http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_28/11/2012_472045

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_29/11/2012_472062

and.....

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_29/11/2012_472049

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_28/11/2012_471960

http://ransquawk.com/headlines/nasdaq-omx-says-due-to-technical-disturbances-the-market-nasdaq-omx-swedish-index-will-remain-halted-unitl-further-notice-28-11-2012

http://www.zerohedge.com/news/2012-11-28/europe-refuses-be-fixed

http://www.finanzen.net/nachricht/aktien/SPD-will-Griechenland-Abstimmung-erst-Ende-Dezember-2163109

BERLIN - The SPD wants to postpone the vote on the Greek bailout in parliament at the end of December. "We still do not know if wearing the debt buy-back program", parliamentary leader Frank-Walter Steinmeier said before the group meeting. In the agreement, the Euro Group has a deadline until 13 December set the carrying capacity of the repurchase program is to be found. Only then can a decision be possible in the Bundestag, Steinmeier said. The black-yellow coalition wants on Thursday a decision on the new grants. To the agenda of the Bundestag is changed, such as the administration of Parliament announced.

He acknowledged, however, that a change in the budget law is always possible, if that is deemed necessary. Brüderle includes a debt by euro partners and the European Central Bank, but in the long term despite the relief of not.

SPD parliamentary leader Frank-Walter Steinmeier pointed out that in the Declaration of the Euro group haircut had not been excluded. Many in the government knew it was coming to, he said. He is facing the upcoming election "clear" that the federal government excludes this topic.

The designated SPD chancellor candidate Peer Steinbrück warned of a departure from the International Monetary Fund (IMF) from the troika of international lenders. That would be a "disaster for Europe," he said. The federal government before he was to have "not the cards on the table" set. "The federal government works its way from decision to decision," said Steinbrueck. Too many questions are open. As an example, he asked who should finance the buyback of Greek bonds since.

and....

http://www.zerohedge.com/news/2012-11-28/greek-debt-buyback-another-idiotic-european-idea-or-step-toward-actual-solution

http://www.guardian.co.uk/business/2012/nov/28/eurozone-crisis-greek-debt-deal-questions

Photograph: PIERRE-PHILIPPE MARCOU/AFP/Getty Images

Photograph: PIERRE-PHILIPPE MARCOU/AFP/Getty Images

Photograph: Eurogroup/Financial Times

Photograph: Eurogroup/Financial Times

A drawing depicting Spain's prime minister, Mariano Rajoy, as a bullfighter preparing to drive a sword into a bull, seen outside a Bankia branch in Madrid this month. The banderillas sticking out of the bull's back read (L-R): "Unemployment, health, education and corruption" Photograph: JUAN MEDINA/REUTERS

A drawing depicting Spain's prime minister, Mariano Rajoy, as a bullfighter preparing to drive a sword into a bull, seen outside a Bankia branch in Madrid this month. The banderillas sticking out of the bull's back read (L-R): "Unemployment, health, education and corruption" Photograph: JUAN MEDINA/REUTERS

The German Bundesbank president, Jens Weidmann. Photograph: Alex Domanski/AP

The German Bundesbank president, Jens Weidmann. Photograph: Alex Domanski/AP

Local stocks head south as bank slide continues

The Athens Exchange (ATHEX) general index ended at 822.72 points, shedding 2.87 percent from Tuesday’s closing figure of 847.06 points. The blue chip FTSE/ATHEX 20 index gave up 3.96 percent to close at 286.50 points. All but one blue chip headed south, led by Eurobank Ergasias (down 11.04 percent), Cyprus Popular Bank (9.43 percent) and Alpha Bank (8.93 percent). Titan cement was the exception, adding 1.54 percent. In total 61 stocks went up, 89 declined and 16 remained unchanged. Turnover amounted to 62.3 million euros, down from Tuesday’s 92.2 million. |

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_29/11/2012_472062

Bankers set to oppose buyback plan

Bond scheme is bereft of financial logic as it constitutes double borrowing, credit sector chiefs argue

Bank managers are planning to express their opposition to the credit sector’s likely participation in the bond buyback program at a meeting with Finance Minister Yannis Stournaras scheduled for Thursday. The administrations of all commercial banks are stressing that they cannot possibly participate voluntarily in a program that leads to the financial exhaustion of shareholders. Senior bank officials told Kathimerini that besides the legal consequences of a possible voluntary participation, such a serious decision, which would signify a change in the lenders’ portfolios, cannot be approved by their governing boards alone. They underlined that such a decision would require discussion and approval at general shareholders meetings, but that would compromise the buyback plan as it is a process that takes time. In their meeting with Stournaras the bank managers will ask for their exemption from the buyback and propose alternative solutions to the problem. They will also request changes to the terms of the recapitalization process. The main point is how to reduce the amount of capital requirements, which could take place via the bond swap or through the guarantee of bank bonds by the European Financial Stability Facility (EFSF), which would allow for their valuation at their nominal value. That would reduce capital needs by 11 billion euros at once and render recapitalization much more attractive for private shareholders. The more funds private investors contribute in the recapitalization process, the less money the state will have to pay through the Hellenic Financial Stability Fund (HFSF). Bank officials argue that the scheme proposed for the buyback process is bereft of financial logic as it constitutes double borrowing and additional burdening for taxpayers. By contrast, they say, the guarantee of bonds would have a better result at no additional cost. However these alternative plans were rejected by the representatives of the country’s creditors a few weeks ago and there is no sign of them changing their attitude on the issue. Analysts say that banks are right to protest as in spring they were burdened by the 53.5 percent bond haircut and a few months later the state is asking to buy the bonds back at 30 percent of their value. |

and.....

http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_29/11/2012_472049

Athens to borrow 10-14 bln to fund scheme which ‘must succeed’

|

Finance Minister Yannis Stournaras said on Wednesday that Greece would borrow up to 14 billion euros to fund a bond buyback scheme which creditors have said must be completed as part of efforts to reduce Greek debt and before fresh rescue loans are released next month.

“It is our patriotic duty to make the scheme succeed,” Stournaras told a press conference. “It must succeed.”

He refuted reports that the government would issue T-bills to raise the money for the scheme, saying that the funds would come from the European Financial Stability Facility. Stournaras fudged questions whether the success of the scheme was a condition for the release of 34.4 billion euros in loans next month. But he said that if the voluntary scheme fails to attract enough interest, there is a “Plan B” which he refused to elaborate on.

The new loan is on top of the 44 billion euros that eurozone and International Monetary Fund officials earmarked for Greece at a Eurogroup summit this week but it has been factored into the troika’s debt sustainability analysis, which sees Greek debt shrinking to 124 percent of gross domestic product from around 175 percent now, Stournaras said.

Early next week, Greece’s debt management agency is to reveal details of the bond buyback scheme which, according to Reuters, will be managed by Deutsche Bank and Morgan Stanley.

Of the 44 billion euros pledged to Greece, 34.4 billion is to be released by December 13 with the remaining 9.3 billion to be paid in three tranches in the first quarter of next year if Greece meets troika targets.

Of the 34.4-billion-euro tranche Greece hopes to get next month, 23.8 billion is to go to bank recapitalization and 10.6 billion to the primary deficit and state arrears. Alternate Finance Minister Christos Staikouras said a plan for the repayment of 9.3 billion euros in state arrears would be announced on Thursday. Of the total, 1.5 billion euros is to be paid out next month and the rest next year.

Stournaras said the Eurogroup deal had helped secure Greece’s position in the eurozone and its prospects for economic recovery but he noted that it is “no cause for celebration.” “Now the hard part begins.”

| Meanwhile it emerged that eurozone central banks may roll over their holdings of Greek debt, which would reduce a funding gap for the 2013-16 period from 7.6 billion euros to 5.6 billion. |

http://www.ekathimerini.com/4dcgi/_w_articles_wsite2_1_28/11/2012_471960

Greece hires Deutsche, Morgan Stanley to run Greek voluntary debt buy back, sources say

"At this moment, we intend the buy back to be voluntary,» the official said. «We hope that early next week, if possible on Monday, the Public Debt Management Agency (PDMA) will publish the invitation for the buy back,» he added. Eurogroup finance ministers and the International Monetary Fund (IMF) agreed earlier this week to conduct the buy back by mid-December, as part of measures to make Greece's debt sustainable. Greece has not determined yet at which price it will offer to buy back the debt from private bondholders, the official said. Concerns that the buy back would be imposed on Greek banks have led their shares to plunge since Tuesday, when the plan was announced. [Reuters] |

http://ransquawk.com/headlines/nasdaq-omx-says-due-to-technical-disturbances-the-market-nasdaq-omx-swedish-index-will-remain-halted-unitl-further-notice-28-11-2012

NASDAQ OMX says due to technical disturbances the market NASDAQ OMX Swedish Index will remain halted unitl further notice

09:48 - European Equities - Source: Newswires

Europe Refuses To Be Fixed

Submitted by Tyler Durden on 11/28/2012 07:05 -0500

- Beige Book

- Bloomberg News

- Bond

- Comcast

- Consumer Confidence

- CPI

- Debt Ceiling

- European Central Bank

- Eurozone

- fixed

- Goldman Sachs

- goldman sachs

- Greece

- Happy Talk

- headlines

- Italy

- Jim Reid

- M3

- Money Supply

- New Home Sales

- Nikkei

- TARP

- White House

It seems like it was only 24 hours ago that Europe bailed out Greece for the third time and everything was "fixed", with a resultant desperate attempt to validate this by pushing the EURUSD above 1.3000. Sadly, as always happens, Europe, and especially Greece, refuses to be fixed, because as we will not tire of saying: you can't fix debt with i) more debt, ii) hockeystick projections or iii) soothing words of platitude and an outright bankruptcy, just like that which Argentina is about to undergo, will be needed. If that means the end of the EUR and the delusion that the Eurozone is a viable monument to the egos of a few technocratic career politicians, so be it. As a result, this time around the halflife of the latest bailout was precisely zero, as was that of the latest Japanese QE episode, as the entire world is now habituated to the lies emanating from Europe, and demands details, which in turn are sorely lacking, especially as relates to the question of just where will Greece get the money desperately needed to fund the Greek bond buyback. But at least Kathimerini was kind enough to advise readers that said buyback must take place by December 7 in time for the euroarea finmins to approve the payment of the next Greek loan tranche at the December 13 meeting, something which will likely not happen, especially if Germany's SPD party delays the vote on the Greek bailout until the end of December as wasreported yesterday. We can't wait to learn the details of the buyback package, which will come in the "next few days" per ANA, and especially where the buyback money will come from, especially with the FT reporting that various European countries will already lose money next year on the latest Greek bailout.

Aside for the lack of "Greece is fixed-er-est" details, the European Titanic continues to drive on autopilot, blissfully unaware it is headed straight into a unsustainable debt load Titanic, and as such Italy was able to sell EUR7.5 billion in 6 Month Bills at lower yield, pushing the 3 Year to the lowest yield since 2010, even as the next Greece, Spain, just reported a collapse in retail sales, which plunged 8.4% Y/Y. But at least it was "better" than lost month's -12.7%.

An update on European monetary developments showed that M3 soared at a 3 month rate of 3.1%, well above expectations of 2.8%, and the highest since October 2008, which means any possibility of further ECB rate cuts has been effectively taken off the table well into 2013. We do, however, eagerly look forward to the pundits' explanation how it is possible that Europe is getting progressively worse even as a near record amount of liquidity is sloshing around in the Eurosystem.

But all of this is largely moot, as the reactionary market follows every update out of Washington, in hopes there will be a fiscal cliff resolution. Advance spoiler: there won't be, at least not until we have a replay of the 2008 TARP/2011 Debt Ceiling scenario, and the market plunges to get DC to act. Sorry, the recent brief downtick was certainly not enough to break the record deadlock in Congress, fondest wishes to the contrary notwithstanding.

Finally, the Shanghai Composite again showed what happens when a local central bank refuses to inject any new liquidity, and dropped 1%, breaching the 2009 lows, and closing at a level of 1973.

Expect little in terms of actual market moving macro news today as the fascination with the Fiscal Cliff persists.

More from Jim Reid:

“Reid moves markets”. I’ve always dreamed of reading such a headline and last night I got my wish. Unfortunately it was Senate Majority Leader Harry Reid who grabbed the headlines and took the shine off what was a mildly positive day for markets by suggesting that little progress had been made in fiscal cliff negotiations over the last week or so. He added that ‘we only have a couple weeks to get something done so we have to get away from the happy talk.’ This overshadowed a day of stronger US data with Durable Goods, Home Prices and Consumer confidence all ahead of expectations. The S&P closed 0.52% lower after being 0.2% higher earlier in the session and again close to the highs just before Reid’s comments hit newswires around 90 minutes before the close.

Yesterday marked only four weeks until Xmas so we do need some US political progress soon. It’s possible that Senator Reid was just reminding his colleagues of the relative urgency of the discussions. This is still the biggest story in global markets at the moment and has the capacity to move the S&P significantly into year end in either way.

Asian markets are trading firmly in negative territory following the weak lead from the US. Losses in equities are being paced by the Hang Seng (-0.83%), Nikkei (-1.0%) and the ASX200 (-0.21%). Chinese equities continue to break new post-crisis lows.

After closing below the symbolic 2,000 level yesterday, the Shanghai Composite is down a further 0.87% this morning. Interestingly the Shanghai index is down 2.5% since the country’s new leaders were unveiled in mid-November, during a period when risk assets have generally performed well. Also breaking new lows is the Japanese 10yr government bond yield which has reached its lowest level in at least 9 years (0.718%), helped by calls from the Japanese opposition leader Abe to pursue aggressive easing until inflation targets are met. Ironic really as if such a policy succeeds then JGBs will be a terrible investment in real terms. Elsewhere the AUD and EUR are virtually unchanged overnight against the greenback (1.0445 and 1.292 respectively) while the Australian iTraxx is 2bp wider at 133bp.

More on yesterday’s Greece deal, it was interesting to see the market’s relatively muted response to the Troika’s package – probably reflecting the fact that the package is conditional on a “positive” debt buyback scheduled to take place over the next few weeks and the approval of member state’s parliaments over what seems to be an aggressive timeline target of Dec 13th. As DB’s Mark Wall pointed out, what is meant by a “positive” outcome on the buyback is not officially defined, however in his view it would be a surprise for the Eurogroup to deny support to Greece on the back of low investor participation in a bond tender after having come this far in negotiations. Greek 10yr bond yields closed 26bp lower yesterday at 16.25%, while the Athex Composite (+0.29%) was denied further gains as Greek financials (-7.9%) reacted negatively to the prospect of dilutive bank recaps from the Troika’s package.

On the subject of European politics, DB’s Gilles Moec published a piece on France’s reform path yesterday, pointing out that since coming to power President Hollande’s stance has tilted towards a more reformist stance than expected, highlighted by the recent competitiveness pact and commitment to fiscal discipline.

On the subject of European politics, DB’s Gilles Moec published a piece on France’s reform path yesterday, pointing out that since coming to power President Hollande’s stance has tilted towards a more reformist stance than expected, highlighted by the recent competitiveness pact and commitment to fiscal discipline.

Returning to the fiscal cliff, the WSJ reported that Morgan Stanley’s CEO James Gorman has called on the bank’s US employees to contact members of Congress in order to urge lawmakers to reach a deal on the fiscal cliff. According to the article, Mr. Gorman’s email doesn’t mention any particular person or parties, but does employ Obama’s rhetoric in calling for a “balanced solution”. The move follows a recent call to action by the CEO of Caterpillar who wrote to employees encouraging them to sign a “Fix the Debt” petition. On that note, Obama is meeting with business leaders and CEOs today as part of his public PR campaign pushing his solution to the fiscal cliff. Amongst those attending today’s White House session are a who’s who of the corporate world including the heads of Home Depot, Goldman Sachs, Deloitte, Merck, Coca-cola, Macy’s, Yahoo, Pfizer, Comcast, State Farm, AT&T, Archer Daniels Midland and Caterpillar (Bloomberg). John Boehner and other Republicans will be meeting with some members of the same group before today’s White House session.

Away from the cliff debate, Bloomberg news said that the Fed may require US units of foreign banks to comply with tougher capital rules by directing non-US firms to house all their businesses within a US holding company.

Given the lack of any major data releases, the likely focus today will be on Obama’s meeting and headlines around the fiscal cliff. Data-wise, Eurozone money supply, German CPI and Spanish retail sales are scheduled today. In the US, we get the new home sales report for October and the Fed’s Beige Book.

http://www.finanzen.net/nachricht/aktien/SPD-will-Griechenland-Abstimmung-erst-Ende-Dezember-2163109

BERLIN - The SPD wants to postpone the vote on the Greek bailout in parliament at the end of December. "We still do not know if wearing the debt buy-back program", parliamentary leader Frank-Walter Steinmeier said before the group meeting. In the agreement, the Euro Group has a deadline until 13 December set the carrying capacity of the repurchase program is to be found. Only then can a decision be possible in the Bundestag, Steinmeier said. The black-yellow coalition wants on Thursday a decision on the new grants. To the agenda of the Bundestag is changed, such as the administration of Parliament announced.

The chairman of the FDP parliamentary group Rainer Brüderle (FDP) contrast with a vote expected later this week. "Looks like the Bundestag will vote this week, as on Thursday," Bruederle said before the FDP parliamentary group meeting. He believes that the FDP will vote overwhelmingly agreed Greece aid. The compromise was supported by the Public Interest, Greece continues to keep open a chance, said Brüderle.

The agreement with the International Monetary Fund (IMF) "was crucial for us, as this allows the international expertise on board will remain," said the FDP chairman. Without the IMF program would be in the opinion of Brüderle certainly not repeatable. A haircut is for legal reasons - not only in Germany - not currently come into question.

The agreement with the International Monetary Fund (IMF) "was crucial for us, as this allows the international expertise on board will remain," said the FDP chairman. Without the IMF program would be in the opinion of Brüderle certainly not repeatable. A haircut is for legal reasons - not only in Germany - not currently come into question.

He acknowledged, however, that a change in the budget law is always possible, if that is deemed necessary. Brüderle includes a debt by euro partners and the European Central Bank, but in the long term despite the relief of not.

SPD parliamentary leader Frank-Walter Steinmeier pointed out that in the Declaration of the Euro group haircut had not been excluded. Many in the government knew it was coming to, he said. He is facing the upcoming election "clear" that the federal government excludes this topic.

The designated SPD chancellor candidate Peer Steinbrück warned of a departure from the International Monetary Fund (IMF) from the troika of international lenders. That would be a "disaster for Europe," he said. The federal government before he was to have "not the cards on the table" set. "The federal government works its way from decision to decision," said Steinbrueck. Too many questions are open. As an example, he asked who should finance the buyback of Greek bonds since.

and....

http://www.zerohedge.com/news/2012-11-28/greek-debt-buyback-another-idiotic-european-idea-or-step-toward-actual-solution

Greek Debt Buyback: Another Idiotic European Idea Or A Step Toward An Actual Solution?

Submitted by Tyler Durden on 11/28/2012 09:26 -0500

From Open Europe

Buying Back Greece: Another Ad Hoc Deal Or A Step Towards A Solution?

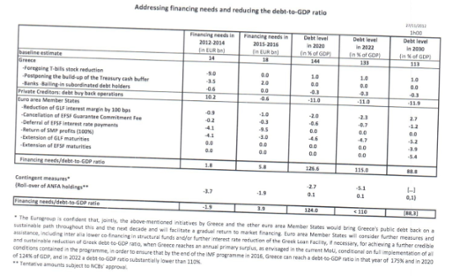

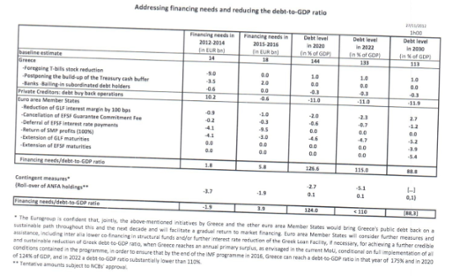

Early on Tuesday morning the eurozone and the IMF reached an agreement which has been widely billed as their most comprehensive package to aid Greece. Now that the dust has settled somewhat, Open Europe assesses the key components of the deal.

Conclusion

For all the talk and all the figures flying around there is still only one that really matters – 124% debt to GDP ratio in 2020, clearly this is not sustainable. Further measures will be needed and the ad hoc nature of this deal, particularly the way it skirts the big decisions, suggests that fears over a ‘Grexit’ will return as soon as Greece begins missing its targets once again.

For all the talk and all the figures flying around there is still only one that really matters – 124% debt to GDP ratio in 2020, clearly this is not sustainable. Further measures will be needed and the ad hoc nature of this deal, particularly the way it skirts the big decisions, suggests that fears over a ‘Grexit’ will return as soon as Greece begins missing its targets once again.

1. Debt buyback

The buyback is short on details, with little clue as to where the money will come from or which bonds will be purchased. The idea behind a buyback is that Greek bonds are currently trading at around 35 cents on the euro, which the Greek government could purchase and then retire, thereby reducing their debt by the difference in the current and nominal price.

Figure 1: Who owns Greek debt?

Source: Greek Ministry of Finance, Greek Public Debt Bulletins, European Commission, Bank of Greece, Open Europe calculations.[1]

As figure 1 shows, taxpayer-backed institutions – or the official sector (EFSF, Eurozone, IMF, ECB, NCBs, Bank of Greece and other loans) – now hold 70.5% (€212bn) of Greek debt. Greek monetary financial institutions (banks, pension funds, investment funds) hold around 10% (€30bn) of Greek debt while similar firms abroad hold around the same amount. Greece currently has a stock of around €18.4bn in T-bills (short term debt).

It seems that the EU/IMF/ECB Troika expects Greece to be given around €10bn to use for buy backs.[2]

Who would actually sell their bonds in a buyback? The official sector debt is ruled out of any buyback (most is in the form of loans while the ECB has rejected including its bonds). To us it seems illogical for any Greek institution to sell their holding of Greek debt at such a significant write-down, especially after the previous restructuring resulted in such a huge recapitalisation (which offset much of the benefit). The Troika seems to expect Greek banks to provide half of the bonds for sale under a buyback – this is either naïve or counterproductive given the likely recapitalisation needs.[3] Therefore, in reality we expect that only the €30bn of foreign held debt would be available for purchase.

This still fits with the €10bn in funding and the price of 35 cents on the euro and could deliver up to €20bn in debt reduction (around 11% of GDP), if all these bondholders took part.

However, it is unclear how many of these bondholders would wish to sell. Some will be holding the bonds to maturity and will not want to accept any further write downs, while others may be happy to wait for a default and take the case to court due to the new Greek bonds being governed under English law. In any case the debt reduction may be much lower.

Where will the €10bn for the buyback come from? This is far from clear but it is hard to imagine it being found anywhere other than the bailout funds, meaning a new transfer of around €9bn will be needed. This again poses significant political problems as leaders in Germany, the Netherlands and Finland (to name but a few) try to convince their parliaments (and public) that this is not more money into a black hole. It has been suggested that some of the other mechanisms mentioned below could be used to fund the buyback, but this looks impossible since they are being tapped to fill the existing funding gap.

These substantial obstacles to a successful debt buyback are crucial since the IMF has already stated its on-going participation in the Greek bailout hinges on this policy. The likes of Finland and the Netherlands have also previously stated that IMF involvement is requirement if they are expected to continue to aid Greece. With a plan on the buyback expected to be in place by 13 December, to allow for the release of the next tranche of bailout funds, this deal could hit a wall even sooner than many expected.

2. Interest rate reduction

The original bilateral loans to Greece will see their rated reduced by 1%, making it 0.5% over the 3 month Euribor rate. This means the interest on the loans could now be around 1% given current rates. Clearly this is much lower than the majority of eurozone countries can borrow at (especially given the very long maturities of the loans). Countries which are under a “full” bailout are exempted, although Spain, which is in the progress of seeking a bailout for its banking sector will not be. This could further political divisions within the eurozone.

This (along with other slight interest adjustments agreed) could deliver around €3.5bn up to 2016, so although it helps with the bailout extension it does not provide any real debt relief.

Meanwhile, reports already suggest that the Portuguese government has told its parliament that it will be seeking a similar deal with regards to its bailout.[4]

3. Deferral of interest and extension of maturities

This could aid in the short term, i.e. helping to fund the two year extension. However, on net it delivers no reduction and is once again a very short term ad hoc measure aimed at avoiding taking any significant decision on the Greek crisis – especially since a deferral on some interest payments was already in place. Similar things can be said of the maturity extension, especially given that many of the loans already have long maturities at 15 years. Once again this rescheduling of debt would amount to a technical default in most scenarios and does represent creditors forgoing real payments for a substantial amount of time.[5]

4. Dispersal of profits from the SMP

A key point here is that the ECB is not providing the money directly to Greece – thereby avoiding the legal problems of ‘monetary financing’, i.e. directly paying for states. The money will be dispersed to member states as usual and they will pass on an amount equivalent to this to Greece.

The issue with this however is that the profit from ECB actions, including profits accrued from its bond-buying programmes, is usually done on an annual basis and is paid out after it has passed through the ECB profit and loss account (meaning it can be used to offset any ECB losses, although this is unlikely at this time). It is not clear yet whether this will constrain when and how the money can be transferred. However, if the schedule is not the same a plausible case can be made that this is an additional injection of funds rather than a transferral of funds (although this is admittedly semantic over a long period).

5. The prospect of further measures in the future

The Eurogroup statement left the prospect of further measures to reduce the Greek debt burden hanging, teasing markets into believing that an official sector write down is just around the corner.

However, this does not quite seem to be the case. Firstly, such a prospect will only be realised if Greece manages to stick to its (still) strict reform and adjustment programme, something which, despite the extension, remains unlikely. This is driven home by the extensive strengthening of the ‘escrow account’ which increases the level of oversight and makes debt servicing the clear primary objective of the Greek government.

Secondly, while many have interpreted this deal as a step towards a larger more complete decision to keep Greece and others in the eurozone (some form of permanent fiscal transfer) this does not seem to immediately be the case. This deal does everything to avoid taking such a decision, and continues to sidestep the issue even if that means prolonging the pain and putting more taxpayer cash on the line. The hope is that such a deal will be politically more palatable after the German elections next autumn. This may well be true but given that many of the constraints on solving this crisis are legal as well as political, such a decision may not be much easier even after the elections.

Lastly, as the WSJ and FT point out today, extra measures will be necessary to reach the target of 124% debt to GDP in 2020.[6]

What does this deal mean for the Greek economy and the Greek people?

This is a question that has not been asked enough in the past two days, particularly the second part. The increase in oversight through the escrow account and the continuation of the current bailout programme mean more of the same for the Greek economy. Significant structural reforms are still to take place and internal devaluation is on-going. The two year delay in fiscal consolidation looks significant on the surface but much of this is offset by the amount Greece has missed its targets by this year given the two elections. The actual pace of fiscal consolidation is still rapid and the adjustment over the next few years, in an economy which is still contracting, will be unprecedented. The pay-out of the tranches (when and if the buyback hurdle is overcome) will be positive for Greece but only serves to help the economy limp along.

Given the impact on the Greek economy, the impact on the people can be inferred. There is unlikely to be any significant turnaround in the economy in the near future and the impact of public sector cuts will continue to be substantial, albeit maybe not as sharp as it would have been before the two year extension. However, the assumptions on unemployment in the Greek budget and latest Troika report look hopelessly optimistic – we expect it to continue to rise and public unrest along with it. In both cases more of the same seems to be on the cards despite this deal.

[1] See here for a more detailed breakdown of debt shares and exact amounts for each share. The debt total of €301bn seems low given projections for the end of the year, however, when the next tranches of €34.4bn and €9.3bn are factored in the debt total is clearly in line with expectations. This does not include guarantees given by the Greek government, which amount to around €20bn. NCBs refers to National Central Banks.

[2] This amount is taken from a leaked document the key table of which was published by the FT. Cited by the FT Brussels blog, ‘Greece, round 3: let the debt relief talks begin’, 28 November 2012. For the specific table see:http://blogs.r.ftdata.co.uk/brusselsblog/files/2012/11/greece.pdf

[3] This is taken from a leaked document the key table of which was published by the FT. Cited by the FT Brussels blog, ‘New Greek bailout: the leaked chart’, 28 November 2012:http://blogs.r.ftdata.co.uk/brusselsblog/files/2012/11/Greece-2.pdf

[2] This amount is taken from a leaked document the key table of which was published by the FT. Cited by the FT Brussels blog, ‘Greece, round 3: let the debt relief talks begin’, 28 November 2012. For the specific table see:http://blogs.r.ftdata.co.uk/brusselsblog/files/2012/11/greece.pdf

[3] This is taken from a leaked document the key table of which was published by the FT. Cited by the FT Brussels blog, ‘New Greek bailout: the leaked chart’, 28 November 2012:http://blogs.r.ftdata.co.uk/brusselsblog/files/2012/11/Greece-2.pdf

[4] Cited by Journal de Negocios, ‘Portugal terá juros mais baixos e prazos mais longos nos empréstimos europeus’, 27 November 2012.

[5] This refers to the ‘Net present value’ loss which countries will face. Essentially this arises as future revenue flows are discounted, therefore the longer the payment of these loans is put off the less the money is seen to be worth in today’s terms. This drives home that creditors will be taking a loss somewhere along the line on these mechanisms.

[6] Cited by WSJ Real Time Brussels, ‘Greek debt deal explained’, 27 November 2012.

[6] Cited by WSJ Real Time Brussels, ‘Greek debt deal explained’, 27 November 2012.

http://www.guardian.co.uk/business/2012/nov/28/eurozone-crisis-greek-debt-deal-questions

Analysis: Spanish bank plans hit workers and bondholders

Photograph: PIERRE-PHILIPPE MARCOU/AFP/Getty Images

Photograph: PIERRE-PHILIPPE MARCOU/AFP/Getty Images

Our Madrid correspondent, Giles Tremlett, has analysed Europe's bailout of the Spanish banking sector - and reports that the four nationalised Spanish banks, led by Bankia, will shrink by a massive 60%.

That means huge job cuts in a country with 25% unemployment and helps show why the OECD was probably right yesterday when it predicted a rise to 27% next year.Brussels has been ruthless with Spain's failed former cajas, or savings banks, which had become bloated with toxic real estate. They must sell their shares in other companies, stop lending to real estate developers and concentrate on retail clients.Clients of Bankia and fellow bailout case Novagalicia who bought hybrid preference shares (often believing they were stable investments) will take a hammering. They, and other holders of subordinated debt, must take a €10bn hit.Bankia holds 10% of Spanish retail deposits, with 7.5 million clients. The other banks are Catalunya Banc, Novagalicia and Banco de Valencia (which is being sold to Caixabank for one euro, after taking €4.5bn in European bailout cash).

As reported at 11.19am, the four banks will jointly receive €37bn from the European bailout fund. They will also sell their real estate assets to a “bad bank” at discounts of up to 63%.

And as flagged up at 11.32am, Bankia is to cut 28% of its workforce. That means around 6,000 job cuts there alone.

Updated

That leaked chart

The Financial Times has now uploaded the leaked chart which shows how Greece will miss the revised debt/GDP targets agreed this week, without further debt relief (as discussed at 8.43am)

Photograph: Eurogroup/Financial Times

Photograph: Eurogroup/Financial Times

The key is the third column, which shows that Greek debts will be over 126% of GDP in 2020, unless new "contingent measures" are taken.

Updated

Details of Bankia's plans to shrink its business, as part of the Spanish bank recapitalisation, have now emerged.

Bankia will shut 39% of its branches and intends to cut staffing numbers by 28% over the next three years.

Bankia shareholders will also take (another) hit, with dividends frozen until 2014. They will also contribute to the restructuring, with the EU determined that investors share the pain of the €37bn recapitalisation.

(that's via Reuters)

Fitch: Greek deal good, but hazy

Ratings agency Fitch just published its comment on the Greek bailout deal – saying it should "strengthen confidence in the fragile Greek banking sector".

However Fitch has concerns, particularly about the Greek debt buyback plan.

The size of losses for the banks would depend on their sovereign debt exposure and valuations, which may vary widely for each bank, and the specific terms of the buyback.An acceleration of asset quality deterioration due to the weak economy could increase the banks' capital needs. With limited financial details available, the solvency implication is difficult to assess at present.

Greek finance minister: nothing is easy

His words were few.

EC approves Spanish bank restructuring

Just in - the European Commission has announced that it has approved the restructuring of Bankia, NCG Banco, Catalunya Banc and Banco de Valencia.

EU Competition Commissioner Joaquin Almunia says that the restructuring will cost a total of €37bn, while €45bn of toxic assets will be transferred to Spain's new bad bank.

Almunia said the plan was:

a milestone in the implementation of the Memorandum of Understanding between euro area countries and Spain.

The four banks will face pay caps and a ban on acquisitions and, as flagged up at 9.06am, thousands of jobs are to go.

Greek finance minister: nothing is easy

And back in Athens our correspondent Helena Smith says the finance minister Yiannis Stournaras emerged from the prime minister's office where the three coalition leaders were holding talks, looking rather unhappy.

She writes:

The economics professor emerged from the meeting, where he had briefed the leaders on the agreement reached at the euro group, looking uncharacteristically glum.His words were few."I am optimistic. Nothing is easy but we are always trying," he said. But as reporters gathered outside were quick to point out, he did not seem so. Stournaras gave an affirmative nod when asked if the leaders had discussed the debt buyback - a central plank of the latest rescue programme for the debt-stricken country - saying "the buyback will happen" but remained deliberately opaque as to the details of how it would be conducted.Greek banks, which stand to be the biggest "victim" of the buyback, are already grumbling, with analysts also pointing out that after the scheme recapitalisation of the lenders will have to be even bigger than the €24bn already earmarked for banks in the €44bn loan for the country."The government, it seems, is keeping its cards close to its chest regarding the debt buyback," said state-run NET TV's reporter. "The details continue to remain very

vague on this issue."

De Guindos explains Spanish bank plan

Spain's finance minister, Luis de Guindos, is revealing details of the Spanish bank restructuring.

Here's some early snaps:

Spain's bank restructuring to be approved today

A drawing depicting Spain's prime minister, Mariano Rajoy, as a bullfighter preparing to drive a sword into a bull, seen outside a Bankia branch in Madrid this month. The banderillas sticking out of the bull's back read (L-R): "Unemployment, health, education and corruption" Photograph: JUAN MEDINA/REUTERS

A drawing depicting Spain's prime minister, Mariano Rajoy, as a bullfighter preparing to drive a sword into a bull, seen outside a Bankia branch in Madrid this month. The banderillas sticking out of the bull's back read (L-R): "Unemployment, health, education and corruption" Photograph: JUAN MEDINA/REUTERS

It's a big day for Spain's banking sector.

The European commission is expected to give its definitive approval to plans to restructure Spain's four nationalised banks, which are receiving €40bn in bailout cash.

Shares in two of the banks - Bankia and Banco de Valencia - havealready been suspended this morning.

Our Madrid correspondent Giles Tremlett flags up that the quartet will also announce plans to shed thousands of jobs, and reveal how much toxic debt (mainly property loans) will be transferred to Spain's new bad bank.

Updated

Spanish retail sales gloom

The eurozone crisis continues to grip Spain, with retail sales falling 9.7% year-on-year last month, according to new data.

That's the 28th month in a row of declining sales, although Reuters points out that analysts had expected an even worse number (-11.5% was penciled in).

Bundesbank won't simply hand bond profits to Athens

The German Bundesbank president, Jens Weidmann. Photograph: Alex Domanski/AP

The German Bundesbank president, Jens Weidmann. Photograph: Alex Domanski/AP

Overnight, the head of the Bundesbank has challenged one of the key planks of the deal – that central banks should give Athens the profits they've made on Greek bonds

Jens Weidmann has declared that the German central bank will not hand back its share of the €11bn of profits unless German MPs give their approval.

Weidmann told German newspaper Die Welt:

The German parliament decides on the use of the Bundesbank's profit as well as other income of the German federation.

This issue could be settled when the Bundestag votes on the whole package later this week.

Updated

Kicking the tyres of the Greek deal

Good morning, and welcome to our rolling coverage of the eurozone financial crisis, and other key events across the global economy.

It's now 32 hours since the Eurogroup announced it had reached an agreement on Greece, and the shine is now coming off the deal.

While there is still relief that the immediate danger of Greece not receiving its bailout funds has been averted, there is growing concern that politicians have not been straight with the public over the actual cost of cutting Greece's debt pile.

As German financial group Commerzbank puts it:

The whole structure of the Greek aid deal intentionally concealed from the taxpayersWe will highly likely need to negotiate the sustainability of the Greek debt again in 2014, but a clear haircut now would have been much better with regard to the transparency for the taxpayers.

Eurozone finance ministers have insisted that the latest deal does not include any debt forgiveness for Greece. However, the Financial Times is now challenging this, saying it has seen document that show euro governments could be forced to accept losses on their rescue loans.

The series of measures agreed, which could relieve Greece of billions of euros in debt by the end of the decade, do not go far enough....

The agreed measures will only lower Greece’s debt levels to 126.6% per cent of economic output by 2020, not the 124% announced by eurozone leaders. This shortfall will be addressed once Greece has a primary surplus:

Because the deal already cuts interest on loans to just 50 basis points above interbank lending rates, any further cuts would almost certainly force losses on to eurozone creditors.

And that also probably won't happen before 2014 – after the German elections.

Bloomberg is also unimpressed, arguing that this new scheme - Plan C - is really no better than what's gone before. Only full debt relief can help Greece, it argues:

When the time comes to craft Plan D, Europe’s leaders would do well to move ahead with the Greek debt writedown they have tried so hard to avoid.If, for example, they cut the government’s debt in half, and if its market borrowing cost could be brought down to about 5 percent, Greece could hold its debt burden steady by running a primary budget surplus (excluding interest payments) of roughly 1.5 percent of GDP - well within the range of what it has been able to achieve in the past. The upfront costs would be greater, but so would the chances of success.

The rest of the eurozone probably understands this all too well. As Sky News's Ed Conway puts it:

On the basis that if Jean-Claude Juncker denies something, it's probably true, it's worth examining the deal cranked through in Brussels last night to "save" Greece....Were this a private sector loan agreement, the probability is it would be regarded as a technical default.

So, the deal's honeymoon is over.

As usual, I'll be tracking developments across the eurozone throughout that day.

Updated

De Guindos explains Spanish bank plan

Here's some early snaps:

No comments:

Post a Comment