http://www.acting-man.com/?p=16679

and.....

and.....

http://economia.elpais.com/economia/2012/05/04/actualidad/1336118031_403238.html

Meet Mayor Loco

You'd think that in the wake of one of the biggest real estate bubbles of all time that has left the country with the highest ratio of houses per capita in the world, Spain would at least stop adding to the housing supply. You'd be wrong.

“From atop the stone walls of Avila, Spain, a medieval city an hour’s drive northwest ofMadrid, beyond the parking lots and empty playgrounds and thousands of vacant new apartments, a construction crane can be seen moving on the horizon as building continues.“Avila isn’t an exception,” said Jesus Encinar, co- founder of Madrid-based Idealista, Spain’s largest property website, and an Avila native. “It’s a small-scale example of the madness that gripped the whole real estate industry.”In the stages of death of a real estate boom, Spain is still in denial.[….]Spain, Europe’s fifth-largest economy, is the current focus of attempts to contain the region’s sovereign debt crisis, as Prime Minister Mariano Rajoy struggles to quell speculation it will need a bailout. Developers are showing similar optimism. They continue to build even with 2 million homes vacant around the country, new airports that never saw a single flight being mothballed, and property appraisers and banks reporting values have fallen only about 22 percent, said Encinar, who estimates the real decline is probably at least twice that.”

(emphasis added)As we often say, you couldn't make this up. Providing proof that he has lost his mind, below is the mayor of Avila giving us his considered opinion on the state of the real estate market:“On the plain below the central walled city of Avila, a world heritage site and a popular tourist destination, the province with a population of 171,680 has about 19,000 apartments and villas empty or unfinished, according to Borja Mateo, the author of “The Truth About the Spanish Real Estate Market.”Ministry of Infrastructure figures show 23,419 homes were constructed in the decade through 2007, with another 11,000 homes built there since 2008. The sprawling developments are dotted with thousands of empty parking spaces, while streets have makeshift barriers where the money has run out, others simply end in fields.Miguel Angel Garcia Nieto, mayor of Avila for the past decade, disagrees that his city has been overbuilt.“When we approved the first urban plan back in 1998 there was an unprecedented demand for homes,” Nieto said in a telephone interview on April 19. “Yes, there is oversupply at the moment because of the financial crisis and everyone’s gone back home to live with their parents, but it’s not because there is lack of demand. When the economy gets back on track I am confident the supply will be absorbed.”(emphasis added)Needless to say, the 'unprecedented demand for homes' of 1998 will be of no help in absorbing the equally unprecedented oversupply of 2012. If it is true that 'everybody has gone back to live with their parents' – not an unreasonable assumption with youth unemployment above 50% – then the current numbers become even starker. As a reminder, there is one house for every 1.7 persons in Spain. This indicates that the very last thing Spain needs is even more housing supply. And yet, here they are in Avila, happily building more homes based on little more than vague hopes.Banks Keep Financing Developments

One wonders where the money for this madness is coming from. Apparently the banks are providing it, in spite of the fact that they are already buried in RE assets gone bad:“On the northern outskirts of Madrid, near Barajas airport and the Real Madrid soccer team’s training ground, is Valdebebas, a development project under construction covering more than 10.6 million square meters of space. About 5,400 of the planned 12,500 homes have been built and another 2,100 are under construction, according to a spokesman for the project who declined to be identified by name, citing company policy. The development, which belongs to private land owners who pooled their property, is backed by banks including Banco Bilbao Vizcaya Argentaria SA andAareal Bank AG. There are bus tours on Saturday for potential buyers, and an open house of the model homes every Sunday.”(emphasis added)And here is another choice tidbit from the article that confirms something we have apprised readers of in a previous article:“Spain shunned proposals to create a bad bank like NAMA to acquire toxic real estate assets, with Economy Minister Luis de Guindos saying this week the nation won’t seek a European bailout for its lenders. Instead, authorities pushed banks to pay for the clean up by absorbing weaker lenders. Spanish banks hold about 329,000 foreclosed homes, helping to prevent steep price declines, and provide 100 percent financing on easy terms such as interest-only payments for up to three years, for buyers who agree to buy the banks’ properties.“Banks are employing financing like a weapon of mass destruction to sell their stock and keep prices artificially high by using high loan-to-value mortgages,” said Mikel Echavarren, chairman of Irea, a corporate finance company that specializes in the real estate industry. “Today in Spain it’s easier to buy a 200,000 euro flat from a bank with 100 percent financing than buy a 150,000 flat from an individual homeowner where you have to have a 20 percent deposit.”

(emphasis added)In short, by means of such accounting and financing tricks the banks hide their losses by distorting the market further and thereby potentially adding new losses to their already existing, but unacknowledged ones. However, Alfredo Saenz, the CEO of Santander recently called anyone who dares to ask questions about this 'stupid'! According to him, we're supposed not to question the 'quality of the information' about mortgage delinquencies. It rather appears that we should question it as deeply and often as we can.Finally, here is an excellent description of the distortions capital malinvestment brings about, using some of the features of Spain's housing bubble as the pertinent example:“Governmental authority also moved to regions and municipalities. The decentralization was nicknamed “cafe para todos” or “coffee all around,” and Spain’s autonomous communities demanded self-government and greater control over issues such as health and education, and taxes and financing. And many local governments were eager to build.“It took 20 centuries for the center of Avila to be developed, and in the last 10 years they’ve developed twice that amount,” said Natalio Encinar, a brother of Jesus Encinar who still lives in Avila. Until demand collapsed, “the main industry here was building houses. And plumbers made more than engineers.”(emphasis added)And it is precisely those plumbers and their colleagues in the construction industry that now form a great part of the rising tide of the unemployed in Spain. It will take some time for them to adapt to the new reality and acquire the skills that are actually in demand following the bursting of the bubble. Given that the housing bubble was especially pronounced and egregious in Spain, this adjustment will be more difficult than in most other European countries.As the article notes, in Ireland it was decided to 'bite the bullet' much faster and acknowledging the losses while moving on without attempting to continue to prop the housing sector up (although bailing out the banks was in our opinion a grave mistake). This is one reason why the markets are these days beginning to grow more sanguine about Ireland's prospects while they are concurrently ever more worried about Spain.

and......

http://economia.elpais.com/economia/2012/05/04/actualidad/1336162543_120103.html

Spending on unemployment accelerates and exceeds government forecasts

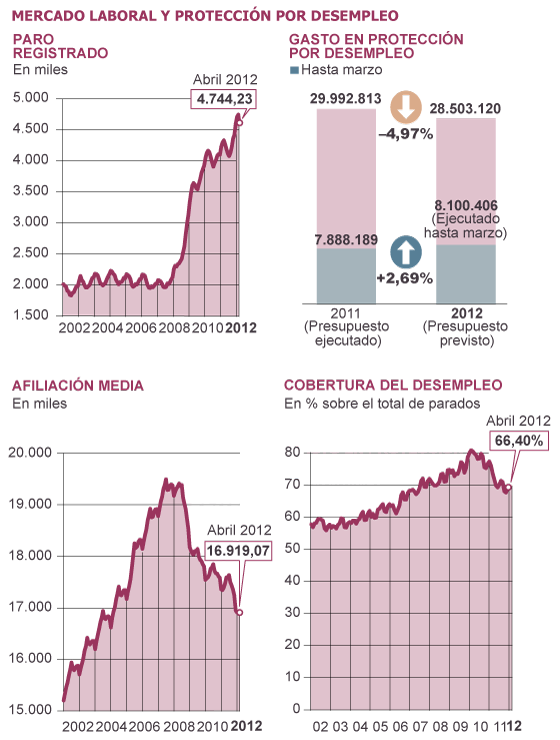

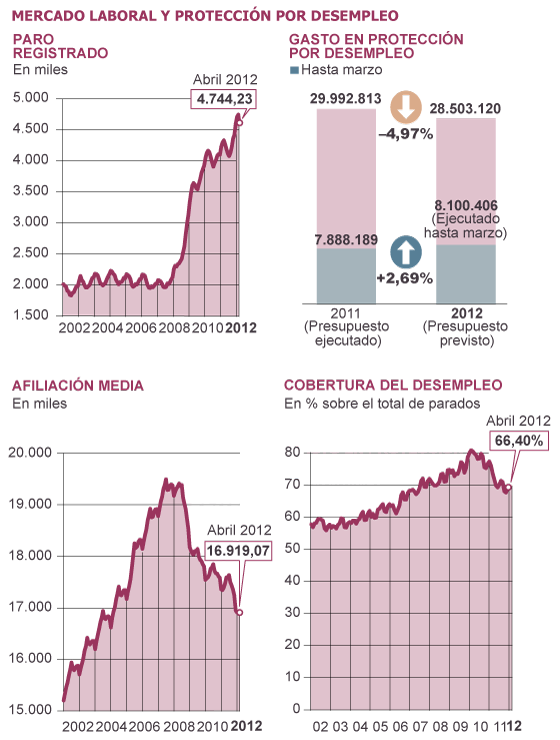

The executive paid millions to March 8100, 2.7% more than in the first quarter of 2011

The budget estimates a 5% drop this year

Recession has become. Job destruction has intensified. Spending increases protection against unemployment. And it does so strongly.The Government has not reviewed this equation to develop the budget for this year-or at least not in all its magnitude, and you may find that before the Parliament's approval of 2012 accounts , the labor market story has become. Treasury estimates that spending on unemployment benefits will drop nearly 5% over 2011. However, until March, this game has consumed 2.7% more than what was spent in the same period last year, according to the Ministry of Employment.

Only in the first quarter, the total payroll benefits and unemployment benefits amounted to 8,100 million, 212 more than in 2011. Last year, the State Public Employment Services, the official name of the old Inem, 29.992 million spent to protect the unemployed. At the turn of summer labor market deterioration intensified, and despite this, the Treasury estimated to produce 28.503 million budget in money for this game.

The two worst years for the Spanish public accounts were 2009 and 2010. This was due largely had to be disbursed over 30,000 million, double that of 2007 - to pay the unemployment of those victims of the crisis, had lost their jobs.

The last year this game waned slightly. And this has caught the government to try to balance the books and meet the demands of Brussels (and Berlin) to reach a deficit of 5.3% of GDP this year . "It responds to the decline in spending on unemployment already began in 2011 and is consistent with it," have justified the Secretary of State for the Budget on occasion.

Turnaround

Apparently, this explanation is true, but when it comes down to detail begins to leak. The trend was reversed just a year ago. In April 2011, the decline in spending over the same month last year was 10.9%. Then the percentage gradually dwindled until picked up again in January (0.52%) in February accelerated to 3.4% in March, last month data has increased trend (4.1%).

The Government also trust their numbers to the new unemployed are less than those accrued entitlements will lose the benefit. That is, those who lose their jobs will now stop and charge less for less time.

This dynamic explains why spending down in 2011 compared to 2010 (when it peaked with 32,200 million) although the number of unemployed will not fail to grow year after year. But the return of the recession is taking the use of permanent workers. The latest Labour Force Survey stood at 138,400 permanent jobs. And this has a very negative reading for the accounts of public employment services: permanent workers are entitled to charge a higher unemployment and longer.

Contributory benefits

As if this were not enough, another factor that clouds the accounts of the Executive: applications for high-contributory benefits. This is the best indicator of how it will evolve spending on unemployment protection in February and March and increased above double digits, 18.1% and 11.5% respectively.

This accumulation of data, to mention the more than 630,000 jobs that the Ministry of Economics predicts that shall be destroyed until December, undermines the credibility of the 2012 budget at the expense with respect to protection against unemployment. More if you consider that the accounts were drawn up for this year between January and March and the Executive already knew much of the data presented.

When it comes to national accounts, the numbers of the State Public Employment Services are one of the three parties which made the Social Security accounts, along with Fogasa and the pension system. The Government has predicted that Social Security will end this year with a 0% deficit. Difficult. Very difficult in light of the evolution of unemployment protection and pension-government forecasts are too optimistic in light of the seen until March.

Group Finance and Savings Bank (BFA), which is included within Bankia, continues with the problem of huge dead property is its large share, although it has increased the coverage of the brick to alleviate their condition.

BFA, Bankia matrix, closed 2011 with a volume of potentially problematic assets and real estate sector promoter of 31.799 million euros. This figure is the sum of the delinquent real estate loans and at risk of default (17,847,000) together with the assets received by non-payment of loans (13,951,000). In total, the financial sector has 184,000 million in assets potentially problematic.

To avoid this situation, the group had a coverage of about 11,900 million. The total gross impaired assets, the greatest of all Spanish institutions, has grown by about 3,000 million year, but also provisions and coverage they have, in nearly 5,000 million. Thus, exposure problems unfilled has been reduced about 2,000 million. This is contained in the consolidated accounts BFA registered this Friday morning as a significant event in the National Securities Market Commission (CNMV).

These unaudited accounts show how the assets and credits of the brick sector are the main threat to the entity that presides Rodrigo Rato, who has insisted that may strengthen its solvency and going solo without mergers. BFA closed the year with a volume of 10.564 million in bad loans and other substandard 7.283 million in loans (at risk of default) only in the construction sector and property development. On these problem loans, BFA has endowed provisions, ie, funds to meet possible losses, for 7.021 million.

That means that the problems affecting 47.6% of the volume of lending to this sector. Delinquencies on the brick fell from 18.2% to 28.1%. The total delinquency ratio of BFA Group shot up to 8.66%, an increase of more than two points from the previous year. The cover is located in 61.2%.

Total credit to construction and property development finished the year at 37.517 million euros, nearly 5,000 million less than last year.However, part of this reduction is that there are loans that are classified as failed, that is, already given up on. The failed totaled 1.749 million at the end of 2011 and 2.241 million at the end of 2010.

Meanwhile, real estate assets for unpaid claims received rose to 13.951 million. The soil is the main game, but also the cover.

Regarding the group's equity BFA, accounts show that in 2011 was reduced by 17% and stood at 8.836 million. Most striking is that own funds, those belonging to the seven founding boxes, rose from 8,500 million in 2010 to only 258 million a year later.

The entity explained because after the IPO, "have increased by 6,300 million minority interests" (ie, property that belongs to shareholders) and have been subtracted at 4,600 the assets of the founders boxes. It so happens that 97% of equity is held by those who are not managers and founders of the group.

In addition, BFA bad assets to equity accrued by another 4,000 million against the capital of the group. These claims surfaced in the merger of Caja Madrid and Bancaja in 2010. With this operation, the group will try to comply in 2012 with the Royal Decree of the Government that requires further consolidation of the brick. The core Tier 1, the highest quality capital is 8.07% in BFA. Loans to customers in the consolidated group fell by 12.3% and deposits by 6.3%.

S & P leaves the debt rating of Catalonia on the brink of junk bond

The agency cut the rating of nine regions

Lower after last week 's note Spanish debt and last Monday of banking, rating agency Standard & Poor's (S & P) did so again Friday. But this time the blow to the credibility of the Spanish economy heads towards one of his weakest flank: regional accounts. S & P downgraded at the last minute to nine regions. They all lose out, but especially Catalonia, one stroke down four steps and is just a step away from junk bond.In addition to casting doubt on the possibility of Catalonia to pay its debt, S & P cut by two notches ratings Madrid, Galicia, Canary Islands, (from A to BBB +), Basque Country and Navarra (AA-to A) and in three those of Andalusia, Aragon (A to BBB) and the Balearic Islands (from A-to BBB-).Baleares, like Catalonia, are on the verge of junk status. These nine autonomous regions, in addition to Valencia, which maintains its BB rating, are at risk of a worse economic performance than expected, and this affects their credit profiles, the agency said.

S & P argues that the government's ability to support communities in the long term has been weakened in a context in which it expects a mild recession in 2012 of the Spanish economy and a "slow business" until 2015. It adds that it is likely that the tax bases of the regions continue to decline in 2012 and face a period of "mediocre growth" over the next three years.

In the case of the Basque Country and Navarre, the agency points out their credit profiles "strong" because of their fiscal autonomy, strong financial management, low debt burden and its export-oriented economies.

No comments:

Post a Comment