579,232

Good evening ! I thought I would do something different , start with a song I've loved for years - try to take the message to where things stand presently . Aren't we collectively cruising for some type of bruising so to speak ? Is it just me - do you feel that as well ? Let's look at a few items of the day , then you make the call ..... BTW , I posted quite liberally from the last piece from Mish - the chart really underline cruising for a bruising in spades,,,,,,

http://news.antiwar.com/2012/02/02/panetta-believes-israel-will-attack-iran-in-coming-months/

Defense Secretary Leon Panetta is worried that Israeli will launch a preemptive, unilateral military strike on Iran within the next few months, according to David Ignatius of the Washington Post.

“Panetta believes there is a strong likelihood,” writes Ignatius, “that Israel will strike Iran in April, May or June,” in an attempt to impede Iran’s quest to acquire nuclear weapons.

“Panetta believes there is a strong likelihood,” writes Ignatius, “that Israel will strike Iran in April, May or June,” in an attempt to impede Iran’s quest to acquire nuclear weapons.Israeli Prime Minister Benjamin Netanyahu disagrees with U.S. assessments that Iran’s nuclear program is civilian in nature and doesn’t want to risk Israeli security waiting for America to bomb Iran, which U.S. officials have said they won’t do under current circumstances.

“President Obama and Panetta are said to have cautioned the Israelis that the United States opposes an attack,” writes Ignatius, favoring instead a harsh set of economic sanctions as punishment for not building nuclear weapons.

“The Obama administration is conducting intense discussions about what an Israeli attack would mean for the United States: whether Iran would target U.S. ships in the region or try to close the Strait of Hormuz; and what effect the conflict and a likely spike in oil prices would have on the fragile global economy.”

http://www.guardian.co.uk/business/2012/feb/02/greece-new-black-hole How may black holes can one really be shocked about regarding Greece ? i mean really....

Pressure on Greece's recession-stricken economy has intensified after international debt inspectors admitted an additional €15b n (£12.5 bn) would be needed to fill a newly discovered black hole in the country's finances.

On a day when Ireland's government reduced its growth forecast and Madrid told Spanish banks to raise an extra €50 bn to cover toxic assets, Brussels officials said European countries and state-owned banks would be asked for contributions to help Athens out of its fiscal troubles.

The fresh evidence of Greece's desperate financial plight came as it continued to discuss the terms of a deal with private sector creditors aimed at writing down debts by €100 bn, and was an admission that the "haircut" being taken by banks, hedge funds and insurance companies would not be enough on its own to remove the risk of a default.

International Monetary Fund officials said that time was running out to finalise the negotiations in time to trigger payment of the next tranche of its €130 bn bailout from the European commission, the European Union and the IMF.

The so-called troika has recognized in the past few days that Greece faces an impossible task in reducing debt when the economy is in such deep recession, and now accepts that the country's sovereign creditors will have to supplement the debt relief being provided by the private sector. Spending cuts, tax increases and the general uncertainty of the crisis have already pushed Greece into a slump, which in turn has eliminated many of the gains from the austerity measures.

http://www.telegraph.co.uk/news/worldnews/africaandindianocean/egypt/9058045/Egypt-Cairo-rages-as-football-disaster-bodies-come-home.html

Police fired tear gas and rubber bullets as supporters of Egypt’s biggest team, Al-Ahly, and thousands of revolutionary activists surrounded the interior ministry to protest against the worst footballing disaster in Egypt’s history.

The crowd, tens of thousand strong, called for the fall of the Army Council and for Field Marshal Hussein Tantawi, de facto head of state, to be hanged

Many accused supporters of Hosni Mubarak, the former presidentwhose sons Gamal and Alaa had close ties to Egypt’s football establishment, of deliberately instigating the violence at the Port Said stadium of Al-Masry following their 3-1 win over Al-Ahly on Wednesday night.

“This was not a sports accident, this was a military massacre!” the crowds chanted. Supporters of the rival Cairo club Zamalek turned out in sympathy.

* * * *

A total of 74 people, mainly Al-Ahly fans, were stabbed, beaten and crushed to death when Al-Masry fans invaded the pitch at the end of the game and attacked the away supporters with knives and metal bars.

The Al-Ahly Ultras, as the club’s fans are known, had played a prominent role in anti-Mubarak protests during last year’s Egyptian revolution, famously helping to beat off a charge by a group of hired men, some on horse- and camel-back, who attacked protesters in Tahrir Square a year ago.

Some said this was the revenge of the “Mubarak gang”.

Saad Abboud, an MP for the Karama Party, said: “It’s no coincidence that the common factor between the Battle of the Camels and Port Said is Gamal Mubarak and his friends.”

http://globaleconomicanalysis.blogspot.com/2012/02/bundesbank-228-billion-euros-in-debt.html

Both Angela Merkel and the Bundesbank are walking an extremely fine line of economic policies and treaty arrangements that appear to be in violation of policy statements made by the German Supreme Court regarding transfer unions. Moreover, the Bundesbank president is now in what amounts to an open Feud with Merkel.

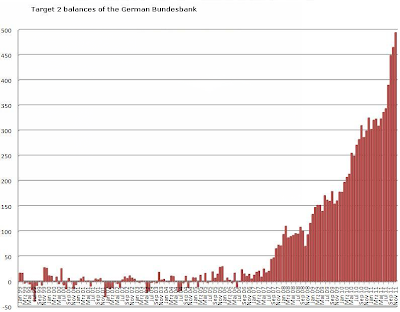

Bundesbank 228 Billion Euros in Debt Rescuing Europe

Ambrose Evans-Pritchard at The Telegraph reports Bundesbank Sinks Deeper Into Debt Saving Europe

Bundesbank 228 Billion Euros in Debt Rescuing Europe

Ambrose Evans-Pritchard at The Telegraph reports Bundesbank Sinks Deeper Into Debt Saving Europe

The operations are part of the European Central Bank's 'TARGET2' network of automatic payments between the national central banks of the Euroland club. The Bundesbank has already provided €496bn (£413bn) to countries in trouble, chiefly Greece, Ireland, Italy and Spain.

The Bundesbank - the dominant body in the euro system - used to keep a stock of €270bn of private securities (refinance credit) before the start of the financial crisis. This was depleted last year as it sold assets to meet growing demands on the TARGET2 scheme.

Once the debt drama began to engulf the bigger economies, the Bundesbank was forced to borrow money to meet its obligations to offset capital flight, since it refused to sell its stash of gold. It now owes €228bn to German banks.Given that German taxpayers are indeed on the hook should something go wrong, I am surprised no one has issued a direct challenge to the German supreme court to stop the madness.The ECB may indeed have taken over "printing money" but German taxpayers are still liable for their large percentage share of any problems at the ECB.

"There are political limits to TARGET2 support. The reason why the ECB started printing money in December was to avoid pushing the Bundesbank deeper into debt," said Prof Westermann, referring to the ECB's provision of €489bn in cheap loans to banks for three years.

David Marsh, author of books on both the Bundesbank and the euro, said the TARGET2 system has the effect of locking Germany ever deeper into monetary union.

"The longer it goes on, the larger the cost of a eurozone break-up since these credits could be wiped out with horrendous losses. It is about time this was the focus of proper debate in the Bundestag, since the German taxpayers may have to pay for it," he said.

Target 2 Balances

In Summit Time – Batten Down the Hatches Pater Tenebrarum posted a nice series of charts on Target 2 balances.

click on any chart for sharper image

Target 2 Germany

Target 2 Netherlands

Target 2 Finland

Target 2 Spain

Target 2 Spain

Anyone see a problem here?

just skip the ad.....

ReplyDelete