http://ftalphaville.ft.com/2012/10/25/1229761/japans-very-own-fiscal-cliff/

And this one might prove more precipitous than its famous US cousin.

From the FT’s Ben McLannahan:

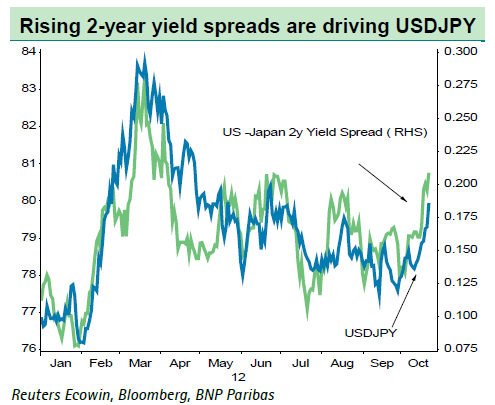

In an echo of worries in the US over the $600bn of spending cuts and tax increases due to take effect in January – the so-called fiscal cliff – Japanese politicians are at loggerheads over a bill that would allow the government to borrow the Y38.3tn ($479bn) it needs to finance this year’s deficit.In return for support of the bill in an extraordinary parliamentary session beginning on Monday, opposition parties are demanding that Prime Minister Yoshihiko Noda fulfil his pledge to call a general election. So far, Mr Noda has refused to set a date, fearing that his Democratic party of Japan – adrift in the polls – will be bounced from office.Failure to pass the bill by the end of November, when the parliamentary session ends, could result in “a very disastrous situation”, said Ikuko Shirota, deputy director of the market finance division at the Ministry of Finance.Scheduled bond auctions would be scrapped for the first time in decades, she said, and the government – the world’s most indebted, with gross borrowings and guarantees of Y1,021tn at the end of June – would effectively run out of money.On the upside, the government says it has enough cash to last until the end of November without passage of the controversial bill:As part of its efforts to rein in spending, the government has delayed Y5tn public spending including regular payments to the country’s regions, while prefectures are covering budget shortfalls by bringing forward their own bond issuances.On the rather significant downside, Nomura’s Tomo Kinoshita and team say:If the deficit-funding JGB bill is not passed by the end of the year, funding shortfalls are expected to arise: ¥8.5trn in 2012 Q4 and ¥20.7trn in 2013 Q1. We think this would lower real GDP growth by 7.6ppt q-q and 6.2ppt, respectively. Even if spending on the police, the Self-Defense Forces, and other areas deemed important to the public’s daily life were continued as special cases exempt from government shutdown, we estimate that the dent to real GDP growth would still be 5.7ppt in 2012 Q4 and 3.1ppt in 2013 Q1.(We’ll put the much more detailed Nomura note in the usual place.)McLannahan points to the the extra yield that investors are demanding to hold 20-year government bonds instead of 10-year bonds. The spread has increased to 92 basis points as proof of the tensions in the bond market — longer-term bonds tend to be more sensitive to questions of fiscal sustainability, say traders.(Click to enlarge)But, significantly, there is disagreement about how JGBs might actually react to an issuance halt. From the WSJ:The lack of fresh supply could lead investors to rush to existing bonds, putting downward pressure on JGB yields. JGBs remain popular among Japanese banks, which are flush with cash obtained under the Bank of Japan’s ultra-easy monetary policy.On the other hand, the suspension of bond auctions would mean that the finance ministry would have to sell a larger amount of bonds through regular offerings once the bill is enacted, possibly causing indigestion in the secondary market and pushing up yields.Some analysts say the confusion could further erode confidence in Japan’s fiscal policy, leading investors to shun JGBs in the longer term.We’ve written about this before and noted then that:This is important because it’s been Japan’s amazing capacity to keep issuing JGBs and run up a captial deficit that has allowed it to defy negative yields in the past, keeping domestic demand satisfied with new asset supply.The latest impasse creates a potential shortage of JGB problem, which naturally opens the door to negative rates. Indeed, without opening the door to below 0.1 per cent yields, any additional QE could be entirely counter-effective.It’s clear, however, that the BoJ had no choice but to announce more asset purchases so as to compensate for the future fall in government spending.Luckily, the market already expects the BoJ to increasing its asset purchase programme by Y10tn at its end of month meeting, with the conventional attitude being that the BoJ has its eyes fixed squarely on the yen. That’s the same yen that tracks the shifts in US Japan 2-year yield spreads by the way, but anyway…So the impact on yields of a cliff-dive might impact the coming decision… if it hasn’t already. But even putting aside the muggy JGB issue, the prospect of lower equity prices on the back of this cliff confusion seems likely to force the BoJ to act in some way.Finally, we’d note that there is still a presumption this issue will be sorted out. From Nomura again:[O]ur main scenario remains that the deficit-funding JGB bill will be passed in the upcoming extraordinary session of the Diet. If there were to be a government shutdown, the Japanese people could increasingly lose confidence in the DPJ and the LDP, currently the two main parties, which would likely work to the advantage of new political groups in the upcoming general election. In our view, both of these parties’ interest lies in avoiding such a situation. From this standpoint, we think some sort of cooperation will be agreed in the extraordinary Diet session, with the result that the worst-case scenario of a government shutdown will be avoided.

No comments:

Post a Comment