ebb and flow of this traffic. So, too, do the residents of Tsagarada, the picturesque hamlet where the sound of chainsaws pierces the morning air. "Things are getting desperate," says Chadziathanasiou, who clothed Greek celebrities before he moved to the countryside. "You hear all the time of people illegally clearing forests for firewood. It's horrible if you're a green like me."

This story showed up in The Guardian on Wednesday evening GMT...and it's Roy Stephens second contribution to today's column. The link is here.

It is early Sunday. The sun has barely risen above the chestnut forest that lies somewhere near the crest of Mount Pelion, but loggers' pick-up trucks are already streaming through the muddy slush, their cargo bouncing in the back. Theirs are rich pickings, much in demand as winter envelopes the villages and towns of an increasingly poverty-stricken Greece. As they pass, they do not look up because many do not have permits to do what they have just done.

From their new home a little further on, Yiannis Chadziathanasiou and Natasa Rempati watch the ebb and flow of this traffic. So, too, do the residents of Tsagarada, the picturesque hamlet where the sound of chainsaws pierces the morning air. "Things are getting desperate," says Chadziathanasiou, who clothed Greek celebrities before he moved to the countryside. "You hear all the time of people illegally clearing forests for firewood. It's horrible if you're a green like me."

This story showed up in The Guardian on Wednesday evening GMT...and it's Roy Stephens second contribution to today's column. The link is here.

After a bashing, Bank of Japan weighs 'big bang' war on deflation

Bank of Japan Governor Masaaki Shirakawa was feeling the heat in February when he was summoned to parliament five times to explain what he planned to do to get Japan out of its deflation doldrums.

Shirakawa had been opposed to another round of policy easing, though most members of his policy board were actually arguing for it at that time, according to sources familiar with the bank's internal discussions.

The threat from lawmakers to withdraw the BOJ's charter granting its independence was what changed his mind, the sources said. So the central bank surprised the markets in February by setting an inflation target for the first time of 1 percent and announcing a $122 billion increase in its asset-buying program.

Those five days of intense grilling and the ones that have followed have been among the most intense ever faced by a Japanese central bank governor. Shirakawa has been summoned 29 times so far in 2012, a decade-long record. And the pressure is having a big impact: it was the catalyst for a radical rethink in central bank policy. The full effect of that pivot is expected after April when Shirakawa is due to step down, according to more than a dozen interviews with those involved in the process.

This longish Reuters story, filed from Tokyo yesterday, is a must read...and I plucked it from a GATA release. The link is here.

Shirakawa had been opposed to another round of policy easing, though most members of his policy board were actually arguing for it at that time, according to sources familiar with the bank's internal discussions.

The threat from lawmakers to withdraw the BOJ's charter granting its independence was what changed his mind, the sources said. So the central bank surprised the markets in February by setting an inflation target for the first time of 1 percent and announcing a $122 billion increase in its asset-buying program.

Those five days of intense grilling and the ones that have followed have been among the most intense ever faced by a Japanese central bank governor. Shirakawa has been summoned 29 times so far in 2012, a decade-long record. And the pressure is having a big impact: it was the catalyst for a radical rethink in central bank policy. The full effect of that pivot is expected after April when Shirakawa is due to step down, according to more than a dozen interviews with those involved in the process.

This longish Reuters story, filed from Tokyo yesterday, is a must read...and I plucked it from a GATA release. The link is here.

Most Netherlands gold vaulted abroad 'because trading is easier'

"And so is fiddling around with it." - Chris Powell, GATA...29 November 2012

The Christian Democratic Appeal (CDA) and Socialist Party (SP) opposition parties are questioning whether it is desirable for Dutch state gold reserves to be largely stored abroad.

More and more citizens, politicians, and economists in Europe are questioning whether the foreign gold reserves, which their country possesses on paper, are still in fact physically there. Germany decided last month to move to verification.

In the next three years the German Bundesbank is to recall about 4 percent of its gold reserves from America, at the same time looking to see if the ingots are pure. CDA and SP want to know whether the Netherlands will follow the German example and physically check the genuineness of the precious metal.

For now, the answer appears to be no. "Repatriation is not yet on the agenda at the moment," De Nederlandsche Bank spokesman Remko Vellenga said yesterday.

I found this short story embedded in another GATA release. It was filed from The Hague yesterday...and posted on the nisnew.nl Internet site. It's a must read...and the link is here.

The Christian Democratic Appeal (CDA) and Socialist Party (SP) opposition parties are questioning whether it is desirable for Dutch state gold reserves to be largely stored abroad.

More and more citizens, politicians, and economists in Europe are questioning whether the foreign gold reserves, which their country possesses on paper, are still in fact physically there. Germany decided last month to move to verification.

In the next three years the German Bundesbank is to recall about 4 percent of its gold reserves from America, at the same time looking to see if the ingots are pure. CDA and SP want to know whether the Netherlands will follow the German example and physically check the genuineness of the precious metal.

For now, the answer appears to be no. "Repatriation is not yet on the agenda at the moment," De Nederlandsche Bank spokesman Remko Vellenga said yesterday.

I found this short story embedded in another GATA release. It was filed from The Hague yesterday...and posted on the nisnew.nl Internet site. It's a must read...and the link is here.

Gold: Solution to the Banking Crisis...Eric Sprott & David Baker

This month's "Markets at a Glance" from Sprott Asset Management is, without doubt, one of the finest essays that these two gentlemen have turned out this year...and it deserves your complete and undivided attention.

"If global banks’ are realistically going to improve their balance sheet diversification and liquidity profiles, gold will have to be part of that process. It is ludicrous to expect the global banking system to regain a sure footing through the increased ownership of government securities. If anything, we are now at a time when banks should do their utmost to diversify away from them,before the biggest “crowded trade” of all time begins to unravel itself. Basel III liquidity rules may be the start of gold’s re-emergence into mainstream commercial banking, although it is still not guaranteed that the US banking cartel will adopt all of the Basel III measures, and they still have years to hammer out the details. If regulators hold firm in applying stricter liquidity rules, however, gold is the only financial asset that can satisfy those liquidity requirements while freeing banks from the constraints of negative-yielding government bonds. And while it strikes us as somewhat ironic that the banking system may be forced to turn to gold out of sheer regulatory necessity, that’s where we see the potential in Basel III. After all – if the banks are ultimately interested in restoring stability and confidence, they could do worse than holding an asset that has gone up by an average of 17% per year for the last 12 years and represented ‘sound money’ throughout history."

As I said above, Eric and David hit it out of the park with this commentary. If I had to pick only one story for you to read [and re-read] today, dear reader, this one wins the contest hands down. It's wonderfully researched...and it's equally obvious that some real hard work went into it. My congratulations to both of them.

It was posted on the sprott.com Internet site yesterday afternoon...and the link is here.

"If global banks’ are realistically going to improve their balance sheet diversification and liquidity profiles, gold will have to be part of that process. It is ludicrous to expect the global banking system to regain a sure footing through the increased ownership of government securities. If anything, we are now at a time when banks should do their utmost to diversify away from them,before the biggest “crowded trade” of all time begins to unravel itself. Basel III liquidity rules may be the start of gold’s re-emergence into mainstream commercial banking, although it is still not guaranteed that the US banking cartel will adopt all of the Basel III measures, and they still have years to hammer out the details. If regulators hold firm in applying stricter liquidity rules, however, gold is the only financial asset that can satisfy those liquidity requirements while freeing banks from the constraints of negative-yielding government bonds. And while it strikes us as somewhat ironic that the banking system may be forced to turn to gold out of sheer regulatory necessity, that’s where we see the potential in Basel III. After all – if the banks are ultimately interested in restoring stability and confidence, they could do worse than holding an asset that has gone up by an average of 17% per year for the last 12 years and represented ‘sound money’ throughout history."

As I said above, Eric and David hit it out of the park with this commentary. If I had to pick only one story for you to read [and re-read] today, dear reader, this one wins the contest hands down. It's wonderfully researched...and it's equally obvious that some real hard work went into it. My congratulations to both of them.

It was posted on the sprott.com Internet site yesterday afternoon...and the link is here.

* * *

¤ THE WRAP

Gold was not selected arbitrarily by governments to be the monetary standard. Gold had developed for many centuries on the free market as the best money; as the commodity providing the most stable and desirable monetary medium. - Murray N. Rothbard

With all traders, except those standing for physical delivery, now out of the December contract...we await how the precious metals will react [or be allowed to react] to the upcoming "fiscal cliff".

We've had a lot of strange price activity in the precious metals market over the last week or so...and at least as of this past Tuesday's cut-off, the short positions by JPMorgan Chase/Scotia Mocatta were at multi-year extremes in the Commitment of Traders Report. But what happened on Wednesday's engineered price decline won't be known until next Friday...a lifetime away.

To go along with that, has been this strange start to the December delivery month in gold...as only 71 gold contracts were posted for delivery. As I pointed out earlier, normally there would be many thousands on First Day Notice. Then there has been the huge surge in the sale of gold from the U.S. Mint this week...over 60,000 ounces of eagles and buffaloes in just the last couple of days. Ted Butler figures that this gold was probably heading overseas...and I didn't argue the point.

It just feels like the precious metal markets are wound up just about as tight as they can get...especially in silver, where the frantic in/out activity on the Comex...and the big draw-downs in SLV during the last two weeks, have been stand out features...along with the recent price activity.

Today we get the weekly Commitment of Traders Report for positions held at the close of Comex trading on Tuesday...and as I've mentioned several times already, the volume and open interest from JPMorgan Chase et al's engineered price decline on Wednesday will not be in that report.

With all traders, except those standing for physical delivery, now out of the December contract...we await how the precious metals will react [or be allowed to react] to the upcoming "fiscal cliff".

We've had a lot of strange price activity in the precious metals market over the last week or so...and at least as of this past Tuesday's cut-off, the short positions by JPMorgan Chase/Scotia Mocatta were at multi-year extremes in the Commitment of Traders Report. But what happened on Wednesday's engineered price decline won't be known until next Friday...a lifetime away.

To go along with that, has been this strange start to the December delivery month in gold...as only 71 gold contracts were posted for delivery. As I pointed out earlier, normally there would be many thousands on First Day Notice. Then there has been the huge surge in the sale of gold from the U.S. Mint this week...over 60,000 ounces of eagles and buffaloes in just the last couple of days. Ted Butler figures that this gold was probably heading overseas...and I didn't argue the point.

It just feels like the precious metal markets are wound up just about as tight as they can get...especially in silver, where the frantic in/out activity on the Comex...and the big draw-downs in SLV during the last two weeks, have been stand out features...along with the recent price activity.

Today we get the weekly Commitment of Traders Report for positions held at the close of Comex trading on Tuesday...and as I've mentioned several times already, the volume and open interest from JPMorgan Chase et al's engineered price decline on Wednesday will not be in that report.

In overnight trading in the Far East on their Friday, both gold and silver have been inching higher...and that has extended into the early morning trading session in London as well. The dollar hasn't been doing a lot, although it is drifting closer to the 80.00 mark...and is down 11 basis points as of 3:53 a.m. Eastern time. Volumes are light...and virtually all of it is in the current front months for each metal. As is usually the case, nothing much of real importance will happen until Comex trading begins at 8:20 a.m. Eastern time this morning...and since it's a Friday...and the last day of the month as well...we should prepare ourselves for any eventuality.

And as I hit the 'send' button on today's column at 5:15 a.m. Eastern time, I see that gold and silver prices have weakened a hair now that London has been open for a bit more than two hours. The dollar index is still down a bit...and volumes are still light.

Although I hate to beat this to death just about every week at this point, I'd like to remind you one more time that there's still an opportunity to either readjust your portfolio, or get fully invested in the continuing major up-leg of this bull market in both silver and gold...and Irespectfully suggest that you take out a trial subscription to either Casey Research'sInternational Speculator [junior gold and silver exploration companies], or BIG GOLD[large producers], with all our best [and current] recommendations...as well as the archives. Don't forget that our 90-day guarantee of satisfaction is in effect for both publications.

That's more than enough for today. Enjoy your weekend...and I'll see you here tomorrow.

And as I hit the 'send' button on today's column at 5:15 a.m. Eastern time, I see that gold and silver prices have weakened a hair now that London has been open for a bit more than two hours. The dollar index is still down a bit...and volumes are still light.

Although I hate to beat this to death just about every week at this point, I'd like to remind you one more time that there's still an opportunity to either readjust your portfolio, or get fully invested in the continuing major up-leg of this bull market in both silver and gold...and Irespectfully suggest that you take out a trial subscription to either Casey Research'sInternational Speculator [junior gold and silver exploration companies], or BIG GOLD[large producers], with all our best [and current] recommendations...as well as the archives. Don't forget that our 90-day guarantee of satisfaction is in effect for both publications.

That's more than enough for today. Enjoy your weekend...and I'll see you here tomorrow.

and....

http://harveyorgan.blogspot.com/2012/11/gold-and-silver-advancelarge-reduction.html

THURSDAY, NOVEMBER 29, 2012

Gold and silver advance/large reduction in OI for both gold and silver/

Good evening Ladies and Gentlemen:

Gold closed up today by $10.50 to finish the comex session at $1726.70. Silver, however was the standout rising by 63 cents to $34.31. Today gold and silver held up pretty good especially for the day prior to first day notice. Yesterday's raid no doubt scared away many longs as they pitched their contracts instead of taking delivery. This has been the ploy of the crooked bankers for many years. Our CFTC commissioners just look the other way to this blatant manipulation. We have many stories to cover today but before we do let us now head over to the comex and assess trading today.....

The total comex gold open interest complex fell by a huge 27,244 contracts as suddenly it seems that many players decided to pitch rather than roll to the next contract month. The contango is tiny (the cost to roll) so it seems rather strange that all of a sudden the huge raid yesterday had this deleterious effect on our longs. The total gold comex OI fell from 479,373 down to 452,129. The big December contract has first day notice tomorrow and late tonight I get to see how many first day notices has been filed for delivery on first day notice. The OI for December fell an astronomical 62,519 contracts from 97,808 down to 35,289. Many longs were just frightened away and they pitched instead of rolling. The next non active month is January and here the OI rose 502 contracts. The estimated volume today at the gold comex was high at 229,299. The confirmed volume yesterday was unbelievable at 486,810 but that includes the many that did roll into another future month like February and April. The total silver comex OI fell by 4645 contracts from 150,727 down to 146,082. The fall was not nearly as pronounced as gold. The November contract month is now off the board. The big December contract saw a mammoth fall in OI from 21,789 down to 7949 as many longs decided to pitch instead of playing against the bankers. It seems our bankers won again. The next non active silver month of January saw its OI rise from 372 up to 498 for a gain of 125 contracts. The estimated volume today came in at a very good 70,357. The confirmed volume yesterday was huge at 163,584.

Gold closed up today by $10.50 to finish the comex session at $1726.70. Silver, however was the standout rising by 63 cents to $34.31. Today gold and silver held up pretty good especially for the day prior to first day notice. Yesterday's raid no doubt scared away many longs as they pitched their contracts instead of taking delivery. This has been the ploy of the crooked bankers for many years. Our CFTC commissioners just look the other way to this blatant manipulation. We have many stories to cover today but before we do let us now head over to the comex and assess trading today.....

The total comex gold open interest complex fell by a huge 27,244 contracts as suddenly it seems that many players decided to pitch rather than roll to the next contract month. The contango is tiny (the cost to roll) so it seems rather strange that all of a sudden the huge raid yesterday had this deleterious effect on our longs. The total gold comex OI fell from 479,373 down to 452,129. The big December contract has first day notice tomorrow and late tonight I get to see how many first day notices has been filed for delivery on first day notice. The OI for December fell an astronomical 62,519 contracts from 97,808 down to 35,289. Many longs were just frightened away and they pitched instead of rolling. The next non active month is January and here the OI rose 502 contracts. The estimated volume today at the gold comex was high at 229,299. The confirmed volume yesterday was unbelievable at 486,810 but that includes the many that did roll into another future month like February and April. The total silver comex OI fell by 4645 contracts from 150,727 down to 146,082. The fall was not nearly as pronounced as gold. The November contract month is now off the board. The big December contract saw a mammoth fall in OI from 21,789 down to 7949 as many longs decided to pitch instead of playing against the bankers. It seems our bankers won again. The next non active silver month of January saw its OI rise from 372 up to 498 for a gain of 125 contracts. The estimated volume today came in at a very good 70,357. The confirmed volume yesterday was huge at 163,584.

Comex gold figures

Nov 29.2012 Month of November now complete

(first day notice for the December contract will be Nov 30.2012)

Today, we had a huge activity inside the gold vaults.

The dealer had no deposits and no withdrawals.

The customer had 3 deposits:

i) Into HSBC: 44,965.92 oz (1.35 tonnes of gold)

ii) Into Scotia: 2121.90 oz

iii) Into Brinks: 964.5 oz

total customer deposit: 48,052.32 oz

we had 2 customer withdrawals:

i) Out of HSBC: 803.75 oz

i) Into HSBC: 44,965.92 oz (1.35 tonnes of gold)

ii) Into Scotia: 2121.90 oz

iii) Into Brinks: 964.5 oz

total customer deposit: 48,052.32 oz

we had 2 customer withdrawals:

i) Out of HSBC: 803.75 oz

ii) out of Manfra: 962.763 oz

Adjustments: none

Thus the dealer inventory rests tonight at 2.528 million oz (78.50) tonnes of gold.

The CME reported that we had 5 notices filed for 500 oz of gold. The total number of notices filed so far this month is thus 396 notices or 39,600 oz of gold. That completes the month of November

Thus the total number of gold ounces standing for delivery in November is as follows:

39,600 oz (served) + nil oz (everything served upon) = 39,600 oz (1.234 tonnes of gold). We lost 200 gold ounces standing at the gold comex today .

Thus the total number of gold ounces standing for delivery in November is as follows:

39,600 oz (served) + nil oz (everything served upon) = 39,600 oz (1.234 tonnes of gold). We lost 200 gold ounces standing at the gold comex today .

Silver:

Nov 29.2012: Month of November now complete.

Thus the dealer inventory rests tonight at 2.528 million oz (78.50) tonnes of gold.

Silver .....

Today, we had huge activity inside the silver vaults.

we had no dealer deposits and no dealer withdrawals:

We had 3 customer deposits of silver

i) into Brinks: 6,002.70 oz

ii) into CNT: 451,145.000 oz (again CNT has a perfectly round deposit )

iii) into Scotia: 1,198,228.54 oz

total customer deposit: 1,655,376.24 oz

we had 4 customer withdrawals:

i) out of Scotia: 1,027.5000 oz

ii) Out of Brinks; 556,540.24 oz

iii) Out of HSBC 6002.7 oz

iv) Out of CNT: 61,300.000 oz (another round number)

total withdrawal by customer: 624,870.44 oz

i) into Brinks: 6,002.70 oz

ii) into CNT: 451,145.000 oz (again CNT has a perfectly round deposit )

iii) into Scotia: 1,198,228.54 oz

total customer deposit: 1,655,376.24 oz

we had 4 customer withdrawals:

i) out of Scotia: 1,027.5000 oz

ii) Out of Brinks; 556,540.24 oz

iii) Out of HSBC 6002.7 oz

iv) Out of CNT: 61,300.000 oz (another round number)

total withdrawal by customer: 624,870.44 oz

we had 1 adjustment:

at the Brinks vault, 318,875.85 oz was removed from the customer account and moved to the dealer account at Brinks.

Registered silver remains tonight at a very low : 34.219 million oz

total of all silver: 141.383 million oz.

The CME reported that we had 0 notices filed for nil oz . The total number of silver notices filed this month remains at 72 contracts or 360,000 oz of silver.

To determine the number of silver ounces standing for November, I take the OI standing for November (0) and subtract out today's notices (0) which leaves us with zero notices left to be filed and thus completes the month.

Thus the total number of silver ounces standing in this non active month of November is as follows:

360,000 oz (served) + zero ( to be served upon) = 360,000 oz

we lost zero oz of silver standing at the silver comex.

Thus the total number of silver ounces standing in this non active month of November is as follows:

360,000 oz (served) + zero ( to be served upon) = 360,000 oz

we lost zero oz of silver standing at the silver comex.

THURSDAY, NOVEMBER 29, 2012

The Unmistakable Sign Of Illegal Market Manipulation

I preface this remark by saying that it is just a theory, but could Wednesday's Comex paper raid possibly be a signal of desperation by the cartel? We have been hearing countless reports out of London - the nexus of the world's physical bar market - that delivery supplies of gold and silver are getting tight. Was Wednesday's raid an attempt by a desperate bullion bank to trigger open interest selling by longs in order to reduce the number of potential accounts that hold for delivery in the face of a tight physical bar market?

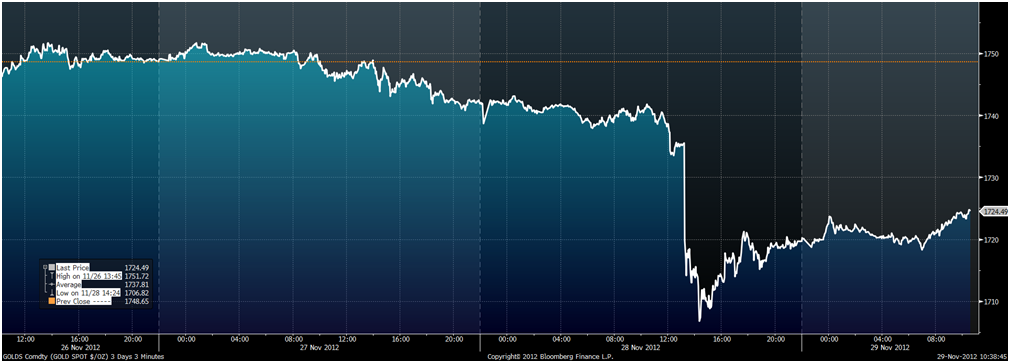

Wednesday right after the Comex opened, a total of 35,000 gold contracts were sold almost at once, with one order reported to be nearly 8100 contracts. This is roughly 104 tonnes and 24 tonnes respectively. It caused a "cliff-dive" in the price of gold/silver that was not cross-correlated with any other commodity market or equity/fixed income index. Why would someone, using paper, sell so recklessly and abruptly like this, flooding the market with an inordinately heavy supply of paper "gold." Any veteran trader knows that if you are trying to unload a disproportionately large long position - that is, large relative to the price and volume context of a given market - you have to bleed your offers into the market and not give away your size in order to try and maximize your sell proceeds. If you are not operating in this manner, you are either irrational or illegally attempting to influence the price lower. In the absence of any other credible explanation or theory being offered - and an open admission that a "computer mistake" was not the catalyst, this was clearly an attempt to exert manipulative - illegal downward influence on the price of gold. There is no other explanation for what happened on Wednesday morning.

I know that some analysts like to see some sort of proof that the manipulation occurred for the purposes of heading off a possible physical delivery squeeze. But you can't make trading profits without analyzing the "dotted lines" and anticipating future events based on what is likely unmistakable evidence. The motive for uneconomical selling like this is to derail potential stoppers (accounts who stand for delivery) as a means to avoid a physical squeeze.In this case, the event has a long history and many experienced eyeballs and brains looking at the evidence of cause. We know that China and several other Central Banks are accumulating physical gold which, at the margin, puts total global demand well in excess of annual mined supply. We also know that several countries have either issued or are threatening to issue a recall of their sovereign-owned gold being held by the Fed, Bank of England and Bank of France (mostly those three custodians). We also have first-hand accounts from several hands-on operators in London who are telling us that the global physical supply of gold is getting very tight. Finally, the open interest in the December gold and silver front-month contracts has persisted at an unusually high level relative to the fact that today is first-notice day for December. This means that any account that is long contracts is legally entitled to receive physical delivery of Comex gold bars from the counterparty who sold the contracts. Usually the open interest starts declining starting a couple weeks before first notice as paper speculators either roll forward or exit the position. But this time the open interest remained quite stubbornly high.

Wednesday right after the Comex opened, a total of 35,000 gold contracts were sold almost at once, with one order reported to be nearly 8100 contracts. This is roughly 104 tonnes and 24 tonnes respectively. It caused a "cliff-dive" in the price of gold/silver that was not cross-correlated with any other commodity market or equity/fixed income index. Why would someone, using paper, sell so recklessly and abruptly like this, flooding the market with an inordinately heavy supply of paper "gold." Any veteran trader knows that if you are trying to unload a disproportionately large long position - that is, large relative to the price and volume context of a given market - you have to bleed your offers into the market and not give away your size in order to try and maximize your sell proceeds. If you are not operating in this manner, you are either irrational or illegally attempting to influence the price lower. In the absence of any other credible explanation or theory being offered - and an open admission that a "computer mistake" was not the catalyst, this was clearly an attempt to exert manipulative - illegal downward influence on the price of gold. There is no other explanation for what happened on Wednesday morning.

I know that some analysts like to see some sort of proof that the manipulation occurred for the purposes of heading off a possible physical delivery squeeze. But you can't make trading profits without analyzing the "dotted lines" and anticipating future events based on what is likely unmistakable evidence. The motive for uneconomical selling like this is to derail potential stoppers (accounts who stand for delivery) as a means to avoid a physical squeeze.In this case, the event has a long history and many experienced eyeballs and brains looking at the evidence of cause. We know that China and several other Central Banks are accumulating physical gold which, at the margin, puts total global demand well in excess of annual mined supply. We also know that several countries have either issued or are threatening to issue a recall of their sovereign-owned gold being held by the Fed, Bank of England and Bank of France (mostly those three custodians). We also have first-hand accounts from several hands-on operators in London who are telling us that the global physical supply of gold is getting very tight. Finally, the open interest in the December gold and silver front-month contracts has persisted at an unusually high level relative to the fact that today is first-notice day for December. This means that any account that is long contracts is legally entitled to receive physical delivery of Comex gold bars from the counterparty who sold the contracts. Usually the open interest starts declining starting a couple weeks before first notice as paper speculators either roll forward or exit the position. But this time the open interest remained quite stubbornly high.

and...

The success of this operation is evidenced by the fact that the uncharacteristically high open interest for the day before first notice of a little over 97,000 dropped precipitously by over 65,000 contracts. I can't recall seeing gold open interest this high the day before first notice or a percentage drop in open interest like this in one day. The 65,000 drop would cover the 35,000 contracts sold to trigger the raid plus account for 27.2k overall drop in open interest yesterday LINK. From the standpoint of reducing the degree of delivery demand today, this illegal manipulation was a resounding success. There will come a time when it will fail...

Is the physical market finally getting to the point at which demand for delivery is starting to overwhelm the amount of paper claims "issued," the amount of which far exceeds available delivery supply? There's no way of knowing for sure but, proverbially, if it looks like and duck and quacks like a duck...

The success of this operation is evidenced by the fact that the uncharacteristically high open interest for the day before first notice of a little over 97,000 dropped precipitously by over 65,000 contracts. I can't recall seeing gold open interest this high the day before first notice or a percentage drop in open interest like this in one day. The 65,000 drop would cover the 35,000 contracts sold to trigger the raid plus account for 27.2k overall drop in open interest yesterday LINK. From the standpoint of reducing the degree of delivery demand today, this illegal manipulation was a resounding success. There will come a time when it will fail...

Is the physical market finally getting to the point at which demand for delivery is starting to overwhelm the amount of paper claims "issued," the amount of which far exceeds available delivery supply? There's no way of knowing for sure but, proverbially, if it looks like and duck and quacks like a duck...

http://www.silverdoctors.com/ned-naylor-leyland-lbma-smoke-signals-smell-fishy/#more-18084

NED NAYLOR-LEYLAND: LBMA SMOKE SIGNALS SMELL FISHY

and....

BLYTHE MASTERS TO LEAD REGULATORY AFFAIRS AT JPMORGAN CHASE

and.....

http://www.zerohedge.com/news/2012-11-29/gold-falls-just-13-despite-massive-odd-35-million-ounce-sell-orders

Gold Falls Just 1.3% Despite Massive, Odd 3.5 Million Ounce Sell Orders

Submitted by Tyler Durden on 11/29/2012 07:53 -0500

- Bank of England

- Bloomberg News

- British Pound

- China

- Commodity Futures Trading Commission

- Crude

- Deutsche Bank

- Exchange Traded Fund

- Futures market

- Gold Spot

- Gross Domestic Product

- Hong Kong

- India

- Japan

- NYMEX

- Precious Metals

- recovery

- Reuters

- SAC

- Wells Notice

Gold Falls Just 1.3% Despite Massive, Odd 3.5 Million Ounce Sell Orders

Today’s AM fix was USD 1,724.50, EUR 1,327.56, and GBP 1,076.47 per ounce.

Yesterday’s AM fix was USD 1,741.00, EUR 1,347.00, and GBP 1,087.38 per ounce.

Yesterday’s AM fix was USD 1,741.00, EUR 1,347.00, and GBP 1,087.38 per ounce.

Gold fell $22.10 or 1.27% in New York yesterday and closed at $1,719.20/oz. Silver slipped to a low of $32.92/oz and rallied back, but finished with a loss of 0.91% at $33.69/oz.

* * *

Gold recovered somewhat overnight in Asia and again today in Europe despite the sharp selling seen on the COMEX yesterday.

As ever, it is very difficult to pinpoint exactly why gold and all precious metals fell in price. Interestingly, oil fell by even more - NYMEX crude was down by 1% and was down by more than 1.7% at one stage.

The CME Group, which operates the U.S. COMEX gold futures market, said Wednesday's plunge in gold was not the consequence of a "fat finger" or a human error. The trading wasn’t even fast enough to trigger a pause on Globex, said CME.

One thing that we can say for certain was that there was massive, concentrated selling as the New York stock markets opened with some 35,000 lots sold which is equivalent to 3.5 million ounces and saw the price fall from $1,735/oz to $1,711/oz between 0825 and 0830 EST.

One sell order alone was believed to be 24 tonnes or 770,000 troy ounces. Incredibly there was 35% daily volume in just 60 seconds.

The selling, like all peculiar, counter intuitive, sharp sell offs in recent months, was COMEX driven with COMEX contracts slammed leading to further stop loss selling.

The selling may have been by speculative players on the COMEX. It may have been algo or computer trading driven or tech selling – although this is less likely.

It would be naive to completely discount the possibility that a bullion bank, short the gold and silver markets, may have been trying to protect their large concentrated short positions. The CFTC data shows some bullion banks continue to have massive concentrated short positions - which are still being investigated.

Informed commentators questioned the nature of the selling as a large institutional COMEX trading entity would normally gradually sell a position of this size in order to maximise profit.

Other speculation was that because of the wholesale liquidation of all precious metals and some other commodities, the selling may have come from a fund forced to sell a range of speculative positions after the SAC Wells notice.

Futures and options expiration may have also played a role, according to some analysts.

The robustness of gold overnight and recovery this morning is encouraging as normally one would expect to see follow through selling after such a sharp move lower.

* * *

http://harveyorgan.blogspot.com/2012/11/gold-and-silver-raidsilvers-oi-for.html

WEDNESDAY, NOVEMBER 28, 2012

Gold and silver raid/silver's OI for December remains elevated/Open Europe comments on the Greek bailout/Spain must slash the balance sheet of nationalized banks by up to 60% for bailout cash

Good evening Ladies and Gentlemen:

Gold closed down $25.70 to finish the comex session at $1716.50. Silver finished down 30 cents to $33.68

Today, the bankers through 7800 contracts at the opening of the comex for a sale of 780,000 oz of gold. This represents 1.00% of global annual production. What doorknob would want to sell that quantity in such a very tiny time constraint. I just shake my head at the vicious collusion as our regulators are bought and paid for. Tomorrow I would expect gold/silver to rise due to the fact that the gold/silver equities rose today.

Please remember that Friday is first day notice and we usually see gold and silver rise on the first day of deliveries. The silver open interest for December remains elevated. The next couple of days will be critical to see how many paper longs roll or stand for delivery. We have many stories for you tonight but first..........................................................................................

Gold closed down $25.70 to finish the comex session at $1716.50. Silver finished down 30 cents to $33.68

Today, the bankers through 7800 contracts at the opening of the comex for a sale of 780,000 oz of gold. This represents 1.00% of global annual production. What doorknob would want to sell that quantity in such a very tiny time constraint. I just shake my head at the vicious collusion as our regulators are bought and paid for. Tomorrow I would expect gold/silver to rise due to the fact that the gold/silver equities rose today.

Please remember that Friday is first day notice and we usually see gold and silver rise on the first day of deliveries. The silver open interest for December remains elevated. The next couple of days will be critical to see how many paper longs roll or stand for delivery. We have many stories for you tonight but first..........................................................................................

Let us head over to the comex as assess the damage due to the vicious raid today.

The total comex gold open interest fell dramatically today from 492,435 down to 479,373.

No doubt some of our longs left the arena refusing to play with the crooked bankers. The non active November contract saw it's OI fall by 8 contracts from 21 down to 13. We had 9 delivery notices yesterday so in essence we gained another 1 contract or 100 oz of additional gold will stand in November. The big December contract saw many roll into February and April. The OI for December now stands at 97,808 falling from yesterday's level of 155,234. The estimated volume today was huge at 445,880. The confirmed volume yesterday was also large at 310,898.

The total silver comex OI refuses to fall like gold. Today the OI fell by a tiny 2669 contracts from 153,396 down to 150,727. The non active November contract month is off the board and all contracts have been fulfilled. The big December contract month saw it's OI fall by 12,100 contracts from 33,889 down to 21,789. We have OI readings for tomorrow (basis today), and Friday's reading which will be basis Thursday.We should lose about 8,000 contracts, so it looks like about 14,000 contracts will stand which is still extremely high (70 million oz). Blythe Masters will be a very busy girl trying to whittle that down. The estimated volume today must be close to a silver record at 148,042. The confirmed volume yesterday was also very high at 104,638.

Comex gold figures

Nov 28.2012

Today, we had a little activity inside the gold vaults.

The dealer had no deposits and no withdrawals.

The customer had 2 deposits:

i) Into HSBC: 3,279.3 oz

ii) Into Scotia: 868.05

total customer deposit: 4,147.35 oz

we had 0 customer withdrawals.

i) Into HSBC: 3,279.3 oz

ii) Into Scotia: 868.05

total customer deposit: 4,147.35 oz

we had 0 customer withdrawals.

Adjustments: none

Thus the dealer inventory rests tonight at 2.528 million oz (78.50) tonnes of gold.

The CME reported that we had 6 notices filed for 600 oz of gold. The total number of notices filed so far this month is thus 391 notices or 39,100 oz of gold.

To determine what is left to be served upon, I take the OI standing for November (13) and subtract out today's notices (6) which leaves us with 7 notices or 700 oz left to be served upon our longs.

Thus the total number of gold ounces standing for delivery in November is as follows:

39,100 oz (served) + 700 oz (to be served upon) = 39,800 oz (1.237 tonnes of gold). We gained 100 gold ounces standing at the gold comex today and everyday we have gained additional gold ounces standing for November.

To determine what is left to be served upon, I take the OI standing for November (13) and subtract out today's notices (6) which leaves us with 7 notices or 700 oz left to be served upon our longs.

Thus the total number of gold ounces standing for delivery in November is as follows:

39,100 oz (served) + 700 oz (to be served upon) = 39,800 oz (1.237 tonnes of gold). We gained 100 gold ounces standing at the gold comex today and everyday we have gained additional gold ounces standing for November.

Silver:

Nov 28.2012:

first day notice for the December contract will be Nov 30.2012:

first day notice for the December contract will be Nov 30.2012:

Today, we had fair activity inside the silver vaults.

we had no dealer deposits and no dealer withdrawals:

We had 3 customer deposits of silver

i) into Brinks: 581,096.75 oz

ii) into CNT: 51,716.000 oz (again CNT has a perfectly round deposit )

iii) into Delaware: 94.30 oz

total customer deposit: 633,807.05 oz

we had 1 customer withdrawals:

i) out of Scotia: 60,711.43 oz

i) into Brinks: 581,096.75 oz

ii) into CNT: 51,716.000 oz (again CNT has a perfectly round deposit )

iii) into Delaware: 94.30 oz

total customer deposit: 633,807.05 oz

we had 1 customer withdrawals:

i) out of Scotia: 60,711.43 oz

we had 0 adjustments:

Registered silver remains tonight at a very low : 33.901 million oz

total of all silver: 140.352 million oz.

The CME reported that we had 0 notices filed for nil oz . The total number of silver notices filed this month remains at 72 contracts or 360,000 oz of silver.

To determine the number of silver ounces standing for November, I take the OI standing for November (0) and subtract out today's notices (0) which leaves us with zero notices left to be filed and thus completes the month. We may still have some notices filed so bankers wishing urgent supplies of silver.

Thus the total number of silver ounces standing in this non active month of November is as follows:

360,000 oz (served) + zero ( to be served upon) = 360,000 oz

we lost zero oz of silver standing at the silver comex.

Thus the total number of silver ounces standing in this non active month of November is as follows:

360,000 oz (served) + zero ( to be served upon) = 360,000 oz

we lost zero oz of silver standing at the silver comex.

* * *

http://www.silverdoctors.com/2-4-million-ounces-of-silver-withdrawn-from-comex-stocks/#more-18022

By SD Contributor

By SD Contributor

Submitted by

Submitted by

Yesterday's action on the crimex was pretty blatant and apparent to most. Really amazing. What gets me is that the obvious manipulation continues to go on unabated.

ReplyDeleteInteresting though is to think how much this kind of felt like an act of desperation. With the physical market so tight, I can't help but think this was an attempt, as noted above, to shake some of the those longs out of their positions and keep delivery from taking place.