http://www.zerohedge.com/news/2012-10-28/some-follow-questions-bundesbank-and-its-gold

http://www.zerohedge.com/news/2012-10-27/bundesbanks-official-statment-where-its-gold-and-isnt

http://goldsilverworlds.com/gold-silver-general/central-banks-paper-gold-vs-physical-gold-is-the-dust-settling/

So , when do we test the TBTJ ( Too Big To Jail ) acronym for validity...... if the Central Bankers have stolen not just their own countries gold but also gold entrusted to them by other sovereign nations ( in collusion with bullion banks ) , should they not all go to jail if face execution for high crimes and treason ? If stealing billions if not trillions is not high crimes and treason , what would be ?

Good morning Ladies and Gentlemen:

Gold closed down $1.10 to finish the comex session at $1710.90. Silver finished the day down 4 cents to $32.01. Throughout the night, bourses were deeply in the red reacting to news of Apple's warnings that things might not be that good in 2013. Amazon also disappointed with big losses. However at 8:30 news that 3rd quarter GDP was better than thought at 2% caused the S and P to stop falling and it gave the green light to investors to pile into the markets. The Dow however at the end of the day faltered and finished up only 3 points. In other news, we learned on Friday that the Troika has given Greece until Sunday for an all party agreement on austerity. That has zero chance of occurring. Also in Spain, their unemployment rate rose again and now tops 25%. We will be going over these and other stories but first let us head over to the comex and assess trading today.

The total gold comex open interest fell by 1130 contracts as the bankers again succeeded in fleecing some longs. This weekend the OI rests at 452,424 compared to Thursday's level of 453,554. The active October contract saw it's OI fall by 36 contracts falling to 163 from Thursday's level of 199. We had 25 notices filed on Thursday so we lost 11 contracts or 55,000 oz of gold standing in October. The non active November contract saw it's OI fall from 601 down to 481. The big December contract saw it's OI fall from 315,515 down to 310,035. The raids orchestrated these past few days certainly had an effect on our longs.

The estimated volume on Friday was quite anemic at 135,649. The confirmed volume on Thursday was much better at 175,822.

The total silver comex finally had some some liquidation but it was a very marginal loss of 1286 contracts settling this weekend at 137,977 from Thursday's level of 139,233. The non active October silver month contract saw it's OI rise by 1 contract to 33. We had zero notices filed on Thursday, so in essence we gained 1 contract or 5000 oz of additional silver will stand in October. The non active November contract also saw it's OI rise by 17 contracts to 64. The big December contract saw it's OI fall by 1960 contracts from 79,975 down to 78,015. The estimated volume on Friday was quite light at 35,314. The confirmed volume on Thursday was slightly better at 42,654.

Comex gold figures

Oct 26-.2012

That said, it is at least a creative idea – so we can be sure, therefore, that it didn’t originate in Brussels. The most likely original source of such a scheme is the front left cerebral lobe of Mario Draghi….or one of his chums in Goldman Sachs. Say for the sake of argument, Mario Monti.

"The idea is new Union, fresh start," my source asserts, "The old fluffy eurozone is dead, long live the gilt-edged FU. They’re not going to do it next week, but there is an ECB task-force working seriously on the ramifications and details".

Two days ago in Berlin, ECB boss Draghi made a significant comment when asked about the inflationary pressures of QE in the eurozone. I quote:

"in our assessment, the greater risk to price stability is currently falling prices in some euro-area countries."This was a calculated comment by Mario, designed to suggest a future where gold would represent a poor investment. Its effect was immediate: gold futures fell to $1703, and the hint was duly trotted out by several commentators.

"Gold is not getting any support since people are not talking about an inflation spike," said Frank McGhee, the head dealer at Integrated Brokerage Services LLC in Chicago.

My view is more anthropological I’m afraid: Mario Draghi wouldn’t be indirectly rubbishing gold if he didn’t fear it.

In fact, The Slog’s bottom-line belief about gold hasn’t changed since 2009: with the exception of top-top end A+++ property, it is the best investment on offer given the current outlook. And although timing one’s purchase entry exactly right is as much about good fortune as calculation, by 2014, $50 this way or that could very easily feel like peanuts compared to the gains made.Those who see gold as purely an inflation hedge are missing the point. Top end property and gold are must-buys for the big investors right now, because they want safety and survival once the global financial system starts unravelling in the face of eurozone debt contagion.

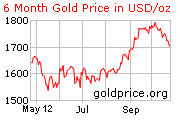

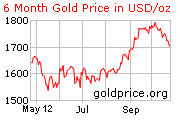

Look at what Soros and Paulson did in August. Both liquidated a huge tranche of stock investments in favour of an enormous call on gold. This is a six-month track of the gold price from May 12 this year:

You can see that by the time Soros and Paulson bought the shiny stuff, it’d been holding at between 1550 and 1600 dollars for three months. This was a rigorous test of the low, and it had failed. All you’d need to do then is read a couple of newspapers about QE, the eurozone disaster, and the global slowdown, and decide it would be daft not to buy.

The other consideration (when dealing with the likes of Paulson and Soros) is whether they know of the Draghi scheme already….and plan to (a) get in while they can, and (b) benefit from what would probably result: a rising dollar price of gold. Odder things have transpired on the Goldman Sachs bush telegraph.

Of course, when Big Dicks like these two buy big, it becomes a short-term self-fulfilling prophecy to some extent: after much hype, the price shot up to test $1800 by the end of September. But this is the lesson: the existence of such major opinion leader actions – and ironically, the current cyclical fall-back of gold making it look increasingly, temptingly cheap – would worry any organisation in charge of a dodgy currency. And as Draghi’s ECB is the proud owner of a Mickey Mouse euro, it is entirely logical that the all-or-nothing brigade would plan to close off the exit-route into gold.It’s not as if there is no precedent in recent times: the Reserve Bank of India very seriously considered banning the sale of gold coins there during last June. And as of early September 2012, private citizens can no longer buy gold in Argentina. That’s not what the new law says, but it is the cast-iron practical effect of the legislation.

In fact, using gold to back bonds has been put forward before by the World Gold Council – they would, wouldn’t they? – but I can imagine the idea terrifying the US Treasury and Reserve. It could well, for instance, trigger an investor desire to inspect the contents of Fort Knox; and it would turn the QE thing into a whole different ball of wax.

Meanwhile, the question is there for European private gold-bug investors to address: should they get in while the window’s still open? More on this later at The Slog.

and......

http://www.silverdoctors.com/netherlands-citizens-group-demands-central-bank-reveal-location-of-countrys-gold-reserves/

http://www.silverdoctors.com/cnbc-mope-actual-existence-of-gold-reserves-is-irrelevant-its-the-bookkeeping-that-matters/#more-16087

( CNBC editorial is anecdotal evidence that Germany's gold is gone allegedly at the New York Fed or BOE , Netherlands gold at the New York Fed or BOE is gone , Fed has no gold , Fort Knox gold long gone...... )

and .....

http://www.caseyresearch.com/gsd/edition/james-turk-german-gold-has-been-gone-2001

Some Follow-Up Questions For The Bundesbank, And Its Gold

Submitted by Tyler Durden on 10/28/2012 14:36 -0400

Yesterday we posted the official statementof Bundesbank executive board member Carl-Luwdig Thiele, which in turn was a response to a recent surge in concerns about the safety and sanctity of German sovereign gold, held mostly abroad (if a major part of it held in London had been secretly repatriated), and demands by the general public - i.e., those who actually own the gold - for either an audit, or full repatriation, or both. There are, however, some problems with the official Bundesbank statement: the statistics cited in it, as well as the various explanations, are wrong, incorrect or misleading. Below we present some of the "facts" stated by Herr Thiele, and what the truth is.

The statistics, and facts, Thiele quotes in the interview are either patently wrong or indicate a major lack of understanding about the gold market.

1. Thiele says:

"By 1956, the gold reserves had risen to DM 6.2 billion, or 1,328 tonnes; upon its foundation in 1957, the Bundesbank took over these reserves. No further gold was added until the 1970s"

This is factually incorrect. From adocumented source such as Timothy Green's gold reserves report from 1999 (source), we find that German gold reserves were 1,328 tonnes in 1956 and contined to rise every year until 1969 when they hit 4034 tonnes,an increase of 200% since 1956! Offical German gold in 1970 was 3,537 tonnes anddeclined to 2,963 by 1979. Since then it has increased by just 400 tonnes.

2. Thiele says:

"At the beginning of the last decade, we brought 930 tonnes of gold to Frankfurt from London and subjected it to a painstaking inspection. Part of the gold was melted down in order to create new bars which conform with the “Good Delivery Standard”.

Fact: All gold stored at the Bank of Englandhas to be London Good Delivery Standard.Bars that do not conform are not accepted. That is how the LBMA system works. There is an accepted refiner list. There would be no need to melt down anything from the Bank of England unless the Bundesbank had been duped with coin bars or similar and/or does not have faith in the BOE in the first place.

3. Thiele says:

"We have at our disposal fully documented lists of the bars, and our partner central banks send us every year confirmation not only of the bars’ existence but also of their quality. We receive confirmation of our gold reserves, measured in troy ounces."

Which is it: on a bar basis or on a fine ounce basis? They are two very different things. One is covered by bailor/bailee law, the other is covered by a debtor/creditor relationship.

Fact: The gold reserves built up and stored on behalf of the Bundesbank at the Bank of England were earmarked on a bar basis in the Bundesbank's set-aside account. Set-aside accounts were not accounted for on a fine ounce basis. Thiele does not seem to be aware of this difference between a set-aside bar basis and a fine ounce basis.

A lot of gold in the FRBNY vaults is in the form of US assay office melts. These have a history of losing fine ounces on re-smelting, so with the Fed he is explicitly off base.

All of this, of course, excludes Thiele's emotional appeal to German heartstrings to please trust the New York Fed and the BOE (whose British Pound apparently is still a reserve currency by the Buba's offered logic), while completely leaving out the ECB (thatother bank in Frankfurt, whose currency is what Germany currently does use). It also excludes his disturbing statement that "when push comes to shove, we can have it available as a reserve asset as soon as possible." The fact that "gold is not money", at least according to the Chairman, aside, one wonders just what signal is, or rather was, the Bundesbank sending by reclaiming its gold: is the need for gold to be used as a reserve assets once again approaching? (this is, obviously, rhetorical).

Finally, all of this begs the question: was the German writing while under the influence when he posted the official Bundesbank retort, or was he simply truly ignorant about some very simplistic facts about gold, official gold reserves and the gold industry, which anyone could fact-check on their own in 5 minutes or less. Or was he simply being disingenuous in hopes that nobody would actually question his authority and thus, his "facts"?

Because if anything, the Bundesbank response only opens up even more question about the credibility, not to mention the validity, of the official German stance, which logically implies that the fundamental hypothesis: that German offshore gold is in good hands, is also debatable at best and null and void at worst.

We hope that this ongoing dialogue between the German Central bank and its people continues, as it is one that is urgently needed in a world in which the old form of currency - fiat - is rapidly losing its credibility around the entire developed, and developing, world.

http://www.zerohedge.com/news/2012-10-27/bundesbanks-official-statment-where-its-gold-and-isnt

Bundesbank's Official Statment On Where It's Gold Is (And Isn't)

Submitted by Tyler Durden on 10/27/2012 16:09 -0400

- Bank of England

- Bank of New York

- BOE

- British Pound

- Central Banks

- Federal Reserve

- Federal Reserve Bank

- Federal Reserve Bank of New York

- France

- Germany

- New York Fed

- None

- Reserve Currency

- United Kingdom

Three days ago, as a result of recent discoveries relating to Germany's official sovereign gold inventory, we asked a rhetorical question: "Why Did The Bundesbank Secretly Withdraw Two-Thirds Of Its London Gold?" There we presented the chonology of official disclosure regarding the whereabouts of German gold over the past decade, with an emphasis on its reclamation from London-based official vaults to the safety of the motherland, and left off with another open-ended statement that: "what is left unsaid in all of the above is that Germany has done nothing wrong! It simply demanded a reclamation of what is rightfully Germany's to demand." Nonetheless, the fact that Germany did this has opened a Pandora's box of unanswered questions, and even demands that Germany promptly demand delivery all of its gold - the second largest such hoard in the world only after the US - held abroad. Below is the official response by the Bundesbank.

Here is the gist::

We do not have the slightest doubt that our holdings in New York and Paris are also made up of the purest fine gold. We have at our disposal fully documented lists of the bars, and our partner central banks send us every year confirmation not only of the bars’ existence but also of their quality.We had nothing but the best of experiences with our partners in New York, London and Paris. There was never any doubt about the security of Germany’s gold. In future, we wish to continue to keep gold at international gold trading centres so that, when push comes to shove, we can have it available as a reserve asset as soon as possible. Gold stored in your home safe is not immediately available as collateral in case you need foreign currency.

How about if you need collateral in your own currency, such as the de facto reserve currency of Europe, the DEM? Crickets?

The punchline:

Take, for instance, the key role that the US dollar plays as a reserve currency in the global financial system. The gold held with the New York Fed can, in a crisis, be pledged with the Federal Reserve Bank as collateral against US dollar-denominated liquidity. Similar pound sterling liquidity could be obtained by pledging the gold that is held with the Bank of England.

And what otherwise would pass as Saturday Humor:

But, please: for years, our gold has been stored by the highly esteemed central banks of the United States, Great Britain and France without provoking any complaints whatsoever – not by just anyfly-by-night operators. Part of the debate in Germany has veered somewhat towards the absurd.

In other words, German gold is being held hostage by the "highly esteemed central banks" of the US and the UK, due to the reserve currency status of the US Dollar, and apparently the British Pound. And the only way a central bank - read the Fed or the BOE - can extend a loan against gold-based collateral, is if said gold is already on location in the US or the UK.

Which of course, does not explain why Germany decided to withdraw two-thirds of its gold from London, as opposed to withdrawing none... or all, if indeed the logic above made sense.

But fear not: Buba has has nothing but the best experiences with its partners in New York, London and Paris, and as a result will gladly continue to allow them sole physical custody of Germany's gold.

Good luck, however, if Germany ever needs to repatriate said gold...

From the Bundesbank:

Gold reserves stored securely

Questions posed by DPA to Carl-Ludwig Thiele, Member of the Executive Board of the Deutsche Bundesbank

How much German gold is stored in the United States, how much in Frankfurt and how much in Great Britain?

The Deutsche Bundesbank keeps part of its gold holdings in its own vaults in Ger-many, while other stocks of gold are stored at the central banks located in major gold trading centres. Specifically, these are

- Deutsche Bundesbank, Frankfurt am Main: 1,036 tonnes (= 31%)

- Federal Reserve Bank of New York (Fed): 1,536 tonnes (= 45%)

- Bank of England, London: 450 tonnes (= 13%)

- Banque de France, Paris: 374 tonnes (= 11%)

Isn’t storing gold abroad an expensive anachronism?

The New York Fed and the Banque de France also offer to store gold holdings for other central banks free of charge. The Bank of England charges warehousing fees amount-ing to roughly €500,000 per year. Storage in the Bundesbank’s own vaults, too, involves costs. Matters of cost, however, are not the sole consideration in determining the choice of storage facility. The usability of gold as a reserve asset and storage security are much more important. During repeated visits to New York, London and Paris, our internal auditors have satisfied themselves that the security precautions in place there meet the same high standards as those in Frankfurt.

What makes the Bundesbank so certain that German gold holdings are being stored securely abroad – even though, according to the German Federal Court of Auditors, these reserves have never been “physically inventoried and checked for authenticity and weight” by the Bundesbank itself or by independ-ent auditors?

At the beginning of the last decade, we brought 930 tonnes of gold to Frankfurt from London and subjected it to a painstaking inspection. Part of the gold was melted down in order to create new bars which conform with the “Good Delivery Standard” which is customary nowadays in gold trading. Of the 930 tonnes of gold, not one gram was missing. We do not have the slightest doubt that our holdings in New York and Paris are also made up of the purest fine gold. We have at our disposal fully documented lists of the bars, and our partner central banks send us every year confirmation not only of the bars’ existence but also of their quality. We receive confirmation of our gold reserves, measured in troy ounces. The Bundesbank has been drawing up its accounts on this basis since it came into existence. All external auditors have confirmed our accounting practices outright since then.

Why doesn’t the Bundesbank bring the gold back to Germany?

The reasons for storing gold reserves with foreign partner central banks are historical since, at the time, gold at these trading centres was transferred to the Bundesbank. To be more specific: in October 1951 the Bank deutscher Länder, the Bundesbank’s predecessor, purchased its first gold for DM 2.5 million; that was 529 kilograms at the time. By 1956, the gold reserves had risen to DM 6.2 billion, or 1,328 tonnes; upon its foundation in 1957, the Bundesbank took over these reserves. No further gold was added until the 1970s. During that entire period, we had nothing but the best of experiences with our partners in New York, London and Paris. There was never any doubt about the security of Germany’s gold. In future, we wish to continue to keep gold at international gold trading centres so that, when push comes to shove, we can have it available as a reserve asset as soon as possible. Gold stored in your home safe is not immediately available as collateral in case you need foreign currency. Take, for instance, the key role that the US dollar plays as a reserve currency in the global financial system. The gold held with the New York Fed can, in a crisis, be pledged with the Federal Reserve Bank as collateral against US dollar-denominated liquidity. Similar pound sterling liquidity could be obtained by pledging the gold that is held with the Bank of England.

In the statement it issued on Tuesday, the Bundesbank said that it would “take up suggestions by the FCA wherever possible.” What does that mean specifically? When, and at what intervals, will Bundesbank auditors physically view the gold being held abroad?

The Bundesbank has decided to strive for a more balanced distribution of gold re-serve holdings at home and broad, thereby taking increased account of gold’s function of preserving trust and confidence. After all, reserve assets have psychological significance, so to speak. In the next three years, we will repatriate 50 tonnes of gold annually from New York to Germany. That will give us the opportunity to inspect these bars, melt them down and convert them into “Good Delivery Standard” bars. That will therefore be a sort of spot check. Moreover, we are currently in the middle of discussions about a further expansion of our rights to conduct audits in New York, London and Paris. But, please: for years, our gold has been stored by the highly esteemed central banks of the United States, Great Britain and France without provoking any complaints whatsoever – not by just any fly-by-night operators. Part of the debate in Germany has veered somewhat towards the absurd.

http://www.caseyresearch.com/gsd/edition/bundesbank-says-new-york-fed-will-help-meet-gold-audit-request

Bundesbank Says New York Fed Will Help Meet Gold Audit Request

Oct

27

¤ YESTERDAY IN GOLD AND SILVER

The gold price traded a few dollars higher up until 10:00 a.m. Hong Kong time...and then got sold down for the next four hours. From there it traded more or less sideways through the London open.

Then around 1:00 p.m. BST...about twenty minutes before the Comex open...a rally of some substance developed. That got hammered flat an hour later...about 9:01 a.m. in New York...and from that point, the gold price slowly declined right into the 1:30 p.m. Eastern Comex close, before trading quietly into the 5:15 p.m. electronic close. The New York high tick...$1,720.40 spot...came at 10:15 a.m.

Gold finished the trading day in New York at $1,711.10 spot...up 80 cents from Thursday. Volume wasn't overly heavy at 139,000 contracts.

Then around 1:00 p.m. BST...about twenty minutes before the Comex open...a rally of some substance developed. That got hammered flat an hour later...about 9:01 a.m. in New York...and from that point, the gold price slowly declined right into the 1:30 p.m. Eastern Comex close, before trading quietly into the 5:15 p.m. electronic close. The New York high tick...$1,720.40 spot...came at 10:15 a.m.

Gold finished the trading day in New York at $1,711.10 spot...up 80 cents from Thursday. Volume wasn't overly heavy at 139,000 contracts.

Silver's price path was virtually identical to gold's. The only notable difference was that JPMorgan Chase et al showed up at 9:30 a.m. in New York...whereas gold got hit a half hour sooner. Silver's high tick was also at 10:15 a.m. Eastern...and after that the silver price pattern followed gold's price path pattern, right to the tick.

Silver closed at $32.02 spot...up 2 whole cents. Volume was only 36,500 contracts.

It should be obvious to anyone with more than a room temperature I.Q. in degrees Fahrenheit that both metals would have finished the Friday trading session materially higher if a willing not-for-profit seller hadn't shown up. And it wasn't just gold and silver the got hammered flat, the charts for platinum and palladium show that these two white metals got hit even harder...especially platinum.

Silver closed at $32.02 spot...up 2 whole cents. Volume was only 36,500 contracts.

It should be obvious to anyone with more than a room temperature I.Q. in degrees Fahrenheit that both metals would have finished the Friday trading session materially higher if a willing not-for-profit seller hadn't shown up. And it wasn't just gold and silver the got hammered flat, the charts for platinum and palladium show that these two white metals got hit even harder...especially platinum.

* * *

The dollar index opened at 80.04 in Tokyo on their Friday morning...and spent most of the day above the 80.00 mark, with the high tick of 80.25 coming about 11:40 a.m. BST in London. From there, the index rolled over a bit...and hit its nadir [79.94] about 10:15 a.m. in New York. It recovered back above the 80.00 mark during the East Coast lunch hour...and then slid slowly back below it to close at 79.997.

The precious metals began to rally strongly shortly after the dollar index hit its high...but the rallies in all four were so powerful, that the "da boyz" had to step in long before the dollar index hit its low tick...but it's worth noting that the high ticks for both gold and silver came at the dollar index nadir at 10:15 a.m. in New York.

The precious metals began to rally strongly shortly after the dollar index hit its high...but the rallies in all four were so powerful, that the "da boyz" had to step in long before the dollar index hit its low tick...but it's worth noting that the high ticks for both gold and silver came at the dollar index nadir at 10:15 a.m. in New York.

* * *

The CME's Daily Delivery Report showed that 115 gold and 12 silver contracts were posted for delivery within the Comex-approved depositories this coming Tuesday. TheIssuers and Stoppers Report showed that it was 'all the usual suspects'...and the link to that activity is here.

That should pretty much do it for the October delivery month, although there may be a handful of contracts in each metal left to deliver before November first notice day on Wednesday.

There was a small 19,385 troy ounces of gold withdrawn from GLD yesterday...and it looked like it could have been a fee payment of some kind. There were no reported changes in SLV.

The U.S. Mint had no sales report.

Over at the Comex-approved depositories, they reported receiving 253,457 troy ounces of silver on Thursday...and shipped 801,417 ounces of the stuff out the door. The link to that activity is here.

Well, yesterday's Commitment of Traders Report was another surprise. Yes, there was the expected improvement in the Commercial net short position in gold...but not as much as I was hoping. In silver, there was a tiny improvement...but that was all. Both Ted and I were amazed...and we were both scratching our heads.

In silver, the Commercial net short position declined by only a tiny 1,595 contracts. The Commercial net short position is still a whopping 277.5 million ounces...and the 'Big 4' short holders are short 246.1 million ounces of that amount...and 44.5% of the entire Comex futures market in silver. The '5 through 8' traders are short an additional 8.6 percentage points. So the 'Big 8' are short 53.1% of the entire futures market in silver on a net basis...and these percentages are minimum numbers.

I would also guess that JPMorgan Chase, along with one non-U.S. bank...the Bank of Nova Scotia?...are short almost 40% of the entire Comex silver market [on a net basis] between the two of them.

That should pretty much do it for the October delivery month, although there may be a handful of contracts in each metal left to deliver before November first notice day on Wednesday.

There was a small 19,385 troy ounces of gold withdrawn from GLD yesterday...and it looked like it could have been a fee payment of some kind. There were no reported changes in SLV.

The U.S. Mint had no sales report.

Over at the Comex-approved depositories, they reported receiving 253,457 troy ounces of silver on Thursday...and shipped 801,417 ounces of the stuff out the door. The link to that activity is here.

Well, yesterday's Commitment of Traders Report was another surprise. Yes, there was the expected improvement in the Commercial net short position in gold...but not as much as I was hoping. In silver, there was a tiny improvement...but that was all. Both Ted and I were amazed...and we were both scratching our heads.

In silver, the Commercial net short position declined by only a tiny 1,595 contracts. The Commercial net short position is still a whopping 277.5 million ounces...and the 'Big 4' short holders are short 246.1 million ounces of that amount...and 44.5% of the entire Comex futures market in silver. The '5 through 8' traders are short an additional 8.6 percentage points. So the 'Big 8' are short 53.1% of the entire futures market in silver on a net basis...and these percentages are minimum numbers.

I would also guess that JPMorgan Chase, along with one non-U.S. bank...the Bank of Nova Scotia?...are short almost 40% of the entire Comex silver market [on a net basis] between the two of them.

In gold, the Commercial net short position declined by a pretty decent 14,718 contracts, or 1.47 million ounces. This net short position is now down to 23.27 million ounces...still light years away from its low several months back...and the 'Big 8' are short 20.97 million ounces of that amount.

The 'Big 4' traders, on a net basis, are short 35.4% of the entire Comex gold market...and the '5 through 8' traders are short an additional 13.9 percentage points. The 'Big 8' in total are short 49.3% of the Comex futures market on a net basis...and these are minimumpercentages.

The 'Big 8' traders are short 20.97 million ounces of the 23.27 million ounce Commercial net short position...or 90.1%. In silver, the 'Big 8' traders are short 293.9 million ounces of the 277.5 million ounce Commercial net short...or 105.9%.

Here are the links to the historical COT Report charts so you can get an idea of how things have changed over the weeks, months and years. Gold is here...and silver is here.

Here's the current "Days of World Production to Cover Short Positions" chart for all the physical commodities traded on the Comex. This is for the week that was...and nothing has changed, as the short positions held by the '4 or less' traders are still egregious. It's my guess that JPMorgan Chase, the Bank of Nova Scotia[?], HSBC USA and Citigroup make up the entire red bar on the silver chart. I'll have more on the COT Report in 'The Wrap'.

The 'Big 4' traders, on a net basis, are short 35.4% of the entire Comex gold market...and the '5 through 8' traders are short an additional 13.9 percentage points. The 'Big 8' in total are short 49.3% of the Comex futures market on a net basis...and these are minimumpercentages.

The 'Big 8' traders are short 20.97 million ounces of the 23.27 million ounce Commercial net short position...or 90.1%. In silver, the 'Big 8' traders are short 293.9 million ounces of the 277.5 million ounce Commercial net short...or 105.9%.

Here are the links to the historical COT Report charts so you can get an idea of how things have changed over the weeks, months and years. Gold is here...and silver is here.

Here's the current "Days of World Production to Cover Short Positions" chart for all the physical commodities traded on the Comex. This is for the week that was...and nothing has changed, as the short positions held by the '4 or less' traders are still egregious. It's my guess that JPMorgan Chase, the Bank of Nova Scotia[?], HSBC USA and Citigroup make up the entire red bar on the silver chart. I'll have more on the COT Report in 'The Wrap'.

news of note.....

Was Syrian weapons shipment factor in ambassador’s Benghazi visit?

A mysterious Libyan ship -- reportedly carrying weapons and bound for Syrian rebels -- may have some link to the Sept. 11 terror attack on the U.S. Consulate in Benghazi, Fox News has learned.

Through shipping records, Fox News has confirmed that the Libyan-flagged vessel Al Entisar, which means "The Victory," was received in the Turkish port of Iskenderun -- 35 miles from the Syrian border -- on Sept. 6, just five days before Ambassador Chris Stevens, information management officer Sean Smith and former Navy Seals Tyrone Woods and Glen Doherty were killed during an extended assault by more than 100 Islamist militants.

On the night of Sept. 11, in what would become his last known public meeting, Stevens met with the Turkish Consul General Ali Sait Akin, and escorted him out of the consulate front gate one hour before the assault began at approximately 9:35 p.m. local time.

This story showed up on the foxnews.com Internet site on Thursday...and is one that I borrowed from yesterday's King Report. The link is here.

Through shipping records, Fox News has confirmed that the Libyan-flagged vessel Al Entisar, which means "The Victory," was received in the Turkish port of Iskenderun -- 35 miles from the Syrian border -- on Sept. 6, just five days before Ambassador Chris Stevens, information management officer Sean Smith and former Navy Seals Tyrone Woods and Glen Doherty were killed during an extended assault by more than 100 Islamist militants.

On the night of Sept. 11, in what would become his last known public meeting, Stevens met with the Turkish Consul General Ali Sait Akin, and escorted him out of the consulate front gate one hour before the assault began at approximately 9:35 p.m. local time.

This story showed up on the foxnews.com Internet site on Thursday...and is one that I borrowed from yesterday's King Report. The link is here.

Doug Noland: The Perils of Bubbles and Speculative Finance

I am convinced – actually, at this point, it seems rather obvious - that global policymakers have made a very problematic situation worse. The global system would be less vulnerable today had speculative markets not again fixated on aggressive policy measures. I argued at the time that the ECB’s Long-Term Refinancing Operations (LTRO) only exacerbated European fragilities. In particular, the $1.3 TN of central bank liquidity ensured that Spanish, Italian and other European banks increased their exposure to suspect sovereign debt. It was a policy roll of the dice. The LTROs did incite big rallies in European debt and equities, along with global risk markets more generally. Not unpredictably, within months Europe was succumbing to an ever deeper crisis. Global markets and economies were hanging in the balance.

In desperation, ECB president Draghi fashioned his “big bazooka:” Outright Monetary Transactions (OMT) – the promise of open-ended support for Spain and other troubled issuers. Importantly, Mr. Draghi made an extraordinary warning to those that had positioned bearishly against Europe. And while the jury is very much out on whether Draghi has much of a bazooka, this somewhat misses the point. The Draghi Plan incited a major short-covering rally in Spain, Italy and periphery bonds, in European equities, and global risk markets more generally. Indeed, the Draghi Plan forced the sophisticated speculators to cover their European shorts and even go leveraged long. Instead of a roll of the dice, it was betting the ranch.

Doug's weekly Credit Bubble Bulletin is always a must read for me...and this one is no exception to that rule. It's posted on the prudentbear.com Internet site...and I thank reader U.D. for sending it our way. The link is here.

In desperation, ECB president Draghi fashioned his “big bazooka:” Outright Monetary Transactions (OMT) – the promise of open-ended support for Spain and other troubled issuers. Importantly, Mr. Draghi made an extraordinary warning to those that had positioned bearishly against Europe. And while the jury is very much out on whether Draghi has much of a bazooka, this somewhat misses the point. The Draghi Plan incited a major short-covering rally in Spain, Italy and periphery bonds, in European equities, and global risk markets more generally. Indeed, the Draghi Plan forced the sophisticated speculators to cover their European shorts and even go leveraged long. Instead of a roll of the dice, it was betting the ranch.

Doug's weekly Credit Bubble Bulletin is always a must read for me...and this one is no exception to that rule. It's posted on the prudentbear.com Internet site...and I thank reader U.D. for sending it our way. The link is here.

Vietnamese Banks Who Paid Dividend On Stored Gold, Were Quietly Selling It To Appear Solvent

Any time a bank, and especially an entire banking sector, is willing to pay you paper "dividends" for your gold, run, because all this kind of quid pro quo usually ends up as a confiscation ploy.

Sure enough, as Dow Jones reports today, the gold, which did not belong to the banks and was merely being warehoused there (or so the fine print said), was promptly sold by these same institutions to generate cash proceeds and to boost liquidity reserves using other people's gold, obtained under false pretenses.

And now, it is time for the forced sellers to become forced buyers, as "the State Bank of Vietnam, the country's central bank, may allow local banks to buy up to 20 metric tons of gold over the next two months to improve their liquidity ahead of a ban soon on their use of gold as a means of boosting their operating capital." What they mean is that having been caught engaging in an illegal reserve boosting operating, the banks are now "allowed" to undo their transgressions ahead of a "ban" on what inherently was not a permitted practice.

This story showed up on the Zero Hedge website yesterday...and I thank Washington state reader S.A. for his second and final offering in today's column. It's a must read...and the link is here.

Sure enough, as Dow Jones reports today, the gold, which did not belong to the banks and was merely being warehoused there (or so the fine print said), was promptly sold by these same institutions to generate cash proceeds and to boost liquidity reserves using other people's gold, obtained under false pretenses.

And now, it is time for the forced sellers to become forced buyers, as "the State Bank of Vietnam, the country's central bank, may allow local banks to buy up to 20 metric tons of gold over the next two months to improve their liquidity ahead of a ban soon on their use of gold as a means of boosting their operating capital." What they mean is that having been caught engaging in an illegal reserve boosting operating, the banks are now "allowed" to undo their transgressions ahead of a "ban" on what inherently was not a permitted practice.

This story showed up on the Zero Hedge website yesterday...and I thank Washington state reader S.A. for his second and final offering in today's column. It's a must read...and the link is here.

Bundesbank says New York Fed will help meet gold audit request

The Bundesbank said the Federal Reserve Bank of New York will help it meet auditing requirements related to its gold reserves that were demanded by Germany's Audit Court.

"We have been in discussions with the Federal Reserve Bank of New York about the Bundesbank's holdings of gold," the Bundesbank said yesterday in a letter to the German parliament's budget committee. "The discussions have been fruitful and the Federal Reserve has expressed a commitment to work with the Bundesbank to explore ways to address the audit observations, consistent with its own security and control processes and logistical constraints."

The agreement is part of a compromise between the German central bank and the Audit Court, which has called on the Bundesbank to take stock of its gold holdings outside Germany, saying it has never verified their existence.

I found this Bloomberg story in a GATA release yesterday. It's certainly worth reading...and the link is here.

"We have been in discussions with the Federal Reserve Bank of New York about the Bundesbank's holdings of gold," the Bundesbank said yesterday in a letter to the German parliament's budget committee. "The discussions have been fruitful and the Federal Reserve has expressed a commitment to work with the Bundesbank to explore ways to address the audit observations, consistent with its own security and control processes and logistical constraints."

The agreement is part of a compromise between the German central bank and the Audit Court, which has called on the Bundesbank to take stock of its gold holdings outside Germany, saying it has never verified their existence.

I found this Bloomberg story in a GATA release yesterday. It's certainly worth reading...and the link is here.

http://goldsilverworlds.com/gold-silver-general/central-banks-paper-gold-vs-physical-gold-is-the-dust-settling/

So , when do we test the TBTJ ( Too Big To Jail ) acronym for validity...... if the Central Bankers have stolen not just their own countries gold but also gold entrusted to them by other sovereign nations ( in collusion with bullion banks ) , should they not all go to jail if face execution for high crimes and treason ? If stealing billions if not trillions is not high crimes and treason , what would be ?

Central Banks’ Paper Gold vs Physical Gold: Is The Dust Settling?

Much has been written lately with regard to the central banks’ gold holdings. One of the triggers was the news out of Germany, where the debate about Germany’s real gold holdings became very hot this week. Among others, financial journalist Lars Schall came out with the results of his “field research”. His findings were that institutions like the German Bundesbank, the Bank of England, the US Federal Reserve and the IMF, refuse to reveal figures about their real physical gold holdings. It’s a confirmation of what was already known, but it caught the attention of mainly the alternative media as well as GATA and increases the pressure for transparency.

The “good news” from earlier this week was that Germany’s Court incited the Bundesbank to bring clarity with regard to their real gold holdings by providing access to their storage sites. Furthermore, a German Court of Auditors reported that the gold had “never been verified physically” up until now. It remains to be seen if and when light will be shed on this situation, but the pressure for clear answers keeps on increasing.

It is more and more believed that the physical gold holdings from the central banks are simply not there in the quantities as they officially appear in their books. GATA even strongly believes that double counting takes place in the bookkeeping of central banks, their intermediaries (the bullion banks) and other large financial institutions. The method that allows this to happen, is based on leasing gold from the central banks into the market (among others). The net effect is a higher supply in the market and hence an artificial setting of the price. Let’s bring this one step further: if that’s true, then it’s a form of “gold printing” and logically it’s falsifying the accounting.

Eric Sprott came to a similar conclusion recently, based on in-depth analysis of data about the gold market. He wrote the following: “Under current reporting guidelines, central banks are permitted to continue carrying the entry of physical gold on their balance sheet even if they’ve swapped it or lent it out entirely. You can see this in the way Western central banks refer to their gold reserves. The UK Government, for example, refers to its gold allocation as, “Gold (incl. gold swapped or on loan)”. That’s the verbatim phrase they use in their official statement. Same goes for the US Treasury and the ECB, which report their gold holdings as “Gold (including gold deposits and, if appropriate, gold swapped)” and “Gold (including gold deposits and gold swapped)”.”

The trigger for Eric Sprott to carry out the analysis, was the worldwide exploding demand for gold which wasn’t reflected in the gold price action. Logically “other forces” would be at work, be it some kind of invisible hand or an entity with a lot of power. In fact it’s almost a combination of both: the invisible actions of powerful entities.

Back to Germany’s gold holdings. The Telegraph revealed an interesting insight about an unknown event that took place a decade ago. Nearly one third of Germany’s total of 3400 tonnes gold was withdrawn from the vault in the UK (Bank of England). It happened exactly at the time the euro was introduced and when the UK was selling 60% of its gold holdings (Gordon Browne affair). That’s a remarkable revelation given the mystery around the real physical holdings of central banks. Furthermore, it could show that Germany was preparing for a worse case scenario with Europe. For sure, it reveals that Germany considers their physical gold backings as important!

In the meanwhile, it seems that in Mexico the dust has settled. Their central bank revealed information regarding their gold holdings.By contrast, the Netherlands joins the movement as a group of 1300 people started to ask for clarity about their countries’ gold holdings.And of course the main stream media needs to voice their opinion as well. In an attempt to downsize the importance of the real gold holdings, a CNBC editor published the following statements (see below). Is the conclusion here that accounting based on assumptions and potentially incorrect figures is “the new normal”?“The actual presence of the gold wouldn’t make a lick of difference unless, say, Germany’s central bank decided it wanted to start using the gold for some practical, non-monetary purpose like making watches.…The actual existence of the gold in Fort Knox or in the vault beneath the FRBNY’s Liberty Street headquarters is irrelevant. The bookkeeping is what really matters here. So long as the Fed says Bundesbank owns X tons of gold, the Bundesbank can act as if it did own the gold—even if the gold had somehow been swallowed into a gold-eating galactic worm hole.”

http://harveyorgan.blogspot.com/2012/10/spanish-unemployment-rises-above.html

SATURDAY, OCTOBER 27, 2012

Good morning Ladies and Gentlemen:

Gold closed down $1.10 to finish the comex session at $1710.90. Silver finished the day down 4 cents to $32.01. Throughout the night, bourses were deeply in the red reacting to news of Apple's warnings that things might not be that good in 2013. Amazon also disappointed with big losses. However at 8:30 news that 3rd quarter GDP was better than thought at 2% caused the S and P to stop falling and it gave the green light to investors to pile into the markets. The Dow however at the end of the day faltered and finished up only 3 points. In other news, we learned on Friday that the Troika has given Greece until Sunday for an all party agreement on austerity. That has zero chance of occurring. Also in Spain, their unemployment rate rose again and now tops 25%. We will be going over these and other stories but first let us head over to the comex and assess trading today.

The total gold comex open interest fell by 1130 contracts as the bankers again succeeded in fleecing some longs. This weekend the OI rests at 452,424 compared to Thursday's level of 453,554. The active October contract saw it's OI fall by 36 contracts falling to 163 from Thursday's level of 199. We had 25 notices filed on Thursday so we lost 11 contracts or 55,000 oz of gold standing in October. The non active November contract saw it's OI fall from 601 down to 481. The big December contract saw it's OI fall from 315,515 down to 310,035. The raids orchestrated these past few days certainly had an effect on our longs.

The estimated volume on Friday was quite anemic at 135,649. The confirmed volume on Thursday was much better at 175,822.

The total silver comex finally had some some liquidation but it was a very marginal loss of 1286 contracts settling this weekend at 137,977 from Thursday's level of 139,233. The non active October silver month contract saw it's OI rise by 1 contract to 33. We had zero notices filed on Thursday, so in essence we gained 1 contract or 5000 oz of additional silver will stand in October. The non active November contract also saw it's OI rise by 17 contracts to 64. The big December contract saw it's OI fall by 1960 contracts from 79,975 down to 78,015. The estimated volume on Friday was quite light at 35,314. The confirmed volume on Thursday was slightly better at 42,654.

Comex gold figures

Oct 26-.2012

Today, we again had very little activity inside the gold vaults.

The dealer had no deposits and no withdrawals.

The customer had one tiny deposit

i) into Brinks: 96.45 oz

The customer had no withdrawals:

Adjustments:

i) into Brinks: 96.45 oz

The customer had no withdrawals:

Adjustments:

There was one huge adjustment:

i) 163,782.442 oz of gold left the customer and entered the dealer at HSBC

Thus the dealer inventory rests this weekend at 2.7349 million oz (85.06) tonnes of gold.

i) 163,782.442 oz of gold left the customer and entered the dealer at HSBC

Thus the dealer inventory rests this weekend at 2.7349 million oz (85.06) tonnes of gold.

The CME reported that we had 2 notices filed for 200 oz of gold.

The total number of notices filed so far this month is represented by 7008 contracts or 700,800 oz of gold.

To obtain what is left to be served upon, I take the OI standing for October

(163) and subtract out today's notices (2) which leaves us with 161 notices or 16,100 oz left to be served upon our longs.

Silver:

Oct 25.2012:

Again, we had quite a bit of activity inside the silver vaults today.

However we had no dealer deposit and no dealer withdrawal.

The customer had the following deposit:

i) Into brinks: 199,495.16 oz

ii) Into CNT; 49,978.000 oz

iii) Into Delaware: 3,983.90 oz

total customer deposit: 253,457.06 oz

The customer had the following deposit:

i) Into brinks: 199,495.16 oz

ii) Into CNT; 49,978.000 oz

iii) Into Delaware: 3,983.90 oz

total customer deposit: 253,457.06 oz

We had the following customer withdrawal;

1. Out of brinks: 801,417.000 oz

total customer withdrawal: 801,417.000 oz

we had one adjustments as a counting error:

i) 15,706.19 oz was removed from the customer account at JPM.

Registered silver remains at : 36,972 million oz

total of all silver: 141.82 million oz.

The huge movements in silver certainly suggests that the bankers are having great difficulty in obtaining physical metal.

Please note the difference in movements between gold and silver.

1. Out of brinks: 801,417.000 oz

total customer withdrawal: 801,417.000 oz

we had one adjustments as a counting error:

i) 15,706.19 oz was removed from the customer account at JPM.

Registered silver remains at : 36,972 million oz

total of all silver: 141.82 million oz.

The huge movements in silver certainly suggests that the bankers are having great difficulty in obtaining physical metal.

Please note the difference in movements between gold and silver.

The CME reported that we had 2 notices filed for 10,000 oz . The total number of silver notices filed so far this month remains at 482 contracts or 2,450,000 oz of silver. To obtain what is left to be served upon, I take the OI standing for October (33) and subtract out today's notices (2) which leaves us with 31 notices or 155,000 oz left to be served upon our longs.

Thus the total number of silver ounces standing in this non active delivery month of October is as follows;

2,450,000 oz (served) + 155,000 oz (to be served upon) = 2,565,000 oz

we gained 1 contract or 5,000 oz of silver.

* * *

Harvey's take on the COT reports....

At 3:30 pm Friday, the COT report is released which gives the position levels of our major players.

Let us see what we can glean from this information:

First the Gold COT:

Quite a report:

Let us see what we can glean from this information:

First the Gold COT:

Gold COT Report - Futures

| ||||||

Large Speculators

|

Commercial

|

Total

| ||||

Long

|

Short

|

Spreading

|

Long

|

Short

|

Long

|

Short

|

222,095

|

40,052

|

31,001

|

132,859

|

365,524

|

385,955

|

436,577

|

Change from Prior Reporting Period

| ||||||

-10,893

|

1,084

|

2,905

|

3,359

|

-11,359

|

-4,629

|

-7,370

|

Traders

| ||||||

203

|

65

|

72

|

51

|

47

|

289

|

157

|

Small Speculators

| ||||||

Long

|

Short

|

Open Interest

| ||||

69,881

|

19,259

|

455,836

| ||||

-2,361

|

380

|

-6,990

| ||||

non reportable positions

|

Change from the previous reporting period

| |||||

COT Gold Report - Positions as of

|

Tuesday, October 23, 2012

| |||||

Quite a report:

Our large speculators:

Those large specs that have been long in gold were fleeced again by the crooked bankers as they pitched a massive 10,893 contracts from their long side.

Those large specs that have been short in gold, added a tiny 1084 contracts to their short side.

Our commercials:

Those commercials that are long in gold and are close to the physical scene added 3359 contracts to their long side.

Those commercials who have been perennially short in gold saw the opportunity and covered a massive 11,359 contracts from their short side.

Our small specs:

those small specs that have been long in gold pitched a considerable 2361 contracts from their long side.

Those small specs that have been short in gold added a tiny 380 contracts to their short side.

Conclusion: extremely bullish for gold as the commercials again went net long this week to the tune of exactly 8,000 contracts.

Those large specs that have been long in gold were fleeced again by the crooked bankers as they pitched a massive 10,893 contracts from their long side.

Those large specs that have been short in gold, added a tiny 1084 contracts to their short side.

Our commercials:

Those commercials that are long in gold and are close to the physical scene added 3359 contracts to their long side.

Those commercials who have been perennially short in gold saw the opportunity and covered a massive 11,359 contracts from their short side.

Our small specs:

those small specs that have been long in gold pitched a considerable 2361 contracts from their long side.

Those small specs that have been short in gold added a tiny 380 contracts to their short side.

Conclusion: extremely bullish for gold as the commercials again went net long this week to the tune of exactly 8,000 contracts.

and now for our silver COT:

Our large speculators:

Those large specs that have been long in silver pitched a tiny 1578 contracts from their long side.

Those large specs that have been short in silver added a tiny 414 contracts to their short side.

Our commercials;

Those commercials that have been long in silver and are close to the physical scene pitched a very tiny 435 contracts from their long side.

Those commercials that have been short in silver saw a bit of an opportunity and covered 2030 contracts from their short side.

Our small specs:

Those small specs that have been long in silver pitched a tiny 544 contracts from their long side.

Those small specs that have been short in silver covered 941 contracts from their short side.

Conclusion: more bullish than last week as our commercials went net long again to the tune of 1625 contracts.

Silver COT Report: Futures

| |||||

Large Speculators

|

Commercial

| ||||

Long

|

Short

|

Spreading

|

Long

|

Short

| |

47,463

|

9,327

|

29,957

|

35,786

|

91,285

| |

-1,578

|

414

|

1,795

|

-435

|

-2,030

| |

Traders

| |||||

82

|

40

|

45

|

32

|

43

| |

Small Speculators

|

Open Interest

|

Total

| |||

Long

|

Short

|

140,643

|

Long

|

Short

| |

27,437

|

10,074

|

113,206

|

130,569

| ||

-544

|

-941

|

-762

|

-218

|

179

| |

non reportable positions

|

Positions as of:

|

136

|

111

| ||

Tuesday, October 23, 2012

|

© SilverSeek.com

| ||||

Our large speculators:

Those large specs that have been long in silver pitched a tiny 1578 contracts from their long side.

Those large specs that have been short in silver added a tiny 414 contracts to their short side.

Our commercials;

Those commercials that have been long in silver and are close to the physical scene pitched a very tiny 435 contracts from their long side.

Those commercials that have been short in silver saw a bit of an opportunity and covered 2030 contracts from their short side.

Our small specs:

Those small specs that have been long in silver pitched a tiny 544 contracts from their long side.

Those small specs that have been short in silver covered 941 contracts from their short side.

Conclusion: more bullish than last week as our commercials went net long again to the tune of 1625 contracts.

* * *

selected news items....

-- Posted Friday, 26 October 2012 | | Source: GoldSeek.com

Today’s AM fix was USD 1,704.00, EUR 1,316.44, and GBP 1,057.01 per ounce.

Yesterday’s AM fix was USD 1,715.00, EUR 1,317.71, and GBP 1,063.24 per ounce.

Gold climbed $11.80 or 0.69% in New York yesterday and closed at $1,712.70. Silver surged to a high of $32.232 and finished with a gain of 1.36%.

Gold in USD (2 Year) With Support At 100 and 200 Day Moving Averages -(Bloomberg)

Gold edged down early Friday, on track for its third week of declines as the US dollar strengthened and momentum traders continued to exit positions or go short.

Investors and dealers await the US CFTC commitment of traders figures due at 1930 GMT, after last week's data showed hedge funds and other big speculators decreased their long positions in gold to their lowest since the end of August. This is bullish from a contrarian perspective and shows that much of the short term speculative froth has been removed from the market.

The US GDP figures are released later today and they are expected at 1.9%. A weaker than expected number would benefit safe haven gold.

Gold corrected in October as we anticipated and has fallen by 5.5% (in USD terms) from over $1,795.55/oz to a low of $1,699.65/oz It is too early to tell yet if the October correction is over. There would appear to be strong support at $1,700/oz and Asian physical demand is very robust down at these levels.

The physical bullion market was subdued in Asia overnight although there was some buying out of Japan. Trade was muted because of a public holiday in Indonesia, Malaysia and Singapore, but Reuters noted that dealers saw gold buying from Thailand.

Importantly, Chinese buying of gold, official and public, on dips is likely to be continuing.

Physical demand for gold bullion coins and bars in western markets remains subdued but smart money buyers continue to add to allocations. Gold and silver 1oz bullion coins from the Australian Lunar – 2013 Year of the Snake Coin Series are officially sold out at The Perth Mint. The sell out of the full mintages of 300,000 pure silver 1oz coins and 30,000 pure gold 1oz coins was achieved in just two months, ranking this release as one of the fastest selling behind the phenomenally successful Year of Dragon coins in 2012.

With gold having pierced slightly below $1,700/oz there is a risk that gold could fall to test the 200 and 100 day moving averages which are now at $1,663.30/oz and $1,664/oz respectively (see chart above).

A rise of over 1% today (from the current price of $1,705/oz) would result in a higher close this week, above $1,721.75/oz. This would be a good indicator that the recent dip is over and it is time to get into position for November, which is one of gold’s strongest months and the November to March rally which is one of gold's strongest periods. A lower close this week could see further falls next week and in early November.

As ever it will be nigh impossible to pinpoint the exact price lows.

The low of $1,699.65/oz seen two days ago on Wednesday may mark the intermediate low however gold could continue falling until October 31st (next Wednesday) as month ends often mark intermediate lows or could even continue falling until the US election or soon after.

There are now 6 trading days left until the US Presidential election on November 6th. The US election has many investors on the sidelines.

Gold will be supported by and likely see gains into year end due to the coming uncertainty surrounding the US “fiscal cliff.” Tax increases and spending cuts are expected which would sink the US economy into a deep recession or Depression. If US Congress cannot agree on a deal by the end of the year it could have deleterious effects on the dollar and on capital markets. The US elections themselves are unlikely to have a significant impact on currencies and wider markets in the short term but we expect the recent calm may recede and the stormy volatility of recent years may again be seen soon after the election when the reality of the appalling US fiscal and monetary situation is realised.

November is traditionally one of gold's strongest months (see gold seasonal charts).

Given the extremely bullish fundamentals due to negative fiscal outlooks, ultra loose monetary policies, negative real interest rates and global currency debasement, we expect this November and year end to be very positive for gold and particularly still undervalued silver.

Prudent buyers should now be buying this dip by cost averaging or getting into a position to do so. While gold may correct by another 2% or 3% from here, there is a greater likelihood of gold beginning to rise sharply and quickly recovering the 5.5% loss seen this month in November.

NEWSWIRE(Bloomberg) -- Eclectica’s Hendry Says Owning Gold Stocks Almost ‘Insanity’

Hugh Hendry, founder of London-based hedge fund Eclectica Asset Management LLP, said buying shares of gold-mining companies is “as close as you get to insanity.”

Hendry said he owns gold and also has a short position on gold-mining stocks, meaning that he’s sold shares he’s borrowed with the expectation of buying them back at a lower price. Mining stocks are likely to fall because the companies are at greater risk as the price of gold rises, he said.

“More precarious societies across the world are more envious of your gold assets at $3,000 than at $300” an ounce, Hendry said today at the Economist magazine’s annual Buttonwood Gathering in New York. “There is no valuation argument that protects you against the risk of confiscation.”

The NYSE Arca Gold Bugs Index has risen about 0.6 percent this year, including reinvested dividends, while bullion climbed 9.2 percent.

“There is no rationale for owning a gold-mining equity,” Hendry said. “Think about it, if you were bullish on gold why didn’t you just buy a gold ETF, gold futures or gold bullion?”

Hendry started Eclectica in 2005 and the firm has $1.1 billion under management, according to its website.

(Bloomberg) -- LBMA Says Gold Trading Surged 26% in September as Silver Rose Gold trading jumped 26 percent to an average of 22.4 million ounces a day in September compared with a month earlier, the London Bullion Market Association said today in an e-mailed report.

That was the highest average since August 2011, the LBMA said. Silver trading rose 4 percent to a daily average of 124.3 million ounces, the LBMA said.

* * *

Germany's isn't the only missing gold, Celente tells King World News

Submitted by cpowell on Fri, 2012-10-26 19:24. Section: Daily Dispatches

2:21p CT Friday, October 26, 2012

Dear Friend of GATA and Gold:

Market analyst Gerald Celente today tells King World News that Germany's gold isn't the only gold that has disappeared -- all official gold reserves are likely gone as well, the proof being the refusal of central banks to answer questions about their reserves and permit them to be audited. An excerpt from the interview is posted at the King World News blog here:

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

* * *

And now another country wishing to repatriate its gold:

One event that may have triggered a large-scale demand for physical delivery of gold was the repatriation of the 211 tons, or 17,000 standard 400-ounce bars, of Venezuelan gold.ROMANIA WANTS RETURN OF 93.4 TONS AS GOLD REPATRIATION RATCHETS UP

Oct 23 2012

Romania wants its gold treasure back from Russia, a recent Bullion Street article says. It’s another signal of the accelerating trend of countries to repatriate their gold—and another indication that the tide is turning toward gold and silver.  Two railway carloads, or 93.4 tons of gold, were transferred to Russia as German troops began to threaten the region during World War I. According to the article, "All the governments of Romania since World War I, regardless of their political colour, have tried unsuccessfully to negotiate a return of the gold."Of course, this is not the first time the Romanian people, or people of any region for that matter, have found their monetary metals tempting to foreign powers. Invaders sent by Roman Emperor Trajan found gold and silver in great quantities in the Western Carpathians, which run through what is now modern-day Romania. Resulting from this conquest, Trajan brought back to Rome over 165 tons of gold and 330 tons of silver.It is interesting that considering this history independent auditors say Germany has stored its gold abroad since the Cold War in case of Soviet invasion. Additionally, the auditor’s report says the German gold stored in London has fallen "below 500 tons" due to recent sales and repatriation. Considering German gold stocks have remained the same, the sale of physical gold must have been offset by an acquisition of paper promising to pay gold from the Federal Reserve Bank or other entities needing a physical supply of gold. "We’ve held 99 tons of gold at the Bank of England since 1980. I agree with bringing that home," President Hugo Chavez said, "It’s a healthy decision." The obvious danger to having others hold your valuables is that they can simply deny your right to audit or access what they store for you. German lawmakers were turned away from viewing the 1,500 tons of German gold reportedly held at the New York branch of the privately held Federal Reserve Bank (Fed). This fact may have played a part in the recent German federal court ruling that mandates repatriation of 50 tons of the gold per annum. For more, see Germany Brings it Home – Gold Repatriation as Stocks Scare. One reason Russia has refused to cooperate with Romania’s demand for its gold is assumed to be Romania’s cooperation with the U.S. missile "shield." According to the Huffington Post, in 2011, U.S. Secretary of State Hillary Clinton signed the agreement with Romanian Foreign Minister Teodor Baconschi and said the United States expected to deploy interceptor missiles at a Romanian air force base in approximately four years.Mr. Eugen Anca at the time of the following quote ran the European arm of the Institute for Foreign Economic Relations (VNIIVS), a governmental agency of the Russian Federation’s Ministry of Economic Development and Commerce. He comments on the Romanian "gold treasure" For this reason the Russians wanted a private corporation to exchange the BNR’s gold with a private Romanian entity that could secure assistance in developing Siberian natural resources as a win-win situation that could offer an new option to offset the 300 million (274 tons of gold) owed Russia per the 1947 Paris peace treaty previously satisfied via confiscation of the BNR gold stored in Russia. This is crucial, the "Romanian gold" is not even owned by Romania, it is owned by a private bank acting as the central bank of Romania. Sounds familiar as Americans handed their gold over to the Federal Reserve in 1934, not their state or federal Treasuries.One lesson here for international players is that "if you can’t hold it, you don’t own it!" Accordingto Edel Tully, precious metals strategist at UBS, "There is a growing preference among many different communities in the gold market to have their physical gold at home." Over the years the Russians have returned to Romania 17 railroad car loads of archives and documents, including as many as 39,320 Romanian art works were returned in 1956, including paintings, drawings, engravings, icons, tapestry works, religious objects, gold coins, medals and the Pietroasele treasure (below).While this recent spate of repatriation may not be what sends gold immediately surging higher, it will be this repatriation movement that prevents the paper price from accurately reflecting the value of the physical metal. The paper market only has sway over prices of real silver and gold because the paper contracts bestow the bearer a right to physical delivery of metal. When the exchange defaults, by either limiting buying or by settling in cash, more and more holders of paper will catch on to the very real physical shortage of monetary metals, especially as gold and silver are more and more commonly used as a medium of exchange. There is infinite demand for money. Even under a fully implemented, "extreme" Paul Ryan budget, the federal deficit would persist until 2040, with debt growing larger and larger. The debt ceiling will be breached in 2013 either way, and printing paper rectangles is slated to increase in speed soon with promises to stop only when unemployment falls "significantly." With the money supply still deflating since 2008, for the first time since the first Great Depression, what makes anyone think this time is different, and that the Keynesian promises of real growth will somehow finally materialize? The fact is, bankers fight deflation with re-inflation, or further increases in the supply of currency and credit. This process, repeated five times in the U.S. and many times abroad since the recent crisis began, has been very good to gold and silver money, the stable landmass to which all fiat currencies are referenced. Better stated, the cycle of deflation and re-inflation has been very bad to paper currency.Generally speaking, prices don’t rise; the value and purchasing power of the Fed’s co-opted dollar falls. Bob Januah of Nomura, who has been calling for a sell-off in markets for some time now, saysthat gold has consolidated by around $100 recently, and that he feels that these look like attractive entry levels to position for additional action by the Federal Reserve. Time to musk up.For more on the Swiss initiative to repatriate their gold see Gold Reserves Increasing at Central Banks and addressing the concerns of Americans, see Gold Audit Fails to Discover Who Owns What. * * *

October 26, 2012 · 1:21 am

EUROZONE GOLD EXCLUSIVE: Draghi mulls gold sales ban….

Marigold Draghi?

….LOOKS AT GOLD-BACKED BONDS TO RESTORE CONFIDENCEThe Slog’s Brussels Mole reports that a bold double-whammy scheme to stabilise the euro and restore confidence in eurozone bonds ‘in the intermediate future’ is under serious consideration at the European Central Bank (ECB). The plan involves banning the private sale of gold in the proposed Fiskalunion, and using ECB gold supplies as collateral for sovereign debt bonds issued by member States.In what will be seen as both sensational and horrifying by everyone from private investors to senior German financial figures, The Slog was today advised of the existence of an ECB plan to protect the single currency from desertion in favour of gold…and back some Fiskalunion eurobond and member State debt issuance with gold bullion. It’s an odd mentality, is it not, that destroys confidence in eurozone bonds by cheating investors one year, and then looks to back the bonds with gold the next. It is, however, typical of ruthless eurofanatic tunnel vision to go for every last throw of the dice to before giving up. |

"The idea is new Union, fresh start," my source asserts, "The old fluffy eurozone is dead, long live the gilt-edged FU. They’re not going to do it next week, but there is an ECB task-force working seriously on the ramifications and details".

Two days ago in Berlin, ECB boss Draghi made a significant comment when asked about the inflationary pressures of QE in the eurozone. I quote:

"in our assessment, the greater risk to price stability is currently falling prices in some euro-area countries."This was a calculated comment by Mario, designed to suggest a future where gold would represent a poor investment. Its effect was immediate: gold futures fell to $1703, and the hint was duly trotted out by several commentators.

"Gold is not getting any support since people are not talking about an inflation spike," said Frank McGhee, the head dealer at Integrated Brokerage Services LLC in Chicago.

My view is more anthropological I’m afraid: Mario Draghi wouldn’t be indirectly rubbishing gold if he didn’t fear it.

In fact, The Slog’s bottom-line belief about gold hasn’t changed since 2009: with the exception of top-top end A+++ property, it is the best investment on offer given the current outlook. And although timing one’s purchase entry exactly right is as much about good fortune as calculation, by 2014, $50 this way or that could very easily feel like peanuts compared to the gains made.Those who see gold as purely an inflation hedge are missing the point. Top end property and gold are must-buys for the big investors right now, because they want safety and survival once the global financial system starts unravelling in the face of eurozone debt contagion.

You can see that by the time Soros and Paulson bought the shiny stuff, it’d been holding at between 1550 and 1600 dollars for three months. This was a rigorous test of the low, and it had failed. All you’d need to do then is read a couple of newspapers about QE, the eurozone disaster, and the global slowdown, and decide it would be daft not to buy.

The other consideration (when dealing with the likes of Paulson and Soros) is whether they know of the Draghi scheme already….and plan to (a) get in while they can, and (b) benefit from what would probably result: a rising dollar price of gold. Odder things have transpired on the Goldman Sachs bush telegraph.

Of course, when Big Dicks like these two buy big, it becomes a short-term self-fulfilling prophecy to some extent: after much hype, the price shot up to test $1800 by the end of September. But this is the lesson: the existence of such major opinion leader actions – and ironically, the current cyclical fall-back of gold making it look increasingly, temptingly cheap – would worry any organisation in charge of a dodgy currency. And as Draghi’s ECB is the proud owner of a Mickey Mouse euro, it is entirely logical that the all-or-nothing brigade would plan to close off the exit-route into gold.It’s not as if there is no precedent in recent times: the Reserve Bank of India very seriously considered banning the sale of gold coins there during last June. And as of early September 2012, private citizens can no longer buy gold in Argentina. That’s not what the new law says, but it is the cast-iron practical effect of the legislation.

Meanwhile, the question is there for European private gold-bug investors to address: should they get in while the window’s still open? More on this later at The Slog.

* * *

http://hat4uk.wordpress.com/2012/10/26/ecb-gold-plans-germany-audits-its-gold-reserves-looks-to-bring-them-home/

ECB GOLD PLANS: Germany audits its gold reserves, looks to bring them home.

As news breaks that Mario Draghi’s ECB is giving serious consideration to gold-backed eurobonds and a ban on gold ownership in the eurozone, respected English-language German site DW reports that Berlin is to ship 150 tons of gold from New York to Germany.

In the light of this revelation, the German Bundesbank stresses that it does not doubt ‘the integrity, reputation and safety’ of the foreign storage sites. But Folker Hellmeyer, the chief economist at Bremer Landesbank, observed that “…the shortcomings in monitoring our gold reserves have to be viewed quite critically. It makes sense that this issue has been taken up by the National Audit Office.”

It makes sense alright Folker, but why now? As DW correctly observes, ‘as the financial crisis has engulfed the European single currency zone, [gold] has shifted into the focus of politicians’. Indeed it has.

Germany has the second largest gold reserves in the world. While the US allegedly has 8,133 tons, Germany has nearly 4000 tons. Gold reserves are an important part of the reserves of national banks in the eurozone: according to the World Gold Council (WGC), the eurozone countries together hold over 10,787 tons of gold.

The European Central Bank holds only 502 tons of that – less than 5% of the total. Is Berlin quietly preparing to give support to the ECB’s Last Redoubt plan for the euro? What will the public reaction there be if and when this scheme gains wider awareness in Germany?

This is a developing story. Stay tuned.

and......

http://www.silverdoctors.com/netherlands-citizens-group-demands-central-bank-reveal-location-of-countrys-gold-reserves/